If the Biden admin was to have any hopes of the Fed cutting rates and monetary easing ahead of the election, the tires would need to start falling off the US economy right… about… now… Which is why we didn’t find it at all surprising that moments ago the Biden Bureau of Economic Analysis reported that in Q1, US GDP unexpectedly collapsed to just 1.6%, down more than 50% from the Q4 print of 3.4%, the lowest print since Q2 2022 when the US underwent a brief technical recession (one which the NBER never admitted of course), and a huge miss to the 1.6% estimate.

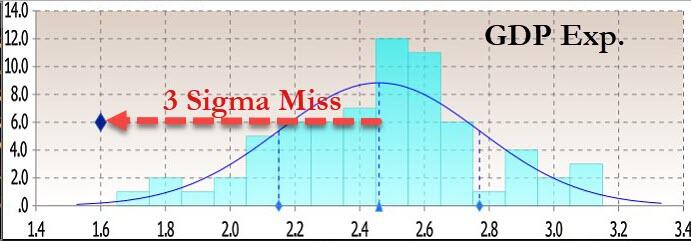

Almost as if on purpose, the GDP printed below the lowest estimate (that of SMBC Nikko) which was at 1.7% (the highest forecast was 3.1% from Goldman Sachs which was off by the usual 50%), and was a 3-sigma miss to estimates.

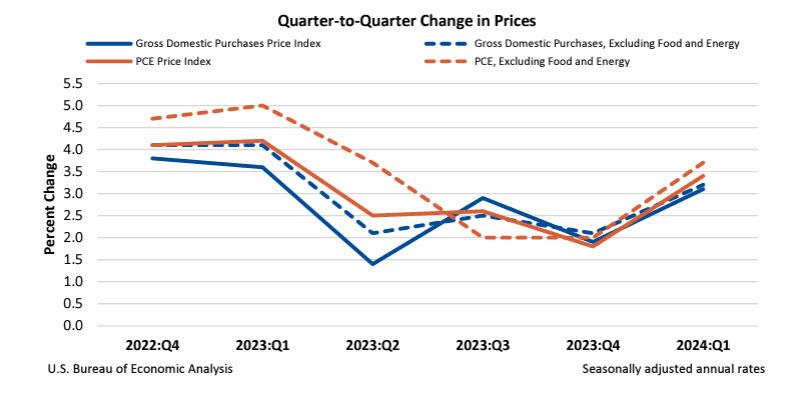

But while a collapse in the US economy is just what the “soft landers” wanted, the huge GDP miss was just half the story because at the same time, the BEA reported that the GDP Deflator (price index) came in at 3.1%, hotter than the 3.0% expected and almost double the 1.6% in Q4. Worse, the all important core PCE for Q1 soared from 2.0% to 3.7%, blowing away estimates of 3.4% (we will get a more accurate core PCE print tomorrow for the month of March) and suggesting that the US is about to not only not pass go, and overshoot soft-landing island completely, but crash-land straight into a stagflationary recession…

… unless the Fed does something, although what it can do – with inflation rising and growth slowing – is anyone’s guess.

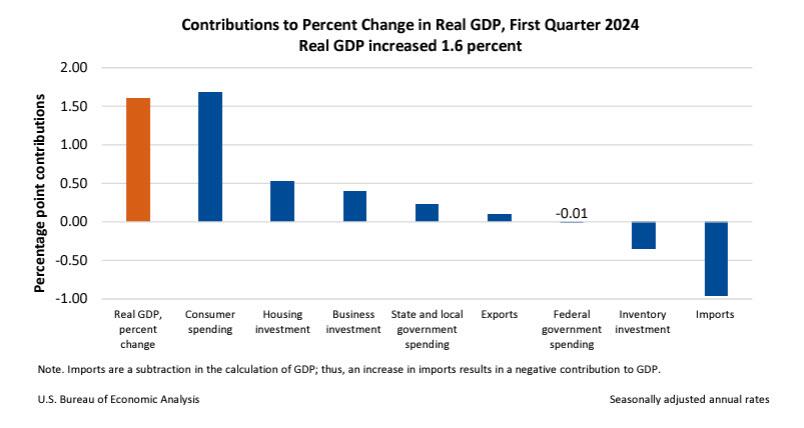

Taking a closer look at the absolute data, the BEA said that the increase in the first quarter primarily reflected increases in consumer spending and housing investment that were partly offset by a decrease in inventory investment. Imports, which are a subtraction in the calculation of GDP, increased.

- The increase in consumer spending reflected an increase in services that was partly offset by a decrease in goods. Within services, the leading contributors to the increase were health care as well as financial services and insurance. Within goods, the leading contributors to the decrease were motor vehicles and parts as well as gasoline and other energy goods.

- The increase in housing investment was led by brokers’ commissions and other ownership transfer costs as well as new single-family housing construction.

- The decrease in inventory investment was led by decreases in wholesale trade and manufacturing.

Compared to Q4, the deceleration in GDP in Q1 reflected decelerations in consumer spending, exports, and state and local government spending and a downturn in federal government spending. These movements were partly offset by an acceleration in housing investment. Imports accelerated.

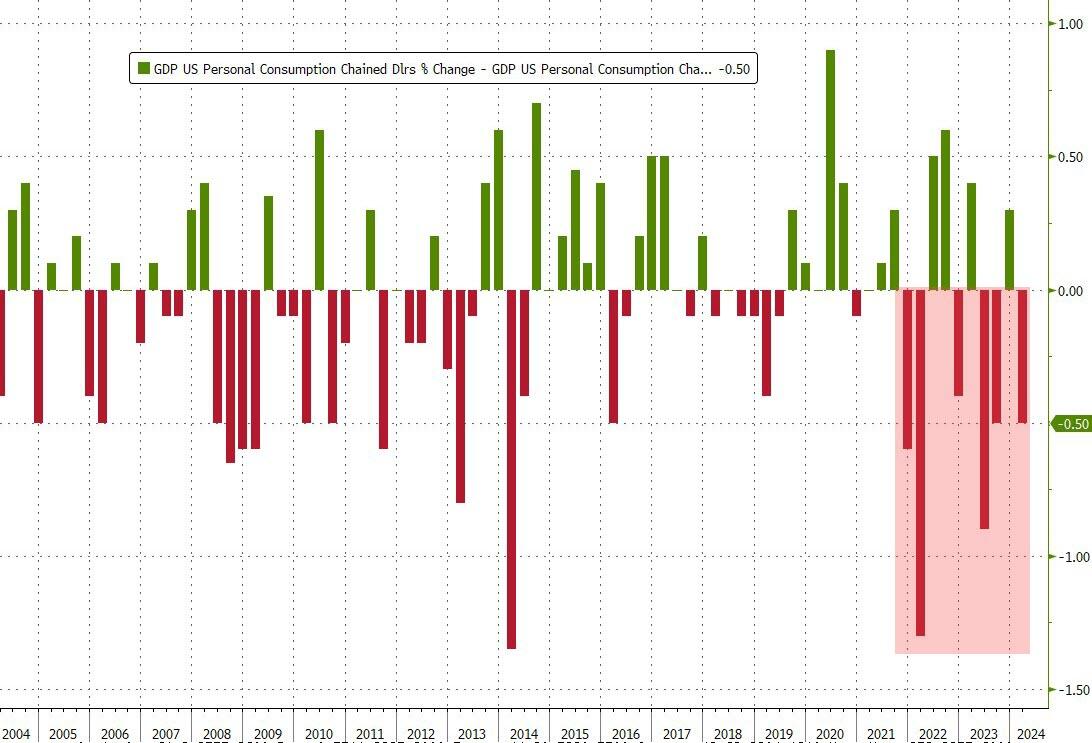

Digger deeper into the data, we find that it was once again the slowdown in consumption that was the biggest culprit, with Personal Consumption rising 2.5%, a big drop from the 3.3% in Q4 and below the 3.0% expected. Taking a step back we find that consumption has now missed on 6 of the past 10 prints.

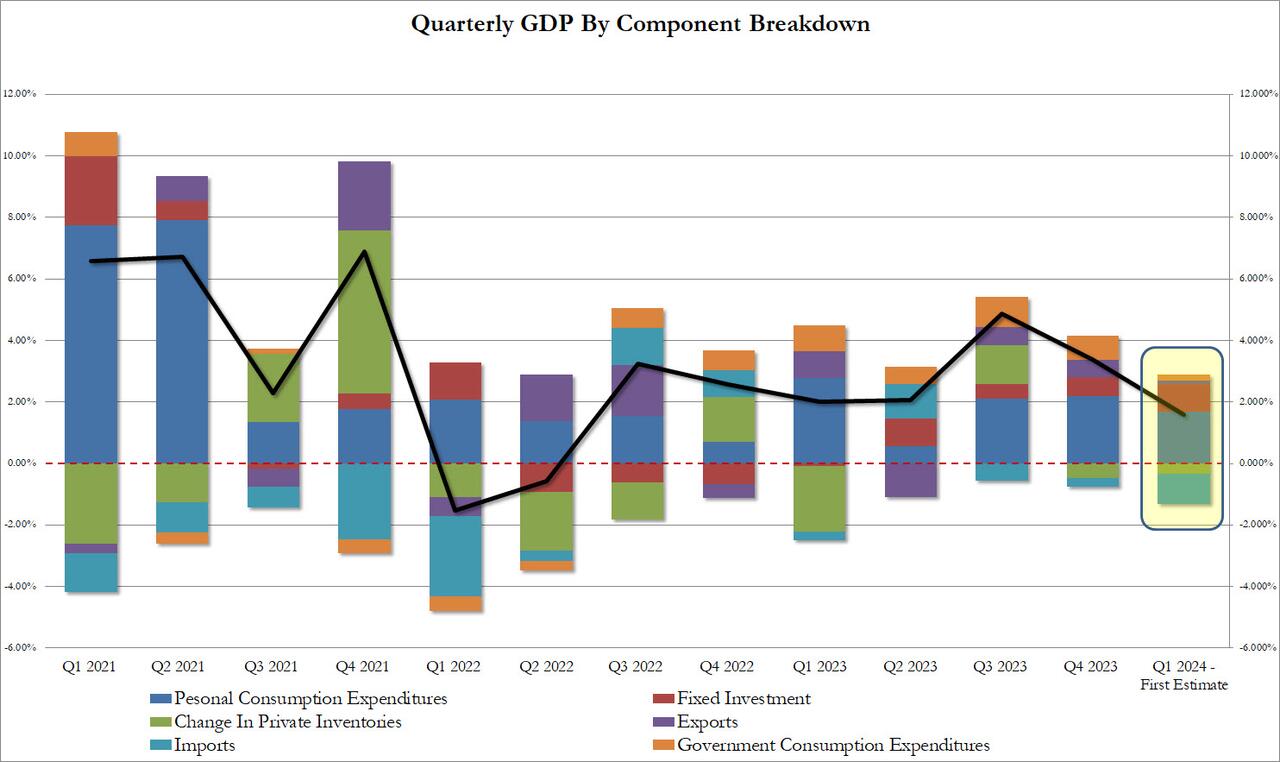

In terms of actual components we find the following picture:

- Personal Consumption added 1.68% to the bottom line GDP print, or more than 100% of it. This was down notably from 2.20% in Q4.

- Fixed Investment rose modestly, to 0.91% of the bottom line contribution, up from 0.61% in Q4.

- The Change in Private inventories continued to detract from GDP for the 2nd quarter in a row, reducing the bottom line GDP print by 0.35%, a modest improvement from the -0.47% in Q4.

- Net trade was a big delta, and after contributing 0.25% to the Q4 3.4% GDP print, in Q1 it subtracted 0.86% from the actual print.

- Finally, government continues to be a contribution but in Q1 it added just 0.21%, a big drop from the 0.79% in Q4 and the lowest since Q2 2022 when it reduced GDP by 0.29%.

And visually:

That was the GDP side of things, what about the inflation/PCE? Well, this is where things get really bad, because after PCE came in hot in Q4, it came in even hotter in Q4, as GDP prices, the prices of goods and services purchased by U.S. residents, increased 3.1% in Q1 after increasing 1.9%, and above the 3.0% estimate. Excluding food and energy, prices increased 3.2% after increasing 2.1%.

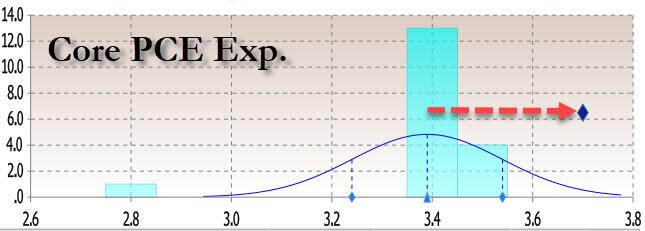

Turning to the all important PCE, Personal consumption expenditures prices increased 3.4% in the first quarter after increasing 1.8% in the fourth quarter. And the punchline: excluding food and energy, the all important core PCE price index increased 3.7% after increasing 2.0%, and coming far hotter than the 3.4% estimate; in fact it came in above the highest estimate!

This, according to Fed-whisperer Nick Timiraos, implies that the March core PCE number which is reported tomorrow, must be higher than +0.22, closer to +0.3% (which is precisely where the estimate is), and would imply upside revisions to Jan and Feb.

Commenting on the report, Fitch economist Olu Sonola writes that “the hot inflation print is the real story in this report. If growth continues to slowly decelerate, but inflation strongly takes off again in the wrong direction, the expectation of a Fed interest rate cut in 2024 is starting to look increasingly more out of reach.”

The bottom line: while a sharp slowdown in growth would have been just the “bad news is good news” the market was desperately hoping for, throw in the unexpected surge in prices and suddenly the threat of a full-blown stagflationary shock is once again front and center… at least until tomorrow, when we wouldn’t put it past this admin to come out with another fabricated core PCE print which makes no sense and somehow comes in well below the 0.3% MoM estimate.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

A lot of stuff is going to shit but none of my oil or gas/pipeline stocks are down even $1 a share. “Something wicked this way comes.”

So what is your crystal ball telling you.

Gas, oil, pipelines. Tangible things people need. Green crap is a loser almost always after the fad fades.

Personally I always go against whatever Goldman Sachs and shitheads like CitiBank say. If they say dump Oil and Gas, buy Oil and Gas, et cetera.

Beyond that we have a profoundly stupid, dishonest grifter supposedly in charge backed by a legion of anti-American scum and low IQ minorities with zero economic knowledge. Barking dogs like the entire Black Caucus and Democrat Communists. Weimar Joe wants to eliminate the Trump tax legislation, raise the Capital Gains Tax to 44.5% and is fascinated/obsessed with the totally disproven idea of taxing unrealized capital gains. The amount of damage this would do to individuals, let alone industry is incalculably BAD.

Anyone with any investments or retirement account would be slaughtered. Everyone would need to hire extremely expensive CPA’s to do their taxes.

It is also claimed he wants to tax unrealized gains in the value of your house and business. For example, if your house is supposedly worth $100,000 more than you paid for it 30 years ago, he might say you owe, right f’ing now, $44,500 for your unrealized gain. We would be reduced to an agrarian society in 18 months.

FJB

With a rusty oil auger.

Update: The amount he wants on the increased value of your house is ONLY 30%.

Nicely done, HR

Tick-tock………….best get your assets out of this rotten to the core system while you still can !

Vaporware and whizbang tech stuff with 500-1 PE’s are likely to go pfffft if this isn’t just the usual several percent jolt we get every few months. Things like Tesla will really get clobbered, maybe destroyed.

And this happens regardless WTF is in the WH. Time and time again.

Even if you believe the government figures, we’re maintaining ~ 2% GDP growth by running deficits equal to 9% of GDP. That’s like maxing out your credit cards to take vacations and then marveling at your fabulous lifestyle.

So you know my wife’s brother?

And I thought it was my ex-wife he was talking about. The reason she is an ex-wife too.

Bro-in-laws fav saying was – ‘blow before you go’ couldn’t save a nickel if he tried.

Well, you can’t take it with you and the GOV won’t let you leave it to anyone without robbing you posthumously.

There seems to be a good amount of faith AND logic involved in his decision.

I’ve personally settled on a hybrid of the two sides…a sort of “happy” medium?

Actually it came down to lack of self control and selfishness. He was killed in an accident while working in Japan, left his two daughters with more expenses than benefits. Zero benefits.

Like with everything, balance in all things…

I’m sorry to hear that.

Just remember…life is tough, but it can only beat you to death ONCE!

You have a choice. Believe math or believe Democrat communist bullshit.

It was GOV that TAUGHT you math! More than a little likely it WAS fucking Democrats doing the teaching as well.

It’s a thinker.

Maff is hard for 50% of the population, the liberal portion of the population, so the will be believing the government.

120% of the experts agree

Makes perfect sense to me. Responsible adults don’t spend money they don’t have. They think beyond today…a practice long in ill repute in this fake ass economy and country.

I think that guarantees a 100 million votes, minimum.

This fits nicely with yesterday’s news to the extent that BLS has been cooking the books.

800k fake jobs just in Q3. I believe they are running out of ways to lie, lies to cover the lies, and ways to keep lying.

The only things that made the charade somewhat credible is Pedo Joe restarted the shuttered economy and massive deficit spending. Time for the post-party hangover.

Good news, Bad News…Biden’s at the helm, however this ships named Titanic. You figure it out…what could go wrong.

My fear is FJB and his cohorts are purposely screwing up the economy in order to lose the election, then have the Fed f&ck Trump presidency to permanently kill the remaing few Repubs that have a brain. Afterwards we get a Kamala or AOC type president to lead the final solution – kill off the middle class.

There are some studies out now according to Redacted that food prices are going to double again in the next year. If that happens, shit is going to get real hard, real fast.

In some parts of the country, people are already being robbed of their groceries trying to load them into their car.

By next year, you may need to use your CCW to go grocery shopping….

Better have it when you go to a dollar general