The linear thinkers that dominate the mainstream media and the halls of power in Washington D.C. are assessing the series of disasters in Japan without connecting the dots of history. Their ideological desire to convince people that things will go back to normal in short order flies in the face of the facts. It makes me wonder whether these supposed thought leaders lack true intelligence or whether their ideological biases convince them to lie. At the end of the day it comes down to wealth, power and control. If those in power were to tell the truth about the true consequences of demographics, debt, disasters, and devaluation, their subjects would revolt and toss them out. Before the multiple disasters struck Japan last week, the sun was already setting on this empire. The recent tragic events will accelerate that descent.

Japanese Beetle Meet Windshield

Smart financial minds have been expecting a Japanese economic tsunami for the last few years. John Mauldin described Japan’s predicament in early 2010:

“I refer to Japan as a bug in search of a windshield. I am not so sure about the timing, however, as the economic and fiscal insanity that is Japan may be able to go on for longer than many think possible. But to me it is not a question of whether there will be a crisis, but when there will be one. This year? 2011? 2012? I doubt Japan makes it to the middle of the decade with a very serious and sad day of reckoning.

The downside to the continuation of running massive deficits is that when the break does come, it will be all the more painful and difficult to deal with as the debt mounts. If there is an upside, it is for the rest of the world to see what can happen to a developed country like Japan when massive deficits are allowed to pile up one after another. It will be a morality play writ large upon the walls, which cannot be dismissed.”

Ambrose Evans-Pritchard expected a 9.0 debt earthquake to strike Japan in 2010:

“Weak sovereigns will buckle. The shocker will be Japan, our Weimar-in-waiting. This is the year when Tokyo finds it can no longer borrow at 1% from a captive bond market, and when it must foot the bill for all those fiscal packages that seemed such a good idea at the time. Every auction of JGBs will be a news event as the public debt punches above 225% of GDP. Finance Minister Hirohisa Fujii will become as familiar as a rock star.

Once the dam breaks, debt service costs will tear the budget to pieces. The Bank of Japan will pull the emergency lever on QE. The country will flip from deflation to incipient hyperinflation. The yen will fall out of bed, outdoing China’s yuan in the beggar-thy-neighbor race to the bottom.”

Mr. Pritchard was either wrong or early, depending upon your point of view.

JAPAN INTEREST RATES

Japan can still borrow for 10 years at 1%. Despite the highest government debt as a percentage of GDP on the planet at 225%, Japan has not felt the wrath of the bond vigilantes. Not only did the Yen not fall out of bed, but it soared to a post-war high against the USD last week after the earthquake/tsunami. Investors drove the value of the yen higher, anticipating a huge rebuilding program in Japan. Japanese financial institutions would need to convert foreign assets into yen to pay for damage claims and construction expenses, a process that would strengthen the currency. In anticipation, investors piled into yen, helping drive up its value. Central banks across the globe intervened and weakened the currency, for the time being. When the world comes to its senses, the Yen will weaken on its own.

Debt & Demographics

Japan is a one trick pony that just broke two legs and is waiting to be put down. They have experienced a two decade long recession. Their stock market is still 70% below its 1990 peak. They have no natural resources. They allow virtually no immigration. And their population is in a death spiral. The one and only thing they have going for them is their phenomenal ability to manufacture high quality products and export them to the rest of the world. The earthquake and tsunami that struck Japan severely damaged their just in time manufacturing machine. A surging yen would destroy their export machine by making their products more expensive. Hundreds of high tech Toyota, Honda, and Sony factories are shut. Four hundred miles of ports and harbors have been wiped out. There are rolling blackouts, with one million households without electricity. Over 500,000 people are still homeless.

The short-term impact of this disaster will push Japan into recession. The rebuilding efforts over the coming years will create a positive GDP figure, but will not do anything to benefit Japan over the long haul. The billions designated to rebuild will be money not invested in a more beneficial manner. The linear thinkers conclude that over the long-term Japan will be OK. These people are ignoring the double D’s – Debt and Demographics. When Japan entered its two decades of recession and experienced the Kobe earthquake in 1995, its government debt stood at 52% of GDP. Today it stands at 225% of GDP. Twenty one years ago, the Japanese population was still relatively young, with only 12% of the population over 65 years old. The population of Japan peaked in 2004 and now is in relentless decline. Over 23% of the population is over 65 and the median age is 45 years old. For comparison, the median age in the U.S. is 37 years old, with only 13% over 65. The projection portion of the chart below paints a picture of death. The population of Japan is aging rapidly and will decline by 4.4 million, or 3.5% in the next ten years.

The question I pose to the mainstream thinkers is, “How can a country with a rapidly aging population and nearly one quarter of its population over 65 years old generate the necessary dynamic enthusiasm for rebuilding a shattered country?” Youthful enthusiasm and hope for a brighter future is essential to any enormous rebuilding effort. Japan does not have it in them. News reports already indicate a lethargic and seemingly insufficient response by emergency workers. The devastation seems to have overwhelmed this aging country. The psychological impact of this type of natural disaster will likely have two phases. Psychology professor Magda Osman describes the expected human response:

“After a disaster, typically small communities become incredibly co-operative and pull together to help each other and start the rebuilding process. There’s an immediate response where people start to take control of the situation, begin to deal with it and assess and respond to the devastation around them. The problem is that we aren’t very good at calculating the long-term effects of disasters. After about two months of re-building and cleaning up we tend to experience a second major slump when we realize the full severity of the situation in the longer term. This is what we need to be wary of because this triggers severe depression.”

This would be the normal response of a traumatized populace. An aged populace is likely to experience worse depression and not bounce back from this tragedy. Japan is still the 10th most populated country on earth, with the 3rd largest economy. China just passed Japan to become the 2nd biggest economy in the world. India will pass Japan by 2012.

Youthful countries across the world are gaining on Japan. The wisdom of the elderly doesn’t cut it in a global economy. Global competition is cutthroat. China, India and the other emerging Asian countries will take advantage of Japan’s misfortune by filling the hole left by Japanese manufacturers. The short-term issues of power, supply lines, and reconstruction are minor when compared to a mass die off of the Japanese population that will result in a population that is 25% smaller in 2050 than it is today. Demographics are a bitch.

With the amount of debt hanging over the Japanese empire, it might be a good strategy to commit hari-kari. The non-thinking pundits on CNBC contend that since Japan hasn’t had any detrimental effects from running their debt to 225% of GDP, running it to 300% won’t be a problem. Reinhart and Rogoff studies concluded that once a country breaches the 90% level, growth slows and a debt crisis is likely to ensue. Japan has been stuck in a 20 year recession, as they chose Keynesian shovel ready projects, quantitative easing, currency manipulation, and covering up the true financial condition of its banks over accepting the consequences of a debt bubble. Remind you of anyone? The result is their real GDP is lower today than it was in 1995. The Paul Krugmans of the world would contend that they just didn’t spend enough.

The only reason Japan has not collapsed is due to its homogeneous population willing to buy virtually all of the debt issued by its government for the last twenty years and its prodigious ability to produce high quality products that the rest of the world wants. Japan has maintained a consistent trade surplus, and its government debt has been held mainly by its own people, with 95% of Japanese government bonds in the possession of Japanese, meaning the country was able to finance itself without depending upon fickle foreign investors who might prefer a return greater than 1%. This ain’t 1990. The savings rate of the Japanese population had already declined from 14% in 1990 to 2% by 2008. In a recent article, Mike Shedlock explained the situation prior to the recent devastation:

“The Government Pension Investment Fund, which oversees 117.6 trillion yen ($1.4 trillion), in September forecast that it would sell 4 trillion yen in assets in the business year ending March 31 to fund payouts. Sales by the fund, which helps oversee public pension funds for Japan’s 37 million retirees, come as the first of Japan’s baby boomers is set to turn 65 in 2012, making them eligible for pension payments. Japan choices are to default on its debt, print money to fund interest on the debt, raise taxes effectively robbing savers of their money, or undertake huge spending cuts. The dilemma stems from years of Keynesian and Monetarist stupidity.”

The new tragedy will just accelerate the conversion of Japanese savers into forced spenders. Millions of Japanese savers will be forced to spend their savings on survival, as many have lost their jobs and businesses due to the monumental damage to northern Japan.

Setting Sun – Race to the Bottom

Traders figured out what must happen over the coming years. A large swath of Japanese insurers and companies will begin repatriating assets held in other currencies to begin the rebuilding effort at home, driving the value of the Yen higher. At a time of crisis a stronger Yen would severely damage Japan’s export based economy even further. Therefore, Central Banks around the world jointly intervened. The Bank of Japan spent Y2 trillion ($25 billion), while central banks across Europe contributed $5 billion and the Federal Reserve spent $600 million to push down the yen on Friday. The Bank of Japan is doing what they do best – printing money. Quantitative easing is an art form perfected by all Central Banks across the globe. Every disaster over the last twenty years, whether man made (wars, internet collapse, housing collapse, debt meltdown) or caused by nature, are met with the exact same solution – PRINT MONEY.

This method works until it doesn’t work. Japan’s central bank cannot reverse the demographics. From this point forward the population of Japan will be net sellers of government debt. Japanese insurance companies will be on the hook for $33 billion in claims. They will need to sell government bonds in order to make those payments. The World Bank has estimated the cost of rebuilding to be $235 billion. The government will need to borrow this money. At least 30% of its energy needs are off-line. It already imports 95% of its oil and coal. They will need to increase energy imports to make up for the nuclear energy shortage. Its positive trade balance was already in decline. The clueless CNBC pundits can drone on about how this natural disaster will be good for the Japanese economy because of the substantial rebuilding program, but they are dead wrong. Japan is trapped, with no way out. They will need to issue hundreds of billions in new debt, which cannot be bought by its citizens, pension funds, or insurance companies. How many foreign investors will buy a 10 Year Japanese government bond paying 1%, knowing that Japan wants to weaken its currency? NONE. The only choices are to raise interest rates to attract buyers or print more money. With an already suffocating level of debt, they can’t allow interest rates to rise. They would choke on the interest.

The Bank of Japan will follow the same script as Ben Bernanke. They will print new Yen and buy the newly issued debt. What an original idea. Japan is caught in a debt stranglehold and demographic nightmare. Their currency will ultimately collapse like a nuclear reactor after a tsunami. When Japan defaults on their debt, the pain will be intense, as they will be throwing their own aged population under the bus. America, on the other hand, will throw the whole world under the bus when we default.

The Japanese own $886 billion of US Treasuries and have bought $256 billion of our debt since October 2008. Timmy Geithner will need to issue $1.5 trillion of new bonds per year. Japan will no longer be a buyer. They will be a seller. This will put upward pressure on U.S. interest rates. Japan’s reconstruction needs will put pressure on commodity and energy prices. Production and supply problems for Japanese parts and goods are already creating problems for GM and other car companies in the U.S. Lack of supply leads to higher prices. The great earthquake/tsunami/nuclear meltdown of 2011 will result in more quantitative easing in Japan and the U.S. This will result in even more inflation than we are experiencing today. Once the inflation genie is out of the bottle, the race to the bottom will accelerate. Gold will decide who wins the race. It has been a neck and neck race since 2001. I’m not sure it is a race anyone wants to win. But the destination is certain.

“The endeavors to expand the quantity of money in circulation either in order to increase the government’s capacity to spend or in order to bring about a temporary lowering of the rate of interest disintegrate all currency matters and derange economic calculation.” – Ludwig von Mises

Jim

Man, you never fail when it comes to writing a great commentary. Thanks for highlighting some interesting facts on Japan. I want to see some msm pundit try to argue this article. Inflate or die is the global standard.

By the way, I read somewhere that financier, Martin Armstrong, has been released from prison. I believe he is on house arrest in Philly until his time is done. He’d be one interesting dude to have some beers with and he is in you neck of the woods now.

Excellent article exposing the dire predicament in which Japan finds itself. Japan is fucked in every conceivable way.

The only difference between Japan and the USA is that Japan will meet its end through default, and the USA will meet its end a few short years later through the loss of the USD as world reserve currency and/ or hyperinflation.

“Land of the setting sun”?

I am not debating this debatable topic. Whether a sun is seen setting depends very much on one’s position relative to the sun.

I am saying this: The recent natural disaster hit to Japan, albeit a major societal and human life shock, has minor negative economic impact to the country.

The area wiped out is quite small and already quite depressed economically. It’s mainly farmland. The farmland will be cleaned up and after being ‘fertilized’ the sea, will be more productive. Houses and other infrastructure will be rebuilt at a modest cost because they are just that – modest. They are not Tokyo landmarks. Many destroyed boats, houses and such are covered by insurance.

Now let’s get to the nuclear power plant. This is a big asset – not in terms of its old technology, but in terms of the value of generated power output and cost of replacing the lost power now that it is out of commission permanently. This 40+ year old inefficient design is due for replacement anyway and if anything, the tsunami did a fine job of blowing away the politics that has hampered such replacement. [I am assuming there is no core meltdown or major release of harmful radiation.]

Replacing a single although large nuclear power plant is a minor economic affair in Japan.

So the overall economic hit is minor. The lost lives, emotional hits, lost properties of course are deep. Japan will overcome and move on – more wiser, more determined, more societal cohesion, more care. And yes, a heck of a lot better in the design of world’s most robust nuclear power plants. Look for ‘new and improved’ power station products from GE/Hitachi 2015 brochure – Now Tested To Richter 9.0 Earthquakes! Who else can make that claim?

[On the subject of Fukushima Daiichi plant let me blow away the sensational and irresponsible media coverage. The design and operation of this plant is quite safe – 40+ years of operation. After the Indonesian tsunami the levee surrounding this plant was beefed up to withstand a 5m high wave hit. Nobody thought a 10m high hit was possible – but it happened. The cost of doing a 10m levee is tiny – so this is an issue of engineering and system design judgement call. When the 10m wave hit, it knocked out the cooling water pumping station. The reactor cores performed as designed – they withstood a 9.0 hit and survived. We should celebrate that engineering feat.]

Apollo

Read the damn article. It has nothing to do with the tsunami.

Apollo

Is $235 billion for rebuilding a minor negative economic impact in your book? Connect the dots dude.

Demographics are a bitch. In under 20 years the US will have approximately the same percentage of population over 65 that Japan currently has. The US is 20 years behind the curve. This has largely happened owing to the immigrants the US takes in, either legally or otherwise. This did not happen in Japan.

The pressure from the decreasing population over the next few decades will be unbearable. Their current financial position is tenuous at best. They have very limited natural resources. They are truly in a world of pain.

That they have managed to do so well up to this point is incredible. They have received an enormous boon for the last 65 years in that the US has largely funded their national security. If you want a shock, compare their military expenditure as a % of GDP to that of the US. The US has totally funded their national security, except for what is essentially a national guard. Over 25 years ago I proposed via a thesis that the US should be billing the Japanese perhaps 3 or 4% of their GDP each year for the expense incurred by the US for providing their security. It still should be done.

The US welfare system – SS/Medicare/etc. – will collapse under the weight of its changing demographics if something severe isn’t done immediately. What we will see happening in Japan is just the preview of the collapse that will be happening here.

$235 billion for rebuilding, and very little private insurance to shoulder the cost. The Japanese govt. holds most of the insurance policies for residential and commercial losses. I read they have a $60 billion cap on payouts and then they pro-rate the damages.

I agree with llpoh, we are watching our future being played out in real-life via Japan.

Demographics CAN be changed in Japan.

Just send Smokey over there with his 11 1/2 inch schlong, and me with my somewhat smaller shlong. We’ll re-populate the place with millions of young ‘uns in under a year.

.

.

225% Debt? Holy crap. Jim .. anyone … what the hell did they spend it on? Not like they have a trillion dollar military or a ginormous free shit army …. so where did it all go?

Stuck

Their banks in 1995 made our banks seem well run. The Japanese taxpayer paid off the bad debts of their banks. They have done multiple stimulus plans like Obama’s $800 billion flush. They have tried every Keynesian idea over the last twenty years. Result – debt and a stagnant economy.

Stuck – haven’t you ever been in a luxury goods shop (ie Prade/Louis Vitton/Chanel)? The Japs overrun those places.

Tiffany’s largest market base is in Japan. They must like diamonds.

Llpoh

Sorry that was my post.

Is Dick’s Big and Tall (a real name) a luxury goods shop? Otherwise, no, i have never been in such a store. Besides, what does personal debt have to do with goobermint debt?

Apollo, salt is NOT condusive to growing crops. Therefor the sea is NOT going to count as fertilizer. If anything it will fallow the land. Try salting your houseplants and see what happens.

@Admin

I am quite aware of all the sensational financial numbers being thrown around (especially by US TV media hypers). These numbers are useless and Japan does not operate according to American concept of economics and finances. (I worked for a major Japanese corporation at the mid-exec level for 6 years and spent 2 years in Japan – just so that you know I am not just another fucking taking head.) I stand by my view that the economic hit, being spread out over the years to rebuild, is minor compared to GDP. In Japan many things are done without the need to count the Yen. In America, nothing is ever done without over-counting the dollar.

I did say I am not commenting on the big topic of Japan sun setting. I did read the article. But the topic is too complex to say much in this forum.

ah, to complex for us to understand. thank you for sparing us from worrying our pretty little heads.

Apollo

I don’t quite understand what you mean when you say, ” In Japan many things are done without the need to count the Yen. In America, nothing is ever done without over counting the dollar.”. Can you elaborate?

As mentioned in a few of my recent Rants, “The Sun has Set in the Land of the Rising Sun” 😉

RE

Stuck – I was being funny – but now that you mention it, private debt in Japan isn’t small taters either – see the chart above, but it seems to be around 113% in 2009.

I go to Dicks Wide and Long, by the way. A real specialty store. Smokey and I are Gold Class customers.

Apollo

“The new tragedy will just accelerate the conversion of Japanese savers into forced spenders. Millions of Japanese savers will be forced to spend their savings on survival, as many have lost their jobs and businesses due to the monumental damage to northern Japan.”

In addition to your ridiculous farmland statement which KaD has accurately addressed, what do find wrong with the above quote from the article? I realize that only a small proportion of Japan’s population was directly affected by this catastrophe, but when 30% of the nation’s electrical power gets knocked out, what do you expect the results will be? My answer is the above quote I lifted from the article.

Jim – one of your best and most original essays of late. You lay out a very strong case for an awful future. {golf clap} Maybe it will be a wake up call, but probably not. The world is just lurching from disaster to catastrophe to apocalypse.

SSS – I have never seen the 30% electricity outage figure before. I have understood that the failed reactors are perhaps 3% of the total generation capacity, plus some knocked out temporarily by the quake/tsunami. I

It’s Ambrose Evans-Pritchard

HERE IS AN EMAIL RECEIVED FROM RE’S FRIEND STONELEIGH ABOUT MY JAPAN ARTICLE AND MY RESPONSE:

From: Ilargi Stoneleigh [mailto:[email protected]]

Sent: Monday, March 21, 2011 11:20 PM

To: Quinn, Jim

Subject: Re:

yeah

deflation

MY RESPONSE:

You evidently don’t do your own grocery shopping or drive a car or pay real estate taxes or pay your kid’s tuition or have a medical deductible that doubled. I wish I had your deflationary life.

Apollo tries to come off as an authority on Japan because he says he once lived and worked there. Instead of revealing any worthwhile knowledge of Japan, Apollo’s words are hollow and reveal a desperate attempt for recognition as an important person. A person with wise answers to foreign economic dilemmas.

AES

Admin, nice article and answer, (at 09:01 am).

Good article Jim.

Japan’s old motto: Export or Die

Japan’s new motto: Immigration or Die?

The treadmill is broken. Don’t judge by appearances or economic models that no longer work. And don’t second guess the Jananese mind. The Jananese are proud and productive people; they will survive and rebuild their economic system. What is the game changer in all this is the radioactive fallout that is ruining their land. Reminds them of WW2. Memories of WW2 are still burned into their minds of what damage atomic power can do. They will sacrefice lives to contain the damage these ruined nuclear power plants are doing to their lands and their population. Once contained they are going to surprize the modern world. Don’t be surprized if they close the rest of their nuclear plants, modern manufacturing plants, and go back to 19th century society.

Some will scoff at this prediction and for those that do all I can say they are in for a rude awakening. This country will not be far behind them; except that america will go into this senario kicking and screaming, and gnashing of teeth.

We are at peak everything, encluding the size of our control systems for population control. The wheels are falling off our economic and political systems. We have made the mistake of thinking the ultimate human intellectual flaw of assuming computers and the internet can finally bring centraliztion of government control to one world government.

Look around the globe and there is no doubt political and economic systems are collapsing. We are now in the phase of going to war to grab the remaining resources to keep our economies going; but it is a losing battle. We are now spending those very resources to keep our economies going on war. How much oil do you think our military is using just to keep the war machine going? Think about it. Western civilization as we know it is about to collapse in turmoil. The insanity of thought amoung the politicians and people is now driving the collapse.

So as we look at the “land of the setting sun” and ponder its future, set back in your armchairs and detach yourselfs for a few minutes from your intimate connections to the economic & political system you are involved with, and just look dispassionately at what is going on in our country and around the globe. You will see a picture of insanity of thought and confusion. You will see wars and contention among people of all colors. You are looking at the economic and political systems that have failed; only many have not figured it out yet because of confusion.

Prepare your minds for change.

Jim,

Excellent analysis, spot on. It is one thing to read about situations. Then you (as always) took it a step further with the facts & figures along with the analysis to give a crystal clear picture of the situation. The figures are amazing. This one is not good.

The parasitic dollar/yen carry trade will unwind with the repatriation of Japanese capital (at no matter what velocity). The Japanese invented quatative easing, and now that the USofA is embraced this, it is a matter of time the forces of physics overwhelm these actions.

Smokey is on with the dollar situation, are the forces of DOOM, the unwind of the dollar/yen carry trade, the with a weakend dollar, the dollar/oil trade is finished, then no more dollar reserve currency?

Apollo, salted earth, the Romans obliterated the Carthaginians, not only with brute military force, but with salt. For after the Roman Legions defeated the Carthaginians in the third Punic War, burned, burned, raped and murdered everyone else, then the Romans spread salt upon the land to make it unhabitable, laying Carthage to dust.

Beware of Bearded Economists:

A short list of bearded economists that appear on financial TV:

Ben Bernanke

Paul Krugman

Joseph Stiglitz

Robert Reiiiiiissssssssssssssssh

Dean Baker Samuelson

THE REAL INFO IS NOT ON CNN or FOX. THIS FROM OIL DRUM WEBSITE:

The Japanese fuel crisis

Posted by Heading Out on March 21, 2011 – 11:01am

One consequence of the Japanese earthquake and tsunami that is not receiving as much press as the ongoing struggle to cool the damaged reactors, but which continues to influence more people, is the lack of fuel. Nine of the Japanese refineries were damaged and put out of action, and this dropped the amount of fuel being refined from 4,500,000 bd down to 3,100,000 bd. (Note that the Guardian report I quoted earlier was off by a factor of ten.) The lack of fuel for transportation affects not only those in the disaster area, but also those away from it, since food and fuel itself depend on transport to move it to customers around the country.

“What we urgently need now is fuel, heavy and light oil, water and food. More than anything else, we need fuel because we can’t do anything without it. We can’t stay warm or work the water pumps,” said Masao Hara, the mayor of Koriyama city, in Fukushima prefecture.

The refineries that remain in production are responding to the need. Idemitsi Kosan has raised production at its four refineries by 83,200 bd (from 87% to 100% production) and Cosmo Oil has raised production at its two operating refineries by an additional 80,000 bd but this does not match the size of the problem.

There are several different aspects to the problem; first the oil has to come ashore. With ports closed and unable to re-open for possibly months, shipments from the Middle East, which supplies 80% of Japan’s need, have now been curtailed until the situation becomes clearer. Within the country, the Japanese Government has released around 8 million barrels of oil from their strategic reserve. It is also shipping 250,000 barrels of refined product to the area affected by sea (though this runs into the issue of how to get into the ports and distribution network). At Chiba some of the port has been able to re-open but not the terminal that fed to the Cosmo refinery (since that had burned).

STONELEIGH RESPONDS TO MY EMAIL BY NOT RESPONDING TO MY EMAIL. THEORETICAL DISCUSSIONS ARE MEANINGLESS IN MY BOOK

From: Ilargi Stoneleigh [mailto:[email protected]]

Sent: Tuesday, March 22, 2011 12:40 PM

To: Quinn, Jim

Subject: Re: RE:

your definition of inflation and deflation just ain’t correct

as we have explained many times, rising prices do not equal inflation

this is not a trivial point, or subject to personal preference

because accepting that false definition

you lose track of where inflation truly lies

which is in expanding money and credit supplies

and both are contracting presently in the US

hence the rising prices originate somewhere else, not in inflation

I think it’s very important to be aware of the differences involved

and yes, I’ll write it all down once again soon

the US is already in deflation, and it will be much more so soon.

simple really: homeowners have lost about $7.5 trillion

while financial institutions have lost at least as much, probably 2-3 times more

Bernanke would have to make up for all those losses,

and then on top create 2-3 times that, say $50-60 trillion,

to get anywhere near hyperinflationary tendencies

are there really people who see that as a genuine option?

MY RESPONSE, WITH A FURTHER QUESTION:

“By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens…If a government refrains from regulations and allows matters to take their course, essential commodities soon attain a level of price out of the reach of all but the rich, the worthlessness of the money becomes apparent, and the fraud upon the public can be concealed no longer.” – John Maynard Keynes

“hence the rising prices originate somewhere else” – Stoneleigh

Hence, where are the rising prices originating?

” … as we have explained many times, rising prices do not equal inflation …” Stonleigh

Wow. Stunning new revelation for me. I suppose it’s also true that;

a) my blood-filled weenie is not an erection

b) the $4,000 on my credit card is not debt

c) the thingee in my driveway is not a car

d) my spermatoza and the former Mrs Stucky’s egg did not produce sons

e) the thingee on my wall that required 4 years to get is not a college degree

Fuckity Fuck Fuck Fuck. Everything I thougt IS … is NOT. My whole world is topsy-turvey. HELP!!!!

How does Japan’s holdings of $900 billion dollars of US treasury holdings figure into all of this? Technically can’t they sell the treasury bonds? Of course, the dollar is worthless and the US ponzi scheme would collapse, but isn’t that the point they are holding these treasury bonds, for a rainy day?? Why should they dilute their own currency, when they hold our debt?

Mark

They will be selling US Treasuries. Not all at once, because that would decrease their value as interest rates rise.

Crash JP Morgan, Charge Silver! (Using JP Chase’s Freedom 0% APR rewards card)

Lets take this viral guys!

http://silverdoctors.blogspot.com/2011/03/crash-jp-morgan-charge-silver.html

Following Radioactive Rain, Radiation In Tokyo Jumps 10 Fold, Hitachinaka Iodine 131 Surges To 85,000 Becquerels

Submitted by Tyler Durden on 03/22/2011 13:25 -0400

Once again, we are left scratching our heads as to just where is it that the mass media is seeing an improvement in the Japanese radiation crisis. Because reading domestic media leaves one with a completely different impression. To wit, from the Asahi: “Iodine 131 detected in Tokyo hit 12,000 becquerels, compared with the previous day: a tenfold increase in both radioactive Iodine and Cesium.” As for Hitachinaka City, which according to SPEEDI has seen a surge in radiation over the past 24 hours, things are far worse: “Hitachinaka City, Ibaraki Prefecture, saw the highest radioactive values recorded, with 12,000 becquerels of cesium, iodine and 85,000 becquerels.”

Per Asahi (google translated):

Ministry of Education, under the influence of Fukushima Daiichi nuclear power plant accident, announced the results of such measurements with radioactive dust fell from the sky. Tended to increase mainly in metropolitan areas. 5300 becquerels per square meter of cesium in Shinjuku, Tokyo 137,3 detection of iodine 131 becquerels 12,000, compared with the previous day, rose about 10 times the concentration of both. The values ??that affect health, but prolonged monitoring is needed.

Measurement of radioactive fallout, we put the nation at 9:00 am on October 22 from 9 am to 21 the ministry, were analyzed.

The value of Tokyo, yesterday’s Cs 560 Becquerel, Becquerel 2900 soared from iodine. Announced value of the cesium 22, 8 / 1 40,000 becquerels of radiation controlled area reference value, iodine value, amount to five quarters.

The values ??of cesium in other municipalities, the 1600 Becquerel Saitama City (790 becquerels day), Kofu, 400 becquerels (the non-detection), Utsunomiya 440 becquerels (250 becquerels same), and rose across the board.

The day before, in Hitachinaka City, Ibaraki Prefecture, the highest values ??were recorded, although down slightly, 12,000 becquerels of cesium, iodine and 85,000 becquerels, still higher values ??are recorded. Fukushima and Miyagi can not be measured.

In the east, where it snowed a lot of rain and dust and floating in the atmosphere, believed to have dropped radioactive material. The short half-life of iodine, 8 days half-life of cesium in 30 years, continue serving after getting off the ground a long period of radiation. Soil and water, because it could lead to radioactive contamination of agricultural products, should continue to monitor future.

Where is the U.S. mainstream media on this?

http://www.youtube.com/watch?v=lm_4gS_qafM (1.5 min)

or this?

http://www.youtube.com/watch?v=iQqP1sNPFPw (1.5 min)

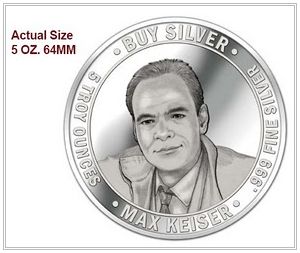

@ Silverdoctors

Have you seen the Max Keiser silver rounds?

[img]http://cgi.ebay.com/ws/eBayISAPI.dll?VISuperSize&item=290548150259[/img]

[img [/img]

[/img]

[img]javascript:;[/img]

@KaD

Any high school grad knows sea salt messes up farming. I did say affected farmland will be ‘cleaned up’. What I am referring to is the churning and mixing of old farmland by the tsunami will rejuvenate the land because it also brought in sea mud. Count on the Japanese being smart enough to fix up the land better than before.

Most of my piece dealt with the power station. I pointed out some facts to debunk media sensationism and hysteria. I.e. do the job they are supposed to do. I am pleased nobody thus far hit me on that one.

ok, apollo, prepare to be quite displeased.

“This 40+ year old inefficient design is due for replacement anyway and if anything, the tsunami did a fine job of blowing away the politics that has hampered such replacement. [I am assuming there is no core meltdown or major release of harmful radiation.]

Replacing a single although large nuclear power plant is a minor economic affair in Japan. ”

heh.

first, your dual assumptions were both long invalid long prior to your post. core meltdown, as well as very likely meltdown of at least some of the stored rods outside of any of the three on-line reactor cores began about a week ago. not complete meltdown, but core meltdown nonetheless.

and if this has not yet been a major release of harmful radiation, i would hate to see your idea of minor release.

i doubt anyone would argue that safe, uncomplicated shutdown of a single nuclear plant would be a major economic affair for a nation with annual GDP of roughly $5 trillion. i also doubt anyone with a brain suggested otherwise. and i know that has diddly to do with this situation. even prior to the radiation release; it was the quake and tsunami, not a single frigging power plant.

not only is this a straw man point, it is one of the dumbest straw men points imaginable to be tossed off discussing japan’s future prospects.

you then go on to proclaim that we should celebrate the engineering feat of this burning, crumbling, poison spewing, deadly to those desperately attempting to regain control of the fuel rod genies. wtf? so incredibly well designed and engineered, it completely failed and risks the lives of tens of thousands at the very least. three fucking cheers.

while your post is truly one of the most ignorant and mind-numbingly inane posts i have even seen on the internet, that is not a big deal. people post stupid crap all the time.

but you condescend to refuse to further support your ridiculous assertions, claiming to be expert based on two years in country with a single corporation. claiming ‘it’s too complex to discuss here’.

take your condescension, your complexity, your vast experience and knowledge of arcane japanese corporate and societal culture, your alternate accounting system in which counting yen doesn’t matter (the one mildly intriguing point, as they have been printing yen for two decades w/o succeeding at weakening the currency–at least not yet), just take all of that and shove it in your ear. while shoving the ignorant garbage you posted above in the other.

Japan’s external debt is 36% of GDP. If they default, it will be to themselves, and they are a homogeneous population they knows how to hang together, which is a foreign notion to Americans.

http://www.nationmaster.com/graph/eco_deb_ext_pergdp-economy-debt-external-per-gdp

Benign

Did you read the article? The senior citizens will be selling the existing debt and no longer buying the new debt. This isn’t 1990. It is 2011 and the Japanese population has entered a death spiral. Demographics don’t lie. Open your eyes.

Benign,

So goes Japan, so goes the U.S. Seniors in Japan don’t make squat on their bonds, they have to live, so they sell bonds or other investments. The same thing is happening here, you hold low interest bonds, or take risk in the stock market. You have to have income to live. Pension Funds have to make money to send to pensioners.

Japan, Europe, and the U.S. have reached their maximum debt level, our living standards is going to take a hit.

The Japanese have it all under control.

[img [/img]

[/img]

RE

[img [/img]

[/img]

RE

[img [/img]

[/img]

RE

Jim, I would believe this but we all just witnessed the forex markets being manipulated to favor Japan. This madness can go on for a LONG time.

Radiation Level At Fukushima Reactor No. 2 At Its Highest Level Recorded So Far, Neutron Beam Observed 13 Times

Submitted by Tyler Durden on 03/23/2011 08:52 -0400

Per the Japan Nuclear Agency: the Radiation level at Fukushima reactor No. 2 at its highest level recorded so far. Only headlines for now. And just as the market was starting to buy the endless lies that things are getting better. And some more truthy news from Kyodo:

Electric Power Co. said Wednesday it has observed a neutron beam, a kind of radioactive ray, 13 times on the premises of the Fukushima Daiichi nuclear plant after it was crippled by the massive March 11 quake-tsunami disaster.

TEPCO, the operator of the nuclear plant, said the neutron beam measured about 1.5 kilometers southwest of the plant’s No. 1 and 2 reactors over three days from March 13 and is equivalent to 0.01 to 0.02 microsieverts per hour and that this is not a dangerous level.

The utility firm said it will measure uranium and plutonium, which could emit a neutron beam, as well.

In the 1999 criticality accident at a nuclear fuel processing plant run by JCO Co. in Tokaimura, Ibaraki Prefecture, uranium broke apart continually in nuclear fission, causing a massive amount of neutron beams.

In the latest case at the Fukushima Daiichi nuclear plant, such a criticality accident has yet to happen.

But the measured neutron beam may be evidence that uranium and plutonium leaked from the plant’s nuclear reactors and spent nuclear fuels have discharged a small amount of neutron beams through nuclear fission.

@howard nyc

Your attempt to outdo Smokey falls way short. Keep trying. You need to up the obscenity and absurdity. At the same time, I am really disappointed that Smokey did not utter a single obscenity when he hit me on this thread. Could be he got radiated by the Japan nuke and what’s left of his brain undergone fusion. Suggest you spend some time worrying about the nuke power plants in NY. The Feds ordered an emergency review on one of them – just to let you know so you can enjoy that peace of mind. Maybe you can give them advise – after all you live close to the freaking plant. Some actual Pu radiation exposure will do you some good.

truest thing you’ve said on this thread–that i come up short of smokey in this one respect. only this one respect.

Japan is in the last throes of a 26 year old economic depression to end in 2016. The fact that a full blown economic disaster will sweep Japan is no surprise as it is happening now to the West and the USA as well.

The difference is the USA, and Europe, will still be faced with a 20 year Economic depression period with their aging population. Japan, in about 5 years, will be free and clear – and out of the woods.

Administrator.

The damage to the land and suffering of the Japanese people as a result of this ongoing nuclear disaster cannot be measured in money; and therefore, don’t be surprized if reconstruction involves a curtural adjustment away from the status-quo systems.

Japan is forever changed by this. It is not the earthquake or Tsunami that will affect this cultural change; as these people have been experiencing these disasters for thousands of years, but rather it is the damage from the incorporation of nuclear power in their society. They have been burned twice now, the first not their doing, but the second is their doing.

I will not be surprized if the Japanese repudiate nuclear power. A society can rebuild after an earthquake and Tsunomi, but it cannot reclaim the land after it has been poluted by radioactive fallout. Without the land there is nothing. Does anyone doubt that there will be a future earthquake and Tsunomic to hit Japan? Japan is in a geological area of the world where earthquakes are common. If this is agreed then what sense does it make to continue operating nuclear power plants in such a zone? None. The Japanese are not stupid. My bet it that they will reject nuclear power plants. Why? Because no one can quarantee or insure 100% that a nuclear accident will never again happen.

Smokey, you really are a fart in an elevator.

JIM,

Can Japan just print up money and secretly buy gold and silver like China is doing?

silverbug

They still have a trade surplus, so they don’t even need to print it up. They have chosen to buy US Treasuries rather than gold and silver. They buy our debt and we buy their Sony TVs and Honda Civics.

Radiation detected in Tokyo’s tap water; smoke prompts new evacuation of leaking nuclear plant

In Higashimatsushima in Miyagi prefecture, about 200 miles (320 kilometers) northeast of Tokyo, soldiers lowered plywood coffins into the ground, saluting each casket.

The Associated Press – Vegetables harvested in Fukushima Prefecture pile up in carton cases after they were withdrawn from shelves at a supermarket in Fukushima City, Fukushima Prefecture, Japan, Wednesday March 23, 2011. Traces of radiation from the Fukushima Dai-ichi nuclear complex in northeastern Japan are being found in vegetables and raw milk from a swath of farmland, forcing a government ban on sales from those areas. (AP Photo/Kyodo News)

Some relatives placed flowers on the graves. Most remained stoic, folding hands in prayer. Two young girls wept inconsolably, hugged tightly by their father.

“I hope their spirits will rest in peace here at this temporary place,” said mourner Katsuko Oguni, 42.

Masaru Yamagata, a Higashimatsushima official, said the crematorium cannot keep up with demand.

“Giving the grieving families coffins is the most we can do right now,” Yamagata said. “Every day, more dead bodies are found, and we need more coffins quickly.”

Hundreds of thousands remained homeless, squeezed into temporary shelters without heat, warm food or medicine and no idea what to call home after the colossal wave swallowed up communities along the coast.

The tsunami also heavily damaged the Fukushima Dai-ichi nuclear facility, with explosions and fires in four of the plant’s six reactors sending radioactive steam into the air.

Progress in cooling down the troubled plant has been intermittent, disrupted by rises in radiation, elevated pressure in reactors and overheated storage pools.

The plant’s operator had restored circuitry to bring power to all six units and turned on lights at Unit 3 late Tuesday for the first time since the disaster — a significant step toward restarting the cooling system.

It had hoped to restore power to cooling pumps at the unit within days, but experts warned the work included the risk of sparking fires as electricity is restored through equipment potentially damaged in the tsunami.

And then on Wednesday, black smoke suddenly billowed from Unit 3, prompting another evacuation of workers from the plant in the afternoon, Tokyo Electric Power Co. officials said. They said there had been no corresponding spike in radiation at the plant.

Hidehiko Nishiyama of the Nuclear and Industrial Safety Agency said officials did not know the reason for the smoke.

Tokyo Electric manager Teruaki Kobayashi said the pump for Unit 3 had been tested and was working Wednesday. But officials weren’t sure when they would be able to turn the power on to the pump.

Nuclear agency official Kenji Kawasaki said workers would not be allowed to return to the plant until Thursday morning, since smoke was still rising as of late Wednesday night.

As a precaution, officials have evacuated residents within 12 miles (20 kilometers) of the plant and advised those up to 19 miles (30 kilometers) away to stay indoors to minimize exposure.

And for the first time, Edano, the chief Cabinet secretary, suggested that those downwind of the plant should stay indoors with the windows shut tight — even if just outside the zone.

EVERYTHING IS UNDER CONTROL. BELIEVE YOUR GOVERNMENT & THE MSM.

Run-Rated Fukushima Radiation Release On Par With, And In Some Cases Greater Than, Chernobyl

Submitted by Tyler Durden on 03/23/2011 14:14 -0400

Even as the spin continues by both the media and nuclear energy advocates that the dangers from Fukushima are overblown, calculations done behind the scenes indicate that Fukushima and Chernobyl are actually very comparable in terms of radioactive particulate release, and in some cases, such as Cesium 137, Fukushima is already runrating as a worse catastrophe than Chernobyl. From Reuters: “The release of two types of radioactive particles in the first 3-4 days of Japan’s nuclear crisis is estimated to have reached 20-50 percent of the amounts from Chernobyl in 10 days, an Austrian expert said on Wednesday. Based on measurements made at monitoring stations in Japan and the United States, Wotawa said the iodine released from Fukushima in the first three-four days was about 20 percent of that released from Chernobyl during a ten-day period. For Caesium-137, the figure could amount to some 50 percent.” In other words, run rating the release of Cesium for a 10 day period, leaked radioactive Cesium is now about 120-150% of what it was during the full blow reactor explosion experiencing during Chernobyl. But yes, aside from the facts, watering the reactor that are certainly melting down (if haven’t done so already) should surely have great benefits.

More from Reuters:

The calculations published by Austria’s Central Institute for Meteorology and Geodynamics may add to growing concern in Japan and elsewhere over the contamination of food products such as milk and vegetables in areas near the Japanese reactor site.

The Austrian institute’s Dr Gerhard Wotawa stressed the two isotopes from Fukushima he had sought to estimate — iodine-131 and caesium-137 — normally make up only one tenth of total radiation.

Based on measurements made at monitoring stations in Japan and the United States, Wotawa said the iodine released from Fukushima in the first three-four days was about 20 percent of that released from Chernobyl during a ten-day period.

For Caesium-137, the figure could amount to some 50 percent.

The International Atomic Energy Agency said on Wednesday Japanese authorities had told the Vienna-based agency that radiation dose rates at the plant were decreasing, although the overall situation remained serious.

One U.N. study has estimated Chernobyl, in Ukraine, may over time cause 4,000 to 9,000 extra deaths from cancer.

And there are big differences in the handling of the crises.

“At Chernobyl, the population was not generally aware that the accident had happened,” said Malcolm Crick, Secretary of the U.N. Scientific Committee on the Effects of Atomic Radiation.

“People in the nearby town of Pripyat were watching the fire from just a kilometre or so away. They were evacuated a day or so later,” he said, adding that children kept drinking milk despite risks of contamination.

“In Japan, there was a precautionary evacuation early on,” he said, adding “it’s too early to make a real assessment of the overall impact.”

Japanese authorities also distributed units of stable iodine which can help protect against radioactive iodine.

Unfortunately following today’s news that radiation was once again surging to record highs, any temporary lull factored into models should be propmtly discarded. It also begs the question: how soon until the first indications of radiation poisoning start appearing. Somehow we are confident we will not find out until years from now when all the truth surrounding this incident is finally declassified.

Japan nuclear crisis: What’s in the smoke emerging from Fukushima I?

Mysterious plumes of white, black, and grey smoke have billowed out of the Fukushima I nuclear power plant, prompting speculation about the status of the devastated reactors.

[img [/img]

[/img]

This still from film footage released by Tokyo Electric Power Co. shows black smoke billowing from the crippled Fukushima I nuclear power plant in northeastern Japan, March 22.

Tokyo Electric Power Co. via Kyodo News / AP

.Enlarge

——————————————————————————–

By Peter Grier, Staff writer / March 23, 2011

Smoke plumes continue to rise from parts of Japan’s devastated Fukushima I nuclear plant. On Wednesday, black smoke suddenly billowed up from reactor No. 3, causing workers to evacuate the area and stopping work at the plant for a few hours. Crews later returned, and officials said radiation levels did not spike during the incident. But smoke has been a continuing problem at Fukushima I (also called Fukushima Daiichi) – white and grey plumes have erupted at the plant a number of times this week.

.What’s causing this smoke? Is it a matter of concern?

In general, workers are making progress stabilizing Fukushima I, said the International Atomic Energy Agency on Wednesday. Electricity has returned – in some measure – to most of the plant’s six reactors. Control room instruments are now powered at all except No. 3, for instance.

But seeing light at the end of the tunnel is not the same thing as reaching open air. The bursts of smoke are among pieces of evidence indicating that Fukushima I is not yet under complete control.

RELATED: Meltdown 101: A brief glossary of nuclear terms

“The overall situation remains of serious concern,” said Graham Andrew, special advisor to the IAEA Director General for Scientific and Technical Affairs.

At this point, officials do not know how serious the smoke bursts are because they are not certain what their cause is.

As Japanese workers have powered up reactors in recent days, shorts or other electrical problems could have ignited debris from last week’s containment building explosions, said David Lochbaum, director of the nuclear safety project at the Union of Concerned Scientists, in a Wednesday phone briefing for reporters.

Smoke from such a cause is not necessarily something to worry about. On the other hand, it is also possible that the spent-fuel pool at No. 3 has overheated to the point where water has boiled away and exposed fuel assemblies, causing them to overheat and release particulate matter into the atmosphere. That could cause plumes of radioactive smoke like the black smoke seen Wednesday.

“That might be an additional cause for concern,” said Lochbaum.

Lochbaum added that Japanese authorities continue to inject seawater laced with boron into reactor Nos. 1, 2, and 3. Boron absorbs neutrons and thus is used to moderate nuclear fission. Its presence in the water indicates that Japanese officials remain worried that fuel in the reactors may have melted and slumped inside the containment vessels, changing shape in a way that might restart a nuclear chain reaction.

“That’s pretty clear evidence of significant damage,” he said.

Meanwhile, on Tuesday the US Department of Energy for the first time released detailed radiation readings taken by US ground and airborne detectors deployed in Japan.

Unlike the periodic measurements taken at the Fukushima I plant gates, the new US readings give a sense of how radiation has settled over the area surrounding the Fukushima I complex.

The good news is that the readings are relatively low – all are less than 300 mSv per hour – according to the Energy Department. The worrisome news is that the data shows a plume of somewhat elevated radiation levels, higher than 125 mSv per hour, extending up to 25 miles northwest into Japan’s interior, instead of east or southeast towards the ocean.

Voluntary evacuations of military personnel, their families, and japanese nationals continue, with very little coverage from the MSM….here is a link to a navy website…

Check out the “what’s new” column. Very interesting stuff.

http://www.cnic.navy.mil/Atsugi/index.htm