Another good article from http://www.mybudget360.com/.

At this point it doesn’t matter whether you were lured into the fantasy of a cushy retirement by Wall Street shysters or you decided to live for today with a leased BMW and a McMansion twice the size of what you needed or you thought you could retire off your internet stock profits and never ending equity in your house or you were just a dumbass and forgot to save for your retirement – YOU’RE PRETTY MUCH SCREWED. Stocks aren’t going up in the next decade. Bonds will fall in the next decade. And most of the Boomers have less than $100,000 saved for retirement. I hope they like the taste of Alpo.

Middle class retirement now largely a postcard fantasy – How Wall Street fabricated a buy and hold fairytale and jumped ship with taxpayer golden parachutes. Did baby boomers think about who they would be selling those 401k and pension stocks to?

The days of dreaming about long days playing golf on a green course and taking luxurious cruises around the world are appearing more and more like a foggy memory for those in the middle class planning for retirement. As Wall Street bankers and hedge fund managers rob the public blind, the mission statement sold to baby boomers is starting to become a large bait and switch catchy enough to make it on a Hallmark card. For decades Wall Street begged and lured the public in either directly or through pension funds into their web of easy money. Save $100 a month and you’ll retire a millionaire! As it turns out, the golden parachute was only available to a tiny fraction of the population while the oligarchy in the financial sector offloads their toxic bets onto the taxpayers struggling balance sheet. The end game? No retirement. At least no retirement like those plastered on glossy mutual fund brochures. What the Wall Street banking charlatans failed to tell you is that you eventually need to sell those stocks to use the money for real world spending. What they also failed to mention is that the baby boomer generation is now going to sell into unrelenting headwinds of demographics bringing on a younger and poorer generation to purchase their stocks. Of course Social Security is in the crosshairs of the financial elite since they already secured their financial piece of the pie. You know things are bad when the Federal Reserve is stating that stocks are not exactly a winners bet in the years going forward.

Retirement becoming more of a postcard fantasy

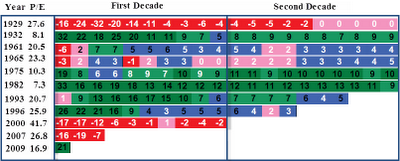

The middle class has been pillaged and ransacked by financial thievery for decades. The debt bubble and mass delusion is now imploding. The graft and con games taking place in the financial sector would be comical if they weren’t so real and economically tragic. The Federal Reserve has given covert loans to big banks while big banks publicly stating all was well. The Federal Reserve has grown their balance sheet to a stunning $2.8+ trillion of questionable assets and other junk with little redeemable market value. It would have a hard time selling these items on eBay let alone the natural marketplace. There is no easier way to make a profit than stealing from the taxpayer. Of course the problems in the system are coming at the expense of the working and middle class. For those who bought into the Wall Street mantra of buy and hold, making a profit has gotten much harder:

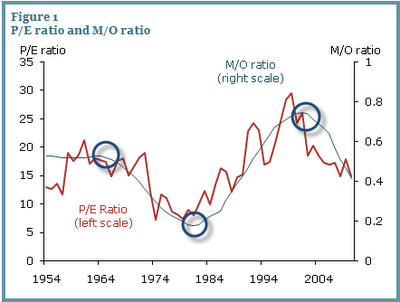

This is fascinating data to look at. This decade has been horrible for stocks. The S&P 500 stands today where it did in 1998. The massive stock volatility is simply a reflection of the problems deep in our financial system. The above chart examines P/E ratios over time. Really fascinating information but the Fed study finds that P/E ratios are likely to go lower because of demographic shifts and also the reality that we have a lower wage employment force dominating our economy. The latest decade is a reflection of the bubble era machinery that has hoisted up the financial sector into an untouchable corner yet middle class Americans have taken it squarely in their stock portfolios. Why? Because Wall Street has been preaching buy and hold as if it were some patriotic mission but many of these hedge funds and banking managers have placed bets that openly aim against American middle class success. In fact, some have made bets on flat out American failure and have made billions of dollars with lower tax rates that are given to hedge funds.

The stock market casino

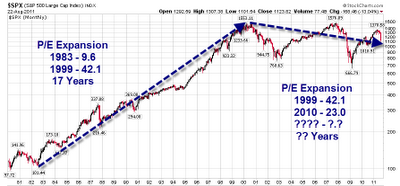

The stock market has been on a wild ride for well over a decade:

Source: Mish Global Economic Analysis Blog

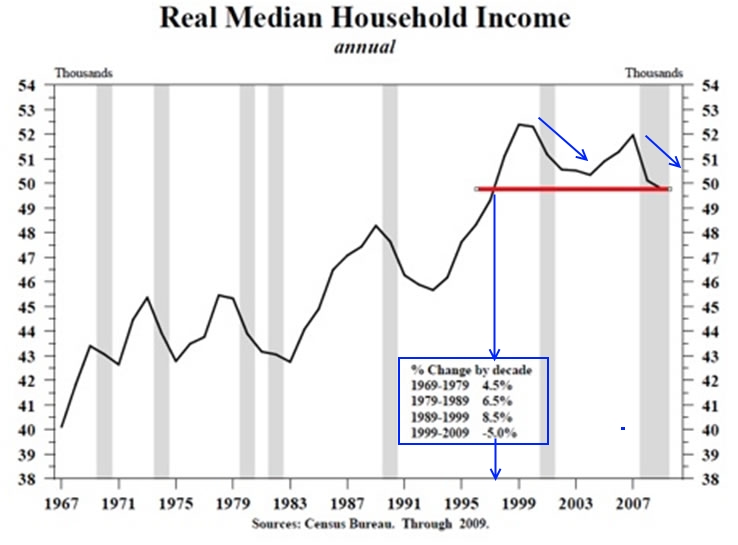

You have a crazy expansion in the 1980s and 1990s with the peak productive years of baby boomers but also the carefree attitude with the debt bubble and the “deficits don’t matter” mentality that has harmed this nation and is leaving the Eurozone in tatters. Of course all of that has come to a crashing halt first with the tech bubble bursting and then the real estate bubble imploding. So you have to ask, when these baby boomers sell out of their 401ks and pension plans who will buy the stocks? The 46,000,000 Americans on food stamps? Or what above the average per capita worker making $25,000 a year? Household incomes have been stagnant for well over a decade:

To use an often quoted cliché, this is the perfect financial storm. For the financially and politically connected the free market rules do not apply. For the working and middle class they do. This massive contraction is happening when millions are entering the retirement pipeline. Now it would be one thing if people had vibrant retirement accounts. 1 out of 3 Americans have no savings account. But for those with a retirement account they likely do not have funds to support their life as they age and this is seen in a Transamerica retirement study:

“Workers estimate their retirement savings needs at $600,000 (median), but in comparison, fewer than one-third (30 percent) have currently saved more than $100,000 in all household retirement accounts.”

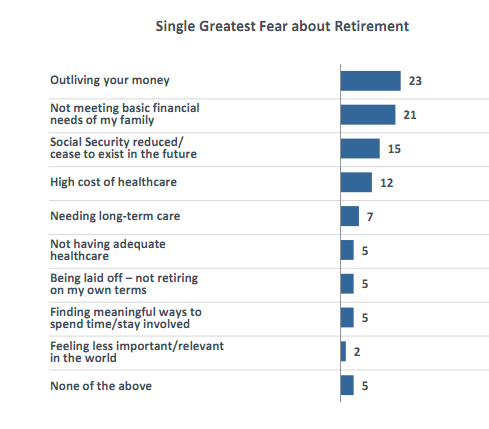

And the fears most have are based on real life issues:

Source: Transamerica

These aren’t fears about not having enough yachts or trips to Paris but whether they will eat decent food or Alpo. Workers are accurate in how much they need but less than one third have even saved $100,000 or more for retirement. For a median household income pulling in $50,000 a year in working years, the funds would likely last 3 or 4 years. The biggest fear is outliving the money while coming in at a close second is simply not meeting basic family needs. The next fear is cuts to Social Security because of course, the bankers and investment banks had to get their bailouts first before setting the U.S. economy on fire.

The Federal Reserve study found that P/E ratios are likely to become compressed as time goes on:

“Between 1981 and 2000, as baby boomers reached their peak working and saving ages, the M/O ratio increased from about 0.18 to about 0.74. During the same period, the P/E ratio tripled from about 8 to 24. In the 2000s, as the baby boom generation started aging and the baby bust generation started to reach prime working and saving ages, the M/O and P/E ratios both declined substantially. Statistical analysis confirms this correlation. In our model, we obtain a statistically and economically significant estimate of the relationship between the P/E and M/O ratios. We estimate that the M/O ratio explains about 61% of the movements in the P/E ratio during the sample period. In other words, the M/O ratio predicts long-run trends in the P/E ratio well.”

In other words, lots of money chasing the Wall Street illusion yet there will be fewer (poorer) buyers ahead. The P/E ratios surged when baby boomers entered their peak earnings years. Given the massive problems in our economy the fact that P/E will take it on the chin is no surprise. What is more stunning is the fact that no real financial reform has taken place and that the political system is so utterly broken. Money has infiltrated politics to a degree never before seen. We have career politicians in the SEC basically training for plush gigs at Goldman Sachs or Morgan Stanley. A revolving door out of D.C. and into big investment banks and back to D.C. No wonder why there has been no true enforcement of the investment banks when many are simply using it as a training ground for future jobs! If the working and middle class actually saw what went on trading floors they would never even think about playing the stock market. The fact that we have millions now needing to dump stocks into the open market is simply another issue we will be facing. These are people that have to sell (you can’t eat your stocks or pay for a medical bill with a stock). Many are now realizing after a lifetime of work that retirement only meant more work with fewer benefits to compensate for the big banking bailouts.

brings new meaning to the term”screw the pooch” doesn’t it?my favorite ted nugent song—dog,eat dog.can’t wait for all the anti-boomers to jump all over this one.

Effing eating ALPO and it’ll be ALPO made in CHINA.

Poor old Boomers

10,000 a day reaching retirement age. Many of those will be unable to retire. Medical care quality is declining. Someone will have to buy the stocks that they dump to pay for some form of retirement because you can’t eat stocks.

Seems to me that someone said the same thing about gold, but we’re not too worried about people dumping that on the open market at this time, are we?

Many of these folks are going to be pissed off beyond belief in the upcoming years. Add that to what the rest of the country is feeling in regards to those who are looting the system in other ways and you have a 4th Turning that is progressing nicely.

No,by the time they stop working?they well be drinking insure to stay alive.Have a paid for RV.

Public sector employees will be the ones at the top of the heap. Glory be to government. They will be working till they drop to feed themselves AND their government retiree neighbor. I had a client imform me this past week that there are some states that do not tax government retirees retirement income from the government. Government dipshit clerks are your gods and you will be paying for their retirements.

Btw, whats with the gay shit post the other day? I never did open it since I thought that was how Admin would know who was gay.

Let the boooomers eat each other. Dog food is too good for them.

I’m a boomer and I think that you usually get what you deserve and they (the boomers) deserve Alpo. They spent their shallow lives buying things they didn’t need with money they didn’t have to impress people who hated them for having all that stupid shit. I saved my money, spent less than I made, invested all of my escess money in to gold and silver and for my efforts I was characterized as a nutcake and a cheapo. Well, at least this cheapo ain’t eating Alpo in retirement. :o)

I’d switch ’em to a dry food.

“1 out of 3 Americans have no savings account” and “30 percent [of workers] have currently saved more than $100,000 in all household retirement accounts.”

I have a friend who went through the last 40 years with the attitude of “spend a third of my income, save a third, and pay the last third in taxes.” Actually his taxes were somewhat less and he spent or, more likely, saved what he didn’t pay Uncle.

My friend never bought anything on credit. He always paid cash for houses, cars, and everything else. Of course he had no fancy wheels and no house until he was 40. He lived close to the bone for a generation and didn’t mind it a bit. His social life didn’t suffer. When he was 43 he married a minx 20 years his junior.

Now, having saved for decades, he has more than he needs and security. House, wife, kids, and a stash – he has it all.

Am I envious, of course. Like many of you and others, I spent when I could have saved; I married too early when I could have played; and now I’m having to rely on SSI, a pitiful savings, and the hope that things will get better.

You people are on a roll today!

Two posts ago you trashed poor people for being poor and failing to create the personal miracles that would transform their lives into middle class nirvana from a heap of garbage.

Now you’re trashing boomers for being ripped off by FIRE economists who pulled the rug out from underneath them in mid-life and told them that personal retirement *investments* (shepherded by bankers and investment professionals who siphoned off any accrued interest and then crashed the economy with magically conjured secured derivatives) would be solid assets to carry them into old age, and the government which greased this slip-and-slide lie while squandering decades of social security inputs.

Well done TPB’ers. Keep blaming the fallguys while criminals make off with the loot.

marissa

Not all Boomers fell for the Wall Street line. Again, that dreaded personal responsibility and critical thinking skill really come in handy for some folks. It’s amazing what you can save if you spend less than you make, live BENEATH your means, buy used cars, bring your lunch to work, take modest vacations, and think for yourself regarding investments.

You are really trapped in that victimhood mentality.

I suppose people who have made bad choices and didn’t do what they should have done need a boogeyman to blame for all the ills in the world. Welcome to America.

And you know what? – TOUGH SHIT.

It’s up to each individual to make their own life choices. If you chose not to study hard in school, then you reap what you sow. If you used debt to look like a big shot, not my problem. If you believed the Wall Street shysters, shame on you.

Jackson Jackson

Shit in one hand and hope in the other same thing. Forget hope, read go to school, think man, think you still have a brain use it

@ Marissa

TBP’s are flexible, agile, nimble, able to hit moving targets.

marissa,

the criminal economists and bankers you speak of are mostly boomers. yes they committed fraud but they concocted derivatives because they knew people couldn’t afford the house, with the car, and the credit card, etc. the sheep were sheared, and your government played along.

the people in government and living beyond their means being mostly boomers as well.

the myth out there is that the whole derivatives scheme was reckless. i don’t believe it was. if not for the derivatives they would have never extended the credit in the first place. it was a way for them to play both sides of the fence. they just had to lie about the true underlying value i.e. fraud.

“If it’s never our fault, we can’t take responsibility for it. If we can’t take responsibility for it, we’ll always be its victim.”

Richard Bach

“Self-pity is easily the most destructive of the nonpharmaceutical narcotics; it is addictive, gives momentary pleasure and separates the victim from reality.”

John W. Gardner

marissa: you make entirely too much sense for some of the douchebags on TBP. Admin is particularly pissed because Shaquanda of the 30 blocks won’t give him the time of day and because he can’t afford an Escalade wif Spreewells. Seriously, I made some of the same mistakes spoken of in this excellent article. Not what I did, but what I didn’t do. I didn’t buy the gold @ $300/oz or the silver @ $3.50/oz. Stay out of debt! Save what you can, but debt is the big killer and everywhere you look some asshole is promoting more of it. Also, I hope that all of our fellow TBPers came through the ‘cane OK. Shit can be replaced or rebuilt, our families and friends cannot.

Ragman

Why don’t you gather all your victimized friends together and have a Jim Jones kool-aid party.

Spare the rest of us

.

I’m not a victim and do not have a victim mentality so I can’t relate to the world of, would of, should of, could of, might have, bullshit.

That was a good article!

Funny how the “business” networks refuse to discuss this. They trot out the wall street hacks day after day telling us that we should buy stocks.

A REAL crash in the stock market has yet to occur, and I say we get one by 2014 when everyone realizes there are no new suckers to play the game.

Ragman

I would love to spend the day mourning over your dumb ass inadequate ability to think and prepare but I have to go put hay in the barn. Something we do on the farm is prepare for winter it comes every year.

Even a squirrel looks ahead and prepares, surely your smarter than a squirrel.

Well maybe not.

Well George,

Now you are a comfortably poor nutcake cheapo. Well done!

Comfortably Poor – .5 to 2 million

Comfortable 2.5 to 5 million

Very Comfortable 5.5 to 10 million, but you still can’t live next door to Casey in Argentina.

This comfort level has a California foundation, I’m sure in the heartland you can make do with less. Having less than 500,000 in usable assets is going to be a tough shit situation going forward, as the social safety net is going to spring a big leak.

TBP,

I hate to tell all you spoiled Americans, a half can of warmed Alpho, some rice, and a sliced cucumber with vinegar and oil would be very tolerable when the TSHTF. Your dog may get upset, but tell him he may be on the next menu. A number of these higher end canned dog foods have emergency ration orgins and are perfectly safe to eat.

This boomerism mythology is approaching RE levels of world ending disasters.

“Two posts ago you trashed poor people for being poor and failing to create the personal miracles that would transform their lives into middle class nirvana from a heap of garbage.” – Marissa

What a classic statement. Let’s examine your “personal Miracle”. Two people get married and have a child in Camden instead of fucking and producing an illegitimate child with the “father” taking absolutely no responsibility for his actions.

The parents both get jobs rather than living off welfare, food stamps, SSDI, and selling drugs.

The parents actually make the poor child go to school every day without paying them to do so.

The parents make sure the child studies his/her ass off every day and read books for fun rather than doing drugs on the street corner.

The parents make sure the child doesn’t wear their pants around their knees and be covered from head to toe in tatooes.

The parents teach their child to speak English, not ebonics.

The parents save more than they make and give the child the boost they need into the middle class.

Is that a miracle, or is it how all hard working, responsible Americans should act?

Marissa – Queen of Victimhood.

Alpo was premium dog food. I noticed that many years ago when I realized the can of ALPO I was giving my dog cost more than the can of BEEFARONI I was going to dine on. Problem was my dog did not like Ken’l’ration or other cheap dog food. ALPO was about as low as he would go. He ran off one day and I never saw him again. Pedigree Irish setter he was too. Guess he decided I was too declasse for him and thought he could do better.

Seriously, I suspect we will always be able to feed the elderly. What may disappear though are the nice individual apartments government has attempted to provide. May have to share dormitory or barrack type facilities if they want government provided quarters. Medical care too will be curtailed. It won’t be formally denied but it will be delayed or subject to ‘quality of life’ review. No other way really.

Admin.,

Victimhood can come from your station in life, be glad you are in your shoes. Marissa has good bones, makes some valid points, and pays her own way. I named my battery powered hedge trimmer “Marissa” after her discription of her landscaping job. She is a TBP keeper.

Welshman

Masissa’s point of view is welcome.

It gives me the opportunity to give the other side.

My parents were poor. They went no further than HS. I even suspect my Dad didn’t graduate HS. My Dad was a truck driver for 40 years and we lived a lower middle class existence in a house no bigger than the row houses in Camden or West Philly. Run the demographics for Collingdale and you’ll see it ain’t no McMansion town.

Work hard. Study hard. Save rather than spend. Work harder. Learn the lesson of delayed gratification. Sacrifice. Keep working harder. Learn how to think critically. Don’t be a dupe. Don’t blame others for your own failures. Learn from your failures. Save some more. Don’t worry about what the neighbors think of your 15 year old kitchen or 13 year old minivan in the driveway.

My wife and I refused to be victims. We refuse to blame others for our own problems. Victimhood is a disease that is destroying this country.

marissa

you are well intentioned, welcome, and certainly have some grasp of our situation. you fight some of our points now and may think we are your enemy, but eventually you will see many on TBP are right and you will become an ally.

“…for my efforts I was characterized as a nutcake and a cheapo.” – George

Why tell them about your finances? I’ve always thought of our finances as personal and private. Let ’em wonder.

My brother is our insurance agent. As we worked on getting out of debt over the past several years it was great! to call him up and tell him to remove the lienholders from our home, rv, & autos. Even more fun was calling him for insurance on the most recent vehicles we bought and when he asked “if” there was a lienholder;) to be able to say no. Best feeling in the world. Hey, maybe he’ll tell all the family and they can wonder too. 🙂 lol

Re the ALPO.

I’m not sure if boomers will be eating dog food (I might prefer kitty kibble 😉 but I’ll bet leftovers won’t be thrown out as frequently as in the past. Glad I know how to eat them and don’t mind doing so either.

see,i was right ,you all jumped all over this—great post—-very polarizing—makes for lively debate—thanks admin!

brann

I love a lively debate.

Admin.,

I understand and agree with your point, but what I am seeing all around me is people losing their station in life. There is only so many open doors, and we are not creating more doors. People are not maintaining the middle class station that they grew up in. The retirement situation is the worst part, and as Scott points out, a group home for the elderly may be as good as it gets.

If your givin situation makes you think you are a victim, then someone tells you are a victim, and points to those they say caused you to be a victum. Think Nazi Germany. If victimhood can be produced during good times, think how fast it can grow in bad times, that we both agree is on its way.

I am a boomer and my generation will not be the only one eat dog food. This will take a gereration to fix. I suspect ,with the current thinking of shelfishness, it will take more than one generation to fix the mess we call USA? The bbomers are not the only one who are shallow. I work with the young they are no different. If ican put macdonalds in my gut i can get alpo down and i will eat your pet dog if i must. Yes the bomers got us here. But he 4th turning is not going to be the USA comomg out on top we are toshelfish and do not care about the future. The next generation is the same. Good luck to all. Just my take on it. Have a great day.

Doc,

Pleeeaase…tell me you somehow photoshopped that pic?!?!?!

A hypothetical. Let’s say a boomer is 65 and is ready to retire. Further, let’s say he gets a pension of some kind and gets SS that net together himself 30K a year. He has no debt, no mortgage. He has a 401K or other savings invested in stocks and bonds and it’s worth 450K. To supplement his yearly income, he withdraws 1200/month from his savings. So why would he have to sell all his stocks?

Dave

The $14,400 per year withdrawn from your $450,000 has to be sold before you can get the cash. If there are 30 million Boomers doing the same thing, who is on the other end of the transaction?

“Welshman says:

Admin.,

Victimhood can come from your station in life, be glad you are in your shoes. Marissa has good bones, makes some valid points, and pays her own way. I named my battery powered hedge trimmer “Marissa” after her discription of her landscaping job. She is a TBP keeper.”

Battery powered hedge trimmers?! Wussie piece of Euro crap that wouldn’t trim the crust off a croissant. Pros wield gas choppers that will shred 100 yards of shrubbery like Edward Scissorhands on steroids.

This is America baby!.

Let them eat cake!

For all the shit I love to give boomers, for all their faults, many will be cared for by their kids. I keep that in mind now as I plot my own retirement path. No way I’ll let my dad and mom eat dog food… If I buy property an in-law dwelling is definitely a must…

The thought that the elderly will soon be geriatric hippy shitbags is a sobering thought. I may do what I can for my folks in the future but I’m not holding open doors or helping boomers across a street. In 20 years the elderly will be of a generation that doesn’t deserve an ounce of polite treatment… let the fuckers get their grumpy ass out of the rascal scooter and open their own door or get their depends off the top shelf.

I loathe the day when the archetypical grandparent is gone and replaced by loopy acid-head draft-dodging swine humming Beatles in their rocking chairs.

If you chase sex, drugs and rock&roll in your youth, you shouldn’t be surprised is you don’t own stocks, bonds and real-estate when you are 60.

– no debt, many assets

sensetti: go fuck yourself! I was not whining, simply stating the truth, something you have absolutely knowledge of.

Yes Anonymous,

I have three battery powered hedge clippers, one on a stick, and they work fine on Wisteria and light trimming, but I am old and a bit of a pus butt. When I get my gas power trimmer out, my son is on the other end

Why I named my clipper “Marissa” is here is a gal over fifty years of age, not very tall, using a gas clipper for eight hours a day to make a living. I’m impressed. She is also kind of a bright pebble, we don’t alway agree, but I’m glad I don’t have to walk in her shoes.

Thanks for stopping by TBP and telling me I’m using wussie Euro garden equipment, I already

know it. With my light weight hedger, I feel like Luke Skywalker with a light saber.

COLMA—all you need is love

Is a sensetti/ragman piss-ff in the offing? I will bring the popcorn. I’ll take ragman and give 2 to 1. Sorry sensetti – you seem to be a fighter but ragman’s experience around here will be telling.

@llpoh – I’ll take that bet. I’ll agree that ragman may have more experience, but I think sensetti may have more drive. Either way it’ll be good to watch 🙂

Jim: The assumption is that the $450K is not generating any interest, dividends? Or that the entire $450K is in stocks?

Dave

Interest rates are .15% and the dividend yield on S&P 500 stocks is 2%.

If the $450k is in stocks and bonds there is an outstanding chance that the principal will decline over the next ten years.

Not all boomers will be eating Alpo. This boomer will be eating smoked salmon, halibut and caribou steaks. Alpo is for dimwitted boomers and millenials who still live in the lower 48.

RE

I have gone back thru the posts and cannot for the life of me cannot figure out why sensetti is motherfucking ragman.

Sensetti – ragman is an esteemed, long term member of TBP and you are a fucking newbie around here. I will give you a word of free advice – shut the fuck up and leave the old-timers alone until you know who is who. You are taking a scattergun approach and are flaming those that simply by weight of time and contribution to this site deserve respect, and you haven’t been around long enough to be motherfucking someone like ragman. If you keep it up you are going to get your shit packed.

Mikey – I will increase the odds, because ragman will have me in his corner. Still like sensetti’s chances?

@ lloph

Pay Mikey I will let the above posts speak for themselves.

I just picked 150 square bales and put them in the barn. I’m bone tired. On I phone goin to eat.

sensetti

Lipoh:

Leave sensetti the fuck alone. He’s learning how to sharpen his teeth. He’s practicing. Give him a break. Until you put out a list of “big old dogs”, quit your bitchin.

Sensetti – you mean all of your posts that are highlighted in pink? Yep – they sure speak for themselves.

As I said, leave the likes of ragman alone. He will not need support, but he will surely get it, and you may find yourself fending off a Fred Flinstone-style stream of abuse.

Choose better targets, because you are showing yourself to be lacking in judgement at the moment – there are plenty of worthy targets out there that will swim by without the need to go after one of the many TBP pillars.

I am being kind, sensible, and measured in my response. It isn’t really like me, but you probably haven’t been around long enough to notice.

Again – leave the old-timers alone that are doing you no harm. If they call you out, go for it. But start shit at your peril.

AWD – the list is out there for all to see. Newbies need to find the list on their own – all they have to do is keep reading posts. I don’t mind him sharpening his teeth – I actually encourage it. Ragman is a prime contributor around these parts, and generally he doesn’t go out of his way to fuck with folks.

Sensetti can practice on Fred, or Colma (Colma loves a good fight and doesn’t need a reason). Or any of the dickhead newbies that come along. And feel free to kick shit out of Gonzalo. But I will help out a bit with a short list of some to leave alone (apologies to anyone I miss!) –

Admin/Stucky/SSS/Robmu1/Punk (unless just having some fun, as he is funny as hell)/OB/Muck/KB/Welshman/Novista/Eugene66 (leave Eugene the hell alone – I love his stuff, and we don’t get many Romanians hereabouts)/bigargon/et al.