The gold bugs have certainly been gloating of late (well, excluding the prior 2 trading sessions) seeing as how bullion prices, miners and precious metals ETFs have been holding up well while most other asset classes spiral downward in a volatility vortex. In the short term, sure, gold has performed well and may well continue for some time to come. However, on a long-term basis, there’s no reason to believe gold, and especially, the most popular gold proxy ETF (GLD) will outperform other conventional asset classes, and in fact, it should probably be expected to actually underperform. Here’s why.

…continue reading 5 Reasons to AVOID the Gold ETF GLD

And there’s no little green onion at trhe end?

Are you kidding me? “You don’t know why you’re buying gold”? “The market is efficient”? What a complete idiot. This should be in the humor section.

Darwin,

I’m taking your TBP card.

My comment (below) is awaiting their moderation. I’m holding my breath that’ll be posted.

I crack myself up.

You’re a F*cking moron. Name the 7 stages of a bubble!

Go ahead, name them you effing d*&chebag.

1% of the world is vested in gold. There is enough of it above ground to fill a effing Olympic sized swimming pool.

On the bubble list we are at stage 2. Go find me some credit to fuel this bubble retard.

http://www.askaboutmoney.com/showthread.php?t=24601

Darwin

“In the short term, sure, gold has performed well”

What do you consider short term? Gold has been up every year for the last 10 years, while the S&P 500 is lower than it was in 1998.

[img [/img]

[/img]

2006 25% of the loans granted were SUBPRIME.

About 70% owned homes.

And how many people own gold???????????

[img [/img]

[/img]

And how big is the market cap of the gold industry?

[img [/img]

[/img]

[img [/img]

[/img]

We’re at Stage II of the bubble – you fucking inept moron. And without credit I don’t think we’re going to get a bubble. The numbers that gold will climb to will make the housing bubble look like a pussy. Use your imagination because I know that is something you couldn’t find with both hands and the lights on.

Darwin

Do you anticipate that Obama will be cutting deficits in the next few years?

Do you anticipate that Bernanke will be raising interest rates and reducing the money supply in the next few years?

There seems to be a correlation between the national debt and the price of gold. Do you anticipate the national debt going down in the next ten years?

[img [/img]

[/img]

My great aunt bought her gold for 18,000,000 Reichsmark an ounce. She is still bitching about owning a non-yielding asset. Better stick to the tried and true. All those dollar and Euro bills will come in handy during the next cold winter.

Efficient Market Theory:

[img ?imgmax=800[/img]

?imgmax=800[/img]

@Der Sheisskerl

Hilarious moniker!!!

For non-Germans

Der = The

Scheiss = Shit

Kerl = Fellow

Nice.

Gold Eats Shit.

From my Best Friend, Gonzo.

===========================================================

Forget Gold—What Matters Is Copper

Saturday, September 24, 2011

by Gonzalo Lira

People are freaking out that gold has fallen to $1,650, from its lofty highs above $1,800—they are freaking out something awful. “Gold has fallen 10%! The world is coming to an end!!!” I myself took a shellacking in gold—

—but copper is what has me worried.

Copper fell from $4.20 to $3.25—close to 25%—in about three weeks. Most of that tumble has happened in the last ten days, and what’s worrisome is that, as I write these words over the weekend, there is every indication that copper will continue its free fall come Monday.

From the numbers that I’m seeing—and from the historical fact that copper tends to fall roughly 40% from peak to trough during an American recession—there is every indication that copper could reach $2.67 in short order. And even bottom out below that—say at $2.20—before stabilizing around the $2.67 level.

But we’ll see. The price of copper is not the point of this discussion. The point of this discussion is what the price of copper means.

What it means for monetary policy.

We all know the old saying: “Copper is the only commodity with a Ph.D. in economics”, or words to the effect.

The ongoing price collapse of copper signals that the markets have collectively decided that there is going to be no resurgence of the global economies—at least not for the next 9 to 18 months. Up until now, the economic data that has been coming out over the last couple of weeks seemed to indicate that there’s going to be a double-dip—but in my mind, this fall in the price of copper confirms this notion that the general economy is going down.

And remember: Market sentiment can not only be a predictor of future economic performance, but its determinant. If today the markets feel that the economy is going to suck tomorrow, often that very sentiment is what makes the economy suck canal water.

So if copper is falling like a mo-fo—which both signals and convinces the market that the economy is gonna suck—what does this mean for monetary policy?

Prima facie, the fall in the price of copper is deflationary: Less demand means that the prices fall—meaning the dollar acquires purchasing power.

What does it mean for monetary policy that copper has fallen so low?

It means that Bernanke will carry out more “non-traditional” Federal Reserve stimulus.

Ben Bernanke is famous for being terrified of deflation—and to his particular mindset, this is a reasonable fear. More to the point, Bernanke’s deflation-phobia actually matters—because after all, he is the Chairman of the Federal Reserve. He controls U.S. monetary policy.

Deflation is supposed to be bad because it shrinks an economy. (Personally, I am more afraid of inflation than deflation: The latter is self-correcting, while the former spirals out of control and into social chaos. But that’s for some other post.)

According to the deflationary world view, falling prices oblige producers to cut back on production—which means firing workers. These fired workers—husbanding their resources during their unemployment—spend less, further contracting demand, thus putting more downward pressure on prices, forcing more producers to cut back and fire even more workers, who thus spend less—

—you get the picture: A “deflationary death spiral”, in the Deflationistas’ parlance.

This is Bernanke’s fear—and he will do anything to alleviate it. Notice: It’s not that Bernanke will do anything to alleviate deflation—he will do anything to alleviate his fear of deflation.

As copper prices continue to tumble, signaling further economic contraction, there is no question in my mind that Ben Bernanke and his Fools of the Fed will view this as evidence of looming dollar deflation.

They will do everything to stop this looming deflation. But since the “traditional” Federal Reserve tools have been used up—that is, the Fed has its rate at zero, and for all intents and purposes all of its liquidity windows open—Bernanke will have no choice but to announce some new “non-traditional” liquidity injection scheme shortly.

Thus I expect some Banana Republic money-printing scheme to be announced by the Bernankster before the end of the year—perhaps as early as this coming October. The fall in the price of copper—more than anything else—is what Benny and his Fools will be looking at, to justify this new scheme.

And my bet is, this scheme they announce will be as big—and as controversial—as QE-II.

I am giving my people at The Strategic Planning Group a detailed analysis of what has happened over the past week, and what we can expect to happen in the markets over the coming weeks. You’ll have to pay to play for that.

But insofar as my overall view of the situation is concerned, this is what I think:

Bernanke will drive a schoolbus over small children, in order to prevent his notion of deflation from coming true. This fall in the price of copper is much more relevant to his course of action as Fed Chairman than the fall in the price of gold (which was just a combination of options expiration coming up, and gold positions being sold to cover losses in other asset classes).

This dramatic fall in the price of copper signals that the markets do not believe reactivation is anywhere near eminent—not for at least 9 to 18 months.

To the traditional twin Federal Reserve mandates of price stability and full employment, Bernanke has added a third mission: That of “growing the economy”—whatever it takes, however unorthodox or reckless the measures.

Therefore, it is my estimation that very soon now—end of this year at the latest—we will have QE-infinity—and beyond!

18 million marks an ounce wasn’t bad….

[img [/img]

[/img]

@ Stuck

Don’t you know that reposting GL’s stuff comes with an ALL CAPS THREAT OF LITIGATION???

Darwin,

Did you write this article all by yourself ? WTF – Gold gives off no value, neither does insurance policies until the world turns to shit in a hand basket.

If it’s a home run, why isn’t gold at $5000 now? Why does gold plummet 2% on certain days? Why are hedge funds lightening up the load? Plus, this was also focused on the issues w GLD in particular (with the gold theme of course).

As a rule, commodities are an inflationary/currency play, not necessarily a long-term growth/income producing asset. Plot gold over other various periods in US history and it was terrible. Recency Effect anyone?

Darwin

Why isn’t the Dow at 20,000 today?

Why isn’t my salary $1 million?

Markets are made up of people making decisions every day. Investors have different views of the future. Some are right and some are wrong. They are betting with their money. That is why markets never go one way forever. Everyone has to judge the value of a share of Exxon stock or a US Treasury bond on a daily basis.

Gold is a judgement on the value of the USD and the ability of the US government and central bank to manage its fiscal affairs properly. I have made a judgement that Obama and Bernanke have not and will not manage the USD and the debt of the country in a reasonable manner. Therefore, I believe that gold will rise in value versus the USD.

I would not buy GLD either as I think it is not really backed by the physical gold. I prefer the real thing.

God, you really are a clueless economic moron. And I’m being kind.

“Why are hedge funds lightening up the load?”

Fund runners use margins, not cash. When they get calls because whatever else they hold went south they sell the desks that aren’t nailed down.

You DON’T KNOW WHAT MONEY IS OR HOW IT IS CREATED. That is your entire limitation, and it will, without a doubt, shove you in the poor house.

For fuck sake, every country in Asia is buying up as much gold as they can get their hands on. Hedge funds and mutual funds are facing massive redemptions/outflows not seen since post-Lehman. Your missing the forest for the trees, and I’m being nice. The money coming out of U.S. gold could be considered part of the trade deficit; more of our assets ending up in the hands of Asians.

GES

SES

When Christie wins in 2012, say goodbye suckers!

Just kidding; I’m hopeful we get someone in there that actually understands the damage being done to current and future generations.

To admin’s point, the dow isn’t at 20,000 because nobody believes stocks are highly undervalued and your salary isn’t a million because it won’t be in the future. I get the whole debt, currency thing, but don’t you think the smart money has digested the current and future situation and gold is priced accordingly?

As to Davos’s point, whether using margin or cash, that is moot. It is returns that draw investors and losses that result in redemptions. Returns matter, leverage doesn’t so much. When I say lightening load, I’m not referring to daily flows, I’m referring to public pronouncements of decreases in holdings.

Curious what all your thoughts are on Faber’s pronouncement – that gold could plummet from here.

Faber said he would be buying in the next two days at $1,500 to $1,600. He said that markets sometimes overshoot and gold could fall back to $1,200. It was at $1,200 last year. That would be a correction in a bull market. Faber is a roaring bull on gold because he believes Bernanke will wreck the USD.

The “smart money” is supposedly JPM and the rest of the Wall Street banks. Based on what they’ve done in the last five years, smart ain’t the word I’d use to describe them.

The vested interests hate gold because it reveals their currency debasement plan of debt repayment. Therefore, they try to break the confidence of the weak hands. It works for a few days, but then the really smart money resumes purchasing it as they did today.

Speaking of Gonzalito:

Why does he disappear like Al Gore in a blizzard every time the dollar climbs over 75 on the FOREX?

You’re fucking clueless. You ask a fucking question and I answer it. And then you proclaim it is moot.

The French banks are Capital FUCKED. Banks here shut them off, 50% of money markets were vested in EU banks. Not anymore. Hedge funds have been getting calls and raising cash.

The last time gold got stuffed over 200 bucks a few weeks later Lehman went. Gold fell about 374 bucks this time. I expect in a few weeks some of the largest banks in the EU will do a Lehman.

Then you’ll get it.

To my favorite stupid fucking moron, who uses the authors name of who wrote this, “It’s not the strongest who survive, nor the most intelligent, but the ones most adaptable to change.”

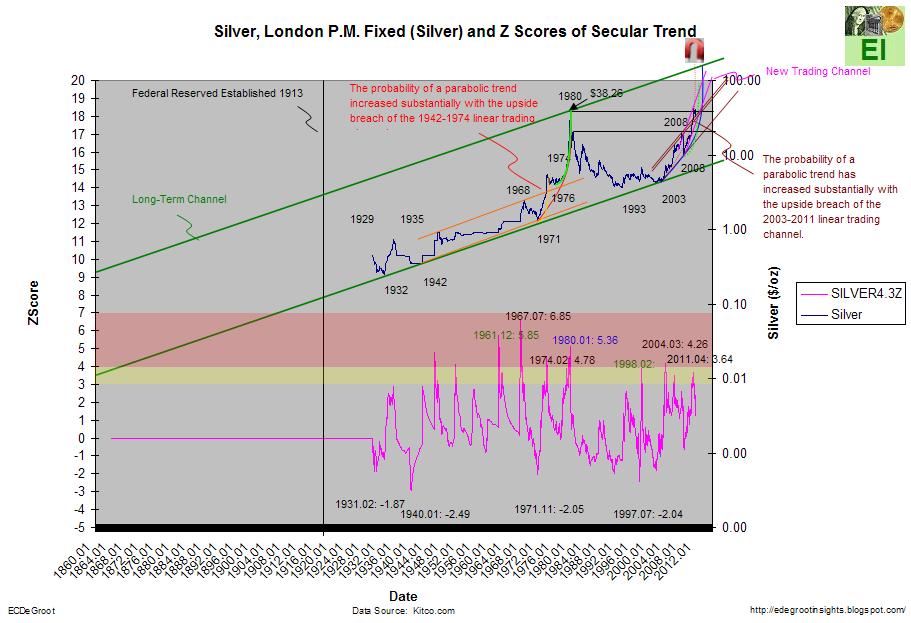

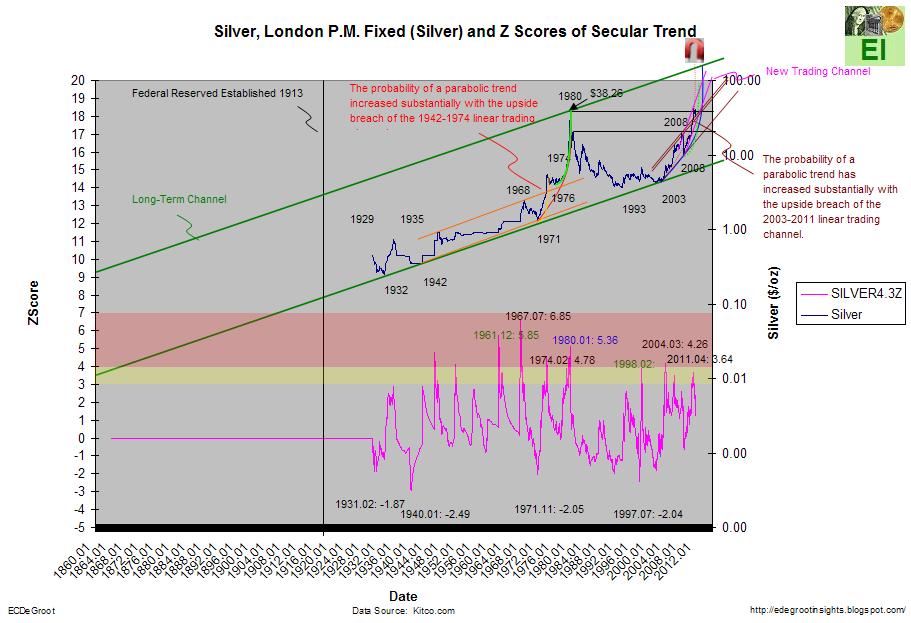

Here is a chart for you.

[img [/img]

[/img]

Wrong fucking URL here:

[img [/img]

[/img]

[img [/img]

[/img]

20th time is a charm[img [/img]

[/img]

Yah do know how long the Vietnam war was and when it started and yah do know Dickhead Nixon took us off gold in 1971 (august 15th of).

And yah do know when Greenspan went nuts, and yah do know about the 14 trillion in bailouts of 2008.

What about Deus Ex Machina. The looters aren’t going down without swinging. Look for massive money printing – then somebody does something stupid.

Let’s see – MRE’s check , Guns – check, Ammo (lots) – check, Bug Out Bag (check), Water (check), Gas and Generator (check), Camping Supplies (check).

Let’s roll.

Investing in the GLD ETF, in my opinion, is no different than investing in any equity. You are betting that the info presented is true (Enron), you are betting that the company will not close its doors (Kmart) and you are betting that the world’s economies will look pretty much the same going forward (dotcom/end of Y2K).

Which is why I laughed at my hub’s broker, then put a 100% ban on buying it, when he suggested it.

I read a bit about both GLD and SLV a couple years back, decided the whole, “we will never be forced to prove we own even one ounce” coupled with no declarations of the overhead/insurance/ security required to house that volume of PMs, led me to believe that they are just another Ponzi.

My “investments” are really more the equivalent of burying my cash in the backyard. I’m not looking for “growth,” I’m looking to end up with something I can use to feed my kid when the rest of the neighborhood is waiting for their rations, or food trucks.

But with no easy gold credit (or are they now offering 110% equity loans on your gold coins? No?), a true bubble won’t form.

Stucky, just tell Smokey “Du bist ein aschlok”. That will set him straight . 🙂

Agree, GLD is a ponzi but Sprott or allocated are better than any paper out there.

There are educated investors that know how this is going to play out. There have been 3800 Fiat currencies, all have gone to a value of 0 and the average lifespan on them is 39 years.

Any article that uses the term “goldbugs” just screams that they author is a fucking retard.

Hey Doppelganger:

Suchen Mein BiggolHanger

The correct spelling is “arschloch”.

And I would never say that to him. He is my all time favorite neocon.

Gott segne und beschütze mein freund, Smokey.

Sprotts’ PHYS ETF is, in my humble opinion, a much better vehicle than GLD.

@TeresaE: Check it out.. http://www.sprottphysicalgoldtrust.com

@Davos: You gotta love a guy who never gives up when he’s dealing with fucking WordPress!

MA

WordPress is right up there with Garmin today.

Boy for people mocking wordpress so much, you sure spend a heck of a lot of time on this wordpress site!

Teresa, I think investing in GLD is VERY different than investing in a stock. GLD has no earnings, no dividend, heck I didn’t even go into the gold holdings issue in the article, but importantly, it is taxed at about double the long-term cap gains rate compared to common equities.

Davos, can you post another chart for me? 🙂

Fuck you!

[img ?w=480&h=322[/img]

?w=480&h=322[/img]

You’ll be Bernanke’s be-itch with your paper shit

[img [/img]

[/img]

12 reasons smokeys comment (GES, SES) eats shit…

http://dont-tread-on.me/12-reasone-not-to-fear-septembers-gold-and-silver-price-smackdown/

Darwin baby….. WordPress sucks most any way you look at it. TBP runs on WordPress. Therefore we use what is available to us but we goddamned don’t have to like it.

Content makes the price a little easier.

By the way, you’re full of crap as a July 4th turkey..

MA

Some more reasons

1) It is leveraged 100:1 paper to the metal.

2) It is controlled by a TBTF bank – HBSC that is so overleveraged that it will go bankrupt the instant Greece defaults on it’s debts.

3) You CANNOT redeem for the actual metal.

4) When the sheeple masses finally piece together Facts 1-3 the stampede to the exits will cause a waterfall/falling knife plunge equivalent to being thrown from the top of the empire state building with a safe lashed to your legs.

On a related note, the price of physical Gold and Silver is starting to uncouple from the CRIMEX spot price… we are very late in the game beware…

Gotta love those Gold Nuggets.

[img [/img]

[/img]