The definition of death rattle is a sound often produced by someone who is near death when fluids such as saliva and bronchial secretions accumulate in the throat and upper chest. The person can’t swallow and emits a deepening wheezing sound as they gasp for breath. This can go on for two or three days before death relieves them of their misery. The American retail industry is emitting an unmistakable wheezing sound as a long slow painful death approaches.

It was exactly four months ago when I wrote THE RETAIL DEATH RATTLE. Here are a few terse anecdotes from that article:

The absolute collapse in retail visitor counts is the warning siren that this country is about to collide with the reality Americans have run out of time, money, jobs, and illusions. The exponential growth model, built upon a never ending flow of consumer credit and an endless supply of cheap fuel, has reached its limit of growth. The titans of Wall Street and their puppets in Washington D.C. have wrung every drop of faux wealth from the dying middle class. There are nothing left but withering carcasses and bleached bones.

Once the Wall Street created fraud collapsed and the waves of delusion subsided, retailers have been revealed to be swimming naked. Their relentless expansion, based on exponential growth, cannibalized itself, new store construction ground to a halt, sales and profits have declined, and the inevitable closing of thousands of stores has begun.

The implications of this long and winding road to ruin are far reaching. Store closings so far have only been a ripple compared to the tsunami coming to right size the industry for a future of declining spending. Over the next five to ten years, tens of thousands of stores will be shuttered. Companies like JC Penney, Sears and Radio Shack will go bankrupt and become historical footnotes. Considering retail employment is lower today than it was in 2002 before the massive retail expansion, the future will see in excess of 1 million retail workers lose their jobs. Bernanke and the Feds have allowed real estate mall owners to roll over non-performing loans and pretend they are generating enough rental income to cover their loan obligations. As more stores go dark, this little game of extend and pretend will come to an end.

Retail store results for the 1st quarter of 2014 have been rolling in over the last week. It seems the hideous government reported retail sales results over the last six months are being confirmed by the dying bricks and mortar mega-chains. In case you missed the corporate mainstream media not reporting the facts and doing their usual positive spin, here are the absolutely dreadful headlines:

Wal-Mart Profit Plunges By $220 Million as US Store Traffic Declines by 1.4%

Target Profit Plunges by $80 Million, 16% Lower Than 2013, as Store Traffic Declines by 2.3%

Sears Loses $358 Million in First Quarter as Comparable Store Sales at Sears Plunge by 7.8% and Sales at Kmart Plunge by 5.1%

JC Penney Thrilled With Loss of Only $358 Million For the Quarter

Kohl’s Operating Income Plunges by 17% as Comparable Sales Decline by 3.4%

Costco Profit Declines by $84 Million as Comp Store Sales Only Increase by 2%

Staples Profit Plunges by 44% as Sales Collapse and Closing Hundreds of Stores

Gap Income Drops 22% as Same Store Sales Fall

Ann Taylor Profit Crashes by 75% as Same Store Sales Fall

American Eagle Profits Tumble 86%, Will Close 150 Stores

Aeropostale Losses $77 Million as Sales Collapse by 12%

Big Lots Profit Tumbles by 90% as Sales Flat & Exiting Canadian Market

Best Buy Sales Decline by $300 Million as Margins Decline and Comparable Store Sales Decline by 1.3%

Macy’s Profit Flat as Comparable Store Sales decline by 1.4%

Dollar General Profit Plummets by 40% as Comp Store Sales Decline by 3.8%

Urban Outfitters Earnings Collapse by 20% as Sales Stagnate

McDonalds Earnings Fall by $66 Million as US Comp Sales Fall by 1.7%

Darden Profit Collapses by 30% as Same Restaurant Sales Plunge by 5.6% and Company Selling Red Lobster

TJX Misses Earnings Expectations as Sales & Earnings Flat

Dick’s Misses Earnings Expectations as Golf Store Sales Plummet

Home Depot Misses Earnings Expectations as Customer Traffic Only Rises by 2.2%

Lowes Misses Earnings Expectations as Customer Traffic was Flat

Of course, those headlines were never reported. I went to each earnings report and gathered the info that should have been reported by the CNBC bimbos and hacks. Anything you heard surely had a Wall Street spin attached, like the standard BETTER THAN EXPECTED. I love that one. At the start of the quarter the Wall Street shysters post earnings expectations. As the quarter progresses, the company whispers the bad news to Wall Street and the earnings expectations are lowered. Then the company beats the lowered earnings expectation by a penny and the Wall Street scum hail it as a great achievement. The muppets must be sacrificed to sustain the Wall Street bonus pool. Wall Street investment bank geniuses rated JC Penney a buy from $85 per share in 2007 all the way down to $5 a share in 2013. No more needs to be said about Wall Street “analysis”.

It seems even the lowered expectation scam hasn’t worked this time. U.S. retailer profits have missed lowered expectations by the most in 13 years. They generally “beat” expectations by 3% when the game is being played properly. They’ve missed expectations in the 1st quarter by 3.2%, the worst miss since the fourth quarter of 2000. If my memory serves me right, I believe the economy entered recession shortly thereafter. The brilliant Ivy League trained Wall Street MBAs, earning high six digit salaries on Wall Street, predicted a 13% increase in retailer profits for the first quarter. A monkey with a magic 8 ball could do a better job than these Wall Street big swinging dicks.

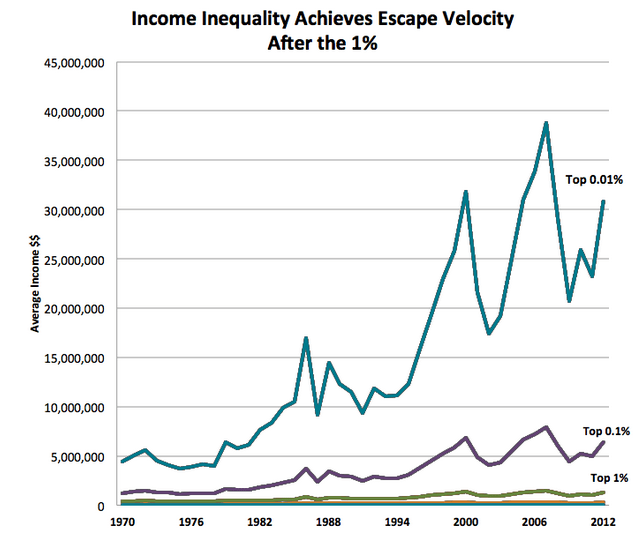

The highly compensated flunkies who sit in the corner CEO office of the mega-retail chains trotted out the usual drivel about cold and snowy winter weather and looking forward to tremendous success over the remainder of the year. How do these excuse machine CEO’s explain the success of many high end retailers during the first quarter? Doesn’t weather impact stores that cater to the .01%? The continued unrelenting decline in profits of retailers, dependent upon the working class, couldn’t have anything to do with this chart? It seems only the oligarchs have made much progress over the last four decades.

Retail CEO gurus all think they have a master plan to revive sales. I’ll let you in on a secret. They don’t really have a plan. They have no idea why they experienced tremendous success from 2000 through 2007, and why their businesses have not revived since the 2008 financial collapse. Retail CEOs are not the sharpest tools in the shed. They were born on third base and thought they hit a triple. Now they are stranded there, with no hope of getting home. They should be figuring out how to position themselves for the multi-year contraction in sales, but their egos and hubris will keep them from taking the actions necessary to keep their companies afloat in the next decade. Bankruptcy awaits. The front line workers will be shit canned and the CEO will get a golden parachute. It’s the American way.

The secret to retail success before 2007 was: create or copy a successful concept; get Wall Street financing and go public ASAP; source all your inventory from Far East slave labor factories; hire thousands of minimum wage level workers to process transactions; build hundreds of new stores every year to cover up the fact the existing stores had deteriorating performance; convince millions of gullible dupes to buy cheap Chinese shit they didn’t need with money they didn’t have; and pretend this didn’t solely rely upon cheap easy debt pumped into the veins of American consumers by the Federal Reserve and their Wall Street bank owners. The financial crisis in 2008 revealed everyone was swimming naked, when the tide of easy credit subsided.

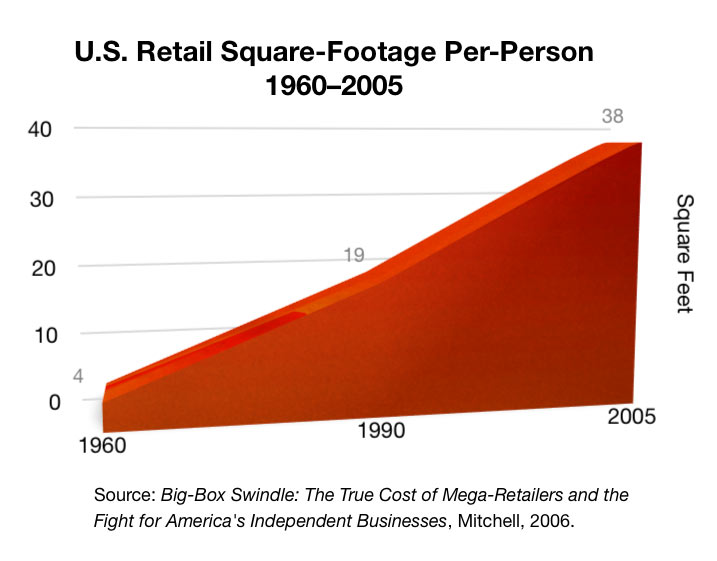

The pundits, politicians and delusional retail CEOs continue to await the revival of retail sales as if reality doesn’t exist. The 1 million retail stores, 109,000 shopping centers, and nearly 15 billion square feet of retail space for an aging, increasingly impoverished, and savings poor populace might be a tad too much and will require a slight downsizing – say 3 or 4 billion square feet. Considering the debt fueled frenzy from 2000 through 2008 added 2.7 billion square feet to our suburban sprawl concrete landscape, a divestiture of that foolish investment will be the floor. If you think there are a lot of SPACE AVAILABLE signs dotting the countryside, you ain’t seen nothing yet. The mega-chains have already halted all expansion. That was the first step. The weaker players like Radio Shack, Sears, Family Dollar, Coldwater Creek, Staples, Barnes & Noble, Blockbuster and dozens of others are already closing stores by the hundreds. Thousands more will follow.

This isn’t some doom and gloom prediction based on nothing but my opinion. This is the inevitable result of demographic certainties, unequivocal data, and the consequences of a retailer herd mentality and lemming like behavior of consumers. The open and shut case for further shuttering of 3 to 4 billion square feet of retail is as follows:

- There is 47 square feet of retail space per person in America. This is 8 times as much as any other country on earth. This is up from 38 square feet in 2005; 30 square feet in 2000; 19 square feet in 1990; and 4 square feet in 1960. If we just revert to 2005 levels, 3 billion square feet would need to go dark. Does that sound outrageous?

- Annual consumer expenditures by those over 65 years old drop by 40% from their highest spending years from 45 to 54 years old. The number of Americans turning 65 will increase by 10,000 per day for the next 16 years. There were 35 million Americans over 65 in 2000, accounting for 12% of the total population. By 2030 there will be 70 million Americans over 65, accounting for 20% of the total population. Do you think that bodes well for retailers?

- Half of Americans between the ages of 50 and 64 have no retirement savings. The other half has accumulated $52,000 or less. It seems the debt financed consumer product orgy of the last two decades has left most people nearly penniless. More than 50% of workers aged 25 to 44 report they have less than $10,000 of total savings.

- The lack of retirement and general savings is reflected in the historically low personal savings rate of a miniscule 3.8%. Before the materialistic frenzy of the last couple decades, rational Americans used to save 10% or more of their personal income. With virtually no savings as they approach their retirement years and an already extremely low savings rate, do retail CEOs really see a spending revival on the horizon?

- If you thought the savings rate was so low because consumers are flush with cash and so optimistic about their job prospects they are unconcerned about the need to save for a rainy day, you would be wrong. It has been raining for the last 14 years. Real median household income is 7.5% lower today than it was in 2001. Retailers added 2.7 billion square feet of retail space as real household income fell. Sounds rational.

- This decline in household income may have something to do with the labor participation rate plummeting to the lowest level since 1978. There are 247.4 million working age Americans and only 145.7 million of them employed (19 million part-time; 9 million self-employed; 20 million employed by the government). There are 92 million Americans, who according to the government have willingly left the workforce, up by 13.3 million since 2007 when over 146 million Americans were employed. You’d have to be a brainless twit to believe the unemployment rate is really 6.3% today. Retail sales would be booming if the unemployment rate was really that low.

- With a 16.5% increase in working age Americans since 2000 and only a 6.5% increase in employed Americans, along with declining real household income, an inquisitive person might wonder how retail sales were able to grow from $3.3 trillion in 2000 to $5.1 trillion in 2013 – a 55% increase. You need to look no further than your friendly Too Big To Trust Wall Street banks for the answer. In the olden days of the 1970s and early 1980s Americans put 10% to 20% down to buy a house and then systematically built up equity by making their monthly payments. The Ivy League financial engineers created “exotic” (toxic) mortgage products requiring no money down, no principal payments, and no proof you could make a payment, in their control fraud scheme to fleece the American sheeple. Their propaganda machine convinced millions more to use their homes as an ATM, because home prices never drop. Just ask Ben Bernanke. Even after the Bernanke/Blackrock fake housing recovery (actual mortgage originations now at 1978 levels) household real estate percent equity is barely above 50%, well below the 70% levels before the Wall Street induced debt debacle. With the housing market about to head south again, the home equity ATM will have an Out of Order sign on it.

- We hear the endless drivel from disingenuous Keynesian nitwits about government and consumer austerity being the cause of our stagnating economy. My definition of austerity would be an actual reduction in spending and debt accumulation. It seems during this time of austerity total credit market debt has RISEN from $53.5 trillion in 2009 to $59 trillion today. Not exactly austere, as the Federal government adds $2.2 billion PER DAY to the national debt, saddling future generations with the bill for our inability to confront reality. The American consumer has not retrenched, as the CNBC bimbos and bozos would have you believe. Consumer credit reached an all-time high of $3.14 trillion in March, up from $2.52 trillion in 2010. That doesn’t sound too austere to me. Of course, this increase is solely due to Obamanomics and Bernanke’s $3 trillion gift to his Wall Street owners. The doling out of $645 billion to subprime college “students” and subprime auto “buyers” since 2010 accounts for more than 100% of the increase. The losses on these asinine loans will be epic. Credit card debt has actually fallen as people realize it is their last lifeline. They are using credit cards to pay income taxes, real estate taxes, higher energy costs, higher food costs, and the other necessities of life.

The entire engineered “recovery” since 2009 has been nothing but a Federal Reserve/U.S. Treasury conceived, debt manufactured scam. These highly educated lackeys for the establishment have been tasked with keeping the U.S. Titanic afloat until the oligarchs can safely depart on the lifeboats with all the ship’s jewels safely stowed in their pockets. There has been no housing recovery. There has been no jobs recovery. There has been no auto sales recovery. Giving a vehicle to someone with a 580 credit score with a 0% seven year loan is not a sale. It’s a repossession in waiting. The government supplied student loans are going to functional illiterates who are majoring in texting, facebooking and twittering. Do you think these indebted University of Phoenix dropouts living in their parents’ basements are going to spur a housing and retail sales recovery? This Keynesian “solution” was designed to produce the appearance of recovery, convince the masses to resume their debt based consumption, and add more treasure into the vaults of the Wall Street banks.

The master plan has failed miserably in reviving the economy. Savings, capital investment, and debt reduction are the necessary ingredients for a sustained healthy economic system. Debt based personal consumption of cheap foreign produced baubles & gadgets, $1 trillion government deficits to sustain the warfare/welfare state, along with a corrupt political and rigged financial system are the explosive concoction which will blow our economic system sky high. Facts can be ignored. Media propaganda can convince the willfully ignorant to remain so. The Federal Reserve can buy every Treasury bond issued to fund an out of control government. But eventually reality will shatter the delusions of millions as the debt based Ponzi scheme will run out of dupes and collapse in a flaming heap.

The inevitable shuttering of at least 3 billion square feet of retail space is a certainty. The aging demographics of the U.S. population, dire economic situation of both young and old, and sheer lunacy of the retail expansion since 2000, guarantee a future of ghost malls, decaying weed infested empty parking lots, retailer bankruptcies, real estate developer bankruptcies, massive loan losses for the banking industry, and the loss of millions of retail jobs. Since I always look for a silver lining in a black cloud, I predict a bright future for the SPACE AVAILABLE and GOING OUT OF BUSINESS sign making companies.

when i saw the article i was like oh shit here he goes again. boots will shake.

u wield a dangerous pen my friend

Brilliant, absolutely brilliant… Terrified, yes, but not frozen and unable to act,. The real curse is the whores on msm, wall street and the banks. The idea they can continue ad infinitum this dance is the lie they live by. They don’t know it but as you so aptly pointed out, the music has stopped playing and they are about to witness a real big can of Whoop Ass open up and rain on their parade….. Thanks for taking the time to put this in print, dj

I always love the retail death rattle articles. The retail collapse is getting worse. I hear about it all the time from my friends working in the service sector. Businesses are getting desperate and throwing employees and customers under the bus. Trying to stretch out the last dollar.

Screw Costco, I went in the other day to buy ONE package of Turkey breakfast sausage [Nine bucks] and they refused me, they wanted a 55$ membership fee.

I left my purchase on the counter and will not be back.

I was out amongst the plebs for a brief period today. Tourists were reveling in the excuse to eat more than usual and consume even more alcohol than usual. I overheard some lamenting that they had already blown their drinking budget on Night #1 of the long weekend. They were also worried about the cost of frozen pizza needed to feed their hungry travelers. I couldn’t partake in the endless baaaaing of the collective sheep. Someone how I knew this website would have a new article while the rest of the country is on weekend hiatus.

The anecdotal evidence does not match the propaganda. The masses are barely hanging on. The new middle class (government workers & contractors) are doing better but they do not have the intelligence to match their money, so it is squandered as quickly as it is deposited in their accounts. The rich are doing better than ever but will not stop gorging until they have completely destroyed the system. Retail CEOs, lawyers, judges, politicians, Ivy League economists, CNBC pundits.. all are playing the same game. Steal as much as you can before the music stops. There is only one rule to said game: don’t ever admit that anything is wrong. They must continue to spew bullshit and denials ad naseum or the game is up. When the music finally ends, the masses will rush to their Telescreens and the talking heads will explain how “no one saw this coming” and “drastic action is being taken by the administration.” Maybe sometime in the future historians will look back on websites like these and realize that some people indeed knew the ship was sinking but were powerless to stop it..

I can only speak to Walmart, Home Depot and Lowes as I never go to any of those other stores.

(But our Conroe Olive Garden is very good and always full of customers.)

Walmart, IMHO, is the canary in the coal mine for the true state of the Middle (and Lower) economic classes. That it is struggling with same store sales and overall revenue is very very ominious

Our local store has had widening aisles and less stuff on the shelves for the last 2 years. I used to go to Walmart fairly regularly for med preps like triple abx ointment, 1% hydrocortisone cream, 1% clotrimazole cream, MVI stocks, gauze, bandaids, etc. I would buy like 10 of these items at a time. Now there is maybe 3-4 on the shelf and the department manager tells me there isn’t any in the back.

The other “news” about Walmart is how dependent they are on EBT purchases and about how their same store sales have plummeted.

http://www.zerohedge.com/news/2014-03-26/walmart-admits-profits-depend-heavily-corporate-welfare

As to Home Depot and Lowes, their store doesn’t have the variety or amount of stuff they had 1-2 years ago. Most everything in these stores is made in China anyhoo. Their poor sales reflect the ongoing collapse in the housing market.

Another eloquent and cogent article of how truly fucked we are, thanks Admin for throwing some Doom on what is otherwise a pretty good Memorial Day weekend.

Since the grand reset is inevitable, I can only hope that it occurs on President Teleprompter’s watch. It couldn’t happen to a nicer guy.

How will the media spin the debacle? What will Janet Yellen do? How will Paul Krugman react?

It is going to be painful for most Americans, but we’ve brought it on ourselves: too much spending, too much borrowing, too much money-printing – all to fund useless wars, a police state, and the FSA.

Same in every country now. It’s all falling apart, retail is DEAD, businesses shedding staff or cutting their hours, closing down citing no customers as the cause.

I’m in a city in a multi-faceted retail industry and have tracked sales on spreadsheet for the past 6 years. As of 2014 they’re down BY by 80%. Yes down BY 80%, NOT down TO 80%.

We do a lot of government work too but even that’s disappeared.

Frightening…not long to go before this place closes down.

The more the sheeple learn, the more discretionary spending disappears ,further accelerating the inevitable collapse. Catch 22.

At least China will get to pay the price for destroying the Western economies/manufacturing…

Excellent work Admin, well done.

I have been finding a few good sales. Time to stock up.

[img [/img]

[/img]

The highest use of capital is not to make more money, but to make money do more for the betterment of life.

Henry Ford

Our desert cities CA town of 40,000 is about to lose our only large grocery store within 4 miles, as well as our Ace Hardware, having already lost Fresh and Easy and several retail shops. 5 miles away our largest shopping center contains a failing walmart, and next door, the biggest defunct retail store anyone has ever seen – an empty Sam’s Club which died 4 years ago. Best Buy and Staples across the highway, also failing big box models, will soon join the ghost façade.

But our senior center is adding a 5000 sq ft exercise weight room using $2 MIL of fed ‘matching funds’ for the $4 MIL expansion: our city hall leaders still suffer the ‘edifice complex’, believing government funding for traffic roundabouts and civic building is ‘free money’ well spent.

Ask them about the upcoming 10-plus year credit and debt contraction resulting from the collapse of the country’s 100 year, or 70 year, or 32 year fed-sponsored debt, credit and spending binges, and their eyes glaze over…

Admin – you did a lot of research. I appreciate your hard work. Some fascinating bits in there. I was specially surprised by the square feet per person info – that was indeed something I did not know.

I was thinking of investing in some commercial real estate. I gather you think that may be a bad idea?

One of the things I thought about in reading the article was how beneficial it will be to the retailers when the minimum wage levels go up. That should really help them out.

I bet Obamacare will be a boon, too.

Your points re the ever and rapidly increasing age of the population is astute – I mean, just how much denture cleaner can the retailers sell? Old folks simply will not have the money to prop up sales.

Re car loans – why anyone who cannot pay cash for a car would buy a new car is beyond me ( if you have the money, buy whatever the hell you want). Used cars can be had for a pittance. A small used car with 50k on the clock can be picked up for peanuts, anfd then can be driven, with regular maintenance, for another 150k miles – or say ten or 15 years. I know – I drove an old beater for years and years, even when I was a very senior manager, because I had better things to do with my money. I did not give a shit that folks working for me had nice shiny new cars – I had a plan, and it did not include wasting money on cars.

Re student loans – if the money is spent studying proper subjects, by folks with the necessary drive, intelligence, and commitment to apply what they learn in the real world, then I see that money as an investment, and it will turn out to be money well spent.

Unfortunately, only a minority of students fall into that category. The vast majority of money being borrowed and spent is being wasted. That money would be far better used on learning a trade, etc.

Thanks for a great article.

Thanks Llpoh. I try to back up everything I write with verifiable facts so the propaganda crowd can’t dismiss my conclusions.

Real estate is always local. An investment in commercial real estate at the right price and solid tenants can still be a good investment. I live in a suburban area that is supposedly well off and the number of vacant retail and office properties is staggering. We are truly in an extend and pretend interlude before the shit hits the fan.

I believe a huge portion of the student loan debt issued in the last few years have been spent in the economy and not on tuition and books. It’s a massive scam.

Zombiedawg – you said “The more the sheeple learn, the more discretionary spending disappears”.

Some may be learning, but I think the real reason is that they have less and less discretionary spending. Fact is, most folks have long run out of discretionary spending money – and are now figuring out ways to trim non-discretionary spending.

I am sure this will help the retailers:

[img [/img]

[/img]

Llpoh

Even online sales have begun to peeter out. The States started to tax online sales and have reduced the cost benefit tremendously. Online sales declined in March.

Is admin the man or what? A holiday weekend and he still has time to research and post an article. Well done.

Retail, housing, they’re going into the toilet. There are 110 million Americans that don’t have jobs, another 110 million that are on the FSA ranks (welfare/disability), the SS geezers, union drone government employees (soft welfare), and millions and millions of retired union government drones getting massive pensions and benefits.

Let’s face it, we’re in a recession now. GDP was negative, even after the government massaged the data. People incomes keep going down, and prices keep going up. The price of everything is accelerating, and taxes, insurance, utilities, education, food, all skyrocketing. Yet, people around here are all driving new cars, thousands of new cars. Can you say sub-prime auto loans? And a whole generation of kids are in debt up to their eyeballs from student loans.

The banksters job is done, they’ve indebted every person, business, and the government to the maximum. Now, people are barely able to make their expenses and debt payments. The trade deficit is more than $500 billion a year, money that keeps getting shipped out of the country. How much longer can that go on until we’re broke? The government is broke. The Fed will be insolvent if interest rates rise (and they will sooner or latter). People are broke, no savings, and businesses large and small have loaded up on debt with QE bucks and zero interest rates. It’s a house of cards, and it’s ready to tumble.

The whole retail system was built on a foundation of debt; credit card purchases, EZ financing, and other bankster-concocted debt instruments. We changed from a production economy to a service/financialization (debt) economy. It only ends one way: bankruptcy. Clear away all the debt and start over. Ooops, too late for that.

Wal Mart would lose half their business if the FSA didn’t get their free SNAP and EBT cash. How much longer can we afford to keep supporting 110 million welfare and disability deadbeats? Not much longer, I’m guessing.

People realize we’re in a recession, and when you’re in a recession, you quit spending and try as hard as you can to hold onto your money (and maybe save a little) as people are losing their jobs everywhere. Even HP announced 16,000 more layoffs. It’s going to be a viscous cycle to the bottom. The last to go will be union government drones and their ridiculous pensions. Detroit showed clearly pensions can evaporate in a heartbeat, and union drones are finally going to get what’s coming to them for the laziness and greed.

It’s kind of difficult to see a positive way out of this mess. I don’t know what’s going to lead us out of the current recession. More debt? More government spending? Nope, the system is rotten to the core. Corporations have pissed away tens of billions buying back their own stock back to improve PE ratios and the illusion of stable profits. They spend little or nothing in CAPEX, and so their businesses have become hollowed out shells.

Faced with cutting spending, especially for the FSA, the government will start wealth confiscation from your bank accounts and IRA”s. The plans are already in the works. The banksters are more than willing to steal half your money to keep themselves solvent, and the government is willing to steal the other half to fund continued redistribution to the FSA. Obama and the liberal progressive democrats are going to run the socialism game to the very end of the line, unless they are stopped. But they will run out of other people’s money sooner or later. Then the FSA finally get’s cut off, and it’s game over.

AWD

And I wrote it while recovering from one of the worst hangovers of my life yesterday. I may have had one too many at the Shamrock. Poor Avalon did yeowoman work getting me home and dealing with the consequences of my overindulgence.

Gotta go. Billy Jack goes on at 10:00. I promise to pace myself.

All true, and is directly tied to the timeline when America stopped using real money,and started using FRNs.The scope of destruction from this scam remains to be seen and judged by the posterity.In the eye of an astute observer however, all signs are pointing to the end of it.In a way, I am glad this is happening with the retail,and there is nothing worth holding onto there.

The miserable pay for the retail worker,the middleman profiteers behind the 70%off signs, these nauseatingly generic,tasteless boudoirs,celled for ages in concrete MALLS of America pushing their crappy slave labor made trinkets.It is breathtaking…pinnacle of anti-culture, celebration of vanity and bad taste… crying loud THIS is WHO you Are… dumb f&@ks!

AWD – I am not one that thinks they will confiscate bank accounts. Why would they do that when they can simply print money? For instance, in Cyprus, bank accounts had a percentage confiscated. But Cyprus is in the Euro – they cannot print money. The US can. Anything is possible of course, but to take money from bank accounts is a direct assault, while printing money is indirect. I think they will be sneaky, not direct.

Thanks to banks not having to “mark to market”, they are hiding commercial loan losses that must be mind-boggling. The housing market is tanking also, so more losses for banks. And banks are still holding onto millions of foreclosures that haven’t even hit the market yet. Good thing Bennocchio printed more than $6 trillion and handed it over to banks.

One can only wonder how much longer the no-volume, no-volatility stock market can continue to make new highs before it rolls over and dies. I suppose it’s just algos trading with other algos anyway. I can’t wait to see companies trying to unload massive amounts of stock they bought back (by borrowing) at the top of the bubble when their stock price is cut in half.

Admin – I have read stuff that supports what you are saying re student loans being spent in the economy – folks are using loans for household expenses and are not attending school, etc. The get the loan and spend it on anything but education. What a scam.

It is not going to end well.

Llpoh

The government (Obama) has already drawn up plans to confiscate wealth (as has England). The British PM has already publicly stated he either has to raise taxes or confiscate wealth.

We will see taxes continue to rise, especially on the rich. Taxes will be raised and raised, and raised some more. But that offers diminishing returns. Once the recession grinds on, and becomes “official”, tax revenue will fall as people lose jobs and sign up for unemployment and free shit.

The Fed can keep printing money, but they risk a currency crisis. And as QE has shown, printing money works okay at first, and it’s not working at all now. It’s only creating bubbles and enriching billionaires (not the Yelling cares). They will reach a point of desperation where they will be forced to confiscate wealth. They’ll start by grabbing everything overseas/offshore first, and work their way back. The IRS passed laws, and foreign banks are complying, were now the IRS knows about every account or offshore hiding spot. They’ll steal that money (almost $17 trillion). That will fund the FSA for quite awhile.

AWD – I agree with you. Just not on the part where they direct confiscate from bank accts. Taxes will rise, etc.

Re the overseas stuff – they will not be able to get that directly. Not at all. They will be attacking it via people failing to report its existence, for paying taxes on the income they receive, etc. They will be fined – excessively – for that stuff. But they have no power to collect it directly. Their power lies in the ability to toss folks in jail for failure to hand it over.

But because there are some 6 million folks overseas affected by this, I suspect the shear numbers will limit their ability to be successful collecting that money. They will get some – the amount will be in the billions, maybe tens of billions, but unlikely it will be in the trillions. In my opinion, anyway.

I remember when people at Home Depot and Wal Mart would fight you for a parking space and a cart. Now, not so much, you can actually walk around without bumping into someone.

I have been calling a bottom too… but never put a date on it coz people will hold you to it.

Won’t you tell me… where have all the good jobs gone? where have all the good jobs gone…

DB – the good jobs were equivalent to having won the lottery after WW2. The US received an enormous lottery windfall at that time. And instead of investing that windfall lottery win, it was squandered. The US people spent the lottery win, and came to believe that their relative standard of living was not as a consequence of having won the lottery, but because they were special, superior, and entitled to that standard of living.

The windfall was squandered and not properly invested – the “good jobs” were illusions. They existed off the back of the lottery win. Compounding the problem, the US borrowed huge slabs of money trying to maintain the illusion.

So the good jobs existed but for a fleeting instance, never were sustainable, and are not coming back for the middle class. The better educated and skilled folks with good work ethics and traditional value systems with respect to thrift, etc., will likely still do well. But for the most part, those in the middle class will continue to see their lifestyles erode, until the steady-state position is reached. My rough estimate is that middle class average incomes will fall at another 25 to 30% before that position is reached.

And that fall will coincide with increased price of goods, increased taxes, etc.

Welcome to the new reality.

To Lipoh:

Well.. I’ve been trying (but why I bothered I don’t know) to warn people re the bleeding obvious since the GFC. It’s the global wake-up call, but the sheeple down here in Oz believed it’s just the USA and Eurozone that can be affected. We’re magically safe by some mystical reasoning.

I said get out of stock and shares, I said don’t buy real-estate at the peak of the global (collapsing) bubble, I said government cutbacks will be like nothing we’ve seen, I said charities won’t be able to cope, and ALL of the above have now hit and I’ve been vindicated not that I take any pleasure in that.

So, yes, a lot of people ARE out of money, have to choose between power or food, so discretionary spending for them is moot. The rest DO have money to spend but aren’t, as the official figures show, for they are preparing for worse to come. Either way, retail is dying here too.

I just wish the whole damn show would collapse right now and stop the slow agonising death spread over the next decade we’re in for.

THE USA Economy is going to fully COLLAPSE, and nothing is going to stop it, period. NO wishful thinking, no protesting, no begging for jobs, nothing. THERE is going to be horrible chaos on the streets like you have never scene before. THIS is why Homeland Security has been buying Billions of bullets, hundreds of thousands of guns, Body armor and armored vehicles. THEY have been preparing for over 3 years, using your tax money to buy enough stuff to supply a large army, but they deny it is for civil unrest. SO Billions of dollars in war equipment is sitting for nothing and not going to be used? BULLCRAP. They know it’s coming soon. WHY? Because the people that control HLS caused the collapse on purpose.

DHS Publicly Denies Preparation for Riots, Civil Unrest

http://www.infowars.com/dhs-publicly-denies-preparation-for-riots-civil-unrest/

Talking about the retail mess, I live in a town of 30,000 people and we have both a Super Target and Walmart and both stores in the last six months have started looking like deserted shopping malls in Detroit. Once these two giants ran the local mom and pops out of town, they raised their prices through the roof.

My worry is since I live in a town that is the county seat we have everything here; the jail, shrinks offices, SNAP benefit offices, etc, we are a dumping ground for the disability bums who wonder our streets night and day. When this thing goes these people (The SNAP army) will go nuts. Some of them already are with cutback to their benefits. At least a few times a month one of them will go up and down our street and knock on doors looking for cigarettes or money to buy them.

man this is going to get bad so everybody get ready to bug out of the burbs and the cities and head to the mountains or desert, may be our only chance to survive.

I work retail and I can tell ya that sales are off by up to 25% from last year and our hours are way down.

Death Rattle. 1 of the most awesome heavy metal bands ever.

Right up there with “Motorhead”.

To stay alive, retailers will automate, robotize, & fire workers, causing the problem to worsen. Add in higher gas prices…1 thing that will not happen is CEOs taking pay cuts or having their golden parachutes taken away.

I was so hoping for more time to prep before the SHTF, but this rattling sound is for real I fear. Yet how can it be otherwise, the parasites have finally sucked their host dry. When the host is well and truly finished the parasites will get their comeuppance as well…but poor host, the real economy deserved better.

I have been retired six years from my business which was one of the top executive search firms in the retail business. My clients included Disney both Parks and Retail, Gap, Best Buy, Bed – Bath & Beyond, Claire’s, Kohls, Meryvn’s, K-Mart and many more. I worked from store mgr. level in 1979 up to CEO level when retiring. I was a consultant for Hedge

Funds and Investment Bankers. In the 30 years you are the first person who has it absolutely right. I would talk to my wife about the rapid expansion of the retail community in both mall and strip center. The big boxes were the last real infusion and now that strategy will fall victim. By this time next year I think Best

Buy, Staples, Office Depot, Sports Authority and many others will be in a store closing mode. Best article about the industry I have read in years.

Bruce Ericksen

Every business listed specializes in selling absolute unadulterated crap as its product and/or service. They DESERVE to be out of business. Mom and Pop will flourish again.

The official employed figures for 2010 according to the I.R.S. were 113 million people. In 2012 it was 115 million. The last figure I saw was 137 million. The nation adds 2-3 million new people to the job market every year with another 400,000+ in H1B visas. So since 2008 we have added a minimum of of 12 million new applicants to as many as 18 million. This completely explains the jump in numbers from 2010 to now but it leaves behind the 9-21 million who gave up looking and are not new college graduates or high school graduates willing to work for less. No new jobs have been added at all, it is all swap-out of existing people and unfilled jobs in low-paying, “no one ever wanted them anyway” type jobs being filled.

151 million earn less than $500.00 a week and that includes social security recipients in the figure AND it is from 2010 so there are (as of 2010) at least 38 million SS recipients. Now there are jobs that pay more than $500.00 a week but by my calculations there cannot be more than 15 million jobs worth having at all left and 6-9 million are government.

This nation has been ruined by globalization.

They are looting and plundering America and Americans. When they are done, they will cast her off like a dead carcass into the sea…. BUT WHO ARE THEY?

the costs for those ‘survival food’ cases are finally dropping to reasonable $50-$75 discounts with free-shipping…so I am starting to buy the 1-to-3 month packages for now

“Armaments, universal debt, and planned obsolescence – those are the three pillars of Western prosperity. If war, waste, and moneylenders were abolished, you’d collapse. And while you people are overconsuming the rest of the world sinks more and more deeply into chronic disaster.”

― Aldous Huxley, Island

When I was a kid my mother and I would watch a program called Million Dollar Movies (isn’t that quaint). One great scene from one of those movies was Jimmy Cagney smashing a grapefruit in some mouthy woman’s face.

That’s the way I see these articles; Admin is Cagney, MSM/CorpGov is the bitchy ho.

Kudos for pointing out what should be obvious to anyone with an IQ on the right hand side of the bell curve.

Picture Janet Yellen as the woman. I watched Million Dollar Movies too on one of our 7 TV channels. I loved Cagney movies. Mister Roberts is still one of my favorites.

llpoh says: AWD – I am not one that thinks they will confiscate bank accounts. Why would they do that when they can simply print money?

LLPOH, the US has limits on its ability to print money. The petro dollar is the mechanism that has allowed the money printing to go forward. China and Russia are signing trade deals and dismantling the petrodollar at a blistering pace, the petro dollar is collapsing along with the United States’s ability to print money. The petrodollar is the reason the United States intervenes in the affairs of oil-rich country’s. Regardless of what Z says intervention in the Middle East is about oil and the petrodollar it has very little to do with the Joos. A major war is the next thing on the horizon, United States will pull out all stops to defend the petrodollar. It’s going to get ugly.

http://ftmdaily.com/preparing-for-the-collapse-of-the-petrodollar-system/

When they are not lying Jew Bankers always tell the truth.

[img [/img]

[/img]

The one sector that is still going strong (at least in TX) Is anything having to do with fracking. Mud disposal, fresh water pumpin, pressure vessel construction, metal buildings designed for ng infrastructure…

it’s an extremely obvious bubble that is doing a lot of ecological damage, but it’s where to be if making money is a concern

This is Mahafarid Amir Khosravi. [/img]

[/img]

[img

He’s from Iran.

He’s a Billionaire.

He scammed the Iranian State Bank out of $2.6 billion.

Now he’s dead …… he was executed last week for the crime.

Thus endeth the Good News Segment for today.

What happens to Big Retail (not to mention us Little People) when Da Fed raises interest rates?

“Fed On Target To Raise Interest Rates In Spring 2015”

——– http://www.forbes.com/sites/advisor/2014/03/27/fed-on-target-to-raise-interest-rates-in-spring-2015/

The great majority of people still believe the King’s new clothes are gorgeous, so this craziness will go on a little while longer with practically no concern from the masses. Gradually, individuals are waking up and trying to get away from the vortex caused by the sinking ship, but this trickle of people is unlikely to cause an “Aha!” moment for the whole society. The following brilliant article spells it out, and identifies what might cause “everybody” to wake up all of a sudden and bring the whole carnival to an abrupt end.

http://www.salientpartners.com/epsilontheory/notes/When%20Does%20The%20Story%20Break.html

Admin.,

Guess I slept in, as everyone got ahead of me. Great retail article, and I was surprized too about the SF retail per person. When it comes to retail your the man with his hand around their throats. Good job!!

When you realize the amount of money the consumer use to spend on “stuff”, and it is not in their wallets anymore, the economy is heading for the exit. The “Death Rattle” with the bar code is spot on. .

I really do think we are in the new “Greater Depression” as Casey puts it.

Stuck,

If Mahafraid had stolen that amount in the U.S., he might of had to do 20 hours of community service work.

Thanks, Admin, for an outstanding post.

Thanks, also, to Doug Ross for linking it.

This analysis fails to consider the impact of e-tail consumer sales on brick and mortar stores.

I didn’t realize how bad it is until I saw this in the article ……

“Dick’s Misses Earnings Expectations as Golf Store Sales Plummet”

This is a national disaster of epic proportions.

I liked the article, kinda puts the mess we’re in right in your lap. No place to run, can’t deny what’s in your face. No ideas on what to do about any of it. I guess the author is saving that for a future article. I look forward to reading it. Enjoy the Holiday everyone, please remember who and what it is really about.

SSS,

Think about it.

Golf sales

Boat sales

Second Homes

Swimming Pools

Motorcycles

Recreational Planes

Cruises

Sporting Events

Eating out

Sure, none these are disasters of epic proportions, but added together is the demise of the middleclass.

SSS probably has a big, fat government pension every month. He can afford to golf and live the good life.

Great article!