Month: June 2014

SEEDS MAY BECOME MORE VALUABLE THAN GOLD

Seeds may become more valuable than GOLD in an economic collapse…

Survival Seeds Vault

Order Your Survival Seed Vault™ $99

Plant Over 2 Acres

Survival Garden!

Or store it for years. (7+)

The Original Survival Seed Vault™

Over 2 Acres | 55,000 Seeds

1.8LB of seeds in water/air-tight Vault. More survival seeds for your money.

Feed your family and friends this year and into the future with 100% NON HYBRID (Open Pollinated) Seeds. You MUST use non-hybrid seeds in order to save seeds from your crops for future planting.

The Original Survival Seed Vault™ is moisture-reduced for long term storage according to USDA developed methods. Twice the shelf life of other “patriot” seeds.

-More than 55,000 Seeds

-More than 1.8 pounds

-Comes in resealable bucket

-Varieties chosen for your SURVIVAL by seed experts

Order your Survival Seed Vault today..for tomorrows future.

WALL STREET ISSUES 39% MORE CREDIT CARDS TO SUBPRIME BORROWERS – WHAT COULD POSSIBLY GO WRONG?

Guest Post by Wolf Richter

Signs Of The Top: Subprime Credit Card Issuance Surges; Finanical Stress Index At All-Time Low

During the first quarter, 3.7 million credit cards were issued to subprime borrowers, up a head-scratching 39% from a year earlier, and the most since 2008. A third of all cards issued were subprime, also the most since 2008, according to Equifax. That was the glorious year when “subprime” transitioned from industry jargon to common word. It had become an essential component of the Financial Crisis.

As before, subprime borrowers pay usurious rates. These are people who think they have no other options, or who have trouble reading the promo details, or who simply don’t care as long as they get the money. In the first quarter, the average rate was 21.1%, up from 20.2% a year ago, while prime borrowers paid an average of 12.9% on their credit cards, and while banks that are lending them the money paid nearly 0%.

These usurious rates and the fees that are artfully tacked on to the bill at every remotely possible occasion make it nearly impossible that the borrowers can ever pay off their credit cards. They’ll just keep paying the minimum payment, while balances balloon. And they’ll balloon even if the holder no longer charges to the card. Subprime credit cards are there to be maxed out, and the only thing that keeps these folks out of trouble is getting more cards, juggling cards, transferring balances, taking out cash advances on one card to make the minimum payments on the others….

Banks play along, whipped into a frenzy by the sweet smell of usury. Their credit-card promos are once again clogging up mailboxes around the country, and profits on these cards soar, and everyone is happy – banks, borrowers, and of course the American economy that thirstily laps up borrowed money.

“I was surprised they’d give me so much,” the Wall Street Journal quoted one of the winners who’d recently gotten a credit card with a $15,000 credit limit. But as long as new credit cards with ever greater credit limits are available, banks won’t have to worry about charge-offs, no matter what the balance or the cardholder’s ability to make payments.

The St. Louis Fed has a measure for that symptom: the Financial Stress Index. It has been skittering from one all-time low to the next. It shows that years of nearly free money sloshing through Wall Street has just about eliminated any kind of financial concern.

The index, which dates back to 1993 and is based on 18 components, has an average value of zero. Higher financial stress shows up as a positive value, lower financial stress as a negative value. In the latest reporting week, ended June 20, the index dropped to -1.332, the lowest in its history for the fourth week in a row.

The previous period of record lows occurred in February 2007, hitting bottom at -1.268. Stocks were flying high, LBOs livened up lunch conversations, and the media swamped Americans with delicious hype. OK, housing was “taking a break,” as it was called. Banks and mortgage lenders were cracking at their foundations. But so what. Financial stress had been wrung out of the system. There were no risks.

Then some reeking details infiltrated the Financial Stress Index. By the time Bear Stearns collapsed in early 2008, it was ratcheting higher erratically. In August that year, it spiked. Then Lehman popped, stocks plunged, junk-bond yields soared, bank CEOs wondered who’d be next, and on October 17, it peaked at a cathartic 6.27. Wall Street had gotten tangled up in its own underwear.

The Fed’s tsunami of free money bailed out Wall Street and our over-indebted corporate heroes. Among them GE whose CEO Jeff Inmelt was a Class B director of the New York Fed, which handled the bailouts. And the Financial Stress Index plunged. By December 2009, it was back at zero. Financial stress was expunged from the system even as the greatest unemployment crisis in recent history was ravaging the country. On the sound principle that handing unlimited amounts of free money to Wall Street would reward Wall Street.

But the Financial Stress Index has a peculiar feature: it pinpoints the time when credit quality deteriorates, when asset prices have been inflated to dizzying levels, when subprime lending becomes a low-risk business model, when reckless financial decisions are being made by everyone in the system, from cardholders to bank CEOs, and when a new set of logic explains in detail why this craziness is perfectly reasonable. Yet these issues are time bombs that are cluttering up the shelves, ticking away.

Meanwhile, thanks to record low financial stress in the system, subprime cardholders are happily spending themselves into nirvana. But once they’ve run up their balances to vertigo-inducing heights, the banks open their eyes. Stunned by what they see, they don’t want to play anymore. They stop raising credit limits and sending out new cards. Then they see the other time bombs ticking on their shelves. And suddenly we’re back to 2008. That’s what the record low financial stress index is pointing at.

The thing is, banks are again taking the same risks that triggered the Financial Crisis, and they’re understating these risks. It wasn’t an edgy blogger that issued this warning but the Office of the Comptroller of the Currency. And it blamed the Fed’s monetary policy. Read….Federal Regulator Details Crazy Risk-Taking By Banks, Blames Fed

This is a syndicated repost courtesy of Testosterone Pit. To view original, click here.

Sarajevo Is The Fulcrum Of Modern History (Part 2): The Great War’s Aftermath Of Keynesianism, Monetary Central Planning And The Permanent Warfare State

Guest Post by David Stockman

The Mythical Banking Crisis and the Failure of the New Deal

The Great Depression thus did not represent the failure of capitalism or some inherent suicidal tendency of the free market to plunge into cyclical depression—absent the constant ministrations of the state through monetary, fiscal, tax and regulatory interventions. Instead, the Great Depression was a unique historical occurrence—the delayed consequence of the monumental folly of the Great War, abetted by the financial deformations spawned by modern central banking.

But ironically, the “failure of capitalism” explanation of the Great Depression is exactly what enabled the Warfare State to thrive and dominate the rest of the 20th century because it gave birth to what have become its twin handmaidens—-Keynesian economics and monetary central planning. Together, these two doctrines eroded and eventually destroyed the great policy barrier—-that is, the old-time religion of balanced budgets— that had kept America a relatively peaceful Republic until 1914.

To be sure, under Mellon’s tutelage, Harding, Coolidge and Hoover strove mightily, and on paper successfully, to restore the pre-1914 status quo ante on the fiscal front. But it was a pyrrhic victory—since Mellon’s surpluses rested on an artificially booming, bubbling economy that was destined to hit the wall.

The Hoover Recovery of 1932

Worse still, Hoover’s bitter-end fidelity to fiscal orthodoxy, as embodied in his infamous balanced budget of June 1932, got blamed for prolonging the depression. Yet, as I have demonstrated in the chapter of my book called “New Deal Myths of Recovery”, the Great Depression was already over by early summer 1932.

At that point, powerful natural forces of capitalist regeneration had come to the fore. Thus, during the six month leading up to the November 1932 election, freight loadings rose by 20 percent, industrial production by 21 percent, construction contract awards gained 30 percent, unemployment dropped by nearly one million, wholesale prices rebounded by 20 percent and the battered stock market was up by 40 percent.

So Hoover’s fiscal policies were blackened not by the facts of the day, but by the subsequent ukase of the Keynesian professoriat. Indeed, the “Hoover recovery” would be celebrated in the history books even today if it had not been interrupted in the winter of 1932-1933 by a faux “banking crisis” which was entirely the doing of President-elect Roosevelt and the loose-talking economic statist at the core of his transition team, especially Columbia professors Moley and Tugwell.

The Pre-1933 Banking Failures Were Caused By Insolvency

The truth of the so-called banking crisis is that the artificial economic boom of 1914-1929 had generated a drastic proliferation of banks in the farm country and in the booming new industrial centers like Chicago, Detroit, Youngtown and Toledo, along with vast amounts of poorly underwritten debt on real estate and businesses.

When the bubble burst in 1929, the financial system experienced the time-honored capitalist cure—-a sweeping liquidation of bad debts and under-capitalized banks. Not only was this an unavoidable and healthy purge of economic rot, but also reflected the fact that the legions of banks which failed were flat-out insolvent and should have been closed.

Indeed, 10,000 of the 12,000 banks shuttered during the years before 1933 were tiny rural banks located in communities of less than 2,500. Most had been chartered with trivial amounts of capital under lax state banking laws, and amounted to get-rich-quick schemes which proliferated during the export boom.

Indeed, a single startling statistic puts paid to the whole New Deal mythology that FDR rescued the banking system after a veritable heart attack: to wit, losses at failed US banks during the entire 12-year period ending in 1932 amounted to only 2-3 percent of deposits. There never was a sweeping contagion of failure in the banking system.

Milton Friedman’s Huge Error: The Fed Did Not Cause the Bank Runs of 1930-1933

Nor did the Fed’s alleged failure to undertake a massive bond-buying program in 1930-1932 to pump cash into the banking system constitute the monumental monetary policy error that Milton Friedman so dogmatically claimed, and which has become the raison d’etre of contemporary central banking.

In fact, fifty years after the fact, Bubbles Ben 2.0 essentially zeroxed the errors in Friedman’s treatise and got awarded a PhD for this tommyrot by Professor Stanley Fischer of MIT, who Obama has now seen fit to make Vice-Chairman of the Fed. Bernanke then passed himself off as a scholar of the Great Depression and a Friedman disciple, thereby bamboozling the ever gullible Bush White House into appointing a rank money-printer and Keynesian to head the Fed.

Bernanke then proceeded to follow Friedman’s bad advice about 1932 and flooded the banking system with money during the so-called financial crisis, and thereby bailed out the rot on Wall Street instead of purging it as the Board of Governors had the good sense to do in the early 1930s.

But…I digress—slightly!

In fact, it is important to refute the scary bedtime stories that have been handed down about the pre-New Deal banking crisis because they are the predicate for the Fed’s current lunacy of QE, ZIRP and massive monetization of the public debt, which, in turn, enables the perpetual deficit finance on which the Warfare State vitally depends.

The Unnecessary February 1933 Bank Panic: FDR’s 10-Day Fumble

In truth, the banking liquidation was over by Election Day, failures and losses had virtually disappeared, and as late as the first week of February 1933, according the Fed’s daily currency reports, there were no unusual demands for cash.

The legendary “bank runs” occurred almost entirely during the last two weeks before FDR’s inauguration. The trigger was Henry Ford’s vicious spat with his former partner and then Michigan Senator, James Couzens, over responsibility for the failure of a go-go banking group in Detroit that had been started by his son Edsel and Goldman Sachs. Always Goldman!

The hapless Herbert Hoover secretly wrote FDR begging him to cooperate in resolving the Michigan banking crisis. Instead, Roosevelt failed to answer the President’s letter for two weeks; lost Carter Glass as his Treasury Secretary because the President-elect refused to affirm his commitment to the sound money platform on which he had campaigned; and allowed Tugwell to leak to the press a radical plan to reflate the economy by reneging on the dollar’s 100-year old linkage to one-twentieth ounce of gold.

Within days there was a massive run on gold at the New York Fed and a scramble for cash at teller windows across the land. Unlike historians today, citizens back then knew that the Fed could not legally issue more currency unless it had 40 percent gold-backing—hence the sudden outbreak of currency hoarding.

In this context, the daily figures for currency outstanding give ringing evidence of FDR’s culpability for the midnight-hour run on the banks. After rising by a trivial $8 million per day in early in the month, cash outstanding rose by $200 million per day by late February and by a staggering half billion dollars on the day before the FDR’s inauguration. All told, 80 percent of the increase in currency outstanding—from $5.6 billion to $7.5 billion—occurred in the last ten days before FDR took office.

Then, even more fantastically, nearly all of the hoarded cash flowed back into the banking system on its own when 95 percent of the banks were re-opened in an “as is, where is” condition during the three weeks after FDR’s inauguration. Moreover, the mass re-opening scheme was actually drafted and executed by Hoover hold-overs at the Treasury, and had been completely accomplished before the heralded banking reforms of the New Deal and deposit insurance had even had Congressional hearings.

In short, the banking system never did really collapse and the true problem was bad debt and insolvency—not Fed errors or an existential crisis of capitalism.

New Deal: Political Gong Show

Beyond that, the New Deal was a political gong show that amounted to a grab-bag of statist gimcrack. The mild fascism of the NRA and AAA caused the economy to further contract, not recover. The legendary WPA cycled violently between 1 million make-work jobs in the off-years and 3 million make-vote jobs in the election years—-before even a Democratic Congress was compelled to shut it down in a torrent of corruption in 1939.

Likewise, the TVA was a senseless boondoggle and environmental curse; the Wagner Act paved the way for the kind of coercive, monopolistic industrial unionism that resulted in “Rust Bucket America” five decades later; and the legacy of New Deal housing stimulants like Fannie Mae speaks for itself.

Finally, universal social insurance enacted in 1935 was actually a fiscal doomsday machine. When in the context of modern political democracy the state offers universal transfer payments to its citizenry without proof of need it thereby offers to bankrupt itself—eventually.

To be sure, during the middle 1930s, the natural rebound of the nation’s capitalist economy continued where the Hoover Recovery left off— notwithstanding the New Deal headwinds. Yet the evidence that FDR’s policies retarded recovery screams out of the last year of pre-war data for 1939: GDP at $90 billion was still 12 percent below 1929, while manufacturing value added was off by 20 percent and business investment by 40 percent.

Most telling of all was private non-farm man-hours worked: the 1939 level was still 15 percent lower than what the BLS recorded in 1929.

How FDR Torpedoed Recovery and Sowed the Seeds of Autarky, Rearmament, Revanchism and War

So the New Deal did nothing to help the domestic economy. But FDR did personally torpedo world recovery and paved the way toward WWII with his so-called “bombshell” message to the London Economic Conference in July 1933. The latter had been the world’s last best hope for rescue of the failed task of post-war resumption. Specifically, the conferees had shaped a plan for restoring convertibility by means of pegging the pound sterling at a lower exchange rate to the dollar and gold, thereby alleviating the beggar-thy-neighbor pressure on the remaining gold standard countries like France, the Netherlands and Sweden.

In turn, monetary stabilization would pave the way for reduction of Smoot-Hawley instigated tariff barriers and the restoration of global trade and capital flows.

The American delegation led by the magnificent statesman, Cordell Hall, had molded a tentative agreement among the British and French, and thereby had attained a crucial inflection point in the post-war struggle for resumption of the old international order. Yet FDR defied his advisors to the very last man, including the nationalistic and protectionist-minded Raymond Moley, who the President had sent to London as his personal emissary.

Roosevelt’s message, penned by moonlight on the luxurious yacht of his chum, Vincent Astor, was undoubtedly the most intemperate, incoherent and bombastic communique ever publicly issued by a US President. It not only stunned the assembled world leaders gathered in London and killed the monetary stabilization agreement on the spot, but it also locked in a destructive worldwide regime of economic nationalism and autarky.

Accordingly, high tariffs and trade subsidies, state-dominated recovery and rearmament programs and manipulated currencies became universal after the London Conference failed, leaving international financial markets demoralized and chaotic.

The irony was that the Great Depression was the step-child of the Great War. American entry had unnecessarily extended it; had greatly amplified its destructive impact on the liberal international order; and had contributed a witch’s brew of Wilsonian nostrums to a Carthaginian peace that laid the planking for a new world war. FDR then delivered the coup de grace, extinguishing the last hope for resumption and insuring that autarky, revanchism and rearmament would hurtle the world to an even greater eruption of carnage, and an even more debilitating rendition of the Warfare State.

Krugman’s Lie: WWII Was Not A Splendid Exercise in Keynesian Debt Finance

World War II soon delivered another blow to the old-time fiscal religion. Not only did that vast expansion of war production fuel the illusion that New Deal statism had alleviated an endemic crisis of capitalism, but it also became heralded as a splendid exercise in Keynesian deficit finance when, in fact, it was nothing of the kind.

The national debt did soar from less than 50 percent of GDP in 1938 to nearly 120 percent at the 1945 peak. But this was not your Krugman’s benign debt ratio— or proof that the recent surge to $17 trillion of national debt has been done before and had been proven harmless.

Instead, the 1945 ratio was an artifact of a command and control war economy which had banished civilian goods including new cars, houses and most consumer durables, and tightly rationed everything else including sugar, butter, meat, tires, shoes, shirts, bicycles, peanut brittle and candied yams.

With retail shelves empty the household savings rate soared from 4 percent in 1938-1939 to an astounding 35 percent of disposable income by the end of the war.

Consequently, the Keynesians have never acknowledged the single most salient statistic about the war debt: namely, that the debt burden actually fell during the war, with the ratio of total credit market debt to GDP declining from 210 percent in 1938 to 190 percent at the 1945 peak!

This obviously happened because household and business debt was virtually eliminated by the wartime savings spree; households paid off what debts they had left after the liquidation of the 1930s depression and business generally had no ability to borrow except for war production. Thus, the private debt ratio plunged from 150 percent of GDP to barely 60 percent, thereby making massive headroom in the nation’s bloated savings pool for the temporary surge of public debt.

In short, the nation did not borrow its way to victory via a Keynesian miracle. Measured GDP did rise smartly because half of it was non-recurring war expenditure. But even then, the truth is that the American economy “regimented” and “saved” its way through the war.

Supplementing the aforementioned “voluntary” savings spree were “mandatory savings” in the form of a staggering increase in taxation. Confiscatory levies on the wealthy and merely onerous taxation on everyone else caused the tax take to rise from 8 percent to a never again equaled 25 percent of GDP.

Compare that to the opposite circumstances of January 2013. Urged on by the Keynesian stimulators and election-minded “progressive” politicians, Obama signed a permanent extension of the unaffordable Bush tax cuts for the “bottom” 98 percent of households at a cost of $4 trillion in added national debt over the next decade. But unlike 1945, this came at a time when household, business and financial sector debt was 260 percent of GDP, not 60 percent.

Yet professor Krugman said don’t sweat it! FDR proved the national debt doesn’t matter. That wasn’t remotely true—but the persistence of this canard amounts to one more nail in the coffin of fiscal rectitude, and still another illusion that perpetuates the nation’s trillion dollar Warfare State.

Triumph of The Permanent Warfare State

After America’s earlier wars there occurred a swift and near total demobilization: the Union Army of 2 million had been reduced to 24,000 within months of Appomattox, and the 3 million called to arms by Woodrow Wilson was down to 50,000 within a few years of the armistice.

By contrast, the American Warfare State became permanent and self-fueling after World War II. So doing, it both catalyzed new extensions of Keynesian statism and monetary central planning and simultaneously flourished from their rise.

How Truman Lost the Battle To Contain the Warfare State

President Eisenhower famously warned about the dangers of the military-industrial complex in his 1961 farewell, but it was Harry Truman who first felt the sting of its political power. Truman was an old-fashioned budget balancer and made remarkable strides in the immediate post-war years toward traditional demobilization— cutting military spending from $70 billion to $15 billion by 1948 and balancing the Federal budget two years in a row.

Unfortunately, his government was still crawling with warriors—like Admiral Leahey and General Curtis LeMay and civilian hardliners like Secretaries Forrestal and Acheson—-who had thrived during WWII and were looking for new enemies to vanquish. Moreover, the unschooled haberdasher and machine politician from Missouri had made it far easier for them with his deplorable decision to drop atom bombs on an already beaten Japan.

There is now plenty of evidence from the archives of both sides that Truman’s brusque treatment of Stalin at Potsdam (July 1945) based on his “atomic secret” was the catalyst that began the Cold War. Thereafter, Tuman’s unwillingness to over-ride the brass and the hardliners and negotiate international control of atomic weapons—eloquently urged by the legendary statesman, Henry Stimson, in his last cabinet meeting after serving presidents for half a century—assured a nuclear arms race and perpetual cold war.

Indeed, upon Truman’s rejection of Stimson’s plea, another Cabinet participant presciently queried, “…. (so) the arms race is on, is that right?”

Truman famously agreed and insisted “but we should stay ahead”. Except that he could not both continue the demobilization and stay ahead in the arms race and nascent cold war.

So by spring 1950 Truman had already lost the battle. His government had become increasingly populated with hardliners in response to alleged Soviet provocations. In fact, fearful of encirclement yet again and Truman’s atomic diplomacy, Stalin was brutally collecting upon his eastern European territorial winnings from Yalta—even as the Republican Right went on a jihad about the “loss” of China.

In that context, the cold warriors led by Paul Nitze at State and the Keynesian professoriat represented by CEA Chairman Leon Keyserling effected a fatal alliance. In that truly insidious policy document known as NSC-68, they proclaimed a Soviet agenda to conquer the world, which was balderdash, and averred that a massive increase in cold war defense spending would levitate the American economy, which was lunacy.

The Pointless “Police Action” in Korea and Full Blast Rearmament

Soon an inconsequential civil war on the barren Korean peninsula between two brutal tyrants became a flash point in the Cold War, causing military re-mobilization and sending the defense budget soaring five-fold to more than $60 billion. Harry Truman, the resolute budget balancer, avoided a torrent of red ink only by seizing on the moment of domestic fear, when the “chicoms” came flooding across the Yalu River, to re-impose FDR’s onerous wartime taxes.

In my book, I gave Truman the hero award for insisting that an elective war be financed with current taxes.

But I also give him a villains badge for succumbing to the war-mongers, and for invading Asian rice paddies that posed no threat to American security. Indeed, they might just as well have become a province of China’s “red capitalism”, which both the Keynesians and Wall Street now tell us is an economic cat’s meow.

Thereafter the “begats” went full retard, old testament-style. To be sure, the great General Dwight Eisenhower held-back the tide for a time and had no trouble seeing the folly of a land-war in Asia. So he did quickly end the hideously named “police action” in Korea after 58,000 American soldiers and upwards of a million civilians had been killed. He also had the strategic vision to see the folly of NSC-68, which called for massive conventional military capacity to fight multiple land and air wars all over the planet.

Instead, Eisenhower drastically downsized the army, shelved naval plans for a massive armada of supercarriers, and cut Truman’s bloated war budget from $500 billion in today’s money to $370 billion based on the gutsy doctrine of massive nuclear retaliation and the correct perception that the Soviets were not suicidal.

By decisively throttling the Warfare State, President Eisenhower gave brief reprieve to the old time fiscal religion. He balanced his budgets repeatedly, refused to reduce Truman’s war taxes until reductions were earned with spending cuts, shrunk the total Federal budget in constant dollars for the last time ever, and over his eight year term held average new public borrowing to a miniscule 0.4 percent of GDP.

The Detestable Dulles Brothers and the Origins of Cold War Imperialism

Yet in his endless quest to economize, Eisenhower carried a good thing too far by delegating cold war fighting to the seemingly low-cost cloak-and-dagger operations of the detestable Dulles brothers. Unfortunately, to this very day the Warfare State flourishes from the bitter harvest planted by the Allen’s CIA and Foster’s bully-boy diplomacy throughout the developing world.

The untoward legacy of the 1953 coup against Mossadeq in Iran is obvious. But it was no less stupid than the Dulles brothers’ senseless assault on Nasserism, which brought the Soviets into the Middle East and turned it into a permanent armed camp.

But the most abominable Dulles legacy was the insanity of Vietnam. Not only did it saddle America with culpability for an outright genocide, but it set-off a string of economic calamities that spelled the final doom of the old time fiscal religion and extinguished what remained of sound money doctrine at the Fed.

In quick sequence, Kennedy gifted Washington’s politicians with the Keynesian gospel of full-employment deficits; Johnson’s guns and butter then engendered a flood of red ink; and thereafter the White House broke the will and integrity of the great Fed Chairman, William McChesney Martin, thereby busting the financial discipline of the Bretton Woods gold standard with a battering ram of unwanted off-shore dollars.

It was Nixon who committed the final abomination of Camp David in August 1971 by defaulting on the nation’s obligation to live within its means and redeem dollars for gold at $35 per ounce. Adhering to the canons of sound money, of course, would have caused a deep recession after a decade of fiscal excess —and that, in turn, might have spared the nation of Nixon’s horrific second term.

Instead of post-Vietnam Peace, Friedman’s Folly

It also would have put the Democrats’ peacenik wing in power, thereby exposing the Warfare State to an existential challenge at just the right moment— to wit, when it was on its heels from the Vietnam fiasco. But instead of serendipity, we got Milton Friedman’s Folly—-that is, floating fiat money and a central bank unshackled from the anchor of gold.

Ironically, the great libertarian’s monetary recipe amounted to statist management of our massive capitalist economy. This would be accomplished through the wisdom of 12 monetary eunuchs ensconced in the Eccles Building where they were to occupy themselves playing scrabble and reading book reviews, while occasionally adjusting the money supply dials exactly in accordance with the Friedmanite formula.

It didn’t work out that way. The cowardly Dr. Arthur Burns quickly became a mad money printer and we were presently off to the 1970s races of double-digit inflation. And soon enough there arose the hoary legend that this calamity of central banking was actually caused by high oil prices and the machinations of the former camel-drivers who had recently conquered the oil-rich lands of eastern Arabia.

Thus, thanks to the abominations of Camp David, the Warfare State got two massive boosts which have carried it far toward its current trillion dollar girth.

First, instead of a house cleaning by the likes of Frank Church, Nixon’s re-election eventually brought the Yale skull and bones back to the CIA. There, during his brief but destructive tenure, Poppy Bush rummaged up the neo-con “B team” and paved the way for the massive Reagan defense build-up a few years later.

The B team’s report falsely painted lurid imagery of an Evil Empire bent on a nuclear war-winning strategy, when, in truth, the Soviet Union was already a beached whale of decaying state socialism.

Secondly, Washington went into the misbegotten business of fighting so-called high oil prices by massive policing of the Persian Gulf. This soon evolved into rampant meddling in the region, including military alliances with an endless stable of corrupt sheikhs, princes, emirs, dictators and despots—-with the despicable royal family of Saudi Arabia in the lead.

By the late 1970s, moreover, Washington had become so mesmerized by the Keynesian predicate—that is, the notion that the state must constantly maneuver to levitate the GDP—that it didn’t even know that American prosperity did not depend on carrier battle groups cruising the straits of Hormuz or alliances with despots.

The simple and pacific solution was free market pricing—the sure fire route to new supplies, alternative energy and more efficient consumption. The truth is, there never was an OPEC cartel—just the Saudi royal family, whose greed and intoxication with decadent opulence apparently knows no bounds.

If they threatened to hold-back production, we should have let the global market price work its magic, meaning probably less GDP in 1974 and more by 1994. The intra-temporal distribution of GDP is a matter for the market to decide, not the state. Accordingly, it should never have been an excuse to arm and ally with the sordid despots of Riyadh, nor to keep them on the throne to avert a Shia uprising in the eastern oil provinces.

Twenty million everyday Saudis would have been every bit as eager for the oil revenues as 2,000 gluttonous princes.

Reagan’s Presidency: Final Apotheosis of The Warfare State

Regrettably the Reagan Presidency brought on the final apotheosis of the American Warfare State. The massive $1.5 trillion defense build-up launched without shred of analysis in February 1981 was not only an unnecessary and utter waste, but it also left four legacies that enabled today’s trillion dollar Warfare State, and which now propel the nation on its appointed path toward fiscal bankruptcy.

First, the only politician of modern times who honestly campaigned against Big Government and the national debt was reduced to enunciating pure fiscal babble once in office. Ronald Reagan was so mesmerized by the brass and so bamboozled by the neo-cons’ scary bedtime stories about the Soviets that he not only gave the Pentagon a blank check, but he then proclaimed that there was no deficit problem because the flood of red ink on his watch amounted to necessary and excusable “war debt”.

Secondly, when the national debt skyrocketed from $1 trillion to $3.5 trillion during the Reagan-Bush era, the GOP interred the old time fiscal religion once and for all and proclaimed the modest debt fueled boom of those years as a victory for tax-cutting and the gospel of painless growth. So with two fiscal free lunch parties now in incumbent in the machinery of governance, the Warfare State was unleashed like never before.

Indeed, in due course the fatuous Dick Cheney proclaimed that Reagan proved deficits don’t matter, and then charted the most reckless fiscal course in modern history: massive tax cuts and a doubling of the defense budget during the midst of a Fed induced credit boom that was destined to collapse.

When it did, the Federal deficit surged to nearly 10 percent of GDP—even before Obama’s Keynesian witch doctors got their hands in the public till.

The War Machine the Gipper Built: Armada of Invasion and Occupation

Thirdly, the massive Reagan defense buildup did not go to countering the alleged strategic nuclear threat posed by the Evil Empire because there wasn’t one in the first place, and there was not much to spend it on anyway—-except the rank fantasy of Star Wars which even the Congressional porkers couldn’t abide.

Instead, the Pentagon poured hundreds of billions into a vast conventional war machine, including the 600-ship Navy and its 13 lethal carrier-battle groups; 12,000 new tanks and armored fighting vehicles; 16,000 fighters, bombers, attack helicopters, close air support and transport planes; and a blizzard of cruise missiles and electronic warfare suites.

All of this soon proved well suited to wars of invasion and occupation in the lands of the unwilling and among the desert and mountain redoubts of the mostly unarmed.

In short, the wherewithal for the pointless invasions of 1991, 2001 and 2003 and all the lesser American aggressions in-between and after was requisitioned during the Reagan defense spending binge to thwart an enemy of liberty that had already failed by eating its own cooking.

Finally, if the truth be told the Reagan White House could not get rid of Paul Volcker soon enough. Doing so in 1987, it removed from what was already a rogue central bank the last vestige of sound money discipline and fearless independence from Wall Street.

Treasury Secretary Jim Baker, a policy descendent of John Connally, wanted low interest rates, a weak dollar and a politically pliant disposition at the Fed. Alan Greenspan 2.0 accomplished all of the above and much more, turning the Fed into a pliant tool of GOP triumphalism and Wall Street speculation—even as he spent 19 years in the Eccles Building institutionalization the destruction of the very doctrines of sound finance and gold-backed money about which Greenspan 1.0 had written so eloquently before he came to Washington.

Now caught up fueling a repetitive and destructive cycle of financial bubbles and busts, the Greenspan-Bernanke-Yellen Fed has taken monetary central planning into the deep waters of wanton monetization of the public debt.

Under these circumstances there is no fiscal governance—-just an inexorable drift toward monetary catastrophe. In the interim, our senseless and dangerous trillion dollar Warfare State rolls on.

Keynesian statism and monetary central planning have triumphed, meaning that the American Republic has no remaining fiscal defenses, nor immunities from its extractions.

The good Ben (Franklin that is) said,” Sir you have a Republic if you can keep it”.

We apparently haven’t.

IT’S JUST A FAULTY IGNITION SWITCH

So GM has killed dozens of innocent people. At least Obama saved thousands of union jobs with your tax dollars so they can kill more innocent people with their millions of defective products. GM has recalled more cars in the last three months than they’ve sold in the last five years. Sounds like a recipe for success. Cramer says it’s a buy. Who in their right mind would ever buy a GM vehicle? Oh yeah, the millions of subprime deadbeats getting seven year, $35,000, 0% down loans from All y Financial.

GM recalls another 7.6 million cars

SAN FRANCISCO (MarketWatch) — General Motors Co. (NYSE:GM) issued six new recalls Monday covering nearly 7.6 million cars sold in the United States between 1997 and 2014, according to reports. The problem once again is linked to faulty switches that allow the ignition key to inadvertently rotate. GM reportedly said the problem could be linked to three fatal crashes in older full-size sedans. GM said it will take a $1.2 billion charge to cover the cost of the recalls, up from a previously disclosed charge of $700 million. GM shares are currently halted. They traded at $36.84, up 0.6%, prior to the halt.

Celebrate Independence Day By Opposing Government Tyranny

Minimum Wage, Maximum Stupidity

Minimum Wage, Maximum Stupidity

By Doug French, Contributing Editor

The minimum wage should be the easiest issue to understand for the economically savvy. If the government arbitrarily sets a floor for wages above that set by the market, jobs will be lost. Even the Congressional Budget Office admits that 500,000 jobs would be lost with a $10.10 federal minimum wage. Who knows how high the real number would be?

Yet here we go again with the “Raise the minimum wage” talk at a time when unemployment is still devastating much of the country. The number of Americans jobless for 27 weeks or more is still 3.37 million. And while that’s only half the 6.8 million that were long-term unemployed in 2010, most of the other half didn’t find work. Four-fifths of them just gave up.

So, good economics and better sense would say, “make employment cheaper.” More of anything is demanded if the price goes down. That would mean lowering the minimum wage and undoing a number of cumbersome employment regulations that drive up the cost of jobs.

But then as H.L. Mencken reminded us years ago, “Nobody ever went broke underestimating the intelligence of the American public.” Which means the illogical case made by Republican multimillionaire businessman Ron Unz is being taken seriously.

We Don’t Want No Stinkin’ Entry Level Jobs

Unz says the minimum should be $12 and recognizes that 90% of the resistance is that it would kill jobs. So what’s his answer to that silver bullet to his argument? America doesn’t want those low-paying jobs anyway. In his words, “Critics of a rise in the minimum wage argue that jobs would be destroyed, and in some cases they are probably correct. But many of those threatened jobs are exactly the ones that should have no place in an affluent, developed society like the United States, which should not attempt to compete with Mexico or India in low-wage industries.”

He doesn’t think much of fast-food jobs either. But he knows that employment can’t be shipped overseas, so Mr. Unz’s plan for those jobs is as follows:

So long as federal law requires all competing businesses to raise wages in unison, much of this cost could be covered by a small one-time rise in prices. Since the working poor would see their annual incomes rise by 30 or 40 percent, they could easily afford to pay an extra dime for a McDonald’s hamburger, while such higher prices would be completely negligible to America’s more affluent elements.

The Number of Jobs Isn’t Fixed

He believes that if all jobs pay well enough, legal applicants will apply and take all the jobs. This is where Unz crosses paths with David Brat, the economics professor who recently unseated House Majority Leader Eric Cantor.

Brat claims to be a free-market sympathizer and says plenty of good things. However, in his stump speeches and interviews, Brat says early and often, “An open border is both a national security threat and an economic threat that our country cannot ignore. … Adding millions of workers to the labor market will force wages to fall and jobs to be lost.”

That would make sense if there were a fixed number of jobs, but that’s not the case. An economics professor should know that humans have unlimited wants and limited means, which, as Nicholas Freiling explains in The Freeman, “renders the amount of needed labor virtually endless—constrained only by the economy’s productive capacity (which, coincidentally, only grows as the supply of labor increases).”

An influx of illegal immigrants may or may not drive down wages, but even if it does, that’s a good thing. Low wages allow employers to invest in other things. More efficient production lowers costs for everyone, producers and consumers, allowing for capital creation. In the long run, it is capital investment that creates jobs.

Employers Bid for Labor Like Anything Else

Mr. Unz claims that low-wage employers are being subsidized by the welfare state. “It’s a classic case of where businesses manage to privatize the benefits of their workers—they get the work—and socialize the costs. They’ve shifted the costs over to the taxpayer and the government,” writes Unz.

It makes one wonder how the businessman made millions in the first place. Wage rates aren’t determined by what the employee’s expenses are. “Labor is a scarce factor of production,” wrote economist Ludwig von Mises. “As such it is sold and bought on the market. The price paid for labor is included in the price allowed for the product or the services if the performer of the work is the seller of the product or the services.”

Mises explained that a general rate of wages does not exist. “Labor is very different in quality,” Mises wrote, “and each kind of labor renders specific services. each is appraised as a complementary factor for turning out definite consumers’ goods and services.”

Not every job contributes $12 an hour in production benefits toward a finished good or service. And many unskilled laborers can’t generate $12 an hour worth of output. The Congress that created the minimum wage knew this and carved out the 14(c) permit provision in the Fair Labor Standards Act of 1938, allowing an exemption from minimum wage requirements for businesses hiring the handicapped.

That Congress included in the act this language:

The Secretary, to the extent necessary to prevent curtailment of opportunities for employment, shall by regulation or order provide for the employment, under special certificates, of individuals … whose earning or productive capacity is impaired by age, physical or mental deficiency, or injury, at wages which are lower than the minimum wage.

Entrepreneurs must purchase all factors of production at the lowest prices possible. No offense to labor—that’s what customers demand. All cuts in wages pass through to customers. If a business pays more than the market wage rate, the business “would be soon removed from his entrepreneurial position.” Pay less than the market, and employees leave to work somewhere else.

Who Picks Up The Tab?

First, Unz says, “American businesses can certainly afford to provide better pay given that corporate profits have reached an all-time high while wages have fallen to their lowest share of national GDP in history.” So, instead of taxpayers supporting the poor, Unz wants business to pay. No, wait: later he writes that consumers will support the poor by paying higher prices.

“McDonald’s and fast-food places would probably have to raise their prices by 8 or 9 percent, something like that. Agricultural products that are American-grown would go up by less than 2 percent on the grocery shelves. And those sorts of price increases are so small that they would be almost unnoticed in most cases by the consumer.” Walmart would cover a $12 minimum wage with a one-time price increase of 1.1%, he says, with the average Walmart shopper paying just an extra $12.50 a year. So it’s consumers—who are also taxpayers—who get to be their brother’s keeper either which way with Unz’s plan.

Walmart Must Be Offering Enough

Fortune magazine writer Stephen Gandel appeared on Morning Joe this week, making the case that Walmart should give its employees a 50% raise (his article in Fortune on the subject appeared last November). According to him, the company is misallocating capital by not paying higher wages. He says investors are not giving the company credit for the lower pay in the stock price, so they should just do the right thing and pay their employees more.

But Walmart does pay more when it has to compete for employees. In oil-rich Williston, North Dakota, the retail giant is offering to pay entry-level workers as much as $17.40 per hour to attract employees.

Walmart isn’t alone. McDonald’s is paying $300 signing bonuses to attract workers. The night shift at gas stations in Williston pays $14 an hour.

By the way, whatever Walmart is paying, it must be enough, because it has plenty of applicants to choose from. In 2005, 11,000 people in the Bay Area applied for 400 positions at a new Oakland store. Three years later near Chicago, 25,000 people applied for 325 positions at a new store.

Last year a new Walmart opened in the DC area. Again, the response was overwhelming. Debbie Thomas told the Washington Post, “It’s hard to live in this city on $7.45 or $8.25 an hour. I’ve lived here all my life, and I want to stay here. In the end, I’m just glad Wal-Mart’s here. I might get a job.”

Throughout history, people have had to relocate to find work. Today is no different.

In the long run, as the minimum wage increases, capital will be invested to replace labor. We’ve seen it for years. Machines don’t call in sick, sue for harassment, require health insurance, or show up late. Now patrons pour their own drinks. Shoppers scan their own groceries and pump their own gas. Soon we’ll be ordering from electronic tablets at our tables in sit-down restaurants to cut down on wait staff, and the cooks will be replaced by automated burger makers.

Unz may well believe what he proposes would be doing good; however, it means kids and the unskilled go unemployed and in the end, are unemployable.

You read an excerpt from the Daily Dispatch, Casey Research’s wildly popular e-letter. Stay in the loop on big-picture trends, precious metals, energy, technology, and more. Sign up here to receive the Daily Dispatch free of charge in your inbox.

WHITE MAN!! LET ME TELL YOU ABOUT YOUR FAMILY.

All this crap about our neighbors to the South overwhelming our borders with their kids …. and today Kuntsler talks about ISIS ….. well, I’ve wanted to post this for a while, and now seems like a good a time as any. I’ll be brief, and let the vids do the talking.

1) Immigration (of which I is one) is a two-edged sword. A certain amount can improve a country, while too many can destroy it. That’s right. Too many immigrants can overwhelm a country, and destroy its culture. I do not know what that percentage is, but I am sure we are approaching it.

2) If it is true that a 2.1 fertility rate is required to maintain a population, and a rate less than that means the population (or, culture of that population) disappears, and if all of white Europe has a fertility rate less than 2.1 ……….. is it not true that white Europe is a generation or so away from becoming extinct?

3) And what about white USA? Should you be worried about this fact?

“Deaths of white people outnumbered births for the very first time in US history, the Census Bureau revealed Thursday. Several demographers have pointed out that no other racial group in the US experienced a similar drop. Such a natural decrease within the white population is the first of its kind and was not even observed in the US during wars or Depression, the Washington Post reported. “ ————— http://rt.com/usa/us-white-births-census-613/

The Head Nigger In Chief wants to give blanket amnesty to everyone, and allow moar and moar to enter this country. What? Me worry? Am I a Rayciss? El Coyote may have the last laugh, and that’s one reason I am nice to him.

http://www.youtube.com/watch?feature=player_detailpage&v=WzbnARyPMMk

http://www.youtube.com/watch?v=62_2049hdzQ&feature=player_detailpage

Amerikan Copf*ks vs German Police

April 2012: — 113 police officers shot at an unarmed couple ONE HUNDRED THIRTY SEVEN times killing them, obviously. They were not innocent — a police chase ensued because the driver was high and driving on a suspended license. Dumb? Yes? But once again we have a mind numbing case of excessive copfuk force. —————— http://www.dailykos.com/story/2013/08/03/1228675/-Unarmed-Couple-Shot-At-137-Times-By-Police

Moar ‘Murikan copfuk brutality.

.

Germany’s population is 81,000,000. About 250,000 German police fired at German citizens about 36 times, killing 6 …….. for the ENTIRE YEAR.

There are only three reasons to explain this disparity;

— A) American copfuks are out of control

— B) American citizens are fucked up animals

— C) Both A & B

America … God Bless Us … defeated the Nazis in 1945. And sometime before 2014, we became them.

Voila: World War Three

Guest Post by Jim Kunstler

Whoever really runs things these days for the semi-mummified royal administration down in Saudi Arabia must be leaving skid-marks in his small-clothes thinking about Abu Bakr al-Baghdadi and his ISIS army of psychopathic killers sweeping hither and thither through what is again being quaintly called “the Levant.” ISIS just concluded an orgy of crucifixions up in Syria over the weekend, the victims being other Islamic militants who were not radical enough, or who had dallied with US support.

Crucifixion sends an interesting and complex message to various parties around this systemically fracturing globe. It’s a step back from the disabling horror of video beheadings, but it still packs a punch. For the Christian West, it re-awakens a certain central cultural narrative that had gone somnolent there for a century or so. ISIS’s message: If you thought the Romans were bad…. Among the human race, you see, the memories linger.

ISIS has successfully shocked the work over the last two weeks by negating eight years, several trillion dollars, and 4,500 battle deaths in the USA’s endeavor to turn Iraq into an obedient oil dispensary. Now they have gone and announced that their conquests of the moment amount to a Caliphate, that is, an Islamic theocracy. In that sense, they are at least out-doing America’s Republican Party, which has been trying to do something similar here from sea to shining sea but finds itself thwarted by hostile blue states on both coasts.

More to the point, the press (another quaint term, I suppose) is not paying any attention whatsoever to what goes down with ISIS and the other states besides Iraq and Syria in the region. I aver to Saudi Arabia especially because Americans seem to regard it as an impregnable bastion against the bloodthirsty craziness spreading over the rest of the Muslim world. Saudi Arabia is, of course, the keystone of OPEC. Saudi Arabia has had the distinction of remaining stable through all the escalating tumult of recent decades, reliably pumping out its roughly 10 million barrels a day like Bossy the cow in America’s oil import barn.

Or seeming to remain stable, I should say, because the Saud family royal administration of mummified rulers and senile princes looks more and more like a Potemkin monarchy every month. 90-year-old King Abdullah has been rumored to be on life support lo these last two years, his successor brothers already dead and gone, and other powerful Arabian clans with leaders who can walk across a room and speak itching to kick this zombie Saud family off the throne. To make matters worse, the Sauds have also managed to sponsor much of the organized Sunni terrorism in the region (around the world, really) in their role as the chief enemy of the Shia — as represented by the politicized clergy of Iran.

Things are happening at lightning speed over in the region and beware of how the turmoil spreads from one flashpoint to another. This would be an opportunity for ISIS to put the Saud family on the spot regarding the just-announced Caliphate — as in the question: who really calls the shots for this new theocratic kingdom? (Answer: maybe not you, doddering, mummified, America suck-up Saudi Arabia). What’s more, what happens to the other kingdoms and rickety states in that corner of the world? For instance, Lebanon, which has been a sort of political demolition derby for three decades. The founder of the group al Qaeda in Iraq (AQI), pre-cursor to ISIS, was the Lebanese Abu Mus‘ab al-Zarqawi — blown up in a USA air strike some years ago. Lebanon has been under the sway of Hezbollah for a decade and Hezbollah is sponsored by Shi’ite Iran, making it an enemy of ISIS. Might ISIS roll westward over Hezbollah now to capture the pearl of the Mediterranean (or what’s left of it) Beirut? I wouldn’t be surprised.

Then there’s Jordan, and it’s youngish King Abdullah, another notorious USA ass-kisser. Those crucifixion photos coming out of Syria must be making him a little loose in the bowels. And, of course, Syria, where this whole thing started, is a smoldering rump-roast of a state. And finally, that bugbear in the bull’s-eye of the old Levant: Israel.

It is miraculous that Israel has managed so far to stay out of the way of this juggernaut. Of course, among its chief enemies are Hezbollah and Hezbollah’s foster father, Iran, which happen to be the enemy of ISIS and, of course, in that part of the world the enemy of my enemy is my ally — though, I’m sorry, it’s rather impossible to imagine Israel getting all chummy with the psychopaths of ISIS. One thing is a fact: all other things being equal, Israel has the capability of turning any other state or kingdom in region into an ashtray, if push came to shove. Voila: World War Three.

Coming in August

World Made By Hand 3

Pre-order:

My local indie booksellers… Battenkill Books … or Northshire Books…

or Amazon…

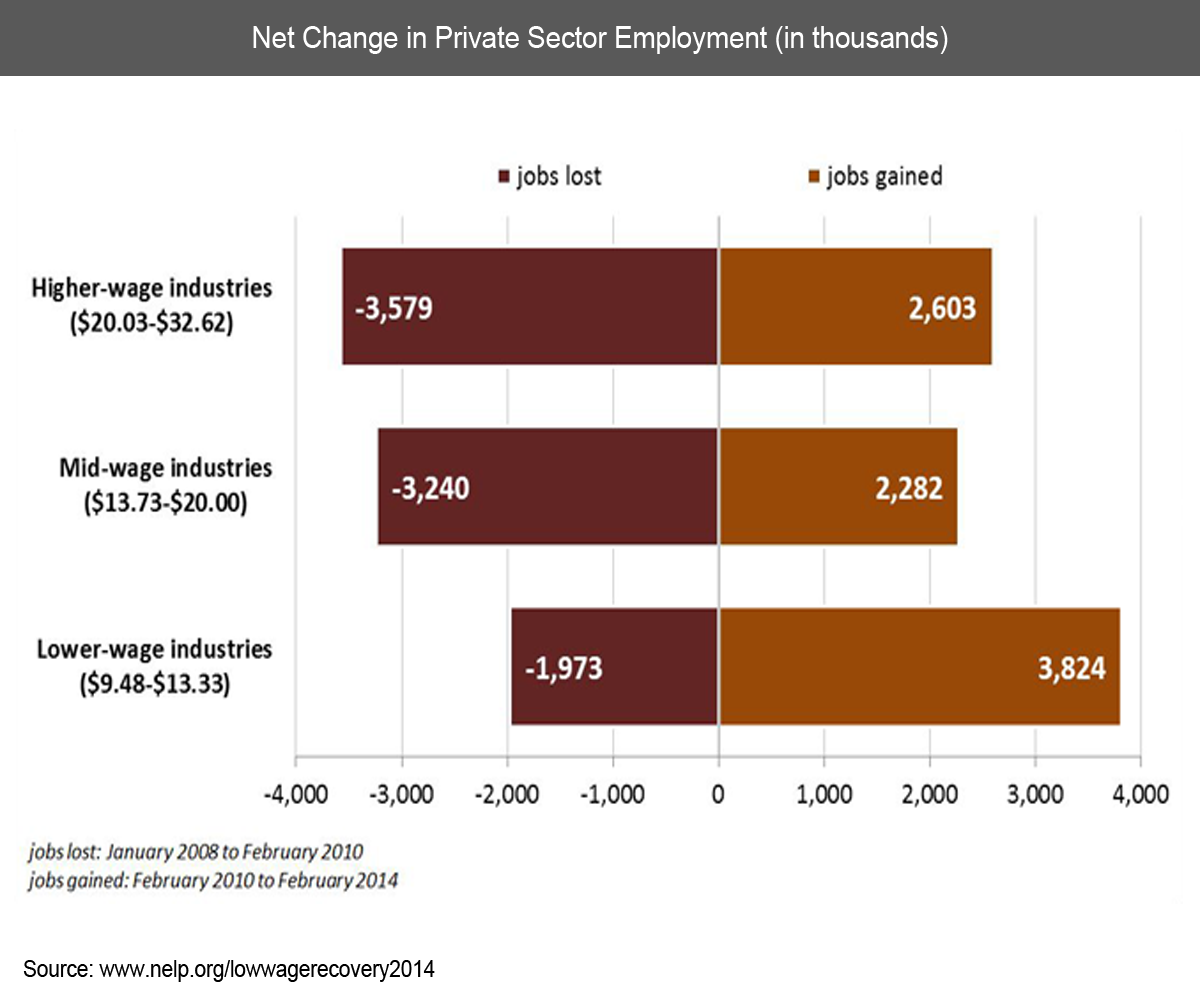

THE OBAMA JOBS RECOVERY

The Obama loving mainstream media have gushed about the “strong” ongoing job growth over the last two years. Oh yes. The Obama jobs recovery has been fantastic. The country lost 8.8 million jobs in the space of two years and has managed to gain back 8.7 million jobs over the next four years. Woo Hoo!!!!

To the talking heads and moronic pundits who are put in front of teleprompters to read whatever storyline they are instructed to sell, a job is a job. One little itsy bitsy problem – The jobs created by Obama have been shit jobs – McDonalds pickle ploppers, Ruby Tuesday waiters, clueless clerks at IKEA, illegal immigrant lettuce pickers, and the ever popular self employed Ebay entrepreneurs.

The quality of jobs has declined precipitously under our savior in chief. The jobs paying $50,000 to $60,000 per year have not come back. They continue to be shipped to China and Vietnam. Even the $30,000 to $40,000 per year jobs haven’t come back. There are 1.9 million less people employed in the higher paying job classes, while there are 1.8 million more people making $25,000 or less per year.

The Obama “solution” to this development is to raise the minimum wage to $10.70. Seattle’s “solution” has been to raise the minimum wage to $15. Why don’t we raise it to $50 and we’ll guarantee prosperity for all? The debasement of our currency by the Federal Reserve is the real problem, never addressed by Obama or the feckless corporate media.

If you think the chart above is bad news, you ain’t seen nothing yet. As the know it all control freaks successfully raise minimum wages around the country, less low wage jobs will be created, less businesses will open, more small businesses will close, and prices for goods will rise.

Most of the Obama jobs created have been in the hospitality, restaurant and retail industry. Their customers were the people making $50,000 to $60,000 per year. They grew because these people had access to easy debt. That ship has sailed. Without good paying jobs, they can’t make their monthly debt payments on the house, cars, and credit card.

The result of the Obama jobs recovery is plunging profits at retailers and restaurants. They will continue to decline. The mom and pop retailers and restaurants have already thrown in the towel and closed up shop by the thousands. The national chains will be next. Radio Shack will be gone in a matter of months. JC Penney, Sears, and a myriad of other retailers and restaurant chains will be shuttering stores by the thousands over the coming years.

Even those shitty Obama jobs will be disappearing. Keep believing that economic recover story. It never gets old.

FACEBOOK IS MANIPULATING & CONDITIONING YOU

Welcome to the Brave New World where you are conditioned, manipulated, and entertained by unseen men seeking control, power and wealth. You’ve been conditioned to love your servitude. Bernays and Huxley had you pegged 80 years ago. Facebook will tell you how you should feel today.

What You Signed Up For

Slow bleeding the GOP Establishment

Most of the 2014 primaries are behind us and the GOP establishment is crowing about its victory of conservatives. Lest you think it is unusual for a party establishment to celebrate winning the primary elections in its own party, you have to realize that the GOP establishment has become essentially the same as the Democrats: same goals, just different paymasters. As Ace says:

The difference between the two parties is the difference between Android and Apple phones. They’re both selling the same product – More Government Solutions! – they just have different branding. They just target different segments of the market with somewhat different aspirational pitches — Apple targets people who think owning Apple products makes them better and more complete people, and Android targets people who think Apple people are silly.

The exact mechanisms of the software and logic differs, but they both deliver the same service. Either way, you’re getting a phone, a camera, a videoplayer, and a map.

Apparently the parties have decided the great ideological struggle of our time is whether the new social services building shall be called the John Murtha Social Wellness Center or the Thad Cochran Freedom & Independence Pavilion.

The win came with a huge price tag, though:

Establishment-aligned groups have already spent some $23 million on independent expenditures propping up favored House and Senate candidates in contentious primaries, according to a POLITICO review of Federal Election Commission records. By comparison, Republican nominees raised and spent that amount in the 2012 North Dakota, Indiana and Nevada Senate races combined — three of the most competitive campaigns fought that year.

The scope of the effort to suppress activist-backed candidates has been broader and costlier than is widely understood, covering at least 20 House and Senate primaries from North Carolina to California, and from coastal Mississippi to the outer tip of Long Island. The loose coalition of establishment forces encompasses two dozen advocacy groups, industry associations and super PACs that have raised and spent millions on behalf of Washington’s chosen candidates.

Pause and consider that for a moment. The GOP Establishment and the Chamber of Commerce has spent $23 million to vanquish conservatives. That is $23 million that they decided was better spent trashing the people who man their phone banks and do GOTV work than in actually winning elections. In fact, the GOP Establishment is treating these primaries like a general election campaign.

But we are an insurgency and insurgencies are always outspent by the Ruling Class. And the Ruling Class always wins until it doesn’t. As Jay Cost notes:

Establishment politicos often act superciliously toward these challengers, but in so doing they are missing a profound point: The Republican electorate is exceedingly angry and frustrated with their leadership. The fact that these second- or third-raters can give established leaders such a scare is proof positive. The party’s leadership can snicker at these challengers all it wants, but it had better understand that its own voters are so fed up with them that they are using these deeply flawed candidates to send them a message.

And if they do not change their ways, they will eventually face credible threats. After all, elections are governed by the law of supply and demand. If a critical mass of primary voters demand quality candidates to challenge the establishment, sooner or later such candidates will appear.

Erick pointed out a while back that the GOP Establishment and their paymasters have to win every battle in order to survive. We don’t. We only have to survive as an “army in being.” We will pick off incumbents (Cantor and Bennett) and prevent the elevation of establishment cronies (Dewhurst and Crist) and we will bleed them on a hundred battlefields in a war of attrition. The loss to senile adulterer Thad Cochran will be seen in retrospect as the time when the tide began to turn. The GOP establishment had to spend millions of dollars and they had to illegally recruit Democrat voters in order to haul Cochran’s moldering, putrescent near-corpse over the finish line. One has to wonder how many of their donors will pony up money in 2016 for another bloody round of primaries with the presidency in the balance.

QUOTE OF THE DAY

“The American fascist would prefer not to use violence. His method is to poison the channels of public information. With a fascist the problem is never how best to present the truth to the public but how best to use the news to deceive the public into giving the fascist and his group more money or more power.”

Henry A. Wallace

THE DISMAL FUTURE HAS ARRIVED

Can zero interest rates permanently keep stock elevated? I guess we’ll find out. I’m sure this time is different from 1929, 2000 and 2007.

The Delusion of Perpetual Motion

John P. Hussman, Ph.D.

“I am definitely concerned. When was [the cyclically adjusted P/E ratio or CAPE] higher than it is now? I can tell you: 1929, 2000 and 2007. Very low interest rates help to explain the high CAPE. That doesn’t mean that the high CAPE isn’t a forecast of bad performance. When I look at interest rates in a forecasting regression with the CAPE, I don’t get much additional benefit from looking at interest rates… We don’t know what it’s going to do. There could be a massive crash, like we saw in 2000 and 2007, the last two times it looked like this. But I don’t know. I think, realistically, stocks should be in someone’s portfolio. Maybe lighten up… One thing though, I don’t know how many people look at plots of the market. If you just look at a plot of one of the major averages in the U.S., you’ll see what look like three peaks – 2000, 2007 and now – it just looks to me like a peak. I’m not saying it is. I would think that there are people thinking – way – it’s gone way up since 2009. It’s likely to turn down again, just like it did the last two times.”

Professor Robert Shiller, June 25, 2014, The Daily Ticker

“If you examine the full historical record, you’ll find that the relationship between S&P 500 earnings yields and 10-year Treasury yields (or other interest rates for that matter) isn’t tight at all. The further you look back, the weaker the relationship. To a large extent, the relationship we do observe is linked to the single inflation-disinflation cycle that began in the mid-1960’s, hit its peak about 1980, and then gradually reversed course over the next two decades. Still, it’s clear that during the past few decades, however one wishes to explain it, earnings yields and interest rates have had a stronger relationship than they have exhibited historically (though not nearly as strong as the Fed Model implies).

“So why isn’t it correct to say that lower interest rates justify today’s elevated P/E ratios? It’s in the meaning of the word ‘justify’ where things get interesting. To most investors, a justified valuation is the level of prices that would still be likely to deliver a reasonable return. Unless that’s true, being able to explain the price/earnings ratio is not enough to say that it’s a justified valuation. While it’s true that lower yields have been associated with higher P/E ratios in recent decades, the meaning of that for investors isn’t positive or even neutral, it’s decidedly negative. Stocks since 1970 have been heavily sensitive, and possibly overly sensitive, to interest rate swings. While lower interest rates have supported higher P/E ratios, those lower rates and higher P/E ratios, in turn, have been associated with poorer subsequent stock market performance. In short, if investors want to argue that low interest rates help to explain today’s elevated P/E ratios, that’s fine, as long as they also recognize that subsequent returns on stocks are likely to be dismal in the future as a result.”

Explaining isn’t Justifying – Hussman Funds Weekly Market Comment, July 2005*

The central thesis among investors at present is that they are “forced” to hold stocks, given the alternative of zero short-term interest rates and long-term interest rates well below the level of recent decades (though yields were regularly at or below current levels prior to the 1960s, which didn’t stop equities from being regularly priced to achieve long-term returns well above 10% annually). The corollary is that investors seem to believe that as long as interest rates are held near zero, stocks will continue to advance at a positive or even average or above-average rate.

It’s certainly true that from a psychological standpoint, the Federal Reserve has induced the same sort of yield-seeking speculation that drove investors into mortgage securities (in hopes of a “pickup” over depressed Treasury-bill yields), fueled the housing bubble, and resulted in the deepest economic and financial collapse since the Great Depression. This yield-seeking has clearly been a factor in encouraging investors to forget everything they ever learned from finance, history, or even two successive 50% market plunges in little more than a decade.

But the finance of all of this – the relationship between prices, valuations and subsequent investment returns – hasn’t been altered at all. As the price investors pay for a given stream of future cash flows increases, the long-term rate of return that they will achieve on their investment declines. Zero short-term interest rates may “justify” the purchase of stocks at higher valuations so that stocks promise equally dismal future returns. But once stocks reach that point, investors should understand that those dismal future returns will still arrive.

Let me say that again. The Federal Reserve’s promise to hold safe interest rates at zero for a very long period of time has not created a perpetual motion machine for stocks. No – it has simply created an environment where investors have felt forced to speculate, to the point where stocks are now also priced to deliver zero total returns for a very long period of time. Put simply, we are already here.

Based on valuation measures most reliably associated with actual subsequent market returns, we presently estimate negative total returns for the S&P 500 on every horizon of 7 years and less, with 10-year nominal total returns averaging just 1.9% annually.

On a historical basis, the CAPE of over 26 is already quite enough to expect more than a decade of negative real total returns for the S&P 500. Aside from the crashes that followed the 1929, 2000 and 2007 peaks, a very long period of negative real returns also followed the other historical peak in the CAPE near 24 in the mid-1960’s. As noted above, one adjustment to the CAPE that significantly improves its relationship with actual subsequent market returns – as it does for numerous other measures – is to correct for the implied profit margin embedded into the multiple. This is true even though the denominator of the CAPE is based on 10-year averaging. At present, the margin embedded in the Shiller CAPE is more than 20% above the historical average. Adjusting for that embedded profit margin – which, again, produces a historically more reliable indication of actual subsequent S&P 500 total returns – the Shiller CAPE would presently be over 32. That level might make even Professor Shiller question whether stocks should be a material component of portfolios (at least for investors with horizons much shorter than the 50-year average duration of S&P 500 stocks). In any event, even the phrase “lighten up” is problematic for the market if more than a few investors heed that advice.

*Though the S&P 500 would achieve a 33% total return from 2005 to its 2007 peak, the index then lost all of that gain, and then another 40% of its value from there, by the 2009 low. That’s how compounding works – a 25% loss wipes out a 33% gain, but a 55% loss compounds that initial 25% loss with a further 40% loss. In the half-cycle since 2009, valuations have recovered and swollen to place the present instance among a handful of extreme valuation “outliers” in history.

See the entire Hussman Weekly Letter