Submitted by Tyler Durden on 12/12/2014 07:52 -0500

Courtesy of the Cronybus(sic) last minute passage, government was provided a quid-pro-quo $1.1 trillion spending allowance with Wall Street’s blessing in exchange for assuring banks that taxpayers would be on the hook for yet another bailout, as a result of the swaps push-out provision, after incorporating explicit Citigroup language that allows financial institutions to trade certain financial derivatives from subsidiaries that are insured by the Federal Deposit Insurance Corp, explicitly putting taxpayers on the hook for losses caused by these contracts. Recall:

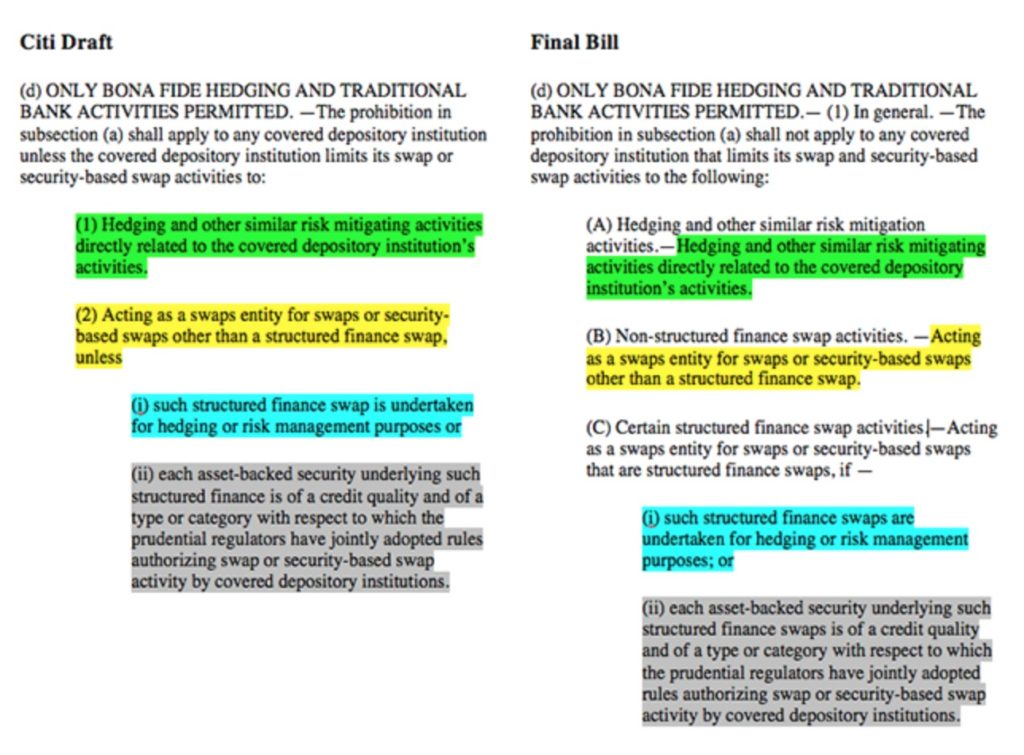

Five years after the Wall Street coup of 2008, it appears the U.S. House of Representatives is as bought and paid for as ever. We heard about the Citigroup crafted legislation currently being pushed through Congress back in May when Mother Jones reported on it. Fortunately, they included the following image in their article:

Unsurprisingly, the main backer of the bill is notorious Wall Street lackey Jim Himes (D-Conn.), a former Goldman Sachs employee who has discovered lobbyist payoffs can be just as lucrative as a career in financial services.

We say explicitly, of course, because taxpayers have always been on the hook implicitly for the next Wall Street meltdown.

Why?

Exhibit A: US banks are the proud owners of $303 trillion in derivatives (and spare us the whole “but.. but… net exposure” cluelessness – read here why that is absolutely irrelevant when even one counterpaty fails):

Exhibit B: Here are the four banks that are in complete control of the US “republic.”

At least we now know with certainty that to a clear majority in Congress – one consisting of republicans and democrats – the future viability of Wall Street is far more important than the well-being of their constituents. Which also, implicitly, was made clear when Hank Paulson was waving a three-page “blank check” term sheet, and when Congress voted through the biggest bailout of banks in US history back in 2008.

The only question is when the next multi-trillion (or perhaps quadrillion now that all global central banks are all in?) bailout takes place.

Source: OCC

I’m done with the fucking Pubbies. These isn’t a dimes worth of difference between the Bolsheviks(Dems) and Mensheviks(Pubbies). They are all owned by the banisters and Wall Street. I just hope I’m out in the country when the whole stinking POS goes down the shitter, which it will eventually.

These=There, dumbs!

We slip deeper into the abyss each day. John

We’re clearly at the “loot the stores” phase on Wall Street.

The corporate officers of all these firms are looting whatever is “on the shelf within reach” with the certain knowledge that when all the bills come due and the bail-ins begin in earnest, they’ll all have most of their wealth off-shored and be sitting on a beach in Bermuda sipping Long Island Iced Tea with the latest Victoria’s Secret model.

None of these people intend to be “around” when the lynch mobs form.

If you could simply reach out your hands and take a hundred million dollars, personally, from where it’s sitting on a table in front of you, would you do it?

This just highlights what is already the case.

Your deposit to your bank is nothing but vapor.

Your expected “benefit” from Social Security is nothing but vapor.

Your pension is nothing but vapor.

In other words, everything you believe you “own,” but is in fact an IOU, is empty because those who owe it to you have no way to actually deliver.

Only the relatively small requirement for cashing people’s IOU’s today disguises the nearly complete and total emptiness of the wealth store expected to deliver those IOU’s.

Just as with any Ponzi, it works only so long as the “current beneficiaries” volume is tiny compared to the IOU volume. Given that the IOU volume has gone from ocean-sized to galaxy-sized in the last 6 years, even small cash-ins risk revealing how bare is the cupboard.

This is why the C-suite of every corporation is ransacking their firms’ underlying value by issuing debt to cash-out their stock-price-based incentive compensation.

This is the final phase before the executives pile into the few existing lifeboats.

Then this leaky, wheezing economy will sink like a stone.

D.C said :

“The corporate officers of all these firms are looting whatever is “on the shelf within reach” with the certain knowledge that when all the bills come due and the bail-ins begin in earnest, they’ll all have most of their wealth off-shored and be sitting on a beach in Bermuda sipping Long Island Iced Tea with the latest Victoria’s Secret model.

D.C…it is my sincerest hope that if the above scenario takes place that at some point, one by one, they’ll take a double tap to the head for the carnage they’ve created .

I’m afraid that the only real solution was offered 20 years ago by a now deceased friend. The initials are KTAN.

Just shows to go ya, as my Daddy used to say, there ain’t such a thing as an “honest politician”.

DC ,I would take that 100 million and leave America. I give each one here a little chunk . After all with a 100 million I could afford to be generous to the monkeys.

Ragman , remember you are going to mountains in NC .You should be ok.It’s the people in the cities that willbe in an earthly hell.

[img [/img]

[/img]

Good one ADMIN. Evil Doers Beware !