The so-called “trustees” of the social security system issued their annual report last week and the stenographers of the financial press dutifully reported that the day of reckoning when the trust funds run dry has been put off another year—-until 2034.

So take a breath and kick the can. That’s five Presidential elections away!

Except that is not what the report really says. On a cash basis, the OASDI (retirement and disability) funds spent $859 billion during 2014 but took in only $786 billion in taxes, thereby generating $73 billion in red ink. And by the trustees’ own reckoning, the OASDI funds will spew a cumulative cash deficit of $1.6 trillion during the 12-years covering 2015-2026.

So measured by the only thing that matters—-hard cash income and outgo—-the social security system has already gone bust. What’s more, even under the White House’s rosy scenario budget forecasts, general fund outlays will exceed general revenues ex-payroll taxes by $8 trillion over the next twelve years.

Needless to say, this means there will be no general fund surplus to pay the OASDI shortfall. Uncle Sam will finance the entire $1.6 trillion cash deficit by adding to the public debt. That is, Washington plans to make social security ends meet by burying unborn taxpayers even deeper in national debt in order to fund unaffordable entitlements for the current generation of retirees.

The question thus recurs. How did the untrustworthies led by Treasury Secretary Jacob Lew, who signed the 2015 report, manage to turn today’s river of red ink into another 20 years of respite for our cowardly beltway politicians?

They did it, in a word, by redeeming phony assets; booking phony interest income on those non-existent assets; and projecting implausible GDP growth and phantom payroll tax revenues.

And that’s only the half of it!

The fact is, the whole rigmarole of trust fund accounting enables these phony assumptions to compound one another, thereby obfuscating the fast approaching bankruptcy of the system. And, as will be demonstrated below, that’s what’s really happening—–even if you give credit to the $2.79 trillion of so-called “assets” which were in the OASDI funds at the end of 2014.

Stated differently, the OASDI trust funds could be empty as soon as 2026, thereby triggering a devastating 33% across the board cut in benefits to affluent duffers living on Florida golf courses and destitute widows alike. Needless to say, the army of beneficiaries projected for the middle of the next decade—what will amount to the 8th largest nation on the planet—- would not take that lying down.

There would be blood in the streets in Washington and eventually staggering tax increases to fund the shortfall. Such desperate measures, of course, would sink once and for all whatever faint impulse of economic growth and job creation that remained alive in the US economy at the time.

In short, this year’s untrustworthies report amounts to an accounting and forecasting house of cards that is camouflaging an impending social, political and economic crisis of a magnitude not seen since the Great Depression or even the Civil War. So here follows an unpacking of the phony accounting edifice that obscures the imminent danger.

The place to start is with the one data series in the report that is rock solid. Namely, the projected cost of $15.5 trillion over the next 12 years to pay for retirement and disability benefits and the related (minor) administrative costs.

This staggering figure is derived from the fact that the number of beneficiaries will grow from 59 million to 79 million over the next twelve years, and that each and every one of these citizens has a payroll record that entitles them to an exact monthly benefit as a matter of law. Even the assumed COLA adjustment between 2-3% each year is pretty hard to argue with—-since it is nearly dead-on the actual CPI increase average since the year 2000.

By contrast, the funny money aspect comes in on the funding side. The latter starts with the $2.79 trillion of “assets” sitting in the OASDI trust funds at the end of 2014.

In truth, there is nothing there except government accounting confetti. This figure allegedly represents the accumulated excess of trust fund income over outgo historically, but every dime of that was spent long ago on aircraft carriers, cotton subsidies, green energy boondoggles, prison facilities for pot smokers, education grants, NSA’s cellphone monitors, space launches and the rest of Washington’s general government spending machine.

So when the untrustworthies claim that that social security is “solvent” until 2034 the only thing they are really saying is that this $2.79 trillion accounting artifact has not yet been liquidated according to the rules of trust fund arithmetic. And under those “rules” its pretty hard to actually accomplish that—-not the least due to the compounding of phantom interest on these phantom assets.

To wit, the 2015 report says that the OASDI funds will earn $1.2 trillion of interest income during the next twelve years. To be sure, the nation’s retirees and savers might well ask how Washington’s bookkeepers could manage to get the assumed 3.5% interest rate on the government’s assets compared to the 0.3% ordinary citizens earn on a bank account or even 2.2% on a 10-year treasury bond.

But that’s not the real scam. The skunk in the woodpile is actually an utterly arbitrary and unjustifiable assumption about the rate of nominal GDP growth and therefore the associated gain in projected payroll tax revenues coming into the trust fund.

What the untrustworthies have done here is indulge in the perfidious game of goal-seeked forecasting. That is, they have backed into a GDP growth rate sufficient to keep payroll tax revenues close to the level of benefit payouts, thereby minimizing the annual cash deficit.

This, in turn, ensures that the trust fund asset balance stays close to its current $2.7 trillion level in the years just ahead, and, mirabile dictu, permits it to earn upwards of $100 billion of “interest” each year. Too be sure, beneficiaries could not actually pay for their groceries and rent with this sort of trust fund “income”, but it does keep the asset balance high and the solvency can bouncing down the road a few more years.

But here’s the thing. Plug in a realistic figure for GDP growth and payroll tax revenue increases and the whole trust fund accounting scheme collapses; the bouncing can runs smack dab into a wall of trust fund insolvency.

To wit, the untrustworthies who wrote the report assumed that nominal GDP would grow at a 5.1% annual rate for the next 12 years. Yet the actual growth rate has never come close to that during the entire 21st century to date. At best these people are dreaming, but the truth is they are either lying or stupid.

Given the self-evident headwinds everywhere in the world, and year after year of failed “escape velocity” at home, no one paying a modicum of attention would expect US GDP to suddenly get up on its hind legs and race forward as far as the eye can see. Yet that’s exactly what the social security untrustworthies have done by assuming nominal GDP growth 35% higher than the actual 3.8% compound growth rate since the year 2000.

But its actually worse. Since reaching peak debt just prior to the financial crisis, the US rate of GDP growth has decelerated even more. And going forward, there is no meaningful prospect of recovery in the face of the growing deflationary tide in the global economy and the unavoidable necessity for the Fed and other central banks to normalize interest rates in the decade ahead. Failing that they will literally blow-up the world’s monetary system in a devastating currency race to the bottom.

Thus, during Q1 2008, which marked the end of the domestic credit binge, nominal GDP posted at $14.67 trillion, and during the most recent quarter it came in at $17.69 trillion. That amounts to an seven-year gain of just $3 trillion and an annual growth rate of 2.7%.

Now surely there will be another recession before 2026. If not, we will end up with 200 straight quarters of business cycle expansion—-a preposterous prospect never remotely experienced previously. Indeed, in our modern central bank driven world, where both recessions this century have resulted from the bursting of financial bubbles, the proposition is even starker. Namely, no bursting bubbles or market crashes for 18 years!

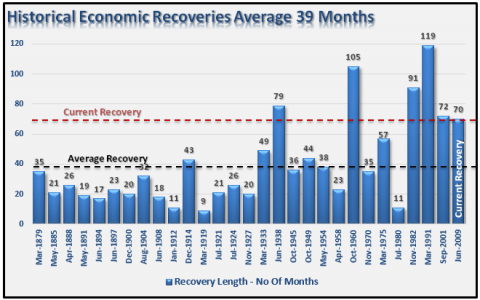

No, the historical business cycle expansions depicted below make clear that there will be another business cycle downturn. After all, contrary to the untrustworthies assumption that the current business cycle will last forever, and, in the analysis at hand for 200 months through the end of 2026, the average expansion has lasted just 39 months and the longest ever was only 119 months.

During the last business cycle contraction, in fact, nominal GDP declined by 3.4% between Q3 2008 and Q2 2009. And when you average that in with the 3.3% nominal GDP growth rate which we have had during the so-called recovery of the last four years, you not only get the aforementioned 2.7% trend rate of nominal GDP growth, but you are also hard-pressed to say how it can be bested in the years ahead.

Indeed, there is a now an unprecedented deflationary tide rolling through the world economy owing to the last 15 years of rampant money printing and financial repression by the central banks. By collectively monetizing upwards of $20 trillion of public debt and other existing securities and driving interest rates toward the zero bound in nominal terms and deep into negative territory in real terms, they have generated two massive, deflationary distortions that have now sunk deep roots in the world economy.

First, credit market debt outstanding has soared from $85 trillion to $200 trillion. This means future economic growth practically everywhere on the planet will be freighted-down by unprecedented, debilitating debt service costs.

At the same time, massive overinvestment in mining, energy, shipping and manufacturing spurred by central bank enabled cheap capital has generated a huge overhang of excess capacity. This is already fueling a downward spiral of commodity and industrial prices and profit margins, and there is no end in sight.

Iron ore prices which peaked at $200 per ton a few years back, for example, are now under $50 and heading for $30. Likewise, met coal prices which peaked at $400 per ton are heading under $100, while crude oil is heading for a retest of the $35 level hit during the financial crisis, and copper is on track to plunge from its recent peak of $4/pound toward $1.

These deflationary currents will suppress nominal income growth for a decade or longer owing to a now commencing counter-trend of low capital investment, shrinking industrial profits, tepid wage growth and falling prices for tradable goods and services. Accordingly, even maintaining the average nominal GDP growth rate of 2.7% realized over the last seven years will be a tall order for the US economy.

Needless to say, the law of compound arithmetic can be a brutal thing if you start with a delusional hockey stick and seek to bend it back to earth. In this case, the trustee report’s 5.1% GDP growth rate assumption results in $31 trillion of GDP by 2026. Stated differently, compared to only $3 trillion of nominal GDP growth in the last 7 years we are purportedly going to get $14 trillion in the next 12 years.

But let’s see. If we stay on the current 2.7% growth track, then GDP will come in at $24 trillion in 2026. Since OASDI payroll taxes amount to about 4.5% of GDP, it doesn’t take a lot of figuring to see that trust fund income would be dramatically lower in a $7 trillion smaller economy.

To be exact, the untrustworthies have goal-seeked their report to generate $1.425 trillion of payroll tax revenue 12-years from now. Yet based on a simple continuation of the deeply embedded GDP growth trend of the last seven years, payroll revenue would come in at only $1.1 trillion in 2026 or $325 billion lower in that year alone.

And here’s where the self-feeding illusion of trust fund accounting rears its ugly head. What counts is not simply the end-year delta, but the entire area of difference under the curve. That’s because every cumulative dollar of payroll tax shortfall not only reduces the reserve asset balance, but also the phantom interest income earned on it.

So what happens under a scenario of lower payroll tax revenues is that the $2.7 trillion of current trust fund “assets” begins circling the accounting drain with increasing velocity as time passes. In effect, the permission granted to Washington to kick the can by this year’s untrustworthies report gets revoked, and right fast.

To wit, instead of a cumulative total of $13.2 trillion of payroll tax revenue over the next 12 years, the actual, demonstrated GDP growth path of the present era would generate only $11.2 trillion during that period. That $2 trillion revenue difference not only ionizes most of the so-called trust fund assets, but also reduces the ending balance so rapidly that by the final year interest income computes to only $25 billion, not $100 billion as under the current report.

In short, by 2026 trust fund revenue would be $400 billion per year lower owing to lower taxes and less phantom interest. Accordingly, the current modest projected trust fund deficit of $150 billion would explode to upwards of $600 billion after the last of the phony interest income was booked.

Needless to say, that massive shortfall would amount to nearly 33% of the projected OASDI outgo of $1.8 trillion for 2026. More importantly, instead of a healthy cushion of $2.4 trillion of assets (or two year’s outgo) as the untrustworthies projected last week, the fund balance would be down to just $80 billion at year-end 2026.

Now that’s about 15 days of the next year’s OASDI outlays. The system would go tilt. Benefits would be automatically cut back to the level of tax revenue or by 33%. The greatest social crisis of the century would be storming out of every hill and dale in the land.

Yes, Jacob Lew is a Washington-Wall Street apparatchik who wouldn’t grasp the self-destructing flaws of trust fund accounting if they smacked him in the forehead. And the same is apparently true for the other trustees.

But here’s where the venality comes in. In order to goal-seek to 5% nominal GDP growth, the trustees report assumes that real GDP will average 3.1% per year through the year 2020.

Now, c’mon folks. Since the pre-crisis peak in late 2007, real GDP growth has averaged only 1.2% annually, and only 1.8% per year during the entire 15-years of this century.

Anybody who signed up for 3.1% real growth through 2020——that is, for scorching growth during month 67 through month 140 of a tepid business cycle expansion which is already long-in-the-tooth by historical standards—-is flat-out irresponsible and dishonest.

Calling their mendacious handiwork the “untrustworthies report” is actually more flattering than they deserve.

We should cut benefits already for current recipients. Maybe not all of them, but some of them. That should get me about 97 thumbs-downs, but it’s true. By the way, libs’ plan to “fix” social security by taking the cap off the income subject to social security tax wouldn’t work. An additional 12.4% income tax (6.2% “employee’s side” + the other 6.2% for the fallaciously-named “employer’s side”) would be a huge tax increase and it would be successfully avoided by most of its targets, who would find a way to get that income as a distribution. There’d be a lot of new S Corps set up and Social Security tax could even go down as they w2 themselves only some minimal figure.

Iska – agree, but it should be done intelligently. There should be a means test – different ways to do it and I don’t have an answer for the perfect means test. I do know many people that have incomes of 50, 80, 100000 that receive social security and that is just obscene.

Iska…someone doesn’t like our comments.

Social Security was established for the POOR. Anybody that has retirement INCOME of $80,000 or more is NOT POOR. And this doesn’t even get into discussion of ASSETS.

@Iska: “We should cut benefits already for current recipients”

Pull your head out of your ass. Many of us never wanted to be in the SS system. We were forced to contribute. I’ll gladly opt out – all they have to do is pay me all my contributions + my employers contributions (on my behalf) with compounded interest based on the average rate of return of the S&P 500 for each year. That’s what’s been stolen from me.

@kokoda: ” I do know many people that have incomes of 50, 80, 100000 that receive social security and that is just obscene”

Pull your head out of Obama’s ass. What a fucking FSA solution. The people who make 50k and up are the ones that are paying the most into the system. Yeah, make us pay FICA but we get no benefit. Just another tax on the middle class.

@kokoda: “And this doesn’t even get into discussion of ASSETS.”

Spoken like a true socialist / communist.

Dutchman- You can say you paid in all you want but the money doesn’t exist. It was gone a long, long time ago. Whatever SS checks folks receive now come directly from payroll and your fellow working Americans.

@Steph: “You can say you paid in all you want but the money doesn’t exist. It was gone a long, long time ago. ”

Sure it exists – as a contract, a law. I can’t help that the thieves in Washington spent it. If the US would cut benefits to current recipients the ‘full faith and credit’ of the US would go down the shitter – further than what it is.

Dutchman- I think it is better to accept it is gone today and start initiating plan B.

All part of the plan to destroy the free market , our currency and our will to resist their schemes for a cash less society and world government. It will probably work because so many people are depending on the entitlements for their survival . One thing I have learned from this site is that most people really don’t want freedom they want security.Most of America especially single women , minorities and elderly will do what the government tells them to do.America was once the great hope but it’s been ruined us.

“Many of us never wanted to be in the SS system. We were forced to contribute. I’ll gladly opt out – all they have to do is pay me all my contributions + my employers contributions (on my behalf) with compounded interest based on the average rate of return of the S&P 500 for each year. That’s what’s been stolen from me.”

I am curious as to why you feel this way about your payroll taxes but not your income taxes.

I read this same headline on several occasions over the last three decades.

Dear Minnies- As you pay for my SS check every pay period, let that be a good lesson to you as to the evils of socialism so you will not be suckered into further schemes. heh

Clammy- Every single SS check I cash, I will be thinking of you and smiling. Thanks in advance.

“We should cut benefits already for current recipients.”

Who is “we” in this instance? It can only be the Federal Government and this would mean making a “law” to “cut the benefits”? correct?

A government solution to a problem wholly created by government? This is a lot like borrowing your way out of debt problem or bombing your way to peace or any number of other government “solutions.”

I don’t know what the solution to the SS crisis is, I am in fact certain there IS no solution. It will end because it must end because it is entirely, mathematically, fundamentally unsustainable.. Period. How do we the people accomplish this while causing as little pain to the masses as possible? I’m not sure, but it starts with changing the way we think about these problems.

Oh, and Clammy…………..I’m not filing for SS until they make me so I can get maximum bang for YOUR BUCKS. Hurry up and get a big paying job so you can pay in maximum payroll tax just like I have all my life life……..Thanks for your support. Bea

Steph says: “I think it is better to accept it is gone today and start initiating plan B.”

Very wise advice, which gets an almost immediate thumbs down, quite possibly from Dutchman. Understandable since he most likely has a lot to lose.

Yes, we never had a choice to put money into the black hole that is Social Security. Well, we all have to get over it…shit, none of us ever had a choice to be born either. Whining about either will accomplish nothing. The SS system will fail, it is a mathematical certainty…the USD will fail, it is a mathematical certainty…Trying to desperately cling to these institutions forever will only result in more pain.

The system is doomed…we (we here, no at TPB specifically, those we can reach more generally) need to focus on what comes next and how it can be shaped into a better future, with a MUCH smaller government and MUCH more liberty.

“If the US would cut benefits to current recipients the ‘full faith and credit’ of the US would go down the shitter – further than what it is.” – Dutchman

Another example of something that is guaranteed to happen, sooner or later. And it is the loss of confidence in government and in the dollar that will ultimately bring this whole fucking system down.

When? I have nod idea…but maybe sooner than most of us can even imagine.

I use it to pay my green fees and gamble at the casinos. I don’t know what I would do without it. Just kidding-I’m still paying and it’ll probably be gone by the time I qualify.

@Pirate Jo:”I am curious as to why you feel this way about your payroll taxes but not your income taxes.”

#1 The article is speaking about Social Security, so that’s what I addressed.

#2. The payroll taxes were ‘taken’ with the express promise to pay at 65.

I get almost $5k a month, direct deposited. I’m 66, a consultant, bill out more than $125k a year.

All the Mexicans, Millennials, Gen X’ers, and Faggots can keep that check coming. The critics can blow me!

Why squabble. It’ll blow up before you know it and we’ll have a whole new raft of real, dire issues to face. Take comfort that you’re not one of those fools who never (and chose not to) see it coming. You gotta be living under a rock to not see shit’s wrong all around us. And while I feel sorry for a certain segment – the elderly that worked, saved, and lived within their means…the signs were there for each and every individual to see. A conscience choice was made to disregard those signs, a choice with consequences. Fuck am I sick of the excuses offered and promoted – funny how nobody gives a shit about the same issues elsewhere. When Greece comes up, all you hear is they deserve it. On another note, payed for by disability……

The other day I saw a customized handicapped van pull up to a boutique coffee shop with two people bringing some 30 year old paralyzed as fuck individual in for a treat. Right or wrong, there’s no math that makes shit like that add up. But hey, at least the parents don’t have to pay, society takes responsibility, parents are relieved and freed from guilt, jobs are created, more small business sales are made, more vans are customized……and if you believe that shit you may be getting a check from the gubmint right now.

So I’ll end my rant with this. All programs where you get more than you give are bad, because they aren’t fair, reward the wrong things, get abused, and end badly (not necessarily in that order).

Dutch says “I want my free shit!” No point in arguing with that. For those who might not be aware, Social Security never was anything but another tax on the middle class. The Supreme Court ruled, in upholding the law, that there was no connection or contract between “contributions” and benefits. I understood this back in the ’80s (see Irwin Schiff’s “The Social Security Swindle”), and never afterwards had an expectation that I would be collecting Social Security.

Dutchman…….

@kokoda: “And this doesn’t even get into discussion of ASSETS.”

“Spoken like a true socialist / communist.”

I was tempted to reply in kind, but I will let that go.

What don’t you understand:

1. SS was established for the POOR (like it or not).

2. It was put into law and we had no choice. Contributions were mandatory.

3. Assets – my point being that if someone had an INCOME of $80,00 or more, why should they get SS payments; just cuz they paid in? At the higher income levels, the gov’t takes 85% of those payments back when filing. Many of those same people have two homes, plenty of $$$ in IRA’s, with their continuing income. They don’t need SS – see No. 1 and re-read it.

“SS was established for the POOR” – kokoda

No. Like Tommy said, it was put in place as just another tax on the middle class. It was put in place because governments grow at all costs…that is just what they do. It was SOLD to the public as “helping the poor.” But it was just another way for govt to stick its hand in the people’s collective pocket and its dick in the people’s collective ass. This is just what governments do!

Kokoda- SS was started to be a SUPPLEMENT to one’s own savings and retirement income, not the entire means of living during the person’s retirement years. It had nothing to do with just being for poor Americans. You are seriously misinformed.

Social Security was established for every working person not exempt from it, not just the poor.

But. OK, just give everyone that paid in their all money back with interest, cancel the program, and let it go at that, problem solved. No one should have an issue with that.

Kokoda

I’ll just bet you and the rest of the whinney asses here would not want any part of your grandparents and parents coming to live in your home full time ala ‘The Walton’s” style living arrangement. AND are you going to take your grandparents/parents to the doctor and pick up the bill for the visit and also their prescription drugs? OH HELL NO, you don’t want to be Johnboy Walton, not at your house and them eating up all of your food. Well that is exactly what you will have if this system were deleted. How many extra people can you and Clammy sleep at your house? Clammy might even have to get a full time job to feed everybody.

Ten bucks says you will be saying “damn, I wish we still had SS payments for these damn old people”.

Bea: you’re exactly correct! The simply look at us as “damn old people”. It doesn’t matter that this old fart and my “damn old wife” have paid over a million dollars in federal income tax over the 50+yrs that we have worked. Or that we “contributed” $300K+ to socialist security and 150K+ to Medicare. We wouldn’t be having this conversation if CONgress had just left the SS money collected alone. Instead, they stole it and spent it.

The SS tax was 1% when it was instituted during the Depression. Life expectancy was 59 years old and the benefits would not start until you were 65. It was a modest program designed to help widows and orphans. It was called an insurance program because it wasn’t supposed to become the retirement plans of tens of millions.

But give politicians a welfare program and they will fuck it up beyond repair. Now there are only 2 people contributing for every 1 collecting and life expectancy is now 79. The math doesn’t work. Most people will get far more than they contributed. Until it goes broke.

@AnarchoPagan: ” The Supreme Court ruled, in upholding the law, that there was no connection or contract between “contributions” and benefits.”

Of course there is. There exists (and has since the beginning of SS) earnings and payment schedules.

There are payment schedules for SNAP, welfare and unemployment benefits, too. Subject to change at any time.

You boomers and silents….collect away. At least have the respect to not jeer and taunt those of us who pay and will never receive it. Just basic courtesy, I think most can agree on that, right?!

Then have the respect to just pay like we did for the seniors without moaning and complaining. I think most can agree on that too, right?

@Admin: ‘Most people will get far more than they contributed.’

Assume you work @ $7.50 / hr = $15,000 a year

Your contribution + employers = $1,875 = $156 month

Assume you work from age 20 to 65 at minimum wage.

Compound this at 5% (this is less than the average rate of return of the S&P 500)

Your contributions would be $316,000. SS says you will receive $730 a month.

316,000 / 730 = 432 months = 36 years

The person would have to live to 101 to get his money back.

Not to mention the $316,000 sinking fund would continue to grow interest upon retirement. Also the minimum wage earner (upon his death) would have an asset to will to his heirs.

Moms 81 and been collecting her meager Social Security since 65, They cut it shortly after dad died this winter. She has taken very good care of herself and had the good fortune to have excellent health to date. She and dad were self employed most of there working life and paid doubly into SS and I feel they earned what they received. Mom still works selling real estate on the south shore as she has done for over 40 years. She had 3 sales this past month and related to me that she could not afford to live in the very modest condominium where she resides without this additional income even though she owns it outright, even though she saved carefully throughout her career, unlike dad. Also with the thousands of dollars stolen from her by the Fed’s artificially low rates it is a meager pay back.

I think hers will be the last full generation to receive full benefits through their deaths. At some point the shear size and inflated costs of the boomer generation will sink the ship. My frustration is I have paid into the system since I was 13, 40 years and cannot retire on full benefits until 67, 14 years from now. I will have paid in for 54 years, and I am assured of reduced benefits, because that is the way it is. When my kids finish college I will save all I can, if I do well I am assured to either suffer reduced benefits or be means tested out because of assets. I am frugal, my house will be paid off in 21 months. I save in my 401k and I will be punished for it, that is just the way it is.

Life is not fair but it does seem to punish us tweeners more than most in this case. If you are very well off these things matter not. If you are very poor the government will take care of you, but if you work 50 to 60 hours a week, keep your nose clean the government feel free to take 1/3 of your earnings. You have little or no say in the matter. My son is in the process of getting his first job out of college and texted me asking what the take home pay was on $70,000. It calculated out to about 50,515 without deducting for 401k and health benefits. I put a note on a return email that yes the government take 1/3 of your pay before you even cash the check. I think if many of the younger generation saw this illustration while in school they might think differently voting for the government we have now.

On a lighter note my 81 year old mother is in Albuquerque skating in the National Dance Roller Skating competition for 55 and older. She has won this twice when she was in her late sixties. Go Ma.

Bob.

We’ve become an immoral people demanding that congress forcibly use one American to serve the purposes of another. Deficits and runaway nation debt are merely symptoms of the real problem.

Walter Williams

Else where he says… the political class has bribed voters to keep themselves in power.

This is what’s wrong. We as a society are now an immoral , secular and many ways godless nation. Mass police state then mass murder comes next.

Bob ,I am down here in Albuquerque right now. Beautiful day but hot.Your mom is obviously in good health and that’s a blessing.

bb,

Ma’s an amazing athlete. Se retired from competition after her second national title and skated exhibition and gave lessons for the past 14 year skating 1 to 2 times a week. About a month before the regionals the partner of one of her friends went down and he needed a new partner. In one month Ma skated 3 to 4 time a week 2 to 3 hours per session. That alone would kill your average 81 year old. I dropped her off at the airport on Saturday with her bags traveling by herself, asked her how she felt.She said great the best she has felt in years. She is one tough old bird and a very sweet grandmother, my kids adore her.

Bob.

This is everyones problem.

From the article:

In truth, there is nothing there except government accounting confetti. This figure allegedly represents the accumulated excess of trust fund income over outgo historically, but every dime of that was spent long ago on aircraft carriers, cotton subsidies, green energy boondoggles, prison facilities for pot smokers, education grants, NSA’s cellphone monitors, space launches and the rest of Washington’s general government spending machine.

Remove the SS income cap and SS will be solvent for many decades to come. There, fixed it for ‘ya.

Oh and the Medicare problem disappears if you reverse that stupid Tauzin (R) gimme to big Pharma. You know, the one that prohibits Medicare from negotiating drug prices.

Bea, I was being civil – you know what I mean. You paid, you receive. We pay, never gonna happen. I’ve accepted it – but call me a whiner or whatever, that’s bullshit and you no know it. I’ll bet you throw a fit when some millenial forgets to apply your AARP discount on some shit you don’t need anyway.

Tommy- to date have not collected a penny of my SS. Not a member of AARP. Also not a whiner, never have been.

Every time one of these SS debates come up, the minnies start screaming rape so get ready to be called out………..WE never complained. Clammy doesn’t even work and you would think she was paying in the maximum payroll tax every year the way she complains.

Westcoaster,

The VA system is far more effective at keeping medical costs down than anything the Medicare system will ever do.

Just put off treatment till after death, saves a very large amount of money,.

FWIW, that’s an official policy in England, which is widely known to have a far superior system to ours.

Tommy ,I’m 53 .Paid into SS since I was 18 and I doubt if I will ever be able to retire.I come to the conclusion last year that I would probably be working the rest of my life. That’s ok for me but others are going to be royalty fucked .I think it’s a good idea to plan on never receiving anything from this broke , insolvent government.

Bea- There is no argument because SS just went into the red for the first time this year. If you are planning on receiving SS for retirement you’ ve already lost. There is no trust holding your years of contribution or my contributions (been paying for 15 years now). Current SS checks come from current payroll from current workers. Employment levels are down, wages are down, and now SS is in the red. When the system goes bust there will be no solutions and nobody to save you if you are dependent on SS. Kiss that money good-bye because it was stolen from you by your government.

Well duh, Steph- Like I don’t know how SS works…………..Gee thanks for telling me that the younger people pay for those who are drawing now. Gee, is that like how all of us paid for the older people when we were younger, damn what revelation.

Check back with me when you have paid in maximum payroll tax for over forty years. Mmmkay

And if I needed that money to live on as you said, don’t you think I would be collecting my SS payments each month? Don’t collect it yet cuz I don’t need it.

Also agreed that soon the whole house of cards will come crashing down and everybody will be fucked to the maximum at which point it will be like last time it crashed. Multi-generations living together under one roof and those without family anchor will be in boarding houses or who knows maybe happy campers at the FEMA park.

Bes- Then why are you putting up a fuss like a nitwit? The program is broke so I really don’t see the need of you pitching a fit. Let it go.

Clam- Because half of my neighbors, my two brothers who are 80 or over and most of my friends depend on SS to make it through the month. Many of my clients draw their SS which helps to pay me. Just tired of all of you screeching younger folk acting like we are asking more from YOU than was asked of US. No, you let it go.

Dutchman

You didn’t contribute the employer portion. The employer did.

The SS funds have been invested in Treasuries. The return has not been 5%. The return would be closer to 3%.

So solly. You are wrong. The average person will get more than they put in.

So what you are saying is while you do not currently taking SS your living depends on it. Yup, got it now. No further explanation needed. What you don’t get is it should have been never asked of you either.

The government is stealing from you. The government is stealing from you. The government is stealing from you.

Why are you not mad the government is fucking stealing from you. You act indignant because young people don’t want the government to steal from them? You are on an illogical loopty-loop. Get off before you puke.

The Urban Institute, a non-partisan research institute in Washington, produces statistics on this topic annually. Institute researchers figured out what people turning 65 in various years have already “paid in” to the system and what can expect to “take out” after they reach age 65. (See our charts below)

Because marital status and family income can significantly affect both the amount paid in and the amount paid out, the institute offers its calculation for various types of family units. To make the final amounts comparable to what might have been done with the tax money had it been invested privately, the institute adjusted all dollar figures at 2 percentage points above the rate of inflation. (The authors note that different assumptions for long-term returns on investment would change the results.)

According to the institute’s data, a two-earner couple receiving an average wage — $44,600 per spouse in 2012 dollars — and turning 65 in 2010 would have paid $722,000 into Social Security and Medicare and can be expected to take out $966,000 in benefits. So, this couple will be paid about one-third more in benefits than they paid in taxes.

If a similar couple had retired in 1980, they would have gotten back almost three times what they put in. And if they had retired in 1960, they would have gotten back more than eight times what they paid in. The bigger discrepancies common decades ago can be traced in part to the fact that some of these individuals’ working lives came before Social Security taxes were collected beginning in 1937.

Some types of families did much better than average. A couple with only one spouse working (and receiving the same average wage) would have paid in $361,000 if they turned 65 in 2010, but can expect to get back $854,000 — more than double what they paid in. In 1980, this same 65-year-old couple would have received five times more than what they paid in, while in 1960, such a couple would have ended up with 14 times what they put in.

Such findings suggest that, even allowing for inflation and investment gains, many seniors will receive much more in benefits than what they paid in.

http://www.politifact.com/truth-o-meter/article/2013/feb/01/medicare-and-social-security-what-you-paid-what-yo/

As predicted in the first comment, the liberal here suggests removing the cap on income subject to social security tax. No one will stand by and just chow another 12.4% tax on a big chunk of their income. (If only a small portion of their income is over the cap, there’s not much additional tax that can be stolen anyway.) Whether half of it is nominally paid the employer doesn’t matter. The “employer’s side” restrains pay and hiring. Also, schedule C self-employed people would pay the whole additional 12.4% themselves as self employment tax. Every single schedule C sole proprietor would start an S Corp, w2 themselves about $35k and get the rest as a distribution (pass through). Which would mean the government seeing its social security tax drop on such a person by 2/3. Unintended consequences. Libs think people’s earnings belong first to the government, and the actual earner should be happy with whatever the government deigns to let them keep. There are plenty of people who would, instead, just tell the government to fuck off and would purposely earn less. 39.6% federal rate + state income tax + 12.4% self- employment tax + 2.8% Medicare tax + phase out of itemized deductions = only keeping about 40 cents of every incremental increase in income. That translates into businesses not being expanded, hiring stopped, etc. Where the fuck is Llpoh on this thread? Wake up you Australian bastard.