Some guy named Jim Quinn is being quoted as a financial expert by other experts on other sites. People who visit this site wonder what took them so long. We’ve known that he is a pretty smart guy for a long time. More than that we know him as a good man and Internet friend.

BUCKHED

March 15, 2016 12:14 pm

I asked two Great Aunts what it was like during the depression . Both were teenagers at the time .

One great Aunt was my grandmothers sister . She told me that the Depression wasn’t that big of a deal . They owned a several hundred acres,were farmers and had money . She said some things were hard to come by but since they farmed all of what they needed no one was hungry . She said folks would show up for food in the morning. Her mother would feed them breakfast tan they’d go help out on the farm with what ever needed to be done. They’d eat lunch and supper there as well and then they’d be gone to the next farm. I guess it really was an era of ” Will Work For Food ” .

My other Great Aunt by marriage said her family lost everything when the bank closed and took all of their money . She said in her later years she was astounded how her mother made due with so little variety of food. They started a garden,raised chickens,a few pigs and got by on what work her father could find .

The next Great Depression is going to be a DOOOZY ! The younger generations have no clue how to survive without a hand-out . With an agrarian based economy a long ago memory most will probably starve . Thank God for the family farm !

Ed

March 15, 2016 12:14 pm

This article presents the incorrect description of “the deflationary spiral” that has been a basic part of the false picture painted of the depression by economists who promoted the tale that all this economic carnage just came out of nowhere. Deflation is the reduction in the amount of money circulating in the economy, not just the falling prices of goods.

This tale leaves out the description of how federal intervention allowed the “bank holiday” which resulted in a huge confiscation of gold and silver specie. It also fails to mention FDR’s confiscation of gold.

The “bank holiday” handed over the savings of the public at large to the Federal Reserve, and the gold confiscation further robbed those people who held their money outside the banks in the form of gold certificates. Together, those two actions are now viewed as “the greatest robbery in American history”.

Visit the source website for the article. Click on the “About” tab in the header of the site.

Ed

March 15, 2016 12:17 pm

“The next Great Depression is going to be a DOOOZY !”

I agree. I read, years ago, some old timer saying that compared to what’s coming, the Great Depression will look like God’s feast for the righteous.

Mike in CT

March 15, 2016 12:53 pm

..A Doozy ??? The Next One ??? I think the past eight years have been a depression…mike

Ed

March 15, 2016 12:59 pm

” I think the past eight years have been a depression…mike”

You’re right. It’ll deepen when the credit stream runs out.

TC

March 15, 2016 1:21 pm

I got to spend a week with my Grandfather on his farm a year before he died. One of the things I asked him about was his memory of the Great Depression. As a poor kid on the farm, each kid only had 1 pair of hand-me-down shoes, which was worn only to go to church on Sunday, otherwise they walked barefoot everywhere they went. Whether it was their experience through the Depression or just being born and raised on a farm, they are/were the most resourceful and efficient people I’ve ever known. Nothing gets thrown away; everything is used, reused, repaired and repurposed until there’s literally nothing left but rust. Anything from the table that isn’t eaten is fed to the cats, dogs or hogs.

DC Sunsets

March 15, 2016 1:26 pm

In terms of life style, the Great Depression didn’t end until after world war two.

In terms of economic stats, there was actually a second depression that occurred around 1937, which had it not occurred during the GD, would have constituted its own depression.

Recall that a farmer was hauled into court for not slaughtering and burying some of his livestock (as ordered by the government to try to “raise prices.”) He claimed the pigs were for his own family’s consumption, but the court ruled that because his consumption of the pig(s) reduced his demand for food coming across state lines, Congress was justified in passing the law forcing him to kill and bury the pigs under the Commerce Clause of the US Constitution.

Yes, your 9 black-robed asshole lawyers who work for Uncle Sam have been ruling in favor of Uncle Sam (and against you, you miserable plebeian) since before you were born.

Nothing changes.

DC Sunsets

March 15, 2016 1:28 pm

People who remained at work and weren’t drowning in debt passed through the GD without much ado.

This time around, the big event will be the draining (and evaporation) of the IOU- (bond) Ocean. Since this is where many trillions of dollars of wealth current reside, it promises to be the largest collapse in wealth in recorded history.

The biggest losers will be

1. The uber-wealthy

2. People depending on promises of future cash flows (e.g., pensioners.)

Greg in NC

March 15, 2016 1:44 pm

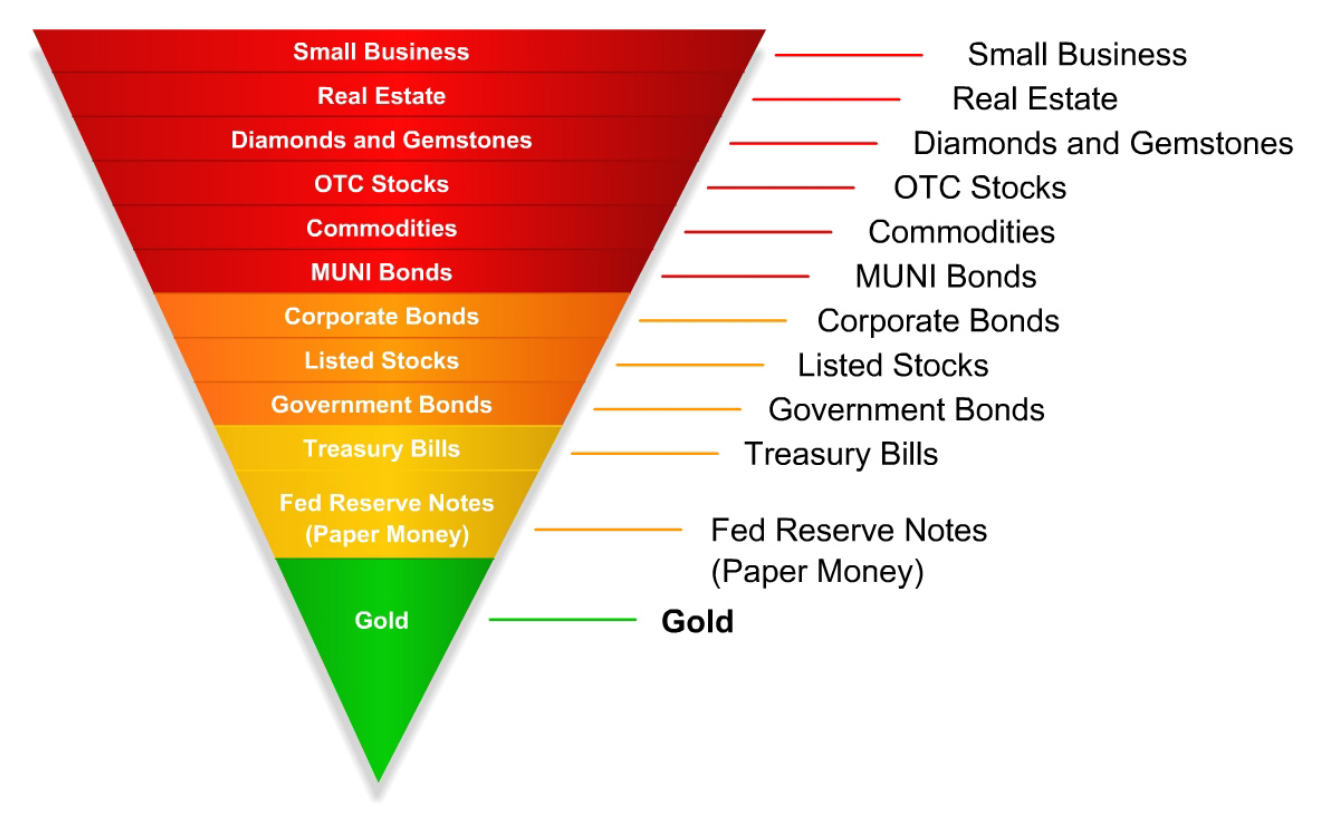

John Exter’s inverted pyramid will continue to collapse but at greater speed…

[img[/img]

DC Sunsets

March 15, 2016 1:55 pm

Greg in NC,

I prefer a different inverted pyramid, one entirely made up of IOU’s, with the top layer being IOU’s issued by the weakest debtors, then next weakest, and so on.

Markets are being held aloft by astronomical amounts of liquidity sloshing around, and the last 20 years have seen that liquidity slosh in and out of various markets at one time or another, resulting in the boom/bust behavior of gold, commodities, real estate and stocks.

The real issue is this: Unimaginable wealth resides in and rests on this Bond Ocean. It is an ocean made entirely of IOU’s and its depth and breadth depend on mass trust (and mass optimism.)

When (not if, WHEN) this cycle finally ends, interest rates will rise for the IOU’s at the top of the inverted pyramid, and those IOUs’ capital value will thus fall. This weakness in bond value will work its way down the pyramid, but most importantly, each high layer will eventually pancake down on top of the next lower layer, like a building being demolished.

As this occurs, the wealth supporting asset prices (in all markets) will evaporate. One market after another should experience hard down-drafts. The virtuous rise of the last 40 years will go into reverse (and usually bear markets occur faster than the preceding bull market.)

For this reason, I believe gold’s price is highly likely to participate in the decline. This is where I believe Exter’s pyramid is wrong; gold may survive the US dollar (in paper form) but prior to the paper dollar entering its destruction phase (due, I suspect, to actual banknote hyperinflation beginning at the bottom of the deflationary crisis), it will be the last man standing.

DC Sunsets

March 15, 2016 2:00 pm

The only reason to suspect gold’s price could rise even during a deflationary crisis would be because

1. the gold market is minuscule compared to energy, food, or stocks markets.

2. gold market “supply” is greatly overstated by leverage in the gold futures market, which is much more like a market for intangibles now than it is a commodity market. If the “intangible” part of the gold market breaks off from the physical market, that could lead to a rise in the latter as the former completely craters. I’m not sure how this could happen, but it seems at least imaginable.

I still look for gold to hit $1,900, not withstanding that its current rally is far from over, I suspect.

Greg in NC

March 15, 2016 3:07 pm

DC Sunsets,

I pretty much agree with what you say as the credit markets are a magnitude greater than equity markets. The pyramid I posted does not reflect the size of each market but merely the “pecking order”.

There is so much manipulation in some of these markets that we cannot get a clear picture of what is actually occurring. What we can see is the small businesses are failing as well as large corporations closing stores(vacancy rate at strip malls), thus impacting real estate values, and commodities have plunged. We also see corporate bonds getting hit especially junk rated. However, thanks to “mark to model” we are not seeing the actual value that they would have decreased. Stocks are overvalued due to Plunge Protection Team manipulation otherwise they would already be in the tank. Now we are down to govt bills notes and bonds. Who is buying? Belgium? Almost no one and most holders are actually dumping them.

If we take a look at the FEDs balance sheet, H.4.1, US treasury securities line and compare it to 2008 we can see that treasuries are already worth junk. US Treasury Securities Jan08- $740,611BB, Jan16- $2,461,535TT. Mortgage Backed Securities Jan08- $0, Jan-16- $1,747,464TT. Reserve balances of member banks Jan08- $13,141BB Jan16- $2,121,654TT. Total factors supplying federal funds Jan08- $943,805BB, Jan16- $4,530,661TT. There are many more things to look at on their balance sheet but it appears to me if it wasn’t for the fed and its member banks we would have known the bond complex to have died in 08.

As for a gold price going down, I don’t think so. It is the only thing that can repair global trade imbalances as the IOUs have already become toxic and without the MIC threats would be dead. So I agree with your second portion of the post on gold.

Jim

March 15, 2016 3:33 pm

DC, just curious, if you are predicting a bond collapse, what about holding cash, if you are lucky enough to be sitting on a pile at this time?

artbyjoe

March 15, 2016 4:12 pm

in my opinion, in a redo of the great depression or worse, water and food will be better than money. my friends call me doom and gloom. my advice is always similar. secure a way to feed yourself, and then start practicing it. if you are lucky enough to produce more than you need, there will be multitudes that will be grateful for a meal, or a days meals for a days work. in ancient Japan, small bags of rice were money. this lasted for many centuries. make your compost piles or rows as high as you can. the higher, the more heat produced, the quicker it is ready.

Ed

March 15, 2016 10:28 pm

Greg and DC, my view is that the increase in the “price of gold” will be limited only by how long the US dollar remains a viable currency. The last height of around $1920 wasn’t really a fluke, as far as I could tell. Spot valuations could exceed anything we’ve seen so far.

The gold spot price beatdown of ’13 led some to observe that, in the gold market, those who had gold weren’t selling and those who were selling had no gold.

Anonymous

March 16, 2016 6:45 am

So why is the US being flooded with illegals?Now Syrians. Its been reported that Greek women are now prostitutes for four dollars an hour or starve. Drive down wages?Eliminate sovereign boarders?

Some guy named Jim Quinn is being quoted as a financial expert by other experts on other sites. People who visit this site wonder what took them so long. We’ve known that he is a pretty smart guy for a long time. More than that we know him as a good man and Internet friend.

I asked two Great Aunts what it was like during the depression . Both were teenagers at the time .

One great Aunt was my grandmothers sister . She told me that the Depression wasn’t that big of a deal . They owned a several hundred acres,were farmers and had money . She said some things were hard to come by but since they farmed all of what they needed no one was hungry . She said folks would show up for food in the morning. Her mother would feed them breakfast tan they’d go help out on the farm with what ever needed to be done. They’d eat lunch and supper there as well and then they’d be gone to the next farm. I guess it really was an era of ” Will Work For Food ” .

My other Great Aunt by marriage said her family lost everything when the bank closed and took all of their money . She said in her later years she was astounded how her mother made due with so little variety of food. They started a garden,raised chickens,a few pigs and got by on what work her father could find .

The next Great Depression is going to be a DOOOZY ! The younger generations have no clue how to survive without a hand-out . With an agrarian based economy a long ago memory most will probably starve . Thank God for the family farm !

This article presents the incorrect description of “the deflationary spiral” that has been a basic part of the false picture painted of the depression by economists who promoted the tale that all this economic carnage just came out of nowhere. Deflation is the reduction in the amount of money circulating in the economy, not just the falling prices of goods.

This tale leaves out the description of how federal intervention allowed the “bank holiday” which resulted in a huge confiscation of gold and silver specie. It also fails to mention FDR’s confiscation of gold.

The “bank holiday” handed over the savings of the public at large to the Federal Reserve, and the gold confiscation further robbed those people who held their money outside the banks in the form of gold certificates. Together, those two actions are now viewed as “the greatest robbery in American history”.

Visit the source website for the article. Click on the “About” tab in the header of the site.

“The next Great Depression is going to be a DOOOZY !”

I agree. I read, years ago, some old timer saying that compared to what’s coming, the Great Depression will look like God’s feast for the righteous.

..A Doozy ??? The Next One ??? I think the past eight years have been a depression…mike

” I think the past eight years have been a depression…mike”

You’re right. It’ll deepen when the credit stream runs out.

I got to spend a week with my Grandfather on his farm a year before he died. One of the things I asked him about was his memory of the Great Depression. As a poor kid on the farm, each kid only had 1 pair of hand-me-down shoes, which was worn only to go to church on Sunday, otherwise they walked barefoot everywhere they went. Whether it was their experience through the Depression or just being born and raised on a farm, they are/were the most resourceful and efficient people I’ve ever known. Nothing gets thrown away; everything is used, reused, repaired and repurposed until there’s literally nothing left but rust. Anything from the table that isn’t eaten is fed to the cats, dogs or hogs.

In terms of life style, the Great Depression didn’t end until after world war two.

In terms of economic stats, there was actually a second depression that occurred around 1937, which had it not occurred during the GD, would have constituted its own depression.

Recall that a farmer was hauled into court for not slaughtering and burying some of his livestock (as ordered by the government to try to “raise prices.”) He claimed the pigs were for his own family’s consumption, but the court ruled that because his consumption of the pig(s) reduced his demand for food coming across state lines, Congress was justified in passing the law forcing him to kill and bury the pigs under the Commerce Clause of the US Constitution.

Yes, your 9 black-robed asshole lawyers who work for Uncle Sam have been ruling in favor of Uncle Sam (and against you, you miserable plebeian) since before you were born.

Nothing changes.

People who remained at work and weren’t drowning in debt passed through the GD without much ado.

This time around, the big event will be the draining (and evaporation) of the IOU- (bond) Ocean. Since this is where many trillions of dollars of wealth current reside, it promises to be the largest collapse in wealth in recorded history.

The biggest losers will be

1. The uber-wealthy

2. People depending on promises of future cash flows (e.g., pensioners.)

John Exter’s inverted pyramid will continue to collapse but at greater speed… [/img]

[/img]

[img

Greg in NC,

I prefer a different inverted pyramid, one entirely made up of IOU’s, with the top layer being IOU’s issued by the weakest debtors, then next weakest, and so on.

Markets are being held aloft by astronomical amounts of liquidity sloshing around, and the last 20 years have seen that liquidity slosh in and out of various markets at one time or another, resulting in the boom/bust behavior of gold, commodities, real estate and stocks.

The real issue is this: Unimaginable wealth resides in and rests on this Bond Ocean. It is an ocean made entirely of IOU’s and its depth and breadth depend on mass trust (and mass optimism.)

When (not if, WHEN) this cycle finally ends, interest rates will rise for the IOU’s at the top of the inverted pyramid, and those IOUs’ capital value will thus fall. This weakness in bond value will work its way down the pyramid, but most importantly, each high layer will eventually pancake down on top of the next lower layer, like a building being demolished.

As this occurs, the wealth supporting asset prices (in all markets) will evaporate. One market after another should experience hard down-drafts. The virtuous rise of the last 40 years will go into reverse (and usually bear markets occur faster than the preceding bull market.)

For this reason, I believe gold’s price is highly likely to participate in the decline. This is where I believe Exter’s pyramid is wrong; gold may survive the US dollar (in paper form) but prior to the paper dollar entering its destruction phase (due, I suspect, to actual banknote hyperinflation beginning at the bottom of the deflationary crisis), it will be the last man standing.

The only reason to suspect gold’s price could rise even during a deflationary crisis would be because

1. the gold market is minuscule compared to energy, food, or stocks markets.

2. gold market “supply” is greatly overstated by leverage in the gold futures market, which is much more like a market for intangibles now than it is a commodity market. If the “intangible” part of the gold market breaks off from the physical market, that could lead to a rise in the latter as the former completely craters. I’m not sure how this could happen, but it seems at least imaginable.

I still look for gold to hit $1,900, not withstanding that its current rally is far from over, I suspect.

DC Sunsets,

I pretty much agree with what you say as the credit markets are a magnitude greater than equity markets. The pyramid I posted does not reflect the size of each market but merely the “pecking order”.

There is so much manipulation in some of these markets that we cannot get a clear picture of what is actually occurring. What we can see is the small businesses are failing as well as large corporations closing stores(vacancy rate at strip malls), thus impacting real estate values, and commodities have plunged. We also see corporate bonds getting hit especially junk rated. However, thanks to “mark to model” we are not seeing the actual value that they would have decreased. Stocks are overvalued due to Plunge Protection Team manipulation otherwise they would already be in the tank. Now we are down to govt bills notes and bonds. Who is buying? Belgium? Almost no one and most holders are actually dumping them.

If we take a look at the FEDs balance sheet, H.4.1, US treasury securities line and compare it to 2008 we can see that treasuries are already worth junk. US Treasury Securities Jan08- $740,611BB, Jan16- $2,461,535TT. Mortgage Backed Securities Jan08- $0, Jan-16- $1,747,464TT. Reserve balances of member banks Jan08- $13,141BB Jan16- $2,121,654TT. Total factors supplying federal funds Jan08- $943,805BB, Jan16- $4,530,661TT. There are many more things to look at on their balance sheet but it appears to me if it wasn’t for the fed and its member banks we would have known the bond complex to have died in 08.

As for a gold price going down, I don’t think so. It is the only thing that can repair global trade imbalances as the IOUs have already become toxic and without the MIC threats would be dead. So I agree with your second portion of the post on gold.

DC, just curious, if you are predicting a bond collapse, what about holding cash, if you are lucky enough to be sitting on a pile at this time?

in my opinion, in a redo of the great depression or worse, water and food will be better than money. my friends call me doom and gloom. my advice is always similar. secure a way to feed yourself, and then start practicing it. if you are lucky enough to produce more than you need, there will be multitudes that will be grateful for a meal, or a days meals for a days work. in ancient Japan, small bags of rice were money. this lasted for many centuries. make your compost piles or rows as high as you can. the higher, the more heat produced, the quicker it is ready.

Greg and DC, my view is that the increase in the “price of gold” will be limited only by how long the US dollar remains a viable currency. The last height of around $1920 wasn’t really a fluke, as far as I could tell. Spot valuations could exceed anything we’ve seen so far.

The gold spot price beatdown of ’13 led some to observe that, in the gold market, those who had gold weren’t selling and those who were selling had no gold.

So why is the US being flooded with illegals?Now Syrians. Its been reported that Greek women are now prostitutes for four dollars an hour or starve. Drive down wages?Eliminate sovereign boarders?