Authored by Simon Black via SovereignMan.com,

Quite literally as a I write these words to you, the heads of the world’s largest central banks are packing their bags and heading home after a three-day symposium in Jackson Hole, Wyoming.

Central bankers aren’t exactly mega-celebrities, so their conferences don’t make international news outside of financial circles.

But if people understood what was at stake, they’d probably pay more attention.

Central bankers wield totalitarian authority over their nations’ interest rates.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

Setting interest rates means they have direct influence over the price of money. In other words, they influence the price of EVERYTHING–

How much you pay for your mortgage. The price of your home. How cheap (or expensive) it is for a business to borrow money for expansion… which directly affects how many people they hire.

Their influence over rates helps determine how much interest the government pays each year on its debts, which ultimately impacts tax rates and other spending programs.

It’s extraordinary power.

And whereas nearly every branch of government has some system of checks and balances to ensure no single body has too much authority, central banks aren’t technically part of the government…

… so their power is nearly entirely unchecked.

To be fair, I’m sure they’re all very nice people with good intentions.

Central bankers are not moustache-twirling villains plotting a takeover of the world.

But the decisions they make have serious implications over the lives of hundreds of millions of people.

Just like politics, every action they take has winners and losers.

And it’s easy to see who’s been winning over the last several years as a result of their policies.

Stock markets around the world are at all-time highs. Bond markets are at all-time highs. Real estate is at all-time highs.

If you own assets you’ve done extremely well.

But if you’re in the rapidly deteriorating middle class, especially the lower middle class, you haven’t.

Looking at the United States, for example, it seems quite strange that the stock market is near its ALL-TIME HIGH while the overall economy has been sluggish for years.

Annual GDP growth for the United States in 2016 was a measly 1.6%, a rate that barely keeps up with population.

And global GDP growth has been low for years.

This has had a significant impact on employment and wages.

Central bankers and politicians tout that the unemployment rate in the US is at a 10-year low.

And that sounds great.

But it’s easy to see a different picture when you look deeper at the numbers.

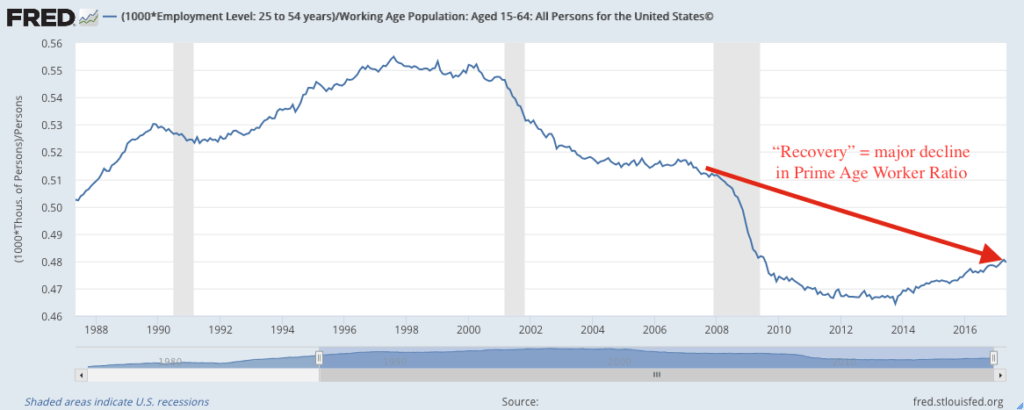

According to data from the US Labor Department, for example, the percentage of Americans in their prime work years (between the ages of 25 and 54) who actually have jobs is still WAY below the level prior to the 2008 Great Recession.

Wage growth has also been stagnant..

On top of that, debt levels are hitting record highs. Student debt. Consumer debt. Auto loans.

And people are once again unable to pay their debts.

Over the last 12 months, for example, Capital One’s net charge-offs increased 40%.

Cash levels are also incredibly low.

We’ve all seen the stories about how little savings the average American has.

Well, I pulled the data myself, using Bank of America as a proxy.

Bank of America’s annual report from 2016 shows that the bank has $592 billion in consumer deposits from 46 million households.

That works out to be an average of $12,870. Per HOUSEHOLD. Not per person.

And that amount includes EVERYTHING: savings, investments, retirement, etc.

What’s amazing is that, 20 years ago, Bank of America’s annual report showed the bank had $392 billion in deposits from 30 million households.

That worked out to be $13,067 per household… in 1997!

So 20 years later, Bank of America’s average customer has LESS MONEY. And that’s before adjusting for inflation.

This is one of the biggest stories of our time: the middle class… especially the lower middle class… is being decimated.

A strong middle class has long been the hallmark of modern western civilization.

In fact, history shows that throughout many dominant empires, from ancient Rome to the British Empire, a robust middle class is essential to maintain a durable society.

Where the middle class is strong and growing, civilization flourishes.

And where the middle class fails, civilization turns over.

The Middle Class was sacrificed to support the Welfare Class. When an employer has to pay huge social security, unemployment, workers comprehension, medicare, medicaid, property, income taxes etc, he cannot compete with countries that don’t. The Socialist have killed the Goose that laid the Golden Eggs. The Progressives are determined to sink our ship just as sure as they did in Venezuela, Rhodesia, the USSR, Cuba etc.

That makes no sense. The middle class was sacrificed to support the elite. The welfare class has no say in the matter. Follow the money.

Ok, the Elite and the FSA split roasted the Middle Class. If you follow the government money, it fills both pig troughs.

What he said!

I’ve worked hard to avoid being average. It’s taken a long time but it’s paying off even in this economy.

Indent Service ,you need to adopt a sub – Sahara African baby.Give you something to do.

BB; You are so full of it! You make me laugh for which I thanks you!

If you really sat down with a calculator , it is not the social security and Medicare taxes paid by percentage of income by employees and employers . It’s what is being done with the money as to who receives it and why plus how much . Not to mention the fact our congress opened the social security box that really never was and pissed it away .

Now on to the central bankers : these were part of the group we sang the song “JUMP YOU FUCKERS” about !

The low intrest policies damaged every person in America that attempted to save a modest nest egg for everything from retirement , children’s education or that first home . However this bunch also conspired to get all the above to be indentured in debt that they had to know was impossible to be satisfied by any actuarial table you could run out . Certainly a modest percentage will pay off but probably 30 % is a high guess .

Meanwhile their efforts assured average savers lost ground daily . The true intrest on savings should be paying account holders a range of 4% to 8% in a true honest risk reward situation of banking investment .

Consequently this is theft by conspirency to commit fraud .

The reason is because our elected representatives spent so far above and beyond they had to rig the intrest rates to prevent total collapse of the dollar . Thus we must create distractions , war and criminalize normal behavior to a point where everyone pays fines . Iraq , Afghanistan , Libya , Syria all part of the game to keep the balls in the air a little longer .

As for the innocent people in the way FUCK EM . They even gave them a new sanitary title “COLATERAL DAMAGE ” . That means some poor basturd minding his or her own business gets blown to bits or they get to witness someone they care about getting blasted and the American media say everything from oops or sadly necessary . Not much comfort if it’s your kids but hey if they hit us it’s terror ????

Quite a quagmire we have going here but it soon will end , our police are being resupplied with some heavy hitter military gear . So your ass better be happy With 1% savings or the “THEY” group will go negative on us ! And our police will be on hand with night vision and Hum Vee’s oh and automatic weapons to assure we better fucking like it !

Several other possibilities:

(1) The bankers got the laws rewritten to allow involuntary “bail-ins”, and the country NOTICED. The law now says the banks can make bad bets and USE YOUR DEPOSITS TO MAKE THEM GOOD (pay out on the bad bets). Given that this can happen OVERNIGHT and WITHOUT RECOURSE or even PRIOR NOTIFICATION (everyone would withdraw any funds in a bad-bet bank), WHO would be stupid enough to keep large sums in a bank?

(2) ZIRP; your deposits earn no interest. Wouldn’t you be better off putting any excess funds (beyond ordinary bills for a month or two) in gold& silver, fine wines, rare stamps, real estate, bullets / bandages / beans, anything but a bank account?

(3) Banks in America are way over-leveraged; wouldn’t a foreign bank / brokerage be a better place to keep any money you really might want to get back?

(4) Assuming you actually know of a business that is honestly / ethically run (leaves out Goolag, Freakbook and similar) that makes a profit and pays dividends, wouldn’t that be a better place to invest than a bank account?

I could probably think of several more but you get the point ….