“The best way to teach your kids about taxes is by eating 30% of their ice cream.” – Bill Murray

When I saw that slimy tentacle of the Goldman Sachs vampire squid, Gary Cohn, bloviating about Trump’s tax plan and how it was going to do wonders for the middle class, I knew I was probably going to get screwed again. And after perusing the outline of their plan, it is certain I will be getting it up the ass once again from my beloved government.

I know everyone’s tax situation is different, but I’m just a hard working middle aged white man with two kids in college and some hefty family medical expenses. I’m already clobbered with Federal, State, City, and real estate taxes, along with huge toll taxes, sales taxes, gasoline taxes, utility taxes, phone taxes and probably a hundred more hidden taxes and fees.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

I fucking hate taxes and want nothing more than to see them cut dramatically. I voted for Trump for the following reasons:

- He wasn’t that evil hateful shrew named Hillary Clinton

- He promised to repeal and replace Obamacare

- He promised to build the wall

- He promised to keep out Muslims

- He promised to reduce our military interventions around the world

- He promised to reduce my taxes

Well, one out of six ain’t bad. Right?

I know the Trump sycophants have a million reasons why he has been thwarted, but his pathetic support of the last GOP Obamacare lite bill reveals him to becoming just another establishment pawn. He has taken war mongering on behalf of the military industrial complex to a new level. No wall on the horizon. Now it is a figurative wall. And now he is disingenuously selling this tax bill as a huge windfall for the middle class, which is a lie based on my analysis of the known details. The truth is they need to screw the upper middle class in order to reduce corporate tax rates.

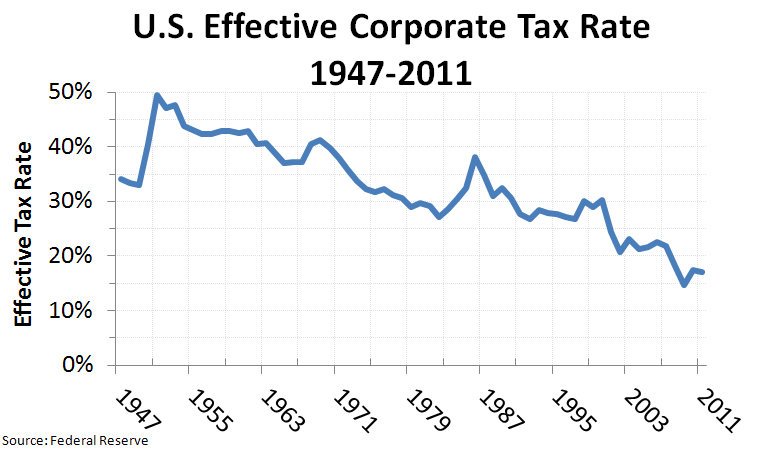

You hear the talking head “experts”, paid for by corporations, spinning a yarn about the 35% corporate tax rate and how it makes our corporations terribly disadvantaged. The truth is corporate lobbyists (I don’t have a white working man middle class lobbyist working for me) have bribed Congress to insert so many exemptions, deductions, credits, and loopholes into the tax code, the big corporations pay an effective tax rate of 19% already. If overly burdensome corporate taxes were really a problem, would corporations be generating record after-tax profits while GDP grows at a pitiful 2% rate?

I don’t know how many people are in my boat, but I’m guessing it is a large portion of the middle class. We already know about 50% of the households in the U.S. don’t pay any Federal Income Tax. Some even get refunds for not working. That’s why there are tax preparation offices all over West Philly and other urban welfare enclaves around the country. Here are the tax brackets for a married middle class family:

Most middle class families see the majority of their income taxed between the 10% and 15% rate, with upper middle class families having a portion taxed at 25%. A family with taxable income of $100,000 would have a tax bill of about $16,500, for an effective rate of 16.5%.

Trump’s plan has three rates: 12%, 25%, 35%. The weasels do not give the income level cut-offs. But we do know they are proposing elimination of the $4,050 personal exemption and the deduction for state and local taxes. They increase the standard deduction from $12,700 to $24,000. The idea is to keep people confused until the 2,000 page bill gets passed in the middle of the night after corporate lobbyists insert their goodies. In my situation, it is certain I will be getting screwed.

My family of four will lose $16,200 of personal exemptions versus gaining $11,300 in the standard deduction. Where I’m really getting screwed is losing the state and local tax deduction. The only single benefit to me working in this godforsaken hell hole called Philadelphia is I get to deduct the massive tax shakedown amount on my tax return. My PA, Phila, and real estate tax bill is huge. It’s far more than my mortgage deduction. And Trump is taking it away.

I’d be in favor of taking all deductions, exemptions, credits, and corporate loopholes away. But that’s not how it works. Corporations and Trump billionaire cronies will add loopholes and goodies into the bill, while people like me get fucked again. By replacing the 10% and 15% tax rate with 12% and 25%, the average middle class family will get screwed.

In the previous example of a family making $100,000, with a significant state and local tax deduction, the $16,500 annual tax bill will likely go up dramatically. Even if they taxed the first $50,000 (a big if) at 12%, their annual tax bill would go up to $18,500, a 12% increase. If that 12% bracket cutoff is lower, then the tax bill will soar. There isn’t a reasonable scenario where a home owning middle class family of four doesn’t pay more taxes under the Trump proposal.

Don’t believe what you hear on TV from paid for propagandists. You are going to get screwed so corporate fat cats can boost their profits even more. If they reinvest those profits, it will be in robots and technology to eliminate the jobs they haven’t shipped overseas. Oh. By the way, where are those tariffs against China, Mexico and the rest of the world to bring back our jobs? Trump is a phony and his tax plan sucks. Remember, up until 1913 citizens didn’t pay a dime in personal income taxes and the industrial revolution still happened and the country grew like a weed.

Yep! Middle Class is going to get screwed if can’t deduct state, local and property taxes.

Deface the Currency,

Diogenes

Or maybe the States will have to collect their taxes from their citizens without the welfare of a Federal subsidy of them.

And States with high taxes will lose their competitive advantage against States with lower taxes.

Anon, that’s all fine and well. But directly confront Jim’s point, if you can. Where is middle class tax relief in this? I see a slew of corporate and high end giveaways, and more welfare at the bottom, but this advantages upper middle class how? This is make or break stuff for Trump. Clever explanations aren’t going to get it done. Put up or shut up.

Exactomundo, states will have to collect their taxes without the benefit of a federal subsidy. A big eff u to CA, for example. So, folks in Philly can scream at the Feds, and the Feds R changing the rules, and now it will be even harder for Harrichberg to raise taxes more…and everywhere else for that matter.

Yet we’re still 2o trill in and the foreign bond and bill buyers are still paying for all those fig newtons bought on SNAP. The whole things gonna pop with a big bang and the way these exponential things work it will hit you smack in the face faster than steppin’ on a rake.

The way I see it….tax code changes are like lawn chairs on a dingy in a hurricane. Your gonna get real wet and the noose is startin’ to rub your neck a little too much.

Ignore the noise. Grab a flotation device for you and yours, which means you may not stay in Philly, decide whether you want to feed the monster, or not, grab some popcorn, sit back and enjoy the show. Gonna be a real hummmmdingerrr.

luminae: “we’re still 2o trill in and the foreign bond and bill buyers are still paying for all those fig newtons bought on SNAP.”

https://saludmovil.com/food-stamps-can-help-people-cut-health-care-costs-study-finds/

A new study released by the Journal of the American Medical Association reveals that SNAP, the Supplemental Nutrition Assistance Program (also known as food stamps), saves each enrollee an average of $1,400 a year on health care costs

Yeah, right. This is pure left wing, welfare state propaganda! Does anyone actually trust or believe the AMA?

Law inforcement. No its policy inforcement, thats communist policy enforcement.

Do police charge any one for violation of Art 1, sec. 10, paragraph 1 of the us of A constitution.

Of ourse not. They enforce support 5th plank of the communist manifesto.

Is there a public right of way. No its been converted to a privilage permission of way if you pay for it license.

Many of you say my property. Ha ha a deed does not transfer ownership, only a patent transfers transfers ownership. So why no police charges against your government agents for fraudulently representing deeds as titles?

Well the first plank of he communist manifesto is abolition of ownership of land and the rental there of applicable to he state. Don’t confuse posession with ownership. If you have control you dont have to pay for permission.

PLAIN AND SIMPLE POLICE ARE COMMUNIST POLICY ENFORCERS.

Your children are brain washed in the communist (tenth plank ) school they believe a promissory note is money contrary to constitution and bible deut 25, but in accordance with 5th plank of the communist manifesto. POLICE, KGB, SS, ARE ALL THE SAME. THEY ARE NOT YOUR FRIEND.

They feed off of you like wolves feed off of sheep.

They the executive like judicial and legislative are communist and will murder you if you dont feed them.

If Americans held them responsible to the law they would all be executed for treason. Betrayal of their oaths of office and public trust.

The rule of law left America when it was replaced by the corporation known as US, a branch of the UN.

The communist bastard Obama has all but finished us and he democratic communist party with Hitlery hillary wanted to finalize your enslavement. Bush’s and the republican facists support the same totalitarian end. THE NEW WORLD ORDER.

Novis ordo seclorum. See the federal (satanic) reserve note.

Ask your minister why he has permission from he state? Yes he has permission as long as he TOUTES the communist party line.

For most people, the standard deduction is larger than the itemized total, so deductibility of taxes won’t matter. But the standard deduction should be much larger. At a minimum, 25k for individuals, 50k for married couples, another 5k for each child. We need to encourage family formation in the middle class.

Pyrrhus:

That was close to his original proposal when he decided to run, but you know the bureaucrats don’t want to reduce revenues.

Why do peeps get deductions for chillrens?

The farm needs replacement livestock.

Maybe those who are getting screwed should move to states that have no or low income taxes and low property taxes.

What a dumbfuck response. That’s a throwback to your old days.

Yeah by YOU! You are one nasty piece of work. That four letter word must be your favorite. That person was RIGHT and you hate to admit it. I have never seen an ADMINISTRATOR who uses foul language to get a point across. Normally that kind of language would not be permitted by the administrator, but this is your site and you choose to go down that road. I should have expected it from a PHILLY resident. Good luck with your site and those you choose to offend.

Mark in Montana

Go fuck a Mongoloid Moose, Mark in Montana!

Blessings ;-}

Looks like I triggered a Montana snowflake. Don’t you presume to know me and tell me how to live my fucking life. You don’t know know jack shit about me or this website. Based on the drivel you posted in your comment, I don’t see your “small business” getting bigger. Does selling sex toys on Ebay count as a small business?

I love when idiots venture onto the site and pompously give their sage advice and then when I kick them in the balls, they get offended and pissed off.

Get the fuck off TBP and don’t let the door hit you in the ass on the way out.

Actually it was an 8 letter word. I believe the correct usage would include a hyphen, but regardless it remains an 8 letter word

“Maybe those who are getting screwed should move to states that have no or low income taxes and low property taxes.”

Even those places are getting more expensive in terms of real estate and such. Texas does not need anymore big government dummies moving here. I wish we could go back 30 years in terms of population.

Old Carrot Top wants to reduce the corporate taxes to 20% if it’s good enough for corporations it’s good enough for the middle class…..20% FLAT TAX….DONE!

The result of almost every election in the western world over the past 120 some odd years (or longer…):

[img [/img]

[/img]

Or this. Angel Martin is the GOPe and Rockford is me. 1 minute.

Awesome, FM. Not only is it brief and to the point, it is funny and totally empathetic. EC

If there was a listing of top ten posts, this would be in it.

Does anyone else daydream about Hurricane Maria turning D.C. into a LITERAL SWAMP?

Can I be arrested for that? Perhaps the FBI has the thought police division on their way to my door right now?

When I was getting educated at the University of Oklahoma (I know… it sounds funny and I hadda write it out for the laugh), I learned that everyone hates Congressmen/women/zhees for their corruption and cronyism. EXCEPT the one they put in office. That guy is trying to do the right thing, they claim. It’s those other corrupt bastards who are on the take, they think.

GET it through your heads… THEY ARE ALL ON THE TAKE. They are all corrupt. They all think you are dirt people and you should shut up and do what your betters tell you to do.

However, Trump appears to still not have turned into a Hillbitch clone. Yet. 1 out of 6. Sucks, but it is all we have.

I don’t think a natural disaster is the answer for the entirely unnatural D.C. unless a giant hole opens up and swallows the whole shebang in a single go then seals itself back up so we don’t have to waste any time or money trying to dig it out.

Yes, a simple natural disaster would not do it. Just watch the movie “San Adreaes” and delight in the scenes of almost total destruction of California with a extra-heavy impact on SanFran……and then the horrific ending with the saddest line where The Rock says solemnly…..”we will rebuild”

How about a meteor? Maybe big enough to take out Baltimore with DC…

screw you, I live in Bmore

tjf,

dc has lots of nice monuments–how about a neutron bomb that kills people but leaves property intact?

and they say we right wingers won’t compromise-have they ever tried?

yep-how many republican senators are grateful to mccain for killing o’care repeal,thus saving them from having to vote to repeal something they say that they want to repeal?

Compounding the bullsh*t misery of a do-nothing congress, my home state of Florida is scheduled for O-hole care increases averaging 45%, http://www.zerohedge.com/news/2017-09-27/2018-obamacare-premiums-surge-45-key-swing-state-florida.

50% here in AZ, but McCain doesn’t care….

What the fuck is with that guy nowadays? I’ve despised him for years for his incessant war mongering and Israel first bullshit, made worse by learning of his treatment of POW families. But lately he has turned into a complete shit lib, ever since he found out he was basically dying. Is he trying to make up for being such a piece of shit his entire life by turning into a leftist or something? His position lately seems to be “must have more gibs for everyone”. He has always been a warmonger, but he hasn’t always been like that. I’m an atheist, don’t believe in hell, but if there is one, McCain is going there 1000 times over, no matter what else he does in this life.

McStain has it in for the president ever since Trump said he didn’t like prisoners (or words to that affect).

Come on…give the guy a break…he’s got a giant wart on his frontal lobe which makes it damn hard to think clearly. If he were POTUS he’d be removed for medical reasons.

Ignore anonofuck.

Don’t forget Trump wants to eliminate the inheritance tax also. This way we will assuredly go to a caste system.

Sweet Jesus!!

I know, right? There’s already an estate tax exclusion that exempts millions of dollars and would cover almost all family farms, but they get doofuses (doofi?) to think that the “death tax” is like a surcharge on caskets.

Because it’s totally moral to tax the same income over and over again, even after death…..In any event, the inheritance tax produces little money because it can be evaded through cleverly written trusts.

That’s why inheritance tax should be low enough to disincent the trust schemery. If you win the lottery you pay taxes. If you win the genetic lottery and inherit money (which you did nothing to merit) why is it being taxed “immoral”?

You are correct in your analysis, I just don’t like taxing people’s property. Its true, the cap is so high that only a small handful of people will inherit that much, but it just seems wrong. I don’t think anyone’s inheritance should be taxed just based on principle.

The key word in your comment – and it’s honest of you to put it this way – is “seems”. It seems wrong because “taxing the same income twice” has been sold to us as immoral by the Steve Forbes of the world for so long that we think it’s obviously wrong. But you could look at all income that way: You earn money. You pay tax on it. You spend some of the remainder and the merchant who profits from your purchase pays income tax on that profit. It’s “taxed twice” (shudder).

There are two main considerations when establishing a tax system: fairness and efficacy. The more convincing case against the estate tax is that it’s not efficacious. As pyrrhus wrote, it can be evaded via trusts. In fact, it may be counter-efficacious in that not allowing someone to pass on wealth to his/her heirs, may (and almost certainly would) reduce the incentive to create wealth in the first place. The “fairness” argument against the estate tax – that it’s not fair to tax inherited wealth is just arbitrary. One could just as logically argue – if fairness were all that mattered – that the estate tax should be 100% – that no one should be allowed to inherit anything. The children of the wealthy should consider themselves lucky that they tasted the fruits of their parents’ wealth – quality education, enriching experiences – while they were being raised and thus started off with an “unfair” advantage.

So if no one inherits the property after death, where does it go? Someone HAS to inherit it. Even if it’s the government, there will be a transfer of assets.

I’m not saying there should be no inheritance – which would presumably mean the govt would confiscate it. I’m saying that the better argument against the estate tax is that it’s stupid, not that it’s unfair.

In the UK, property is “leased” from the Crown. The Crown, by the way, is NOT the Queen. It is the same bunch of lizard people our Central Bankers evolved from.

Part of the problem with the estate tax is the understanding that it’s just another way to raise money for the general tax fund that will do little to nothing to provide support and material/moral benefits for PWLLM (okay, here’s a hint, first word, ‘People’) and together with other taxes will have no effect on spending.

That’s the problem with a multicultural empire. The people at the top don’t necessarily identify too strongly with people at the bottom, at which point it just becomes tribal.

The money was already taxed when the person was alive and earned it. It’s just like taxing a savings account.

tax the same income over and over again

What bullshit. Most of this wealth has never been taxed. If I die with an estate consisting of capital gains and real estate, the profits are not taxed until the assets are sold. And my heirs can sell, but are only taxed on the profits accrued from the time they inherited it, not the profits accrued from the time I bought them. So these assets may have increased 100s of times from the time I bought them, but my heirs only have pay on the small percentage increase at the very end.

Educate yourself rather than mindlessly repeating what the plutocracy want you to believe.

As the Spartans said to Philip II: “If”

Check it out. The children who inherit money lose it fast. They don’t know how to earn it and as soon as their trustees get it away from them, the third generation is broke.

“I voted for Trump for the following reasons:

He wasn’t that evil hateful shrew named Hillary Clinton

He promised to repeal and replace Obamacare

He promised to build the wall

He promised to keep out Muslims

He promised to reduce our military interventions around the world

He promised to reduce my taxes”

He actually tried on #4 and we saw absolute treason from supposed judges to thwart him.

Other than that, yeah, he’s pretty bad but at least he’s not Hillary.

The country is circling the drain. Hillary would have been a dose of Drano, Trump is like some extra tissue adding to the clog, but one way or another it’s going down.

The Catalan independence vote is VERY interesting and may well be a preview of things to come in the US, and elsewhere.

I wish I could find someone to vote for who promised to keep out Jews.

Nobody promised to keep them out. Vote for Nobody next time.

EC

Persnick, your list is not numbered, which one is #4?

EC

Maroons don’t know the backstory of Stuck’s numbering faux pas and give me the thumbs down.

EC

I like fox paws.

Persnick-anonymust Where’d you go to screwl? #4 is B45naphtr3. Hope that helps.

I am generally supportive of using the tax code the way the DC uniparty does….to hurt our enemies. They set the rules, ‘we’ need to apply them to them too. Taking away the SALT deductions will fall more heavily on the bluer and richer areas. I am for it. Make the NY and CA f***kers pay for their big government voting.

But it should be offset by taking care of your friends. It should not be take away the SALT deductions so you can give money to Apple and Google enemies to repatriate money.

Especially given the robot/ai challenge to labor, I would allow corporations who keep their employment count within 1% of 3 year average gets to ‘double deduct’ social security withholdings. You offshore your people…lose the tax benny. Your shrinking, you lose it, you’re growing, you get it. I think we should create a new bucket to keep rates the same. You make more than $1mm AGI, your rates go up, or at least stay the same. Limit the mortgage interest deduction to $12k/year. That is more than enough for a middle class house, but the mortgages on the hampton estates or second vaca homes are not deducible. Heck I’d put a 20% surcharge on all movie, concert and sporting event tickets above $10. You can afford the entertainment spend, you pay (and it punishes leftwing celebs). Heck, I would put a $0.01 per online ad served fee by any company worth more than $100mm. Kill those f***kers too.

Here’s an article by the estimable Nomi Prins (who should be a regular contributor on TBP) that dials in the real truth to waken the most sycophantic Trump dung beetle:

Here’s a snippet:

“Meanwhile, the Trump brand rolls on abroad. Though his election campaign took up the banner of isolationism, the Trump Organization didn’t. Not for a second. On January 11th, days before placing his hand on the Bible to “defend the Constitution,” Trump proudly noted that he “was offered $2 billion to do a deal in Dubai with a very, very, very amazing man, a great, great developer from the Middle East… And I turned it down. I didn’t have to turn it down because, as you know, I have a no-conflict situation because I’m president… But I don’t want to take advantage of something.”

He also promised that he wouldn’t compromise his office by working privately with foreign entities. His business empire, however, made no such promises. And despite his claims, Dubai has turned out to be ripe for a deal. This August, the Trump Organization announced a new venture there (via Twitter of course): Trump Estates Park Residences. It is to be “a collection of luxury villas with exclusive access to” the already thriving Trump International Golf Course in Dubai, a Trump-branded (though not Trump-owned) part of an ongoing partnership with the Dubai-based real-estate firm DAMAC. Its president, Hussain Sajwani, is well known for his close relationship with the Trump family. Units in the swanky abode are expected to start at about $800,000 each.

So buckle your seatbelts. U.S. foreign policy and the Trump Organization’s business ventures will remain in a unique and complex relationship with each other in the coming years as the president and his children take the people who elected him for a global ride.”

Because it’s totally moral to tax the same income over and over again, even after death…..In any event, the inheritance tax produces little money because it can be evaded through cleverly written trusts.

Please stop repeating this lie.

I don’t recall isolationism being a part of the campaign.

Perhaps you’re referring to some other position than isolationism?

All this talk about sycophancy is beside the point, imo. We took the better choice among available options. If there’s no Wall by 2020, he won’t get my vote.

Curious about the “he won’t get my vote” thought (not just from you). Suppose he gets a primary challenge from Jeb, and then faces Hillary again in the general (and we all know damn well she’s going to run again if she’s still alive). Will he still not get your vote?

Yes. Because Charlie Brown.

Trump vs. Kamala Harris or Corrie Booker….Who are you going to vote for, LOL?

Same as I did in 2008: [img [/img]

[/img]

My husband told me that Oprah plans to run.

the income tax, collected by the federal govt. is not used by the govt. to spend on military, medical, social security, or any other visible program.

that particular income stream is used to pay the interest on the national debt.

so, as the national debt continues to grow, we can expect the tax burden to grow.

PS, while all of this goes on in the daylight, inflation reduces the purchasing power of your savings, while at the same time it reduces the actual amount of the national debt.

this is how the whole ponzi scheme can continue forever.

I think most people know this, but it worth repeating.

Death to the 401(k)? The asset-management industry is fearful. Now, the exact words are: “Tax reform will aim to maintain or raise retirement plan participation of workers and the resources available for retirement.” That doesn’t sound ominous, but what could be in the works is the so-called “Rothification” of the program. That would mean that workers would contribute after-tax — not before-tax — dollars to their savings. The flip side of that is the savings wouldn’t be taxed at retirement. But considering the tax rate for most people declines at retirement, that’s a worse deal.

Worse than that is the Gov’t mandating that everyone in a 401K (or similar) will be forced to buy a percentage of their ‘investment’ as Gov’t Bonds (debt).

We are in the terminal period of the all-out Government hunt for taxes at every level….They are destroying the economy, but governments never care about that…

https://fred.stlouisfed.org/series/FYFRGDA188S

AZEK, the solution is simple. You don’t store your marbles in a govt. piggy bank. Don’t use the (k)s. Keep it all in regular accounts.

They’ll nationalize those forced 401(k) savings to fund whatever replaces Social Security Insurance when it finally collapses.

Word.

Weedhopper

savings won’t be taxed at retirement… are you kidding? WTH up… geez man, they say anything to get what they want then change it later… like means testing SS bennies. Daryl Issa did not respond to my query as to why my SS benefit (that has been paid into over 50 years) will be cut via means testing and medicare changed, while he as a multi-, multi-millionaire chooses not to forego his Congressional healthcare and has not agreed not to accept his eventual Congressional pension?

We are being ruled, not governed… I read somewhere or heard on a podcast that the DS now is lower than in 1980… think about it

If you’re single or married without kids, it’s pretty easy to structure your life so that you minimize or even eliminate the taxes you pay and live pretty much independently of all the government imposed bs. For those who need to live in high tax states and urban areas, have kids to raise and send to college, and are compelled to carry mortgages or other debt, well, you are unfortunately screwed whether there are Democrats or Republicans in office. The decades long trajectory of our country on many levels has painted its citizens into a corner with regard to how we must live in order to prosper.

We are in the terminal period of the all-out Government hunt for taxes at every level….They are destroying the economy, but governments never care about that…

It’s not a tax refund if you never paid taxes…it’s a redistribution of a wage-earners paycheck. Period.

Weedhopper

I see the practical effect of this is an exodus from the high tax blue states, at even a faster rate than now. In NJ I will loose these deductions also. I was planing to abandoning NJ anyway. I only hope I can sell my house before this kicks in. I need to find a quiet, civilized part of the country to live out the sunset of America

100 points up!!

Ed, I just moved from NJ to NC. Lots of tax refugees down here.

The problem Pablito is that you Jersey Boys come to a fine state like NC and start voting like you’re still under the boardwalk and phuckitallup again.

same with florida–

ed: If I was American I would move to the “American Redoubt”

Right next to the super volcano expected to blow at any time.

I am just north of New Madrid fault line which is going to turn our log home into the nuttiest beachfront home ever. New Orleans will not be there.

If the super volcano blows there will be nowhere to hide in North America. So no use planning for that if you plan to stay in the US.

No problem Jim…invest all of your money in KY jelly. The increase in demand due to our National Screwing will offset your increase in taxes.

That Kentucky Jelly’ll get you. Whatchit.

I’ve always said that when my tax burden reaches 50% I’d quit working,build a small home on my farm and live off the gooberment tit . My tax burden on paper is close to 30% . I would imagine that the 50% threshold isn’t to far off .

Beatcha tuit.

Ed said “I need to find a quiet, civilized part of the country to live out the sunset of America”.

Ed…don’t come South…were already filled with folks from Ohio etc .

Com’on…..calm your emotions…does it really matter that they’re proposing a faux tax cut? Oct 2015=National Debt = $17.76Trillion. September 2017 = National Debt=$20 Trillion. The IRS collects around $3.5T but we’re spending $4T annually. Why do you think China and Russia are hording gold? Why is China pursuing a consumer driven economy rather than an export economy. They’ll develop their own currency and kick the dollar to the curb and then the USA will realize that our politicians (since 1971) have been lying. USA Inflation will make the Weimer empire look like kid stuff. So the bs about a tax cut is pure theatrical.

…So the bs about a tax cut is pure theater. Fixed it for you Rob

Also, when was the Weimer empire in existence?

Uh..never. Germany under Weimar didn’t have an empire.

Every since we allowed ‘income’ to be taxed we opened the door for Congress to sell the tax code. Its really all they have to sell so they have created a massively complex tax code by selling various definitions of income.

For this and some economic reasons I would rather tax consumption and wealth and leave ‘income’ tax free. It would be pretty straight foward, you buy something you pay a sales tax on it. You list your assets and liabilities and pay a tax based on your net worth. Makes no difference to Uncle Sam if you hoard gold , Microsoft shares, Rembrandt’s or Real Estate. It’d be like property tax and could be made progressive unlike property tax. A $100,000 condo pays a lower rate than a $ 1,000,000 house.

Removing the deductibility of state and local taxes is a good idea too. Its just a subsidy to state and local politicians to lessen the pain of their policies.

“Remember, up until 1913 citizens didn’t pay a dime in personal income taxes and the industrial revolution still happened and the country grew like a weed.”

The monetary power is the federal governments, given too it by the states, as specified in the Constitution. It is a function of government.

The Federal Gov has a duty to provide the money to its citizenry on their demand.

Government cannot tax a function of government.

1913 the federal reserve was created by an act of government to assist the gov in carrying out its monetary powers. (McCulloch v. Maryland, 17 U.S. 316 (1819))

The federal reserve issues its own notes at the discretion of the board of governors. (12 USC 411) Meaning it is doing so outside of congresses direct control, as is any other bank creating credit.

Veazie Bank v. Fenno, 75 U.S. 533 (1869) says:

“Congress may restrain (tax), by suitable enactments (tax code), the circulation as money of any notes not issued under its own authority (federal reserve notes). Without this power, indeed, its attempts to secure a sound and uniform currency for the country must be futile.”

The 16th amendment is largely moot. Unless a large % of your income is from rents. Or income derived from sitting on your ass.

But but but look, no tax preparers needed.

Flat tax, consumption tax…what ever you call it, that’s what we need.

Weedhopper

Admin

Thanks for sorting this out. I will send it to all the Trump-haters I know, and it will make them happy. I will send it to the Trump-lovers so they can find some truth.

You’ve made Modern Heretics blog Admin. You da man. Also, don’t forget to tune in to your favorite Africa Ball team this weekend and watch your tax exempt NFL owners pawn’s on the field. And to hell with that West Point Commie pussy, a future John McShitstain.

The article is on Silver Bear Café but the link is screwed up.

http://www.silverbearcafe.com/private/war.html

The middle class was an aberration of post-WWII America. Those of us in it have systematically fucked for decades. I have zero surprise that this trend continues despite the fact that the people managed to shoehorn an obnoxious billionaire into the White House instead of the Queen of the Harpies.

Those of us in it have systematically fucked for decades. – Drud

I must have done it in my sleep, no wonder I woke up tired.

EC

In order to cdeduct your state and local taxes, you have to surrender your standard deduction. Which means you need to be paying a hell of a lot in those taxes, or a hell of a lot in mortgage interest in order to make up for it. If you have a 5 year old mortgage on a $250K house you’re only going to get to deduct like $4000, which means you need an additional $2K in state and local taxes just to make up for the loss of your standard deduction. If your 30 year mortgage is halfway paid off or more, then you’re looking at even less of a deduction. And these are just deductions. You need a $3000-$4000 deduction in order to realize $1000 in reduced tax. You really need to be hit by local taxes for this to matter. And in my opinion this is how it should be. Being able to deduct state and local taxes is a yuuuuge federal policy error. It allows these high tax libs to get away with not paying as much as they should.

Your closing observation is 100% correct!

Read for comprehension. They are eliminating the $4,050 personal exemption too. Guess what? I’m well paid and work in Phila. 4% income tax in Philly. 3% Pa income tax. And significant real estate taxes on the modest home I’ve owned since 1995. Now tell me I should move to a low tax state and I shouldn’t have had kids. That’s the usual douchebag response.

Why should we keep the mortgage deduction and charitable contribution deduction? Let’s hear your rationale for why they should be kept.

Charitable because I think charities accomplish things more efficiently than government. Mortgage interest deduction should go.

We should donate to charities because we believe in their cause. WTF does that have to do with taxes? The government shouldn’t be encouraging anything through the tax code.

We shouldn’t even have a tax code so there! Amazing to think of it but the US was a leading industrial economy with schools, excellent universities, a navy and military big enough to fuck with people without cause…everything except paved roads when was no fucking income tax at all.

I’m with you 100%. The country did pretty fucking well from 1789 to 1913 without a personal income tax.

I agree. I’d like to see no income tax at all.

When I make donations, which is usually locally, I never claim it on taxes. I give because I want to help who or whatever I’m giving to.

Admin, don’t you use the education expense deduction for your college kids? I think there is a sunset on that (possibly this year?). I took advantage of it the last 5 years that my son was in college and plan on doing so for this FY taxes as well, since he graduated in June.

That and mortgage & charitable (gave a ton of clothes and stuff to Goodwill) deductions reduced my federal tax rate to 13%.

Zero deduction available for modified adjusted gross income > $130,000. Another example of progressivity layered on top of progressivity. Earn your way into a higher tax bracket and lose your deductions. Sometimes it doesn’t pay to work.

i’ve advocated for years that we should get rid of both of those deductions–

iska,are you saying that you’re ok w/the local mosque being financed by people who are writing off their tithes?

i believe that i remember you saying that you are catholic-should tithes that go to john hagee be tax deductible?

I love John Hagee! He has charts and everything. I see your point about churches, mosques, etc. Maybe I need to re-think it.

I did notice, though, that for his entire eight years, in every proposal Obama rolled out, he snuck in a plan to radically reduce or eliminate charitable deductions. We’ll always have some system of helping people who need help – the mentally ill, the severely handicapped, battered women, etc. It could be a federal program, a state program or a charitable one. I’d rather have Catholic Charities, Lutheran Social Services or United Way spend $5 for a free breakfast than spend $50 of tax money through some State program to create the MN Department of Free Breakfasts. And if state income taxes (to buy $50 breakfasts) are deductible, why shouldn’t donations to United Way (to buy $5 breakfasts) be deductible? It’s cheaper all around.

IMO, the reason Obama opposes not only the deductibility of charitable donations but privately charities themselves is that their very existence is counter to his preferred system of having the government own everything, collect everything and dole out everything. The better to control what people think and ensure equality. His own donations to charity (Nobel peace prize money, etc.) were only because the spotlight was on him.

Eliminating deductibility of charitable contributions would suppress those contributions – and spur more government spending to fill the “gap”. So, more government, less private sector. Very Soviet.

Don’t forget the 50% of non tax paying “citizens” and “non citizen dreamers” will keep their deductions, and continue to get a “tax” refund at the end of the year, even tho they didn’t pay a dime in taxes. Stealing the earnings from productive citizens, because “they earn more” and somehow “deserve to have their money taken away from them” is obsessive jealousy, and a pillar of communism. AND the 39.6% tax bracket is paid by some small business, not corporations. Plus, we still have the Obama/Ryan/McConnell/Trump/Care taxes, and mandated health insurance premiums skyrocketing into the great beyond. And for those who don’t understand, or don’t give a sh#t, this progressive taxation bankrupts first the earners and then the government. So it will hurt everyone. Bottom line is, the liars in government at all levels are selling this tax increase as a tax cut, same old song and dance, from SCREWYOU@GOP.

When I got divorced, I wasn’t earning much, and when I filed my taxes, I actually got more money back than I was expecting because I was in the low-income earner category. That was a surprise. After I was able to get my income back up, I lost that deduction. But even people who work, but don’t earn muchm get that deduction. It would have been OK if I just payed the tax I owed and had been done with it. (Actually, they took the tax beforehand, but you know what I mean.) But this is another place where redistribution occurs. You don’t have to be unemployed to get that deduction.

Nice article, Admin. I never bothered to figure out the math of Donnie Boy’s tax plan … I sort of guessed/suspected that he was lying. Wow, you laid out the details nicely. He really has turned into a lying piece of shit. I suppose Trump-eteers will just remind me that Trump is play 5-D chess. “It’s all in his PLAN, Stucky …”

The ideal thing is to be POOR … at least on paper.

Get the two biggies for most folk out of the way; mortgage and no car payments. (And tear up your fucken credit cards.) It’s amazing how well you can live on what’s left over when you have no mortgage/car/credit car payments! Believe me.

Of course, some folks have kids in college and medical payments. That’s tough, really. Work harder, slave!!! Then get yourself nice and “poor”. lol

Also, get as much free shit from the government you can. Who the fuck cares at this point?

Too bad the author doesn’t understand the point. The aim of eliminating the 1040 deductibility of local/state taxes is to stick it to the high tax Liberal enclaves like California and New York. Currently, when those taxes are deducted, what’s happening is those states are using a free ride on the net Federal taxes paid by their residents to subsidize the state/local streams of income. I say that CA and NY, etc. should be allowed to starve for revenue – and that’s what will happen when normal thinking move away from those high local taxes (after the deductions are eliminated).

What a crock of shit, rex. Let’s fuck people to punish them for living where their job is? Easy to trick fools like you, out there making excuses for stuff like this, are as bad as the traitors lying while they shiv us. On the positive side, let’s wait and see what actually emerges.

I live in a high tax state. Deductibility of state & local taxes makes people accept high local taxes with less complaining. Ending deductibility would increase the pressure on local governments to quit wasting money.

You actually believe your state and local governments will get more efficient and REDUCE your taxes because they won’t be deductible???

That’s the funniest fucking thing you’ve ever written. I can guaranfuckingtee you your state and local taxes will way higher five years from now than they are today. Book it Dano.

I’ve written funnier things. Sometimes on purpose. Nothing as good as “he had me at pussy-grabbing”, though. That was a classic, and I’ve used it a hundred times since then. Thanks.

El Tronk he prometio’ to beeld a gual eef we pay, we no pay. Mama’ she no raise ful.

EC, “El Tronk”. That is funny.

Administro, The gringo he say eat incris the presion, no make eat efficiente. Esos ladrones nunca van a dejar de robar, caray! En que cabeza cabe que esa bola de jodones van a dejar de chingar a..esperame..mi amor, la botella de tequila por favor que se me sube la presion.

This is what my translator tells me you said:

The gringo I say eat the pressure, not make efficient eat incris. Those robbers are never going to let Rob, Wow! In head it that that ball of jodones going to stop fuck to… Esperame… my love, the bottle of tequila that gets me the pressure please.

I presume a great deal was lost in translation.

Ay, Mague, joo keel all thee romance een my comentario.

The tax rates won’t go down, the people will leave.

star,you’re wrong on this–remember,we used to get hosed because fl had no income tax while the big northern states did-we can now deduct sales tax but that isn’t squat–

Red, I’m good with any money, anybody, anywhere, pays in any kind of taxes being deductible. Why should people pay taxes on money they had to pay taxes with? I’m a federalist at heart, fifty states, fifty systems, let everybody pick what suits them. But the subject here is middle class tax cuts. The details wouldn’t matter, as long as everybody’s net tax bill went down in a significant manner. Doesn’t have to be paid for. Doesn’t have to punish blue states. But net taxes need to be reduced. What Cohn outlined the other day was quite the opposite. May never become policy, if it does, Trump is finished. He has a lot of goodwill. But he can’t not come through on his key campaign promises. Congress is fighting him every step of the way. So what? He has to win. Build the wall. Repeal obongocare. Cut my taxes.

What will actually emerge is a tax hike. Like a good union leader, lawmakers will negotiate a smaller tax hike on your behalf, all the while working for somebody else.

The author says fuck you. I don’t give a flying fuck about CA or NY. I live in PA and I’m going to get fucked and so are millions of other middle class taxpayers. Why not eliminate the mortgage deduction, since those states also have the highest home values? Stop making excuses for Trump. He’s been captured by the establishment. What happened to doing my taxes on a postcard? Remember that bullshit?

Trump is a liberal Democrat , always was. For all who waved signs at the poles and praised the second coming, just REMEMBER ………..you asked for it. Those who sounded the alarm were flogged unmercifully.

Forget about the promises, the election’s over. After the wedding, nobody remembers the promises either. Me love you long time was just romantic drivel.

What we are facing is less deductions and higher tax brackets. Read my lips, well you can’t read my lips because they are imitating a Hoover vacuum right now.

That giant sucking sound is the MIC sucking up the excess dollars in the Fed vault out of your pockets.

EC

But a couple making $50k a year, with 8 kids, pays $0 in Federal and State taxes and still receives a $7,000 refund under the Earned Income Credit (which remains under Trump’s proposed plan).

Definitely an immigration incentive right there. New boss same as the old boss.

You shall know them by their actions.

Maybe it is true, but 8 kids today is rare. True in my dad’s time but the propaganda for limiting children to 2 per family worked and now few folks know what it’s like to have more than one sibling.

But let me back up and say that I’ve heard and imagined (which makes it real, right?) there are certain women in new a cottage industry pushing out babies from that hard-working vag with the golden eggs. Of course, they collect from the baby daddy (ies) and the EIC. Ch-Ching!

Trump Tax Plan To Benefit “Top 1%” Most, Cost $2.4 Trillion, Middle Class To Pay More Taxes

http://www.zerohedge.com/news/2017-09-29/new-trump-tax-analysis-shows-most-benefits-go-top-1-middle-class-pay-higher-taxes

Eliminate the EIC

Everybody pays something

Flat rate postcard tax form no deductions 18%

I’m sure Trump’s Tax plan will drastically put this chart into a downturn. Right?

[img [/img]

[/img]

Trump has never been anything but a salesman. Kinda like Reagan but less likable.

Dammit, I was gonna say that and then figured it was not necessary to say. The president is ought but a marketing minion. He sells his brand. He is the Kardashian of politics. Celebrity is his stock in trade.

Gosh, just saying that makes me feel stupid. It is too obvious to be true, maybe he is playing multi-level chess.

I thought paying my Uncle Samwell was an act of charity. After all he does redistribute what I pay to others worse off and frequently better off than me.

Hey, why not claim last years taxes paid as a charitable contribution on this year’s taxes?

?

Will you be my accountant?

will he sign your return iska,that’s the important question?

No tax plan will ever work. The issue is and will remain expenditure. If they slash expenditure by half, then perhaps a tax plan might work. Then they could actually offer some tax breaks, instead of just shuffling the cards.

Currently, half the population currently pays zero fed tax, which means half of the middle class pays no fed tax (defining the middle class as the 25 – 75% band). Currently the top 10% pays what, 90% of all fed taxes? That is despicable. Everyone should pay something. That half the middle class pays zero is wrong, in my opinion.

If the middle class has to shoulder more of the tax burden, maybe the squealing would be heard and something will be done about expenditure. With the top 10% shouldering almost the entire burden, no one listens to them squeal, as they are easy targets and are considered the 1%, and can afford it. Only a uprising by the middle class has any hope of addressing the expenditure issue, and thus the tax issue.

A far bigger issue is local and state taxes. Those are going to explode as unfunded liabilities (pensions for govt drones!) and govt drone wages come home to roost. The middle class is really going to take a hit then.

The issue remains an expenditure issue. The current system of soaking just 10% of the population ensures that the expenditure issue will never be addressed.

Depending on definition, the cut-off for middle class is around $100k for a family income. Above that is the top 25%. And that is the range where almost all fed income taxes are collected. I do not know, but I suspect that is the Admin’s band. And it is that band that deserves a true tax reduction, spread across the bottom 75%. That any folks in that top 25% are going to be hit is a crime. They all deserve a break.

Llpoh,

I agree that everybody with an income needs to pay income tax, and that expenditures are at the root of what needs to be addressed.

But I also note that when the top Federal income tax rate was 90+%, the country as a whole did better. Neither Clark Gable or Frank Sinatra exited stage left from their profession (as you have threatened to do) because of it.

Sarc on:

In short, I propose that the one-percenters, like you, bail us out. It will be a difficult “tightening of the belt” at first, but for a good cause. We’ll talk about ‘relief’ later, after the temporary “tightening of the belt”. Just like the middle-class has been told for the last 35 years.

I should have skipped the “Sarc on” tag. Some might think that I’m not serious with the sentiment.

When the top nominal rate was 90%, no one paid it. Total federal tax receipts were no higher as a percentage of GDP than now. And the main reason we thrived in the ’50’s was that every other country was flat on its back. During JFK’s term, rates were cut, but the top nominal rate stayed >70%. I remember the work-arounds in the ’70’s. I was a kid, but my old man explained everything. All taxes (other than fed income tax) were deductible against income – the way starfckr wants it. That meant everyone saved every receipt from the hardware store when you spent 57 cents on some washers – because you had three cents of sales tax to deduct. On a bigger scale, there was three year retroactive income averaging (which was actually fair given the progressivity of the tax brackets), accelerated depreciation, etc. You had doctors and lawyers buying some company’s warehouse and leasing it back to the company on a net-net basis solely to get the depreciation write-off. It was a cluster fuck of epic proportions.

Just remember that everything Paul Krugman tells you is a lie. And when Ezra Klein faithfully parrots it, it’s still a lie.

It’s still a clusterfuck. Every time they change the tax code the rich get richer, the deadbeats get more welfare and the middle-class gets screwed. Pre ’86 works for me.

Several years ago I had some tenants move out and they left many personal items behind.

They had allowed a friend to move in with them,a woman w/2 hellion sons.

I found her tax return.The year b4,she had income of $16-18,000,I don’t remember exactly,but about half was from unemployment compensation.

She had a refund of over $6,000.

There are plenty of middle class families who do not have that much in accessible savings.

The plan outlined by Cohn would increase that welfare EIC payment. Total bullshit

For those of you who constantly complain about the mind boggling debt in this country, the Trump tax plan will add at least 4.2 TRILLION dollars. This will be mostly because of the large tax breaks for the wealthy. The majority of the commenters here will be getting it straight up the wahzoo while they also see increases in state and local taxes going forward.

I am pretty sure this would require a majority vote and I am also sure that Demos won’t support huge tax breaks for the wealthy, so will it pass? How bad do they want to destroy the middle class?

The future of the American middle class looks more bleak day by day and Trump is NOT helping.

“My tax bill is really terrific, that I can tell you. And there will be winners in my tax bill. Believe me, I’m a winner, you’re a winner, we’ll all be fantastic winners. Aren’t we winners? Win, win, win. Are you tired of winning yet?

Sure, there are losers too. Big losers, like those blue state democrats that acted unfairly and voted for Hillary. What losers. She’s a big loser too. Those fake news losers at CNN are hiring her.

They treat me unfairly, that I can tell you. They should kneel around winners like… speaking of kneeling, those NFL guys. Believe me, they’re losers, that I can tell you. Big losers, like Rocket Boy. He’s a big loser in my tax bill.

My tax bill Alternative Minimums will hit him like a thermonuclear warhead. A big, fantastic, terrific alternative minimum tax nuclear warhead. Thermonuclear AMTs raining down on losers. And he has terrible hair. Loser hair. Not like me.

I’m winning, we’re winning, that I can tell you. Gotta go, time to work on Repeal and Replace. Believe me, we have a terrific plan for that. A winning plan. Win, win, win.”

Very cool Mr. WIP, I’m impresssed. TBP generates top flight trolls, that, I can assure you!

WIP is “WINNING”.

+100

My response to Trump and the GOP senators pushing this awful tax increase bill.

Luminant, who won? I went to sleep thinking Hillary was ahead and then I wake up several months later and we have a tax increase, that means she won, right?

That seems like the new game plan, vote for Obama and he pushes Obamacare through, vote for Trump and he pushes Trumpdon’tcare through.

I really wonder how long Bannon can keep cheerleading for Donald J. Tax n Spend. His shtick may get old like Scott Adams’.

The country’s fucked, they were going to have to raise taxes to correct the Reagan error eventually so the bigwigs decided the Republican slate was all wrong for America, they’d only keep promising no new taxes, what they needed was a Republican candidate (they were a sure bet to win) who would do what needs to be done, somebody with no baggage, not beholden to anybody but the Oligarchs yet trusted by the hoi-polloi.

The Ruskies make a great patsy, shit, it worked with Oswald, why not play that old record again? Just keep playing it over and over until it becomes a hit. It worked for the Archies, it’ll work for the Olies.

I think many of us hoped Trump would end up being a good conservative…maybe to Ronnie’s right even, except he’s not. Shrill Hill and the other Leftys (like Springsteen, break my heart) are so far left, they made Trump look and sound more conservative than he really is. So when DT’s Wall Street buddies like Cohn and Lipshitz and whoever else he hangs with in NYC start giving him ideas, he gets pulled left….now that Bannon’s gone. Speaking of Bannon….Judge Roy Moore? Yeehaaa!

Absolutely great post – people need to see that Goldman Sachs and Co have seized control of this admin. Time to enact Part II of the Greatest Wealth Transfer ever (the GFC facilitating part I). Also, as a fellow Philly-based worker, I hear you brother – now we are going to get shaken down by all parties!! Eventually the U.S. populace is going to have its French Revolution moment if this keeps up.

Hey Enough Already………If El Trump has been seized by the left and da joo banksters then it was before he was even sworn in. Go back and take a look, I shit you not.

If you come out of the starting gate filling positions with GS people then how was he anything but their bitch to begin with?

Out-of-the gate he had more influence from the right to counteract the leftward pull. With Bannon gone the leftward pull is stronger.

I think his own instincts are right, but advisers and Ivanka-Jared pull him left.

Your basic point is well taken and every administration, even that of BhusseinO, has to listen to Wall St. At the end of the day the Fed and Wall St. runs the show. Been that way since JP Morgan was a person, not an entity.

I hate to say it but the author sounds gullible and naive. The only thing Trump could talk about with any level of detail is that he’s not Hillary Clinton. Everything else was, “Believe me!” Well if I promise you a million dollars to mow my lawn and then I can’t pay up after you do it who is the bigger fool? Me for promising you something I could never deliver or you for believing the obviously impossible?

Blow me asshole. I don’t believe shit from anyone. And I don’t give a flying fuck what you think. I’ll promise you a million dollars to fuck off.

Look at all the great tax reform debate in this thread. There’s definitely no consensus on what direction we should go with the tax system. So why should we expect the idiots in DC to make any sense of it all? Their process isn’t any better than ours for figuring out what is fair or smart. So we shouldn’t be surprised by the bad results.

The extra charges of a government on the monthly sales of business can be eliminate easily with in a seven days according to the rules and regulations of a government,If you write an application with the authentic reasons for a elimination of business sales tax and also attached a legal documents of a business tax pair after that submitted in the government office by the tax layers which is helpful for your business tax layer to approved the claim of your business sales tax in the seven days without any allegations of a government on the application of your business sales tax ,Remember don’t write any irreverent reasons in the applications of business sales tax you want to submit in the office of government and also don’t attached any illegal or extra document of business sales tax which increase the chances to refuse or neglect your claim application ,So keep it in your mind all the instructions and requirements given to you by the tax layer after concerning this kind of matter according to the current policy of government .

Thanks .

Thanks for opening this discussion.

I am tired of subsidizing commie shitholes, we passed TABOR decades ago and have kept our State spending decent. Why? What is responsibility going to do for us, when CA, NY, IL, and even fucked up Puerto Rico, plus others, including the Feds spend like drunken sailors with credit. Will we be spared the bailouts?

Also, what is up with the mortgage deduction? It is just the interest, right? This is the single biggest gift in the 10 million pages of tax code to be found. Who is the recipient of this gift?

The fuckin Banksters.

Most I know are so fuckin stupid they only pay interest, as their loans are amortized of course, and they either sell or refi every 5 years. So they brag like dumbfucks about thier 3.8% rate and pay 100% interest, and get to deduct it.

Why the fuck should we subsidize that shit, and bequeath all that tax free income to the banksters?

[img ?w=500&h=367[/img]

?w=500&h=367[/img]

Yep. [/img]

[/img]

[img

My only request is to be decently fed before I am decently shot.

Death by a 1000 cuts. The tiny small increments will slowly eat away at you till you’re dead… then they’ll tax you for being dead.

Is that what they mean by “tax cut”? Yet another fake out like humanitarian action which actually means – invasion.