“The best way to teach your kids about taxes is by eating 30% of their ice cream.” – Bill Murray

When I saw that slimy tentacle of the Goldman Sachs vampire squid, Gary Cohn, bloviating about Trump’s tax plan and how it was going to do wonders for the middle class, I knew I was probably going to get screwed again. And after perusing the outline of their plan, it is certain I will be getting it up the ass once again from my beloved government.

I know everyone’s tax situation is different, but I’m just a hard working middle aged white man with two kids in college and some hefty family medical expenses. I’m already clobbered with Federal, State, City, and real estate taxes, along with huge toll taxes, sales taxes, gasoline taxes, utility taxes, phone taxes and probably a hundred more hidden taxes and fees.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

I fucking hate taxes and want nothing more than to see them cut dramatically. I voted for Trump for the following reasons:

- He wasn’t that evil hateful shrew named Hillary Clinton

- He promised to repeal and replace Obamacare

- He promised to build the wall

- He promised to keep out Muslims

- He promised to reduce our military interventions around the world

- He promised to reduce my taxes

Well, one out of six ain’t bad. Right?

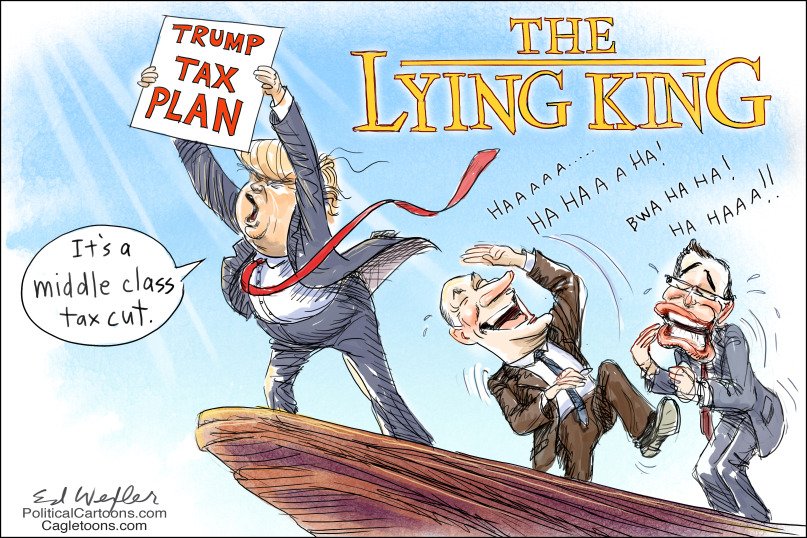

I know the Trump sycophants have a million reasons why he has been thwarted, but his pathetic support of the last GOP Obamacare lite bill reveals him to becoming just another establishment pawn. He has taken war mongering on behalf of the military industrial complex to a new level. No wall on the horizon. Now it is a figurative wall. And now he is disingenuously selling this tax bill as a huge windfall for the middle class, which is a lie based on my analysis of the known details. The truth is they need to screw the upper middle class in order to reduce corporate tax rates.

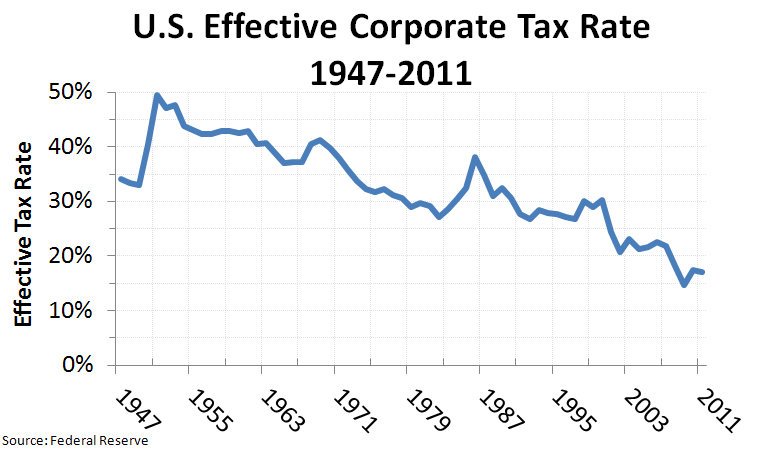

You hear the talking head “experts”, paid for by corporations, spinning a yarn about the 35% corporate tax rate and how it makes our corporations terribly disadvantaged. The truth is corporate lobbyists (I don’t have a white working man middle class lobbyist working for me) have bribed Congress to insert so many exemptions, deductions, credits, and loopholes into the tax code, the big corporations pay an effective tax rate of 19% already. If overly burdensome corporate taxes were really a problem, would corporations be generating record after-tax profits while GDP grows at a pitiful 2% rate?

I don’t know how many people are in my boat, but I’m guessing it is a large portion of the middle class. We already know about 50% of the households in the U.S. don’t pay any Federal Income Tax. Some even get refunds for not working. That’s why there are tax preparation offices all over West Philly and other urban welfare enclaves around the country. Here are the tax brackets for a married middle class family:

Most middle class families see the majority of their income taxed between the 10% and 15% rate, with upper middle class families having a portion taxed at 25%. A family with taxable income of $100,000 would have a tax bill of about $16,500, for an effective rate of 16.5%.

Trump’s plan has three rates: 12%, 25%, 35%. The weasels do not give the income level cut-offs. But we do know they are proposing elimination of the $4,050 personal exemption and the deduction for state and local taxes. They increase the standard deduction from $12,700 to $24,000. The idea is to keep people confused until the 2,000 page bill gets passed in the middle of the night after corporate lobbyists insert their goodies. In my situation, it is certain I will be getting screwed.

My family of four will lose $16,200 of personal exemptions versus gaining $11,300 in the standard deduction. Where I’m really getting screwed is losing the state and local tax deduction. The only single benefit to me working in this godforsaken hell hole called Philadelphia is I get to deduct the massive tax shakedown amount on my tax return. My PA, Phila, and real estate tax bill is huge. It’s far more than my mortgage deduction. And Trump is taking it away.

I’d be in favor of taking all deductions, exemptions, credits, and corporate loopholes away. But that’s not how it works. Corporations and Trump billionaire cronies will add loopholes and goodies into the bill, while people like me get fucked again. By replacing the 10% and 15% tax rate with 12% and 25%, the average middle class family will get screwed.

In the previous example of a family making $100,000, with a significant state and local tax deduction, the $16,500 annual tax bill will likely go up dramatically. Even if they taxed the first $50,000 (a big if) at 12%, their annual tax bill would go up to $18,500, a 12% increase. If that 12% bracket cutoff is lower, then the tax bill will soar. There isn’t a reasonable scenario where a home owning middle class family of four doesn’t pay more taxes under the Trump proposal.

Don’t believe what you hear on TV from paid for propagandists. You are going to get screwed so corporate fat cats can boost their profits even more. If they reinvest those profits, it will be in robots and technology to eliminate the jobs they haven’t shipped overseas. Oh. By the way, where are those tariffs against China, Mexico and the rest of the world to bring back our jobs? Trump is a phony and his tax plan sucks. Remember, up until 1913 citizens didn’t pay a dime in personal income taxes and the industrial revolution still happened and the country grew like a weed.

One more step for Trump in alienating his base. Goodbye GOP and good riddance.

Well you must be a tax wizard. If you are paying so much local tax I have one word for you and I use it all the time for folks like you who complain about where they are, MOVE!

There are many states near you that have no state income tax. If you complain about your local taxes and just sit still and take it well enough said. Oh I cant move I have a job and a house etc. Many people move and make it work. You may have an excessive amount of debt on top of the taxes that may make it hard to relocate, then it sucks to be you and you are at the mercy of the local government. Most of the big cities in the east are dead broke and they need more taxes just to stay afloat and pay the unions retirements.

I have a small business and lower taxes would help me. But I do not complain or blame Trump for things not getting done. For any of the items you listed at the beginning of this article to get accomplished we need the 535 losers to vote for them and that is not going to happen. PERIOD!

President Trump cannot pass laws only Congress can. He can only suggest.

As for war mongering, you are clueless. We need someone who will stand up to the mentally ill DPRK (Democratic Peoples Republic of Korea) loser. Not bow down like the last loser president. More troops in Afghanistan is a good thing not bad. To have a show of strength for a change is welcome.

You are mad at Trump for the situation you find yourself in at the present time. If you knew that Congress is the only one that can make these changes then you would understand his hands are tied for Obamacare, Taxes, the wall and Muslim immigration. You must not have been aware of this FACT or you would never have written this article. Hope your situation gets better.

Good luck

Mark In Montana

Go fuck yourself douchebag. Please direct me to the MANY states near me with no state income tax. Keep sucking Trump’s dick. I’m not mad at Trump for my situation you idiot. Read for fucking comprehension. I was assessing his fucking tax proposal because I’ve got the intelligence to do so. You on the other hand are the perfect example of the ignorant masses. Only a brain dead idiot actually thinks NK is a threat to the US. They don’t make them too smart in Montana, do they?

Good Luck living your delusional life of Trump worship.

Such a filthy mouth. You can’t get a point across without four letter words. I never said DPRK was a threat. I was stationed in South Korea and they are a threat to the local region. Taxes can only be passed by Congress, again its a fact. Nothing has been passed yet so why are your panties in a bind. Tennessee, New Hampshire are close and they have no state income tax!

AGAIN IT SUCKS TO BE YOU! I do not worship Trump. That would be idol worship.

Goodbye BUTTER KNIFE enjoy your living hell!

Wow. So triggered, he had to make the same comment over again. Now don’t get your panties into a knot Ignorant Masses in Montana. Time to go into your bunker and hide from those incoming ballistic missiles from NK. Low IQ idiots like yourself actually believe if we commit even more troops to Afghanistan after 15 years, we’ll surely win now. The stupid, it burns bright in Montana.

Wow, I think Quinny triggered a nerve or two with this missive. As usual, he gets it half right. This is not surprising, since :500 was about his batting average at IKEA so we shouldn’t expect it to be any higher now. The new brackets need to be lower or we will all get stung but getting rid of the state and local tax deduction is a must. There is no reason low state taxpayers should subsidize Park Avenue penthouses or the sprawling mansions in suburban Philadelphia like the one Quinny lives in.

Skinny

Still living in that Toll Brothers mansion on a golf course?

Toll Brothers? I can’t afford Toll Brothers on account of the high salaries they paid to their finance people. I’m slumming it in a Realon home. Once they realized people like me were buying their houses, they went out of business.