Guest Post by Scott Adams

Today might be one of the biggest days of my life, and it will be impossible to explain why that is so unless you know at least a little bit about blockchain, dAPPS, cryptocurrencies, Ethereum, and the legal distinction between a Simple Agreement for Future Tokens (SAFT) and an ICO.

If those words look unfamiliar, one of the biggest technical revolutions the world has ever known is sneaking up on you. The folks in Silicon Valley – who live about three years in the future compared to the rest of the country – can’t stop talking about this topic. The smartest people in the Valley tell me blockchain will change nearly everything, and already is. It’s like “the Internet” before anyone had heard of the Internet. That’s how big it is.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

One small example is that startups are raising funds by creating and selling their own digital “tokens” or “coins,” using blockchain technology, that serve as the payment mechanisms within their products. The tokens have an advantage over regular money in part because you can program simple rules for them using distributed apps, or dAPPS, to add function to your product. And blockchain brings its own set of advantages I’ll mention below.

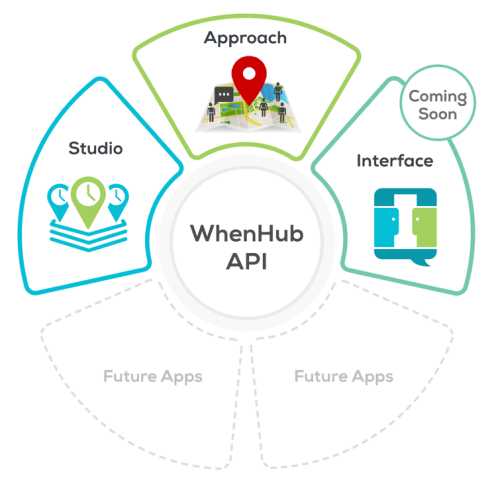

In the case of WhenHub, a dAPP will trigger an automatic payment when certain conditions are met. The effect is to eliminate billing and invoicing efforts for micro-contracts while creating a distributed record of each transaction that is impervious to manipulation.

View Full-size Image

My example doesn’t get at the full power of blockchain. It’s just one of the many things it can do.

The reason people buy these digital tokens from startups is that they hope the value will rise as the startup adds customers. The tokens are artificially limited in quantity, so the value of each token increases with demand. Customers of the startup won’t notice the rise in token value because prices within the product are pegged to nominal “real money” value. In other words, if one token is worth a dollar today, but worth ten dollars tomorrow, the startup auto-adjusts the price within the product to ten-percent of a token. The customer always pays the same “real money” price even as token values rise.

Tokens can easily be exchanged for Bitcoins or cash on websites that do that sort of thing. See Bitcoin Exchanges.

The process of creating digital tokens to raise funds is called an ICO (initial coin offering) when you do it the wild-west unregulated way. If you lawyer-up in advance, jumping through lots of (expensive) hoops to minimize future regulatory risks, your lawyers will tell you to call it a Simple Agreement for Future Tokens (SAFT). A SAFT is a contract with the startup to issue you tokens if and when it is able to launch a network in which the token has utility value. That’s what WhenHub is announcing today.

To be clear, ICOs and SAFTs are not investments, nor do they give the buyer equity in the startup. But they do provide an easy way – compared to angel investing – to share in whatever success the startup experiences. With SAFTs and ICOs the startup describes its plans in a white paper so any potential token buyers can evaluate the risks. WhenHub already has several products on the market, with more coming soon, but we describe in our white paper a proposed new product that is based on our existing scheduling platform and takes advantage of blockchain. The proposed product (WhenHub Interface) is the one that will use digital tokens.

If you are new to this field, I hope I just gave you a toe-hold for understanding it. And I would be delighted if you share this post with friends.

Our tokens are only available in Australia, Canada, European Economic Area, Hong Kong, India, Israel, Japan, Russian Federation, Switzerland, United Kingdom and United States (excluding New York State). If you are in the United States, you need to be an Accredited Investor (meaning kinda rich) to participate. Outside the United States, regulatory restrictions are lower.

Our Pre-sale is now in progress and our Public Sale starts on Nov. 10, 2017. During the Pre-sale, the minimum investment amount is $50,000 and participants get an Early Bird bonus of 30%. For the Public Sale the minimum amount is $250, and the the Early Bird discount starts at 20% and decreases to none in two weeks.

Here’s the executive summary from our white paper. A link to the full paper is at the end.

— Executive Summary —

WhenHub proposes to build a mobile app for connecting consumers to experts of all kinds via two-way video streams, text, audio, or in person. The app will be part of a larger service ecosystem called the WhenHub Interface Network (WIN) (Patent Pending).

The service will use dAPPS (distributed apps) running on the Ethereum blockchain to create secure micro-contracts – that can be as short as 15 minutes – as well as to provide frictionless billing and payment service. At the end of each micro-contract, payment in the form of WHEN Tokens will be automatically transferred to the expert. No paperwork or billing is involved.

Users buy WHEN Tokens using a credit card or with Bitcoins at an online exchange via the WhenHub Interface app. The tokens are used within the app to pay experts for their time.

For privacy, your phone number and address are not shared with experts.

Our partners will provide verification services on participating experts to give consumers confidence.

No international billing and currency issues when WHEN Tokens are involved.

Pricing for experts can be fixed or auction-based.

In the gig economy, think of this product as a “long tail” market for expert advice. Experts of all kinds can display their availability whenever they like, for as short a window as 15 minutes.

The WhenHub Interface app will use the existing commercial WhenHub API for scheduling and geofencing features.

WhenSense is our proposed technology for allowing third-party sites to host ads about our participating experts’ availability and share in the income from completed contracts. Site owners paste our HTML code into their site to participate.

WHEN Tokens are not an investment vehicle, but because they will be artificially limited in quantity, their value is expected to fluctuate based on customer demand for the WhenHub Interface app.

What Adams fails to discuss is that ANY of these “digital” forms of “currency”

are a joy to the government.

Why? CONTROL OVER YOU….aka SLAVERY.

If you have a dollar (or better yet, a gold coin) in your hand/pocket,

YOU OWN and CONTROL IT and how it is spent.

Similar to these “digital” SCAMS, If a credit card company decided to

shut down your credit – regardless how much you have in the bank – you’re

at *their* mercy…under *their* control. Same goes if a bank were to have

a “bank holiday” and shut off access to (what you imagined was) “your” cash.

If you don’t have it in your hands (sometimes literally), it’s NOT YOURS.

[see videos by Mike Maloney “The Hidden Secrets of Money”]

Call me thick but ‘blockchain’ is just more ‘hocus pocus’ masquerading as value.

That’s the problem with all of the so called advances of Silicon Valley. They are skimming operations that add little or no real wealth to an economy.

Schemes like Lifelock depend on internet criminals corrupting the internet with ransomware to induce you to buy a product that, at the end of the day won’t even protect you. How much of their revenue is spent on advertising? Other crap like Eharmony advertises success in romance something people once accomplished for free. Uber and Lyft are just methods to drive the wages of cab drivers down so a handful of moguls can skim the revenue into their own pockets. Yellow Cab may not have been perfect but it worked well enough.

Silicon Valley just cuts vast swathes of middle management jobs from the economy and replaces them with a handful of people with multi billion dollar fortunes.

Damn , sometimes I think this world has left me behind and I will never catch up.I’m Still trying to understand the ends and outs of Bitcoin.Now this!!

No it’s really very simple. You take real money that you worked for and have in the bank and you give it to a stoner cartoonist who is too stoned to realize that he is being played by his (((buddies))). Then they take that real money and exchange it for absolutely nothing, which you get to keep in your digital wallet, and they will tell you how much your absolutely nothing is worth whenever you want to change it back into real money again. It will all be great until you want some real money for your absolutely nothing and then you will see that there is no real money available to give to you. So you get nothing sir…Good Day To You!

Oh and thanks ever so much for your contribution to my excessive lifestyle. Too bad you bought those coins. You really should have know better.

Tell me again how blockchains are a safe, impenetrable store of value, and how that helped all of those cryptoidjits – who lost shitloads of Bitcoins – keep their currency safe when Mt. GOX took the money and ran?

A fool and his blockchains are soon parted.

The blockchain itself is cryptographically safe.

Storage of your bitcoins – really, the hash of your bitcoin wallet – at an exchange is only as safe as the security measures implemented by that exchange.

Bitcoin has many interesting properties as a medium of exchange – flexibility, speed, ability to divide into eight decimal places.

But these properties also make totally useless as a store of value in my opinion. Especially considering that literally *anyone* can fork the Bitcoin code to create their own *coin – Altcoin, Dogecoin, Litecoin, etc.

Even now, all of the “investment hype” in Bitcoin revolves around converting your Bitcoin into some other sovereign fiat currency – dollars, Euros, yen, etc. You can’t buy a house in Bitcoin. You can’t buy a car in Bitcoin. You can’t buy a college degree, a gallon of milk, or advertising on TBP in Bitcoin.

Underlying Blockchain technology is much more interesting than any *coin algorithm built on top of it; but the current P2P nature of Blockchain verification makes it cumbersome and unscalable. And it has not approached the level of simplicity needed to get your average idiot on the street to use it to pay for his day-to-day expenses.

But in the meantime, if you can make “money” speculating in Bitcoin as a pure trade – because that’s all it is at the moment, despite protests to the contrary – then more power to you. Just remember, bulls make money, and bears make money, but pigs get slaughtered.

There are 73 million baby boomers, 24 million gen xers, and 77 m illion….unfortunately most millenials are snowflakes educated in public school and servants of the govt and bank scam. Most have zero understanding of real assets or money and no knowledge of history (you mean there was actually a world war 2?). That is why bitcoin is going gangbusters and the govt is complicit. The govt loves a digital currency as every dollar will then be taxed, no more cash and no bartering. When govts need to raise revenues there are no more laws to stop bartering or cash transactions needed as which mean simply raising taxes as they will see every transaction. Eventually rates will exceed 90% taxation in all and they will either cause a revolution or move to dictatorship. Until then I feel these blockchains and bitcoins will be the newest tech boom like the internet was. Wondering if I should have invested $10k into a little known company called Apple or Microsoft in the 80’s or that weirdly named Google. We loath these today due to privacy issues imagine what blockchain and bitcoin will be loathed for in the future but until then it may be worth $10k investment….I still don’t understand it, nor the business model nor how it will interfere or enhance business. Maybe I’m a little slow, or maybe I understand actual asset value. Time will tell.

I don’t know it stops bartering. If I chop your wood and you now my lawn, how is anyone going to know?

I think Truther is referring more to people paying each other in cash (and not paying taxes) than people actually directly bartering, which – as you said – would still be possible, but more complicated to arrange.

What silly putty valley fails to recognize if and when the subway tokens are accepted in Wally World and Circle K the folks in flyover will not take them seriously. Additionally if the establishment palms are not greased in the national capitol region then again it will not play…..

None of it is going to amount to shit unless someone figures out a way to prevent the government from monitoring / regulating / suppressing its use as “real” money – i.e. is accepted nearly universally for buying and selling. However, if that can be accomplished, it not only could be what averts 1984-world, it’s arguably the only thing that has a chance of doing so.

Julian Assange tweeted thanks to McCain for limiting Wikileaks’ access to cash – and forcing Wikileaks to invest in Bitcoin, which made them a shit-ton of money. Some people may make money off of this, but I’m too stupid to do so. Or maybe I’m too stupid to lose money on it.

I just hope Wikileaks takes their profit before Bitcoin gets hammered by the gov – which I think is all but inevitable at some point. But I still have some optimism about the underlying technology, especially if it is linked to precious metals and / or commodities. Search on “hawala” for some ideas about how that could happen.

This is fine until you need it and it’s not there. Maybe it won’t be there because it’s not real. And if you don’t need it, or if it’s not real, why bother? Find new trends, but keep the old. One is fleeting, the other’s gold.

Back in the 60’s – 80’s, we lived in a small Southern town. Next town over had Trader’s National Bank (don’t know who bought them out, don’t think they’re there anymore). My Dad went in and found a banker – Jordan, I remember his name was. When Dad needed to borrow money, he would call Jordan up and tell him, “Jordan, I need to buy a car this week”. Jordan knew my dad was an engineer, was good for the money and would reply something like, “How much? Come pick up the check tomorrow, we’ll have it ready for you” and that was it. Whatever the rate was that week, Dad would get that less a percent or two, terms so much monthly until it was gone (Dad would pay off early) until the next time.

Nowadays your bankers don’t know your name or care, unless something craters in a big way. I got a mail circular from My Bank (intials W.F.) saying rates have dropped, come re-finance. This was a couple of years back; when I went in, they declined to re-finance me at that time, saying they could not understand how I qualified for the rate I already had (I was a graduate student at the time). The fact I had already had the loan, never missed / never late, for over eight years did not seem to matter. Later, the rates dropped further, and they did indeed re-finance.

This last spring I paid off the balance on a small credit card; they raised my limit as a response. The same folks who said I didn’t qualify for the higher mortgage rate I already had / maintained eight years back!

It’s getting to the point I’d rather just save up more money (when I can) and avoid screwing with bankers altogether. It’s slower and takes discipline not to blow it on a vacation or something, but nowadays with ObamaDontCare’s uncertain premiums / increases you’d better have a stack somewhere to cope with the new (increased) rates every year. Moving to Japan looks like it would be cheaper sometimes!

Scott, do I have to be an accredited investor to take part at the $250 level starting on Nov. 10.