By the SRSrocco Report,

While the U.S. Shale Energy Industry continues to borrow money to produce uneconomical oil and gas, there is another important phenomenon that is not understood by the analyst community. The critical factor overlooked by the media is the fact that the U.S. shale industry is swindling and stealing energy from other areas to stay alive. Let me explain.

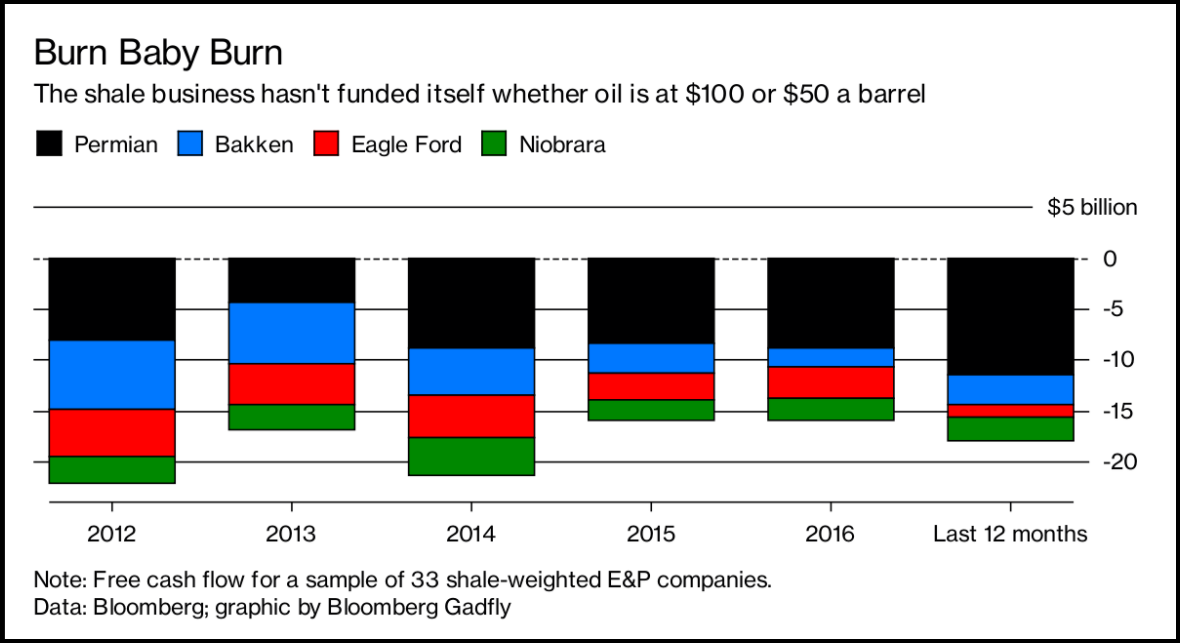

First, let’s take a look at some interesting graphs done by the Bloomberg Gadfly. The first chart below shows how the U.S. shale industry continues to burn through investor cash regardless of $100 or $50 oil prices:

The chart above shows the negative free cash flow for 33 shale-weighted E&P companies. Even at $100 oil prices in 2012 and 2013, these companies spent more money producing shale energy in the top four U.S. shale fields than they made from operations. While costs to produce shale oil and gas came down in 2015 and 2016 (due to lower energy input prices), these companies still spent more money than they made. As we can see, the Permian basin (in black) gets the first place award for losing the most money in the group.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

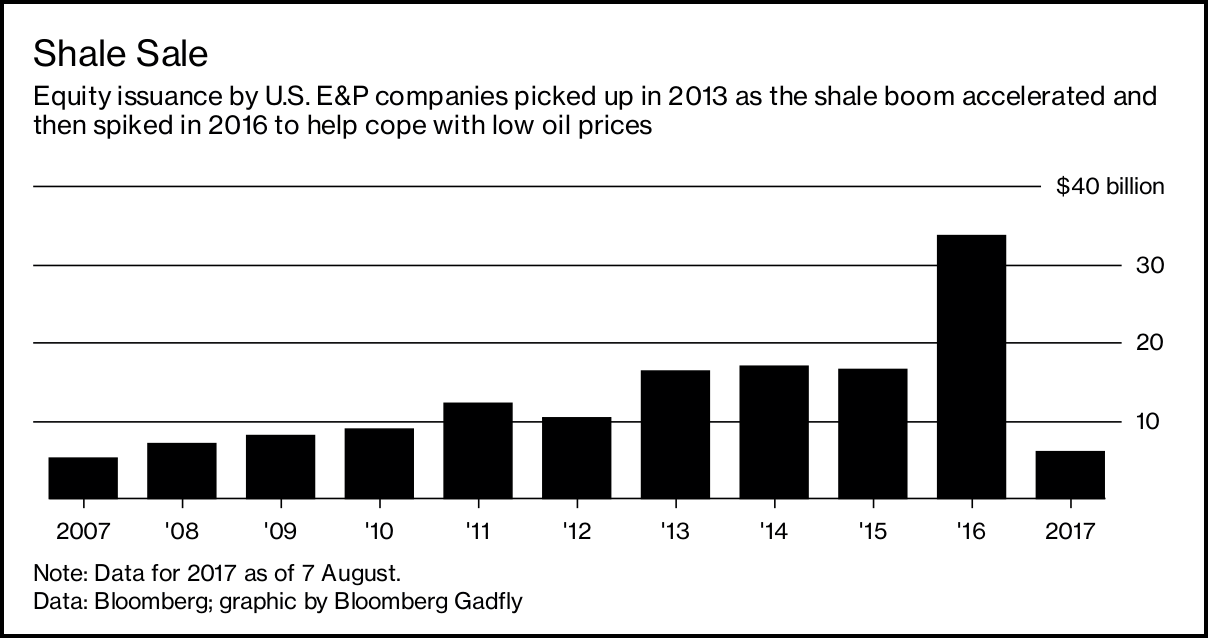

Now, burning through investor money to produce low-quality, subpar oil is only part of the story. The shale energy companies utilized another tactic to bring in additional funds from the POOR SLOBS in the retail investment community… it’s called equity issuance. This next chart reveals the annual equity issuance by the U.S. E&P companies:

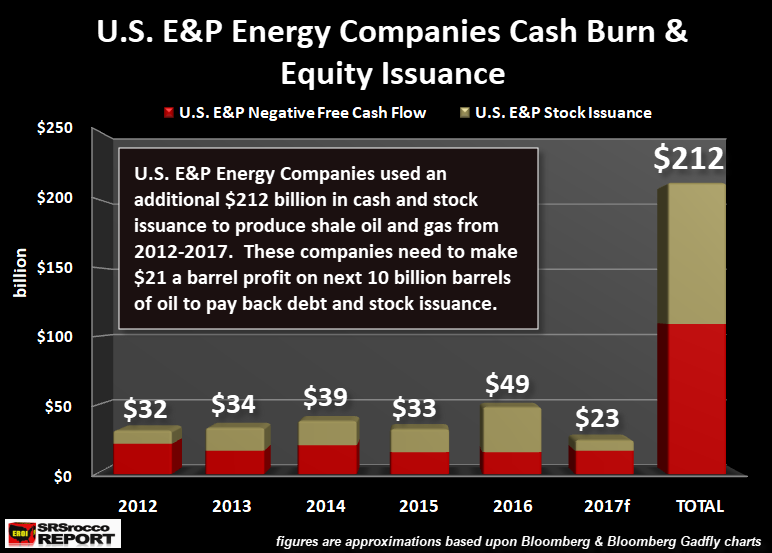

According to the information in the chart, the U.S. E&P companies will have raised over $100 billion between 2012 and 2017 by issuing new stock to investors. If we add up the funds borrowed by the U.S. E&P companies (negative free cash flow), plus the stock issuance, we have the following chart:

Thus, the U.S. E&P companies tapped into an additional $212 billion worth of funding over the last six years to produce uneconomical shale oil and gas. Now, this chart is an approximation based on the negative free cash flow (RED color) from the four top U.S. shale fields and the shale equity issuance (OLIVE color). So, how much money would these U.S. E&P companies need to make to pay back these funds?

Good question. If we assume that the U.S. shale oil companies will be able to produce another 10 billion barrels of oil, they would need to make $21 a barrel profit to pay back that $212 billion. However, they haven’t made any profits in at least the past six years, so why would they make any profits in the next six years?

Okay, now that we understand that the U.S. shale industry has been burning through cash and issuing stock to continue an unprofitable business model, let’s take it a step further. If we understand that the U.S. shale energy industry is not making enough money from producing the oil and gas, then it also means that it takes more energy to produce it then we are getting from it. Sounds strange… but true.

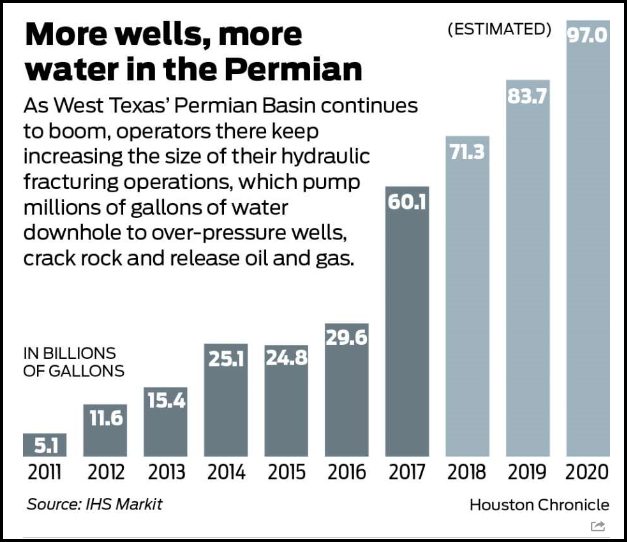

We must remember, investors, furnishing U.S. shale energy companies with funds are another way of providing ENERGY. These U.S. shale energy companies are taking that extra $212 billion (2012-2017) and burning the energy equivalent to produce their oil and gas. For example, it takes a lot more water to frack oil and gas wells. To transport the water, we either do it by truck or by pipeline. While this extra water usage is a Dollar Cost to the shale energy industry, it is really an ENERGY COST. Think about all the energy it took to either transport the water by truck, or the energy it took to make the pipelines, install them and the energy to pump the water.

Moreover, if we add up all of the additional costs to produce U.S. shale oil and gas, the majority of it comes from burning energy, in one form or another. Again, investor funds translate to burning energy. Thus, the U.S. shale industry needs more energy to produce the oil and gas than we get from it in the first place.

Unfortunately, investors don’t see it this way because they do not realize they will never receive their investment back. It was spent and burned years ago to continue the Great U.S. Shale Energy Ponzi Scheme.

Let me put it in another way. The U.S. and world economies are based on burning energy. When we burn energy, we create economic activity and hopefully growth. If the U.S. shale energy industry needed $212 billion more to produce the oil than they made from operations, then it means it burned more energy than it sent to the market. Do you see that now??

So, the U.S. shale energy industry is STEALING & SWINDLING energy wherever it can to stay alive. This is the perfect example of the Falling EROI (Energy Returned On Investment) forcing an industry to CANNABLIZE itself (and the public) to keep from going bankrupt.

Lastly, as time goes by the U.S. shale energy industry will behave like a BLACK HOLE, by sucking more and more energy in to produce even lower and lower quality oil and gas. At some point, the shale energy industry will collapse upon itself leaving one hell of a mess behind. While it’s hard to predict the timing of the event, it will likely occur within the next 2-5 years.

Check back for new articles and updates at the SRSrocco Report.

I am an email subscriber to SRSrocco; been reading their stuff for a while.

They have had a negative view on Fracking since whatever; they may be correct; I do not have the data or resources to verify or refute them.

My take on Fracking is negative based on the huge amount of water is used. Between CA agriculture and Fracking, potable water supplies will eventually become scarce in US.

Potable water is necessary for life and the US does Not manage water supplies.

Even within the context of the semi-arid mountain west, compared to your average reservoir storing thousands of acre feet of water, the amount of water used in fracking is negligible. Virtually all fracking water is recovered as produced water and eventually rejoins the water cycle. Fracking has been in use for over fifty years now. The hype is as illegitimate as AGW.

“”Virtually all fracking water is recovered as produced water and eventually rejoins the water cycle.””

In time frames meaningful to humans, no. This “produced water” in injected 1000’s of feet below the ground in (supposedly) sealed/unreachable formations. Water used in Fracking will NEVER be available to the water cycle again … at least not for 10,000’s-100,000,000’s-millions of years.

Since water and CO2 are the primary products of fossil fuel combustion, the amount of fossil water freed from geologic captivity far and away exceeds the amount injected into depleted gas and oil reservoirs and porous formations.

The latest trend is toward using CO2, a developing technology that sequesters captured CO2 from coal and various other emissions and removes them from the environment.

I understand the Leftists and Warmers hate that development.

If you wonder why countries around the world arent exploiting their shale reserves like we are, this is why. It isnt economical. Other countries dont have this wild reckless money printing driving investors into money losing ventures. Well, Japan would certainly be doing if they could, but they cant. This shale boom is literally throwing money away by the trillions. The price of oil is going to go back up because the real profitable oil fields (like the giant saudi oil fields that produce 500 kbpd for decades) are declining. They are spending more and more money and tech just to maintain production rates on these giant conventional oil fields. When oil is $200 a barrel, the shale would actually be profitable. But now, already, the most profitable shale reserves in the US have already been tapped. Millions of wells, almost all of them literally losing money and making it up on volume, just like AMZN. I guess its the american way.

The problem with the shale industry is that high oil prices crush the economy because we are so dependent on oil. So how do you ever get the type of oil prices necessary to make investment in shale truly profitable? If the price spikes, the economy takes a giant dump, and then the price of oil dumps and they lose money. Oil will probably hit $500 a barrel within 10-20 years. But does that mean anything if the price of a cup of coffee is $20? Or if the price of a drilling rig is 300% higher than it is today? Or if the price of water is 10x what it is today?

Oil has worked back to almost $60 after basing for many years. I’ve read alot of SRS, but what none of these commentaries can account for is the raw willingness to print money for the favored to keep it going. I expect oil will continue its slow climb higher and think that is attributable to emerging market demand … but, that is my bias.

I’ll go along with that. World uses 94 Million barrels of oil per day (2014). It will be 95 Million by December 2018.

This is a staggering amount and think of the amount used in the last 70 years. Oil has been the life-blood of the industrialized and human enrichment scene. Someday the supplies will decrease and the liberal leaders will rejoice when Billions of people die.

I’m thinking this is why the libs oppose Nuclear power.

News Flash: Nuclear power is entirely based on oil.

So true… it takes a lot of oil to make the jet fuel to fly the Clintons around the world so they can make money selling uranium to russia.

Steve St. Angelo is one of those guys that has his little pet theory and tries to apply it to every situation. You can toss this analysis out with the trash.

Shale oil companies and investors need one thing to be profitable . From Tesla to corn alcohol for fuel to section 8 landlords it’s easy rape pillage and plunder taxpayers some more . I’m sure the circle jerk from Wall Street to K-Street to Capitol Street could be bought off enough to find any thing you want !

For me the question is what would happen after a nuked ME? Who would benefit? Who would do it? Who would false flag it?

Saddam set the oil rigs on fire and Red Adair put them out. It ranks behind Chernobyl and Bhopal as the third worse environmental disaster and first on intentional acts behind Hiroshima and Nagasaki and god knows what else short of naming the Federal Reserve and (((???))). Saddam’s sin dwarfs all other oil spills making the Deepwater Horizon spill look like a faucet drip.

So in the case of the unthinkable but doable, we best know how to extract what we have. But I am just a bit paranoid sometimes…

There is more than one way to frac – you can water frac, CO2 frac, and so on. “Hydraulic” fracking merely means you are using a _fluid_ to open up geologic formations that would otherwise be tough to get oil (or gas) flow from – “tight” sands or shales that aren’t very permeable.

Some formations can be opened up even further – you frack to get the main arteries, then use chemicals and proppants to enlarge the network of capillaries and keep them open. That way a larger area will flow tightly-held oil to the capillaries, then to the arteries, then to the well bore and up to the surface.

As to whether or not EROI is a problem, I’m not sure; certainly, it costs more (in inflated USD) to drill and produce now than it did. Whether or not EROI is negative I think still remains to be proven.