On June 5, 1933, the United States went off the gold standard, a monetary system in which currency is backed by gold, when Congress enacted a joint resolution nullifying the right of creditors to demand payment in gold. The United States had been on a gold standard since 1879, except for an embargo on gold exports during World War I, but bank failures during the Great Depression of the 1930s frightened the public into hoarding gold, making the policy untenable.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

Soon after taking office in March 1933, Roosevelt declared a nationwide bank moratorium in order to prevent a run on the banks by consumers lacking confidence in the economy. He also forbade banks to pay out gold or to export it. According to Keynesian economic theory, one of the best ways to fight off an economic downturn is to inflate the money supply. And increasing the amount of gold held by the Federal Reserve would in turn increase its power to inflate the money supply. Facing similar pressures, Britain had dropped the gold standard in 1931, and Roosevelt had taken note.

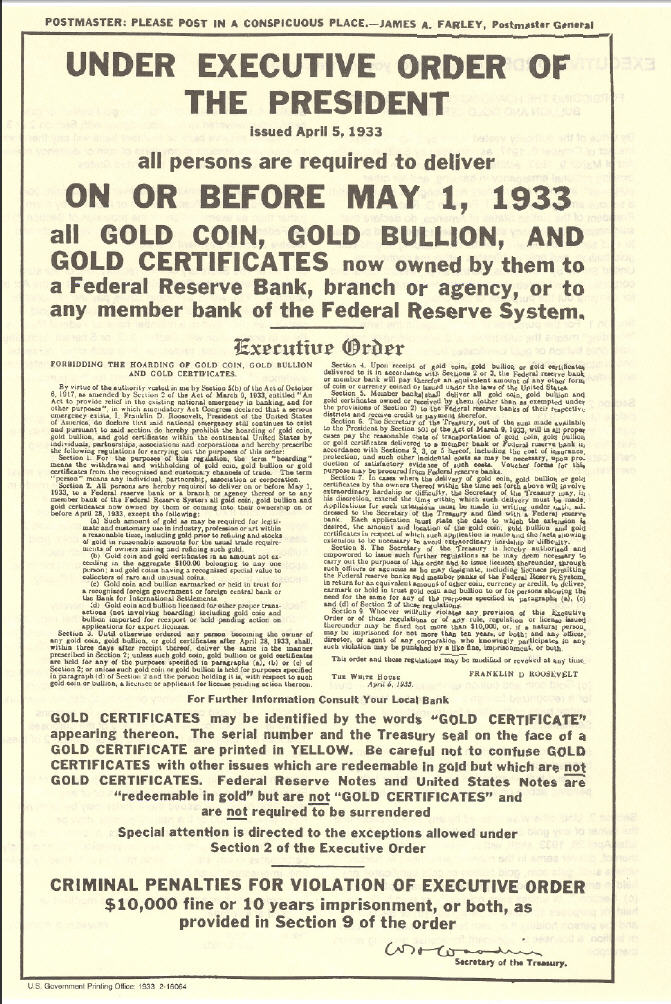

On April 5, 1933, Roosevelt ordered all gold coins and gold certificates in denominations of more than $100 turned in for other money. It required all persons to deliver all gold coin, gold bullion and gold certificates owned by them to the Federal Reserve by May 1 for the set price of $20.67 per ounce. By May 10, the government had taken in $300 million of gold coin and $470 million of gold certificates. Two months later, a joint resolution of Congress abrogated the gold clauses in many public and private obligations that required the debtor to repay the creditor in gold dollars of the same weight and fineness as those borrowed. In 1934, the government price of gold was increased to $35 per ounce, effectively increasing the gold on the Federal Reserve’s balance sheets by 69 percent. This increase in assets allowed the Federal Reserve to further inflate the money supply.

The government held the $35 per ounce price until August 15, 1971, when President Richard Nixon announced that the United States would no longer convert dollars to gold at a fixed value, thus completely abandoning the gold standard. In 1974, President Gerald Ford signed legislation that permitted Americans again to own gold bullion.

thank you Gerald Ford

Hard to link an “elastic currency” to a hard asset with a relatively fixed quantity. It was inevitable the moment the FR act was signed that gold, then silver, then copper, in future…..zinc would be driven out of the coin of the realm.

Excuse my ignorance, but how in the heck can we be ORDERED to surrender our gold???

If it came down to it once again, how many of those few of us that own gold (not me), and silver (me) would willingly comply with such demands???

Like a said, forgive my ignorance… Just trying to understand the logic…

FDR had a few things going for him within the general public. It was the Depression, and most people were suffering quite a bit without truly understanding that government actually caused the collapse and worsened the problems with their “solutions.” Most still were not aware of just how criminal their government was or that collusion with the Jewish and other banking cartels was the reason their currency was in trouble. Additionally, gold not only circulated as coin, but gold certificates were quite well-circulated, so the use of paper money that was “as good as gold” was very common. By this point, FDR had also become a bit worshiped, and so his appeal for the gold as a way to “restore the US Dollar and its soundness” or whatever the exact lie was that he told, was believed. He of course blamed “hoarding” of gold and silver, and truly, holding of these items prevented the Federal Reserve from simply printing money at will. As people had always been able to exchange their gold certificates for $20.67 per ounce, most people did not see this as an issue. Of course they didn’t know that rat-bastard criminal of a president was going to up the value the next morning, thus screwing everyone and driving inflation up literally overnight.

Today people know exactly why they are holding gold and silver (and other precious metals), and so all the government will get from most people when they come to try and take these metals in the future, will be a lot of lead.

Thanks for sharing your insight Mr. Liberty. I’ve got a much clearer picture now.

Regards…

Keyword “joint resolution” aka “bipartisan ass-reaming”.

Bipartisan = double penetration.

One more nail in the coffin.

FDR’s Executive Order 6102 of Apr 5, 1933 required all publicly held gold coins and bullion to be delivered to a Federal Reserve member bank in exchange for paper “Federal Reserve Notes”. Failure to comply could be punished by 10 years in prison.

The order was one of FDR’s first official acts after taking office in March, and had been planned well in advance. Banker Eugene Meyer Jr., member of the Rockefeller CFR and future owner of the Washington Post, was chairman of the Federal Reserve at the time. The paper notes were devalued by 30% relative to gold after Henry Morgenthau Jr. was sworn in as Secretary of the Treasury a few months later.