My broker/mentor was fond of saying; “It’s easy for investment advisors when the market is booming. When times are tough you learn who is doing their homework!” She was a veteran and the voice of experience.

My broker/mentor was fond of saying; “It’s easy for investment advisors when the market is booming. When times are tough you learn who is doing their homework!” She was a veteran and the voice of experience.

We looked out her office window and counted a dozen starter BMW’s in the employee parking lot. They belonged to their cadre of freshly licensed young brokers that talked a good game.

Each morning the squawk box told them what to push – and push they did, mimicking their provided script. She predicted, “Once the market turns many will be gone.” A few months later, we sat in her office watching a tow truck repossess a BMW.

Today we’re interviewing another of our panel of experts, Nathan Slaughter, editor of High-Yield Investing. Nathan prides himself on finding solid investments that are overlooked, ignored or disliked by Wall Street.

| Nathan feels, “popular, momentum-driven stocks making all the headlines can be productive for short-term traders, but dangerous for long-term investors when the tide inevitably turns.” |

He does his homework. I’m concerned about the tide turning.

DENNIS: Nathan, I know you cast a wide net looking for solid, safe investments. With the Fed raising rates, now implying caution, a new congress, and a lot of uncertainty, what do you see on the investment horizon for 2019?

NATHAN: There are many cross-currents tugging investor sentiment in different directions. We’ve got a decelerating economy, worrisome geopolitical development, and trade skirmishes that could potentially erupt into a full-blown war. The bulls also have some compelling arguments; such as a powerful labor market, the stimulative effects of tax reform, and buoyant corporate earnings.

Where will that take us in 2019? I’m not in the business of market timing. While I pay attention to the big macro picture, my approach is more bottom-up, with the goal of finding competitively advantaged businesses that can deliver reliable cash flows (and dividends) even under tough conditions.

DENNIS: Your newsletter always educates me about something I didn’t know. Do you see anything that might affect the market that we are not reading about in the mainstream media? If so, what would it mean to investors who need both income and safety?

NATHAN: I’ve built a long-term rapport with readers by arming them with information to make their own smart decisions. I can’t control what the market will do from day to day, but I can always fill each issue with practical information and insight that helps investors sharpen their edge over the crowd. To me, that’s far more valuable than just providing a stock tip.

Part two of your question; I’m surprised that the media hasn’t given more coverage to dangerously excessive corporate debt levels. A decade of low interest rates has encouraged companies to borrow hand-over-first. And not just for ordinary business expansion, but also financial engineering tools such as share buybacks.

Excluding banks, corporate debt has set new levels, increasing by more than $2.5 trillion (40%) since the 2008 recession. With the era of cheap money winding down, the interest burden will become harder to bear. The Fed recently issued a stern warning that cascading debt defaults could tip the country into recession.

I’m watching this closely.

DENNIS: Your portfolio is well diversified. How much should investors hold of any single stock as a part of their overall holdings?

NATHAN: Some investors have sprawling portfolios with 50 or more holdings, while others might only own 8 to 10 investments. I’m near the middle with 36 stocks, bonds, and funds in my High Yield Investing portfolio.

Warren Buffett feels that investors should put the bulk of their investable assets into as few as six stocks, saying “very few have gotten rich on their seventh best idea”. While there is some logic in that, none of us is Warren Buffett. We can’t appoint personal representatives to sit on the boards of the companies we invest in.

While some may put more dollars in their highest-conviction picks, I rarely advise putting more than 10% in any one stock, and usually no more than 5%. Yes, that might water down returns from a big winner, but it can also protect against a catastrophic setback on a loser.

Dennis, you recently wrote about a large allocation to one pick, having it go south and moving your retirement back a few years. That is a hard lesson to learn.

By capping a position size at 5%, a stock that tanks and loses half its value won’t cost you any more than 2.5% of your assets – it stings, but won’t threaten your financial independence.

Nine of my last ten closed trades have produced positive returns ranging from 16.0% to 135.3%. Unfortunately, some readers bet heavily on the 10th and lost a bundle. I truly hate to see that. Nobody has a perfect batting average; don’t put yourself in a situation where one strikeout cancels out four or five base hits.

DENNIS: Please explain your focus on companies making special dividend payments, very few editors do that. Does it make a difference?

NATHAN: Special dividends are just what they sound like – a bonus distribution. In most cases, they are non-recurring, one-time events.

This cash might come from an asset sale, or even the recent tax reform windfall. Debt-financed special dividends have also become popular with fast-growing companies such as Wingstop (Nasdaq: WING) although I’m not sold on the idea of borrowing money (and paying interest) to immediately hand the proceeds over to shareholders.

Honestly, 90% of these special dividends don’t interest me. Many of the issuing companies are subpar. And even if they are reputable, my readers are long-term investors with little interest in capturing a single payment.

However, I do find hidden value in companies that utilize special dividends as an ongoing method to return surplus cash to stockholders. Instead of a one-off transaction, they do it year after year.

This is particularly smart for businesses whose cash flows might deviate significantly as conditions change. Set the dividend too low, and you don’t share enough profit with stockholders. Set it too high, then you are forced to make a dreaded cut during the next down-cycle.

The solution? Set a low (or no) fixed dividend at all. Wait until year-end, tally up your profit and then pay out a predetermined percentage. Take RLI Corp (NYSE: RLI). The specialty insurer offers a meager regular dividend yield of 1.2%, largely ignored by most income seekers. But that’s just the appetizer – the entrée comes later.

With a healthy balance sheet and 22 consecutive years of underwriting profits, the company also hands out a special year-end treat. Last year, it paid $1.75 per share. This year, even with more Hurricane claims, the bonus will still be $1.00 per share.

This policy has been in place for nine years, which is a big reason why I recommended RLI to readers

These bonus payments aren’t reflected in stated yield, so they often go unnoticed by investors. I track a special index of companies like RLI that make these “hidden” payments year after year. As this is a corporate strategy rather than a simple one-time transaction, I feel we’ll see these disbursements continue.

This index has beaten the S&P by 214% over the past decade.

DENNIS: You recently issued some sell orders. What do you look for in today’s market that might cause investors to sell?

NATHAN: Each investor is different. Some watch technical indicators such as moving averages. Some follow the Fed. Others may sell whenever the wind changes directions.

I try to avoid all the noise in the market. Deep down, the contrarian in me knows the best time to purchase any asset is when others are trying to get rid of it.

I’m more concerned about business performance than share price performance. I monitor both. If a share price is volatile, I look to see if there is any material business change from my initial entry point, I don’t get too worried about a dip from $60 to $50. It might be a good buying opportunity.

I’m not an active trader; I’m an investor. When I sell, it’s generally because the stock surpassed my fair value estimate and has become overvalued – or I’ll sell if the long-term cash flow outlook darkens (particularly if dividends are in jeopardy), or if I lose faith in management.

Industry conditions can (and do) change quickly – we have to expect the unexpected – surprise mergers, new competitive threats, regulatory overhauls, etc. I then step back and re-evaluate on a case-by-case basis.

DENNIS: One final question. In 2010, the Pew Research Center told us: “As the year 2011 began…the oldest members of the Baby Boom generation celebrated their 65th birthday. …. Every day for the next 19 years, 10,000 baby boomers will reach age 65.”

Approximately 30 million baby boomers have since retired. Since 2010 they have seen a constant bull market. What advice would you offer for those retirees needing to make their life savings last for the rest of their life?

NATHAN: Last month I used those same statistics to explain how long-term demographic trends point to increased healthcare spending – a brisk tailwind for companies that own medical office buildings, assisted living facilities, etc.

Retirees must shift their priorities from the wealth accumulation phase to the wealth preservation phase. Don’t stuff your money in a mattress (you still need to outpace inflation), but don’t take any unnecessary risks either.

Overall asset allocation is more important than individual security selection. Find reliable sources of income, and don’t forget about tax considerations. Enjoy the fruits of your labor – you’ve earned it.

DENNIS: On behalf of our readers, thank you for your time.

NATHAN: My pleasure Dennis

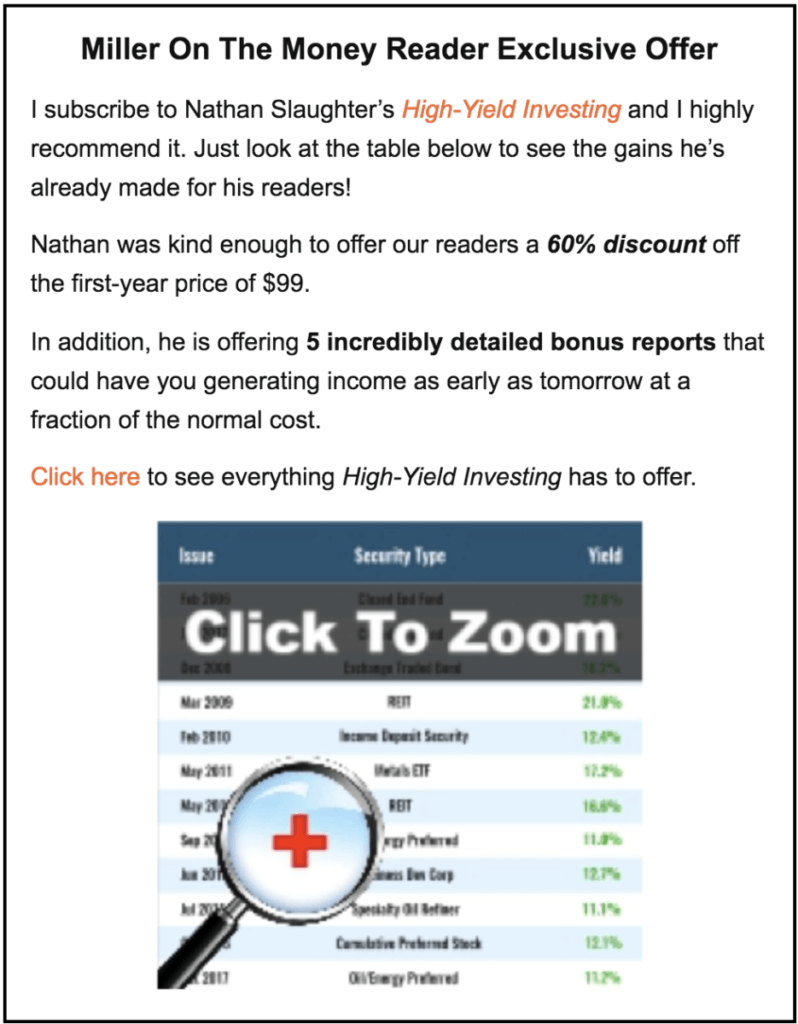

Dennis here. I learn something every time I read Nathan’s newsletters and I highly recommend it.

Baby boomers are no longer trying to get rich; but rather preserving their life savings. It’s time for caution! Holding some cash in reserve until we see how things shake out is a good thing.

For more information, check out my website or follow me on FaceBook.

Until next time…

Dennis

You gave me a good laugh this morning, Dennis. I love the term “starter BMWs.” And as maligned as they might be, they can be wonderfully motivational for a young workforce.

Thanks Dennis. Some good stuff in there.