Several experts, who are not in the gold business, recently suggested gold will be a good investment in 2019.

Several experts, who are not in the gold business, recently suggested gold will be a good investment in 2019.

Zerohedge reports on David Einhorn’s annual letter to Greenlight Capital shareholders with my emphasis:

“Gold – Long – U.S. debt to GDP is over 100%. The…U.S. debt has increased by over $2 trillion…. When the economy eventually slows, the deficit is sure to expand rapidly, possibly catastrophically. The politicians say deficits don’t matter. …. History says otherwise. Gold continues to be a hedge in our portfolio to imprudent global fiscal and monetary policies.”

The Aden Forecast, a highly respected newsletter, tells us:

“GOLD’S TURN TO SHINE – This too will likely continue this year, especially if the U.S. dollar also heads lower. If so, gold will get a double boost and it’ll shine as the world’s safe haven. For a number of reasons, we believe that’s what’s coming up… Already, gold hit a 6½ month high, mostly thanks to its safe haven status during these volatile times.”

Since the bank bailouts, pundits have predicted rising inflation with gold rising like a shooting star. It has not happened. Kitco reports the gold price on 12/31/2017 was $1,291/oz. It closed in 2018 at $1,279/oz.

Our gold expert is Jeff Clark, senior precious metals editor at GoldSilver.com.

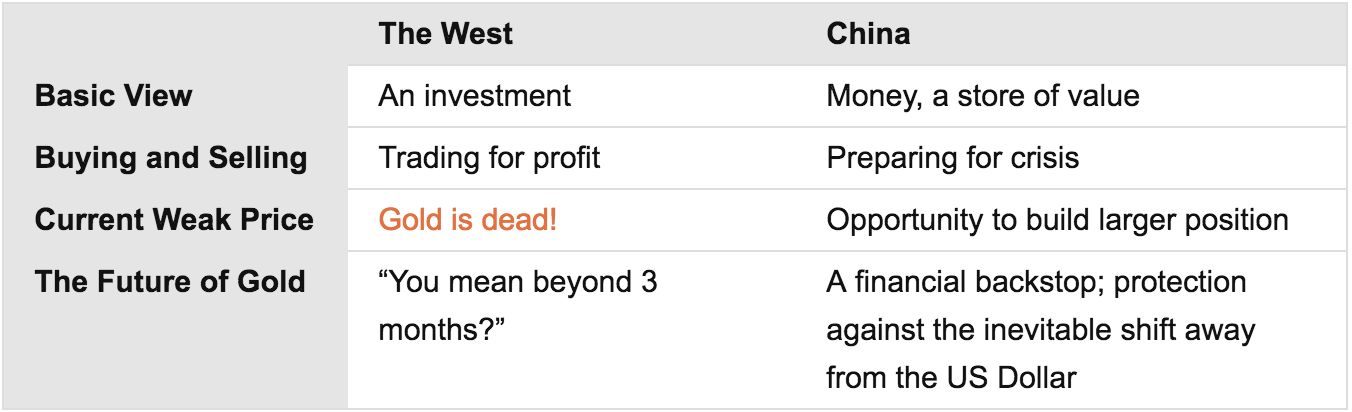

Jeff wrote a terrific article, “Don’t Worry About the Gold Price – China’s Got Your Back” outlining major differences in how Chinese and Americans view gold.

I’ve asked Jeff to weigh in on his thoughts for the upcoming year.

DENNIS: Jeff, on behalf of our readers thank you for your time. In your article you presented a great analysis on how the Chinese look at gold. Please explain what you mean.

JEFF: China has a very different culture than the West. And that includes how both the government and its citizens think about gold. They see it very differently than Westerners (US, Canada, Western Europe):

The Chinese view gold in the context of its role throughout history. Gold isn’t a vehicle for trading in and out of, or even an investment. It is the most secure asset they can hold to safeguard their country’s future monetary and financial standing.

The implication is that they will be better prepared for the next crisis than those who don’t hold a meaningful amount of gold.

DENNIS: For years Chuck Butler and I have told readers we hope we never have to sell our gold. You explained our reasons well.

In my opinion, the US view is shaped by money managers advising clients not to hold gold because it provides no yield. I’ve urged readers to make sure their money managers are listening. They need a reasonable amount of “inflation insurance”. Do you see things the same way?

JEFF: While the argument that gold provides no yield is accurate, that’s not the point of gold. Gold is money, pure and simple. Even a cursory review of history shows this.

It’s not “currency” at present, but it is a far superior store of value than US dollars or any other fiat currency. Dollars don’t produce income either, until you put them to work (and thus at risk). Should we not hold dollars then? As you know, money managers are biased; they can’t earn a commission on selling gold, so of course they don’t promote it.

There are a lot of potential catalysts for gold to rise in the coming years, especially when you consider that almost every investment market is in a bubble or beginning to pop. Virtually every segment of society is completely overwhelmed with debt, to levels that can never realistically be repaid. When one or more of these things begin to break, gold will serve as a crisis hedge, much like it has many times throughout history.

Gold’s biggest catalyst is what you’re suggesting: inflation. Historically gold has spiked the most when there has been high inflation, particularly at the beginning stages. Inflation seems inevitable to me, especially if you think central bankers and politicians might use some form of QE again in the next crisis.

Dennis, there are many reasons to be overweight gold right now. I believe this period will go down as a textbook example of when one should buy. Especially when the price is a full one-third below its 2011 high.

| “The world’s central banks have been buying gold at a pace not seen for nearly half a century!”

– Tony Daltorio, Premium Digest |

DENNIS: It’s not only China, our mutual friend Ed Steer reported Russia added 300,000 ounces of gold to their reserves in December alone. In the last decade they have increased their gold reserves almost four-fold.

If you look at gold as insurance, you are insuring against an event. China wants to marginalize the US dollar as a world currency. Russia is unloading US treasuries, buying gold and other currencies.

If the world shifts away from the dollar, what does that mean for gold? And why?

JEFF: It means the US dollar will continue to lose more value. If global demand for dollars decreases, so will its value. As gold and the dollar are inversely correlated, gold would rise. In every major US dollar bear market, the gold price has risen.

Countries diversifying out of the dollar is a big picture trend. What we don’t know is if it continues to be a slow transition-or if there could be a sudden overnight event. If it happens suddenly, it will be too late to buy gold.

DENNIS: Can you explain what David Einhorn means when he refers to gold as a “hedge”? How would holding gold, which produces no interest, benefit his fund holders?

| Dennis here. Craps players call hedge bets “insurance”! |

JEFF: Great question. When you “hedge your bet,” as the saying goes, you’re essentially saying that, while you believe your bet on bonds is a good one, you acknowledge that it’s not a sure thing. You put a hedge in place that will mitigate your risk if it doesn’t work out.

Gold provides a hedge such that if your investments in stock, bonds, real estate, currency and whatever else you might hold don’t go well, then you have a hedge against a cataclysmic outcome.

David Einhorn’s comment on bonds and gold is historically correct; bonds, including some government bonds, not only cratered in price in 2008 but some also stopped paying interest. Gold, meanwhile, doubled in price. So much for the argument that one should avoid gold because it doesn’t produce interest.

DENNIS: One final question. The gold price didn’t change much in 2018. If an investor looks at it through the eyes of the west, it was a poor investment, it didn’t make any money.

If you look at gold like the Chinese, you would say the insurance premium has not increased.

The Minneapolis Fed provides some scary, historical inflation data.

Jeff, when I say “I hope I never have to sell my gold”, I mean it. Unlike the grim reaper, I hope the end is NOT near.

I lived through inflation in the’70s and early ’80s and saw what happened to my parents. Seniors and savers can’t afford to see the purchasing power of their life savings destroyed.

I’d rather see the gold price go nowhere in 2019 as opposed to skyrocketing because of out of control inflation.

How much gold do you recommend investors hold so they have properly hedged their life savings? We all need to sleep well at night.

JEFF: Good point about gold’s performance in 2018. In fact, the only thing that rose was the dollar and inflation!

Most advisors will tell you to have 5% or 10% in gold. But I believe the current environment should dictate how much gold one has in their portfolio. If the economy is strong, for example, I would be underweight gold. If the economy is getting shaky or uncertainty is growing, then I would be overweight gold.

In today’s current environment, I believe I need to be overweight gold. Until politicians can balance a budget, stop adding tons of debt and markets aren’t so darn overvalued, I will be overweight gold.

While you’re correct, if gold goes nowhere it would mean things haven’t fallen apart. It’s more likely that gold rises over the coming years – probably substantially. Mike Maloney believes gold and silver will be more than just a hedge in the near future; he expects metals will provide large capital gains due to the type of crises we are likely to endure. It’s certainly happened before.

DENNIS: On behalf of our readers, thank you for your time.

JEFF: My pleasure, any time.

Dennis here. Will Gold shine in 2019? No one really knows for sure. It looks like the Russians and Chinese continued accumulation is putting a floor under the price. I’d like to see the price rise slow and steady giving Americans time to adjust to the dollar losing status in the world.

In the meantime, if you don’t have an adequate hedge, it would be a good time to begin an accumulation program. Maybe the Chinese do have our back….

I met Jeff when I joined Casey Research. When it came to metals, he was a terrific mentor and educator. I’m pleased we became a GoldSilver affiliate. They are a reputable firm with a “best price” guarantee. If you are considering gold, be sure to call them for a quote.

For more information, check out my website or follow me on FaceBook.

Until next time…

Dennis

And what are Central Banks doing? Buying gold and a lot of it. What are corporate insiders doing? Selling the stock of their own companies and buying gold. What do they know that we don’t? What price are the Saudi’s REALLY Paying for the gold they get in exchange for their oil? Nobody knows for sure but estimates are they are paying around $ 5000/oz now! Gold has an intrinsic value of around $16,ooo/oz right now. To balance the outstanding debt it could and may be revalued suddenly to over $65,000/oz. I know this sounds crazy but it’s all entirely possible and even likely. Gold, get you some.

CRAIG HEMKE – MAKE BELIEVE GOLD AND SILVER SCHEME GOING TO COLLASPE

Published on Feb 19, 2019

Financial writer and precious metals expert Craig Hemke has a prediction for gold and silver prices in the not so distant future. Hemke says, “A collapse of the scheme they cooked up. . . . This scheme of digital alchemy, this make-believe gold, getting people to accept gold exposure as an alternative to the real thing, is going to collapse too.”

Hemke says watch the palladium market. It is highly leveraged, and that could be the first metal market to fall when people demand delivery and say ‘I want my metal.’ Hemke says, “Right, that’s when the music stops, and that is what we are all waiting for.”

Join Greg Hunter as he goes One-on-One with Craig Hemke, founder of TFMetalsReport.com.

https://www.youtube.com/watch?v=RCCpljYVkzw

I like the message since I have most of my liquid assets–what’s left of them–in gold and silver miners, but I’ve read the same arguments maybe a thousand times over the past several years. For instance, I’m told once again the Chinese value gold, so the gold price must increase. They did in 2013, too, but gold plunged (after the banksters met with Obama and made a plan to savage the gold price). Only when the criminals can no longer control the price through dumping billions of ounces of paper gold, conjured from thin air, onto the market, will gold zoom. I thought this would’ve happened long ago, but they somehow keep the scheme going. Why is now different? Nothing in this article tells me.

Too right, Bob.

Gold bugs are always bullish.

“The price has nowhere to go but UP!”

I remember the last time various Central Banks got involved

with gold (notably the Bank of England) in 1999 through 2001.

But back then they were selling. Gold was “too

volatile”. Headlines were “Gold has lost its luster” and “just

another barbarous relic”.

So……..should you have sold, too? ‘Cause Central Banks are

so good at timing and market strategy?

They sold at the lowest price in several decades.

Nope.

That was the time to buy.

And now………

Central Banks are buying. They’ve got your back.

Time to load up the truck.

Uh-huh.

Tell me another one.

Will gold shine?I am not sure but know me brass shines very nicely.