Authored by Mike Shedlock via MishTalk,

The amount of sheer nonsense written about inflation expectations is staggering.

Let’s take a look at some recent articles before making a mockery of them with a single picture.

Expectations Problem

On July 17, 2017, Rich Miller writing for Bloomberg proclaimed The Fed Has an Inflation Expectations Problem.

Expectations matter because they shape how households and companies act and thus can go a long way in determining where inflation actually ends up. Consumers accustomed to meager inflation will resist paying up for goods and services.

“Lower inflation expectations make it all the more difficult for the central bank to achieve its inflation objective,” Charles Evans, president of the Chicago Fed, said in remarks posted on the bank’s website on July 14.

Key Element

The Business Insider says The Fed is missing a key sign of economic weakness coming from American consumers.

Andrew Levin, a career Fed economist who was a special adviser to Fed Chairman Ben Bernanke, told Business Insider he was worried by a noticeable decline in inflation expectations, both as reflected in consumer surveys and bond-market rates.

“The reality is that the longer-term inflation expectations of consumers and investors have shifted downward by about a half percentage point. Thus, even with the economy moving towards full employment, it’s not surprising that core PCE inflation remains about a half percentage point below the Fed’s inflation target,” he said, referring to a closely watched reading indicator that excludes food and energy costs.

“If the FOMC continues to ignore the downward drift in inflation expectations and simply proceeds with its intended path of policy tightening, actual inflation is likely to keep falling short of the Fed’s target and might well decline even further,” he said.

Janet Yellen Yesterday

In a brief speech following yesterday’s FOMC announcement Janet Yellen made these statements.

Turning to inflation, the 12-month change in the price index for personal consumption expenditures was 1.4 percent in July, down noticeably from earlier in the year.

For quite some time, inflation has been running below the committee’s 2 percent longer-run objective.

One-off reductions earlier this year in certain categories of prices such as wireless telephone services are currently holding down inflation, but these effects should be transitory.Such developments are not uncommon, and as long as inflation expectations remain reasonably well anchored, are not of great concern from a policy perspective because their effects fade away.

Complete Nonsense

One can find thousands of such references, all of them idiotic. Let’s prove that with a single picture and a few comments.

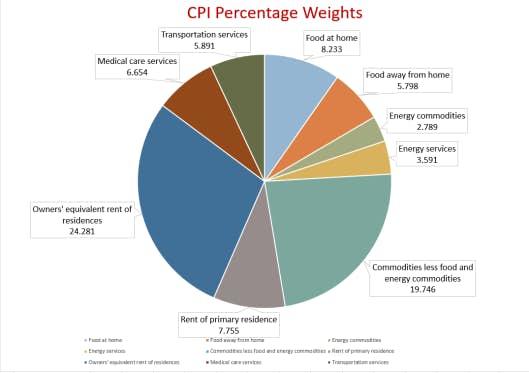

CPI Percentage Weights

The idea behind inflation expectations is that if consumers think prices will go down, they will hold off purchases and the economy will collapse. The corollary is that is consumers think inflation will rise, they will rush out and buy things causing the economy to overheat.

With that backdrop, let’s have a Q&A. I believe the answers are obvious in all cases.

Inflation Expectations Q&A

Q: If consumers think the price of food will drop, will they stop eating out?

Q: If consumers think the price of food will drop, will they stop eating at home?

Q: If consumers think the price of natural gas will drop, will they stop heating their homes and stop cooking to wait for the event?

Q: If consumers think the price of gas will drop, will they stop driving or not fill up their car if it is running on empty?

Q: If consumers think the price of gas will rise, can they do anything about it other than fill up their tank more frequently?

Q: If consumers think the price of rent will drop, will they hold off renting until that happens?

Q: If consumers think the price of rent will rise, will they rent two apartments to take advantage?

Q: If consumers think the price of plane tickets, taxis, and bus tickets will drop, will they hold off taking the plane the train or the bus?

Q: If consumers think the price of plane tickets, taxis, and bus tickets will rise, will they rush out and buy multiple tickets driving the prices even higher up?

Q: If people need an operation, will they hold off if they think prices might drop next month?

Q: If people need an operation, will they have two operations if they expect the price will go up?

All of the above questions represent inelastic items. Those constitute 80.254% of the CPI. Commodities other than food and energy constitute the remaining 19.746% of the CPI. Let’s hone in on that portion with additional Q&A.

Q. If someone needs a refrigerator, toaster, stove or a toilet because it broke, will they wait two months if for some reason they think prices will decline?

Q. If someone does not need a refrigerator, toaster, stove or a toilet will they buy one anyway if they think prices will jump?

Q. The prices of TVs and electronics drop consistently. Better deals are always around the corner. Does that stop people from buying TVs and electronics?

Q. If people thought the price of TVs was about to jump, would they buy multiple TVs to take advantage?

For sure, some people will wait for year-end clearances to buy cars, but most don’t. And if a car breaks down, consumers will fix it immediately, they will not wait for specials.

Stupidity Well Anchored

The only thing that’s “well anchored” is the stupidity of the belief that inflation expectations matter.

Asset Irony

People will rush to buy stocks in a bubble if they think prices will rise. They will hold off buying stocks if they expect prices will go down.

People will buy houses to rent or fix up if they think home prices will rise. They will hold off housing speculation if they expect prices will drop.

The very things where expectations do matter are the very things the Fed and mainstream media ignore.

No Reliable Measures

“There is no single highly reliable measure” of longer-run inflation expectations, Fed Governor Lael Brainard told The Economic Club of New York on Sept. 5.

Lovely. She’s also correct. Yet, she proposes to know what to do about it! How idiotic is that?

Economic Challenge to Keynesians

Of all the widely believed but patently false economic beliefs is the absurd notion that falling consumer prices are bad for the economy and something must be done about them.

I have commented on this many times and have been vindicated not only by sound economic theory but also by actual historical examples.

- My article Deflation Bonanza! (And the Fool’s Mission to Stop It)has a good synopsis.

- My Challenge to Keynesians “Prove Rising Prices Provide an Overall Economic Benefit” has gone unanswered.

There is no answer because history and logic both show that concerns over consumer price deflation are seriously misplaced.

BIS Deflation Study

The BIS did a historical study and found routine deflation was not any problem at all.

“*Deflation may actually boost output. Lower prices increase real incomes and wealth. And they may also make export goods more competitive,”** stated the study.*

It’s asset bubble deflation that is damaging. When asset bubbles burst, debt deflation results.

Central banks’ seriously misguided attempts to defeat routine consumer price deflation is what fuels the destructive asset bubbles that eventually collapse.

For a discussion of the BIS study, please see Historical Perspective on CPI Deflations: How Damaging are They?

Finally, and as a measure of insurance against the Fed’s clueless tactics, please consider How Much Gold Should the Common Man Own?

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

Inflation is theft. It’s so comforting the FED only wants to “target” 2% theft annually from us. With all the technological advancements over the years there should be significant deflation across many sectors. Fuck You FED!

At 2% inflation the price of everything DOUBLES in about 34 years… Chip

“The BIS did a historical study and found routine deflation was not any problem at all.

“*Deflation may actually boost output. Lower prices increase real incomes and wealth. And they may also make export goods more competitive,”** stated the study.*

It’s asset bubble deflation that is damaging. When asset bubbles burst, debt deflation results.” Look at Mish, getting religion. You know, we really can fix all this shit, and the more of the so-called smart guys that start preaching reality can accelerate us on that path, the better. I’ll take a convert over a hold out, any day. Bravo, Mish.

Yep, we need write downs, write off and bankruptcies of the TBTFs. Bahahahababa, likely? Bwahahababa.

Everything we don’t need will deflate and everything we need will inflate (especially food).

Imagine you had a gold bar and 2% of it evaporated every year.

That’s all inflation is and ever was.

Wait.

In 50 years there would be no gold bar.

You can’t CTRL+P gold bars but you sure can CTRL+P j00 bucks.

Rule of 69. Divide 69 by the annual percentage rate and you’ll get the number of years it takes to double the price (or disappear the gold). 34-35 years… Chip

having a consistent comparison is somewhat good but any definition that leaves out food & energy seems to be bogus–

i do not believe the official inflation rate,do you?

No. John Williams at Shadow Stats don’t lie… Chip

a bit off topic but apparently warren (hurry up & die )buffett took some shots at trump in his annual shareholder letter–

https://www.thewealthadvisor.com/article/did-buffett-just-take-swipe-trump-berkshire-letter?

mkt_tok=eyJpIjoiTnpWak5XTmlZMll6T0RGayIsInQiOiJlN0hMNUZNXC9ubFwvUVdUTlJTaHJkQzAxSTJOMWt0U2h1TlFRSVNkd1JQUTMzWHRuM3dWaTlIanpxZ0xnK0l3aWVZeHNtQzdcL2x4Nm9ZNDNDMFFZeFlINGtmcTZpQ01ObDlxdUVlT1UrbTh5V1o2Q2d1WFFxN2t0WnNWRHoxNEMrVCJ9

Do you think he visits the same places as Mr. Kraft?

The bankster-owned Federal Reserve established in violation of the US Constitution causes inflation through the creation of trillions of dollars out of nothing for the benefit of the owners of the Fed. Consumer choices and supply and demand have little impact on inflation despite the lies put out by the diabolical Federal Reserve. Put another way, central and fractional reserve banking is the most evil system of theft and plunder ever devised by mankind.