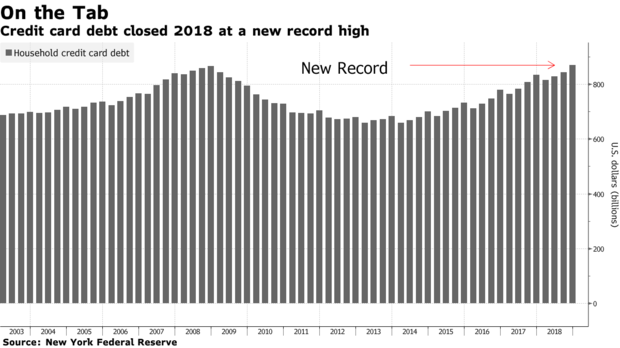

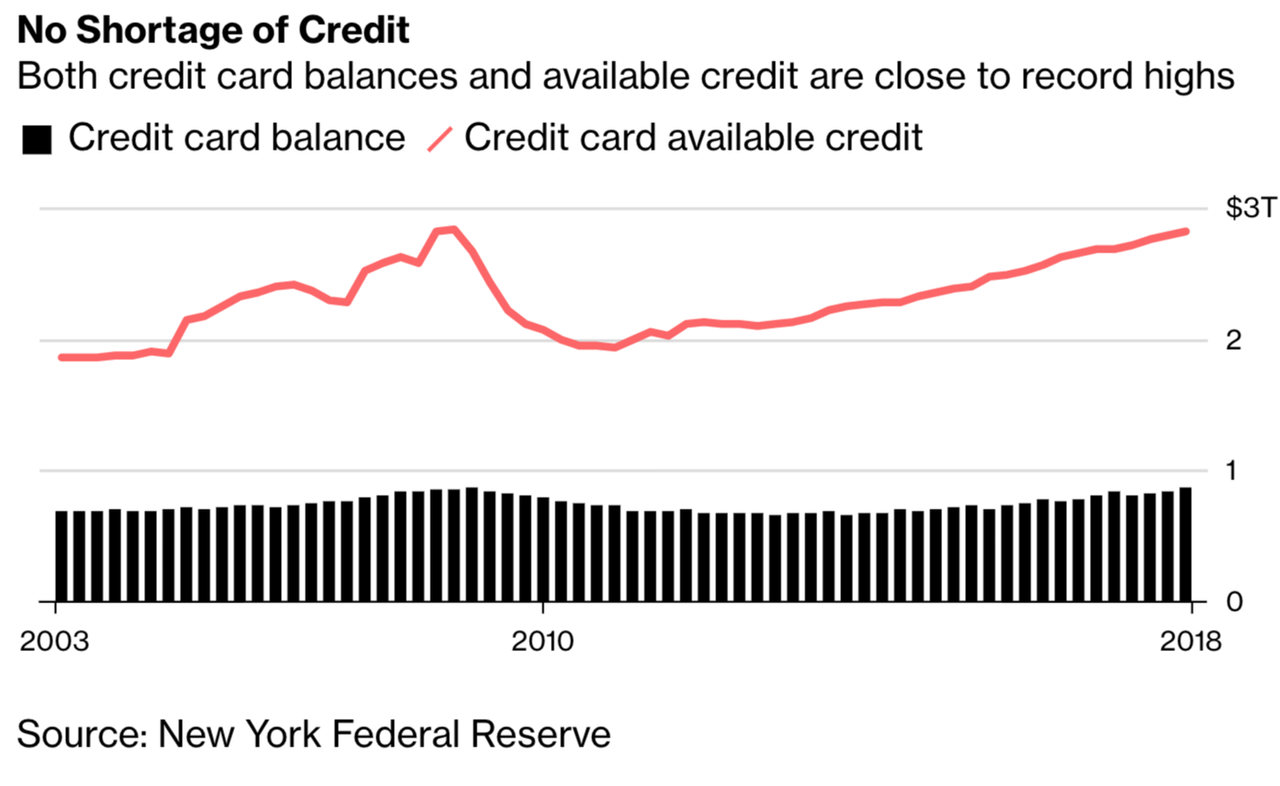

As those who follow our monthly consumer credit updates already knew, aggregate household debt balances jumped in 4Q18 for the 18th consecutive quarter, and were $869 billion (6.9%) above the previous peak (3Q08) of $12.68 trillion. As of late December, total household indebtedness was at a staggering $13.54 trillion, $32 billion higher than 3Q18. Overall household debt is now 21.4% above the 2Q 2013 trough, according to quarterly data from the Fed.

“The increase in credit card balances is consistent with seasonal patterns but marks the first time credit card balances re-touched the 2008 nominal peak,” according to the report.

There are approximately 480 million credit cards in US circulation, that is 1.47 credit cards per citizen, and up more than 100 million since the 2008 financial crisis.

More troubling is that according to the Fed, 37 million Americans had a 90-day delinquent strike added to their credit report last quarter, an increase of two million from the fourth quarter of 2017. These 37 million delinquent accounts held roughly $68 billion in debt.

Credit-card balances slipping into serious delinquency have been growing for the last several years, according to the Fed. As of 2019, a record number of Americans also have auto loans that are 90 days past due.

“The substantial and growing number of distressed borrowers suggests that not all Americans have benefited from the strong labor market and warrants continued monitoring and analysis of this sector,” economists Andrew Haughwout, Donghoon Lee, Joelle Scally, and Wilbert van der Klaauw noted in a Feburary report.

Rising delinquency levels pose a serious risk to consumer spending, which accounts for more than 2/3 of economic activity.

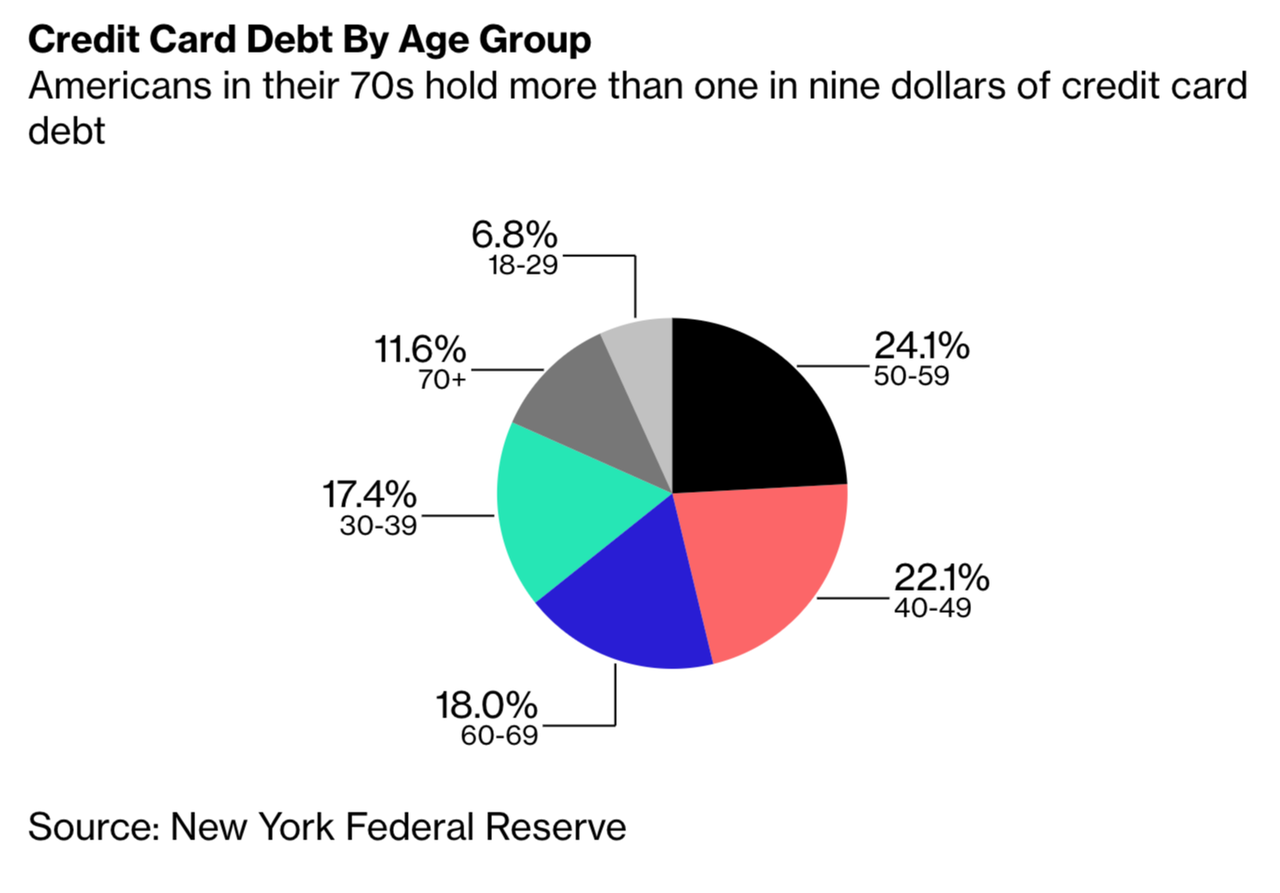

Almost a third of the credit card debt is held by the baby boomer generation, while millennials are up to their eyeballs in student loans. That could be troubling because some of the oldest and youngest borrowers are financially dependent on family members, according to Josh Wright, the chief economist at iCIMS and a former Federal Reserve staffer.

“This tells us that if the expected economic slowdown gets serious, these are the groups that will pose the biggest threat to the economy,” he said.

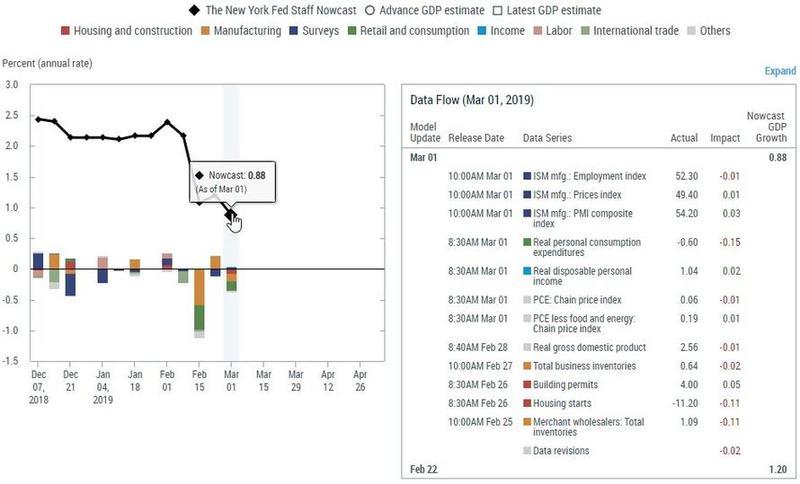

While President Trump continues to promote the “greatest economy ever” on Twitter, 1Q19 GDP expectations have crashed, a troubling sign that consumers have topped out.

Last week, Goldman published its 1Q19 GDP tracking estimate at a paltry +0.9%. This forecast, as Goldman’s chief economist Jan Hatzius said, “reflects an expected drag from inventories, sequentially slower consumption growth, a decline in residential investment, and a four-tenths drag from the government shutdown.”

Goldman wasn’t the only one echoing low-growth forecasts for 1Q19, but also the NY Fed’s GDP Nowcast, which showed growth crumbled from 1.22% (and 2.17% as recently as a month ago), to a stunning 0.88%, as a result of the collapse in Personal Consumption, Housing Starts, Wholesale Inventories, and others.

The most shocking: Atlanta Fed’s 1Q19 GDP nowcast – recently tumbled to just 0.5%. And while it is possible that consumers hit their maximum threshold of borrowing ahead of the holiday spending season, the growing refusal to service their credit card debts is an ominous sign of a nearing recession.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

Fails to mention that student loan debt exceeds credit card debt and is accelerating faster.

Wonder what it will be at the end of 1Q2019?