Guest Post by Eric Peters

ABS can only do so much.

After going gangbusters for the past several years, new car sales are skidding all of a sudden – and the industry might just end up in the ditch, again.

The reason for the power slide is easy enough to grok – the rising the cost of money – which is upticking alarmingly, if you’re in the market for a car.

About 14 percent of people who took out a loan on a new car last month are paying more than 10 percent interest – and the average interest rate is now well over six percent.

Which is higher than it’s been since – interestingly enough – about ten years ago.

Which was the last Time of Troubles for the industry, back in ’08.

People talk about the bailout, but that’s not really what has kept the industry afloat since then.

Low (and no) interest financing has worked like the injectable plastic and make-up embalmers use to make a corpse look like it’s just sleeping. They make it possible for people to buy more car than they can afford – and for government to impose cost-adding mandates that people think they’re not paying for.

It works like withholding. If you don’t see it, you don’t feel it. Or so the theory goes.

If there were line-items on new car window stickers listing the cost of every federal fatwa – plus a profit margin for the car company, which is part of what you’re paying for, too – people would notice and perhaps object. But the costs are folded into the overall price of the car – and the cost of that price is hidden, in turn, by low (and no) interest financing.

Thus, the average price paid for a car is now $36,534 – a number which ought to scare the skin off anyone who is tied to the car business in any way whatsoever.

Because of the other number.

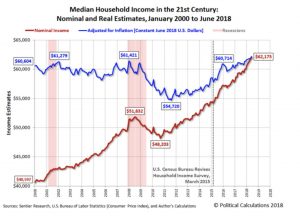

$61,891.

That is the current median household income in the United States. It is the gross – not after tax – median household income. And it is not after-mortgage/rent/utilities/food and Obamacare income, either.

Less federal and state taxes, mortgage/rent/utilities/food and Obamacare, the real median household income – the money available to spend on other things – is closer to $35 or $40k.

Even if half the people in the country were actually taking home $61,891 – and didn’t have to pay their mortgage/rent/utilities/food and Obamacare out of that sum – spending $36,534 on a car amounts to about 60 percent of their annual income.

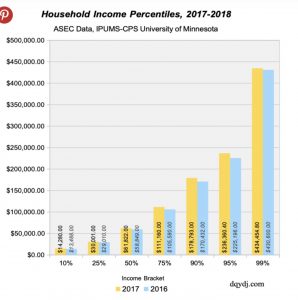

Much more for those making less-than-median income – which is half of the population, to the left of the median. The other half – to the right of median – makes more, of course.

But not enough more, as regards most of them.

Most home loans are kept to 28 percent or less of the borrower’s income. For car loans to be held to the same standard, the median household could not afford to buy a car priced higher than about $17,000.

Or – looked at another way – it would take an income of $130,000 to qualify for a car loan on a $36k purchase using the same standards mortgage issuers use for home loans. How many American households have incomes of $130,000 or more?

Fewer than 20 percent.

It is insanity – and it cannot be sustained – at least not without low (or no) interest financing – and that has apparently come to a screeching halt.

It has done so because of the inherently appliance-like nature of cars as opposed to homes and other things of enduring – or at least not axiomatically losing – value.

You stand a decent chance of building equity in a home. You are almost certain to lose the equity you put into a car. Put another way, the car loan not only leaves you with next to nothing to show for it at the end of it, you are now in the position of needing to take out a new loan.

And the new loan costs more now than the last one.

What will the next bailout be? Will Uncle “guarantee” – that is, subsidize/wealth-transfer – low (or no) interest rates on car loans, in order to prop up what has become an otherwise unsustainable business?

Perhaps owning a new car will become a “right,” like health care. The “logic” isn’t much different.

Doesn’t everyone, after all, deserve to have a car with eight air bags, automatic emergency braking, a direct-injected turbocharged engine and 10-speed transmission? Plus a 12-inch touchscreen and heated leather seats?

When the next crash comes – and you hear the sound of screeching tires and breaking glass – don’t blame the car industry. Blame Uncle – and people who can’t do elementary school arithmetic with regard to their personal finances.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

Eric, one of your best articles, good insight.

Recently, I was going to buy an old mid 70’s car / toy that was appreciating in value according to Hagerty.

Instead I bought a land in the country to add to what we have. At least the land can be kept in the family.

I wish people writing these articles would actually do the math. With an income of $61,000 and a combined Federal, state tax rate of 20%, that leaves you with $48,800. If we’re supposed to have $35, 000 left over, that leaves roughly $1,000 per month for mortgage, insurance, utilities, property tax, internet, auto insurance, and yes food.

That’s ridiculous.

Which probably explains the delinquency rates.

Bingo.

“Doesn’t everyone, after all, deserve to have a car with eight air bags, automatic emergency braking, a direct-injected turbocharged engine and 10-speed transmission? Plus a 12-inch touchscreen and heated leather seats?” Sheet, my car doesn’t even have power steering.

I figure twenty year loans for cars will be the next stupid thing.

Excellent assessment Eric, thank you. Your words of wisdom will fall on deaf ears I am afraid because the dumbed down Millenials and those Gen Z following know nothing else but budgetting on the ‘monthly nut’.

My book tries to educate our younger brethern to understand how all this works and hopefully they will be reading ‘The Financial Jigsaw’ here at TBP to supplement your great advice. We are already halfway through the book – wow, how time flies when you are having fun!

“Thus, the average price paid for a car is now $36,534”

Holy shit!

Bought my first BRAND NEW CAR in 1975 for $3,800 cash. OK, it was a Mercury Capri, really, but still ….

Considering the cost of new cars today, I might be able to sell my ’95 Buick Century for $10,000. Send me an email if you’re interested. It’s in near mint condition.

So us regular folks who can’t/won’t spend $34k wait until the model year changes or some light mileage repos show up and pay 1/2 the sticker!

There are incredible deals out there if you know what to look for.

Imports suck!

STUCK! STUCK! STUCK! STUCK! STUCK! STUCK! STUCK!