Authored by Charles Hugh Smith via OfTwoMinds blog,

It’s the list of workarounds – always growing, never shrinking – that’s telling us the true story of inflation in America.

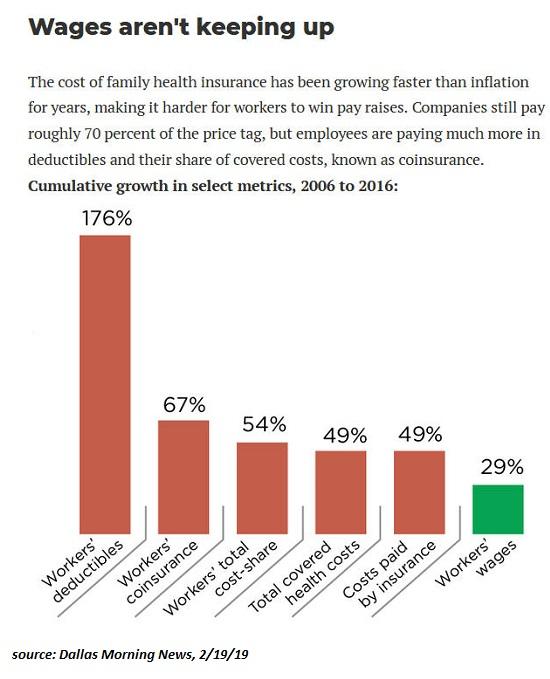

Today I’m publishing a guest post by writer Bill Rice, Jr., on “real inflation,”which as everyone knows far exceeds the “official” inflation rate of 2%. Bill and I corresponded earlier this year when he was researching and writing his recent article What Does Your Toilet Paper Have to Do With Inflation? Manufacturers have been engaging in “shrinkflation,” leaving consumers paying more for less, but stealthily. (The American Conservative magazine)

Bill’s extensive list of links (50 Dots…) follows his essay. Thank you, Bill, for sharing your insightful research with Of Two Minds readers.

‘Workarounds’ galore: How real Americans deal with ‘real’ inflation By Bill Rice, Jr.

While working on a story on inflation and shrinkflation, I quickly zeroed in on the concept of “workarounds” as an alternative, perhaps superior, way to gauge the true state of our economy. I define workarounds as the changes individuals or families (or businesses) must make in their daily living to adapt to a world of rising prices. If nothing else, these examples, taken in the aggregate, challenge the conventional wisdom that inflation is “low” or “contained,” or that the economy is just fine, thank you.

As decades have passed, the list of workarounds families have utilized to deal with rising prices has rapidly grown.

Women and mothers entering the workforce in massive numbers – the disappearance of families where one income was sufficient to maintain a “constant standard of living” – might be the earliest and most important workaround on my list. Other trends from this expanding list include:

Shoppers switching to less expensive store or private-label brands, families “substituting” hamburger or chicken for steak, buying from “value” menus, couponing, shopping at discount or “dollar” stores more often, buying in bulk to get the lowest unit-cost (think Costco), buying more items at yard sales or from Internet swap meets, “cutting the cord,” cancelling the land line, getting fewer haircuts per year, taking clothes to the dry cleaners less often, cutting out the maid service or paying for it fewer times each month, attending sporting events less often (here, here, here and here), going to the movies less frequently, playing golf or hunting less frequently, dropping out of country clubs and civic clubs, going to the dentist less often, cancelling newspaper and magazine subscriptions …

Cremation instead of burial, casual instead of (more expensive) “business” attire, eliminating or “rationing” prescription medications, moving from high cost-of-living states (or cities) to lower-cost-of-living communities, adult children moving back in with their parents (and aging adults moving in with their grown children), car-pooling and now “car sharing,” the growth of “do-it-yourselfers,” delaying or “reversing” retirement, taking on a part-time job … the list of “workarounds” goes on and on.

Americans have always resorted to workarounds to counter rising prices or help “make ends meet.” However, the list of necessary workarounds has “absolutely” been increasing Ron Paul told me, a trend he said is “going to continue to grow.”

As it always has, the market place has rewarded businesses that helped families save money.

Then again, lower prices do not necessarily equal a higher standard of living, a point made by John Williams, the creator of ShadowStats, the best known “alternative” measure of inflation.

To illustrate the difference between simply compiling prices without taking into account reductions in the quality of goods (or of “buying experiences”), Williams cited the example of his long-time tailor, who eventually had to close his haberdashery as customers fled to the mall and more affordable prices.

Yes, Williams could still buy clothes (in fact for a lower price), but the quality had diminished; so too had the level of service. The experience of acquiring clothes was not as satisfying or memorable. His question: Had he in fact maintained a “constant standard of living” by “substituting” suits from, say, JC Penney for the finer suits and richer experiences he had grown accustomed to?

Walmart assuredly saves consumers money. However, it also helped kill the downtown merchant, and with it our Norman Rockwellish memories of downtown America. “Self serve” killed the neighborhood “full-service” filling station, saving customers 40 cents a gallon on a fill-up, but also taking away our grandmother’s ability to get her tires and oil checked and her windshields cleaned on a regular basis (not to mention eliminating a popular first-time job for many males).

Netflix killed the neighborhood video store. Clothes that don’t require pressing, as well as employers allowing casual attire in the workplace, thinned the ranks of dry cleaners. iTunes largely killed the record store. Craigslist helped kill the (more expensive) newspaper classified section, expediting the slow death of the journalism industry. Barnes & Noble placed the independent book store on the extinction list, before Amazon threatened this same retailer.

Today, Uber is killing the taxi driver. Hulu and streaming video services threaten cable and the TV networks. TD Ameritrade threatens the traditional stock broker. Aldi (with its more affordable private label brands) threatens Kroger. Walmart, once unchallengeable, is today threatened by Amazon and Dollar General. People choosing to make their own turkey sandwich probably contributed to Subway closing more than 1,100 of its stores.

Most of these innovations/trends/changes kept CPI lower than it would have been otherwise, but did they actually allow people to maintain the same “standard of living” they enjoyed in prior years? Some innovations probably did; others probably did the opposite.

And how exactly did families from prior periods of time (often with just one income) afford to pay those full-service gas prices, or trade with the downtown hardware store instead of Home Depot?

Today it’s uncomfortable to think about, but in working on this story, a question I’d never thought about suddenly occurred to me. Namely, how did so many middle and upper-middle class families (families with just one income from the “poor” South) actually afford the full-time domestic “help” depicted in the movie and book of the same title?

Was everyone richer back then? Or is inflation higher today? Or, in “real” terms, is it possible the answer is “both?”

Labeled by Ron Paul as the “cruelest tax,” inflation is not a trivial topic, especially for the poor and those on fixed incomes. Even if people manage to “get by,” their new “standard of living” cannot be described as improved, superior or welcome.

Yes, the “Ten Percent” are doing better than ever, but is this really the case for the bottom 50 or 60 percent? If real standards of living were rising would it be this easy to identify so many “workarounds?”

All of these workarounds and business trends have been noticed. Details have been provided in journalism, academic papers, books and seminars.

What’s missing from much of this coverage is any effort to connect all the dots. That is, for some reason, the elephant in the room is too often ignored. The “elephant?” Practically every trend mentioned above shares one common antecedent – prices that, in the minds of consumers, had become unaffordable.

Perhaps we never pause to add up all the workarounds we are using. We might think about our decision to drop out of the civic club (and save on those membership dues), but we don’t tally up the other 10 changes we made for the exact same reason. If more people did this, inflation might become a bigger political issue than it is.

In fact, this might already be happening. In a country where so many people are forced to employ so many workarounds to make ends meet, politicians of a certain ideological bent might see a grand opportunity. In such a nation, for example, one might see a surge in presidential candidates suddenly espousing more liberal or even socialist “solutions.”

At least at the micro level of the economy, families are increasingly forced to deal with a reality they’ve been told is not a reality. Today’s economic conventional wisdom tells us that rising prices are no big deal. Indeed, we’re told what the economy really needs is more inflation.

But in a country where 46 million Americans rely on charity food banks to supplement their food intake, and 42 million qualify for food stamps, and millions more Americans are forced to max out credit cards to purchase necessities, do we really need higher prices?

Another trend I identified was the proliferation of payday and title loan businesses. Montgomery, AL (population 200,000) has nearly 100 such businesses, according to one city councilman. (By way of comparison, the city has 11 McDonald’s restaurants.)

One council member proposed an ordinance to limit the growth of such “stores.”

“If you see 18 of them on a main thoroughfare going into our city, it makes you think that the people who live around here must be desperate,” he said.

Well… yes. Apparently providing “quick cash” is another workaround created by entrepreneurs to serve (some say exploit) “desperate” people.

In researching this topic, I read dozens of stories on inflation. I also read the Reader Comment sections that followed these stories. As a measure of “Man on the Street” sentiment, these message boards were often more illuminating than the articles proper.

While Fed governors, academics and the business press declare that inflation is “low” and “contained,” real, live Americans are calling BS.

If one is seeking to determine whether inflation is a bigger deal than we are being told, simply read the Reader Comments. And then add up all the changes Americans have been forced to make in their lives to keep up with rising prices.

At least in my opinion, it’s this list of workarounds – always growing, never shrinking – that’s telling us the true story of inflation in America.

Bill Rice, Jr. is a freelance writer in Troy, Alabama. He can be reached at [email protected].

Connecting 50 dots…

Do headlines, presented in aggregate, reveal a story that’s not being fully told?

The 50 headlines listed below support the thesis that – perhaps more than ever – families and individuals must adopt “workarounds” to deal with rising prices and an economy that may not be as robust as portrayed in the media. The list is not comprehensive. Others can certainly identify trends or workarounds not immediately identified by the author. (Research by Bill Rice, Jr.)

Women enter workforce…

“Women enter workplace in massive numbers, death of 1-income family” (source)

Private label and store brands…

“Surge in customers buying Private Label brands described as retail ‘revolution’”(source)

Chicken, it’s what’s for dinner…

Chicken vs. Beef Consumption Comparison 1960 to 2018 – Chicken catches, blows past beef (source)

“2014: (Cheaper) Chicken more popular than beef for first time” (source)

Couponing…

“Coupon use (traditional and digital) soars, trend expected to grow” (source)

Shopping at ‘discount’ stores…

“Dollar General now has more stores than McDonald’s” (source)

Buying in bulk…

“Costco crushed it in 2018” (source)

‘Value’ menus…

“Fast food prices are rising, but so are deals” (source)

Yard sales, Swap meets…

“Why an old-school tradition is more popular than ever” (source)

“550 million people visit formal ‘buy-and-sell’ Facebook Groups each month” (source)

Cutting the cord…

“Cord-cutting keeps churning, 33 million people abandon pay TV in 2018” (source)

Cancelling the landline…

“Most households have given up the landline” (source)

Fewer haircuts…

Number of people getting 4 or more haircuts a year declines by 10 million (59 million in 2018 compared to 71.X million (?) in 2011) – Statista chart (source)

Using dry cleaners less often…

“In Illinois: Dry cleaning establishments decline by 50 percent over last 20 years”(source)

Declining attendance at sporting events…

– NFL:

“Empty seats galore at NFL games” (source)

– College Football:

“The Growing Problem of College Football Attendance” (source)

– MLB:

“MLB attendance down 4 percent” (source)

– NASCAR:

“NASCAR, Daytona numbers continue to sag” (source)

Movie theater attendance…

“Domestic movie theater attendance hit 25-year low in 2017” (source)

Golf anyone?…

“Why are we playing less golf?” (source)

Hunting …

“Hunting participation numbers continue to drop – and it’s a sorry situation” (hunters drop from 18 million to 10.5 million) (source)

Country club memberships…

“Money-losing country clubs adapt to changing times” (source)

Civic club memberships…

“Are service clubs dying?” (Rotary memberships decline by 70,000) (source)

Dentist office visits…

“Survey: More Americans want to visit the dentist (but visits drop by 4 percent)(source)

Cancel my subscription…

“Paid circulation at newspapers declines by 11 percent in 2017” (source)

“Time was giving magazines away for free” (source)

Slow death of newspaper industry …

“Newspaper crisis is growing: More than 1 in 5 local newspapers have closed since 2004” (source)

Homeschooling…

“In 16 states studied: Homeschooling grew by 25 percent in 4 years” Note: I deleted this one from story for for space reasons. (source)

Cremation over burial…

“Why is cremation becoming more popular in the U.S.?” (Growth described as ‘astronomical’) (source)

Casual is fine…

“Why Americans now dress so casually?” (source)

Voting with feet, plenty of Americans are moving out…

Cities:

“41 percent of New Yorkers say they are going to leave” (source)

States:

“Why are so many people moving out of the Northeast?” (source)

Rationing or eliminating prescription medications…

“How to pay less for your meds?” (source)

Moving back in with parents (or parents moving in with children)…

“More than 1/3 of young adults live at home (up from 26 percent)” (source)

“Aging adults moving in with children” (source)

Car pooling…

“Car pooling on the rise again?” (source)

And now car sharing…

“The big trends shaping the future of the car-sharing industry” (source)

Do It Yourself (DIY)…

“Why the huge do-it-yourself market is just getting started” (source)

Delaying retirement…

“More than half of 60-somethings say they are delaying retirement” (source)

Reverse retirement…

“Many retirees (one third) are going back to work” (source)

Part-time employment…

“America’s part-time worker problem is permanent, San Francisco Fed says” (source)

“More Americans need a second job to make ends meet” (source)

Making our own sandwich…

“Subway closed 1,100 restaurants in 2017” (also: 500 more in 2018) (source)

Self-serve took Gomer’s job…

“‘They’re like dinosaurs:’ But at least one full-service gas station still exists” (source)

Deflation fears… Wanted: More inflation

“Why is deflation a Central Bank’s worst nightmare?” (source)

Do we really need higher prices?…

“Feeding America serves 46 million people” (source)

“Food Stamp recipients number 42 million in 2017” (source)

“Credit card balances at all-time highs” (source)

Payday, title loan stores proliferate in many states…

“Payday lending has blossomed over past 20 years” (source)

“Number of Americans who took out title loans doubled in recent years” (source)

“Councilmen seek moratorium on payday lenders” (source)

* * *

If you found value in this content, please join me in seeking solutions by becoming a $1/month patron of my work via patreon.com. New benefit for subscribers/patrons: a monthly Q&A where I respond to your questions/topics.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

Make your own popcorn: 1/4 cup olive oil + 3/4 cup popcorn in deep pan, cover – then cooked on stove set to “high”. When done, lightly dust with sea salt.

Make your own french fries: Preheat oven to 400 degrees. Long cut potatoes & place into pan or glass baking dish. Apply olive oil liberally to cut potatoes, season with sea salt and/or Lowry’s, and dill weed. Lightly cover dish with tin foil, cook for 20 minutes, stir potatoes (bottom to top), and cook for another 2o min (or longer without tin-foil of you like your all-natural fries more crunchy)

Replace the soda-pop: with homemade tea sweetened with honey.

Make your own veggie/chip dip: 1/2 mayo + 1/2 sour cream + dash of Lowry’s & Dill weed

Make your own tarter sauce: 2/3rd’s mayo + 1/4th sweet pickle relish

Regarding making fries;

BEFORE putting them in the oven …. boil water, throw in the potatoes for two minutes. Remove and cool over running cold water.

What does this do? It makes them really really crispy. Saw this on a TV show, and they even explained the science behind it — which I have forgotten. But, I tell you this, it truly produces the crispiest fries.

Also potatoes should be soaked in salt water about 10 minutes after cutting to help remove starch before boiling, before frying or putting in oven.

Still have your tips for making the best hashed browns for brekky.

And bone broth soups.

And the latest research on preventing Old Timer’s disease, or Alzie’s.

You research expertly.

There. Appreciation stated.

There’s certainly many more of your great contrib’s, but, only known you for a couple of years here.

-It’s why I like the retro-posts that occasionally get posted, where you were active.

I’ll respectfully abstain to mention the occasional times the ridicule from a dickhead emerges.

Nobody bats 1000. Even Babe Ruth struck out a few times, and hit numerous foul balls, sure.

When in the right frame of mind, the core good in all of us shines through.

When in the wrong frame of mind, we do and say things that reflect our irritable alter egos.

For really yummy popcorn use coconut oil instead of olive oil.

You have to be careful with honey. Most grocery store honey has very little (if any) honey in it these days.

My advice is to check online for information on the company producing the honey. Much of it is high fructose corn syrup, extremely bad for you.

ummm, honey is WAY more expensive than sugar in your tea, if you want to be cheap be cheap don’t use it as a disguise for being healthy or “green”.

Honey is a better sweetener health-wise than any sugar. Refined sugar is the worst thing you can put in your body. It encourages diabetes and fuels cancer. Unrefined sugar, called Sucanet, which still has the molasses in it, is healthy for you. I use that whenever I need to use sugar. I use honey in my coffee daily.

One more thing is the complete lack of standards for clothing sizes. No exaggeration, I have shoes that range from size 7-1/2 to 13. If I order an identical pair to one that fits perfectly, it will be too big or too small. When I was a kid 50 years ago, the salesman measured your feet and the shoes he brought out from the back room would fit almost every time. Same with pants and shoes. What a crock.

For a price-only measurement of inflation, check out the Chapwood Index. Instead of using government-provided (fake) data, it actually looks at the real cost of things that people buy. The numbers are pretty surprising.

There are no standards for condom sizes either. Very frustrating when even XXL doesn’t fit.

Worried about your hand catching a disease?

Stucky:

Pffft…that made me laugh out loud….

That’s because shoe sizes differ in the U.S., the U.K., Europe and Asia. Your shoe size will depend on from which country the shoe was manufactured and imported. If you look at the sizing label on your shoes, you will notice different sizing for different countries.

Articles like this one make me want to smack my head into the keyboard; the continual erosion of the “value” of our “money” is evident, and yet, it remains a target of the Fed to maintain a 3 percent rate of inflation – so, every year, the value drops another 3 percent? On purpose?

alskekdkfnboi mseiobj;pmadlpkse ;vnisroj af;ojnsevanbiope vgteh

Costco has nailed it. They have high quality merchandise – meat / vegetables / dairy – for 1/3 to 1/2 the price of many supermarkets. Additionally they discount their gas 4% – if you drive to work – the discount on gas alone pays for the membership.

Also, they have rotisserie chickens for $5 / apiece. That will feed a meal or two to a family of four (with no football players included). My wife is a constant fan, usually at least one a week goes on our table. The scraps left after the breasts, legs and wings are eaten are usually enough to add to / supplement Rice-a-Roni and give it the heft of a one-dish casserole.

Nowadays we can’t find RAW whole chickens for $5 each. That should tell you something about supermarket prices, and markups in grocery retail are supposed to be rather small.

Back in the 70’s I worked as a heavy equipment mechanic making around $10.00 / hr. The job came with free health insurance, no deductibles, vacation, sick time, etc. A new car cost around $3000.00, a decent house 20K. I didn’t go to trade school, we had something known as “on the job training”. Today that job pays twice as much but stuff costs 10X what it did then. Considering the benefits I probably had the purchasing power of a 75.00 an hour paycheck. I’m glad I’m an old guy now.

I love crispy French fries. Used to eat them all the time. Not so much now as I now have heart disease. I still seek out and get a burger and fries every now and then. I love sweets . I love Mountain dew sugar water. I love ice cream. I love all the wrong shit. It’s hard as hell for me to eat healthy and I don’t like it.

BB, there is no reason to give up your beloved burger and fries. Regardless of what the news media tells you, saturated fat is healthy for you. ( I recommend Dr. Mercola’s website on the subject.) It’s what our ancestors lived on, before cancer and diabetes became epidemic. Use organic grass-fed meat to make the burgers and fry on a low heat. The fries should be set in salt water for 10 minutes, boiled about 10 minutes, then baked or fried in lard – yes, lard, a healthy fat – under low heat until golden brown. Our ancestors lived on saturated fats. It wasn’t until vegetable oils became predominate that heart problems became prevalent from ingesting cooking oils. Vegetable oils should never be heated.

Also a process known as “medical tourism” has become popular in America. The U.S. has the highest cost medical and health care of any other nation. So when someone needs surgery or any other medical procedure they will book a flight to a foreign country to have it done at a fraction of the cost.

I was recently relieved of a back molar. The bridge needed to fill the gap would cost $4,500. A dental implant would cost the same. I asked the dentist why so much? He claimed overhead. I claimed bullshit and am chewing sans tooth, albeit a bit more slowly.

I’ve always been frugal and I’ve enjoyed making stuff that I could easily buy. I sew, cook, clean my own house and yard, I make soap, yoghurt and bread. I quilts and in my spare time I comment on TBP

Being frugal was natural to me growing up. We didn’t have a lot of money because my parents divorced and it left little money for any type of luxury. Making things yourself, cooking yourself, etc. became the norm. I continue that to this day.

NEWS FLASH!!

2 Aircraft Carriers Have Left Port – Are The USS Eisenhower And The USS Roosevelt Headed South Toward Venezuela?

http://theeconomiccollapseblog.com/archives/2-aircraft-carriers-have-left-port-are-the-uss-eisenhower-and-the-uss-roosevelt-headed-south-toward-venezuela

I sure hope not.

The immigration problem will solve itself if this keeps up.

Not if they make their countries shittier even faster than we make our country shittier.

Anybody else notice that a 5 pound bag of sugar now only has 4 pounds of sugar in it? And a half gallon ice cream container only has a quart and a half. And the hotdogs we like have gone from 10 in a package, to 8, to 7, and now they’re down to 6.

buy bluebell ice cream on sale you still get a full half gallon and the sale price is usually $4.44

Ice cream is extremely unhealthy. I wouldn’t eat it if it were free of charge.

I make some “ice cream” on vitamix using frozen fruits. There are some receipts on vitamix.com.

Scientists recently announced that eating kale doesn’t make you live longer. It just makes it seem longer until you get to die.

This is called “shrinkflation” dear. It is a deception to make the consumer think that the price i.e. inflation is not going up.

It seems I see inflation every week at Kroger. Every couple of months, the dog food and cat food I use goes up about $1. And that’s just food for the pets.

Edit: Before long, I’ll have to start shooting squirrels.

The Real question should be…. just who received those dollars inflation took from the working people? Both government workers and bankers via credit cards. And ultimately those same bankers will repo all those homes with a mortgage. It’s an old, old story and we the people still fall for it.

That was a great article.

It all comes back to the real elephant in the room…the currency.

Fix the money, and affordable commerce should follow. Too late.

In the 50’s, the single breadwinner had already started bitching about rising prices.

So, it’s been happening here since 1913.

The cycles are picking up speed, like a cyclone.

Lot of destruction being left in its wake.

Federal Reserve Banksters. Robbing us blind, because the blind can’t see it. Stealth inflation.

Death by a thousand cuts. Slowly, to avoid rebellion. Yet very effective. The results are obvious.

Let those with eyes be able to see, and ears be able to hear; with brains, able to understand.