The Fed loves to tell us how necessary and vital inflation is for economic prosperity, but in the case of midtown Manhattan’s “prime” retail real estate, it is doing nothing but helping cause once extremely prominent shopping areas to become the very same “ghost towns” they turned into during the 2008 housing crisis. Mayor DeBlasio’s asinine solution to this issue created in part by faulty government policy? More government and more regulation. So much for the recovery.

As if brick and mortar retail didn’t have enough problems to deal with being methodically decimated by the ever growing behemoth that is Amazon, store owners are now facing rent that is simply so high that it makes it prohibitive for them to open retail shops and do business in once prominent areas of downtown Manhattan.

On Saturday, the New York Post wrote an article confirming our writeup from late March – that these high prices were driving businesses out of town:

If you want to see the future of storefront retailing, walk nine blocks along Broadway from 57th to 48th Street and count the stores.

The total number comes to precisely one — a tiny shop to buy drones.

That’s right: On a nine-block stretch of what’s arguably the world’s most famous avenue, steps south of the bustling Time Warner Center and the planned new Nordstrom department store, lies a shopping wasteland.

It shouldn’t come as a surprise to anybody that Amazon and other online retailers have had a profoundly negative effect on traditional brick-and-mortar retailers. This is the narrative that has been playing out for the last couple of years as we have watched retail stocks like Sears, JCPenney and Macy’s get destroyed while online shopping names have performed extraordinarily well.

But what may come as a surprise to some is the fact that the constant need to keep prices of real estate and rent rising, regardless of traditional supply and demand, is exacerbating things to a degree where some of the most sought after real estate in the world has now become deserted and barren. The article continued:

The same crisis blights the rest of Manhattan. The people invested in storefront retailing — real-estate developers, landlords and retail companies themselves — tell us not to worry. It’s a “transitional” situation that will right itself over time. Authoritative-sounding surveys by real-estate and retail companies claim that Manhattan’s overall vacancy is only just 10 percent.

But they are all wrong. Bricks-and-mortar retail is shrinking so swiftly and on such a wide scale, it’s going to require big changes in how we plan our new buildings and our cities — although nobody wants to admit it.

…

And yet, it’s scary to think that one of the city’s great pleasures, window-shopping — which also ensures vibrant, crime-deterring sidewalk life — will become a thing of the past except at certain locations.

At this rate, we face a future where streets will be mostly dark at sidewalk level for miles on end. Third Avenue in the East 60s, Broadway north of Lincoln Center, many blocks in the supposedly thriving Meatpacking District are halfway there already.

What is Mayor DeBlasio’s solution to the problem of rising rents as a result of government policy? More government, of course! He wants to actually fine landlords who keep spaces empty until they fine tenants. Talk about the blind leading the blind:

Few retailers can afford to pay more than $250 per square foot annually in rent — yet landlords persist in asking $400 a square foot and up to $2,000 a square foot in prime zones like Fifth Avenue and Times Square.

Mayor de Blasio wants to fine landlords who keep spaces empty until they find tenants who’ll pay astronomical rents. But there’s no fair way to judge who’s actually guilty. Would he punish the owners of the small corner building at 1330 Third Ave. at East 76th Street, who slashed the “ask” from $420,000 a year in 2016 to $360,000 in April 2017 and still can’t find a tenant?

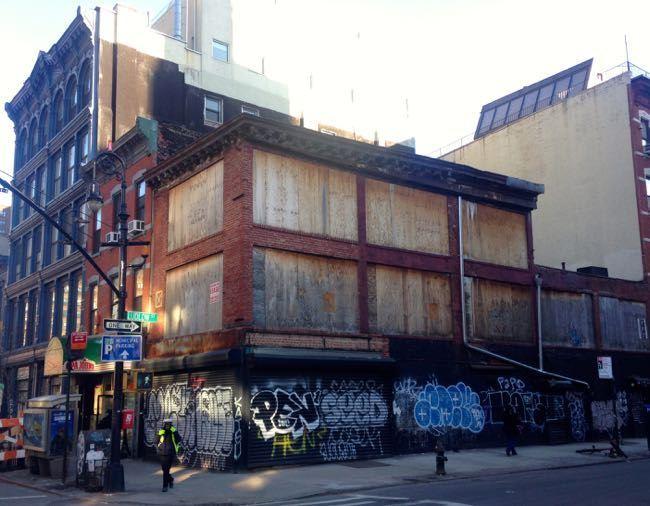

Of course, this really comes as no surprise to us, because in late March of this year we recalled our own 2009 tour of Madison Avenue to discover that it also had turned into a ghost town. Just a week ago we told our readers that the ghost town that was New York’s “Golden Mile” was not surprising: after all the US economy had just been hit with the worst recession since the Great Depression, and only an emergency liquidity injection of trillions of dollars prevented a global financial collapse.

What is more surprising is why nearly 9 years later, at a time of what is supposed to be a coordinated global recovery, a walk along Madison Avenue reveals the exact same picture.

And aside from us and the New York Post, Starbucks CEO Howard Schultz also noticed the disturbing trend, stating at the company’s Annual General Meeting:

Now, as a result of what we’re witnessing, we’re also seeing something else and that is, there is a proliferation around the country right now of empty storefronts. We took a walk in New York two weeks ago from 59th street to 79th on Madison Avenue, and we lost count of how many empty storefronts there were in Manhattan. It reminded me of the cataclysmic financial crisis in 2008. But what’s happening is very simple, the rent structures for the last 5 to 10 years, have been rising at historic rates and retailers do not have the amount of customers they had during these last 5 to 10 years and could no longer economically survive.

So they’re closing stores and as a result of this, I can promise you just like I predicted in 2014 that rents are coming down and landlords are going to have to get religion, or else their stores are going to stay empty. And we’re already beginning to see a different level of reception in terms of what we believe the cost of occupancy should be. And this is going to bode extremely well, specifically for us. We’re adding almost 700 new Starbucks stores a year. And so we are going to take full advantage of the economic reality of this situation. And as we go forward two, three, four, five years out even though labor is going up in terms of cost of labor, we believe rents are going down and the economic model of Starbucks is going to be enhanced as a result of this macro situation. And we’re just at the beginning of this trend.

So the hilarious irony of Keynesian theory once again rears its ugly head as New York’s current retail apocalypse and prime real estate exodus has, in effect, caused some of the most traversed city streets to look like they did during the financial crisis of 2008 once again.

This is the result of what happens when you engineer a recovery, instead of letting the free-market recover on its own: you get a recovery that isn’t really recovery. The Fed and the media have always been able to duck behind the outperforming stock market as a false indicator of the health of the economy as a “scorecard” for the recovery. But with the market now topping out and reaching levels of significant volatility, and the March jobs number handily missing expectations, how can the Fed justify that their policy continues to make sense when it is putting a good portion of Manhattan into the very same shackles and chains it was in during the crisis we are “recovering” from 10 years ago?

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

The odd thing is that a lot of developers keep pushing the status quo of yesterday building commercial centers almost entirely around storefront retail.

There is a center not far from my home that was built about a decade ago with many storefronts that still don’t have anything in them. It’s a lifestyle center because there is a movie theater and some restaurants, but don’t kid yourself – it’s an outdoor shopping mall.

Ten years ago maybe the writing wasn’t on the wall regarding Amazon but today? I know of several developers doing new retail all over the country. I’m not sure the economy will hold long enough to flip those properties. After all, that’s what it’s about. Develop something and sell it quick. We are in a massive commercial real-estate bubble that’s ready to blow.

There’s exactly a place like this in a suburb of Minneapolis – St Louis Park:

Just beyond West End’s restaurant row, a steady stream of moviegoers head in and out of Showplace Icon Theatres. But on the other side of the theaters, the hum of activity abruptly falls off. It’s 6 p.m.—most stores won’t close for another three hours, but they look to be done for the night. (Sometimes, it looks that way at noon.) A handful of women wander around Anthropologie and Evereve. Directly across the street, a string of four storefronts stands empty. As you walk south, the vacancies seem to outnumber the stores. The frozen yogurt place didn’t last. Charming Charlie closed last year after the company declared bankruptcy. Kittsona, a Fargo-based boutique chain, closed physical stores outside of North Dakota earlier this year to focus on e-commerce. But the recent exit that has sales associates throughout West End talking is lululemon, an original tenant and one of those magnetic brands every commercial developer knows will draw a crowd. When lululemon leaves, there’s got to be cause for concern.

A 20,000-square-foot box at the southern end has never been filled. Its vacancy rate hovers at 21 percent, according to the most recent Cushman & Wakefield retail study; the overall Twin Cities vacancy rate was 9.4 percent at the end of 2018. The only west metro mall in worse shape is Southdale Center, at 23 percent.

Indisputably, Shops at West End is a victim of bad timing. Post-recession, retail has only become more nuanced. That aside, it’s easy to look back on mistakes that were made in building a 350,000-square-foot lifestyle center on spec: Inconvenient parking, bad sight lines, restaurants concentrated at one end with nothing to draw shoppers down the sidewalk.;

Even more challenging is figuring out how to fix it.

http://tcbmag.com/news/articles/2019/may/shops-at-west-end-right-place-wrong-size

The Shops at West End is the exact development I was referring to. Developed by Duke Realty and flipped soon as the economy recovered. It should’ve never been built, like most retail centers in the past 20 years. Drive by it every time I go to Costco. Have not stopped at even a restaurant in there in over 5 years.

If I hear the term “live, work, play” from another asshole on our city council, I’m going to explode. NOBODY who works there can afford to live there and there is only so much there to “play” at. Just more central planning by government with the belief that THEY somehow know better how the world should work that tens of thousands of independent consumers exercising their INDIVIDUAL choices over time. Such arrogance.

Most of the shopping centers in the Chicago area went bust decades ago..The only ones surviving are on the North Shore, one of the wealthiest areas in the Midwest, and I don’t give them more than 15 years…

Doesnt it seem so obvious? If the price of the building is so fucking high that there is no possible way to pay the rent from sales, then what the hell can you do? Print more money I guess. That’s all they’ll ever do, until a horde of angry masses mows em down.

DeBlowMeO is Amerika’s equivalent of Maduro …. only even more corrupt and five times dumber. I suspect he has a good chance of becoming POTUS.

Did you know he wants to outlaw glass skyscrapers in NYC?

Did you know the nuclear power plant which supplies a significant portion of electricity to NYC will be shut down this year. And there’s no replacement? Did you know that he is preventing ANY new natural gas lines from coming into the city? Maybe NYC can get its power from homeless people farts?

NYC will become a total 3rd world shithole within the next decade.

Most urban centers are either already third world shitholes or rapidly heading there. I can’t think of any that aren’t.

The movie Escape From New York has turned out to be prophetic…

Smoke and mirrors of the propagandists cannot hide the concrete reality of a simple walkabout with camera.

Refreshingly horrifying.

New Yorkers -Manhattanistas – more than anyone (other than Silicon Valley technopirates and Hollyweirders), deserve to have a cataclysmic implosion of the stratospheric values to their real estate holdings.

Also, NYC has been taken over by aliens and minorities who don’t have the cash or inclination to buy at such ridiculously expensive retail stores….Minorities will eventually destroy NYC’s shopping areas, just as they did in Chicago..