Authored by Lance Roberts via RealInvestmentAdvice.com,

The $70 Trillion Dollar Graveyard

On Thursday, Congress passed the spending bill we discussed last week:

“A divided House on Thursday passed a two-year budget deal that would raise spending by hundreds of billions of dollars over existing caps and allow the Government to keep borrowing to cover its debts, amid grumbling from fiscal conservatives over the measure’s effect on the federal deficit.

65 Republicans joined the Democratic majority in the 284-149 vote, with 132 Republicans voting against the bill, despite President Trump’s endorsement and pressure from key outside groups, including the Chamber of Commerce, to avoid a potentially catastrophic default on the Government’s debt.”

I highlighted the last sentence in red because it is an outright “LIE” used to convince Americans that out of control spending must be done.

The reality is that “interest payments on the debt” are part of the MANDATORY spending in our budget along with social security, medicare, etc. Currently, about $0.75 of every dollar of tax revenue goes to mandatory spending. For the last few months the Government has been at its statutory debt limit, and “surprise” we didn’t default on our debt. Why? Because there is enough revenue currently coming in to cover the mandatory spending.

As I noted specifically last week,

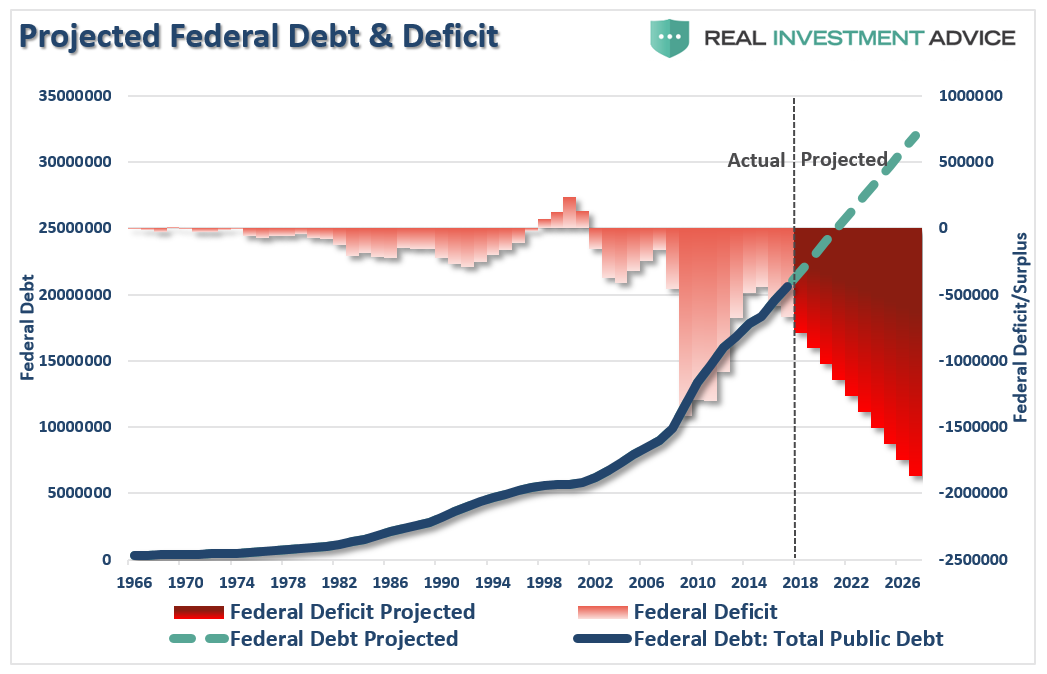

“In 2018, the Federal Government spent $4.48 Trillion, which was equivalent to 22% of the nation’s entire nominal GDP. Of that total spending, ONLY $3.5 Trillion was financed by Federal revenues, and $986 billion was financed through debt.

In other words, if 75% of all expenditures is social welfare and interest on the debt, those payments required $3.36 Trillion of the $3.5 Trillion (or 96%) of revenue coming in.”

Do some math here.

The U.S. spent $986 billion more than it received in revenue in 2018, which is the overall ‘deficit.’ If you just add the $320 billion to that number you are now running a $1.3 Trillion deficit.

The U.S. will not default on its debt.

This is particularly the case since we no longer have any budgetary controls.

Importantly, the spending increase of $320 billion is on top of the annual 8% automated budget increase and the preexisting deficit. My original projection above is too conservative by $500 billion, or more.

But that’s not the real story.

The crux of that article was focused on the roughly $6 Trillion of unfunded liabilities of U.S. pension funds which Congress is now drafting a piece of legislation for entitled the “Rehabilitation For Multi-employer Pensions Act.”

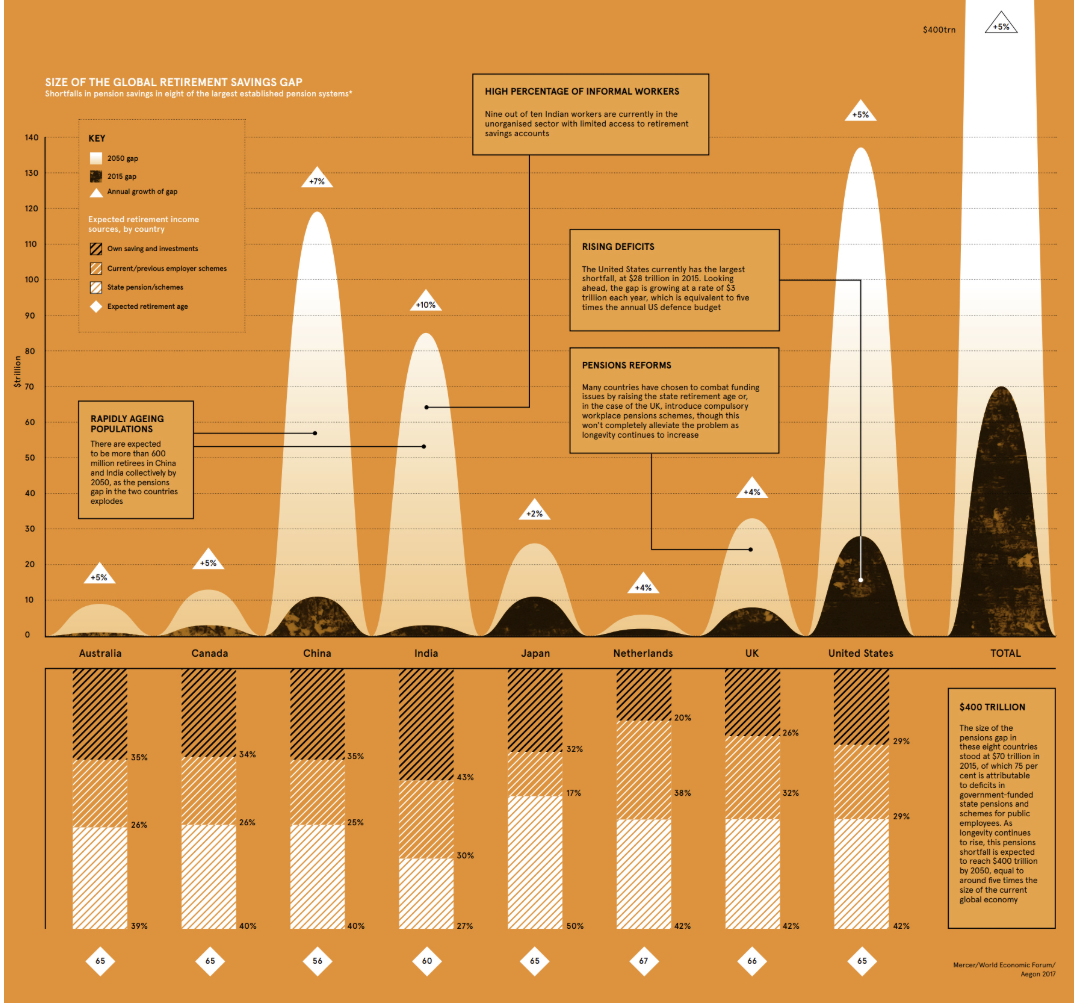

As noted in that article, while Congress is preparing a bailout for U.S. pension funds, there is a $70 Trillion pension problem globally which is not being addressed.

“According to an analysis by the World Economic Forum (WEF), there was a combined retirement savings gap in excess of $70 trillion in 2015, spread between eight major economies…

However, this isn’t the $70 Trillion graveyard we are addressing today. From CNN:

“America’s debt load is about to hit a record. The combination of cheap money and soaring debt helped fuel the decade-long economic expansion and bull market, but America’s gluttony of loans could work against it if its fragile economic balance shifts.

In the first quarter of 2019, the United States’ total public- and private-sector debt amounted to nearly $70 trillion, according to research by the Institute of International Finance. Federal government debt and liabilities of private corporations excluding banks both hit new highs.”

Oh…you are talking about THAT $70 Trillion.

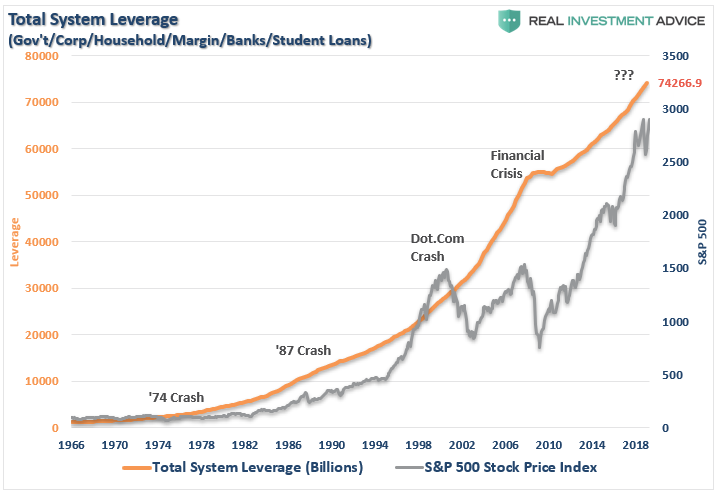

The chart below is Total U.S. Credit Market Debt (including Student Loans) which is currently running just a smidgen over $74 Trillion.The last time there was even a hint of deleveraging was during the “Financial Crisis.”

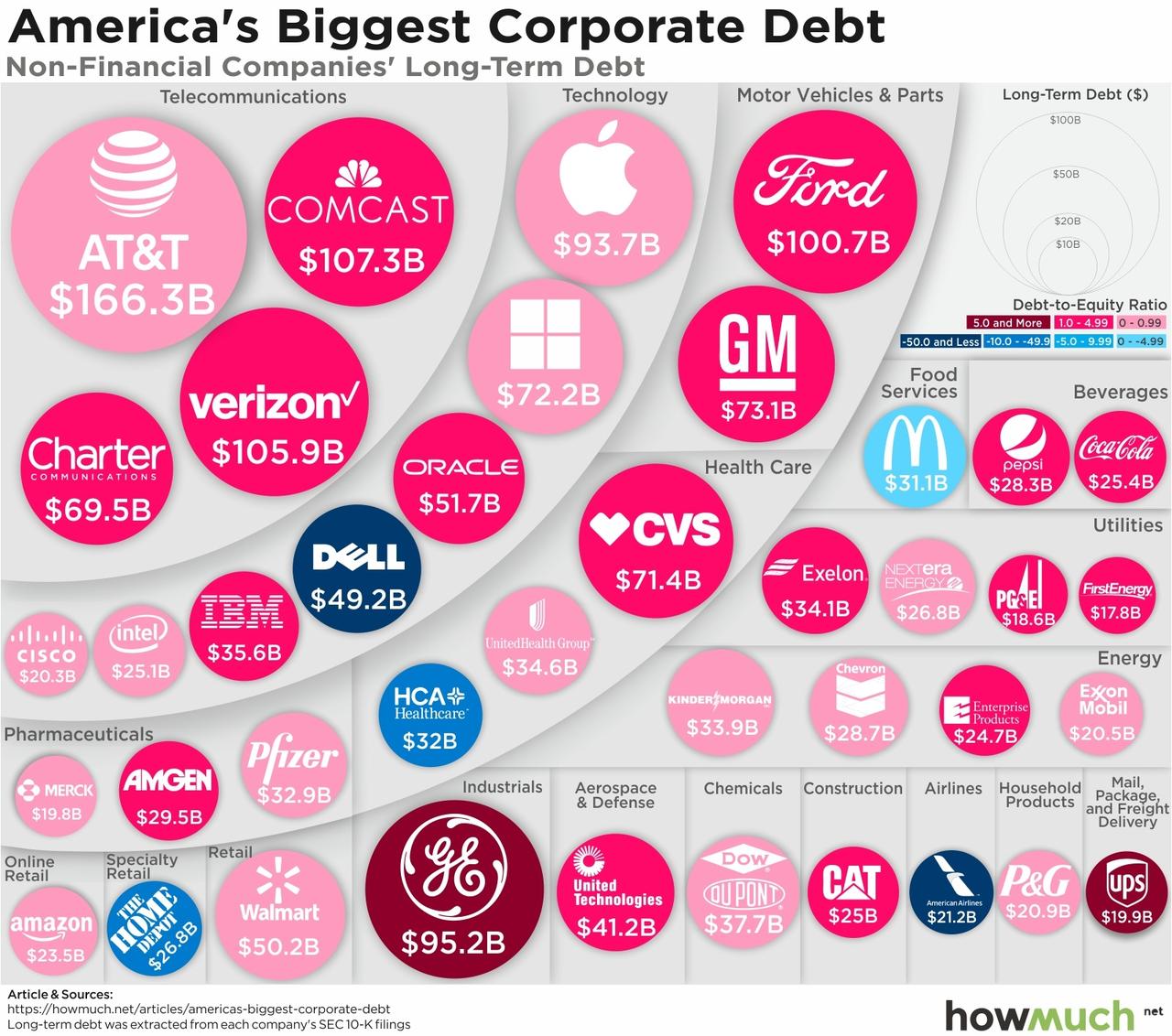

Corporate debt is a problem.

The wonderful website “HowMuch” put the corporate debt bubble into a graphic to help us visualize the potential for widespread defaults during the next economic and market downturn.

The problem with corporate debt is the amount of debt which is at risk of default during the next economic recession. (This isn’t an “IF,” it’s a “WHEN” statement.)

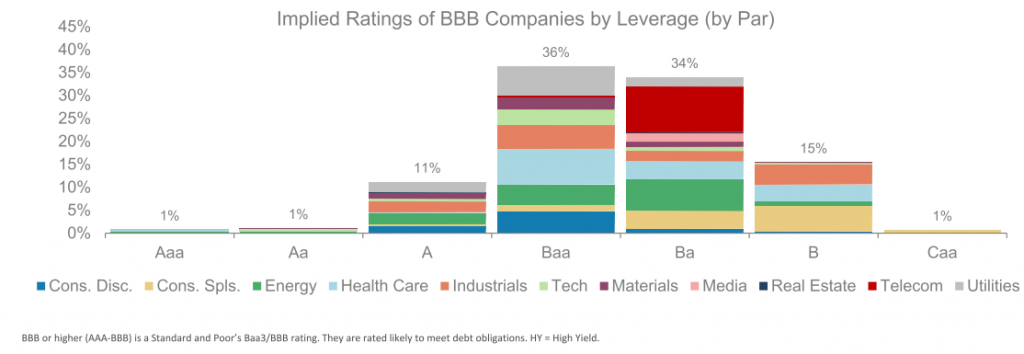

Let’s start with a note from Michael Lebowitz:

“The graph shows the implied ratings of all BBB companies based solely on the amount of leverage employed on their respective balance sheets. Bear in mind, the rating agencies use several metrics and not just leverage. The graph shows that 50% of BBB companies, based solely on leverage, are at levels typically associated with lower rated companies.”

“If 50% of BBB-rated bonds were to get downgraded, it would entail a shift of $1.30 trillion bonds to junk status. To put that into perspective, the entire junk market today is less than $1.25 trillion, and the subprime mortgage market that caused so many problems in 2008 peaked at $1.30 trillion.Keep in mind, the subprime mortgage crisis and the ensuing financial crisis was sparked by investor concerns about defaults and resulting losses.”

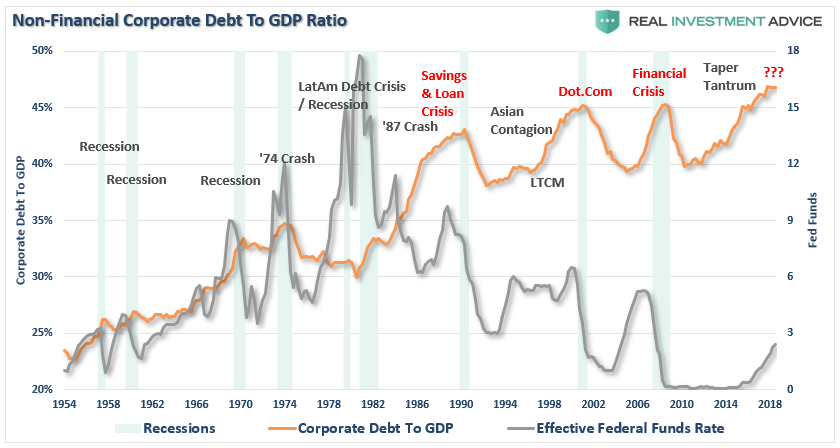

The reason BBB-rated debt is so plentiful is due to the Fed’s ultra-low interest rate policy over the last decade. Near zero rates, and easy credit terms, has seduced companies into taking on debt to fund operations, dividends, and stock buybacks. The consequence is we are now seeing corporate debt exceeding the levels of the global financial crisis.

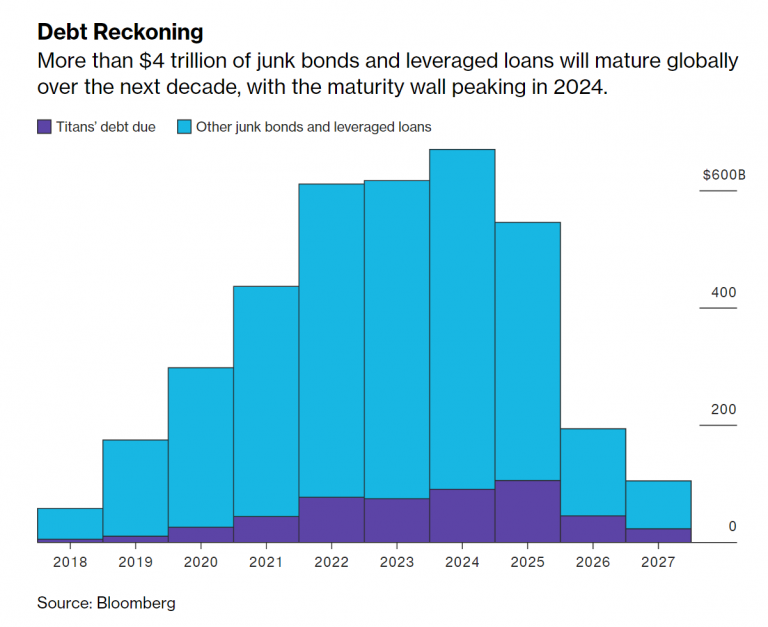

The real risk is that over the next 5-years more than 50% of the junk-bonds and leveraged-loans (which is sub-prime debt for corporations) is maturing and must be refinanced.

Let that sink in for a minute.

A weaker economy, recession risk, falling asset prices, or rising rates could well lock many corporations OUT of refinancing their share of this $4.88 trillion debt. Defaults will move significantly higher, and much of this debt will be downgraded to junk.

But it isn’t just corporate debt, that’s a problem.

Whistling Past The $246+ Trillion Graveyard

“According to the latest IIF Global Debt Monitor released today, debt around the globe hit $246 trillion in Q1 2019, rising by $3 trillion in the quarter, and outpacing the rate of growth of the global economy as total debt/GDP rose to 320%.

This was the second-highest dollar number on record after the first three months of 2018, though debt was higher in 2016 and 2017 as a share of world GDP. Total debt was broken down as follows:

- Households: 60% of GDP

- Non-financial corporates: 91% of GDP

- Government 87% of GDP

- Financial Corporations: 81% of GDP

And while the developed world has some more to go before regaining the prior all time leverage high, with borrowing led by the U.S. federal government and by global non-financial business, total debt in emerging markets hit a new all time high, thanks almost entirely to China.”

This is why Central Banks, from the ECB to the Federal Reserve, are terrified of an economic recession or downturn. As I said previously, “debt is the ‘weapon of mass destruction’”

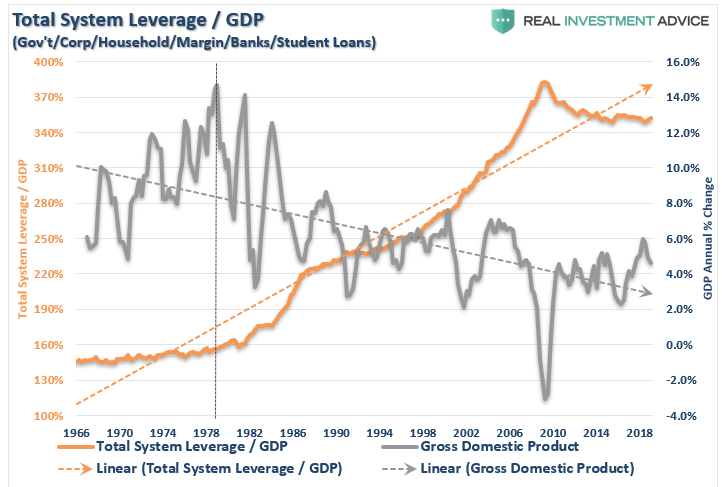

Given that global debt is 320% of global GDP, a deleveraging cycle will be too large for Central Banks to contain.

The deleveraging cycle WILL occur, all that Central Banks can do is hope to extend the current cycle long enough that “maybe” economic growth will catch up with the problem and lower the risk.

The irony is that it is the Central Banks on actions (lowering interest rates to zero and flooding the system with liquidity) which has inflated the debt bubble.

But that’s everyone else’s problem, right.

As noted above, the U.S. is currently running a debt-to-GDP ratio of roughly 350% so we are certainly not immune to the risk of a global “debt contagion.”

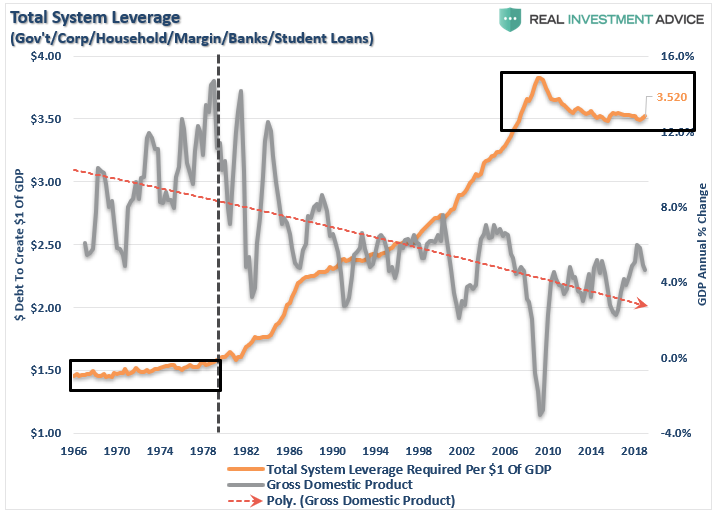

We can look at this a bit differently. The economy currently requires $3.50 of NEW debt just to generate $1 of new growth.

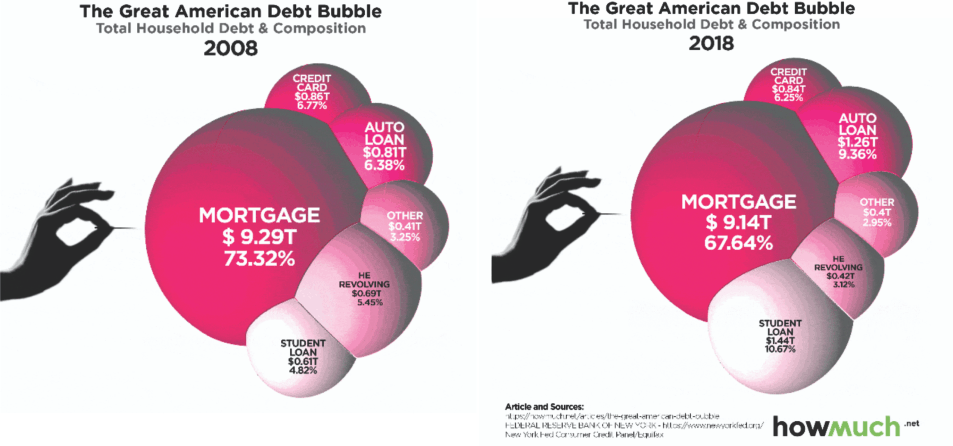

The problem with the exceedingly high debt levels is that since economic growth is a function of debt-supported spending, there is a finite limit to how much debt can be absorbed. As “HowMuch” showed, 10-years after the financial crisis, individuals are more levered today than they were then. (Notice the doubling of auto and student loan debt in particular.)

The Real Crisis Is Coming

As I noted this past week, the real crisis comes when there is a “run on pensions.” With a large number of pensioners already eligible for their pension, and a near $6 trillion dollar funding gap, the next decline in the markets will likely spur the “fear” that benefits will be lost entirely.

The combined run on the system, which is grossly underfunded, at a time when asset prices are dropping, credit is collapsing, and shadow-banking freezes, the ensuing debacle will make 2008 look like mild recession.

It is unlikely Central Banks are prepared for, or have the monetary capacity, to substantially deal with the fallout.

As David Rosenberg previously noted:

“There is no way you ever emerge from eight years of free money without a debt bubble. If it’s not a LatAm cycle, then it’s energy the next, commercial real estate after that, a tech mania years after, and then the mother of all of them, housing over a decade ago. This time there is a huge bubble on corporate balance sheets and a price will be paid. It’s just a matter of when, not if.”

Never before in human history have we seen so much debt. Government debt, corporate debt, shadow-banking debt, and consumer debt are all at record levels. Not just in the U.S., but all over the world.

If you are thinking this is a “Goldilocks economy,” “there is no recession in sight,” “Central Banks have this under control,” and that “I am just being bearish,” you would be right.

But that is also what everyone thought in 2007.

With global tensions spiking, thousands of Americans are moving their IRA or 401(k) into an IRA backed by physical gold. Now, thanks to a little-known IRS Tax Law, you can too. Learn how with a free info kit on gold from Birch Gold Group. It reveals how physical precious metals can protect your savings, and how to open a Gold IRA. Click here to get your free Info Kit on Gold.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

That TITLE really says it ALL!

Wow

Sometimes the title of an article is too short, and fails to adequately describe the content of an article.

Not this time.

Or, it hints at something that it doesn’t supply. I think the whole article might need repackaging as a condensed version, retitled.

Damn you Quetzacoatl.

Denninger at Marketticker has been saying for some time that we have about five years until the whole thing falls apart. Just this past week Jim Sinclair at J S Mineset spoke of the same time frame. Trump likes to expound on our amazingly strong economy. I don’t think so! An economy that can’t handle a 2.5% interest rate doesn’t sound very strong to me. If interest rates increased to a traditional 5% the payments on our 22T national debt would run about 1.2T, mas a menos. It’s later than we think, folks. Maybe someone a whole lot smarter than this old fart has a solution to this problem. If so, I’d certainly like to hear it.

Massive inflation.

Not sure the word “massive” quite covers it, but that is what will happen.

The U.S. will make Zimbabwe and Venezuela look like amateurs when it comes to the rate of hyper-inflation.

The author states that

But that’s only because both the interest on the debt and GDP are measured in dollars.

So whether it costs you $1 to buy an apple, or $10,000 to buy that same apple — it’s all the same with regard to debt payments vs. GDP. That is, when you’re using imaginary numbers that can be borrowed into infinity, there’s no way to default.

However, that doesn’t mean that going from paying $1 for an apple in March to paying $10,000 for that same apple in April, has no effect on you & me.

=====

The author is also selling “gold-backed” IRA’s. In other words, paper gold.

I recall hearing ads for both physical gold and paper gold that would state “Plus! Gold has never been worth zero!”

Well, when the entire system collapses either through default on the debt or through hyper-inflation, we may indeed see a period where physical gold IS worth zero. Ask a Venezuelan eating a zoo animal whether they’d trade that zoo meat for gold.

Paper gold, however, is certain to be worth zero when the SHTF. That is, at best it will be worth $1 for every $1 you’re invested in it … or, 1/10,000th of an apple. You’ll never see or hold the actual gold that supposedly “backs” your investment.

Physical gold may (or may not) have some value in an entirely new “reset” monetary system, if you’re lucky. Paper gold? …. pfffft.

Interesting thoughts. I really don’t believe that gold will ever be worth zero. However, an ounce of gold may be so valuable that it’s not practical to use said ounce to buy anything. Rather, silver US coins, dimes quarters and halves could be much more desirable to possess.

Yea buddy….silver for day to day purchases gold for wealth.

Food for thought: a few years ago cash rich Apple floated a couple billion dollars of long term bonds at somewhere around 2% interest. Regardless their rationale for doing so, their borrowing reflects something seriously out of kilter. Foolish? Opportunistic?

Thoughts, anyone?

Use the borrowed money to 1) buy back stock to inflate the stock price and 2) buy other stock. With free (or nearly free) money everyone has been borrowing and buying back their own stock. With the Fed continually fueling the stock market bubble (now at Trump’s insistence) it’s guaranteed to return a lot more than 2% …. until …. well, until it doesn’t.

The stock market reminds me of a scene that 1980s movie adaptation of Frank Herbert’s “Dune”. The main characters fly out to check on a “spice harvester” and along the way they see a giant sandworm headed for the harvester, and someone (Max Von Sydow, I think) says “they work right up to the last minute” to extract all the “spice” they can.

This is what all companies and all investors are doing right now, extracting all they can “right up to the last minute”. Unfortunately, nobody really knows when the “last minute” is going to be. Some will cash out in the nick of time, and many, many others will end up in the belly of a sandworm. He who lives, and extracts the most spice, will be rich enough to buy up all the wreckage of the companies that didn’t get out in time.

Ah! found it: (@1:45 to end)

Precious metals in your hands will be about the only way to carry wealth through the coming reset. Paper assets? Nuts !!

Funny thing is, I’m afraid that it may also be true of real property. That is, real estate may not be a very sure way to hold wealth either.

Inflation, even hyper-inflation, is only a problem because the money doesn’t get evenly and instantly distributed. If a $1 apple today becomes a $2 apple tomorrow, it wouldn’t matter if the single dollar in your wallet spontaneously generated a duplicate dollar — i.e. price doubles, but at the same time you have twice as much money.

The problem is that that doesn’t happen. The price doubles, but you’ve still only have that one lonely single in your wallet.

What happens when there’s massive, or hyper-, inflation and your State & local government want their property taxes in inflated dollars, and you only have enough to pay the pre-inflation property tax?

Government confiscation of real property via inflation.