Update 5:05AM EST:

The overnight bloodbath in U.S. futures picked up steam about 3AM Eastern Time, despite China’s A Share market ending the session down just 1.31% and the SZSE Component finishing its session actually higher by 1.23%.

And despite Trump touting an Indian trade deal and hilarious headlines that hit around 5AM EST that the U.S. “doesn’t expect any Phase I trade deal impact from the virus”, Dow futures fell more than 700 points and gold is now just about 10% from its all time highs.

As of 5:05AM EST:

* S&P futures -79 to 3260, -2.37%

* Dow futures – 724 to 28258, -2.49%

* Nasdaq futures -280 to 9178, -2.98%

* Gold futures +34, bid to 1682, +2.07%

* USD/JPY -.229 to 111.31, – 0.21%

Of course, traders at the NY Fed are still probably just waking up, so we’ll reevaluate how things look heading closer into the cash open.

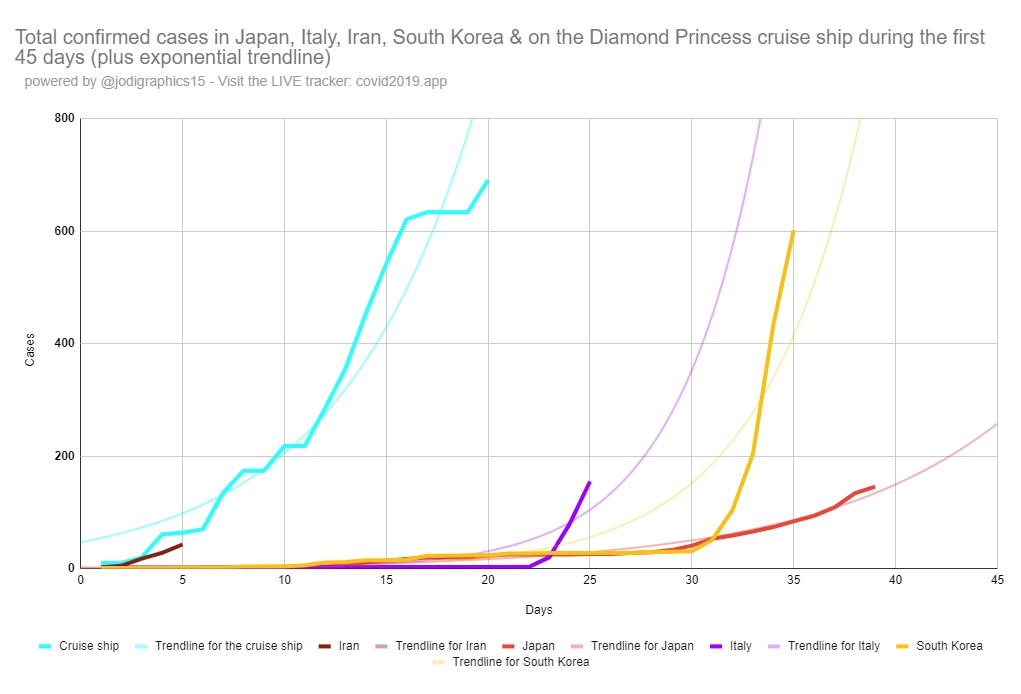

After a weekend in which attention is now firmly focused on the accelerating spread of the coronavirus outside of China (whose epidemic numbers have become a bigger joke than the country’s GDP), with Italy now a supercluster of new cases that has sealed off Northern Italy and threatens to shut down Schengen…

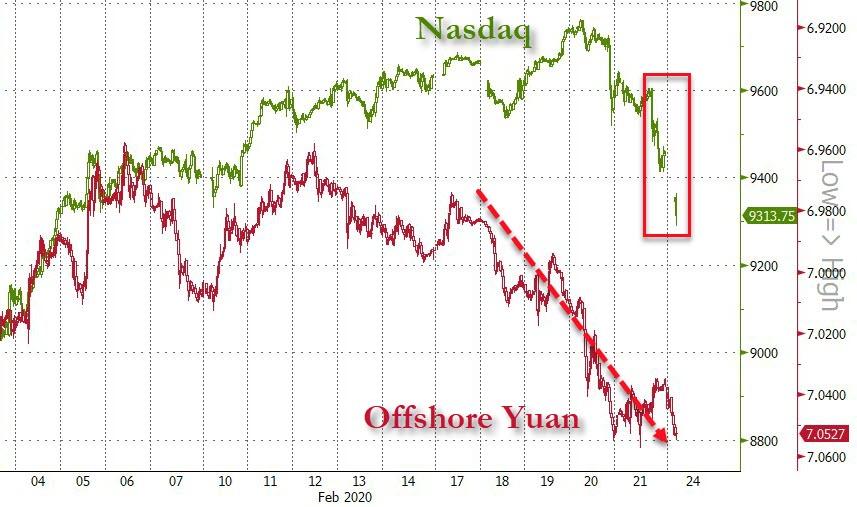

…traders are back to their desks and for once, it appears they are realizing that central bankers can’t print their way out of this particular pandemic mess.

US equity futures are accelerating their catch down to reality…

Dow Futures are down 400 points…

Spot gold is up over 2%, breaking $1680…

WTI Crude is also plunging, back to a $51 handle…

And after JPY’s recent collapse, Nikkei futures are down 500 points in early trading…

And therefore, as always, The BoJ is out with its standard boiler-plate – we’ll puke more money and buy more of everything – plan…

The Bank of Japan will be fully prepared to take necessary action to mitigate the impact of the coronavirus on the world’s third-largest economy, its Governor Haruhiko Kuroda said. Kuroda said there was no major change to the BOJ’s projection that Japan’s economy would keep recovering moderately thanks to an expected rebound in global growth around mid-year.

He also repeated the view that, while the central bank stands ready to ease monetary policy further “without hesitation”, it saw no immediate need to act.

But Kuroda said the BOJ would scrutinize developments on the virus outbreak carefully, since the damage to Japan’s economy could be profound if the epidemic is prolonged and disrupts supply chains.

First of all, just how is printing money going to fix the virus; and second, what is this “moderate recovery” he is talking about after the -1.6% GDP print?!

Finally, we do note that Japan is closed for the Emperor’s Birthday celebration so markets are especially illiquid… and cash bond trading remains closed. However, 10Y bond futures are surging, implying a 1.41% yield…

Nevertheless, it appears, as we noted above, investors are starting to wake up to the fact that central bankers can’t print vaccines… and you can only swallow so many blue pills before the red one becomes too tempting.

Time for a phone call…

Tfw futures are down over 1% pic.twitter.com/ZERqmvPAVi

— TheCreditBubble (@TheCreditBubble) February 23, 2020

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

The overnights were ugly, the opening bell will be very interesting this morning but I will be following the metals closely .

6:37am dow mini at -743.41

Fasten your seat belts

They are seeing clusters of cases with no real explanation of contact… I suspect child trafficking networks.

Watch this clip of Italy at the 8 minutes point. Nick’s uncle is still in Bari and they are planning to leave the city soon.

Empty store shelves in Milan at 12 minute point…

I picked up more TP.

Metals always make a jump after I sell some.

Financial theater meets Wu-Flu theater.

22- Watching the X-Rates today will be interesting also. You wish you owned that much phyzz.

It’s not theatre it’s reality Things are going to get really interesting very soon Better buy that gold back and get yourself a lot of undervalued Silver because that’s next on the launch pad

I tried to warn you’all

All the examples of plunging are less than 3%. Talk about hype, call me when those f***ers are jumping out of windows.

NEWS FLASH>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>

Current dow is -809.25.

GOLD spot price – 1673.71

Look Out Below……

Current dow is -905.81

It would have to drop to 22,440 to look like Black Monday. I have no way to recover my comments from a long time ago but I had in mind 2020 would be the bottom. Up to now, I was afraid I would be wrong.

Bea, considering only fat cats are in the market which is propped up by printed money, how is this crisis not simply an opportunity to take profits?

So… what is the price of tea in china?

EC- It is just profit taking. Sooner or later all that money the fed stuffed in the market has to go poof. I think somewhere around dow 50,000.

What is up?

I wonder what the excuse would be if not for nCoV-19 ?