If the oil market can crash like this in one day, so can stocks. Beware folks. The world is fucked up.

History In The Making: Oil Crashes To NEGATIVE $40 Per Barrel

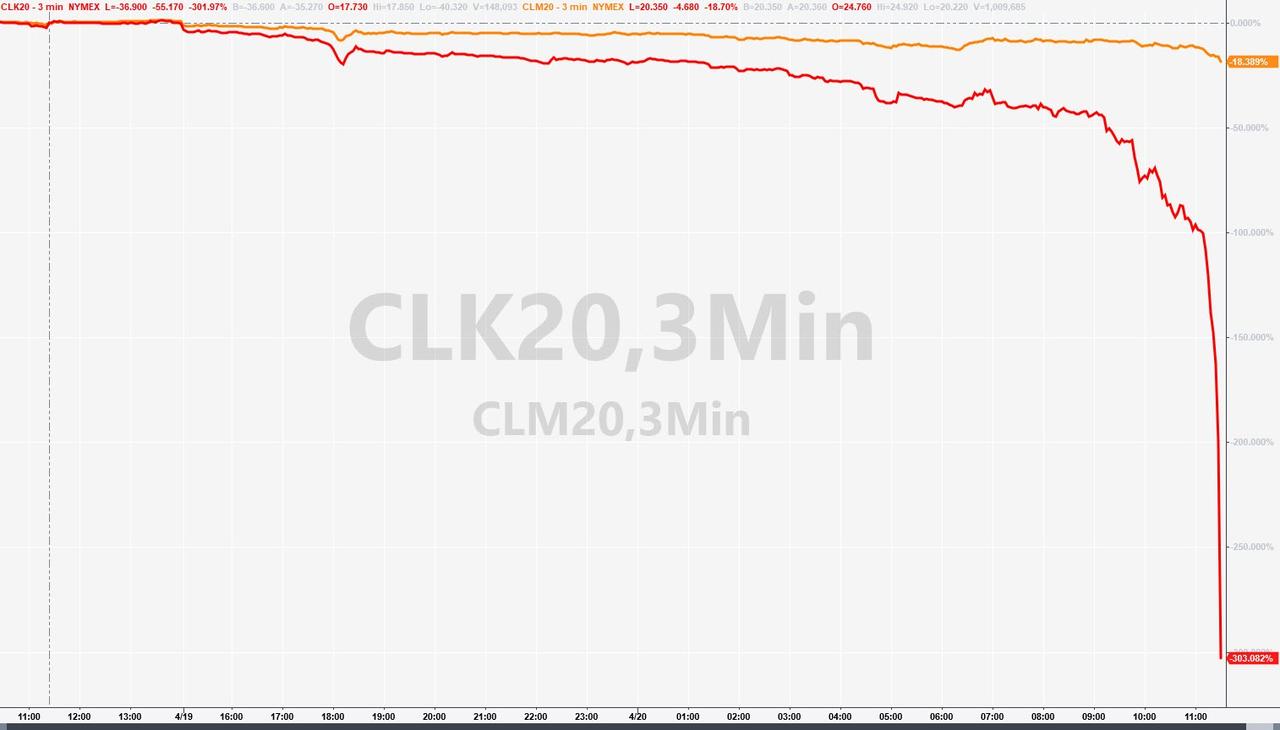

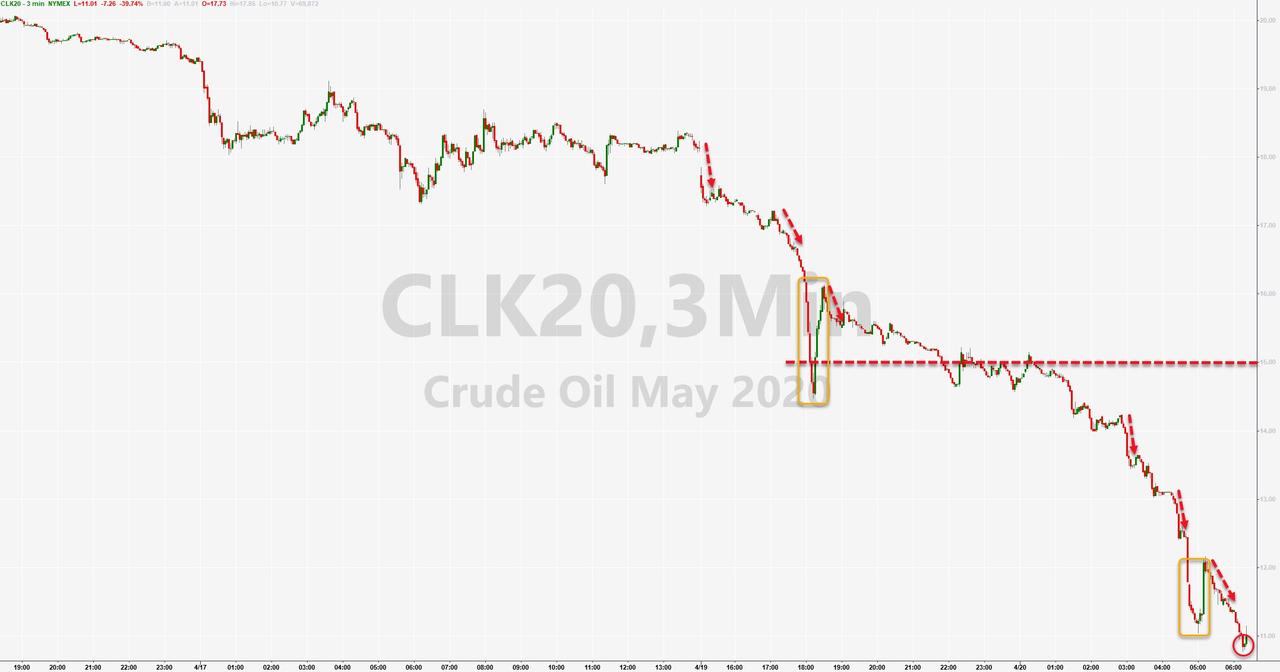

Update (1425ET): And there it is… May WTI just traded below zero for the first time ever (trading below NEGATIVE $40 per barrel)…

May is down over 300% today…and June is down 18%

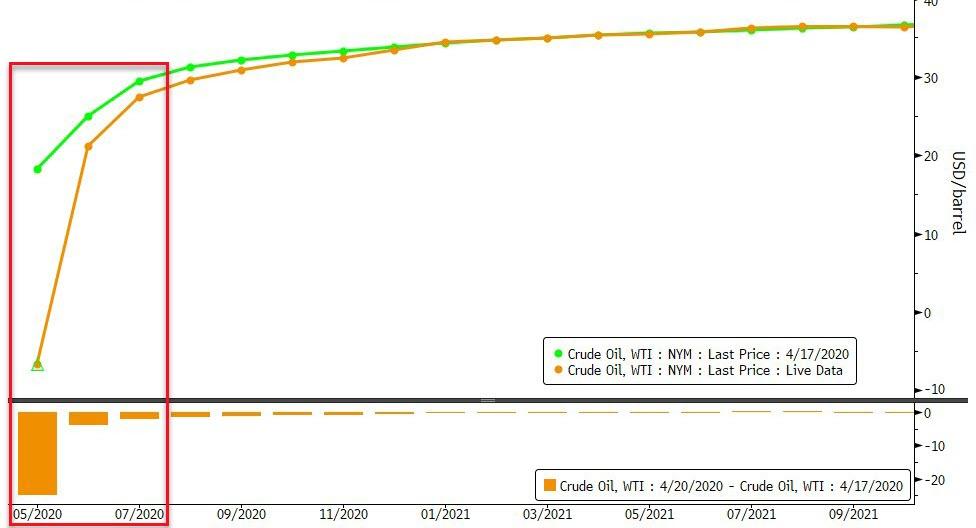

A complete collapse of the front-end of the curve…

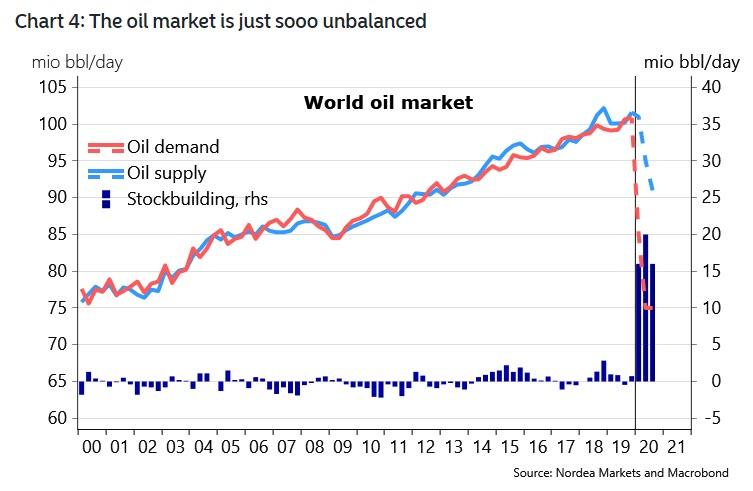

As Nordea notes, oil markets are likely to remain under pressure from huge unbalances in the physical market, like we also highlighted last week.

Saudi Arabia and Russia are whispering about further production cuts, but we have a hard time getting too enthusiastic about the oil price anyways. There is a real risk that the oil storage capacity is filling up, even with the agreed lower pace of production; maybe already within the next six weeks. Therefore, more production cuts could be needed just to prevent the oil price from crashing further. Better data on new corona cases are probably keeping the oil price “alive” for now, but the physical market tend to matter the most in the end.

* * *

Update (1355ET): Just stunning – the May WTI contract just traded at 1c…

The May contract – obviously – is down 100%…

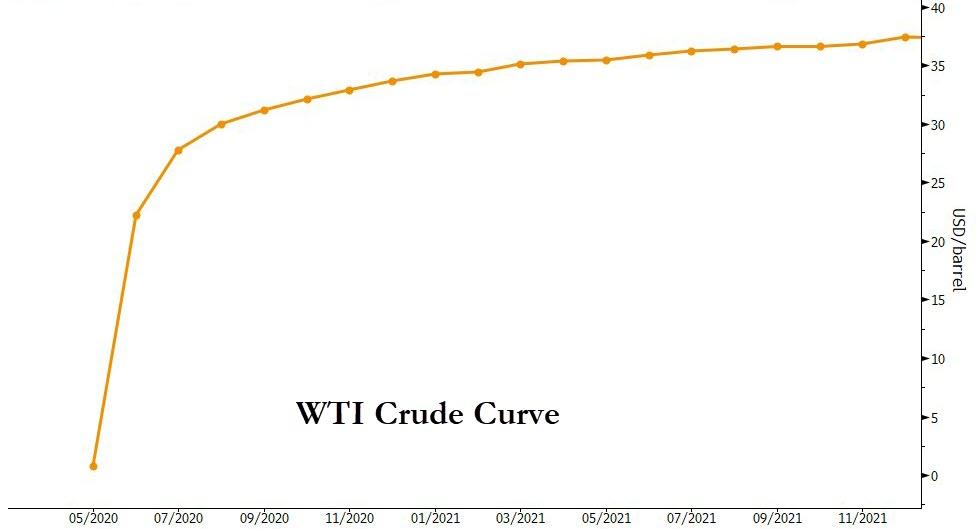

The WTI curve is in record contango…

* * *

Update (1350ET): WTF WTI! The May contract just traded below $1…

It was $10 90 minutes ago!

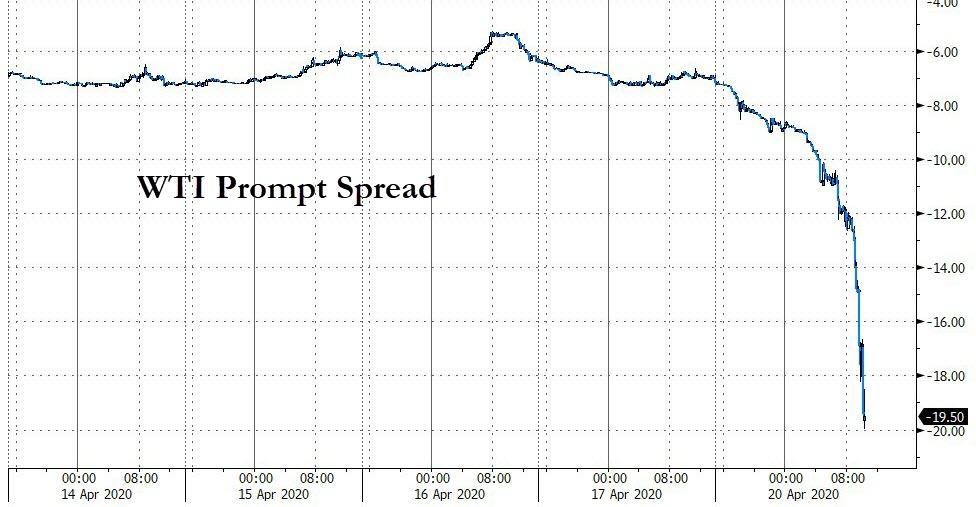

The prompt spread (May-June) is now at a record $20…

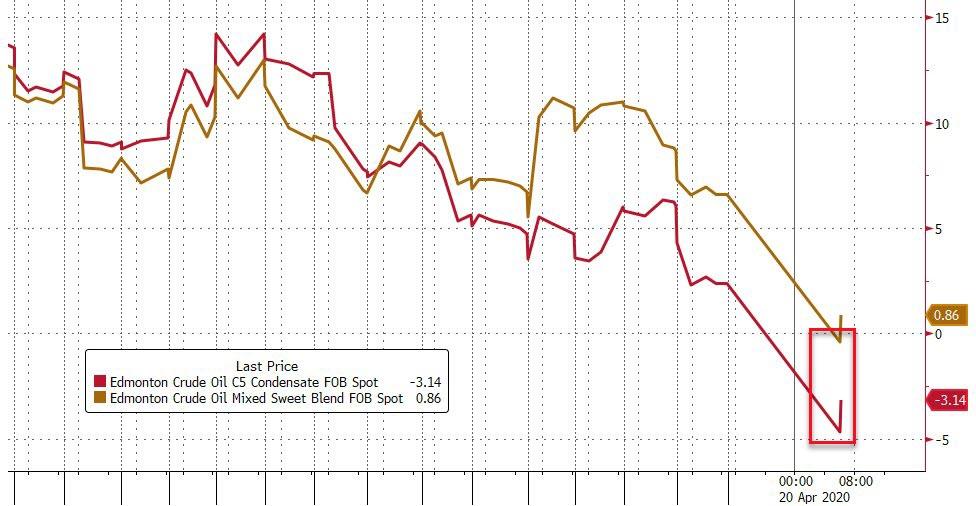

And now Alaska, Bakken, and Edmonton are all trading negative

Update (1325ET): And just like that, a $2 handle ($2.24) for May WTI…

May is down a stunning 86% today while June – also hammered – is down a mere 11%!

* * *

Update (1250ET): The CME just issued a statement that May WTI Futures can trade negative, which sent the May contract reeling to a $4 handle (low $4.04)…

* * *

Update (1210ET): The May WTI Crude futures contract just crashed to a $7 handle..

* * *

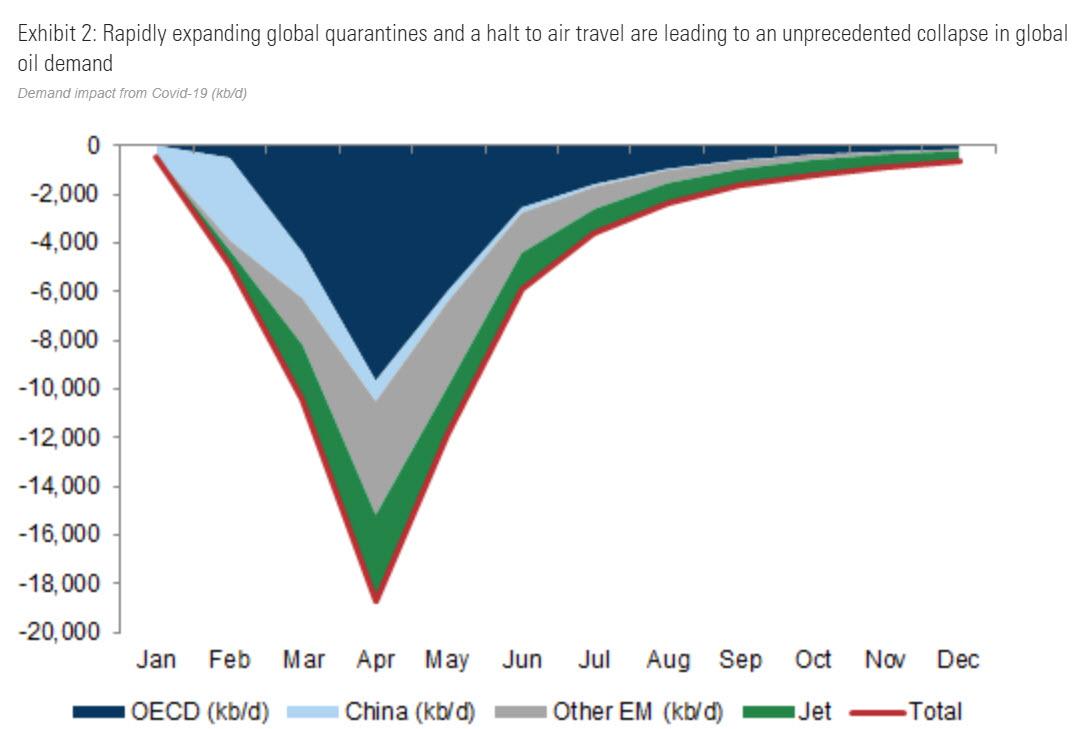

When Goldman’s crude oil analysts turned apocalyptic last month, writing that “This Is The Largest Economic Shock Of Our Lifetimes“, they echoed something we said previously namely that the record surge in excess oil output amounting to a mindblowing 20 million barrels daily or roughly 20% of the daily market…

… the result of the historic crash in oil demand (estimated by Trafigura at 36mmb/d) which is so massive it steamrolled over last week’s OPEC+ 9.7mmb/d production cut, could send the price of landlocked crude oil negative: “this shock is extremely negative for oil prices and is sending landlocked crude prices into negative territory.”

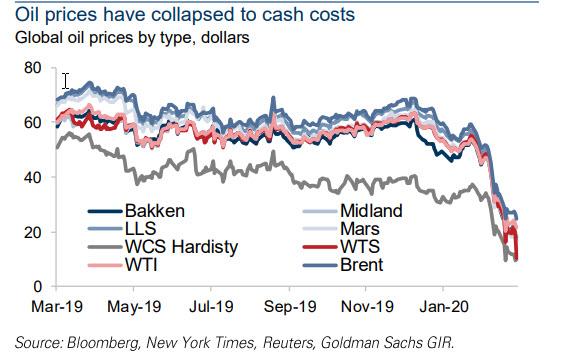

We didn’t have long to wait, because while oil prices for virtually all grades have now collapsed below cash costs…

… today’s historic plunge in WTI – the biggest on record – which sent the price of the front-month future freefalling 40% to just $10/barrel…

… has resulted in selected Canadian crude oil prices now officially turning negative with Canada’s Edmonton C5 Condensate deep in the red…

… while the Edmonton Mixed Sweet Blend dipped briefly negative for the first time ever before fractionally rebounding in the green.

In other words, landlocked Canadian oil prdeucers – who don’t have easy access to expandable tanker storage – are now paying their customers to take the oil off their hands!

Why the historic plunge in the front-end? Simple: it shows the real demand and how much storage capacity there is for actual physical oil (virtually none), as opposed to speculating on future oil prices and hopes for a recovery, which however with every passing month will get dragged to the catastrophic spot (current-month) price. As such, where the May contract – which matures tomorrow – prices will show what the market for physical delivery looks like but as Adam Button notes, “the June contract is also increasingly ugly as it approaches the cycle low” adding that “so far retail keeps buying the dip but I think there’s a rising chance they puke it in the days ahead.”

And while retail keeps hoping that the Fed will somehow start buying crude next, Button is absolutely correct.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

How the frig does that work, hey here is a barrel of oil and I’ll give you 40 bucks to take it off my hands. WTF is going on?

I know. That’s the kind of thing you say about a democratic party presidential candidate…..not oil.

it’s quite simple.

an oil pipeline is not a lightswitch.

you can’t just turn that shit on and off at will, there are costs to consider.

they’re running out of storage… they have enough problems to worry about.

So the pumps can’t be shut off? Why can’t they just let it sit in the ground?

.

Steve…so help me understand. Why wouldn’t our government jump in and save oil companies in a crash like they do everything else?

Anon

Because they don’t want to. this is deliberate, as in on purpose, as in welcome to the New world Order rising from the debris of the one we just left 3 months ago.

everything but workers and farmers

Physically, they could. But there are contracts, etc. and laws that require them to continue producing.

You’re still kidding, right?

No.

Anon.

You need help. Rules, laws, contracts? Have you been paying attention or watching the View.

I’d rather watch turds floating down a river in the Congo.

You know how many people are still living in that world? They don’t even fathom what has taken place and they think all the old forms apply.

I cannot imagine the shock they are in for.

That process is somewhat expensive in and of itself, and in certain cases can damage the reservoirs, I have read. You just don’t know if you can get it back up and running.. it’s not like Jed Clampett’s bubblin’ crude anymore. Pretty sophisticated ops with all kinds of water and chemicals added to optimize pressure and such.

Anon.

Costs to consider? You’re kidding, right?

Crude oil that is unrefined is essentially useless. Crude is what is the issue here. Too much crude, not enough storage and refineries turning it into fuel so you get a glut. Unlike squash or milk, you can’t just dump the stuff, it has to go somewhere. Demand is down because the economies of the globe are shut down, so the dominoes keep falling with everything impacting everything else.

Russia and Saudi started the glut, essentially to cut off US shale, now they too are feeling the pinch.

Texas oil is one continuous boom/bust cycle, what’s different now is the scale. Mexico, Venezuela and other countries that need oil revenues are screwed. The oil can stay in the ground if necessary, start ups aren’t as onerous as some claim. Open up economies and the refineries and storage and all will be well…maybe, sorta……

Guess Greta didn’t think her whole plan through.

Mexico hedges most of its production at $40/barrel…..good day for them on a relative basis….until the counter -parties fail

Russia & KSA did not cause the tanks at Cushing to fill.

You cannot shut down 40% of the world’s economy and not expect a glut of oil and refined products, especially with Putin and the Saud’s having a pissing contest by opening the spigots.

Hey, Putin! Yeah, it’s me, Trump. Forget Nordstream 2. We’re leaning on Germany to get it stopped, then we’re going to ship (very, very expensive) LNG to replace Russian gas. And there ain’t a damn thing you can do about it!!! Mwahahahaha. You’re so fucked. Hahahaha.

Hey, Trump! Yeah, it’s me, Vlad. Just so you know, shale actually loses money below $60 give or take. Also, if they stop pumping, those fracking straws quit working and the well is worthless. Also, I don’t give a fuck if I lose money for the next couple of years – unlike you assholes, we’re completely in the black and running largish surpluses.

But you have a bigger problem than me: why is the House of Saud no longer on the right page? They’re pumping as much as we are. Did you lose control or something? You might need to do something to get their mind right. Just sayin’.

Oh, and Nordstream 2 is coming along nicely. Thanks for your concern.

What’s going on is that the people finally got what they wanted, “free energy”. I guess that old saying be careful of what you wish for just came into play again.

Welcome to bizarro world. Or more appropriately, you are getting a look at the world you have always lived in. It’s fake. What a time to be alive.

yep!

It’s the end-game of global financialization of everything.

Negative interest rates; negative price for oil. I bet there’s a negative price for whores, too, what with social distancing making their business rather tenuous. Signals are everywhere that all markets are dead. Anything like this should send stockholders and bondholders to gold, but stock and bond prices remained priced for perfection, and gold rises very slowly; it should be five figures with craziness like negative oil prices. Thank you, central bankers. You should be at the front of the guillotine lines.

Negative prices for whores. Signaling. Aha. So now you can have sex and maintain social distancing via semaphores.

Damn clever…..

Commodities HAMMERED and markets are broke!

First it was metals, now oil. Drillers will be forced to shut down production until demand and labor costs catch up with oversupply. I can’t believe how badly the government and banks are burning the economy with these stupid lockdowns but I don’t know any peons with free cash and large scale storage who can take delivery of WTI and hold it for months until the inevitable snapback comes.

Anon.

They are burning down the economy with these stupid lockdowns by design and intent.

When you’re dealing with politicians and the wealthy elite of wealthy elites, never attribute to incompetence that which can be explained by malice.

Incompetence is a fine excuse for low or mid-level bureaucrats living in a deep state bubble of government employees and red tape. The few people who control levers of power and influence and shape the world didn’t get where they are by being stupid or incompetent.

Thank you for stating the obvious.

Not sure what you were going for there. But just for point of reference, you have Hanlon’s razor bassackwords.

“Never attribute to malice that which is adequately explained by stupidity.”

Um, that’s exactly what I was going for.

The few people who control levers of power and influence and shape the world didn’t get where they are by being stupid or incompetent.

The percentage of worldwide derivatives tied to oil is huge. 1,000 to one leverage is the rule rather than the exception. We might see 1.00 gasoline again but you won’t have any money to buy it and nowhere to drive with it.

Costco was $.999 last week in Memphrica. Never thought I would see gas below $1.00 a gal again.

Is there a way to turn barrels of oil into gallows and guillotines? Because I know of a need coming soon.

Not exactly required, changing the barrels of oil into slicing machines that is:

Are you getting all fired up Mr. L. ?

Because its 4:20? You bet.

I bet Yokes is blowing out the candles of his Holocake. Just kidding, Flea!

The Romans used to use oil and people to light the streets at night. We might try it out for a while and get rid of some of the greedy bastards.

Word

Nero dipped Christians in pitch to use as torches to light his parties. Crude oil should work similarly. Unfortunately, there’s no need. 99% cower in homes bc of beer-virus. 1% are left without much recourse but to do likewise.

Pretty sure we can use oil to boil oil.

-$40? That’s like Kate Beckinsale paying me $10,000 to fuck her.

Iska

That’s a fair market price to have to do one of those hollywood witches. I would demand cash first though.

Nice analogy right there.

Counterparties on wrong side of trade have most likely been blown to smithereens

We shall know of their deeds by window jumpers and defenestrations on Wall and Bay Streets.

No, just follow the money from the Treasury and you will see who got secretly bailed out. You don’t think the “problem” is going to let one of their own fail….do you?

Ok, where did the Market Insider link go that was posted here?

USO ETF investors put $1.6 billion in last week to BTFD as the commodity price dipped negative KNOWING US shale was going tits up and the Saudis were pumping like crazy.

Sucks to be them.

It’s all true! Our corner gas station has 87 octane priced at -$1.50 / gallon. So when I fill up the Suburban, they give me 45 bucks!

Ha…if only.

Think how bad Mexico’s got it. Their three main sources of revenue have been oil, narcotics and “remittances” from the US. Remittances will be drying up – on account of the depression. The narcos are having trouble getting their product across the border, and now oil is negative $40/barrel. Thank God they still have the donkey show industry.

They still have Fred Reed.

Who’d you think was doing the donkey?

LMAO

Wondering if Fred’s hacienda has barbed wire and glass embedded in the compound walls like the ones I lived in while in ROK and PI.

Can’t wait to hear how cool Mexico is once they start eating people.

Could be worse. Could be Canada. With oil going the way of pot and the hockey season cancelled for the year the only thing we have left is beer. And with pot and oil being worthless no one has enough money to buy beer. It’s a viscous fucking circle.

2 words…brewers yeast

You bet.

Yeast, malted barley, water. Brew your own.

If you re-use the yeast and can find good grains making 5-7 gallons of your own beer might take some effort, but it’s way cheaper than buying the commercial stuff.

“viscous circle”

Good one!

Can’t wait to see how many of the economic refugees who crawled across the border decide to go home.

Their kids are piled into sanctuary “Blue State” school systems. I’ve personally witnessed multiple extended families inhabiting local residences as NJ cuts state funding assistance to our local schools system. They can barely afford to keep the township school buses maintained and running on a good day. I’m going to watch them kill the bloated extra-curricular activities and school sports programs first while the NJEA struggles to keep up their political kickbacks to the Dems.

I fricking love it.

The financial blowback on the Dems will be well deserved but the remaining taxpayers are going to get squeezed hard in the coming months.

The school lunch (dinner and breakfast) programs are still running, even though schools are closed. The cafeterias are still preparing food for those needy families and the families drive up and grab the boxed and ready to go meals. This is Texas, BTW.

Here, too, Girl.

Same in Tallahassee Florida.

Memphrica, too.

Mexico hedges much of its production…..somebody on Wall Street is screwed…..

The only way to know what is actually happening is to look at what they are doing, not listen to what they are saying.

There is a war going on that is unlike any in the past and thus it remains unrecognizable to the population. We’re roughly the Cargo Cult trying to make sense of planes dropping bundles of goods.

This is a signal, a front, a theater of operations- whatever you want to call it, but it is not an economic condition, nor it is a reflection of current markets. This was done to either send a message, to force a hand, or to oust a government by proxy.

The rest is occult.

Can you believe nobody liked my Donkey show tale in the Obama article? Right in the middle of it I said they have a media that tells them the news of tomorrow. All we get is old news.

The history of this country, if not the world, is occult.

It will all make more sense in hindsight. Right?

Force a hand.

What is happening right now is a conventional war that’s destroying oil by other means.

Do not read into this. Futures sre still pricing in the 20’s. Futures contracts specify delivery in cushing oklahoma. What you have is maxed out storage capacity and they have to people to take the oil.

And, so just because the contract turns that storage capacity will suddenly become available? Don’t think so.

Just remember. No matter how low the cost of gas to the station goes, you will be paying at LEAST $0.50 a gallon to the pieces of shit in DC and your state capitol for the privilege of driving on roads with potholes, roads without visible lane stripes, crumbling bridges, bridges to nowhere, etc.

Well, road work it seems, is an essential business. If there’s a pothole anywhere in the country after this (if there is an ‘after this’), heads should roll. But, I guess that’s a little too much redundancy just for potholes.

It works based on real supply/demand (and bids/asks) and the logistics and costs involved with turning oil wells on/off.

Pre-corona, the world oil use was 100 MBD (Million Barrels per Day). After corona lockdown (whether you believe in the virus or not, the lockdown happened – personally, I call TOTAL BULLSHIT, but that’s another conversation) world oil use immediately went to about 80 MBD!

That is 20 million barrels per day that no one is using. That is a shit load of oil – Every Single Day! There are several hundred tankers floating around the planet that might hold 400-600 million barrels (going from memory). But, at 20 million barrels per day overage, that is only about 1 months worth.

Imagine your faucet running constantly in your house. At first, you have neighbors that come by with buckets to pay you and take water from you because they have none of their own or don’t feel like turning on their water. Then, out of the blue for whatever reason, 20% of your neighbors stop coming over and taking your water or paying you.

Would you pay the remaining neighbors to come with extra buckets to take water they don’t need and store your extra water somewhere instead of letting it go all over your house? Remember, shutting off your tap and turning it back on in the future will be ridiculously expensive. You have 100 gallons per day coming out and 20 will go on the floor if you don’t pay to take it away. You’ll pay about the price it sells for (per gallon) in good times, so maybe $1 per gallon to have the water removed, or 20 bucks daily. You can pay that 20 bucks for a long time if the cost to turn off your water (and turn it back on later) is thousands of dollars.

Again, is there no one in charge anywhere on the planet? How could someone somewhere not say, Hey Dude, cut the pump! I don’t know, a month ago? And they’re still pumping?

No, this isn’t some supply chain miscommunication, this is the deliberate murder of the oil industry, like every other one. Somewhere there are men running the most massive campaign of warfare against the Old World Order in order to kill it all so they can take control of EVERYTHING.

Me thinks that the situation is; If I stop pumping, no income for me and the price rises, benefiting your competitor. Hell of a bind for all.

Various laws and contracts require them to continue pumping.

There is a massive housing development going up a few miles from me ( I’m thrilled shitless) and they are working on breaking ground and laying roads and utility lines, lots and lots of earth moving going on, no lay offs on the construction of houses that may not get sold if the economy tanks. The developers have their loan monies and are using it up. Shades of the SNL crisis and who cares, they’re going to be bailed out anyways.

In my little town we had a SBUX that went out of business a few years ago after being in business for just a couple years. Last week, they started breaking ground for another one. Whatever.

Small Business loan to a minority for the franchise etc. The loan will not be repaid (duh) but the Banking System supports this stuff.

As hard as it is to believe, I’ve heard that many of the shale producers (and maybe others) have covenants with their lenders that require them to pump regardless of the price of the commodity. Seems stupid, but I wouldn’t doubt that its true.

Same as it ever was.

@HSF

If you like I can try explain it. This is a financial market and contracted delivery problem in the futures markets.

I have heard the explanations, and I fully understand them, unfortunately, like everything else about our situation they make no sense. A pipeline that cannot be shut off, for example, when the prices on futures make unloading that product on the terminal end of the delivery impossible because there is no storage available is not a functioning system, wouldn’t you agree? Telling people that there are contractual reasons to take something out of the ground without having a place to put it with no means to trip the circuit in the event of some catastrophic event is not a system worth perpetuating.

Trying to explain nonsensical systems as if there were reasoning behind it is why we are in our predicament.

Systems work until they don’t but actually this system worked as expected, although it was unexpected 🙂

Selling oil (or really anything) in the futures market for delivery (and production) in the future is a good system allowing both seller and buyer to lock-in prices they think are advantageous in their current thinking and planning about their industries and the economy at large. Both parties are legally obliged to adhere to their end of the bargain; the producer must produce and the buyer must take delivery. These contracts are made for production and delivery months, sometimes even years in advance.

In the case of yesterday, the oil price can go “negative” if the holder of the delivery end of the contract (the purchaser) tries to get rid of the product they no longer want or need or can handle, and no one wants to take over the contract. Some poor sap (or many) got hammered because they didn’t expect the lockdown scenario in their planning which severely curtailed the need for oil by, apparently, some 2 million barrels per day. The purchaser has nowhere to store the oil, or only expensive options, and therefore they are prepared to get rid of the oil they purchased at almost any price including paying someone else to take it off their hands. If I can’t use the oil now and if it costs me $X to store it then getting rid of it for any amount less than $X is better than storing it.

What probably does really happen is production is actually curtailed and reduced. But the contract price of the contracts already signed in the futures market reflect something else. They reflect the desperation of obliged purchasers to take delivery of a product they no longer want but have signed contracts to take.

The situation is complicated by traders in these contracts who never had any intention of taking delivery and were only buying the oil in the hope to sell the contract to someone else at higher prices which they expected in the future.

You will see that WTI oil is now back to $20 because that is the price for the new near-futures contract (yesterday the old contracts expired).

The oil war is between Russia, Saudi, and the US. Shale ruined the market for the Saudis and now everyone wants to try and put everyone else out of business.

Aside – re the article headline; unlike oil, stock prices cannot go negative. They can go to zero. You can only lose more than 100% on stocks if you sell stocks short.

You have no idea how much this OILMAGEDDON will effect EVERYTHING. All of the oil producing countries just lost their paycheck also. Shit will really go sideways now folks and it could get freaky.

Talk about deflation…………OMG!!

The only way for the rest of the world to get out of this is to Nuke us. don’t rule it out.

Putski shit the bed today.

BL.

Vlad is lookin good compared to the sheik of Araby. He’s singing to Bibi saying Shia’s to the left of me, Yemeni’s to the right of me. Here I am stuck in the middle with you. He hasn’t seen 1 dollar oil since he was a twinkle in Grandpas eye.

Look at the X-Rates in the morning.

And yet gold is… steady???

FM- You will wish you had bet the farm on Au one day. How do they keep gold and silver this low? It’s amazing……. the fact that it is steady is good.

Still holding on a variety of fronts. To be honest though, I’d take a massive corruption purge over getting rich off my investments.

Why one or the other….

Ideally, both would be good. I just want God to know I’m not greedy. Justice is enough for me.

If it were allowed to seek it’s real price we couldn’t spend it because nobody could make change.

Tuesday Headline:

Gold Goes Under a Dollar …….

Would not surprise me at this point. 🙂

Right there with you.

Look at the premium price for an ounce not the paper price.

Eactly.

If you can take delivery for 1700 good for you but I have to see it. Von Greyerz epects gold to reset in october.

Even if it did go to 1 dollar it would still buy the same amount of goods or services it did at 1,700.

Just for sport I bought one gold coin back when the buying frenzy was going on and the dealers were out of stock. I now have a $400 dollar increase on that coin. That’s today, tomorrow? Who knows. I am going to get a bezel and wear it around my neck on a long leather thong, want to feel the primitive metal against my skin.

Folks with paper gold still think they’ll see a return … or even physical delivery. With everything being a self sustaining system of make believe supporting towers of more make believe that the Fed and our betrayors in government always manage to keep levitating in spite of gravity and reality, it’s now beyond my meager capacity to say they’ll never see returns. Physical delivery is, of course, physically impossible … but physics don’t seem enter into the Fed’s or globalists’ plans.

Up is down. White is black. You get paid to take oil. On and on it goes and where it stops I don’t know. The world is unrecognizable, normal rules need not apply.

Looks like the banker class is looking to buy up some serious oil production capacity for pennies on the dollar.

War?

War would be the perfect answer for the fuckers right now. My sons ain’t going.

War between who? Sorry…it’s not clear to me.

Anybody, just so long as it’s war to keep the raging rabble distracted.

It’s not clear to anybody. I’m not sure it matters who.

Who stepped in? Look at the futures market. It is now UP now to +39 pts.

https://finance.yahoo.com/

Brewer.

For one, the Feds said they will take it to fill up the reserve. Probbly just enough relief to prop it up a bit.

Brewski- Ha ,up +39.31, it had no where to go but up. Who stepped in is right.

You’re looking at 30-day futures contracts. Today was the last day on the April contract, which is why the shorts got burned. Now you’re looking at overseas trading on the May contract. Another bloodbath is likely in May unless market fundamentals drastically improve and they build a whole lotta more tank farms in Cushing, OK (where these contracts are settled by delivery of the physical oil in a pipeline).

By comparison, Google WTI spot price and you’ll find oil tickers that show the current vs. forward prices. Some US domestic spot prices were also seriously negative today.

Thanks for the information. I was not aware of those points you made.

Here’s a decent futures ticker:

https://www.cmegroup.com/trading/energy/crude-oil/light-sweet-crude.html

Futures and spots:

https://oilprice.com/oil-price-charts