From Birch Gold Group

This week, Your News to Know rounds up the latest top stories involving gold and the overall economy.

Stories include: Two billionaire investors think you should own gold, Swiss are stocking up on gold, and woman arrested for selling $18,000 in fake gold bars.

John Paulson and Mark Mobius think gold could go much higher

As gold moves around the $1,800 level, billionaire investors John Paulson and Mark Mobius talked about what it would take for gold to set off another round of fireworks.

Paulson, president and portfolio manager of Paulson & Co, is bullish on gold and sees several possible reasons for a sharp rise in price. He spoke to Bloomberg about his expectations of an inflationary stretch similar to that of the 70s, when gold had one of its best performances ever.

Wealth erosion is going to become a primary concern, with cash in its center. Paulson said that people will want to move away from cash in order to store value, and that gold will be the natural choice of harbor. Partly because of this and partly because of the gold market’s relatively small size, Paulson thinks gold could go much higher than many optimistic predictions list. Here are some excerpts from the interview:

Q: Do you think that gold is a good investment at this price?

Paulson: Yeah, we do. We believe that gold does very well in times of inflation. The last time gold went parabolic was in the 1970s, when we had two years of double-digit inflation.

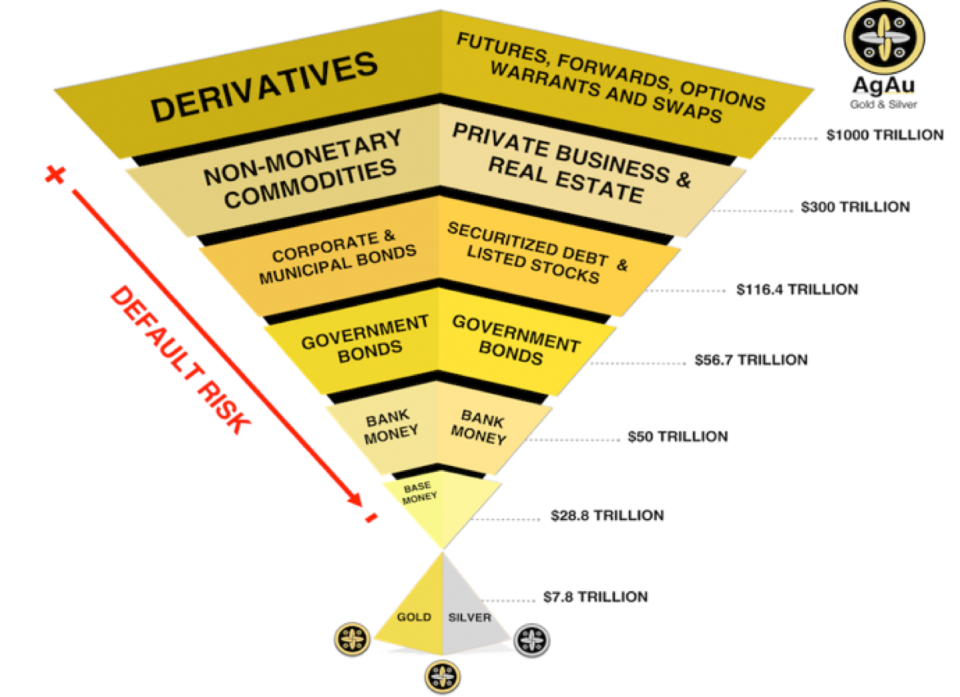

The reason why gold goes parabolic is that basically there’s a very limited amount of investable gold. It’s on the order of several trillion dollars, while the total amount of financial assets is closer to $200 trillion. So as inflation picks up, people try and get out of fixed income. They try and get out of cash. And the logical place to go is gold. But because the amount of money trying to move out of cash and fixed income dwarfs the amount of investable gold, the supply and demand imbalance causes gold to rise.

Q: So you’re a big believer in gold as a good investment now?

Paulson: Yes.

Also speaking to Bloomberg, Mobius advised everyone to hold 10% of their savings in physical gold. He is also concerned about the erosion of paper money’s purchasing power, at the hands of endless currency-printing and quantitative easing. But there’s still a little time to act.

Mobius said, “Currency devaluation globally is going to be quite significant next year given the incredible amount of money supply that has been printed.”

Why physical gold? Isn’t it more convenient to open up the Robinhood app on your smartphone and buy a dozen shares of the paper-gold fund GLD?

Mobius thinks its smarter for the prudent investor to have control over their own wealth, stashing gold “in their mattresses,” as the saying goes. Specifically, Mobius said:

It is going to be very, very good to have physical gold that you can access immediately without the danger of the government confiscating all the gold.

While this may sound far-fetched, Mobius isn’t just speaking to Americans. His words are intended for a global audience, especially those whose nations don’t enjoy the same respect for the rule of law or of property rights as America does.

On the other hand, the U.S. did outlaw private gold ownership in 1933, and force citizens to sell at well-below market rates. Perhaps it’s wise to diversify custody as well, holding a portion of your physical precious metals in a secure vault and another portion within your direct, physical control?

Speaking of which, the Swiss may have been listening to Paulson and Mobius…

Why Switzerland’s residents are stocking up on gold

Last year was quite a hectic one for Switzerland and its gold. As the world economy crawled to a halt, one of the largest gold processing hubs in the world shut down its operations temporarily, causing supply disruptions and anxiety among both domestic and foreign buyers. Removed from those circumstances but not the crisis that caused them, Eurasia Review‘s Claudio Grass gives us a snapshot of today’s Switzerland.

Grass acknowledges that the Swiss enjoy a good deal of privilege, not the least of which is a government that is kept in check by the public. This kind of environment brings about free and open discourse and has, in turn, made the Swiss less than keen on trusting what the government says or believing it has their best interests in mind.

This has translated to a considerable surge in physical gold demand. More interestingly, recent purchases are coming in smaller amounts and from both individual and private accounts. The average citizen is buying gold, either to plan for the future or to prepare for it.

The Swiss government, like any other, has issued numerous promises over the last two years. It seems, however, that the average person in Switzerland isn’t buying them. Whether it pertains to draconian government measures or a weakening economy, the Swiss are less likely to take an official’s word for granted than people elsewhere, even in the West.

After independently assessing the current global situation, countless Swiss are coming to the conclusion that gold investment is one of the best decisions they can make to ensure their hard-earned prosperity.

At least Switzerland (unlike most nations) enjoys a wide variety of globally-respected gold refiners to choose from: Argor-Heraeus, Valcambi, Produits Artistiques Métaux Précieux (PAMP) and Metalor. They’re a lot less likely to get duped by fake gold…

Oregon woman arrested for selling $18,000 in fake gold bars

According to a report from the Eugene Police Department, a woman is being charged with multiple cases of selling counterfeit gold bars. The first crime occurred last year, when the 37-year-old Amanda Laine Bryant sold $18,000 in alleged gold bullion to a Eugene, OR resident.

A trip to the neighborhood jewelry store quickly revealed that the bars were ordinary gold-colored metal with close to no value. By the time Bryant had again reached out to the victim with offers to sell more gold, sending numerous messages between June and August, the police had already opened an investigation. After a sting that involved the police agreeing to meet with Bryant while posing as the previous buyer, the woman was apprehended following a brief chase.

In times of great demand, counterfeit gold cases like this one occur. It’s relatively easy to electroplate tungsten (which has exactly the same density as pure gold, to three decimal places) in a garage, with $100 in equipment and supplies. These quick-and-cheap frauds look, feel and even sound correct. That’s more than enough to convince a non-specialist.

If you’re looking to purchase physical gold bullion or coins, make absolutely sure you’re dealing with a reputable retailer with an established history, positive reviews and an established brand. This is not a situation where a great offer on Craigslist is likely to end well.

This week, Your News to Know rounds up the latest top stories involving gold and the overall economy.

Stories include: Two billionaire investors think you should own gold, Swiss are stocking up on gold, and woman arrested for selling $18,000 in fake gold bars.

John Paulson and Mark Mobius think gold could go much higher

As gold moves around the $1,800 level, billionaire investors John Paulson and Mark Mobius talked about what it would take for gold to set off another round of fireworks.

Paulson, president and portfolio manager of Paulson & Co, is bullish on gold and sees several possible reasons for a sharp rise in price. He spoke to Bloomberg about his expectations of an inflationary stretch similar to that of the 70s, when gold had one of its best performances ever.

Wealth erosion is going to become a primary concern, with cash in its center. Paulson said that people will want to move away from cash in order to store value, and that gold will be the natural choice of harbor. Partly because of this and partly because of the gold market’s relatively small size, Paulson thinks gold could go much higher than many optimistic predictions list. Here are some excerpts from the interview:

Q: Do you think that gold is a good investment at this price?

Paulson: Yeah, we do. We believe that gold does very well in times of inflation. The last time gold went parabolic was in the 1970s, when we had two years of double-digit inflation.

The reason why gold goes parabolic is that basically there’s a very limited amount of investable gold. It’s on the order of several trillion dollars, while the total amount of financial assets is closer to $200 trillion. So as inflation picks up, people try and get out of fixed income. They try and get out of cash. And the logical place to go is gold. But because the amount of money trying to move out of cash and fixed income dwarfs the amount of investable gold, the supply and demand imbalance causes gold to rise.

Q: So you’re a big believer in gold as a good investment now?

Paulson: Yes.

Also speaking to Bloomberg, Mobius advised everyone to hold 10% of their savings in physical gold. He is also concerned about the erosion of paper money’s purchasing power, at the hands of endless currency-printing and quantitative easing. But there’s still a little time to act.

Mobius said, “Currency devaluation globally is going to be quite significant next year given the incredible amount of money supply that has been printed.”

Why physical gold? Isn’t it more convenient to open up the Robinhood app on your smartphone and buy a dozen shares of the paper-gold fund GLD?

Mobius thinks its smarter for the prudent investor to have control over their own wealth, stashing gold “in their mattresses,” as the saying goes. Specifically, Mobius said:

It is going to be very, very good to have physical gold that you can access immediately without the danger of the government confiscating all the gold.

While this may sound far-fetched, Mobius isn’t just speaking to Americans. His words are intended for a global audience, especially those whose nations don’t enjoy the same respect for the rule of law or of property rights as America does.

On the other hand, the U.S. did outlaw private gold ownership in 1933, and force citizens to sell at well-below market rates. Perhaps it’s wise to diversify custody as well, holding a portion of your physical precious metals in a secure vault and another portion within your direct, physical control?

Speaking of which, the Swiss may have been listening to Paulson and Mobius…

Why Switzerland’s residents are stocking up on gold

Last year was quite a hectic one for Switzerland and its gold. As the world economy crawled to a halt, one of the largest gold processing hubs in the world shut down its operations temporarily, causing supply disruptions and anxiety among both domestic and foreign buyers. Removed from those circumstances but not the crisis that caused them, Eurasia Review‘s Claudio Grass gives us a snapshot of today’s Switzerland.

Grass acknowledges that the Swiss enjoy a good deal of privilege, not the least of which is a government that is kept in check by the public. This kind of environment brings about free and open discourse and has, in turn, made the Swiss less than keen on trusting what the government says or believing it has their best interests in mind.

This has translated to a considerable surge in physical gold demand. More interestingly, recent purchases are coming in smaller amounts and from both individual and private accounts. The average citizen is buying gold, either to plan for the future or to prepare for it.

The Swiss government, like any other, has issued numerous promises over the last two years. It seems, however, that the average person in Switzerland isn’t buying them. Whether it pertains to draconian government measures or a weakening economy, the Swiss are less likely to take an official’s word for granted than people elsewhere, even in the West.

After independently assessing the current global situation, countless Swiss are coming to the conclusion that gold investment is one of the best decisions they can make to ensure their hard-earned prosperity.

At least Switzerland (unlike most nations) enjoys a wide variety of globally-respected gold refiners to choose from: Argor-Heraeus, Valcambi, Produits Artistiques Métaux Précieux (PAMP) and Metalor. They’re a lot less likely to get duped by fake gold…

Oregon woman arrested for selling $18,000 in fake gold bars

According to a report from the Eugene Police Department, a woman is being charged with multiple cases of selling counterfeit gold bars. The first crime occurred last year, when the 37-year-old Amanda Laine Bryant sold $18,000 in alleged gold bullion to a Eugene, OR resident.

A trip to the neighborhood jewelry store quickly revealed that the bars were ordinary gold-colored metal with close to no value. By the time Bryant had again reached out to the victim with offers to sell more gold, sending numerous messages between June and August, the police had already opened an investigation. After a sting that involved the police agreeing to meet with Bryant while posing as the previous buyer, the woman was apprehended following a brief chase.

In times of great demand, counterfeit gold cases like this one occur. It’s relatively easy to electroplate tungsten (which has exactly the same density as pure gold, to three decimal places) in a garage, with $100 in equipment and supplies. These quick-and-cheap frauds look, feel and even sound correct. That’s more than enough to convince a non-specialist.

If you’re looking to purchase physical gold bullion or coins, make absolutely sure you’re dealing with a reputable retailer with an established history, positive reviews and an established brand. This is not a situation where a great offer on Craigslist is likely to end well.

With global tensions spiking, thousands of Americans are moving their IRA or 401(k) into an IRA backed by physical gold. Now, thanks to a little-known IRS Tax Law, you can too. Learn how with a free info kit on gold from Birch Gold Group. It reveals how physical precious metals can protect your savings, and how to open a Gold IRA. Click here to get your free Info Kit on Gold.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

If I was ever to dredge the lake and recover that barbaric relic, would it be a useful backstop in the end? Cannot Uncle Stasi-Sam simply criminalize its use in transactions?

They could but N America is a pretty big place and to police it would be near impossible. Thats why when the collapse does hit, its best to keep your circle of friends small and be wary of outsiders. Just like in every communist marxist regimes the underground flourishes… people learn how to navigate it and smoke out the infiltrators pretty quick. Which leads to another staple in the arsenal so to speak… a back hoe. Saves a lot of energy that could be spent elsewhere.

Gold and silver markets are just another toy the ultra rich play with and use to fleece the rest of us.

Wanna ge into precious metals. Buy PHYSICAL bullion and keep it where YOU have control over it.

Anything else is just fodder for the crooks to steal.

I have concerns with PMs. If they implement a new digital currency (which they will), they could effectively cut off the means of converting PMs and control all real-estate and property purchases. What if we are stuck with unusable PMs until the new regime fails?

So many unknown unknowns. Oh well. It is the best bet, and I still have plenty of Pb.

Things that make you go…Hmmm…

https://www.youtube.com/watch?v=LHu-qpRf0Kk