Best of Dennis…

Dennis is tending to his health and hopes to be back writing very soon. The following article is the most viewed article on the Miller On The Money website and is very interesting to read again 3 years later. This article appeared on February 22, 2018.

An Inconvenient Truth About Social Security

Did I achieve a journalistic milestone? I got my first tip from an insider. What I learned is darn important for our readers.

Did I achieve a journalistic milestone? I got my first tip from an insider. What I learned is darn important for our readers.

Our article “The Social (IN)Security Charade”, discussed how the government gave us a COLA increase and took it right back by increasing medical premiums.

The tipster confirmed I was spot on – however, I barely scratched the surface. While I prefer interviewing the experts, he politely declined, wishing to remain anonymous (now John Doe).

John’s concerned; all generations need to know the facts, so they can plan accordingly. After following his research suggestions, I’ve come to a conclusion about social security.

| Things are WORSE than I imagined, going in the WRONG DIRECTION, and many changes are hidden from the public. |

Americans depend on social security

In a Motley Fool article Sean Williams tells us:

In a Motley Fool article Sean Williams tells us:

“Social Security is, for many Americans, a vital source of retirement income. …. just 8.8% of seniors currently live in poverty compared to an estimated 40.5% that would be living in poverty if Social Security didn’t exist. (Social Security) is counted upon by better than 3 in 5 retired workers to comprise at least half of their monthly income ….”

The government’s impossible promises

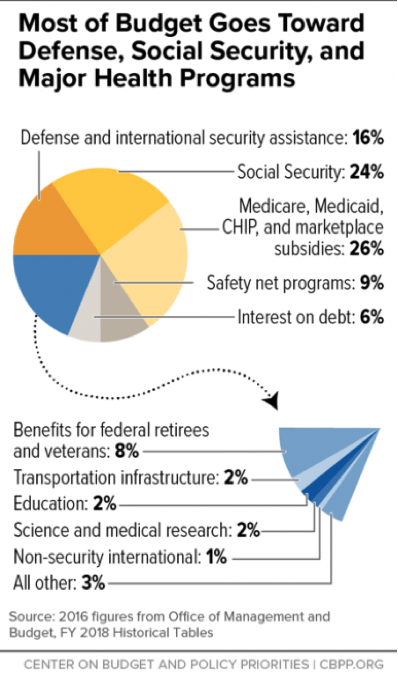

The Center on Budget and Policy Priorities provided a graph showing us how our 2016 federal tax dollars were spent:

Government programs, regardless of whether they are earned like veterans or promises like medical care, comprise the majority of the budget. Add the recent increase in the military budget and ever-growing interest on the debt and there is little room to maneuver.

Government programs, regardless of whether they are earned like veterans or promises like medical care, comprise the majority of the budget. Add the recent increase in the military budget and ever-growing interest on the debt and there is little room to maneuver.

| The politicos know they can’t keep their promises. Their political challenge is to find ways to weasel out of the commitments, blame their political opponents and avoid a public uprising. |

Borrow – tax – spend

During FY 2016, the government borrowed a record amount of money in an effort to prevent the uprising. CSNnews.com reports:

“In fiscal 2016, which ended on Friday, the federal debt increased $1,422,827,047,452.46,

according to data released today by the U.S. Treasury.

…. The total federal debt now equals about $165,575 per household.”

The most cruel, hidden tax of all – inflation

The Social Security Administration (SSA) outlines a major 1983 change – taxing some of your benefits:

“If the taxpayer’s combined income … exceeds a threshold amount ($25,000 for an individual, $32,000 for a married couple filing a joint return), the amount of benefits subject to income tax is the lesser of 50% of benefits or 50% of the excess of the taxpayer’s combined income over the threshold amount.”

In 1993, a second bracket created an 85% threshold.

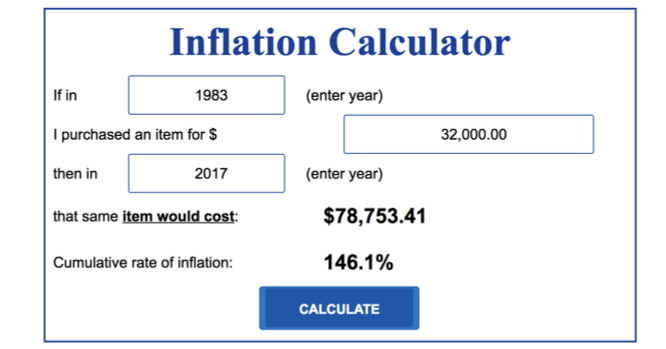

The government has never adjusted the brackets for inflation. This becomes a never-ending stealth tax increase for millions of social security recipients. The US Inflation Calculator illustrates how dramatic the hidden increase is:

Had the brackets been adjusted for inflation, those with a combined joint income under $78,753 would not pay any taxes on their social security benefits.

Had the brackets been adjusted for inflation, those with a combined joint income under $78,753 would not pay any taxes on their social security benefits.

A 2015 SSA study tells us:

“In 1984, less than 10 percent of beneficiaries paid federal income tax on their benefits. …. (SSA) projects that 52 percent of families receiving Social Security benefits will pay income tax on their benefits in 2015.”

It’s going to get worse

John Doe suggested I look deeper into “why” the COLA increase didn’t reflect true inflation, and “why” the government took it back in increased healthcare premiums.

The Bureau of Labor Statistics (BLS) calculates inflation in a few different ways:

“From 1913 through 1977, BLS focused on measuring price change for groups of urban wage earners and clerical workers, or what BLS now calls the CPI-W. …. The CPI-W population represents about 28 percent of the total U.S. population.

…. As part of the 1978 revision, BLS planned to introduce a broader target population, covering all urban consumers (the CPI-U). The … group represents about 88 percent of the total U.S. population.

BLS initially announced in April 1974 its intention to replace … the CPI-W with the broader CPI-U population. That decision, however, was criticized by some … members of Congress ….

As a result, since 1985, the two indexes have differed only in the expenditure weights assigned to item categories and geographic areas. While the CPI-W is used to calculate Social Security cost-of-living adjustments, most other COLAs cited in federal legislation, such as the indexation of federal income tax brackets, uses the CPI-U.”

John suggested investigating CPI-E (as in elderly). I’d never heard of it.

The National Committee to Preserve Social Security and Medicare tells us:

In 1987, …. Congress directed the Bureau of Labor Statistics (BLS) to develop an index focused on the elderly. BLS then developed the Experimental CPI for Americans 62 Years of Age and Older (CPI-E) ….

…. Research has shown that … seniors 65 and older spend more than twice as much on health care, and those 75 and older spend nearly three times more on health care than younger consumers.

Not only do health care expenditures steadily increase with age but healthcare costs have also consistently risen much faster than other market basket categories. The current price index (CPI-W) does not take these critical differences in the elderly population into consideration.

| “Seniors spend a significant portion of their income on out-of-pocket health care expenses not covered by Medicare. As time goes by, more and more of their Social Security benefit checks will be eaten up by rising health care costs.” (Emphasis mine) |

Why hasn’t the government used CPI-E in calculating the COLA benefits?

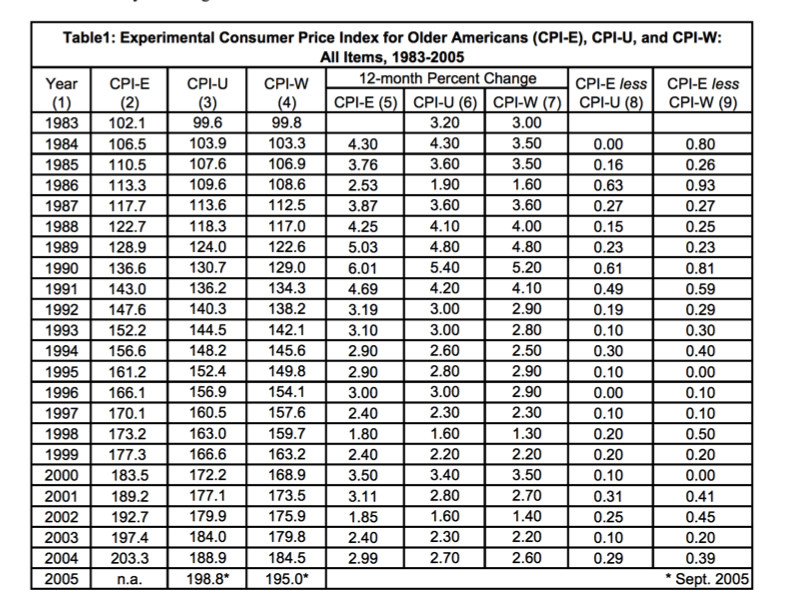

This AARP graph answers that question.

Focus on columns 1-2 & 4. If you started with a $1,000 monthly check in 1983, in 2004, using the current CPI-W, you would receive $1,848.70. Using the CPI-E method it would be $1,991.19.

Focus on columns 1-2 & 4. If you started with a $1,000 monthly check in 1983, in 2004, using the current CPI-W, you would receive $1,848.70. Using the CPI-E method it would be $1,991.19.

The government doesn’t want to spend the money – you must pay your higher medical costs and cut back somewhere else!

Let them eat hamburger

Income tax brackets are also indexed to inflation. ThinkAdvisor.com reports about another recent hidden tax increase:

“Under the new legislation marginal personal tax rates, tax credits and the standard deduction, … are indexed to inflation using the Chained Consumer Price Index … or C-CPI-U, instead of the more traditional CPI-U.

The chained CPI, like traditional CPI measures, tracks the prices of a basket of goods and services but adjusts for changes in purchases as consumers substitute cheaper products and services for more expensive ones.

…. Linking tax brackets to the chained CPI means taxpayers will move more quickly into higher brackets as their incomes rise, but the tax credits they receive and standard deduction they take will rise more slowly.” (Emphasis mine)

If the price of steak gets too high, heaven forbid – don’t raise the CPI – substitute hamburger!

What if hamburger gets too high, do they substitute dog food?

What comes after dog food?

In the 1970’s doom & gloom pundit Howard Ruff suggested, “If things got tough at home, I suppose we could eat the Labrador retriever.”

No wonder friend Chuck Butler calls them “hedonic adjustments.”

| Inflation is a stealth tax, robbing seniors and savers of buying power each month. The politicos know social security benefits don’t keep up with inflation – and they don’t care! Their focus is on finding ways to inflate their way out of debt. |

How long before chained CPI is used for Social Security?

The Medicare Challenge

The Tax Policy Center tells us, “The Medicare trust fund finances health services for beneficiaries of Medicare …. It is financed by payroll taxes, general tax revenue, and premiums paid by enrollees.”

In 2015, premiums were approximately $82 billion, while $272 billion came from general tax revenue.

More political games

The politicos are fighting over repealing Obamacare. Free health care is expensive and they want to hide that from the public.

The political trick is to announce a nice COLA benefit for retirees, and then take it back in medical premiums. It doesn’t save the government a dime, but it makes the cost of government medical care look cheaper.

A little known “hold harmless” provision has protected the majority of retirees. It mandates Medicare Part B premiums cannot be raised if it reduces social security benefits.

USA Today tells us that protection recently (and quietly) disappeared:

“In order for you to be among those … held harmless … you must have been enrolled in Part B before 2017 with premiums deducted from your Social Security check. If you’re delaying Social Security benefits but are benefiting from Medicare Part B, the protection would not apply ….

…. Hold harmless also does not apply to those 5% of beneficiaries who fall into high-income brackets.”

The SSA encourages seniors to defer their benefits, promising larger checks if you wait to file. Deferring benefits was considered an inflation hedge. The government quietly removed the safety net. The guarantee that social security checks will never be reduced because of rising medical costs has vanished!

|

The Inconvenient Truth about Social Security Never expect a real COLA increase. Inflation will reduce your buying power every month. Expect higher medical premiums. Expect means testing. Expect all benefits will be taxed in the future. You are responsible for your well-being, not the government! |

Government created inflation is a stealth tax like carbon monoxide. It’s hard to detect and can be disastrous.

In our recent interview with Chuck Butler he recommended that gold and silver should be 20-25% of your portfolio to combat inflation.

Protecting your nest egg from inflation must be part of your retirement plan – the government isn’t going to help you!

For more information, check out my website or follow me on FaceBook.

Until next time…

Dennis

“Economic independence is the foundation of the only sort of freedom worth a damn.” – H. L. Mencken

Affiliate Link Disclosure: This post contains affiliate links. If you make a purchase after clicking these links, we will earn a commission that goes to help keep Miller on the Money running. Thank you for your support!

The little guy doesn’t have much of a chance in the Demonrat world. Unfortunately the Reflublicans have seemingly pitched their tent in the hooray for us and fooey on the little guy also. Only one thing left for the little guy now. Time will tell. The meek will inherit the earth. God’s word brings a sure hope.

Several points that were not mentioned that IMHO, play a big part in forcing the elderly to pay more for their care. (1) Obama took $716 billion from Social security to fund his name sake Obamacare. As it was explained to me , this mainly impacts Medicare co-pays , caps on medicare payouts and Part D . From my own research , it is difficult for the elderly to pay for medications that are above Tier one. This would include most if not all of the medications you see advertised on TV. (2) I have been told that Ezekiel Emanuel, the chief Obamacare architect and brother of President Obama’s chief of staff Rahm Emanuel, have been unofficially hired as a “medical contributor “and as a health care advisor to Biden. The Emanuel’s believe that people , particularly the aged who aren’t contributing materially to society should get out of the way for the benefit of the young and strong , a hint towards the inevitability of health-care rationing.

As a Public Health RN, it was sad to see elderly American’s struggle to pay for tier 2 and above medications that would assist in a better life . While conversely, non Americans are on the State Medicaid and some were on the ACA , somehow, and their medications were low cost to free. The non-American elderly also received more medical assistance than the average American who payed into the system over their work years. This is tragic that our elderly are deemed non essential. It reminds me of Hitler’s t4 program.

I’d have been glad to ‘be responsible for my well being’ lifelong… if it worked both ways. I get to opt out of SS at 18, gov doesn’t get to take any of my earned money including income tax and I don’t get to expect anything is owed to me later. Nearly all my family members were sucked of SS contribution for 40 working years then died before getting a penny back.

Most of the money spent on medical care is a complete waste. There have been countless studies that point to four main things that people can do to avoid 75% of health problems.

1. Eat well (not the high carb crap that most people eat)

2. Exercise

3. Don’t smoke

4. Don’t drink, or at least minimal alcohol intake

I usually add a few more:

5. No drugs

6. No promiscuous sex

7. Basic primary care (lab work, blood pressure checks, generic medications)

Of course, that’s not where the money is…..