Submitted by QTR’s Fringe Finance

This is part 1 of an exclusive Fringe Finance interview with fund manager Lawrence Lepard, where we discuss the state of the economy, gold, bitcoin, catastrophic outcomes for the market, the supply chain in the country and more.

Larry manages the EMA GARP Fund, a Boston based investment management firm. Their strategy is focused on providing “Monetary Debasement Insurance”. He has 38 years experience and an MBA from Harvard Business School. On Twitter he is @LawrenceLepard.

Q: Hi, Larry. Thanks for joining me today. I wrote earlier this week about why I thought the NASDAQ could be primed for a crash. Let’s get right into it off the bat: what do you think could be the most likely catalyst for a market crash right now?

A: Very hard to say, think of it as like an avalanche. What snowflake is going to be the last one before it breaks free?

The market is insanely overvalued, but until now has proven that what is insane can become more insane. So you can’t short it. Frankly all price signals are broken and we could be in a “crack up boom”.

I do see signs of weakness (Evergrande, yield curve heading toward inversion, Fed reducing QE won’t help). Personally I think we are near the end and close to a crash, but I have thought that for some time and have obviously been wrong.

Inflation coming in hot and being persistent is probably the most likely catalyst. Inflation will reduce profit margins and will make the current multiples look even more insane. Catalyst: psychology changes. Technically upward momentum has slowed. I think we are very near the end.

What do you think could be the LEAST noticed cause for a crash?

I think the precious metals and Bitcoin are about to go on another run, and that this will signal inflation and that will cause awareness that the stock market is overvalued.

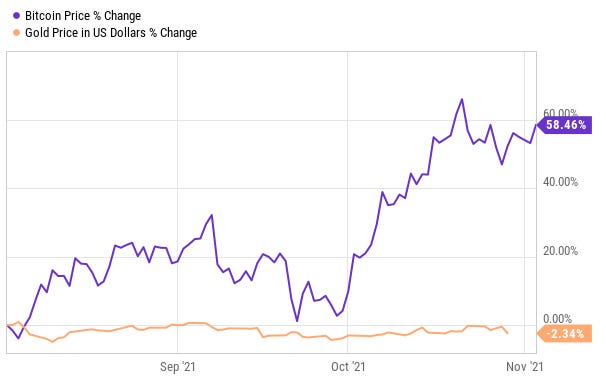

If Bitcoin and gold start performing better than the stock market (Bitcoin has, just needs to continue) that will suck money out of the stock market because everyone is a trend follower these days.

You are an advocate for owning crypto as well as gold – how much excess do you see in the crypto space right now?

I see a lot of excess in the crypto space (NFT’s and Doge are two good examples), but I make a very firm distinction between crypto and Bitcoin. Bitcoin is a crypto currency, but all crypto currencies are not like Bitcoin. I think Bitcoin is legitimate signal. I think all the other cryptos are mostly noise.

Do you only stick to BTC or do you own other cryptos – why or why not?

I am exclusively BTC and do not own any other cryptos.

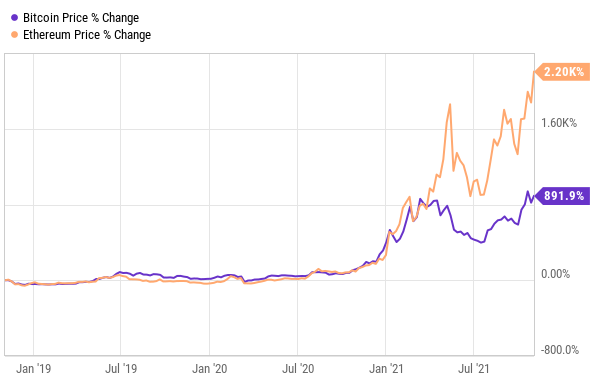

I understand BTC and I think it works for a store of value which is my primary goal since the government is destroying the currency. Ethereum is a nice development layer and it and other use case cryptos will emerge and survive but they are something different than stores of value and therefore I do not own them.

Also, I think many cryptos are frauds and bad things. Tether comes to mind. I think pump and dump bad cryptos have hurt the legitimate store of value coin: Bitcoin. This is sad in my opinion. People should take the time to learn about and understand Bitcoin. It is very important in my view. My Twitter thread has my New Orleans Gold Show speech where I directly address this topic.

Despite all our crowing, the price of metals still seems to be the only commodity that hasn’t caught the inflation bug yet. Why is that, do you think?

The metals were early to the party and are now taking a breather while all the other commodities catch up.

Gold was up over 50% in a two year window. It is down 15% in the past year. It is crazy and partly due to price suppression by the Central Banks, but they cannot hold it down forever and the next run will take it to new all time highs quickly in my opinion.

You’ll be able to read Part 2 of this interview here.

You can listen to Lawrence’s last appearance on my podcast here:

—

If you enjoyed this post, I would love to have you as a subscriber. Zerohedge readers get 10% off a subscription for life by using this link.

—

DISCLAIMER:

Lawrence owns Bitcoin and precious metals, as disclosed. I own exposure to ETH, BTC, Silvergate Capital (SI), and exposure to gold and silver. None of this is a solicitation to buy or sell securities. It is only a look into our personal opinions and portfolios. These positions can change immediately as soon as I publish this, with or without notice. You are on your own. Do not make decisions based on my blog. I exist on the fringe.

MORE DISCLAIMER:

These are not the opinions of any of my employers, partners, or associates. I get shit wrong a lot. If I am here listing things I got right or things I think will happen in the future, note that there are likely twice as many things I got wrong over the same period of time. I’m not a financial advisor, I hold no licenses or registrations and am not qualified to give advice on anything, let alone finance or medicine. Talk to your doctor, talk to your financial advisor or your therapist. Leave me a alone and do your research elsewhere. If you can find somewhere to rate this Substack one star, please do so as to save future readers from the misery of my often wholly incorrect prognostications

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

I can’t wait to trade in my bitcoin for loaves of bread while FRN holders starve in silence, because everyone knows that wheat farmers are crazy for digital currency. I just hope the electricity doesn’t go out and shutdown my massive bitcoin servers in China , or war breaks out with US. that would be bad too, but regardless, the best investment is on muh hard drive.

Didn’t I read we’re very close to a crash last week and last month and last quarter and last year and last decade?

@Bob P – Yes, you’ve been reading that for the last nearly 15 years. I fully expected to see the phrase “kick the can” in this article, as I’ve been reading that phrase for the same time frame. I’ve become convinced that (((they))) can kick the can down the road as long as they want. All the chicken littles, ie, Glenn Beck, have been crowing this shit for so long, I’m sick of hearing about it.

I still have my stacks of silver, and a few buckets of stored flour and cornmeal, but meanwhile, I’ve got a life to live.

The guy is doing nothing more than talking his book.

The notion that even a tiny fraction of liquidity goes into Bitcoin is insane.

Total US stock market cap is around $40T.

Bitcoin’s performance to date has been due to an influx of somewhere in the $10B range.

A 0.1% switchover from stocks to Bitcoin would mean $400B flowing into bitcoin – and given bitcoin’s entire market cap is all of $1.1xT at the moment, is why the bitcoin faithful are eyeing $100K or even $400K.

But the problem is that a stock market crash marks the end of the Bezzle – the Galbraith term coined in describing the 1929 bubble. The Bezzle is not just fraud and crime but unrealistic expectations. The popping of the Bezzle in the Y2K bubble resulted in every stock collapsing – good as well as bad. Cisco in 1999/2000 was supposed to be the first $1T market cap stock – their market cap today is $240B. Their earnings in 2020: $12.2B revenue, $2.6B income.

Compare with Cisco in 2000 was over $500B, closer to $600B or $700B at peak even as their revenue and earnings were a fraction of 2020: revenue $3.9B, income $415M.