Best of Dennis…

Dennis is still tending to his health and hopes to be back writing very soon. Here’s another article I felt was relevant and worthy of a re-read. This article was originally posted on February 23, 2017.

Student Loans: A Multi-Generational Curse

For many, student loan debt is a giant step backward. Is it possible to get a good college education without a multi-decade debt burden? Yes, but it requires some hard work and discipline.

For many, student loan debt is a giant step backward. Is it possible to get a good college education without a multi-decade debt burden? Yes, but it requires some hard work and discipline.

It seems like yesterday when I held my newborn grandson Jacob. Today he is taller than I am, graduating from high school heading off to college. The extraordinary cost of college education is looming, with his sister following close behind. There is money saved, including some of his own, but not nearly enough.

I cringed when student loans were mentioned. Student loans are a curse that keeps on haunting and should be avoided. Jacob can learn from his cousins before him. His older cousin married right before graduation. Their combined student loan debt would buy a nice home. Paying off their loans may take decades.

They were good students, received scholarships, grants, parents and grandparents chipped in; yet that was not enough to cover the cost of their diploma. They’re now in their 30’s and, like most of their peers, they both work, pay rent, pay down debt, have two small children and hope to save enough for a down payment on a home – “someday”.

Is a college degree worth it?

About News tells us, “…over an adult’s working life, high school graduates can expect, on average, to earn $1.2 million, while those with a bachelor’s degree will earn, $2.1 million; and people with a master’s degree will earn $2.5 million.

On average, a $100,000 bachelor’s degree would provide $800,000 more net income over a lifetime. Taking more than four years to graduate changes the math considerably. Complete College America publication Four-Year Myth reports, “… It has become the accepted standard to measure graduation rates at four-year colleges on a six-year time frame.” The top state schools (called Flagship Universities) report “36% graduate on time”.

Is a degree worth the money? It depends on many variables – the cost of the degree, the type of degree, the job market and the skills of the student. Student loans (for the lucky ones) may have been a blessing, however for many it’s become a curse.

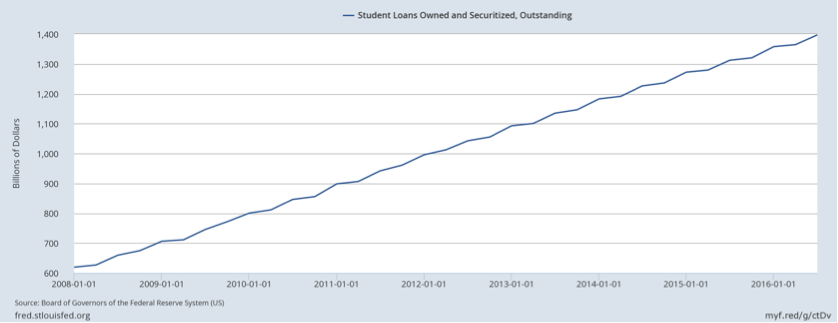

Since the 2008 recession began student loans have skyrocketed to over $1.4 trillion.

The Wall Street Journal recently reported, “Revised Education Department numbers shows at more than 1,000 schools, at least half of students defaulted or failed to pay down debt within 7 years.” Many young people (not all graduated) owe several hundred billion dollars they have been unable or unwilling to repay.

The curse that keeps on giving

While there are some limited exceptions, you cannot discharge student loans in bankruptcy court. In 2012 Marketwatch reported:

“According to government data … the federal government is withholding money from a rapidly growing number of Social Security recipients who have fallen behind on federal student loans. From January through August 6, the government reduced the size of roughly 115,000 retirees’ Social Security checks on those grounds.”

Billions of dollars in student loan debt is on the books. Learn from the experience of others and don’t get caught in the trap.

The challenge for all families with school-age children

Screw the statistics! We are concerned about our offspring. How do we get him/her through school, into a good career, without the burden of overwhelming debt, so they can enjoy the rest of their life?

Properly addressing issues in advance can go a long way toward achieving that goal.

- Is college the right choice? Not everyone is college material, or scholastically motivated. Forcing a square peg into a round hole can be very expensive and setting them up for failure. Family elders must talk and LISTEN to their children. The goal is to help them become financially and emotionally independent adults. If college is not for them, the goal should not be negotiable, but rather how to get there.

- What would be a good major? Because dad is a CPA and wants junior to buy out his practice is not why he should become an accountant. What skills and interests does junior have? What does he see himself doing in ten years? I had a friend who was terrified of flying tell me his son worked at a small airport and wanted to be a pilot. His son prevailed.

- Be financially responsible. Once you have an idea of a major, finding an affordable school to fit is the next step. My friend was surprised to find a local college that had exactly what his son needed and he could continue to work his part-time airport job.

- All schools are not created equal. CNN Money provides a great tool for estimating college costs. I started with Northwestern University. The annual cost of tuition, room and board is $70,177. They also provide estimates after grants and scholarships (none guaranteed), which vary by family income. By contrast, the annual cost for our local Arizona State University is $26,191 before grants and scholarships. Is the big-name school worth almost three times the price?

- Expectations should be clearly understood. A four-year degree is expected, be one of the 36%. Using the above numbers, two additional years at Northwestern would cost $140,000 more. Time is money! Put a master’s degree on top of it and the educational cost could be well over $500,000.

How do the 36% make it through in four years?

For some, college was considered a right of passage. It made little difference what kind of degree you earned; you could find a job. Times and costs have changed. A party school today can become a very expensive six-year party. Young people at the most uptight school in the country will still have time to make friends and have fun. It’s a given!

- Make the counselor work for you. Complete College America tells us, “On average, there is one advisor available for every 400 students.” They don’t always work in our best interest. In two cases, a college counselor told our incoming freshman to take 12 hours; it is less stressful. Don’t fall for it! If you need 120 hours to graduate, you just added an additional year to your cost – assuming you have a perfect schedule, don’t change majors or have a bout with mono.

- Build a complete academic plan. Expect 15 credit hours per semester. Require the counselor to map out the required courses for the major, or a plan to get the student to a point in year one or two where they can declare their major without having to take additional classes. Take summer classes if you need to. On average, students with a bachelor’s degree end up with 134 credits when 120 are sufficient. That’s expensive and unnecessary.

- If you consider a junior college, do your homework. College costs escalate rapidly when students transfer to another school. If your goal is to get a bachelor’s degree from your state school, will they give credit for all the classes from a state junior college? Avoid remedial classes if at all possible. Start with the goal and build a plan working back through the freshman year. You need to ensure all credits are acceptable and build a road map. Yes, it takes time, but you could be saving thousands of dollars.

- Go to class every day. School is a full-time job. Only going to class a couple of days a week, and the holy grail of no Friday classes will not get you a degree in four years. The student must schedule classes when they are available – even if it means getting up early in the morning.

- Dropping classes is unacceptable. If a class is hard and might affect your grade point average, “blowing it off” is unacceptable. Those with technical degrees can name the “weed out” classes. They are hard, require a lot of study time and many have dropout rates of 50% or more. Stressfully working hard to pass tough classes is part of the deal. That’s real life! Get a tutor if you need help, it is much cheaper than dropping out and changing majors.

- Inquire about grants and scholarships every semester. Ask your professors and department heads for help. Many times there is money available just for the asking.

- Parents, do your job! Parenting does not stop when your offspring leave for college; they still need your guidance. Have a realistic, jointly agreed-upon budget from the minute they enter college. Keep them on track and you will avoid a lot of problems down the road. I’ve heard cases of students underperforming and totally exasperated parents exclaiming, “You are on your own!” By spending their own money parents hope their offspring will suddenly become more responsible.

One of the curses of student loans is the money is too easily available. Students do not learn financial responsibility until much later. Reality sinks in when they have to pay back the debt. Do you really want an irresponsible child running up thousands of dollars in student loan debt? I am NOT suggesting you continue to bail them out financially. Refocus and recommit to the budget. It’s time they learned to focus on priorities and distinguish needs from wants. If student loans become necessary, they should be as little as possible providing the shortest path to graduation.

Student loans have allowed the cost of education to escalate to ridiculous levels.

As family elders, our goal is to get our offspring educated, without the horrible burden of student loan debt affecting the rest of their lives. Be among the 36% who get it done right!

For more information, check out my website or follow me on FaceBook.

For more information, check out my website or follow me on FaceBook.

Until next time…

Dennis

“Economic independence is the foundation of the only sort of freedom worth a damn.” – H. L. Mencken

Affiliate Link Disclosure: This post contains affiliate links. If you make a purchase after clicking these links, we will earn a commission that goes to help keep Miller on the Money running. Thank you for your support!

I wonder how long it will be before the kikes bring back inheritable debt?

I am certain you can measure it in days better than decades. It is coming. They can’t resist usury. They abhor doing God’s work.

Statisitics can’t tell you if a college degree is worth it or not. The only thing that matters is the person and their drive and focus. Nobody likes to admit that. They just want numbers so they can pretend it is calculatable. They can not accept the risk or the responsibility that comes with major life decisions.

Obviously federally subsidized student loans is fundamentally a criminal racket.

Statistics may not provide a clean calculation, but put all lending back in the hands of private lenders, and make them liable for their losses, and they will come up with a measure that communicates the relative “utility” and economic “payback” of various fields of study through the mechanism of variable interest rates. Not perfect, but at least no longer “our” problem.

Government involvement in “education” at all levels is a multi-century plague at this point.

Good luck.

Wonder if Colorado’s governor and his husband had anything to do with this?

Back when I started college in the early 80’s I was able to pay for my education with part-time and summer jobs. I did this till my first quarter as a senior when the business school of the university lost its accreditation. My education was aimed at a useless degree so I decided to take a year off to work at making money to go somewhere else. It was 10 years before I finished my BA as a non-traditional student with 2 kids and a supportive wife. I did have the benefit of the GI Bill but I worked two part time jobs while in school.

The way college cost have risen I could not do either today. Since I was 18 I have never worked a minimum wage job, close sometimes but always above it. My daughter graduated with her Masters in 2011 and my son graduated with a business degree 2 years later. Both their educations cost about the same. The 3 year difference in college cost was about $6 thousand more for my son’s 4 year business degree over the cost of my daughter’s BS and MS degrees.

Two points: 1) the premise is all wrong. The question is not first and foremost how to get a College degree as cheaply as possible but IF a College degree is a good fit/idea in the first place. For many, the answer is no.

2) if you still insist: to get a legitimate College degree for under $10K, read

http://www.degreeforum.net

Everything is FUBAR. This country is killing itself because of G.R.E.E.D

https://www.theblaze.com/news/asian-attack-septa-train-video