Best of Dennis…

Dennis is tending to his health again but is on the mend and hopes to be back writing very soon. Here’s another article that is very relevant today and worthy of a re-read. This article was originally posted on April 5, 2018.

Inflation Is Quietly Poisoning Your Retirement Nest Egg

Remember how excited you were when you got your first “real job”? It was early January and I was fresh off active duty. I began washing cars at an auto dealer – for $1.00/hour. I’d wash off the snow and grime from every car on the sales lot. It was freezing cold. I quickly realized what I didn’t want to do for my life’s work.

Remember how excited you were when you got your first “real job”? It was early January and I was fresh off active duty. I began washing cars at an auto dealer – for $1.00/hour. I’d wash off the snow and grime from every car on the sales lot. It was freezing cold. I quickly realized what I didn’t want to do for my life’s work.

My mother said “Pure Oil is advertising for office help. Maybe you should apply.” I grabbed my only white shirt and tie and got hired. Salaries for someone with no experience was $250/month ($3,000/year). I was excited – I was making $1.44/hour! I was still at home, basically broke, but at least I wasn’t outside freezing.

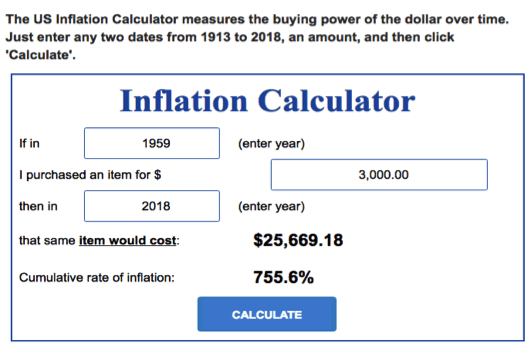

I looked at my 2017 social security statement and wondered how it compared to my first job. The US Inflation Calculator answered my question:

Today it takes $25,669 to maintain the same buying power as my entry level clerical job. I’ve gone full circle, despite paying maximum social security taxes for decades, that’s about what I receive in benefits today.

I’m lucky!

The Motley Fool reports, “How Big Is the Average Person’s Social Security Check?”:

“In the 12-month period ending June 2017, over 2.9 million Americans signed up for Social Security benefits. On average, these retired workers were awarded $1,413.08 in monthly benefits…. 1.4 million women filed for Social Security benefits, and their average award was $1,231.50. Men, however, were awarded $1,583.77, on average.”

The buying power of the average male benefit is 26% below my entry level job.

Healthcare.gov provides information about the Federal Poverty Level. The amount is used to calculate eligibility for other government benefits. For individuals, the poverty level is $12,140 and it’s $16,460 for a family of 2.

| If you want to maintain a working-class lifestyle in your golden years you better plan on saving a lot of money. Social security alone won’t get the job done! |

Is inflation good or bad?

It depends! The highest inflation in most of our lives came during the Carter years.

Inflationdata.com provides the yearly data:

| Year | Rate |

|---|---|

| 1977 | 6.5% |

| 1978 | 7.72% |

| 1979 | 11.22% |

| 1980 | 13.58% |

| 1981 | 10.35% |

The inflation calculator tells us the accumulated inflation was 59.9%. If you bought a $20,000 automobile on 1/1/77, and prices increased at the inflation rate, that same vehicle would cost $31,984 – just five years later!

Who benefits from inflation?

In 1977 we moved to Atlanta. I had a good job, growing family and a significant mortgage. While prices were increasing rapidly (I was furious about gas prices), my salary was rising. With each passing month, our house payment became a smaller portion of our income.

Inflation favors debtors because they are paying down their debt with depreciated dollars. Generally most residential real estate will appreciate with inflation. If you are still working, and your income is rising accordingly, your debts become easier to pay.

Who benefits the most? Who are the biggest debtors? Governments all over the world! Politicos know it is impossible to keep all their political promises or pay off the accumulated debt. By design, they inflate their way out of debt, borrowing money today and paying it back with depreciated dollars in the future.

Who is hurt the most by inflation?

Seniors and savers. If you bought a five-year $20,000 bond in 1977, when it matured you received your $20,000 back. Unfortunately, it’s worth approximately $8,000 in 1977 dollars.

| Retirees do not have the benefit of an income like they did when they were working. While expenses rise, retirees hope their investment income and social security keep up with inflation, so they can maintain their standard of living. |

Despite a law indexing social security benefits to inflation, your monthly benefit is unlikely to increase – and it could go down!

Our article, “An Inconvenient Truth About Social Security”, outlined how government medical premiums (deducted from your social security) are rising well ahead of the inflation rate.

A little known “hold harmless” provision protected the majority of retirees. It mandated Medicare Part B premiums could not be raised if it reduces social security benefits.

USA Today tells us that protection recently (and quietly) disappeared:

“In order for you to be among those…held harmless…you must have been enrolled in Part B before 2017 with premiums deducted from your Social Security check. If you’re delaying Social Security benefits but are benefiting through Medicare Part B, the protection would not apply….

…. Hold harmless also does not apply to those 5% of beneficiaries who fall into high income brackets.”

The bigger problem

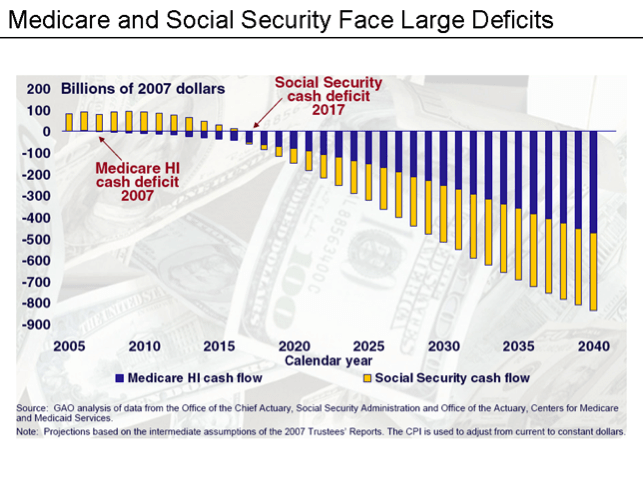

The Peterson Foundation tells us, “Social Security will run a cumulative cash deficit of $2.8 trillion between now and 2034.”

Social security is a fraction of the bigger problem. The US Debt Clock shows government debt has now surpassed $21 trillion. That does not include social security which is included in the $112 trillion of “US Unfunded Liabilities”.

Social security is a fraction of the bigger problem. The US Debt Clock shows government debt has now surpassed $21 trillion. That does not include social security which is included in the $112 trillion of “US Unfunded Liabilities”.

UN-funded??? What about the trust fund? Historically government social security income exceeded benefits paid out. The government spent the excess and put IOU’s in the trust fund. Today’s expenditures exceed revenues. Now the government must borrow to meet the promises – on top of the rest of the federal budget.

What about future inflation?

In 2017 the average male benefit is approximately $19,000 (before medical premium deduction). Here’s a great tool for calculating future inflation.

If the Fed maintains their 2% inflation target, in 20 years (approximate life expectancy) it will take $28,233 to provide the same buying power. If inflation is 3%, the number jumps to $34,316. At 2% your buying power drops approximately 33% – 3% would be around 45% loss.

Can we depend on only 2% inflation?

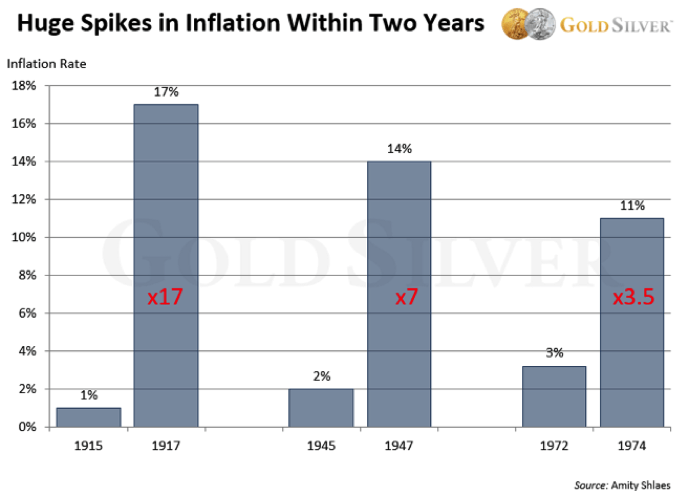

Our friend Jeff Clark at GoldSilver.com paints a different picture in his recent article, “Here’s What Inflation Could Look Like in 2020, Based on Past Surges”:

“I ran across a study by Amity Shlaes…. Her research found several examples from the past 100 years when US inflation started mildly but then soared to alarming levels. What’s perhaps even more startling is that those inflationary spikes occurred within just two short years.

Check out how much the rate of inflation rose during these periods:

…. Shlaes says US inflation was at 1% in 1915. Within just two years, it soared to 17%….

The official inflation rate in 1945 was 2%, but surged to 14% within a mere 24 months, a 7-fold increase.

The CPI registered 3.2% in 1972 and hit 11% by 1974. Worse, it continued to march higher over the decade, peaking at 14.7% in April 1980, in what amounted to a near 5-fold rise.

…. There is clear historical precedence that inflation can rise suddenly and rapidly, and that prices can quickly spiral out of control. It would thus be dangerous for us to assume that inflation will stay subdued indefinitely.

…. Notice these inflationary spikes occurred roughly 30 years apart. And it’s been over 40 years now since the last one….

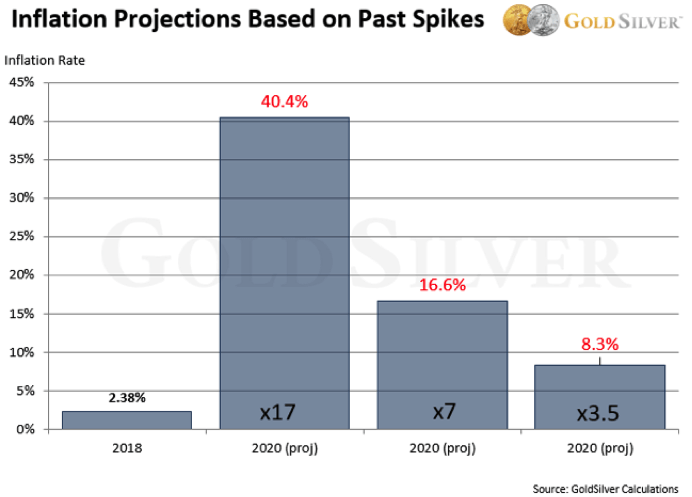

What Inflation Could Look Like in 2020

…. Let’s apply those historical increases to today and project how high inflation could potentially be two years from now.

If we matched any of those prior rates, here’s what inflation could look like by the year 2020, based on the current 2.38% CPI reading.

If we matched the 1917 rate, inflation in the year 2020 would hit a whopping 40%.

If we matched the 1917 rate, inflation in the year 2020 would hit a whopping 40%.

The 1947 increase would take us to 16.6%, exceeding what we saw in the 1970s and ’80s.

The 1974 rate would push us to 8.3%.”

Can anyone guarantee an inflation spike will not happen? Many suspect the deep state would love a huge inflation surge. If we experienced 60% inflation like the Carter years, the deep state would not only benefit politically, it would also make it much easier to service government debts.

While there is not much we can do on the political side, how would your portfolio fare? Fortunately, we have control over how and where we invest.

THE DIFFICULT TRUTH

Inflation is like carbon monoxide – tough to detect and very dangerous.

Many diligent savers and investors saw their retirement dreams go up in smoke during the Carter years because they didn’t have adequate inflation protection.

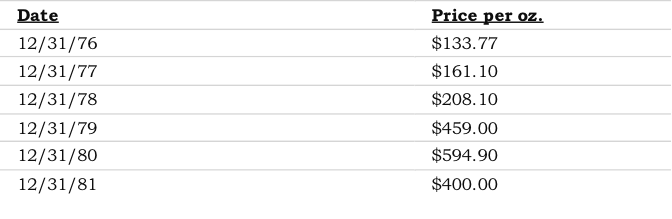

Would owning gold have really helped at the time? Only Gold supplies us with the gold prices:

The value of the USD depreciated by approximately 60% – while the value of gold tripled.

The value of the USD depreciated by approximately 60% – while the value of gold tripled.

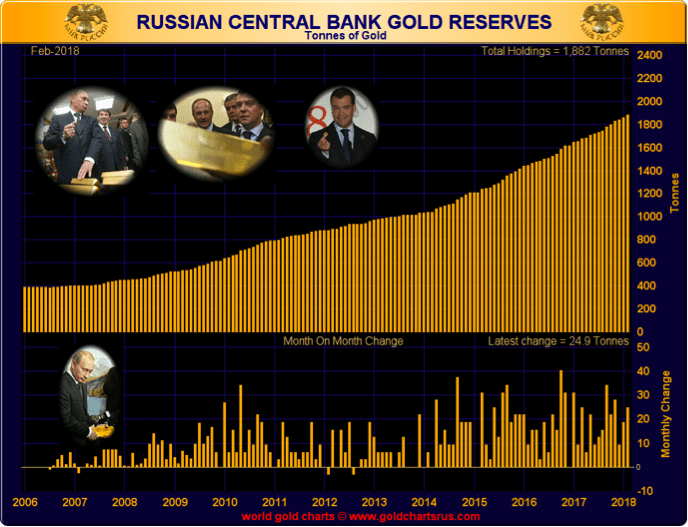

Can we guarantee gold would appreciate in the same fashion today? Of course not. Ed Steer’s Gold and Silver Digest regularly supplies charts like this one. We can only speculate why Russia has almost doubled their gold reserves in less than five years. I wonder how much gold is really left in Fort Knox?

Jeff Clark’s warning that inflation can rise suddenly and “it’s dangerous to assume that inflation will stay subdued indefinitely”, is an understatement. It’s a huge risk to all retirees and savers!

Jeff Clark’s warning that inflation can rise suddenly and “it’s dangerous to assume that inflation will stay subdued indefinitely”, is an understatement. It’s a huge risk to all retirees and savers!

|

THE DIFFICULT TRUTH Saving a lot of money to supplement your social security income is merely a start. Investing wisely and protecting your buying power are major factors in allowing you to retire comfortably. |

Generally, inflation appears under control, until it isn’t! No one knows when it will trigger, or quite how bad it will be – but it will happen!

It’s tough enough to save and invest wisely. The catastrophic consequences of high inflation wiping out your life saving should not be ignored. Remember, there are no do-overs!

For more information, check out my website or follow me on FaceBook.

For more information, check out my website or follow me on FaceBook.

Until next time…

Dennis

“Economic independence is the foundation of the only sort of freedom worth a damn.” – H. L. Mencken

Affiliate Link Disclosure: This post contains affiliate links. If you make a purchase after clicking these links, we will earn a commission that goes to help keep Miller on the Money running. Thank you for your support!

Not my eggs…I’m 97% out of the digital dollar and the ORC Bankster’s control.

It’s doable.

I have no idea how much time is left…I never thought in my wildest dreams we would have had this much…make every day, and every soon to be worthless fiat dollar…count.

https://media.istockphoto.com/photos/man-with-his-head-bowed-and-holding-a-holy-bible-in-prayer-picture-id161063333?k=6&m=161063333&s=170667a&w=0&h=zsqDehOfI-ER3ilPzdpNu6tS14fIXjH1JwonAATMX1k=

Hilarious– a 2018 article referencing our “$21 trillion national debt” and predicting soaring interest rates by 2020 as we are still hovering at 0% interest.

The inflation calculator was interesting– I was better off financially in 1987 as a young man than I am now (salary purchasing power)

It looks like we’re going to cross the 30 TRILLLION dollar national debt mark within a month–mind numbing numbers on that Debt Clock.

Shall we hold a Party with Jay P … and Jan.

It will be a Blast as the Billionaires realise their costs are up, the share prices falling and they can’t raise prices because the Plebs cannot afford it. Trust me the very wealthy are losing buckets of fiat to inflation even if they can still afford Lobster

Jay is in a Lot of trouble from his Bosses

Against the wall

Per shadowstats most recently calculation, inflation is about 15%.