Since the repeal of the Glass-Steagall Act in 1999, the role of the Federal Reserve has changed. The Fed used to be owned by banks while high-risk investment houses were separated and not considered part of the banking system.

Since the repeal of the Glass-Steagall Act in 1999, the role of the Federal Reserve has changed. The Fed used to be owned by banks while high-risk investment houses were separated and not considered part of the banking system.

Since the repeal, banks have consolidated where the top four banks now account for 50% of all US Banking assets. In addition, they have merged with high-risk investment houses and become casino banks.

What has (hasn’t) changed?

President Andrew Jackson (1767-1845) called out the banks:

“Gentlemen! I too have been a close observer of the doing of the Bank of the United States. I have had men watching you for a long time and am convinced that you have used the funds of the bank to speculate in the breadstuffs of the country. When you won, you divided the profits amongst you, and when you lost, you charged it to the bank. You tell me that if I take the deposits from the bank and annul its charter, I shall ruin ten thousand families. That may be true gentlemen, but that is your sin! Should I let you go on, you will ruin fifty thousand families, and that would be my sin! You are a den of vipers and thieves, I have determined to rout you out, and by the Eternal God, (bringing fist down on the table) I will rout you out!”

During the Great Depression, the government finally reigned in the banks and passed the Glass-Steagall act, protecting taxpayers and depositors from banks making investment mistakes with our money. The FDIC was designed to protect citizens from bank failure. No depositor has lost money since then.

Today the situation is reversed. These huge casino-banks own the Federal Reserve, and their risky operations are now being bailed out with our tax dollars under the guise of their bank charters.

Since Glass-Steagall was repealed, the mantra of the Fed’s master has changed. Within a decade the taxpayers subsidized their first big bailout, and the process continues. The banks make risky trillion-dollar bets, knowing the Fed (taxpayers) will cover their mistakes – while paying themselves huge bonuses.

| “The Federal Reserve System is nothing more than legalized counterfeit.”

— Ron Paul |

In 2010 the Dodd-Frank bill was passed and has been ineffective. The Fed protects (subsidizes) the casino bank profits while breaking the law. No one is routing them out.

Bloomberg News Editor in Chief Matthew Winkler tells us: (Emphasis mine)

“At some point long before the credit markets seized up in 2007, financial markets collapsed and the economy plunged into the worst recession since the 1930s, the Federal Reserve forgot that it is the central bank for the people of the United States and not a private academy where decisions of great importance may be withheld from public scrutiny.”

Friend Chuck Butler published a twitter post by Marc-Andre Fongern that sums things up well:

“What the Fed has achieved so far:

1) Intensified inequality

2) Made the rich even richer

3) Boosted inflation alarmingly

4) Inflated stocks massively

5) Engaged in insider trading

Impressive. Congratulations.”

Retired libertarian congressman Ron Paul’s cries of ending the Fed, fall on deaf ears.

OUR problem grows dramatically

Since the 2008 bailout, we’ve seen Fed Chairs, Bernanke, Yellen and Powell talk a good game, but their behavior tells a different story. Their primary mission has been spending trillions to bail out (subsidize) their casino bank owners – all at the expense of Main Street.

Alex J. Pollock, tells us, “Since 2008, Monetary Policy Has Cost American Savers about $4 Trillion.” This reckless money printing brought us double digit inflation – which continues to rise. The American people are seeing their life savings shrink in buying power at the highest rate in over 40 years. Inflation is here, the public is on to their game. The Fed and congress keep fiddling…

In a recent Daily Pfennig, Chuck Butler quotes John Dienner from Ruminations of the World Economy:

“The Fed printed more money in just one-month last year than the nation printed during its first 200 years. You may remember from high school physics class that for every action there is a reaction (Newton’s Third Law). That reaction might not be immediately observable but there will always be a reaction. The reaction to the rapid expansion of the money supply can be described either as ‘price inflation’ or ‘dollar devaluation.’ …. Your money buys less than it did before the money printing.”

Chuck concluded:

“Remember months ago, when I was waving my arms and yelling from the rooftops that this inflation that we were seeing was 1. Not transitory, and 2. Not wage influenced, that it instead was a Money printing phenomenon? That’s exactly, what’s going on here folks…”

CNBC reports:

“Amid rising prices, American families fall deeper in debt

Higher prices are already taking a toll.

As consumers pay more for everything from groceries to gasoline, household income is failing to keep pace with a higher overall cost of living, according to recent reports.

…. The average U.S. household with debt now owes $155,622, or more than $15 trillion altogether…– up 6.2% from a year ago.”

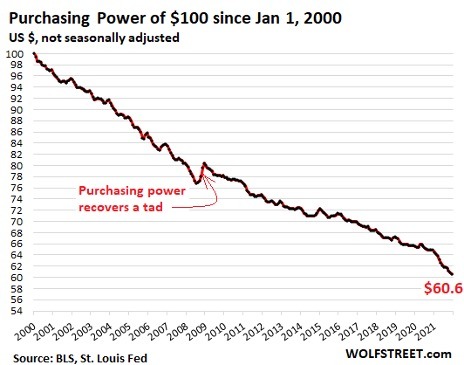

Wolf Richter reports, “Purchasing Power of the Dollar Goes WOOSH!”

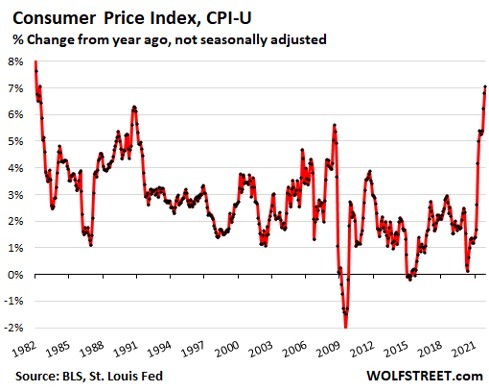

“The broadest Consumer Price Index (CPI-U) jumped…by 7.04% from a year ago, the highest since June 1982….

But there’s a big difference between now and 1982. Now, the inflation index is spiking, and has been getting worse month after month; back in 1982, inflation was coming down. The last time inflation actually spiked like this on the way up and broke through the 7%-mark was in June 1978:

…. The effective federal funds rate (EFFR), which the Fed targets with its interest rate policy, is now at 0.08%. …. The inflation-adjusted or “real” EFFR is a negative 6.96%, the most negative “real” EFFR in the data going back to 1954, the hallmark of the most reckless Fed ever.

…. Inflation is the loss of the purchasing power of the dollar…. By December 2021, the purchasing power of $100 in January 2000 dwindled to $60.60:

But so far, the Fed has refused to deal with this inflation. It is still repressing short-term interest rates to near 0%, and it’s still printing money in large amounts, though less than it did two months ago.”

CBS news tells us:

“The Federal Reserve on Wednesday announced that it is accelerating its removal of monetary support for the economy, citing a rise in inflation that has seen the biggest jump in prices nearly 40 years. (Emphasis mine) In a move to cool growth, policy makers also said they expect to hike interest rates three times in 2022.

…. ‘The inflation that we got was not at all the inflation we were looking for,’ Fed Chairman Powell said.”

When Powell was questioned about inflation reaching Carter year highs, he told Congress:

“As we move through this year…if things develop as expected, we’ll be normalizing policy, meaning we’re going to end our asset purchases in March, meaning we’ll be raising rates over the course of the year.”

Let’s get this straight. Americans are going further in debt, prices are skyrocketing, and you keep yapping about it but do nothing? Why the hell are you not raising rates now? Fiddle…fiddle…fiddle…

Chuck Butler’s response:

“Our Fed/ Cabal/ Cartel is still sitting on their collective hands… I mean give me a break Powell! If you think, and have said, that inflation is a problem and that higher interest rates will be needed, but you’ve put the rate hike off until March, what gives? If rates need to go up, they need to go up now! You, fumbling, bumbling, poor excuse of a Central Banker…

.… If we calculated inflation the way it used to be calculated before the hedonic adjustments were added in the 90’s, Inflation is really running at 15.2%, according to shadowstats.com…”

Serving two conflicting masters

Mr. Powell knows he cannot serve two masters, the American people, and the casino banks. So far he has made his choice clear. Powell isn’t stupid, he just hopes we are.

Powell knows that even a small rate increase will negatively affect the stock and bond markets and his master’s profits. The “most reckless Fed ever” keeps fiddling while Main Street burns.

| “Socialism/Keynesianism assumes governments can be trusted, while Austrianism ask ‘Where is evidence for this faith?'”

— Richard Maybury |

Congress also cannot serve two masters. Will congress reign in the Fed? While we can HOPE another Andrew Jackson or Ron Paul emerges and the Fed is brought under control, retirees must still protect their accumulated wealth.

What can we do?

Investors must protect themselves. Buy and hold assets that provide inflation protection. Many investors are doing that.

The Perth Mint reports, “Perth Mint records highest annual sales for gold in 10 years.”

Nikki Asia tells us:

“Central banks around the world are increasing the gold they hold in foreign exchange reserves, bringing the total to a 31-year high in 2021.

…. The value of the dollar against gold has dropped sharply over the last decade as large-scale monetary relaxation has kept boosting the supply of the U.S. currency. Although the U.S. Federal Reserve is starting to tighten its grip on credit, other central banks continue their shift to gold, reflecting global concerns about the dollar-based monetary regime.” (Emphasis mine)

Throughout history gold has maintained its value while paper money becomes worthless. Owning physical metal and gold stocks are considered insurance, protecting you from the catastrophe of worthless paper money destroying your wealth. While the Fed may fiddle, investors can’t afford to sit idly by. Got gold?

For more information, check out my website or follow me on FaceBook.

For more information, check out my website or follow me on FaceBook.

Until next time…

Dennis

“Economic independence is the foundation of the only sort of freedom worth a damn.” – H. L. Mencken

Affiliate Link Disclosure: This post contains affiliate links. If you make a purchase after clicking these links, we will earn a commission that goes to help keep Miller on the Money running. Thank you for your support!

EXCELLENT work here Sir.

Short memories fail to recall that in the 08 melt down the FED had to bail out all the world’s banks, including the massively over leveraged D Bank, to the amount of about NINETEEN TRILLION.

“The FED has only mandate. To insure the profits of the member banks and then bail them out when they get caught out speculating for gross profits to pay themselves bonuses on the mythical magical computer bits and bytes of derivatives, in the decades long recurring cycle of the FED created Boom – Bust cycles.”

“Lenin is said to have declared that the best way to destroy the Capitalist System was to debauch the currency. By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. Lenin was certainly right.

“There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose.” Keynes

Another great article with good collection of facts on the legally created Criminal enterprise.

https://mises.org/wire/fed-trapped-it-has-no-room-taper-or-raise-rates

It was once said that the banks only know how to print money, and when things get too hot, pull the punchbowl away. Rinse and Repeat, things just never seem to change with our Banksters.

I came across this article on banking philosophy that came out in 1941 that explains how the bank do their jobs.

An example of banking philosophy Page 1 of 3

Written by Louis Even on Sunday, 01 June 1941. Posted in Banks

TO SEIZE THE BELONGINGS OF ALL NATIONS AND

INDIVIDUALS

THIS IS THE REAL REASON FOR POVERTY IN THE WORLD

An example of banking philosophy was first published In 1941 by Louis Even and in

reading it, one will quickly realize that the plan of the Financiers to seize the people’s

wealth and the farmers’ land has been going on for a long time. But today, one can dearly

see that this plan has been fully realized. The people owe ail of their country’s wealth to the

Bankers through national debts, and a majority of the farmers of developed countries have

disappeared; those remaining must work night and day to pay interests to the Bankers. Let

us ail read again this important document that enlightens us ail on the real reasons for

poverty in the world.

Here is the full text of an article published in the United States Bankers’ Magazine in

1892. It was recently re-published in the New Era and in the Social Creditor, where we took

it:

must go forward cautiously and consolidate each acquired position,

because already the inferior social stratum of society is giving unceasing signs of

agitation.

Therefore, prudence dictates to us a line of conduct that seems to give in to

the will of the people, until the execution of our plans be well-enough established

for us to be able to declare our intentions without having to fear any organized

resistance.

Our confidence men shall have to closely watch the Farmers Alliance and the

Knights of Work, and take steps immediately, either to control both associations

in accordance with our interests, or to break them.

Our men will have to attend the Convention that will be held in Omaha on the

4th of July, and be in charge of ail activities. Otherwise, this Convention could

muster such an antagonism to our plans that we would have to resort to force to

overcome it.

Now, at the present time, using violence would be premature. We are not yet

ready to confront such an assault. Money must first of all seek maximum

protection in schemes and in legislation.

https://www.michaeljoumal.org/articles/banks/item/an-example-of-banking-philosophy 4/16/2020

An example of banking philosophy Page 2 of 3

“Let us make use of the courts. Let us go forward as fast as possible at perceiving debts, at

foreclosing (depriving of recourse to justice when a certain time limit hasbeen transgressed) on debentures and mortgages.

“When, through the law’s intervention, the common people shall have lost their homes, they will be more easy to control and more easy to govern, and they shall not be able to resist the strong hand of the Government acting in accordance with the orders of the central power of imperial wealth, under the control of the leaders of finance.

“Our top leaders are perfectly aware of the truth. They are presently working at establishing an imperialism of the capital to rule the world. But while they are implementing this plan, they must keep the people busy with political antagonisms.

“We’ll therefore speed up the question of reform in the custom rates by the political organization called the Democratic Party; and we’ll put the spotlight on the question of protection and of the reciprocity by the Republican Party.

“By dividing the electorate this way, we’ll be able to have them spend their energies at struggling amongst themselves on questions that, for us, have no importance whatsoever, and on which we only touch upon as instructors of the common flock.

“It is thus that, through discreet acts, we can maintain what was so generously projected and executed with such a remarkable success.”

* * *

Commentaries are unnecessary on a text that speaks for itself. Let us take the date into

consideration: 1892 – one year before the crisis of 1893. We now have in our possession three documents relative to this 1893 crisis.

1. The 1891 document, the confidential leaflet of the bankers, encouraging mortgages on properties, in anticipation of the crisis that the bankers would launch a little later on to grab all of the mortgaged properties. Besides, here is the text:

“We are authorizing our loan officers from the Western States to loan on properties, monies

repayable by September 1t, 1894. No fatal date is to exceed this date.

“On September 1st, 1894, we shall categorically refuse all loan renewals. On that day, we shall demand the repayment of our money, under penalty of foreclosure on collaterals.

An example of banking philosophy Page 3 of 3

“The mortgaged properties will become ours. (Money will have become scarce beforehand, and the repayments will have become generally impossible.) We’ll thus be able to acquire, at a price agreeable to us, two-thirds of the farms west of the Mississippi and thousands more east of this great river.

“We’ll even be able to possess three quarters of the western farms as well as all the money in the country. The farmers will then become land tenants only, just like in England.”

2. The above-mentioned 1892 document in which the Bankers expose their philosophy.

3. The March 11, 1893 leaflet, since then called: “The Panic Circular”, addressed by the American Bankers’ Association to all national banks throughout the United States:

“The interests of national banks require immediate financial legislation by Congress (the United States Government). Silver, silver certificates, and Treasury bonds (that is to say, all the Government’s money) must be retired, and National Bank Notes made the only money.

“This will require the authorization of $500 million to $1 billion of new bonds as the basis of

circulation. You will at once retire one-third of your circulation (your paper money) and call in one-half of your loans. Be careful to make a monetary stringency among your patrons, especially among influential businessmen.

“Advocate an extra session of Congress to repeal the purchasing clause of the Sherman Law, and act with other banks of your city in securing a large petition to Congress for its unconditional repeal per accompanying form. Use personal influence with your Congressmen, and particularly let your wishes be known to your senators.

“The future life of national banks, as fixed and safe investments, depends upon immediate action, as there is an increasing sentiment in favor of Government legal-tender notes and silver coinage.”

The very-well organized Bankers’ Association won the day over an ignorant public solely organized for political struggles of colours. A special session of the Congress was convened expressly to demolish the ever-increasing confidence of the people towards a government issued money.

To force the people and the governments to kneel down in front of the banks, an extreme

scarcity of money had to be created. The whole of America felt this scarcity. It was the crisis

that was called the “Panic of 1893”. Planned in the offices of the makers and the destroyers of money, this crisis sowed ruins and pains in every corner of the country.

https://www.michaeljoumal.org/articles/banks/item/an-example-of-banking-philosophy

4/16/2020

I wonder what day of this year these Banksters will pull the plug.

More on the subject from a super smart lady.

Federal Reserve reviewed VERY well by Nomi Prins. Check out her book.

I read Naomi Prins’ 2009 book titled “It Takes a Pillage.” A very good book. I emailed her, and she was kind enough to answer me and discuss some of my thoughts..A very intelligent lady.

If only Jackson could return and deal with the every countrys central bank

I am convinced the only benevolent Presidents we have had were Jackson and Jefferson. Heroes against the banks, both. That said, does anyone have any experience with small local banking? My service credit union done pissed me off for maybe the last time.

Jackson #1..That’s why his portrait and bust are removed from the Oval Orifice whenever Commies an Fascist reside there.

And why putting him on the $50 FRN was not a show of respect.