When the Fed bailed out the banks in 2008, interest rates dropped to historic lows. Many retirees were heavily invested in CDs and quality bonds earning a safe 6% interest, paying their bills, and enjoying their golden years.

Overnight, trillions in CDs and bonds were called in, savers lost a major portion of their anticipated income as interest rates dropped to historic lows.

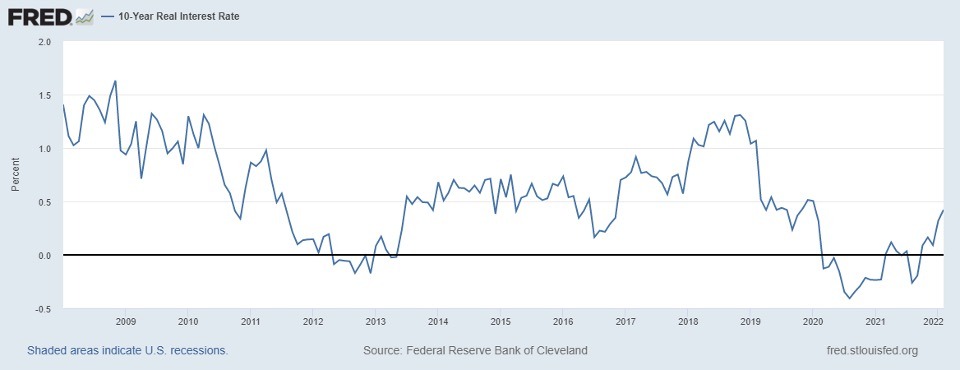

We were reassured the bailouts were temporary, expect interest rates to quickly return to normal. So much for political promises, 14 years later interest rates are negative when adjusted for double-digit inflation. Seniors, savers and pension funds lost trillions in interest they anticipated.

Inflation skyrocketed, became the elephant in the room which could no longer be ignored during an election year. Reluctantly the Fed announced a 1/4% increase in rates, with the possibility of more to follow.

Inflation skyrocketed, became the elephant in the room which could no longer be ignored during an election year. Reluctantly the Fed announced a 1/4% increase in rates, with the possibility of more to follow.

Many pundits, like Bill Bonner mocked the Fed’s approach:

“Is he kidding? A quarter point increase? That will bring the Fed’s key rate to about MINUS 7%. Is this ‘tightening?’ Of course not. Powell is not fighting inflation; he is enabling it.”

…. Now, if it were serious about fighting inflation, it would have to boost rates by as much as 1,000 basis points – 10% – to get ahead of rising prices. But even a smallish move in that direction will almost certainly crash the stock market and the economy.”

What about bonds?

We’ve discussed the stock market, but what about the bond market? Should savers be hoping interest rates go back to the 6% “normal” rates of yesteryear?

The interest rates on corporate bonds have turned north, and the Fed announced more rate hikes are in the future.

As interest rates rise, the price of existing bonds drop – if you want to sell it. If you hold a bond to maturity, you will receive a lower than current market interest rate, until it is redeemed.

For years, expert Chuck Butler and I have told readers NOT to buy bonds. Interest rates are well below inflation; they are guaranteed money losers.

Now, some are now worried about a “liquidity crisis” in the bond market.

The CFA Institute tells us: (Emphasis mine)

“Market liquidity is a market’s ability to facilitate the purchase or sale of an asset without causing drastic change in the asset’s price. So, an asset’s market liquidity describes an asset’s ability to sell quickly without having to reduce its price to a significant degree.

…. The corporate bond market plays a critical role in the US economy. Businesses tap the bond market to raise more than $1trillion in financing each year, and the more than $8 trillion of corporate bonds outstanding represent an important asset class for a variety of investors.”

It’s time to check in with Chuck Butler. Raising interest rates is going to affect bondholders, IRAs, pension funds and more.

DENNIS: Chuck, we told readers NOT to buy bonds, anticipating the day when the Fed would be forced to deal with inflation by raising interest rates, and stop buying government/corporate bonds.

It looks like a liquidity crisis applies to those who want to sell bonds before maturity. While there may be a market, a “drastic change in the asset’s price” is the caveat.

Who’s crisis is it? Shouldn’t bondholders expect to sell at a loss?

CHUCK: Thanks again for the opportunity to opine, Dennis.

The crisis will be for the folks that didn’t heed our warnings and bought negative yielding bonds while inflation keeps rising. I told people that the Fed keeps saying they will hike rates. So why would you lock in a yield at, say 1.5%, or less, particularly for several years? Yields will be going higher to combat inflation.

Bond holders are a lot more than just moms and pops… Pension plans, insurance companies, town governments, etc. All MUST buy bonds because of their bylaws…

And here’s their dilemma… how will they achieve their stated returns of, say, 7%, when they are stuck with bonds yielding less than 2%?

They will have to sell their bonds in an illiquid market at HUGE losses to buy newer bonds with higher yields….

DENNIS: Why wouldn’t they just hold the bonds to maturity? When we bought CDs, we never tried to resell them, we just accepted the interest we bargained for when we bought them.

CHUCK: Holding them to maturity means having lower yielding bonds on your books for the life of the bond… If you can deal with that, fine… But most institutional bond holders have “return requirements “… and holding a low-yielding bond for 10 years is NOT in their playbooks.

Individual investors will likely hold them. Pension plans, etc. will walk a tightrope, trying not to take losses as they buy bonds with higher interest rates. If they have bonds with short term maturity, they may hold them.

DENNIS: We both doubt the Fed is serious about fighting inflation. The minute their casino bank owners start to feel the pinch, they would back off. Assume Powell does follow with more increases, and/or even raises the rates by 1/4% or more. What kind of effect should we expect for the bond market?

CHUCK: The bond market used to be called the bond boys… and there were “bond vigilantes” …. that would put their weight behind making the Fed react to higher yields that they had created. The Fed had to offer higher interest to sell their bonds in the market. With QE, the Fed stifled free market interest rates and became the largest bond buyers at the auction. Effectively they put the bond boys out of business….

Now the Fed are the Bond Boys… So, is the Fed going to buy these bonds at losses from investors? The market knows the Fed came to the aid of the casino banks by buying up their toxic bonds and mortgages – sticking taxpayers with the losses… I doubt seriously that the Fed will take your bonds off your hands because, well you’re not a casino bank….

I think this is a good time to explain bond pricing… Bond prices and bond yields move in opposite directions… when bonds get issued the price of 100 is equal to the stated yield…. As time goes on, if yields rise, then the price of the bonds go down below 100. And vice versa when yields decline, then the price of bonds rise….

In this current environment yields are rising, and bond prices are declining. It’s likely to get messy.

DENNIS: My son asked a good question. There are funds that set a retirement date, say 2030. They adjust between stock and bond funds as you get closer to your retirement date.

I know others who have bought into bond funds, dealing in higher risk bonds, trying to get more income.

While our readers might hold an individual bond until maturity, bond funds are different. What advice do you give readers who might have a significant part of their portfolio in a “fixed income” fund? My fear is their brokers are telling them not to sell.

CHUCK: Unlike pension funds and insurance companies, bond fund managers must deal with client redemptions. They may be FORCED TO SELL some of their holdings to meet these redemptions at the WORST POSSIBLE TIME.

At the same time, many corporations may be unable to roll over maturing debt and default on repayment. There will be losses – and they could be “drastic”.

At the same time, many corporations may be unable to roll over maturing debt and default on repayment. There will be losses – and they could be “drastic”.

Following their brokers advice and staying invested in these funds could destroy retirement at the anticipated retirement date. Dennis, it’s downright scary…

DENNIS: Might there be a point where a “drastic change in the asset’s price” is a time to buy?

CHUCK: I was once a bond trader… so I’m very comfortable discussing bonds… There is a time to buy bonds and a time to wait. This is obviously a time to wait. When inflation is brought to its knees, the Fed signals that they will not be hiking rates further – and the zombie corporations have defaulted on their debt – that will be the time to buy bonds again… You don’t have to time the market perfectly to make a good profit.

DENNIS: One final question. As you explained, at bond auctions the Fed jumped in and bought, not allowing interest rates to rise in a free market.

What would cause a liquidity crisis? Would it be announcing a rate increase, or might it just happen in the market?

CHUCK: There’s not a liquidity crisis until there is one…. Would be sellers with low yield bonds will call their broker and ask for a price to sell it… and be told…. No offer available…. Or, I once had a client say, “At that price, I’m giving it away!” Yep, that is correct.

The public is demanding the Fed calm inflation… Hiking rates and not interfering with free market bond auctions will do that.

Treasuries and corporations will issue new bonds….and if the Bond Boys have any gumption left in them… they will begin marking existing bond yield higher…

Dennis, thanks again for the opportunity to opine for your readers. I know this is a lot to take in, but it must be done. The market will return to normal if the government doesn’t interfere, but it will be a painful process.

Dennis here. Today the government is interfering with free-market capitalism. Once we get through the “painful process”, it would be nice to see 5-6% interest paid by quality borrowers. Baby boomers and retirees would sleep well.

For more information, check out my website or follow me on FaceBook.

For more information, check out my website or follow me on FaceBook.

Until next time…

Dennis

“Economic independence is the foundation of the only sort of freedom worth a damn.” – H. L. Mencken

Affiliate Link Disclosure: This post contains affiliate links. If you make a purchase after clicking these links, we will earn a commission that goes to help keep Miller on the Money running. Thank you for your support!

What rates are annuities guaranteeing these days? It may make sense to put a portion your retirement money into an annuity if you can wait out the surrender charge timeframe.

Any recommendations? Use to hear of the 4% annuity but then the adjustments around 2008 forward…1% GUARANTEED. Better now I assume. I bonds supposedly hot. Gold man, gold.

Not nearly enough, should be ten times whatever they decide to raise, Keynesian death rattle good for nothing

the dollar is a ponzi scheme, therefore inflation must, will, go up faster than interest rates. by law, the dollar is backed by the physical collateral of the united states. when the default finally happens the “federal” “reserve” will confiscate all u.s. property. which was the plan all along.

“If the American people ever allow private banks to control the issue of their currency first by inflation then by deflation the banks and corporations that will grow up around them will deprive the people of all property until their children wake up homeless on the continent their Fathers conquered… I believe that banking institutions are more dangerous to our liberties than standing armies… The issuing power should be taken from the banks and restored to the people to whom it properly belongs.” thomas jefferson

Interest Rates Are Rising, So Now What?

Gee, let me see, it will negatively impact anyone who isn’t a wealthy elite? People will lose homes/be unable to buy homes/transfer even more wealth from the middle class to the banker class- did I miss anything?

Dogs and cats living together.

Mass hysteria.

Before anyone reminisces about the 80’s and says “this is nothing – I remember when rates went from 13% to 16%”, I’ll just point out that on a $100,000 30 year mortgage, a 3% rise in rates from 13% to 16% raises the monthly principal & interest from $1,106 to 1,344 – an increase of 21.5%. On a $100,000 30 year loan, a 3% rise in rates from 3.00% to 6.00% raises the monthly principal & interest from $422 to $599 – a 42% increase. People who borrowed at 3% on a fixed rate the last couple years shouldn’t lose their house – because they have the payment they bargained for. As with 2006-2010, most people who “lost their house” walked away from it because they didn’t like owing 50% more than it was worth. We’ll see where it goes from here. Could get interesting. What could get even more interesting is the federal government trying to service $30 trillion in debt once average treasury yields hit a measley 4%.

But working people naturally get raises in order to compensate, right? The Road To Serfdom

I use to understand the interest stuff. Last mortgage was a variable rate that worked out on the low side of the “gamble”. Probably the only time my “hunch” came to fruition. A measly 80k “loan” reduced the monthly payment by 50 bucks. I came out swimming when I sold. Praise the Lord, no more mortgage stuff after that. It’s called, cash on the barrel head, some physical work and FREEDOM from man’s financial schemes. Did not ask, but, Praise the Lord.