The public is up in arms, and rightfully so.

The public is up in arms, and rightfully so.

Gas prices are going through the roof with no end in sight. I don’t ever remember spending $100 to fill the tank on my Honda minivan.

This is nuts!

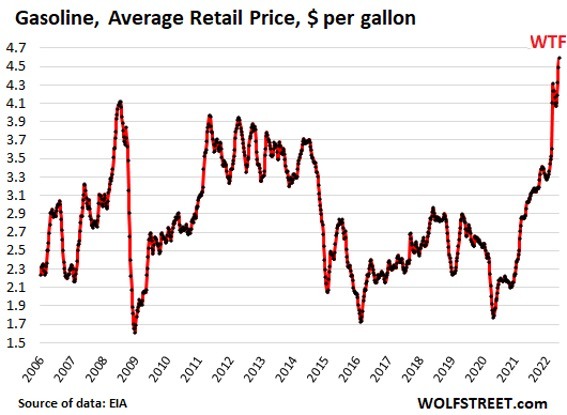

Wolf Street provides a graphic.

Supply is government restricted, prices are rising, affecting the cost of everything we buy, not just our personal transportation.

Former colleague Nick Giambruno recently reported:

“Rapidly rising food, housing, medical, and tuition prices are squeezing Americans….

The explosion in the cost of living is a predictable consequence of money printing.

…. The Federal Reserve has printed more money than it has for the entire existence of the US.

From the founding of the US, it took over 227 years to print its first $6 trillion. But in just a matter of months recently, the US government printed more than $6 trillion.

…. In short, the Fed’s actions amounted to the biggest monetary explosion that has ever occurred in the US.”

Reckless spending while constricting the supply of oil is a recipe for a disaster of epic proportions.

How high can it go?

Friend Chuck Butler shared this:

“I received an email from a dear reader yesterday….

‘Gas prices will continue to surge higher, and many Americans will be shocked by how high they eventually go. If you can believe it, in Washington State at least one gas station has now reprogrammed their gas pumps ‘to make room for double-digit pricing’….

…. A spokesperson at 76 confirmed…that the gas pumps were reprogrammed to allocate for double-digit pricing. Although not confirming that they are expecting prices to increase up to $10.00 or more, the current trend suggests the possibility.

Supplies of fuel will continue to get even tighter in the months ahead….”

If Wolf Richter has WTF at $5.00 gas, what do we call gas at $10.00/gallon?

People are hurting

Brietbart reported on several polls:

“Highest Recorded Percentage Say Their Financial Situation Is Worsening

…. Americans indicate that the dire state of affairs is affecting them directly. More than half say their financial situation is getting worse – 56 percent. That is the highest recorded percentage in the Harvard-Harris poll….

(Another poll)…asked, ‘As a result of the rise in gas prices, have you cut back your spending on groceries so that you can pay for gas, or not?’

Over one-third of Americans, 35 percent, said ‘yes,’ they have had to cut back on groceries.”

I contacted expert Chuck Butler for some input. If 35% of Americans are already cutting back on groceries to pay for gas, what can we expect?

DENNIS: Chuck, thank you for your time for the benefit of our readers.

You’ve predicted people are going to be forced into making some lifestyle changes because their income is not keeping up with rising prices.

The survey question asks about groceries. When times get tough, needs versus wants becomes clear.

Chuck, where do you see people cutting back?

CHUCK: Thanks again Dennis for allowing me to address your readers.

I for one will have to stop buying books to read… I went grocery shopping recently and you won’t believe the one food item that is still reasonably priced… Hot Dogs …. In past tough times, people would switch from Steak to Hamburger, or Chicken or even pork, but, even those cuts of meat have become quite expensive, so you might as well, get your taste buds prepared for Hot Dogs…

My dad was a Teamster, and it seemed like they were always on strike… We would eat, puffed rice for breakfast, saurkraut for dinner and hot dogs for lunch! Get ready to make sacrifices such as these…

I expect there’ll be less buying of expensive cell phones and children will get used to “hand-me-downs”, not the newest version. People will likely drive their cars longer; hoping the cars last longer than the payments.

Dennis, each household will struggle with their own method of cutting back…

When I was young my parents talked of “debtor’s prison.” While there is no such thing; however, many can be “debt slaves.” Paying something off does not mean you should automatically go incur more debt.

DENNIS: In pre-credit card days, we had three kids in diapers and a $20/week grocery budget. We mixed powdered milk with regular milk to fool the kids, or they wouldn’t drink it. I worked three jobs.

A young friend once proudly told me how she and her husband “sacrificed” by giving up their daily Starbucks…and making their own coffee and put it in a thermos.

Do you see any of this playing out?

CHUCK: Yes, I do, Dennis… It will start with “discretionary spending.”

Restaurants are getting back on their feet. I believe that restaurants and bars will once again see a downturn in business. If you’re going to cut back, eating at home is a good place to start.

Paying $5-$10 for a beer at a bar with a live band is expensive. Young folks will have to learn very quickly how to cut back. It’s a challenge but I have faith that they will do what needs to be done.

As I said above, as a child, we were saddled with being poor; particularly when the Teamsters were on strike. We had to make do, with everything from food, to clothing, to shoes. The younger generation will go through the same process.

DENNIS: While we focused on gas prices, food, services, and everything else is going up.

Remember the old saying, “The cure for high prices is high prices.” Eventually high prices reduce demand as people seek alternative solutions.

This reduced demand can cause an economic downturn, people lose jobs, a real negative spiral. Prices may come down, along with inflation, but if people don’t have jobs or money, how will they buy goods?

Is this the kind of thing that can lead to another Great Depression?

CHUCK: The economists call this Demand Destruction… If we go down this road too far, we could very well be staring at another Depression. … But, maybe someone will come up with a solution to our problems… I’m not saying that would be easy to do, I’m just saying maybe…

For those of you who do not read the daily letter of a friend of mine for many years now, Bill Bonner… I’ll let Bill explain Demand Destruction:

“‘Demand destruction’ is the term economists use. It describes the self-correcting phenomenon: how high prices cure high prices…and why inflation will take care of itself if it is left alone. As prices rise, people can’t afford to buy so much. Because they are poorer. So, prices fall simply because there is less demand for goods and services. Less is made. Less is consumed. Prices fall. And less energy is used.”

Economists believe this will be the way we combat this rising inflation. Former Fed head Janet Yellen called the effects on the working class “collateral damage”. Typical Econospeak!

DENNIS: I fear for some, cutting back here and there won’t cut it; this could be different.

I’m telling readers to keep working as long as they can, get out of debt and stay that way.

What advice are you giving readers in this regard?

CHUCK: I’ve always told my readers to get out of debt; the sooner the better … especially, when you begin to age.

Working as long as you can, is a gift that good health brings you. Find something you love and keep on trucking.

I fear the “collateral damage” and political consequences will cause the Gov’t to revert back to printing money and sending out stimulus checks once again…

They have no idea that their money printing, and their shutting down of our Oil production in this country, have had anything to do with, the rising inflation. They will do what they must politically to mollify the citizens.

And just for the record… more stimulus checks and Casino Bank bailouts will mean more money printing, and more inflation…

DENNIS: We have both doubted the government and Fed’s commitment to tame inflation. Won’t that just drag out the inevitable?

CHUCK: Yes… as I just described, I do believe that the Gov’t will revert to printing money to “avoid the crisis de jour”. The political class will not allow the Fed to continue with rate hikes.

What I feel we’ll end up with is “Stagflation”… Where’s there’s no economic growth, and inflation at the same time… Now that’s the recipe for throwing the bums out if I ever saw one!

DENNIS: One final question. For some, there has to be a positive side. We tell readers to hold money in reserve; when the market crashes, there will be some real bargains. Those with cash, and minimal debt may find some real bargains, not just in the stock market.

How/where might we see this?

CHUCK: Well, for those who are not senior citizens, look for land that’s cheap and buy as much of it as they can. Why younger people? Older people should not take on debt!

For those who dream of owning their own business, some good ones will be for sale, cheap!

While stockbrokers tout, “The stock market always comes back”, it took 25+ years during the last depression. Younger folks who have cash, and patience, will have time on their side and can do very well.

Dennis here. When times were tough, famed University of Georgia football announcer Larry Munson used to say, “It’s time to hunker down one more time!” Start now, and beat the crowd!

For more information, check out my website or follow me on FaceBook.

For more information, check out my website or follow me on FaceBook.

Until next time…

Dennis

“Economic independence is the foundation of the only sort of freedom worth a damn.” – H. L. Mencken

Affiliate Link Disclosure: This post contains affiliate links. If you make a purchase after clicking these links, we will earn a commission that goes to help keep Miller on the Money running. Thank you for your support!

Thank you Dennis. There is a large and rapidly growing segment that have no way to cut back. They will soon figure out that driving an hour or more for a ten hour day of work at just over min wage no longer works with fuel, groceries, rent and everything else outpacing their own value in the workforce. They will soon start leaving the workforce en masse. It is better to stay home and beg, borrow, steal, or take gig jobs than to continue the treadmill life that many Muricans experience daily with no end in sight.

That will work for a while, but when fuel is $8-12 per gallon all bets are off. Then there will either be more stimulus (helicopter money), debt relief, rent subsidies etc. OR the shooting, looting, and burning starts. No one plays a losing game forever–especially when they wake up and realize it was a rigged game all along.

basic guaranteed income at minimum subsistence. followed by government work assignments.

slavery.

Yup. Workfare at first to ease the transition and then outright coal mine slavery.

The Ludlow massacre has been erased from memory.

Had a gas pump discussion with an older dude about what he was contemplating doing since he has an 80 mile a day commute, he was thinking about sleeping overnight in the company parking lot a couple nights a week…sigh…

that’s how it was done in silicone valley early in the tech boom. the programmers had full motor homes in the parking lot, lived there.

Hookers and blow.

I think I’ll wander over to the local/legal brothel and see if the ‘working girls’ have raised their rates.

Many drive over from L.A. or fly in from a far.

I have been living as cheap as possible for two decades. Problem is now, there is no fat left to cut from the budget.

People like me are the ones really feeling this first, but at least we understand how to live cheap. I don’t see how the generation that can’t even do basic math is going to make a workable budget plan. Especially when their priorities start with phone, internet & TV package and $20/day for coffee.

These are the people that will be screaming for the government to “do something” and will hand over what little is left of their rights when the government says it will take care of them.

genesis 47: 13 Now there was no food in all the land, because the famine was very severe, so that the land of Egypt and the land of Canaan languished because of the famine. 14 And Joseph collected all the money that was found in the land of Egypt and in the land of Canaan in payment for the grain which they bought, and Joseph brought the money into Pharaoh’s house. 15 When the money was all spent in the land of Egypt and in the land of Canaan, all the Egyptians came to Joseph saying, “Give us food, for why should we die in your presence? For our money is gone.” 16 Then Joseph said, “Give up your livestock, and I will give you food for your livestock, since your money is gone.” 17 So they brought their livestock to Joseph, and Joseph gave them food in exchange for the horses and the flocks and the herds and the donkeys; and he fed them with food in exchange for all their livestock that year. 18 But when that year ended, they came to him the next year and said to him, “We will not hide from my lord the fact that our money is all spent, and the livestock are my lord’s. There is nothing left for my lord except our bodies and our lands. 19 Why should we die before your eyes, both we and our land? Buy us and our land for food, and we and our land will be slaves to Pharaoh. So give us seed, so that we may live and not die, and that the land may not be desolate.”

Result of the Famine

20 So Joseph bought all the land of Egypt for Pharaoh, for every Egyptian sold his field, because the famine was severe upon them. So the land became Pharaoh’s. 21 As for the people, he relocated them to the cities from one end of Egypt’s border to the other.

that’s the battle plan.

So, Joseph used the extreme hardships people endured as the result of the famine, and then parlayed their misery into his boss (and surely himself, also) owning ALL their possessions, even their very bodies, impoverishing them forever?

Go, Joey, go!! This story makes me love Joos even more than ever.

“Joseph used the extreme hardships people endured as the result of the famine, and then parlayed their misery into his boss (and surely himself, also) owning ALL their possessions, even their very bodies, impoverishing them forever?”

yes. he took the warning of god (“7 years of plenty, followed by 7 years of famine”) as insider information. to them, that’s just how it’s done.

Okay. You did make me laugh.

Can someone please take a moment and explain what happened in late 2019 in the banking sector that caused, what some believe, TPTB to take serious action to cover up with the Covid Hoax?

Qualitative easing on steroids.

Try 2008 for the start of this and, no, this is not the only or real reason for the inflation and ‘food shortages’ and fuel prices to the moon. When Lenin and Stalin and others of that ilk wanted to gain complete control of…everything…they fomented starvation. Why? Hegelian dialect. The government creates the problem, the people suffer, the government presents the ‘solution’ of nationalizing… everything…while confiscating guns and rounding up the dissidents and, in the case of the present activities…implementing Agenda 21.

Agenda 21 must be implemented together with the outcomes of the major United Nations Conferences held since 1992, which have been particularly effective in articulating an agenda for social development and human rights. Those outcomes have come together in the development goals articulated in the Millennium Declaration.

https://iefworld.org/wssd_sg.htm#:~:text=Agenda%2021%20must%20be%20implemented%20together%20with%20the,the%20development%20goals%20articulated%20in%20the%20Millennium%20Declaration.

Mygirl,

Yes, I understand 2008. But, there was something specific that happened in August(?) of 2019. I remember a few on TBP talking about it. I just can’t remember what happened. I have searched online but these financial articles are not the easiest for me to understand.

Repos

That was the beginning of the overnight repo bailout but more importantly it was the beginning of the reset. The fed and treasury conspired to pump billions and then trillions into the overnight repo markets to keep them from imploding prematurely. It was joined at the hip with the destruction of the mom and pop businesses and what was left of the middle class during the lockdown. None of it was a separate event. They were all part of a big event.

I frequently mentioned it here and supplied links but it was crowded out by the covid hysteria as planned. Without MSM and government involvement in spreading hysteria it would have gotten more attention. As it is, it all went off without a hitch.Trump was no longer needed and they ushered in the Dem takeover to apply the finishing touches.

“The Fed’s involvement in the repo market as we know it can be traced back to Sept. 16, 2019, when a traffic jam occurred at the intersection of cash and securities. Experts say that piles of cash flowed out of the system because corporate tax payments came due. That happened right as new Treasury debt settled onto the markets. Financial institutions wanted to borrow cash to purchase those securities, but supply didn’t match those demands.

All of that worked to cause a cash crunch, and the repo rate soared — reaching as high as 10 percent intraday on Sept. 17. In other words, banks didn’t want to part with their cash for anything lower than that rate. It pushed up the federal funds rate along with it, which was supposed to be trading in a target range between 2-2.25 percent at the time. The Fed was also days away from making a second rate cut.

“Yet, largely in the background, the Fed had also been shrinking its balance sheet and selling off the large holdings of assets (which included mortgage-backed securities and Treasurys) that it’d purchased in response to the 2008 financial crisis.”

https://www.bankrate.com/banking/federal-reserve/why-the-fed-pumps-billions-into-repo-market/#:~:text=The%20repo%20market%20is%20essentially,a%20certain%20date%2C%20typically%20overnight.

1,000 + Flea…Admin has laid out the Reader’s Digest version as well…and a few other regulars in comments.

I believe it caught the Luciferian Banksters flat footed and they panicked…throwing out the Plandemic early (they had it waiting) before they were really ready.

Then TLPTB (L=Luciferian) hubris and overreach was a snowball going down the mountain and it is about to crash into the lodge.

They took their masks off and made all the Mooers put theirs on.

Thanks Flea.

So, it seems to start with a bailout. Doesn’t that mean the top layer of the financial sector of the US economy is still playing fucking games and getting rewarded for it? The blame, imo, goes straight to the top layer of finance that keep helping themselves out to free money to stay solvent and put the burden on the productive class.

Amiright?

Yes but you were more accurate with your reply to Llpoh below. The “Other” freeloaders and petty crooks who failed to stop it in it’s tracks with the dubious(It’s unclear if it was even done legally) passage of a series of acts and amendments beginning with the Federal reserve act and income tax. The voters gave it a wink and a nod because it was sold as a tax to rob the rich. Truth was debased before the currency could be debased.

Just as in August 2007 the first serious tremor happened towards the GFC (but almost everybody missed it’s significance, in that case including the Fed),

in August 2019 the first serious one towards the coming GFCOAT occurred.

In this case it was the Repo markets; I’ll spare you and myself the technicalities.

Suffice to say it was a part of the market that was still moving (mostly) freely at the time, and by chance became the signal to show that trust in each other -especially between banks-, that debts and other commitments could and would be honored, had once again evaporated to the point that markets would have collapsed if they had been given free reign.

The Fed and other central banks had… well not really learned anything from the GFC [and it’s real underlying causes], but had become afraid enough to jump at the tiniest probably serious signal and flood the markets with freshly minted Dollars, figuratively speaking (now simply digital ones.)

That obviously “fixes” nothing in the big picture, but just kicks the can a little further down the road.

And don’t continue staring at repo rates, at least the ones publicly shown are now likely also so much fixed as to be worthless as an indicator. (That’s why I wrote “by chance” above, something else that is still mostly free moving and not fully on the radar of the Fed yet will become the next signal to indicate approaching meltdown.)

https://www.investopedia.com/terms/r/repurchaseagreement.asp

The Financial Crisis and the Repo Market

Following the 2008 financial crisis, investors focused on a particular type of repo known as repo 105. There was speculation that these repos had played a part in Lehman Brothers’ attempts at hiding its declining financial health leading up to the crisis.11

In the years immediately following the crisis, the repo market in the U.S. and abroad contracted significantly. However, in more recent years it has recovered and continued to grow.

Nonetheless, in spite of regulatory changes over the last decade, there remain systemic risks to the repo space. The Fed continues to worry about a default by a major repo dealer that might inspire a fire sale among money funds which could then negatively impact the broader market.

Would a default be caused by some type of malfeasance?

Read “Wall Street on Parade” about the overnite repo loans made by the big banks at the Fed window.

“what do we call gas at $10.00/gallon?”

a slow start.

In Canada? Regular grade.

“How high can it go?”

as high as necessary to achieve their goal: 1) they have fuel, 2) you don’t.

really, that’s all this is. you can talk about supply and demand and regulations and prices and deliveries and this and that and the other until the cows come home, but that’s all beside the point: 1) they have fuel, 2) you don’t.

“get out of debt”

can’t. the ones behind all this have driven the government to borrow $90 trillion in your name – that’s $900,000 for every remaining taxpayer. they’re gonna come looking for it saying “pay up or we take all your property!” not because they want you to pay, but because they want you in permanent lifetime debt – you, your children, and all your descendants, forever. isaiah 61:6 “you will consume the wealth of the nations, and in their riches you will boast.”

Why the hell do you repeatedly cite that verse when you have no idea what it means?

The LORD is speaking to the exact OPPOSITE nation in that verse to the one you erroneously think He is.

“Why do you repeatedly cite that verse”

because there’s always new people cruising the board. you’re not the only one here.

“when you have no idea what it means”

1) doesn’t matter what it means – what matters is what THEY think it means and how THEY seek to implement THEIR understanding of it.

2) I invite everyone to read the last ten chapters of isaiah and decide for themselves.

What is this copout crap you hide behind — let the readers decide for themselves?

I’m addressing YOU. Not the board.

You cite that verse for a specific reason. The words of Scripture ALWAYS have particular meaning. What the verse means is not a matter of private interpretation, but is to be interpreted by the volume of the Scriptures at large, and in this case by the surrounding verses, and by the remainder of the verse which you leave uncited, which all tell us SPECIFICALLY to whom that verse is addressed and why.

They way YOU use it, you prove you do not understand it. And this has nothing to do with how anyone else interprets it or why.

If you think the homeless problem is bad now, just wait.

Does he really believe that they “have no idea?” C’mon now! Rising inflation is the point! They’re trying to break the middle class – they’ve been chipping away at it for years – and this is the endgame stage.

They don’t care about political consequences now that they can rig elections with impunity. The precedent was set in 2020, it’s all smooth sailing from now on. There are no consequences to worry about when you can cheat – even blatantly – and get away with it.

Moar roadkill for dinner.

you mean death race 2000 roadkill?

Klassick!

Since the cost of living has doubled we should cut spending starting with a 50% cut in taxes billed to individual citizens especially property taxes

Everywhere I can.

…

I will still be driving my 12mpg truck and I will yell out the window ” NICE TATS” as they walk down the street.

I have been saying this would happen, and it appears to have now arrived. The gifts have debt that cannot be paid. The lightbulb answer was always going to be to inflate that debt away. I guessed they would target around 10%. The problem with inflation is that it can accelerate to infinity.

I also said the lightbulb moment would turn to “oh fuck” when the implications of the increased interest rates on the debt hit. Current interest repayment is around $500 billion. Much of that debt rolls over in a around two to three years. That number could balloon to $2 trillion. Oh fuck. At the same time a recession could be hitting tax receipts hard.

We spent and borrowed ourselves into this. The US lived far above its means. Spending and borrowing trillions a year artificially propped the economy by a much as 30 or 40%. So standard of living for the US will eventually fall toward that sustainable position. That is the reality. The govt has been borrowing one or two trillion a year for a long time. Assuming a 4:1 multiplier effect on say 1.5 trillion, that is a $6 trillion effect on the economy. Out of $18 trillion gdp. But it was artificial, and the bill is now due. Compounding this is the US dollar steadily losing its reserve currency status. Oh fuck.

Again I will point out that the US consumes 25% of the world’s resources at 5% of its population. That is not sustainable. And that consumption has been funded by debt, and by importing and consuming far more than exporting and producing. Oh, and there are also $200+ trillion in unfunded liabilities- payments that have been promised but no money set aside to pay. If interest rates go to say 5%, that is an additional interest bill of $10 trillion – a year. Interest on that plus interest on the fed debt plus govt expenditure will exceed the GDP of the entire economy.

I just discussed how this will crucify middle and lower class families in Oz and the US. She was worried how in the long run this will hit us.

I explained that it is devastating on people who have to consume with the funds they have coming in. However, those sitting on large cash stocks, and who don’t have to sell hard assets, stocks, etc., will be able to buy distressed assets (houses, land, etc.) at fire sale prices. If you have a fixed income stream you are fucked. If you have a lot of cash, you are king. Watch Warren Buffett swing in to action as soon as the fire sale happens. And Apple. And Microsoft.

So, who is the architect of this end game? Was it a conspiracy by TPTB to end up here? Who helped get us to this point? Corporations, Government, the Buffets and Gates of the US?

Not sure about architect. The plan was always to kick the can down the road. The US came out of WW2 the only man standing. The US made hay from then until the 70s as everyone else was rebuilding. Lots of bad decisions were made – refusing to upgrade steel plants, automakers caving in to outrageous union demand because they thought the good times would never end, etc. Then world completion came along, and welfare sprung up. Then eventually the borrowing happened. We are USA!USA!, with no thoughts that our exalted place could be challenged. Then the fed and state liabilities took off. Then debt increased more rapidly. Then more and more of the population forgot the hard times. Then political parties started printing money hand over fist. Then normal interest rates were abandoned for near zero rates to drive growth that the economy was addicted to. Then the zero rates encouraged speculation of all kinds with free money, and the idea of saving was a thing of the past. Toss in the degeneration of the education system, allowing the education and skills to be diluted by rampant immigration, add in stupid left policies (climate change, etc.) and you get a massive national disaster.

And the “leaders” kept kicking the can down the road – let it all be someone else’s issue.

Well, it is now someone else’s issue. And the music has stopped. So those in power turn to what they hope will help stop the can in mid-flight as it plummets toward the ground having now fallen off the cliff.

People knew this was going to happen. It was a certainty. They just were more interested in their positions, and couldn’t care less that it was going to happen, so long as it wasn’t on their watch, or at least they hoped it wasn’t on their watch.

The American people were willing conspirators. Admin has been screaming for a long time, for instance. Only few listened to him, or me, or us.

I guess you could call it a conspiracy. But make no mistake – almost everyone was involved. They were wilfully ignorant – which is a legal term. They intentionally ignored what they knew was coming, in hopes they would not be found guilty of involvement. There were also a lot of people far too stupid to be able to see it coming (hello Detroit, Phillie, Shitcago slum dwellers) who were just happy that the free shit kept flowing today, and had no concern whatsoever for tomorrow.

So, lots of folks are guilty.

Good summary but, I need someone to blame :). I can’t help but believe there have been tons of financial shananagins played by many an insider. Not only that but endless bailouts to the elite who have done nothing but make the problems worse through monopoly. If you can’t lose, how can you fail? How can you not end up at the top with free money to take care of all your mistakes once they get catastrophic? I blame the freeloaders at the top and the freeloaders at the bottom.

The 25% consumption while 5% of population is a fallacy. We produce a lot with that consumption

You clearly do not understand what fallacy means. It means something is false. And the US consumes around 25% of the world’s resources. And it is not a false statement. And it finances a lot of that consumption via debt.

The point is such a small percentage of the world’s population consuming a hugely inordinate amount of the resources is not a sustainable situation. And to consume so much while financing a lot of the consumption via debt is not something that can last. And we are going to have a front row seat to the unwinding.

“The problem with inflation is that it can accelerate to infinity.”

I would disagree with that statement.

Between the “unstoppable force” Inflation and the “unmovable object” Dollar [figuratively speaking], the latter will disintegrate into nothingness long before inflation reaches infinity.

“inflate that debt away”

this misunderstands the situation. inflation is increasing debt. the debt is not inflated away, rather the original debt is replaced by a larger debt.

Ummmm. No. The old debt is in fixed dollars. Those fixed dollars ate at fixed interest rates for varying periods, which are very low at the moment. Inflation makes the old debt less valuable. The govt hopes it will collect inflated dollars at a faster rate, which they use to pay off old debt. The 100 owed last year is worth onLy 90 this year. They hope to effectively reduce the value of the old debt by paying it off with dollars that are worth less than the original dollar borrowed.

I’m cutting out the seven grain organic toast and just having avocado on cheap white bread….

BTW – I ain’t cutting out a damn thing.

I’m cutting out paper dolls.

Just don’t cut out anything that will turn an AR-15 into a full-auto weapon.

The bar I go to has five/ten dollar beers and no live band, Am I getting ripped off?