I am increasingly frustrated, wading through my weekly reading stack. It is maddening!

I am increasingly frustrated, wading through my weekly reading stack. It is maddening!

Despite the recent fed action, inflation is soaring, prices are out of control. The economy is slowing, the stock market is tanking. The long-predicted results of outrageous government and central bank policies are coming home to roost.

The signs were clear, anyone with common sense could see it coming, but the politicos ignored the needs of the common people.

When the Glass-Steagall act was passed in 1933, it separated commercial banking from investment banking. It created the Federal Deposit Insurance Corporation (FDIC) to protect individuals from losing money because banks made bad investment decisions. It worked; no depositor lost money under the FDIC umbrella.

In 1999, the Clinton Administration repealed the law. Banks and investment houses merged, and the banking party began. The government required banks lend money to “high risk” borrowers to encourage home ownership, resulting in a housing crisis and bank bailout in 2008.

The huge casino banks were deemed, “Too big to fail!” The government told us they took steps to reign in the high-risk banks. It didn’t happen, Congress failed to protect the citizens, continuing to bail out risky investments with taxpayer money – things got worse.

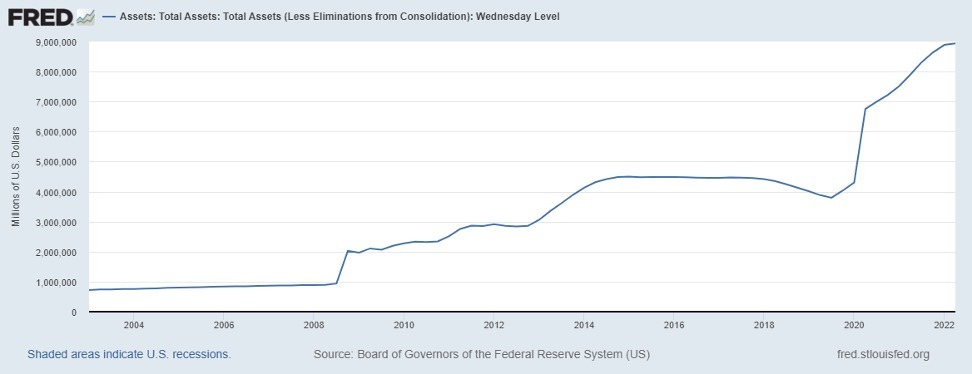

The Federal Reserve (owned by the same big banks) created cheap money out of thin air; interest rates hit historic lows. In less than 20 years the Federal Reserve Balance Sheet rose from around $700 billion to around $9 trillion.

How do these casino banks make money? They borrow cheap and make loans; many times, packaging those loans and selling them as “investments” to their clients and the general public.

- Hey Zombie Company, want some easy money to buy back your stock, pay extra dividends and award yourself some great bonuses? Step right up, don’t worry about having to pay off the debt. We’ll get you a better bond rating than you deserve.

- Want money for a new house, car, high risk stocks, step right up, get in on the easy money.

- Hey politicos, want to finance your latest vote buying scheme without raising taxes, step right up! Let’s see who can give away the most “free stuff!”

Banks and investment houses would lend money to governments, companies, and individuals without worry about repayment of the debt. The government would bail out the “too big to fail” banks with taxpayer dollars.

The world was awash with cheap money, the stock market boomed, Wall Street and the banks thrived. Defaults on debt? No such thing for the most part, the risky loans were rolled over and sold to the Fed (backed by taxpayers).

The game continues, until it doesn’t. Expanding the money supply 10-fold (doubling in less than two years) has led to horrible inflation. Prices are skyrocketing. The politicos are feeling the heat.

The winners

Bill Bonner shares the details: (emphasis mine)

“Basic expenses – food, shelter, and fuel – are going up so fast, households have less and less left over for “discretionary” spending, which leaves the big box retailers with a lot of unsold products in the box.

…. They are still the people who add the most real value to our lives. Not the hedge fund managers, influencers, or policymakers…but autoworkers, farmers, UPS drivers, cooks, baristas and waiters…carpenters, plumbers and masons.

And here’s the gist of our story: the masses have been cheated, deleted and mistreated. And it’s going to get worse.

In a nutshell…while the wealth of the crème de la crème was teased up by the feds…the working class – which is most of us – got nothing. The top 1% added $36 trillion in wealth since 1999 – or about $3 million per person. The bottom 50% added wealth too, but only about $13,000 each. Each person at the tiny top got 230 times more money than those at the broad bottom.

But all that froth came at a cost. The feds had no extra money, so they pushed down interest rates, borrowed…and printed money to cover the extra costs. The result was $50 trillion worth of debt added to the US economy since 1999.

Who will pay for it? We ‘the people,’ of course. That is what the ‘inflation tax’ is all about.”

In his article, “Decision of the Century” Bonner makes it sound simple:

“We are coming up to the Decision of the Century. There are only two real choices. One way or another, this scam economy is going to blow up. So, the question is whether the Fed blows it up by stopping inflation now. Or, it lets inflation rip and the whole thing blows up later.

Either way, there will be hard times ahead – with crashing stocks, bonds and real estate… and probably riots and maybe even revolution. But if the feds end the scam voluntarily, the wreck could be short and sweet, like ripping off a Band-Aid, with a crash followed by a depression, but ending in a fairly quick recovery. …. The whole thing could be over in 18 to 24 months.

If inflation is allowed to run wild…. These intentional, government-policy inflations last about 16 years on average. In the end, the economy is almost completely destroyed…and the nation’s political and social institutions are left as burnt-out hulks.”

Bonner’s “Fantasy Land” solution:

“It would be an easy fire to put out.

Congress could begin by balancing the federal budget. Why should the feds spend more than ‘the people’ are willing to pay for? Why should they burden future generations with debt and inflation? Aren’t they just forms of ‘taxation without representation?’

The Fed could do its part too. It would…announce that it would no longer be backstopping the stock market or bailing out Wall Street. No more money-printing. No more rigging interest rates. No more loans to member banks.

…. In a matter of minutes, the whole grotesque abomination…the scam economy…would be history. No more zombie businesses. No more ‘negative’ real yields. No more inflation.”

…let us take a deep breath and come back down to earth. Can you imagine Joe Biden, Jerome Powell, and the 435 members of Congress actually doing these things?”

David Stockman’s column, “Real Personal Income down 20% from One Year Ago” asks (Emphasis mine):

“Is it conceivable that the Fed can ease up on monetary restraint-especially during an election season in which the GOP will be in full-throated anti-inflation war cries?

We think the answer to the above question is negative, and that means the impending hit to the insanely over-valued stock market will be biblical.”

Stockman’s “biblical” terminology grabbed my attention. It’s not just the stock market, it means loss of jobs. Businesses can’t sell their products to people who have no money to buy them.

History.com shares the details of the 1929 crash: (Emphasis mine)

“On October 29, 1929, Black Tuesday hit Wall Street…in a single day. Billions of dollars were lost, wiping out thousands of investors. …. America and the rest of the industrialized world spiraled downward into the Great Depression (1929-39), the deepest and longest-lasting economic downturn in the history of the Western industrialized world up to that time.

…. During the 1920s, the U.S. stock market underwent rapid expansion,…after a period of wild speculation during the roaring twenties. By then, production had already declined, and unemployment had risen, leaving stocks in great excess of their real value.

…. By 1933, nearly half of America’s banks had failed, and unemployment was approaching…30 percent of the workforce.”

Blow up now, or blow up later?

While the Fed is talking tough, there’s a dirty little secret no one is discussing. Wall Street On Parade (WSOP) let the cat out of the bag, “New York Fed Stuns with new Report: At Year End Its Trading Desk Owned 38% of All 10-30 U. S. Treasuries.”

While the Fed is talking tough, there’s a dirty little secret no one is discussing. Wall Street On Parade (WSOP) let the cat out of the bag, “New York Fed Stuns with new Report: At Year End Its Trading Desk Owned 38% of All 10-30 U. S. Treasuries.”

“There is one paragraph in the…report that took our breath away. It reveals that the New York Fed’s trading operation currently owns 38 percent of all outstanding U.S. Treasury Securities with 10 to 30 years remaining until maturity.

…. The U.S. Treasury market is massive – at $22.6 trillion as of year-end 2021. That any one entity controls a big chunk of the market is deeply concerning. (The same report showed that the New York Fed…owned 25 percent of all maturities of outstanding Treasury debt.)”

Following Bonner’s logic, the quick solution is for Congress to stop deficit spending, do away with the Federal Reserve…or at least reinstate Glass-Steagall; forcing investment banks to sink or swim on their own.

The little secret? Those investment banks own the Federal Reserve, along with 25% of our government debt.

What happens if they are forced to let that debt roll off the books, resulting in the government paying free market interest rates?

The Fed and big banks have Congress over the barrel, even if they want to do the right thing?

Are we screwed?

Probably so for at least a couple of decades. With $30 trillion in debt and another $170 trillion in “unfunded liabilities” politicians have made political promises they can’t keep.

Many will fare better than others, but all will suffer from the misdeeds of the elite and political class, moving on as best we can.

During the Great Depression, banking controls were instituted to keep the banks and much of government spending under control for a couple of generations. Let’s hope we do the same for our offspring that our grandparents did for us.

For more information, check out my website or follow me on FaceBook.

For more information, check out my website or follow me on FaceBook.

Until next time…

Dennis

“Economic independence is the foundation of the only sort of freedom worth a damn.” – H. L. Mencken

Affiliate Link Disclosure: This post contains affiliate links. If you make a purchase after clicking these links, we will earn a commission that goes to help keep Miller on the Money running. Thank you for your support!

As if the demolition was a bug not a feature.

Exactly. Pretty obvious at this point they want to destroy the country. They think they can control the destruction and build it back how they want but they are wrong.

We need to go all Mad Max when we reach ‘the bottom’, so we can reduce the rest to ashes. Then we would have a chance for prying the grasping claws of the Globalists from our necks and sending them one and all to hell by whatever means presents itself.

What groups/industries would you day make up the elite class?

–GNL

Bank Debenchers, loaning other financial institutions money which they can repackage as investments or loan out the same amount ten times… what could possible go wrong… Actually lost money in one of these schemes, not a lot but enough to know that stocks, mortgage loaning, debenchers all prey on the little fish. They are nothing more than financial pyramid schemes…

Cycles…

cosmic,planetary, human,economic,societal,empire, etc etc

You can’t escape it.

My guess is have entered a period where the timing of our economic, societal, empire and planetary cycles are all entering their cycle finish and once they all collide it will biblical ipo

Pssst…reelect me. I promise no more kicking the can down the road, Charlie Brown.

Psst…nonsense. Just apply for a Lowes or Home Depot credit card and load up on a bunch of shit at 0% interest and no payment for six months. Then, bam! The chickens come home to roost.

Jan 26, 2018

World Economic Forum Annual Meeting

Isn’t this World Economic Forum the same one headed by Clown Klaus? In Lobo , Texas, anyway, “It don’t get no better than this.”

https://lh5.googleusercontent.com/p/AF1QipP_F9sXwUmiU8kBDOlBkxAFx-dGVNgZ_pPK6rtj=w408-h408-k-no

Old Mil sold “7-paks” back then. 6 14 oz. cans. Good cheap beer. I miss Falstaff to this day.

Only old timers will remember, Falstaff! Why, it was a sponsor of major league baseball on black and white TV in the day when players played the game for the game not so much the dough. Jax was another “old timer” long gone. And of course, Pearl Beer in Texas.

I remember when Coors could not be sold on the east coast. People would finance their trips west by coming back with a van load of Coors

The story of Coors in Texas:

March 1976

https://www.texasmonthly.com/food/muscling-in-on-texas-beer/

I know I was drinking Coors before ’76 but remember when it was not common. Coors was a good beer for many years. Now, like so many domestics with the corn pone dupe, it sucks! Rocky Mountain Spring Water ain’t what it use to be.

The only thing none of these geniuses actually talk about:

THE WESTERN WORLD WANTS THEIR ECONOMIES AND SOCIETIES TO IMPLODE.

The elite believe themselves insulated from the coming hunger strikes, grid collapses, riots, and general societal collapse.

They are Luciferian AI-worshipping morons who were sold a bad bill of goods.

They think they can reduce the population willy-nilly while some kind of personal robots do all the hard work while they scoot around on anti-grav sleds eating grapes and getting their dicks sucked by sex robots.

I don’t like to give these fools too much credit. I don’t think it’s going to pan out the way they think.

No big deal, all the laid off people and closed business owners can learn to code. That’s what FJB said. Just think of all the great software we will have. We may even get to use some of it for free.

Instead of cutting each others hair, we will write software for our neighbors. Can’t wait. sarc/

President Trump’s Impact on the National Debt

The national debt increased by almost 36% during Trump’s tenure

…and he built the “Wall” too. OH,no,wait.

He’ll get ‘er done “next time” at half the cost to Mexico…50 cents on the dollar, let’s make a deal.

The last Prez to allow the market to correct itself was Warren Harding in The 1920 Panic. Despite all pundits telling him that’s crazy, everything straightened out over 6-8 months.

30%? Isn’t that less than the real unemployment numbers today, if you calculated them the way they did in 1933?

And YES. Screwed.

The needs of the common people? Do you know what they need? To fill their stomachs, that’s all. Anything else is secondary.

Can’t really remember Who/When. An early ‘Hot Mic’ moment…Can’t remember what group he was referencing. Either.

“Loose shoes, Tight Pussy, and a warm place to Shit”* i believe.

* i forgot about the magnanimous munificence of algore! Turns out i was paraphrasing, Non-sequentially.

http://www.thisdayinquotes.com/2009/09/earl-butz-three-things-loose-shoes.html?m=1