In the waning days of 2022, one of the most bearish (and accurate, at least as far as last year was concerned) strategists, SocGen’s resident permabear Albert Edwards, laid out what he thinks will be the big surprise of 2023, which will be “a return to deflation fears as headline CPI inflation drops close to, or likely below zero. Investors are already anticipating recession and have an unusually strong preference for bonds.”

Edwards’ also expects that while the current recession and collapse in commodity prices will also cause headline inflation to collapse, core inflation will abate too but remain sticky around 3% due to residual wage-price inflation (justifying the inevitable change in the Fed’s target).

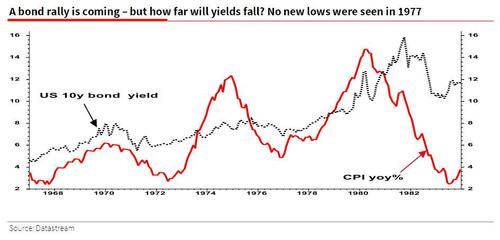

Which, to Edwards, sets us up for the worst possible scenario: a second wave of inflation, just like we saw in the 1970s under the Burns Fed, to wit: “any decline will be purely a cyclical phenomenon rather than a full-blown return to the Ice Age theme” and as a result, “investors have not yet discounted a second secular wave of inflation as we eventually exit this unfolding recession – ie the Great Melt.”

While Edwards is hardly alone in calling for a recession and a deflationary reversal of current soaring prices, following by an even more brutal inflationary wave as Powell reveals he was not Volcker by Burns all along, overnight another bearish icon repeated the exact same sequence of events.

Tweeting late on Monday, Scion Capital’s Michael Burry, aka “the Big Short” said that while inflation has peaked, it is likely to pick up again in response to the coming stimulus which will be unleashed to offset the painful 2023 recession.

“The US in recession by any definition,” Burry tweeted on Sunday, echoing Albert Edwards verbatim, adding that “Fed will cut and government will stimulate. And we will have another inflation spike.”

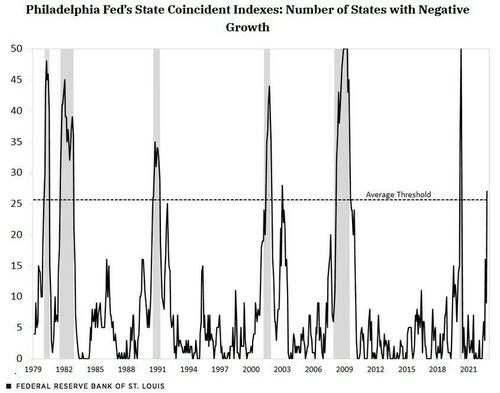

Burry is certainly right about the US being in a recession, especially now that more than half of US states have negative growth, a threshold that has always led to recessions in the past…

… the last, missing piece is the BLS admitting the US labor market is in freefall and now that even the Philadelphia Fed has opened up the pandora’s box over rigged jobs data, it is only a matter of weeks if not days before the Dept of Labor admits it made a “mistake.”

Where Burry is wrong is in expecting a government, or fiscal, stimmy. With Congress now divided at least until 2024, one can kiss any major, multi-trillion injection goodbye until after the next presidential election (absent a war with China of course). Which means the only stimulus for the next 24 months will have to come from the Fed, i.e., monetary, and thus will stimulate risk assets far more than the economy.

This was Burry’s latest warning since September, when the S&P tumbled to its 52-week lows, and when the Big Short predicted more pain for the stock market, saying “we have not hit bottom yet.” However, the weeks following the September dump saw stocks briefly soar into a bull market amid a powerful short squeeze expect a Fed pivot; it remains to be seen if stocks will take out

In the second quarter, Burry put his money where his mouth is, as his firm dumped all of its equity exposure besides one company. One quarter later, Burry was back in the market, adding to his GEO Group stake and opening new positions in 5 companies as we discussed at the time.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

Only usurers and their victims fear deflation.

Can it really be assumed congress won’t “compromise” on stimmy spending? It does make sense risk assets bear most of the monetary inflation, though. People can’t pay with money they don’t have. It seems the economic system has been deliberately manipulated to resemble a host and parasite relationship.

Agreed pay off all your debt now.

Don’t go on vacation eat out buy a new car or a new house. Do none of these things until you’re debt is paid off.

I’m debt free and don’t do any of those things. It only feeds the beast. ALL economic activity should be minimized until this upside down clown world and its monetary systems collapse. Withdraw participation, withdraw consent; minimize consequences. There are still ways to create real wealth that are not system dependent, but you must have the proper definition of wealth.

oh please, what is debt if they can’t collect on it? Avoid collateralized debt, max out those cards, get what you need and then let them do as they can….

They can garnish your wages.

Userers only fear Deflation if their borrowers can’t pay them back. Otherwise, they like being paid back more.

Good news-A LOT of debtors won’t be able to pay them back.

Wrong, Wrong Wrong! The Fed can monkey with money supply- and do.. They have no power over interest rates. They follow the market. Any chart of Fed rates against 2 yr, 5 yr or 10 year interest rates will show that the market rates change and the Fed is forced to follow. Fed power over interest rates is a myth..

We just finished a 32 year down cycle of interest rates, now they are headed up for perhaps another 32 years. Cycle is easy to see on a chart of the 2 yr t-note.

Anyone yammering about the Fed controlling or affecting anything with interest rates is lying or an idiot or both. They do not deserve your attention.

December is my “slow” time of the year, so have no idea what’s outside our bubble. In Charleston high $$$ restaurants & bars are busy. Xmas tourons over invaded. Bill Murray wandering aroundour Waterfront Park and bars at Beaufort’s First Friday Festival in December. Maybe he’ll be back this Friday.

Half the US population is basically broke, and have no assets. However, when they do get their hands on their paycheck or other sources of income, they run out and spend it like drunken sailors, which is why they never accumulate any wealth. So long as they have jobs, restaurants and entertainment will continue to have customers, but when they lose their jobs all heck is going to break lose….

I know were in a recession, but my customers don’t. I had my best months in Oct, Nov and Dec in 15 years. I think there are 400 people in the state doing what I do and I think I finished top 5 again, my area is not a top 5 area, it’s a mid 200 area.

Nah, the Fed’ll act differently this time, than in the past 110 years. It’s different this time. They’ve decided to stop inflating the money supply. They’re abandoning their founding mission statement of theft by counterfeiting until terminal velocity is achieved.

/s

The Fed is not going to ease until inflation goes back to near 2%. The Fed does not give a damn what happens to the economy, they are not a government agency looking to make things better for consumers, they are a private corporation who’d shareholders are their member banks. They will do what is in the best interest of their member banks just as they always have, and always will do in the future.

High inflation is very bad for banks and other lenders because it wipes out their income from interest and means they get paid back in dollars that are worth significantly less than what they lent. If they in turn raise interest rates on loans high enough to offset high inflation, they kill the market for borrowing.

The Fed will not consider changing course until the recession they now admit we are in, get bad enough to bring inflation back to low single digits. It would not be in their member banks interest to do so.

The Feds hands are tied as long as Biden keeps spending trillions, no matter what they do, it will be the wrong thing.