Submitted by Hardscrabble Farmer

“Third Straight Month Of Good News On Inflation”: Wall Street Reacts To The CPI Report

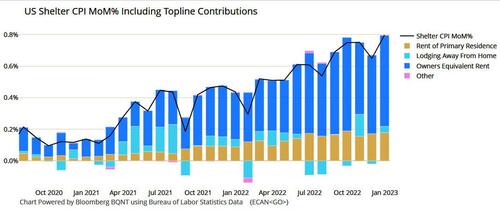

Below is a snapshot of several Wall Street kneejerk reactions to today’s CPI report which came in right as expected, and absent a bizarrely high, and 12 month-delayed shelter/rent print which rose 0.8%, or the highest since at least 1990…

… would have been flat M/M instead of the 0.3% reported.

Bloomberg Economics Anna Wong

“December’s CPI report offers a third straight month of good news on inflation, with outright deflation in the headline measure. Momentum points to underlying headline CPI running at a pace close to the Fed’s 2% price target, though core CPI is still in the 3%-4% range because of sturdy core-services readings.

“While the mostly favorable report gives the Fed scope to further slow the pace of rate hike to 25 basis points at its upcoming meeting, officials are likely to conclude they still have work to do. Bloomberg Economics expects the Fed funds rate to reach 5% in March and stay there for the remainder of the year.”

Omair Sharif, founder of Inflation Insights:

“The broader message is that we now have a 3m SAAR core CPI rate of 3.1% vs 6.0% in Sept. And a 6m SAAR of 4.55% vs 6.9% in Sept. We still clearly have moderation in the core, and the idea that we’d see a string of lower core CPI prints starting with the October report, something I’ve been discussing since September, remains intact.”

TD’s Priya Misra:

“Even though headline MoM CPI was negative and YoY CPI is declining, core CPI came at consensus and the strength in core service CPI brings up the pain trade for markets. A 50bp hike in Feb looks more likely — that is our call. A sticky inflation trajectory will also make it difficult for the Fed to cut rates once the economy enters a recession. They are already reluctant to cut early because of the concern of a mis-step like the easing in 1970s. This is a huge negative for risk assets…. The market’s a little too optimistic, extrapolating that this decline in service inflation will continue. Historically, service inflation is very sticky on the way down.”

CIBC economist Katherine Judge:

“The data argue for going by 50 in three weeks. With shelter costs set to soften, and the impact of past interest rate hikes materializing more, the Fed will likely be able to pause after a final 50 basis-point hike at the next FOMC.”

Morgan Stanley economist Ellen Zentner

“This month’s report provides confirmation that the downshift in inflation pressures is becoming entrenched, setting the stage for another reduction in the pace of rate hikes at the upcoming February FOMC. Fed speakers have signaled to a preference for a step down to 25bp increments as the end of the tightening cycle comes closer. While the December FOMC’s SEP points to a higher peak rate, we continue to expect only one final 25bp rate hike before a pause and an eventual first rate cut in December. The inflation data look consistent with our call, and more slowing in the two payrolls reports between now and the March meeting should move the Fed to an earlier end of tightening.”

Andrew Patterson, senior economist at Vanguard

“It will be all the more important to monitor Fed officials’ communication for a steer on what they will decide Feb. 1. We will be paying close attention to Fed communications going forward as we assess the likelihood of 25 v 50 basis points for the Jan/Feb FOMC meeting.”

Richard Flynn, managing director of Charles Schwab UK.

“Looking ahead, the Fed has promised to ‘hike and hold’ interest rates throughout 2023, which is unsurprising given the inflation rate remains well above the central bank’s target. However, the story for the US economy in coming months will likely shift focus from inflationary concerns to potential stresses in the broader economy and labor market.”

Bryce Doty, senior portfolio manager for Sit Investments.

“The single largest component of core CPI is housing as measured by owners equivalent rent and is based on outdated leases. As a result, it showed that housing continued to rise rapidly, going up 0.8% last month. Clearly, home prices and rents are declining. The result of this flawed methodology was an understatement of inflation a year ago and an overstatement today.”

And tied to that, here is Pantheon Macro

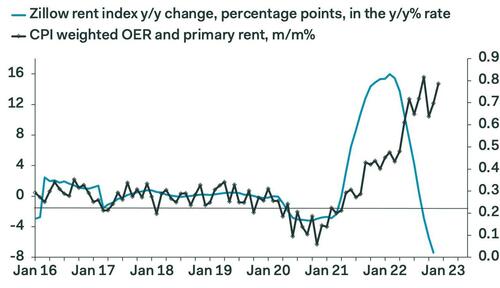

“The biggest contribution to the core was rents they account for the entire increase in the core owners equivalent rents up 0.79% biggest increase in the three months but it won’t last, given the steep drop in rents for new tenants recorded by Zillow and others”

And incidentally, if one uses the latest Zillow or Apartment List data instead of CPI, the core CPI M/M would be flat (0.0%), instead of 0.3%.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

I notice some prices have gotten lower here in AK, not eggs.

Egg prices supposedly driven up by avian flu. The good news is some people are taking correct action….

TEMPLE, Texas — If you haven’t noticed, egg prices have skyrocketed and have recently reached historically high prices.

In 2019, the price of eggs were $1.40 for a dozen. Today, a dozen of eggs is well over five dollars.

Texas A&M Central Texas economist Robert Tennant says avian flu is to blame.

“In the last six months to a year, the problem has primarily been because of avian flu, affecting the bird supply, which means affecting the egg supply,” Tennant explains…

While this hasn’t been the best time for the average grocery store shopper, business has been great for the farmers market Mustard Seed Farm in Waco.

More and more people are outsourcing to farmers market to do their grocery shopping and get their produce.

“People are now looking for their own chickens and starting to raise their own chickens whether it’s with and the city or a small farm within the community just so they have the opportunity not to have to spend so much at the grocery store,” Mustard Seed Farm owner Amanda Hubbell explained.

She hopes more people decided to support their local farmers market even after the egg prices get to some sort of normal.

https://www.kcentv.com/article/news/local/avian-bird-flu-causes-egg-prices-to-increase-nationwide/500-d3d85dda-dd51-43c0-b9b4-516c1675b8a6

Fertilizer, feed and energy prices are also up and are having an affect on farm commodities.

Read two articles today saying egg prices are NOT related to the avian flu but rather to grocery stores raising prices yet not compensating farmers for their increase costs.

So they quit producing eggs at a loss.

I suggest a trip to a grocery store once a week for two or three months. Track the prices of what you buy on each trip then take a cheap pocket calculator at the end of that time and tell me what the inflation was. No gimmicks, no hedonic adjustments and no B.S., just real numbers.

In my state, meat prices are up 200% since May at local grocery stores (veggies are only up 100%).

I stocked up in May & June.

I figured out what was dead ahead……….

What I can’t tell you…….how much of the price rises are greed and how much due to real shortages……

If I didn’t preplan, grocery bill increase in 2023 would be over 150%…….each week, based on prices 7 months ago…..what was $50 spent is now $125…..

(Just a tip I NEVER buy an item unless it is on sale, no discount I walk out and try a different neighborhood or chain)

I check prices online weekly, approx 10 different price adjustments since May.

I guess eggs will soon be $8 a dozen.

You have to consider the fuel costs of store hopping to save a buck or two.

I saved over a grand…..

Know what I am doing.

By the end if this year replacement cost probably 3 grand in savings….

Extra gas $100….maybe $200.

You do realize our dollar will likely lose 50% of its purchasing value in the next year and a half?

Everybody sitting on there hands is not a strategy……..

And 5% are somewhat ready for what is ahead……10% tops.

When the food runs out at the grocery store your plan is?

I was just in the Monticello Fl Winn Dixie and large eggs were $8.

You know how sometimes products will advertise “50% more” or “now with 20% less fat (or sugar)” or something similar. I recently bought a cleaning product that had a big sticker on the top proudly claiming that the bottle:

“now uses 30% less plastic!!!”

They shrank the bottle. Which means less product. Price stayed the same though.

Limes have gone from 50¢ to 69¢ over the last 6 months. Non-organic raspberries (6 oz.) jumped from $2.99 to $4.99 in the last month.

My 6 backyard chickens are looking better and better every day.

It is a good thing nobody uses food and energy on a daily basis, so they can keep it out of the CPI calculation. Used car prices coming down really helped out the masses and moved CPI a notch or two. /s

I buy very little meat any more and I use less of it per meal. Used to buy 3 lb bags of onions and 5 lb bags of potato’s . Now I just buy two onions or potato’s at a time. I still spend a hundred a week at least.

My mortgage is $31 Trillion but my household expenses are rising at 3% this month instead of 6% a few months ago.

Fuckin A! Let’s celebrate!

Drop in CPI is fully the result of gas. Food is still soaring and owner equivalent rent is a delayed metric. Inflation in services is ridiculous. This is nowhere near under control and their headlines are bullshit. MMM!

Make More Money…