In my late 40’s, fresh out of a divorce, I took stock of my life. I had a good job, a small 401k, an old car and lived in a rental apartment. I’d enjoyed my share of good times and raised a family. My personal balance sheet would have fit on a Post-it-Note with room to spare; it was pretty bleak.

In my late 40’s, fresh out of a divorce, I took stock of my life. I had a good job, a small 401k, an old car and lived in a rental apartment. I’d enjoyed my share of good times and raised a family. My personal balance sheet would have fit on a Post-it-Note with room to spare; it was pretty bleak.

Soon after, I met Jo and we were married. We bought a $100K home and paid mortgage insurance; our down payment was inadequate.

Approaching 50 provided my wake-up call. I was responsible for supporting my new family. My biological clock was warning me I could forget about retirement unless I did something differently. In the past, I’d say, “We can worry about retirement later.” I was scared, which turned out to be a good thing.

I recently wrote about winning the lottery. It’s a fantasy. If you want to accumulate wealth, you have to do it the old-fashioned way; earn good money, spend less, save, and invest the difference. While it’s easy to say, unlike a get-rich-quick lottery winner, it’s a difficult, time-consuming process.

Sadly, many folks come into instant wealth, live high on the hog for a few years, and end up back where they started. They never understood what wealth is really all about.

I’ve had many friends who earned terrific incomes, lived lavishly, yet ended up with very little. They might drive luxury cars, take expensive vacations, dress in the finest clothes, send their kids to the best schools, and be members of the finest country clubs; however, their wealth is an illusion.

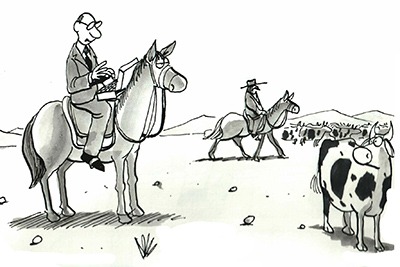

The author of the book, “The Millionaire Next Door” interviewed many wealthy people to learn what makes them different. One wealthy Texan referred to these folks as, “Big hat, no cattle.” Forget the lavish spending, buy some acreage, a cow and a bull and start building your herd.

The author of the book, “The Millionaire Next Door” interviewed many wealthy people to learn what makes them different. One wealthy Texan referred to these folks as, “Big hat, no cattle.” Forget the lavish spending, buy some acreage, a cow and a bull and start building your herd.

The real issue is not how much you earn, but how much you keep and invest so your money is working for you, providing additional wealth and income.

My personal journey

I was fortunate to have worked with many wonderful, successful people who were willing mentors. This week I am going to share some of their tips, adding my own comments.

Pay yourself first and learn to live on the rest. I was a member of the “deposit your paycheck, pay the bills and hopefully there was money left over” tribe. Sometimes I couldn’t pay off a credit card; incurring double digit interest rates on the unpaid balances.

A mentor suggested writing a check to savings for 10%, then pay the bills and living on what was left. I scoffed, “Impossible”.

I was surprised when he said, “You don’t have to live from paycheck to paycheck, you do so because you choose to.” He went on to explain that my life, up until that moment, was a result of choices I made along the way – some good, some bad. He added, “Until you are willing to make the choice to get out of debt and build wealth, things will not improve.”

“But what about all my bills?”, I asked. He grinned and said, “They will be paid off in time. Your spending habits will also change.” He was right.

Do a personal financial assessment. He deliberately avoided the word budget, knowing it would scare me. He had me take our checkbook and credit card statements for the last two years and build a spreadsheet tracking where the money went. I paid lots of interest, I’d whip out a credit card whenever I wanted something.

He was right, when it came to spending, many of my choices were made impulsively. If I set my mind to it, I could reduce spending enough to save 10% – once I got out of debt.

Save enough for 3-6 months expenses, then begin to invest. Great theory, but it didn’t work well for me. I’d save some money and have the urge to spend it.

Here’s what I had to do….

Hide money from yourself. If I was going to really save, I had to hide it from myself. In an impulse moment I didn’t want to blow the whole plan. Instead, I maxed out my contributions for my retirement account and started making additional house payments. That was saving, building my net worth, and not available for “stuff”.

Get out of debt. Credit card interest was 22% at the time. Home mortgage interest was more than the principal payment. Renting other people’s money is expensive!

Jo and I worked well together. We targeted certain credit cards, paid them off and cut them up. We kept some for convenience and pay them off each month. When they started offering cash back, we looked for those who gave us good rebates.

Don’t wait to start investing. This required a major change in thinking. We hear stories about investors getting rich overnight, hitting the biggest, hottest investment in the market. That is gambling, not investing.

| “It has been said that people who understand compound interest receive it while those that don’t understand it, pay it.”

— Subscriber Scott M. |

Real investors understand growing and compounding your income and net worth. Like many, I had to learn by losing money betting on get rich quick schemes as opposed to investing into solid companies that produce income like clockwork.

A personal note here. Many young, hard-working people dismiss the idea, saying they don’t have time. Don’t blindly abdicate your life savings to a money manager. They don’t always put your interest ahead of theirs.

You can invest passively by maxing out your 401k. After age 50 you can make “catch up” contributions. Compounding really works in your favor when you start young.

Earn more – save more. While there is truth in the old saying, earn more, spend more, don’t forget the goal. Enjoy the fruits of your labor, but increase your “pay yourself first” amounts; there will still be some left over for fun.

A personal note here. When you pay something off, you don’t have to go buy something else because you can afford the payments.

The consumer electronics industry has brainwashed much of the public into believing they have to have the newest hottest technology. I needed a new screen protector for my phone and asked the salesman what I would get if I upgraded. He said he’d make me a great deal, quoting the monthly payment. I asked how much the phone cost – “$1,400.” A few more camera pixels and bragging rights didn’t cut it, I spent $29 bucks on the screen protector.

Factor in taxes & inflation. It’s more than just taking all the legal deductions you are entitled to.

Look hard at the income portion, particularly investment income.

Are you better off with an investment grade bond that pays 5% interest or a solid stock that pays 5% in dividends? Stocks might increase in value helping to offset inflation where the bond coupon is fixed.

Interest income is generally taxed at your normal tax rate. Nerdwallet.com tells us a married couple filing jointly with taxable income from $89,451 to $190,750 is in the 22% bracket.

Receiving “Qualified dividends,” that same couple’s dividend income would be taxed at 15%. In 2023, if they earn less than $89,250, they pay zero taxes on their dividends.

Check with your licensed professional, some investments may provide the same gross income, but their after-tax income will be lower.

More personal thoughts….

I wish I’d met Tim Plaehn, and his Dividend Hunter philosophy 30 years ago. He recommends good-paying dividend stocks and reinvesting dividends.

For working people feeling they don’t have time for this, I recommend finding good dividend stocks, and using their broker’s automatic reinvestment program. Passive income and compounding become automatic. A few years ago I started the process. In two cases, my share count is already up 10%.

As I approached retirement, near the end of the Bush II administration, a friend suggested rolling my retirement plan into a self-directed Roth IRA. Yes, I had to pay a lot in taxes, but once in a Roth, I could earn all I want without required minimum distributions or additional income taxes. With government debt going through the roof, who knows what the personal income tax rates will be for those withdrawing money from their 401k in the future? I no longer have to worry about it.

Work together with your spouse. I saved the best for last. Changing your mindset was the key. I was lucky, Jo and I were on the same page. We work as a team and have enjoyed a good lifestyle along the way.

We’ve seen cases where both partners don’t work together, creating real problems; particularly as you get older. Sadly, some seniors are working into their 80s to pick up the slack.

I’m required to add, I am not licensed or qualified to give personal, individual investment advice. While these ideas worked well for me, I suggest you work with a licensed professional to determine what is best for you.

It’s never to late to start, despite ridiculous government spending and high inflation, financial independence is the goal. Forget the past, you can’t change it, but you can change your future – positively. It took me 50 years to start figuring it out; it can be done. You don’t have to live from paycheck to paycheck forever!

For more information, check out my website or follow me on FaceBook.

For more information, check out my website or follow me on FaceBook.

Until next time…

Dennis

“Economic independence is the foundation of the only sort of freedom worth a damn.” – H. L. Mencken

Affiliate Link Disclosure: This post contains affiliate links. If you make a purchase after clicking these links, we will earn a commission that goes to help keep Miller on the Money running. Thank you for your support!

The advice that I give to my grandsons is to live way below your means and stay out of debt.

Read “The Richest Man in Babylon.”

I guess I understand the idea behind maxing out retirement savings, but I still have my doubts.

Certainly max it out up to the employer match, if that makes sense. You should still remember that retirement plans are merely part of the IRS code, and subject to changes, restrictions, and additional taxes at the gov’t’s whim. Retirement funds can, and have been, and will be seized or rolled into gov’t managed plans in various countries.

Having property, land, or other productive assets outside of IRS regulated accounts is what most rich people have. You don’t see the multi-millionaires sweating out ROTHS or whatnot. And since the gov’t does what the rich people tell it to, it makes sense to do what the rich people do with their own money, even if in a small way, doesn’t it?

Sometimes I can’t wait for the dollar to become worthless. It passes, but sometimes I really can’t wait.

The dollar is gets a little more worthless every day.

Most people are like frogs slowly boiling to death. The can’t see it happening right before their eyes.

I think you’re one of those people anal mouse.

He mentions him and his wife being in harmony. Every time my wife and I agreed on something. Things worked out perfectly. When we didn’t, and one of us said. I’m going to do it anyway. It ended up bad. Not once. Every single time. I noticed this after about 5 years and talked to my wife about it. It doesn’t matter what you do. Only that you’re in harmony about it. It worked out well as I retired at 55, and she at 52.

If she or he is a spender do not date or marry that person.

Your choice of spouse is the most important financial decision you will ever make. If you get married at all.

Most women subconsciously understand this most men do not.

Amen!!

I’ve heard that a “shit test” women use on dates is to see if the guy wants to bring home his left-overs from the restaurant. If he does, then he is “too cheap.”

So, I, in turn, bring home a doggy bag every time I go out. If I am too cheap for my date, then I’d better find out now, rather than later.

People can find out so much about a potential partner if they pay attention, rather than focus on getting “lucky.”

(of course, I am still single, so YMMV)

You don’t have to live paycheck to paycheck, but you can’t stay here.

H.L. Mencken also said, “Every normal man must be tempted at times to spit upon his hands, hoist the black flag, and begin slitting throats.”

yeah, a lifetime of working hard , earning pretty good wages, being frugal and saving every penny, all to have it robbed from me by armed goons in a matter of minutes. in the current age of collapse, the opportunities for being able to just make a humble living will be poor enough, the opportunities to actually save up any meaningful capital, are pretty much gone from the earth until things collapse and the dust settles. the era of collapse is an era of the conversion of capital into waste.

more important is to learn to adapt to living more simply, even a rapid and involuntary changed forced upon us from without that suddenly takes away what we thought was a security blanket – to be able to continue living as decent human being even when we _dont_ have that comfortable buffer there for us.

many people who i thought were friendly became scarce one it became generally known in the area that i was now broke. it became clear who thought of me not as a neighbor or a cousin or a nephew or whatever, but as a walking wallet ready to distribute on generous terms (i did too much of that, yes).. now that theres no more feast there one sees little of those people. There are also those who were genuinely nice and remained so despite knowing that theyd never get anything out of us , they didnt ever expect to anyway. likewise some other folks who are poor but retained their humanity, i think became even friendlier.

it’s not easy for any of us who grew up in the peak of industrial civilization, to adjust or adapt to living without so much of what we’d taken for granted – even if we werent living a life of luxury or stepping into any of the obvious or classical traps, we still had gotten used to a lot of comforts and conveniences. learning to let go of those , or even to reject them deliberately, is an important exercise. I’m sure that my already having been for many years on the path to rejecting most of the modern way of life, was of great help in adjusting to the majority of those things now no longer being an option for economic reasons.

perhaps my kids , more likely my future grandkids, will live in a world where the turmoil of collapse has settled back down, and they can again _accumulate_ capital. i dont think there will be very much of that during the rest of my lifetime. indeed the only likely method of accumulating capital for the next few decades looks like the story of what happened to my own capital – robbery, theft, expropriation, will be the only really viable mechanism, and that will as time goes on also carry a bigger and bigger risk of retaliation. as it is now i knew that to retaliate with force against a large, organized, armed body with the cover of official sanction, would be a deadly folly only suitable for a movie script. retaliation through the ‘approved’ channels, i.e. lawyers, is my only avenue in our present stage of early collapse, and will likely be merely a waste of time and remaining capital. but a few years down the road those goons will have to at least risk their lives to rob someone, as the bigger organization that backs them up wont be there and it’ll be their force against any defensive force. later yet it will coalesce into warlords in some places , for more effective robbery/expropriation. thats still some ways down the timeline from here.

meanwhile dont get your nuts in a vise about accumuation capital in an era when capital is all going up in flames. cover the basics of food, water, shelter, and community, do what you can for defense and focus on making it through the bottleneck with as much humanity intact as possible to pass on to the next generation.

i say this as much for myself to hear it again and again, as i do for anyone else to hear it.