Guest Post by Dr. Robert Malone

More data for the data driven

Clearly I am not a stock analyst. But I am also very bothered when I can’t get good data. Yeh, I am a data guy at heart. When I go to the news aggregators and can’t find up-to-date information on bank stocks, valuations, closures – in the middle of a crisis, I get annoyed. And then I look for data.

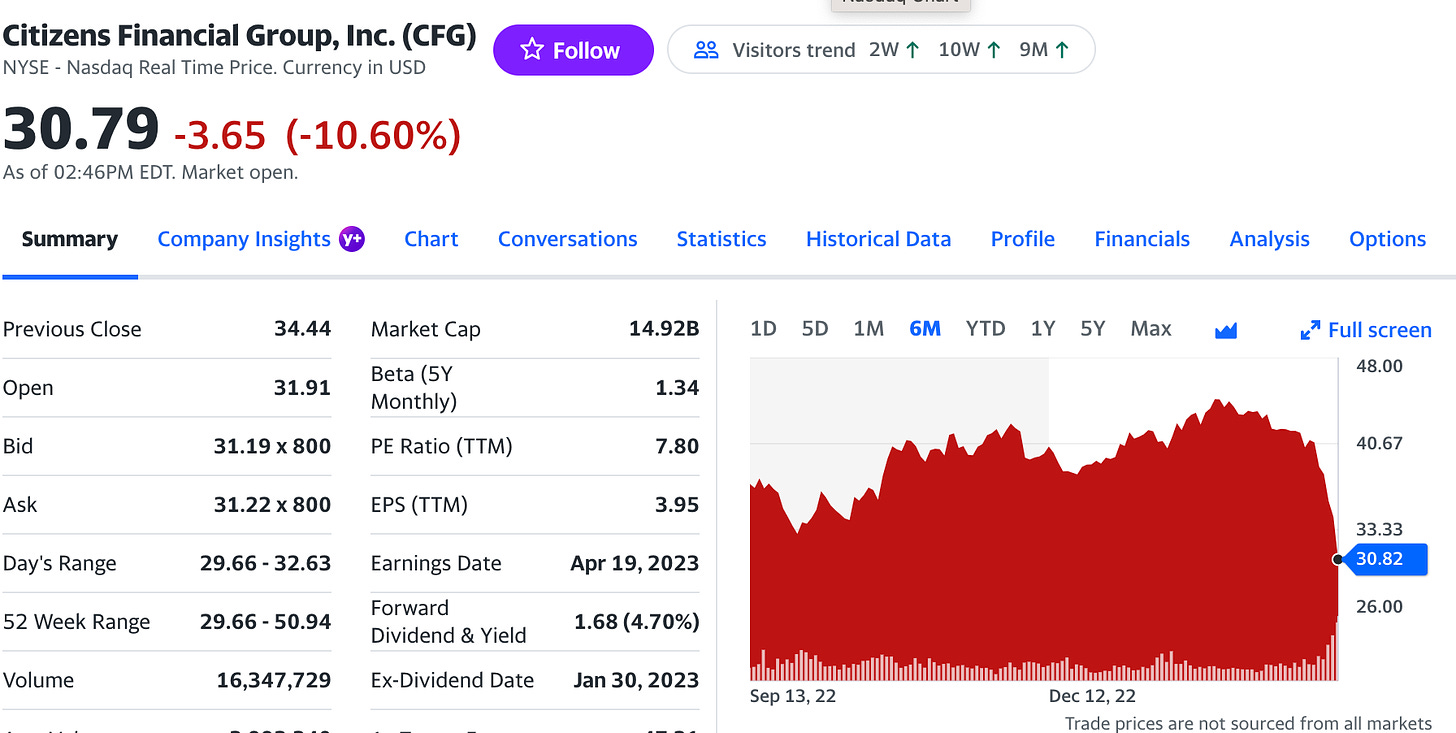

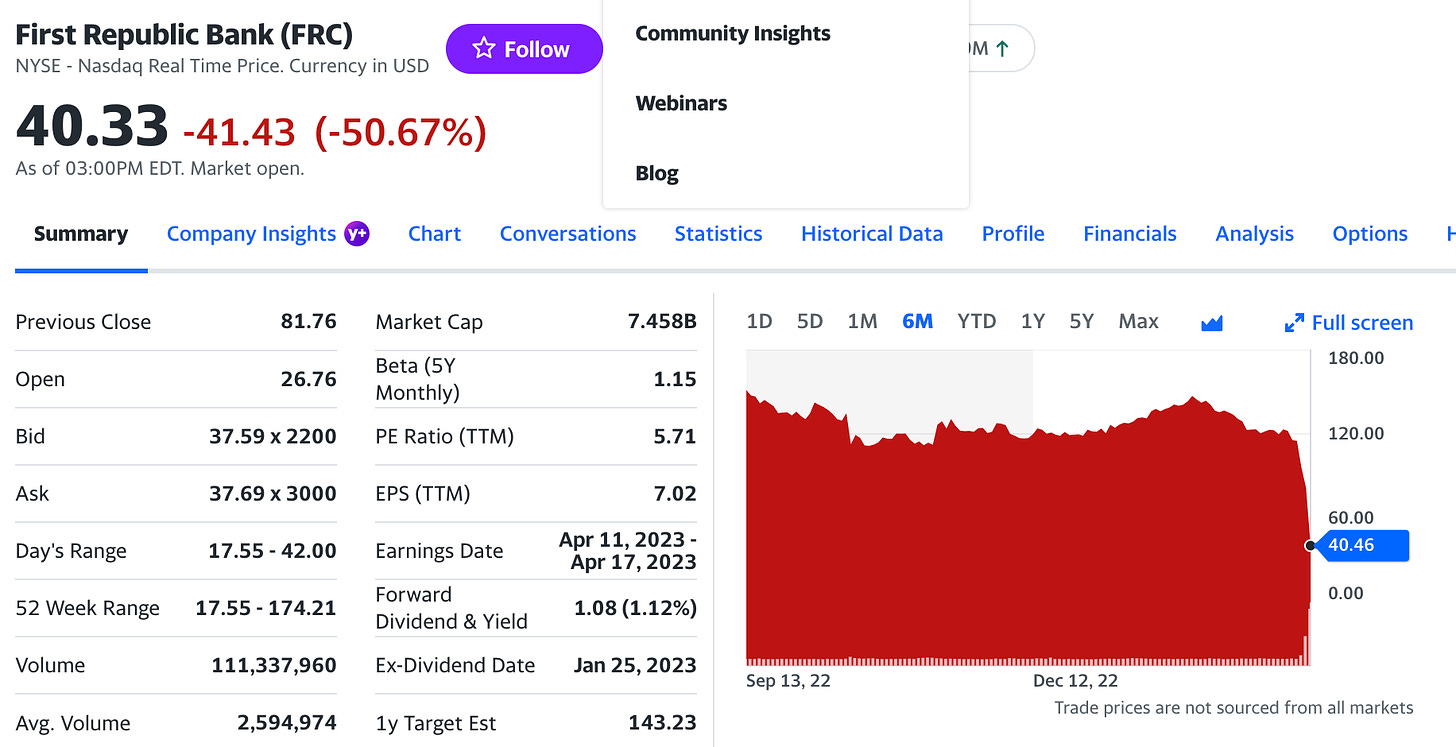

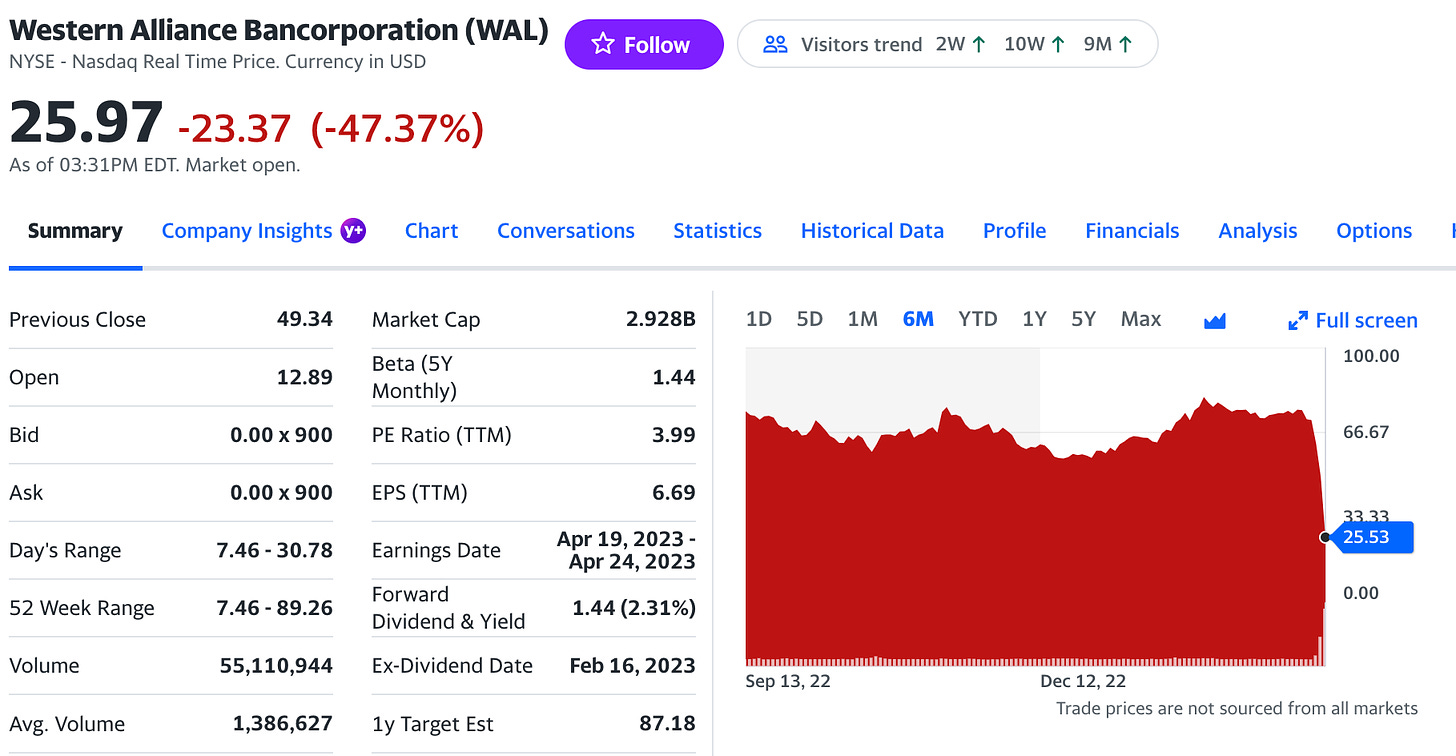

My “go to” is the Yahoo Finance page, which has a great search engine – Just put in a corporate name and it spits out the current stock valuation, percent price change and a nice graph. Wiki lists the 100 largest banks in the USA. From there, I began entering names into the Yahoo Finance page.

The list at Wiki of the largest 100 banks is here.

This is just more data for the data driven.

My little search around Yahoo Finance soon revealed that Wall street seems to be doing an extremely efficient job of sorting viable from non-viable banks.

The majority of banks are holding value – with stock prices being negatively affected by less than 5%. This is good news.

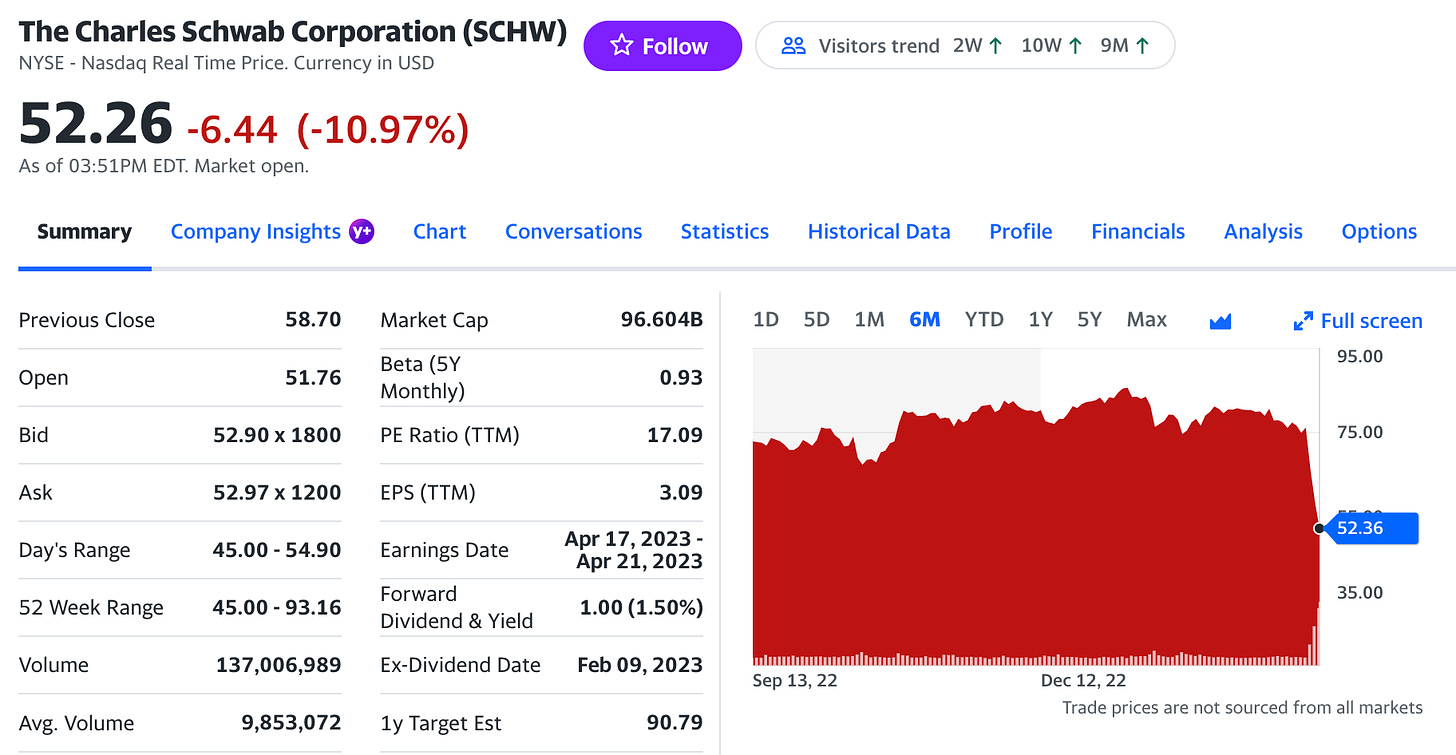

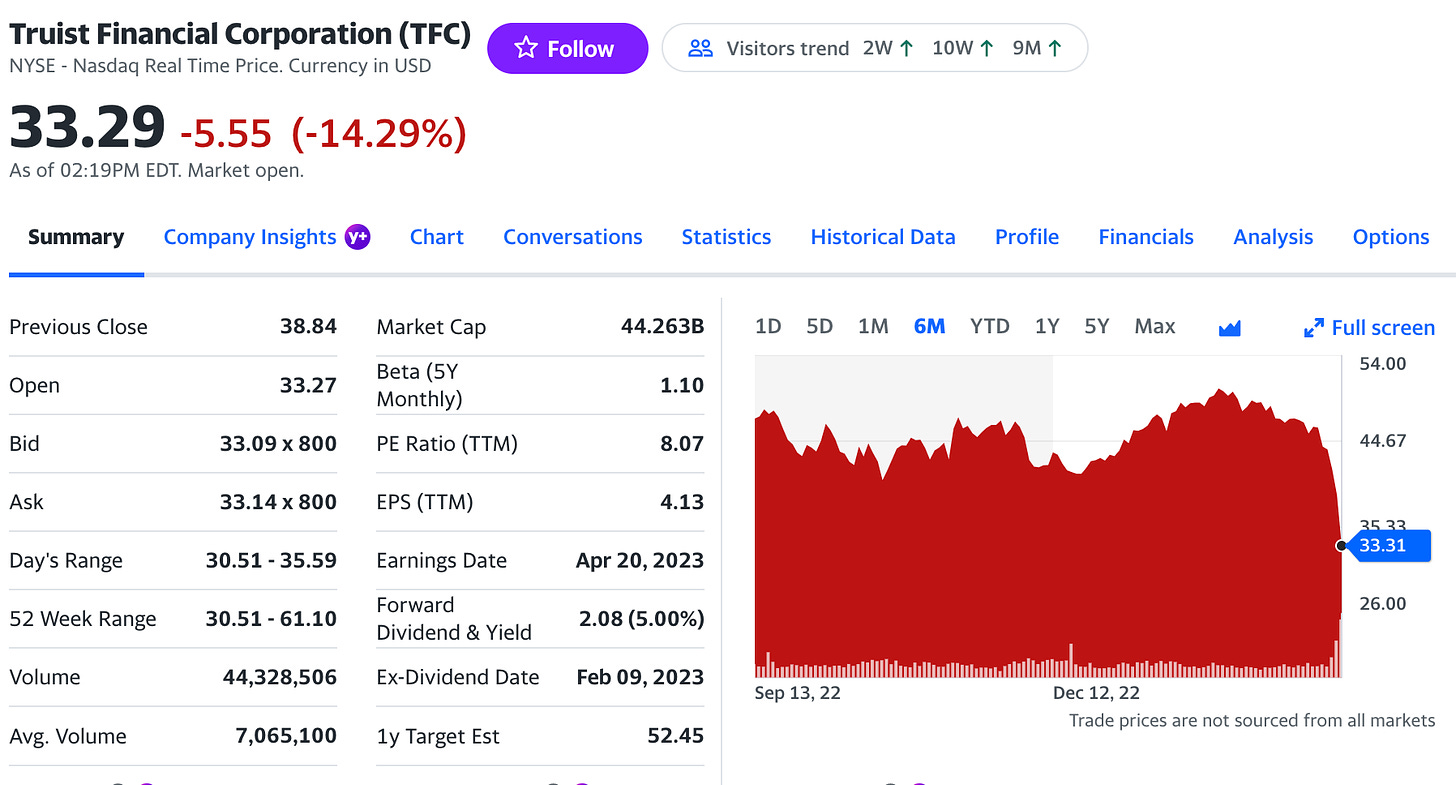

These are the ten largest banks in the USA – most are not losing stock value of any real significance. Charles Schwab and Truist being the two outliers (see the charts below).

Investors are generally savvy. I am sure that as soon as the news hit about Silicon Valley Bank, everyone went scurrying to the various bank’s 2022 annual reports and 4th quarter balance sheets. Many of the smaller and regional banks appear to be in trouble.

Here are the graphs from Charles Schwab and Truist. The percent in parenthesis is the stock value price change for the day at the time of the image capture. I set the X axis on all graphs to six months.

The 11% loss of value of the Charles Schwab corp worrying because this is where so many people stash their retirement monies. But the holding company is making many assurances that they are actually ok. Another article lists the reasons why Schwab’s stocks are being affected here.

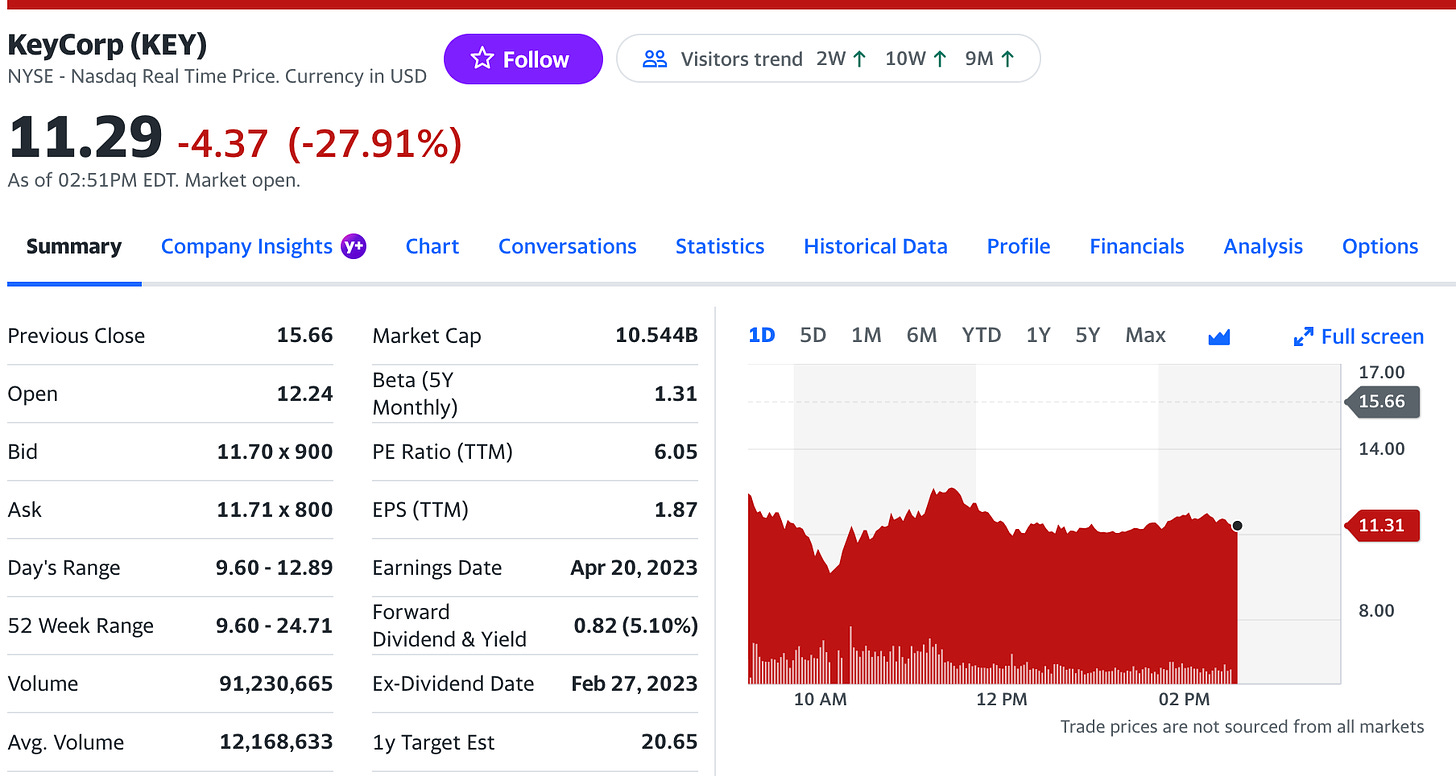

Some of the smaller banks lost a lot of stock value today.

Stock analysts appear to reacting to what they are finding on a closer inspection of the balance sheets.

Also note, that this is just the daily change in stock valuation. Some of these charts show a sharp decline in valuation over the past week. Trading was very volatile in the banking sector today.

The worst hit from this crisis are as follows (this may not be a complete list) – obviously SVB has stopped trading, so it is not here.

One interesting thing about the banking system, is that many of the smaller banks (the lower 50% of the top 100 banks in the USA list) are privately held. So, if they are on the verge of folding, there is literally no way to know.

As I said, I am not a stock analyst- take all of this with a grain of salt. But I do like data and I have a nose for detail. I hope this helps someone make a bit more sense out of this mess!

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

While I like Dr. Malone and don’t think he’s a bad guy, I am amazed by how many so called smart people can be so easily and completely BULLSHITTED – and buy into it.

Dr. Malone admits he worked for DOD – DTRA , defense threat reduction agency.

If I wanted the best minds to help me further bio-weapons research and development, I would ” SELL ” the people the idea that working for me would save lives , instead of perfecting weapons of war.

Of course , I would be a scumbag deep state liar , intelligence wonk …. and I would exploit their willingness to help , reverse engineer any discovery or findings they made , and open up some experimental labs in an odd , obscure country like , geee , Ukraine ?

STOP HELPING THE MACHINE

Somewhat odd that Malone ventures into topics that he, obviously, is not an expert on. He recently wrote about psychological mass formation and now the banking industry? Are his insights on banking what most people want to hear from him? I don’t care what he writes about, I just think it weird and waters down his scientific credibility.

Yep. He and Dowd are buds, too. Dowd’s Econ career got a real boost from antvaxxx info. He’s now mostly talking money. His antvaxxx stuff is connected to his money business and he says it upfront- go to his site. The medical field is the place to invest.

Both worked for the beast.

Malone might still be employed and went through a lot of their money, and Dowd for Blackrock of all places.

FAKE GLOBAL PANDEMICS have a way of making you wary, Or should.