Direct from BOOM Finance and Economics at the links below

Hat Tip to my colleague at: BOOM Finance and Economics who posts Weekly here: http://boomfinanceandeconomics.substack.com/And at: COVID GLOBAL NEWS Updated TWICE Weekly: https://cmnnews.substack.com/

BOOM Finance and Economics seeks out the very best information from authoritative sources and strives for consistency in its quality and trustworthiness. Over 5 years, BOOM has developed a loyal readership which includes many of the world’s most senior economists, central bankers, their senior advisers, fund managers and academics. If you want a real edge in understanding the complex world of finance and economics, subscribe to BOOM on Substack or as a Follower on LinkedIn. BOOM is also published weekly on Sundays at WordPress:https://boomfinanceandeconomics.wordpress.com/ — where all previous BOOM Editorials are available — the entire Archive.

THIS WEEK’S EDITORIAL – THIS WEEK’S SUBJECT MATTER

- The current status of CPI inflation in the United States

- CPI inflation in China and Russia

- The economic outlook in New Zealand – a nation left badly damaged by its former Prime Minister, Jacinda Ardern, a WEF operative. Then we look at…

- Ardern’s latest job, where we find her, unsurprisingly, on the Board of Prince William’s new “environmental” venture which appears closely aligned to the WEF. Then we turn our attention to…

- The US housing market and…

- Binance Crypto Exchange ceasing operations in Canada

US CPI INFLATION CONTINUES TO FALL: Relatively good economic news in the United States continues to provide stability to the financial markets and confidence to investors. The annual inflation rate in the US unexpectedly edged lower to 4.9% in April, the lowest since April 2021, below forecasts of 5%. Food prices grew at a slower rate (7.7% vs 8.5% in March) and energy costs fell (-5.1% vs -6.4%) but especially gasoline (-12.2%) and fuel oil (-20.2%). Prices for used cars and trucks declined again (-6.6% vs -11.6%).

On 16th October last year, BOOM wrote — “the inflation statistics and retail sales figures were a good result, offering some firm evidence that the peak of CPI inflation may be in the past. If we are past the peak, then the prices of stocks and bonds should start to rise from here”. US stock prices started rising 2 days later and US bond prices started rising 5 days later.

US ENERGY INFLATION AND SERVICES INFLATION ARE BOTH FALLING: Falling services inflation in particular is actually critical to look for in our current situation. Why? Because the US is predominantly a services based economy; so any slowing of inflation in this sector is hugely significant and boosts hopes for a lower inflation outlook for the future. Services inflation in the United States eased to 6.8% year-on-year in April, the lowest in nine months, from 7.3% in the prior month.

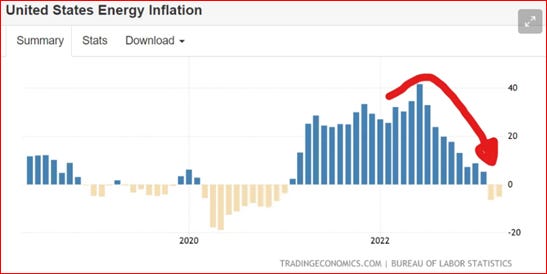

In regard to energy inflation, the Bureau of Labor Statistics in the United States released this statement on Wednesday: “The cost of energy in the US fell by 5.1% year-on-year in April 2023, following a 6.4% decline in the prior month. It was the second consecutive drop in energy prices since January 2021. Prices fell for fuel oil (-20.2% vs -14.2% in March), gasoline (-12.2% vs -17.4%) and natural gas (-2.1% vs 5.5%). In the meantime, electricity prices slowed down (8.4% vs 10.2%).”

These falls in energy inflation are very significant indeed. BOOM is of the opinion that the US economy has begun to slow significantly and that this slowing has reduced demand for energy. Subsequently, that reduction in demand has caused energy prices to drop.

This is good news potentially for investors. They will expect the Federal Reserve to soon back off on its hawkish interest rate policies.

This graph of energy inflation clearly shows what has happened to energy inflation over the last 5 years. The Peak of energy inflation occurred in Mid-2022 and by October was falling consistently. Over the last 2 months it has become a dis-inflationary situation with prices no longer growing but falling. The Fed would be wise to notice this and check for indications of further slowing in demand:

The chart for the Continual Contract price of Natural Gas in the USA over the last 5 years illustrates this even more dramatically – source: Stockcharts:

CPI INFLATION FALLING IN CHINA AND RUSSIA: In contrast to the inflationary pressures in the advanced Western economies, China’s CPI inflation rate is very flat indeed. China’s annual inflation rate fell to 0.1% in April from 0.7% in the previous month, missing market estimates of 0.4%. Core consumer prices have been flat for 12 months with no inflation evident. Food inflation is falling towards zero. In fact, food prices rose by only 0.4% Year-on-Year in April.

In Russia, it is the same story. The annual inflation rate in Russia fell sharply to 3.5% in March, the lowest since July of 2020 and compared to 11% in the previous month. The latest data for the Month-on-Month inflation rate is 0.4%. The Core inflation rate is collapsing and so is the Food inflation rate.

FOOD INFLATION AND DEATH IN NEW ZEALAND: After having suffered through countless Covid jabs and all the adverse consequences of medical fascism, New Zealanders must now face a moribund, flat economy along with horrendous food inflation.

GDP growth is flat to negative while the cost of food in New Zealand jumped 12.5% year-on-year in April, the biggest annual growth since September of 1987, accelerating from a 12.1% increase in March. Grocery food prices soared by 14%, the main contributor to the rise in food inflation.

Excess Deaths also continue to rise each year. So far, during the first 15 weeks of 2023, they are approximately 16.6% above average (expected) numbers, and that is, before the onset of winter.

Jacinda Ardern has left the sinking ship. She is apparently now working alongside Prince William at a climate change charity he founded called ‘Earthshot Prize’, aimed at saving the environment. It has Klaus Schwab’s privately funded, unelected World Economic Forum as a global alliance partner and Microsoft as a global alliance member. Many other usual suspects have signed on as partners and/or members. Having “saved” New Zealand, Jacinda obviously has bigger fish to fry.

US HOUSING: BOOM has indicated previously that housing prices may already be on the rise in the US. On 16th April, BOOM wrote: “This suggests that US house prices may soon begin to rise in price”.

The Philadelphia Stock Exchange PHLX Housing Sector Index (Code: HGX or $HGX) continues in strong uptrend. The total market value of the US housing market is around $36 – 40 Trillion and mortgage rates on offer in the US are continuing to fall. This chart shows the last 6 months of daily price action in HG:

Mortgage applications in the US jumped 6.3% in the first week of May, the biggest rise in nearly two months and rebounding from a 1.2% fall in the previous period. Applications to refinance a home loan surged 10% and those to buy a home 4.8%.

The average interest rate for 30-year fixed-rate mortgages with loan balances $726,200 or less dropped by 2 basis points to 6.48%, the lowest in three weeks.

The Zillow Home Value Index (ZHVI) captures home values across a wide variety of geographies and housing types in the United States. After falling from its peak in August, it is now rising again since February, according to the latest March figures.

MAJOR CRYPTO EXCHANGE CEASES OPERATIONS IN CANADA: Binance is the largest Crypto exchange operating globally. On Friday, it announced via Twitter that it is ceasing operations in Canada. The Tweet stated: “Unfortunately, new guidance related to stablecoins and investor limits provided to crypto exchanges makes the Canada market no longer tenable for Binance at this time. We put off this decision as long as we could to explore other reasonable avenues to protect our Canadian users, but it has become apparent that there are none.”

The Canadian Securities Administrators (CSA) stated objective is to improve, coordinate, and harmonize regulation of the Canadian capital markets. The CSA co-ordinates initiatives on a cross-Canada basis with the 10 provinces and 3 territories responsible for securities regulations and their enforcement.

In February, the CSA unveiled new guidance demanding “enhanced investor protection commitments” from Crypto asset trading platforms amid “insolvencies involving several Crypto platforms.” It set investor limits and mandatory registrations for Crypto exchanges, and prohibited them from allowing customers to buy or deposit Stablecoins within the country without the CSA’s permission.

In last week’s editorial, BOOM wrote about a draft Bill in the US Congress which is aimed at regulating Stablecoins: “BOOM thinks that this Bill will simply drive Stablecoin issuance offshore into other national jurisdictions – out of the reach of US regulators and US depository institutions. Perhaps that is it’s true, unrevealed purpose because driving the Crypto world away from US shores will have the effect of reducing any negative impact it may have upon US financial institutions. In other words, they can have their cake and eat it.”

So Canada has already had this exact effect on Binance. This will make it much harder for Canadian Crypto investors to repatriate their funds back to Canadian financial institutions. The effect will be to discourage Canadian residents from engaging in the world of Crypto.

However, some will see it as an advantage in clearly separating their funds from the Canadian banking system. The problem, however, will come when or if they have to pay Canadian taxes levied on their Crypto trading or investing capital profits while any capital losses made on their Crypto holdings may not be recognised.

Over the last week, the Bitcoin price in US Dollars has dropped by 6.22%. Over the last month, it has fallen by over 11%. BOOM expects other Western nations to follow in the footsteps of Canada and the United States in regard to Stablecoin regulation very soon. The net effect of that on the prices of all Cryptos will probably be a negative impact.

QB Explained: https://boomfinanceandeconomics.wordpress.com/2019/12/15/boom-as-at-15th-december-2019/ AND BOOM’s Perfect Economy: https://boomfinanceandeconomics.wordpress.com/2020/01/18/boom-as-at-19th-january-2020/

In economics, things work until they don’t. Until next week. Make your own conclusions, do your own research. BOOM does not offer investment advice.

CLICK HERE FOR PODCASTS: OUR BRAVE NEW ECONOMIC WORLD

BANKS DON’T TAKE DEPOSITS, THEY BORROW YOUR MONEY: LOANS CREATE DEPOSITS — that is how almost all new money is created in the economy (by commercial banks making loans). https://www.bankofengland.co.uk/quarterly-bulletin/2014/q1/money-creation-in-the-modern-economy Watch this short 15 minutes video and learn as Professor Richard Werner brilliantly explains how global banking systems really work.

AND Watch for 4 minutes, this Bank of England explanation: Money is essential to the workings of a modern economy, but its nature has varied substantially over time. This video describes what money is today.

Most economists are unaware of this and even ignore the banking & finance sectors in their econometric models.

On 25th April 2017, the central bank of Germany, the Bundesbank, released a statement on this matter — “In terms of volume, the majority of the money supply is made up of book money, which is created through transactions between banks and domestic customers. Sight deposits are an example of book money: sight deposits are created when a bank settles transactions with a customer, ie it grants a credit, say, or purchases an asset and credits the corresponding amount to the customer’s bank account in return. This means that banks can create book money just by making an accounting entry: according to the Bundesbank’s economists, “this refutes a popular misconception that banks act simply as intermediaries at the time of lending – i.e. that banks can only grant credit using funds placed with them previously as deposits by other customers”. By the same token, excess central bank reserves are not a necessary precondition for a bank to grant credit (and thus create money).” Reference: https://www.bundesbank.de/en/tasks/topics/how-money-is-created-667392

The Reserve Bank of Australia (Australia’s central bank) has also contributed to the issue in a speech by Christopher Kent, the Assistant Governor on September 19th 2018…“the vast bulk of broad money consists of bank deposits” “Money can be created…when financial intermediaries make loans“ – “In the first instance, the process of money creation requires a willing borrower.” “It’s also worth emphasizing that the process of money creation is not the result of the actions of any single bank – rather, the banking system as a whole acts to create money.”

DISCLAIMER: All content is presented for educational and/or entertainment purposes only. Under no circumstances should it be mistaken for professional investment advice, nor is it at all intended to be taken as such. The commentary and other contents simply reflect the opinion of the authors alone on the current and future status of the markets and various economies. It is subject to error and change without notice. The presence of a link to a website does not indicate approval or endorsement of that web site or any services, products, or opinions that may be offered by them.

Neither the information nor any opinion expressed constitutes a solicitation to buy or sell any neither securities nor investments. Do NOT ever purchase any security or investment without doing your own and sufficient research. Neither BOOM Finance and Economics.com nor any of its principals or contributors are under any obligation to update or keep current the information contained herein. The principals and related parties may at times have positions in the securities or investments referred to and may make purchases or sales of these securities and investments while this site is live. The analysis contained is based on both technical and fundamental research.

Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

Disclosure: We accept no advertising or compensation, and have no material connection to any products, brands, topics or companies mentioned anywhere on the site.

Fair Use Notice: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of economic and social significance. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

I am positive those government numbers are accurate…

You don’t get my covering email on TBP, Kerry, I said: ” But it’s not all bad news when later on BOOM proves that the US housing market is decidedly healthy. I am doubtful – perhaps BOOM is using ‘official’ sources – but what do I know?”

So I share your doubts. If you would like to get my postings direct (with email) then you can subscribe to my Substack here: https://austrianpeter.substack.com/p/us-cpi-inflation-falling-cpi-inflation

Latest on home sales – you are right of course:

As for “strong” housing demand, please explain why Home Depot crahsed today when they reported dismal earings and YoY sales.

Yes, LC, (see my comment to Kerry) – I don’t agree with BOOM on this either. On some points we agree to differ! For example, I happen to love gold, but that’s an emotional decision on my part – BOOM uses solid facts as his historical musings show.

When does multiple quarters of temporary recession become actual years of real recession become a depression is a question government economist won’t get asked. When will months of 5 and 6% decreases in the government’s official CPI be enough declines in economic output to reflect a decline in real inflation that people realize , is another trick question the government economist won’t be asked; or people experience. TPTB had a half dozen snipers shoot at JFK to be certain they killed him. TPTB are also creating multiple Black Swans to be sure to kill the US dollar and crash the economy: excessive money printing and over spending, raising interest rates and killing employment, open borders, national Kakistocracy quotas, off shoring manufacturing, very stupid wars & sanctions, pipeline sabotage, phony charges against the ex-POTUS, ignoring graft and treason by the current POTUS, communist style J6 treason show trials, mass murder false flags, CV-19 Genocide Shots, Global Warming Hoax, sabotage of food and fuel production, fomenting protests and riots, etc.

Your listing is indisputable rhs jr and thank you for highlighting the criminal cartel. As you know, I contend that TPTB know their fantasy magic money tree has come to an end and think that retail CBDCs are the answer because they observe China.

As you say, to do this they have to tank the current western civ and this accounts for all the illogical decisions having been made since at least 1971 and The Club of Rome book ‘Limits to Growth’ followed by many more writers and ongoing today:

https://ourfiniteworld.com/

https://surplusenergyeconomics.wordpress.com/

I thought this a rather nice summary in charts:

Fantastic charts!!!

Just saw a chart showing a dramatic drop in bank deposits; it’s gonna go somewhere. A lot of it must be going into Funds that invest in land; I am getting letters almost every day with offers to buy some parcels I own; they have appreciated at 10% per year. The premiums for 1 oz silver eagles have gone from about $3 to about $17 in about a decade. Cattle prices are headed back up and I heard cotton is short. DeSantis got his Bill passed to ban Retail CBDCs in Florida, the first in the Nation; God Bless DeSantis!

Bank deposits down $1 Trillion (5.5%) in a year. Don’t get too taken with the hype, rhs jr: https://fred.stlouisfed.org/series/DPSACBW027SBOG

Also be careful what you wish for – I am not convinced about DeSantis yet. If WaPo is praising him – what’s going on? https://www.aei.org/op-eds/unlike-trump-desantis-is-showing-a-populist-can-be-presidential-in-a-crisis/