Direct from BOOM Finance and Economics at the links below

BOOM Finance and Economics seeks out the very best information from authoritative sources and strives for consistency in its quality and trustworthiness. Over 5 years, BOOM has developed a loyal readership which includes many of the world’s most senior economists, central bankers, their senior advisers, fund managers and academics. If you want a real edge in understanding the complex world of finance and economics, subscribe to BOOM on Substack or as a Follower on LinkedIn. BOOM is also published weekly on Sundays at WordPress: https://boomfinanceandeconomics.wordpress.com/ where all previous BOOM Editorials are available — the entire Archive.

THIS WEEK’S EDITORIAL

THIS WEEK IN BOOM:

- Facebook Fined 1.2 Billion Euros

- The Myths of Blackrock and Vanguard

- Jack Bogle — An Extraordinary Man

- Germany in Recession

META FINED 1.2 BILLION EUROS IN IRELAND: Founded by Mark Zuckerberg, Meta Platforms, Inc is a company based in Menlo Park, California. It was formerly named Facebook, Inc., and The Facebook, Inc. The company owns Facebook, Instagram, and WhatsApp. It generated more than 97.5% of its revenue from the sale of advertising in 2021.

Last week, Meta was fined a record €1.2 Billion in Ireland. It was also ordered to suspend the transfer of user data from the European Union to the US. The fine was imposed by Ireland’s Data Protection Commission (DPC) and was levied for a breach of the EU’s General Data Protection Regulation (GDPR) whereby the company violated the regulation by sending the personal data of EU citizens to the US despite a 2020 European court ruling against such a procedure.

In 2020, the European Court of Justice enacted an EU-US data flows agreement known as the Privacy Shield over fears of surveillance by American intelligence services. Meta has been given five months to stop the international transfer of data to the US.

In response to the news, Meta’s share price on the US Nasdaq exchange rose 6.68% over the week to close on Friday at US$262.

Investors in Meta have had a wild roller-coaster ride over the last 5 years. The share price has tracked from $125 in 2019 to $375 in September 2021. Then it fell to $100 in October last year. Since then, it has more than doubled to its current price. Ten years ago, Meta’s share price (then called Facebook) was around US$60.

Meta has also been given six months to stop “the unlawful processing, including storage, in the US” of personal data collected from its European users. That covers data that has already been transferred across the Atlantic. In other words, Meta will have to remove that user data from their US records.

Of course, Meta will appeal the ruling as per usual but it will probably not escape it. The fine is small peanuts in the scheme of things for Meta. Meta made a net income last year in excess of US$23 Billion. Its current market capitalisation is around US$671 Billion and that makes it the 8th most valuable publicly listed company. In August/September 2021, its market capitalisation exceeded US$1 Trillion.

The Top 10 Companies by Market Capitalisation in US Dollars are —

- Apple $2.76 Trillion

- Microsoft $2.475 Trillion

- Saudi Aramco $2 Trillion

- Alphabet (Google) $1.58 Trillion

- Amazon $1.2 Trillion

- NVIDIA $963 Billion

- Berkshire Hathaway $701 Billion

- Meta $671 Billion

- Tesla $612 Billion

- TSMC $535 Billion

BLACKROCK AND VANGUARD – THE MYTHS SHATTERED: Based on market capitalisation, BlackRock, the company often mythically referred to by poorly informed analysts and newsletter writers as the “the company that owns all companies” is listed as 138th with a market capitalisation barely above $100 Billion. Based on revenue, BlackRock is rated 184th largest in the US and 678th largest on the planet.

BlackRock’s share price performance over the last 5 years has not been stellar. It currently pays a dividend yield of 3.03%, again hardly stellar. So where did the myth come from? The chart is courtesy of IncredibleCharts.com – 5 years of BlackRock.

Vanguard, the other major fiduciary which is also often referred to as the second “company that owns all other companies” has an odd structure. Vanguard is owned by its member funds, which are owned by fund shareholders. Therefore, anyone that has purchased shares of a Vanguard fund is automatically a Vanguard owner.

In other words, Vanguard doesn’t own any companies. The fund’s shareholders do. The founder of Vanguard, Jack Bogle, described it as a “mutual, mutual” fund. He started the world’s first index mutual fund in 1976. By the way, Jack does not own Vanguard. He has stated in interviews that he does not even own a share in Vanguard and has been only paid a salary throughout his career.

Vanguard is the biggest issuer of mutual funds worldwide and the second-biggest ETF issuer. It is the second-largest investment firm in the world after BlackRock. Vanguard has about US$8 Trillion in Funds under Management. Blackrock has US$9.5 Trillion in Funds under Management.

AN EXTRAORDINARY MAN: Jack Bogle founded the Vanguard Group, structuring the business as a mutual company in 1975. Since then, Vanguard has always tried to charge the lowest fees possible in its role as an investment manager. Jack’s thesis at university was titled “The Economic Role of the Investment Company”.

Despite Vanguard’s incredible success, Jack did not become fantastically rich. In fact, he often gave half his salary to charity. In 2012, he said “my ideas are very simple. In investing, you get what you don’t pay for.” He was referring to the fees charged by fund managers which inevitably lower the net returns to investors. All investors are indebted to Jack Bogle for his efforts over many decades to make the investment industry better serve the interests of individuals. He died in 2019.

The man who founded Vanguard was not a rapacious capitalist, quite the opposite. His philosophy was often called “spread-the-wealth”. He described that philosophy in his book from 2008 titled “Enough: True Measures of Money, Business, and Life.” In the book Jack explained the virtue of giving. He also expressed deep scepticism regarding the desire for the ceaseless accumulation of wealth. He did not become a billionaire but lived a truly remarkable life, having had 6 children and, despite having his first heart attack at the age of 31, he lived on to die at 89 years of age. Along the way, he survived a heart transplant in 1996 at the age of 66. Yes – a truly remarkable man.

GERMANY IN RECESSION: The German economy is in recession. It has contracted for two consecutive quarters. Its GDP fell by 0.3% in the first quarter of 2023. This followed a decline of 0.5% in the fourth quarter of 2022. The Finance Minister, Christian Lindner, was surprised by the decline.

One month ago, on 30th April, BOOM wrote — “The German and French economies are poorly led by politicians who appear totally unable to understand what is happening. Their economic data look eerily similar, stuck in the mud of low to negative GDP growth, high CPI inflation rates and chronic unemployment levels.”

“Overall, the German economy, once called the “powerhouse, the engine of growth” of Europe, is a shadow of its previous strength. The German people are clearly very worried. Food and energy prices are high and rising, unemployment is stubbornly refusing to improve and confidence is poor. Businesses are attempting to see a better future through the fog but BOOM expects their confidence to be short lived as the reality of their situation sinks in.”

Unless Germany can rid itself of its poor leadership, there is little hope for its economy to again become the powerhouse economy of Europe. Retail sales and consumer spending figures are both falling. BOOM expects unemployment levels to rise at the next release of official data. Private Debt-to-GDP is rising back towards record levels at 185%.

Despite the realities, the German stock market DAX Composite index last week reached a record new High at 16,331. This is a stark example of how stock markets can often be disconnected from their economies. Stock markets look forward, trying to anticipate the future. Economic data is very different. It is always a representation of the past. The previous German DAX record was at 16,290 achieved in late November 2021.

Investors currently appear confident that the future will be bright but BOOM is not so sure. If the war in Ukraine continues in the long term, there can be no bright economic future for Germany. It will be crippled by high energy costs. A peace agreement in Ukraine and a new, more balanced relationship with Russia are the key ingredients required to take Germany’s economy forward. Here’s 5 years of the DAX Index- Stockcharts.com

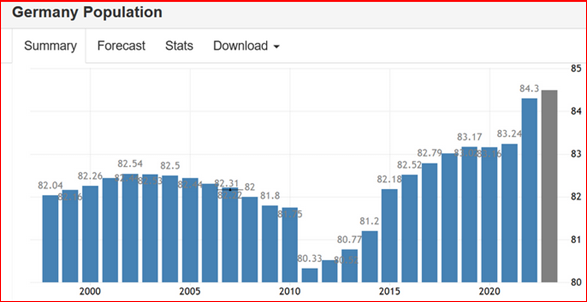

POPULATION GROWTH IN GERMANY: Germany’s population has continued growing over the last 12 years under the effect of net immigration and has reached 84.3 million at the end of 2022. During 2022, the population grew by 1.1 million people. The chart shows the last 20 years of population with a forecast for the expected total in 2023.

Such persistent population growth can obviously contribute to increased transactional volumes in the economy. In other words, GDP should (theoretically) grow as the total value of transactions grows. However, if new arrivals cannot find sufficient work, then the increased population can become a social security dead weight to the economy, leading to falling standards of living and social disruption. If high unemployment becomes entrenched, then the economy can become stagnant. And if high CPI inflation persists as well, and then the dreaded Stagflation can take hold and strangle the nation.

The current crop of German politicians seem blissfully unaware of the potential long term dangers to their nation being created by their misguided policies. They should be pushing hard for a Ukrainian peace agreement inside the European Union, and in NATO, for a resumption of cheap Russian energy flows. But don’t hold your breath. After all, their previous leader, Angela Merkel has admitted that they had no intention of holding to the previous two peace agreements with Russia signed in Minsk in 2014 and in 2015. In 2022, she said that the Minsk agreements had been “an attempt to give Ukraine time” to allow Ukraine to strengthen its armed forces.

QB Explained: https://boomfinanceandeconomics.wordpress.com/2019/12/15/boom-as-at-15th-december-2019/ AND BOOM’s Perfect Economy: https://boomfinanceandeconomics.wordpress.com/2020/01/18/boom-as-at-19th-january-2020/

In economics, things work until they don’t. Until next week. Make your own conclusions, do your own research. BOOM does not offer investment advice.

CLICK HERE FOR PODCASTS: OUR BRAVE NEW ECONOMIC WORLD

BANKS DON’T TAKE DEPOSITS, THEY BORROW YOUR MONEY: LOANS CREATE DEPOSITS — that is how almost all new money is created in the economy (by commercial banks making loans). https://www.bankofengland.co.uk/quarterly-bulletin/2014/q1/money-creation-in-the-modern-economy Watch this short 15 minutes video and learn as Professor Richard Werner brilliantly explains how global banking systems really work.

AND Watch for 4 minutes, this Bank of England explanation: Money is essential to the workings of a modern economy, but its nature has varied substantially over time. This video describes what money is today.

Most economists are unaware of this and even ignore the banking & finance sectors in their econometric models.

On 25th April 2017, the central bank of Germany, the Bundesbank, released a statement on this matter — “In terms of volume, the majority of the money supply is made up of book money, which is created through transactions between banks and domestic customers. Sight deposits are an example of book money: sight deposits are created when a bank settles transactions with a customer, ie it grants a credit, say, or purchases an asset and credits the corresponding amount to the customer’s bank account in return. This means that banks can create book money just by making an accounting entry: according to the Bundesbank’s economists, “this refutes a popular misconception that banks act simply as intermediaries at the time of lending – i.e. that banks can only grant credit using funds placed with them previously as deposits by other customers”. By the same token, excess central bank reserves are not a necessary precondition for a bank to grant credit (and thus create money).” Reference: https://www.bundesbank.de/en/tasks/topics/how-money-is-created-667392

The Reserve Bank of Australia (Australia’s central bank) has also contributed to the issue in a speech by Christopher Kent, the Assistant Governor on September 19th 2018…“the vast bulk of broad money consists of bank deposits” “Money can be created…when financial intermediaries make loans“ – “In the first instance, the process of money creation requires a willing borrower.” “It’s also worth emphasizing that the process of money creation is not the result of the actions of any single bank – rather, the banking system as a whole acts to create money.”

DISCLAIMER: All content is presented for educational and/or entertainment purposes only. Under no circumstances should it be mistaken for professional investment advice, nor is it at all intended to be taken as such. The commentary and other contents simply reflect the opinion of the authors alone on the current and future status of the markets and various economies. It is subject to error and change without notice. The presence of a link to a website does not indicate approval or endorsement of that web site or any services, products, or opinions that may be offered by them.

Neither the information nor any opinion expressed constitutes a solicitation to buy or sell any neither securities nor investments. Do NOT ever purchase any security or investment without doing your own and sufficient research. Neither BOOM Finance and Economics.com nor any of its principals or contributors are under any obligation to update or keep current the information contained herein. The principals and related parties may at times have positions in the securities or investments referred to and may make purchases or sales of these securities and investments while this site is live. The analysis contained is based on both technical and fundamental research.

Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

Disclosure: We accept no advertising or compensation, and have no material connection to any products, brands, topics or companies mentioned anywhere on the site.

Fair Use Notice: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of economic and social significance. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

I’m glad you pointed out the Vanguard and Blackrock fallacies. I find it interesting that people don’t understand mutual funds.

Who gets to vote on corporate governance, with those shares Vanguard holds?

It’s not Vanguard’s “owners,” it’s Vanguard’s management. They leverage someone else’s wealth to control corporations. Same at BlackRock, State Street, BlackStone, etc.,

Between Blackrock, State Street and Vanguard, they own at least 20% of the shares of almost every company on the S&P 500. Their management & board of directors exert massive amount of pressure on all of these companies.

Very true TNP – BOOM and I differ on the the DEGREE & TYPE of influence exerted by these guys. My take is that it all filters down from the Globalists, through global corporations (with the shareholders’ influence) to the small fry, governments and NGOs et al. ESG and DEI are classic examples. However pushback like Bud Lite is empowering consumers to vote with their feet – long may it prosper. We could win the war in the end? Here’s a great analysis a while ago:

https://hannenabintuherland.com/usa/the-federal-reserve-cartel-the-eight-families-who-own-usa-dean-henderson-herlandreport/

It does not matter what the valuation of Blackrock is, with S9.5 Trillion they are a large shareholder in almost the entire S&P 500. The Boards of Blackrock, Vanguard & State Street have the ability to influence every publicly traded company of any size in the US and probably most of the West.

If you have some time to kill, do a deep dive into any major corporation ownership, then look into the ownership of Blackrock and State Street. It’s a small club and you ain’t in it.

Yes TNP and TBP covered a bit of it in April: