Direct from BOOM Finance and Economics at the links below

Hat Tip to my colleague at: BOOM Finance and Economics who posts weekly – Subscribe to BOOM, it’s free http://boomfinanceandeconomics.substack.com/ . And at: COVID GLOBAL NEWS Updated TWICE Weekly: https://cmnnews.substack.com/

BOOM Finance and Economics seeks out the very best information from authoritative sources and strives for consistency in its quality and trustworthiness. Over 5 years, BOOM has developed a loyal readership which includes many of the world’s most senior economists, central bankers, their senior advisers, fund managers and academics. If you want a real edge in understanding the complex world of finance and economics, subscribe to BOOM on Substack or as a Follower on LinkedIn. BOOM is also published weekly on Sundays at https://boomfinanceandeconomics.wordpress.com/ where all previous BOOM Editorials are available — the entire Archive.

THIS WEEK’S EDITORIAL

THIS WEEK IN BOOM

- Cash is essential to Democracy and Freedom — Austria knows this

- US Dollar Dominance will continue for many years yet

- ESG can harm companies — Target and Bud in trouble

- Turkey Cooperation

- US energy prices falling — Production static

CASH IS ESSENTIAL TO DEMOCRACY AND FREEDOM – AUSTRIA KNOWS THIS: BOOM has written often about the importance of physical cash in an economy. Cash is the antidote to excessive credit. In many advanced economies, physical cash is now only 2 – 3% of the supply of fresh new money with bank loans originating 97 – 98% of the money supply. Credit money (originated via new bank loans) is interest bearing, dependent upon demand from borrowers and subject to interest rate influence set from central planning committees — central banks.

Availability to make and receive credit contracts (loans) is essential to any healthy economy but if the balance of fresh new money supply is tilted too much in favour of profligate, non-productive, speculative credit creation (and not cash issuance) then the economy will be more susceptible to CPI inflation and asset price inflation. Then, the conventional, centralised control mechanism via higher interest settings throws a blanket over all national economic sectors and regions. Inevitably, the best economic endeavours may suffer as much as the worst.

So money originated as cash, issued by the Treasury in sufficient volumes and distributed by the banking system (or alternatively, by governmental post offices or other governmental offices) is critical to the long term health and stability of any complex economy. It also provides other critical components of a free, democratic society.

The people of Austria seem to understand this. Over half a Million Austrians, (530,000 to be exact), signed a Referendum Petition in 2022 calling for the right to cash payments to be enshrined in Austria’s constitution. In other words, the petition called for the unrestricted right to use cash as generally accepted payment to settle all transactions. This means that cash cannot be refused as a payment mechanism. However, Austria’s political class now appears to be refusing to move forward with adding this legal right according to the Freedom Party of Austria (FPÖ).

The Freedom Party argues that citizens would be “financially incapacitated” in a world without cash. It argues that cash represents freedom. “This freedom of choice must continue to exist in the future. Cash is data protection in action. Cash is printed freedom.” “Cash means survival, freedom and self-determination”.

Austria has a total population of almost 9 million so almost 6% of the total signed the petition. But 25% of Austrians are aged below 24 years. Thus, perhaps 8% of adults may have been signatories. A referendum should proceed.

According to reports from within Austria, the centre-right Austrian People’s Party (ÖVP), which has supported the right to cash for many years, is now joining the left-wing parties of Austria and blocking all attempts to add this right to the country’s constitution.

It seems that this matter will be settled in an election if this blockade is not cleared and, if so, such an election would be historical. It would be the first election in history where preserving physical cash became the major issue.

US DOLLAR DOMINANCE FOR MANY YEARS YET: Moody’s Corporation is a company that issues credit ratings. It was founded in 1909 by John Moody, the man who invented bond credit ratings. Last week, Moodys released a statement on the US Dollar that said “We expect a more multi-polar currency system to emerge over the next few decades, but it will be led by the Greenback because its challengers will struggle to replicate its scale, safety and convertibility in full.”

BOOM agrees with this statement, as regular readers will know. The global dominance of the US Dollar is maintained by the large volume of US Dollars held offshore making it the most readily available and convenient currency to use in settlements of international trade and capital movements. These off shore dollars are not under the control of the US government, the US Treasury Department or the US financial regulators. They are not exported from the US. They are mostly created offshore as US Dollar denominated loans in tax haven banks. Those loans are made to large, global corporations seeking to finance expansion. As a result, at present, other currencies simply cannot be found in sufficient volumes off shore to threaten the so-called “reserve currency” role held by the US Dollar.

BOOM is often asked how long this situation can last. And the answer is always the same – “it can last for perhaps another 50 – 100 years”. Of course, that may be an over estimation. A multi-polar world of currency settlements is an honourable and important goal but it will not and cannot happen quickly. Analysts who preach that “the US Dollar will collapse soon” are simply not sufficiently cognisant of US Dollar convenience and availability aspects in global settlements.

ESG CAN HARM COMPANIES — TARGET AND BUD SINKING: Environmental, social, and governance requirements, otherwise known as ESG, are defined by Wikipedia as “a business framework for considering environmental issues and social issues in the context of corporate governance”. “It is designed to be embedded into an organisation’s strategy that considers the needs and ways in which to generate value for all organisational stakeholders (such as employees, customers, suppliers, and financiers).”

The key words here are “considering” and “considers”. A company should consider all of these things but surely must be careful to not adopt policies that may lead to the detriment of its continued existence as a viable business entity? Unfortunately, ESG requirements for companies are slowly but surely turning them into hotbeds of political action and this creates a potential for corporate self -harm. That may be a good thing if a company makes a product or service that may be harmful to society. It may be a bad thing if the ESG goals are poorly constructed and harmful to a company that makes essential, beneficial products and services.

Over the last 3 – 4 decades, politicisation has already happened in many national education systems, especially in universities. Schools and universities are not (generally) profit orientated institutions. Their survival is based upon a more complex mix of funding channels. However, within any business organisation, political goals will inevitably create conflict with the need for companies to seek profit. And, after all, profit is necessary for their very survival. It is obvious that if political goals are allowed to dominate over profit-seeking, then company revenues may inevitably suffer and, if those companies are publicly listed, shareholders may abandon them slowly but surely or perhaps rapidly. The ultimate nightmare for any business manager is to see their sales, revenues and profits suddenly declining while their shareholders run for the hills.

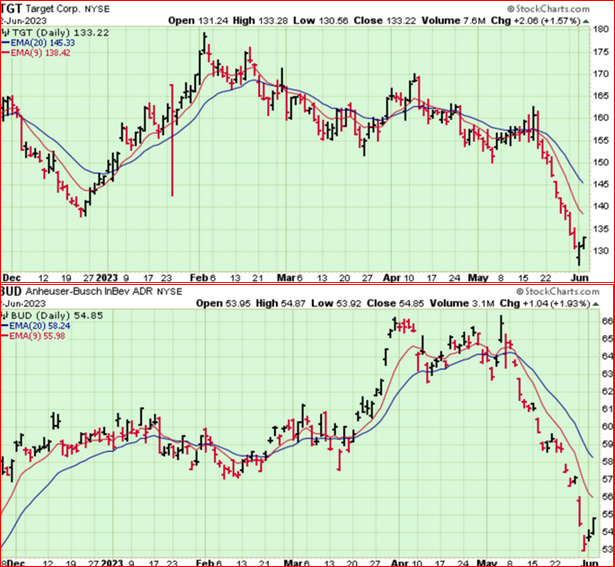

This dynamic is being played out right now in regard to Target and Anheuser-Busch (Budweiser) in the United States. The charts – courtesy of Stockcharts – clearly display the actions of some of their shareholders. Those shareholders are selling out because they perceive that the companies are pursuing controversial political goals which clash with their own personal values. Anecdotes tell us that their customers are also turning to alternative products.

It’s hard to describe exactly what is happening and why but one thing is certain. The charts don’t lie. Target’s shares have fallen almost 20% since the current controversy arose in the public domain. Anheuser-Busch’s shares have also fallen by the same amount, around 20%. They began their fall in early May after the release of the now famous “trans” promotion. Of course, these share price falls could be caused by other factors. However, these are serious and sudden declines in market capitalisation. If they continue, then both companies may have damaged their ability to pay future dividends and to raise capital just to meet some ill-defined ESG goal.

And, by the way, it’s important to know that these share price weaknesses did not arise in just the last 4 weeks. Over the last 18 months, Target’s shares have fallen by more than 50% and Anheuser-Busch shares have fallen by 50% since mid-2016. Charts: TGT and BUD over the last 6 months:

TURKEY COOPERATION: Turkey is a critical nation in the Global Geopolitical balance. It is a NATO member with a large military force and, through its President Recep Erdogan, it seeks a destiny independent of interference from larger nations. This is a difficult course to follow and it requires a delicate act of political skill.

Last week, the Chinese President Xi Jinping congratulated Erdogan on winning his re-election, referring to “extensive common interests” between their countries. Xi said he “stands ready to work with Erdogan to promote mutual understanding and mutual support” and to boost “the two countries’ cooperative relationship.”

Vladimir Putin also sent a congratulatory message to the Turkish President: “your victory in the elections was a natural result of your selfless work as head of the Republic of Türkiye, and is clear evidence of the Turkish people’s support for your efforts to strengthen state sovereignty and pursue an independent foreign policy.”

Victor Orban, the President of Hungary, congratulated Erdogan with this Twitter message – “Congratulations to President Erdogan on his unquestionable election victory”.

The Prime Minister of India, Narendra Modi, tweeted a similar message “Congratulations President Erdogan on re-election as the President of Türkiye! I am confident that our bilateral ties and cooperation on global issues will continue to grow in the coming times.”

The US President, Joe Biden, chimed in but with a slightly more nuanced Twitter message — “I look forward to continuing to work together as NATO Allies on bilateral issues and shared global challenges“. Biden seemed to put NATO objectives forward as his objective rather than having thoughts for future friendly cooperation between the US and Turkey. There was possibly a taint of “do as I say, or else” in the message. At the least, it could be interpreted as such.

Turkey is the only member that has not sanctioned Russia over its military operation in Ukraine. Last year, they hosted peace talks between Moscow and Kiev. Turkey also negotiated the Black Sea Grain Initiative that allowed Ukrainian wheat to be transported safely to world markets with Russia’s cooperation.

Unfortunately, Turkey’s economy appears to be under persistent attack by forces unknown with its currency plunging against the US Dollar on global currency exchanges. In fact, over the last 22 years, since the turn of the century, a Turkish citizen holding US Dollars has seen their currency investment appreciate 20-fold against their national currency, the Turkish Lira. This can cause hyperinflation inside Turkey if the US Dollar is allowed to circulate freely. Currently, the Turkish annual CPI inflation rate is 43.7%. Thankfully, over the last 6 months, it has been in decline from its recent high of 85.5%.

It would be wise for Turkey to strictly ban all foreign cash in circulation as soon as possible plus all foreign currency denominated loans in their banking system. It would also be wise to limit foreign currency deposits in the commercial banking system. A nation’s currency is a key element of societal trust and general acceptance. It must be protected and supported by the national government. The circulation and acceptance of foreign currencies should be banned in all nations.

US ENERGY PRICES FALLING AS PRODUCTION IS STATIC: In mid-2018, daily crude oil production in the US stood at around 11Million Barrels per day. Steady growth then occurred and it reached a high point at 13Million Barrels per day during the first few months of 2020. Then, very suddenly, US oil production fell sharply from 13 to 10.5Million Barrels per day by early June. Something dramatic had occurred that triggered the drop in output – the Covid Panic and Fear campaign.

After June 2020, production stabilised around 11Million Barrels for the next 14 months. Sharp reductions in production occurred during this period from time to time but the average production stabilised towards an average of around 11Million Barrels per day.

After October 2021, US production slowly began to recover and rose again in a relatively steady pattern. However, since January 2023, oil production has stopped rising and has stabilised around 12.0 – 12.2Million Barrels per day. The period of growth appears to have ended and production now seems to have become static.

Over the last few weeks, crude oil prices have been falling again in the United States, confirming the downtrend that began 12 months ago. If prices fall while supply is static, it suggests (strongly) that demand for energy in the US economy is falling. The price chart for Light Crude Oil (Continuous Contract at the CME) shows the downtrend in price since June last year:

Other US energy prices are also continuing to fall recently:

A fall in demand for energy accompanied by falling prices suggests that the US economy is no longer growing.

Alarm bells should be ringing in Washington DC but they are not. American politicians seem blissfully unaware of what is happening in their economy at large. They prefer to play politics or games of foreign war. They play games of budgetary finance. They invent threats. They focus only on the election cycle. They indulge in gender politics and identity politics. They are easily distracted by these agendas, arguably controlled by the mainstream media who are also, arguably, in turn, controlled by unelected people and foreign, non-governmental organisations. Democracy is undermined by these influences.

This happened in Rome in AD 64, thirty years after they crucified Christ. The city was burning but the Emperor, Nero, is said to have watched on and played fiddle in his palace. Nero was popular with the members of his Praetorian Guard and lower-class commoners. He was apparently also popular in the Roman provinces but the Roman aristocracy did not approve of him. Many sources describe him as tyrannical, self-indulgent, and debauched. After being declared a public enemy by the Roman Senate, he committed suicide at age 30 in the year AD 68.

The Roman Empire continued for another 160 years after Nero’s death before it slowly began to unravel. Things happen more quickly in modern times. The US economy and the US Dollar Empire are both at stake here. The politicians in Washington DC seem willing to gamble with both. Irrationality seems as rampant there as in Western Europe.

QB Explained: https://boomfinanceandeconomics.wordpress.com/2019/12/15/boom-as-at-15th-december-2019/ AND BOOM’s Perfect Economy: https://boomfinanceandeconomics.wordpress.com/2020/01/18/boom-as-at-19th-january-2020/

In economics, things work until they don’t. Until next week. Make your own conclusions, do your own research. BOOM does not offer investment advice.

CLICK HERE FOR PODCASTS: OUR BRAVE NEW ECONOMIC WORLD

BANKS DON’T TAKE DEPOSITS, THEY BORROW YOUR MONEY: LOANS CREATE DEPOSITS — that is how almost all new money is created in the economy (by commercial banks making loans). https://www.bankofengland.co.uk/quarterly-bulletin/2014/q1/money-creation-in-the-modern-economy Watch this short 15 minutes video and learn as Professor Richard Werner brilliantly explains how global banking systems really work.

AND Watch for 4 minutes, this Bank of England explanation: Money is essential to the workings of a modern economy, but its nature has varied substantially over time. This video describes what money is today.

Most economists are unaware of this and even ignore the banking & finance sectors in their econometric models.

On 25th April 2017, the central bank of Germany, the Bundesbank, released a statement on this matter — “In terms of volume, the majority of the money supply is made up of book money, which is created through transactions between banks and domestic customers. Sight deposits are an example of book money: sight deposits are created when a bank settles transactions with a customer, ie it grants a credit, say, or purchases an asset and credits the corresponding amount to the customer’s bank account in return. This means that banks can create book money just by making an accounting entry: according to the Bundesbank’s economists, “this refutes a popular misconception that banks act simply as intermediaries at the time of lending – i.e. that banks can only grant credit using funds placed with them previously as deposits by other customers”. By the same token, excess central bank reserves are not a necessary precondition for a bank to grant credit (and thus create money).” Reference: https://www.bundesbank.de/en/tasks/topics/how-money-is-created-667392

The Reserve Bank of Australia (Australia’s central bank) has also contributed to the issue in a speech by Christopher Kent, the Assistant Governor on September 19th 2018…“the vast bulk of broad money consists of bank deposits” “Money can be created…when financial intermediaries make loans“ – “In the first instance, the process of money creation requires a willing borrower.” “It’s also worth emphasizing that the process of money creation is not the result of the actions of any single bank – rather, the banking system as a whole acts to create money.”

DISCLAIMER: All content is presented for educational and/or entertainment purposes only. Under no circumstances should it be mistaken for professional investment advice, nor is it at all intended to be taken as such. The commentary and other contents simply reflect the opinion of the authors alone on the current and future status of the markets and various economies. It is subject to error and change without notice. The presence of a link to a website does not indicate approval or endorsement of that web site or any services, products, or opinions that may be offered by them.

Neither the information nor any opinion expressed constitutes a solicitation to buy or sell any neither securities nor investments. Do NOT ever purchase any security or investment without doing your own and sufficient research. Neither BOOM Finance and Economics.com nor any of its principals or contributors are under any obligation to update or keep current the information contained herein. The principals and related parties may at times have positions in the securities or investments referred to and may make purchases or sales of these securities and investments while this site is live. The analysis contained is based on both technical and fundamental research.

Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

Disclosure: We accept no advertising or compensation, and have no material connection to any products, brands, topics or companies mentioned anywhere on the site.

Fair Use Notice: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of economic and social significance. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

Author: Austrian Peter

Peter J. Underwood is a retired international accountant and qualified humanistic counsellor living in Bruton, UK, with his wife, Yvonne. He pursued a career as an entrepreneur and business consultant, having founded several successful businesses in the UK and South Africa His latest Substack blog describes the African concept of Ubuntu - a system of localised community support using a gift economy model. View all posts by Austrian Peter

DISCLAIMER:

IF this was not the plan, Endless pallets of Crisp New Benjamins would NOT be flown to world wide destinations on u.s. military transports on a regular basis.

But the power is NOT in the internal US control – however many Bs they fly around the world. The Power is in Eurodollars outside US control – read the bloody narrative.

…Been some time, and 👁 had nearly forgotten to check in @ Her site. Much appreciated.

https://caitlinjohnstone.com/

Her Site? Been a few yrs. My 1st exposure to the term ‘Narrative’. Do Not agree unequivocally w/Her, but generally agree w/Her observations, over time, from memory.

IF You are referring to THIS ‘narrative’?

“US DOLLAR DOMINANCE FOR MANY YEARS YET: Moody’s Corporation is a company that issues credit ratings. It was founded in 1909 by John Moody, the man who invented bond credit ratings. Last week, Moodys released a statement on the US Dollar that said “We expect a more multi-polar currency system to emerge over the next few decades, but it will be led by the Greenback because its challengers will struggle to replicate its scale, safety and convertibility in full.”

BOOM agrees with this statement, as regular readers will know. The global dominance of the US Dollar is maintained by the large volume of US Dollars held offshore making it the most readily available and convenient currency to use in settlements of international trade and capital movements. These off shore dollars are not under the control of the US government, the US Treasury Department or the US financial regulators. They are not exported from the US. They are mostly created offshore as US Dollar denominated loans in tax haven banks. Those loans are made to large, global corporations seeking to finance expansion. As a result, at present, other currencies simply cannot be found in sufficient volumes off shore to threaten the so-called “reserve currency” role held by the US Dollar.

BOOM is often asked how long this situation can last. And the answer is always the same – “it can last for perhaps another 50 – 100 years”. Of course, that may be an over estimation. A multi-polar world of currency settlements is an honourable and important goal but it will not and cannot happen quickly. Analysts who preach that “the US Dollar will collapse soon” are simply not sufficiently cognisant of US Dollar convenience and availability aspects in global settlements.”

Just agreeing with You. Semantics, by and large. The BOLD above?

Counterfeit?

In essence. Pretty much same as it EVER was. Since they paid the mercenaries with fake money to march on “The Whiskey Rebellion”. No matter. nearly TOTALLY electronic, Now. Everywhere. U.S. ‘Money’.

Except for the Benjamins. Shocked! Shocked i say!

MORE $100 bills than $1 bills in circulation. Apparently, quite a few are fond of ’em?

The BOLD below:

“it can last for perhaps another 50 – 100 years”

Trust me. No One was/is more shocked than me, but i’ve kinda been ‘seeing’, and ‘hearing’ things from a Biblical perspective for a minute.

ALL started because of what Some would blithely call a Wedding Ceremony. (Looong Story) HOWEVER, We Shook Hands on it. NOT SURE what that means where You come from. But The Boss is well in excess of 5’1″, scares the shit outta me. (i always call Her ‘Baby’ to Her Face, coward that i am) But i digress.

Nearly inconceivable that ANYTHING is going to last ANOTHER 50 – 100 yrs.

HIGHLY unlikely ‘We’ will be here anyhow. Another facet of the handshake. Old Age. In our sleep. Together. She would KILL me if i succumbed 1st, trust me.

Just my 2¢

Look forward to Your articles, Take care.

Sincerely, Seethings Differently

Thanks my TBP friend – It is always good to hear from my ‘family’ in the zoo where there are so many clever monkeys! Admin gave me my first break when I serialised my book over 100 weeks – 2018-20 then we agreed I would write a weekly ‘Letter from Great Britain’ on Saturdays. I supplement this with BOOM’s financial report on Tuesdays because I tend to focus on UK decline, geopolitics and economics with some fun items too.

Chapter 13 – The New Emergent Economy describes how I see our world panning out over the coming years. BOOM is not yet convinced of my speculation, even though I have already posted an article about the End of Growth. This is Part 2 of my book which I am writing now and publishing timely articles. https://austrianpeter.substack.com/p/the-financial-jigsaw-part-2-the-end?s=w

You can download or read Chapters of my Part 1 here: https://www.researchgate.net/publication/358117070_THE_FINANCIAL_JIGSAW_-_PART_1_-_4th_Edition_2020

I would love for someone to prove me wrong – but it hasn’t happened yet! 🙂

I agree with you that a long-range outlook is unpredictable but I have faith in our Creator, that those who have found Him will see a perpetual world emerge from the End Times. We will need a currency/money and so far, the US dollar is the best horse in the glue factory! https://www.latimes.com/socal/daily-pilot/entertainment/tn-hbi-et-0604-god-squad-20150604-story.html#:~:text=A%3A%20Deism%20is%20a%20system,to%20us%20through%20sacred%20scriptures.

Blessings

AP

I don’t think Busch or Target have learned the lesson.

Busch just donated millions to some Alphabet mafia cause. Target is still selling Alphabet mafia merchandise to kids

They will never learn Mary because they are bought and paid for – after this – who cares? They have the money in the bank and that’s all that counts in this sick world – Sodom & Gomorrah no less.

Butt Bud will make a comeback with the limited Harley edition can. lol

Didn’t the recent spending limitation of $4trillion over the next two years give congress even more yearly deficits than before ; student loans were overdue payback anyway so the only thing saved was political pork? Doesn’t the recent report of FBI and CIA fraud to frame Trump constitute a crime deserving prosecution? Doesn’t the obvious drug company, NIH and CDC COVID frauds that have killed a million Americans with hospital induced pneumonia’s, CV-19 mRNA Shot induced Spike Protein blood clots, turbo cancers, abortions, etc, deserve congressional investigations and prosecutions? This Eddy Minimum’s Grand Solar Minimum (GSM) conditions may have progressed far enough to be possibly measured in Global Cooling and atmospheric drying; only India, California, a part of Texas etc are wet at the moment; has the NWS investigated a possible growing global drought yet in China, South America, North America, Africa, Europe, South Asia, Australia, Mid-East, etc, as the atmosphere has finished draining out now? The Republicans have let the whole government be stolen except the House by a vote. They could be holding serious hearings and investigating all the associates of the Bidens and various crimes like the Nord Stream Sabotage, Vote Fraud, COVID Excess Deaths, Chem-Spraying, FBI-CIA Fraud and Abuse, the Fed Reserve and US Treasure Conspiracy to Destroy The Dollar and Implement the Rothschild Monopoly FedCoin, the Tyrannical J6 Show Trials, Open Borders, the imposition of WOKE doctrines on the Military and the gutting of the Army Arsenal by the Ukraine War, etc. The Republicans should be proceeding with MTG’s Bill to Impeach FJB and holding hearings and sending Biden associates to prison clean up to Nov2024 just like the democrats did to them. Why not???

Bravo rhs jr – thank you for all your good work in your inimitable way of summarising all the shit in one paragraph. Your talent is wasted here my good friend – you need to be on Substack! https://on.substack.com/p/writing-a-good-welcome-email-on-substack?utm_source=post-email-title&publication_id=1&post_id=105846114&isFreemail=true&utm_medium=email

Really my good buddy – you have an amazing ability to write simple explanations of complex subjects which confuse so many others – it’s a rare talent. We NEED you!

We have the real issues, the true answers and arguments, and enough platforms per se but we don’t have an audience. Do we need to get half naked, pretend to make music or play some sport, call a press conference to denounce Trump or the farmers etc. to draw a crowd because offering intelligent information to MSM brainwashed Useful Idiots is just Chupchink (my spelling for Jewish “pissing into the wind”). Everything is money & marketing today. There is an educational theory that you have to hit a donkey in the head to get its’ attention. The western donkeys must be on dope and need an electrical shock. My people are destroyed for lack of knowledge; we set a free banquet before them but they pass it to buy junk food. We have the experts of experts, but they run after the clowns.

A powerful description my good TBPer rhs jr. Actually it’s quite prophetic -the end can’t be that far away!

I have tried to get a solution to the Long Freight Trains blocking intersections to congress repeatedly with no luck evidently so I put it here and Y’all send it too. Create a RR Intersection Center and give their phone number to 911 Operators, First Responders, etc. When someone is blocked, call the RRIC and they will call the offending RR, who will call their offending Engineer, who will call the people blocked, and if appropriate, someone can turn off the two airbrake valves and lift the uncoupling lever at a coupling. Then the Engineer move the train forward about three car lengths and clear the intersection.

Or just cut to the chase and teach the affected communities how to take back the freedom to travel being stolen by RRs.

How to Safely decouple a train, training video:

Betcha that stimulates some RR initiated bills eh rhsjr?

Thanks, it need not be kept a RR secret; and we know the RR gods in Chicago and NYC ain’t gonna cooperate; and congress ain’t either. Florida , Texas, etc, should just go ahead and do it. When I was a trainman, Florida had a law as I understand that we were not to block an intersection over 15 minutes.

Turn both air valves off.

I didn’t know that rhs jr – thank you – I live and learn 🙂

Turkey — or Turkiye; I still like the visual of the ugly bird for that country, myself — is in a very amenable position at the moment, and with Syria’s readmission into the Arab League along with Russian support for both these countries, it appears a certain other (self-proclaimed) country may have overstayed its welcome.

Also, Iran and Saudi Arabia normalizing ties is definitely creating a favorable environment for Islamic republics; again, not good news for those in an occupied territory.

Given their history, it should be incredibly obvious who has been undermining Turkey’s economy, however, toadyism and greed have also played major roles (just like UK/US). Yes, their inflation has been almost halved recently, but it was election time, so even though Erdogan has done next-to-nothing with their burgeoning lira for the past four years or so, he gets credit for the drop. Honestly, Erdogan does not deserve it; the Turkish lira is, as can be seen, on its way up, so inflation was bound to fall; but if the economy does not improve now, Erdogan is on a tight leash, and others are waiting in the wings.

This whole situation could blow up at any moment, since this is the Middle East about which we are talking. Regime changes and internecine fighting has kept these people at odds — why expect anything less now? At the very least, it should be interesting to see how this plays out in the next few months/years.

Time will tell CO – but in the meantime this is what BOOM means:

AND here’s an example of the war on cash:

I think Erdogan is a hardline Muslim and dictatorial Nationalist, where as Ataturk and the military governments before Erdogan were more Western leaning and free. Turkey has made a huge leap economically (possibly based a lot on financial magic) but I think Erdogan will ultimately lead Turkey into serious military conflict that will undo his progress.