Direct from BOOM Finance and Economics at the links below

Hat Tip to my colleague at: BOOM Finance and Economics who posts weekly Subscribe to BOOM, it’s free http://boomfinanceandeconomics.substack.com/ . And at: COVID GLOBAL NEWS Updated TWICE Weekly: https://cmnnews.substack.com/

BOOM Finance and Economics seeks out the very best information from authoritative sources and strives for consistency in its quality and trustworthiness. Over 5 years, BOOM has developed a loyal readership which includes many of the world’s most senior economists, central bankers, their senior advisers, fund managers and academics. If you want a real edge in understanding the complex world of finance and economics, subscribe to BOOM on Substack or as a Follower on LinkedIn. BOOM is also published weekly on Sundays at WordPress: https://boomfinanceandeconomics.wordpress.com/ where all previous BOOM Editorials are available — the entire Archive.

THIS WEEK’S EDITORIAL

BLINKEN BLINKED? WHY? Last week, after meeting with Xi Jinping, the President of China, the US Secretary of State, Anthony Blinken, made a clear statement — “We do not support Taiwan independence”. It was obvious that he did this publicly in return for a concession by China or in response to a demand or a threat by China. We will never learn whether China made a concession or if a demand or threat was made. However, the statement sums up the situation succinctly.

For many decades, the United States has had a “One China” policy. In other words, the US concedes that Taiwan is a part of China. However, this does not exclude Taiwan from having its own government, separate from Beijing. And the US has made it clear that they will come to Taiwan’s aid if China attempts to take control of Taiwan militarily.

BOOM regards this as a typical misunderstanding by the US State Dept. They take a short term view of the situation while China takes a long term view. China has no intention of attacking Taiwan. However, it also intends to defend Taiwan if it is attacked. Why? Because Taiwan is a part of China.

So – the United States must never attack Taiwan. That is the situation plain and simple. And, in return, China (and Taiwan) will continue to provide the US with goods that it cannot acquire from anywhere else. That is the deal. So the only question that remains is this. What commodities does the US desperately require from China that it cannot get from anywhere else? The answer is Rare Earth minerals.

Rare Earths comprise 17 elements with names such as Scandium, Yttrium, Lanthanum, Cerium, Praseodymium, Neodymium, Gadolinium, Ytterbium (to name just a few). Over the last decade, these elements have become essential for the production of many devices used in modern life such as magnets, batteries, catalyzers, computer and phone screens and much more. Thus, many industries in the Western advanced economies are now highly dependent on a reliable supply of Rare Earths and China is that supplier.

Cerium is used in light bulbs, TVs and ovens. Dysprosium is mixed within alloys used in wind turbines, electric vehicles and nuclear reactors. Erbium is used in lasers and fibre optic cables. Europium is used in light bulbs, nuclear reactors and lasers. Gadolinium is used in magnets, nuclear reactors and magnetic resonance imaging (MRI). Holmium is used in magnets and nuclear reactors. Lanthanum is mixed within alloys that are used in batteries and hydrogen vehicles. Lutetium is used as a catalyst in refineries. Neodymium is used in magnets and lasers. Praseodymium is used in aircraft engines, fibre optic cables and magnets. Promethium is used in pacemakers and guided missiles. Samarium is used in microwave devices and magnets. Terbium is used in light bulbs, memory devices and x-rays. Thulium is used in lasers. Ytterbium is used in displays, x-ray machines and fiber-optic cables. Yttrium is used in radars and as an additive within alloys used in high tech devices. Scandium is used for fuel cells and alloys used in jet planes.

A recent estimation, published by a known authority on the subject, showed that China produces 70% of the world’s Rare Earths while the US produces 14.3%, Australia produces 6% and Myanmar produces 4%. The US must import Rare Earths to meet its needs. And the only place where such supply can be guaranteed is China.

So – now we can all see clearly why Mr Blinken blinked after meeting Xi Jinping.

NEW US CRYPTO EXCHANGE – PRICES SURGE IN RESPONSE Since mid-June, in just 10 days, the total market capitalisation of the entire Crypto market has quite suddenly gained almost US$200 Bn. And the price of Bitcoin has increased from around US$25,000 to above $30,000. These have been unexpected gains after the recent turmoil stemming from the collapse of Silicon Valley Bank, the uncertainty surrounding some Stablecoins and the “war” against Crypto being waged by the US Securities and Exchange Committee (SEC) and its chief, Gary Gensler.

So – what happened? Why have buyers suddenly appeared after all those threats to the market?

In last week’s editorial, BOOM explained that a safe harbour had been offered for Crypto exchanges in Hong Kong. However, the dark shadow of Chinese Government surveillance could be perceived as a possible threat to their independence. That offer from Hong Kong does not seem to explain the sudden, optimistic recent price surges.

However, 5 days ago, we learned through an announcement that a new entrant to the Crypto Exchange world had suddenly appeared from EDX Markets to offer competition to the established players. Surprise, surprise. We also learned that the new exchange was being backed by Citadel Securities, Fidelity Investments and Charles Schwab – all US companies and all titans of the conventional securities markets based in the USA. This is obviously a move to retain a US based Crypto exchange with strong connections to the SEC already well established. The US is clearly not ready to see the US Dollar Proxy world of Crypto fleeing entirely from America’s shores after all (!).

The battle between the US and China/Hong Kong is now engaged. However, whatever happens, the result will be the same as it has been since 2008 — the Crypto world will continue to generate increased demand for US Dollars both onshore and offshore. And such increased demand will support US Dollar hegemony globally. The US Dollar Empire will benefit.

One major difference was announced. EDX Markets Crypto Exchange will be “non-custodial”. It will not directly handle its customers’ digital assets. EDX will simply run a marketplace where firms can reach agreement to execute trades of coins for dollars and vice versa. Then the firms will move the Crypto and the funds between each other to settle the trades. EDX also plans to launch EDX Clearing, a clearing-house aimed at settling trades executed on the EDX Markets platform.

Most current Crypto exchanges at present are custodial in their operations model. They require customers to park their digital coins in wallets run by the exchange. This introduces risk that the exchange could cease operations, lose the funds or be tempted to “misuse” them.

Also, unlike most Crypto exchanges, EDX won’t directly link with individual investors. Investors will have to go to conventional retail brokerages that will then send the investors’ orders to the EDX Exchange to buy and sell Cryptos. US stock markets operate like this. Investors cannot directly access the New York Stock Exchange or NASDAQ. They must arrange for their orders to be managed by brokerages such as Fidelity and Charles Schwab.

So – the choice is this for Crypto investors – do you prefer US surveillance of everything you do or Chinese surveillance?

BOOM thinks that most Crypto enthusiasts will reject both options. The Wild West will continue but in some other location which will somehow try to ensure a lack of such overt surveillance. Good luck with that. Then there is covert surveillance which is another matter altogether. The location will (probably) be in a jurisdiction not linked to the US or China. However, surety of funds will continue to be a problem for the Wild West of Crypto. Trust is not easily constructed or maintained and it is the essential element in all successful financial systems.

UK INFLATION STUCK ON 8.7% – United Kingdom CPI inflation numbers were published last week and came in unchanged at 8.7%. The latest figures show that British households are paying 8.7% more for goods and services, including food, fuel and energy in May this year than they were during the same month last year.

This “sticky” inflation result came as a surprise and the Bank of England (the UK Central Bank) immediately raised their official interest rate by 50 bps to 5% which is the highest level in 15 years. BOOM has been pessimistic about the UK for a considerable period of time and can find no reason to change that stance.

Early this year, BOOM wrote on February 13th, “The British economy is heading into a stagflationary mess with GDP growth at Zero.”

In August 2022, BOOM wrote — “In summary, the UK economy has not performed well over the last 15 years. The population has grown strongly from 58 million in 2000 to 68 million in 2022, an increase of almost 20%, but this growth in numbers has not been reflected in the economy. BOOM cannot see a bright future here. Recession is surely coming and may be much worse than predicted by the Bank of England. And CPI inflation may be much worse than predicted. Stagflation is going to make things harder for everyone.”

And way back in October 2021, BOOM stated “it is clear that the UK economy is suffering from significant CPI inflationary pressures that are showing no signs of stabilization“. BOOM then summed up the whole UK economic outlook by stating “the UK is seeing CPI inflation that does not look like it is transitory at the same time as the supply of fresh new money is not being put to productive use in the real economy. Money is stagnating in the financial system instead. That starts to strongly suggest STAGFLATION”.

Perhaps the boats that have been taking illegal migrants into the UK may soon turn around and be used to take the disenchanted back out of the UK?

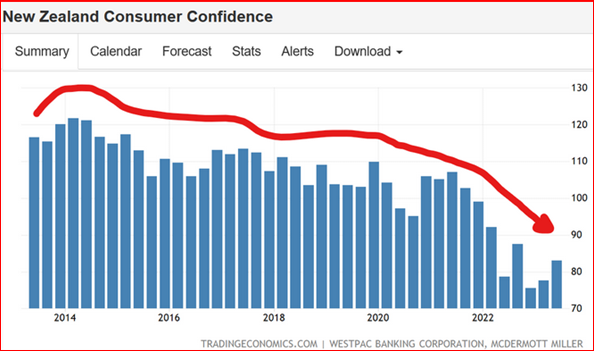

NEW ZEALAND CONSUMER CONFIDENCE FALLING, FALLING

As BOOM has pointed out, the previous Prime Minister of New Zealand, Jacinda Ardern, has left a considerable mess behind her. Her fanaticism on all things Covid and her experiments with fascist government have badly damaged the nation. Ardern was PM for 5 years from 2017 until early 2023. During that period, consumer confidence fell by 36% and is in a long term downtrend. The nation’s CPI inflation rate is also a grave concern. It will be a long fight back to a civil society for the small island nation.

VON DER LEYEN WANTS TO STEAL RUSSIAN ASSETS TOO – IS THIS PIRACY? The unelected head of the European Commission, Ursula von der Leyen, now wants to get into the act of stealing Russian assets. As BOOM has previously pointed out, this is tantamount to piracy and will cause great concern for any nations with offshore assets.

Last week, it was reported that the European Commission “intends to submit a legal proposal on the transfer of frozen Russian assets to Ukraine”. So Von der Leyen is not content with just stealing another nation’s assets. She wants to transfer them to yet another nation. Does she think she is the Fairy Godmother? Under what authority does she think she can do this?

QB Explained: https://boomfinanceandeconomics.wordpress.com/2019/12/15/boom-as-at-15th-december-2019/ AND BOOM’s Perfect Economy: https://boomfinanceandeconomics.wordpress.com/2020/01/18/boom-as-at-19th-january-2020/

In economics, things work until they don’t. Until next week. Make your own conclusions, do your own research. BOOM does not offer investment advice.

CLICK HERE FOR PODCASTS: OUR BRAVE NEW ECONOMIC WORLD

BANKS DON’T TAKE DEPOSITS, THEY BORROW YOUR MONEY: LOANS CREATE DEPOSITS — that is how almost all new money is created in the economy (by commercial banks making loans). https://www.bankofengland.co.uk/quarterly-bulletin/2014/q1/money-creation-in-the-modern-economy Watch this short 15 minutes video and learn as Professor Richard Werner brilliantly explains how global banking systems really work.

AND Watch for 4 minutes, this Bank of England explanation: Money is essential to the workings of a modern economy, but its nature has varied substantially over time. This video describes what money is today.

Most economists are unaware of this and even ignore the banking & finance sectors in their econometric models.

On 25th April 2017, the central bank of Germany, the Bundesbank, released a statement on this matter — “In terms of volume, the majority of the money supply is made up of book money, which is created through transactions between banks and domestic customers. Sight deposits are an example of book money: sight deposits are created when a bank settles transactions with a customer, ie it grants a credit, say, or purchases an asset and credits the corresponding amount to the customer’s bank account in return. This means that banks can create book money just by making an accounting entry: according to the Bundesbank’s economists, “this refutes a popular misconception that banks act simply as intermediaries at the time of lending – i.e. that banks can only grant credit using funds placed with them previously as deposits by other customers”. By the same token, excess central bank reserves are not a necessary precondition for a bank to grant credit (and thus create money).” Reference: https://www.bundesbank.de/en/tasks/topics/how-money-is-created-667392

The Reserve Bank of Australia (Australia’s central bank) has also contributed to the issue in a speech by Christopher Kent, the Assistant Governor on September 19th 2018…“the vast bulk of broad money consists of bank deposits” “Money can be created…when financial intermediaries make loans“ – “In the first instance, the process of money creation requires a willing borrower.” “It’s also worth emphasizing that the process of money creation is not the result of the actions of any single bank – rather, the banking system as a whole acts to create money.”

DISCLAIMER: All content is presented for educational and/or entertainment purposes only. Under no circumstances should it be mistaken for professional investment advice, nor is it at all intended to be taken as such. The commentary and other contents simply reflect the opinion of the authors alone on the current and future status of the markets and various economies. It is subject to error and change without notice. The presence of a link to a website does not indicate approval or endorsement of that web site or any services, products, or opinions that may be offered by them.

Neither the information nor any opinion expressed constitutes a solicitation to buy or sell any neither securities nor investments. Do NOT ever purchase any security or investment without doing your own and sufficient research. Neither BOOM Finance and Economics.com nor any of its principals or contributors are under any obligation to update or keep current the information contained herein. The principals and related parties may at times have positions in the securities or investments referred to and may make purchases or sales of these securities and investments while this site is live. The analysis contained is based on both technical and fundamental research.

Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

Disclosure: We accept no advertising or compensation, and have no material connection to any products, brands, topics or companies mentioned anywhere on the site.

Fair Use Notice: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of economic and social significance. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.