In a largely anticipated decision, the Supreme Court on Friday ruled in two separate cases that the Biden administration exceeded its authority with its $400 billion student loan forgiveness plan. The court ruled 6-3 along ideological lines.

The first case, Department of Education v. Brown, was brought by two student loan borrowers who didn’t qualify for relief sued to vacate the program on the basis that Biden’s invocation of the post-9/11 HEROES Act constitutes executive overreach. The Court ruled unanimously that the borrowers did not have standing to sue – but that the Biden administration also doesn’t have the authority to forgive the debt.

“The HEROES Act allows the Secretary to ‘waive or modify’ existing statutory or regulatory provisions applicable to financial assistance programs under the Education Act, but does not allow the Secretary to rewrite that statute to the extent of canceling $430 billion of student loan principal,” reads the opinion.

Proponents of cancellation have warned of dire consequences, such as Persis Yu – deputy executive director of the Student Borrower Protection Center.

“If payments are to resume without cancelation, we can expect a tremendous increase in defaults and forbearance,” said Yu, adding “There absolutely must be a plan to avoid the economic devastation.”

Writing the dissent was Justice Elena Kagan, who said the court was making national policy in place of Congress and the executive branch.

“Congress authorized the forgiveness plan (among many other actions); the Secretary put it in place; and the President would have been accountable for its success or failure,” she wrote. “But this Court today decides that some 40 million Americans will not receive the benefits the plan provides, because (so says the Court) that assistance is too ‘significant.’”

The challenge to the student loan program was brought by Republican-led states in one case, and two individuals from Texas in another. In both cases, the Justice Department questioned whether the plaintiffs had legal standing to file their suits.

To qualify to challenge the loan-forgiveness effort, the plaintiffs must show they have suffered a specific, rather than generalized, injury that can be remedied by relief from a federal court. It is not enough just to object to the size of the program or even to allege that the president has exceeded his authority.

A panel of the U.S. Court of Appeals for the 8th Circuit gave the states a toehold to continue their litigation, finding that the Missouri Higher Education Loan Authority, a quasi-independent entity, could suffer losses from the program change that would hurt Missouri, one of the challenger states. A different court said the two borrowers, Myra Brown and Alexander Taylor, have standing to proceed because Taylor doesn’t qualify for $20,000 of forgiveness, while Brown is ineligible altogether. –WaPo

Who will be most affected?

According to the Wall Street Journal, citing a Wells Fargo report, typical student loan payments will be between $210 and $314 per month once payments resume.

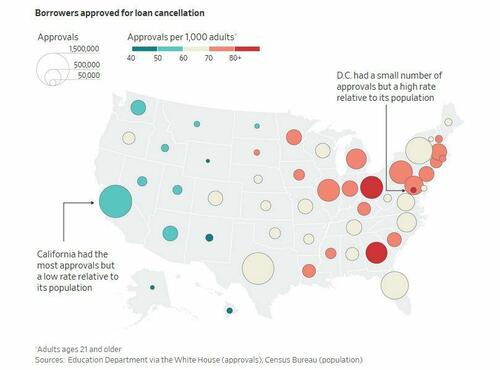

Overall, more than 40 million borrowers would have qualified for loan forgiveness through a required application. Before legal challenges halted the plan, borrowers in every state were approved for loan cancellation. Big states such as California, Texas, Florida and New York had the most approvals overall. The District of Columbia had the most approvals in proportion to its adult population, followed by Georgia and Ohio.

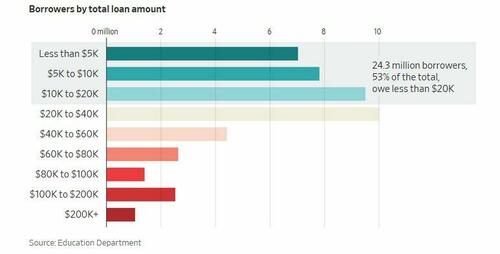

According to the Department of Education, over 43 million people collectively owe $1.6 trillion in student-loan debt. These loans include Direct Loans, Federal Family Education Loans and Perkins Loans. Around half of these borrowers owe less than $20,000.

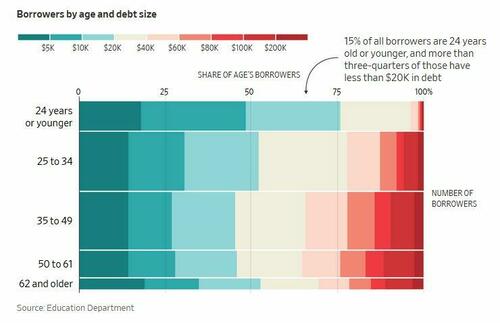

When broken down by age, borrowers 24 and younger owe $103.4 billion in federal student-loan debt. Less than 4% owe over $40,000. The largest cohort of borrowers is those aged 25-34, of which nearly a quarter owe more than $40,000. Of those aged 35-49, more than 1/3 owe more than $40,000.

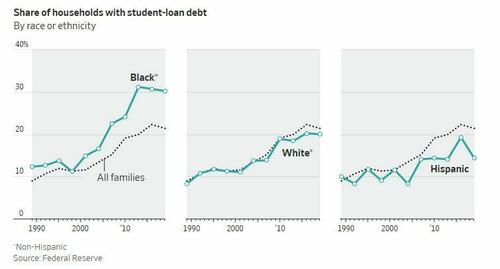

By race, around 30% of black households had student-loan debt in 2019, vs. around 20% of white households and 14% of hispanic households.

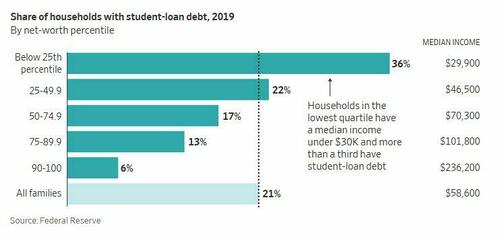

By household net worth, of those who are in the bottom 25%, more than 1/3 hold student debt, vs. 6% of those in the top 10%, per the Federal Reserve.

As noted last week at Real Clear Education, the administration’s plan to transfer up to $20,000 in student loan debt per borrower – from individuals who voluntarily took out loans to finance their college education to unsuspecting taxpayers – was one of the most audacious examples of executive overreach in American history.

Despite its $400 billion price tag, the action is only a small piece of the administration’s strategy to create a massive new public subsidy for higher education. A cynic might wonder whether the headline-grabbing but legally dubious bailout now before the Court was conceived as a decoy to distract public attention from the real centerpiece of the debt-transfer agenda.

With public attention focused on the blanket forgiveness plan (and the pleas of those demanding more), the Department of Education was busy crafting an ambitious plan to bail out future borrowers in perpetuity by changing the rules governing income-driven repayment.

Currently, multiple income-based repayment programs exist. All would cap the payments of enrollees at a percentage of their current income and then wipe away debt that remains after many years of repayment. When income-based repayment plans are designed properly, they align the timing of repayment with career earnings trajectory, such that borrowers pay the loans back faster as their incomes increase. (It is reasonable for doctors with very large loans to have smaller payments in their residency years when salaries are modest).

* * *

As we also noted last week, the restart of student loan payments is expected to slash household spending by $15.8 billion each month.

According to Barclays economist Adrienne Yih, the bank estimates a potential aggregate $15.8bn monthly headwind – or $190 billion per year – to US spending as the average student debt holder sees an incremental monthly payment of ~$390 beginning this fall. This represents an ~8% headwind to monthly personal income, affecting 16% of the US population, and adding pressure to not just consumer discretionary and apparel, but all retail spending.

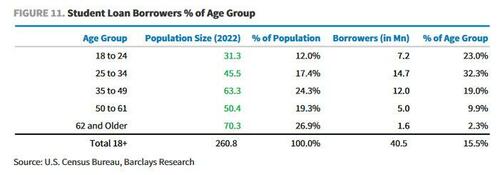

The analysis is based on federal student loan data for the aggregate $1.4 trillion balance across the 40.5mn borrowers by age cohort. Utilizing a 10-year payment period and a 5.8% interest rate, the bank calculates an approximate $390/month payment across cohorts.

Compared to a median pre-tax personal annual income of ~$57k, this payment represents an approximate 8% headwind to monthly income. In aggregate, this amounts to an “additional” (or rather, original, as the payments were there and then three years ago, they just stopped) $15.8bn in monthly payment for federal student loans affecting approximately 15.5% of the U.S. adult population (and 32% of the 25- to 34-year-old cohort).

As an aside, Barclays’ monthly estimate of $15.8bn in incremental payments is conservative as the analysis only takes into account federal student debt (Direct Loans), which is 87.2% of total student debt.

Estimated spending impact to consumer discretionary

- Based on our analysis, the Barclays economists estimate the total impact from the resumption of federal student loans to consumer discretionary spend to be ~$15.8bn (monthly), derived by aggregating the total cost among all Federal loan holders and the Federal loan repayments.

Next, the economists calculated the total percentage of the adult U.S. population that will be impacted by the resuming of Student Loan Repayment (using U.S. Census estimates as of 2022 to calculate the total population size vs. the total amount of recipients of Federal Student Loans, and then further disaggregated that by age group). Based on calculations, 15.5% of the adult (18+) US population will be effected and will need to resume paying their student loans, with an outsized impact among the 25-34 year old cohort (32%)

In short, expect Biden’s 2024 platform – should he make it through Huntergate – to rely on blaming the ‘MAGA Supreme Court’ for going against his vote-buying scheme.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

A comment from PREMIUM ZH member, “Relapsing” – 2 minutes ago

How does everyone miss the elephant in the room? It’s not the students that need the loans. The BANKS and UNIVERSITIES need the loans. They are a unified cabal decimating our youth, and we are RETARDED enough to attack the kids who are getting duped.

Of course, when Trump gets duped a billion excuses and rush to his defense. But don’t defend the young adults who are by definition vulnerable to being conned.

All good but the last. They were not conned. They knew the deal and signed off on it.

18 year olds?

Horseshit.

My guess is that this is your lame excuse for failing to teach or even raise your own kids yourself, then forcing them to go to college or become homeless on their 18th birthday, and then saddling them with unpayable debt for the diminishing returns of a college degree, all so you could vicariously virtue signal that “My son is going to such and such prestigious university”.

No one teaches these kids jack shit pre-college. Least of all their parents. Taking on loans of this magnitude is something that only baby steps and the actual real life experience of making the loan payments of smaller loans while earning and income and paying bills can provide.

A nation that sabotages its own children is a nation doomed. So, here we are.

Can’t we just hire all the indebted college grads as Drag Queens and pay ’em a couple hundred K bucks every year? They could become the bedrock of our new nation while paying off their loans at the rate of $10 a month. Future leaders!

I’ve been saying that for years.

And on top of that, we all will continue so watch the things required to live, let alone succeed, will become more and more expensive. THAT’S how you take over a population/country/society…monopolize every requirement of life. Healthcare, currency, housing, roads/tolls, food etc etc.

So … according to ‘Relapsing’ … students have no personal responsibility for the choices they make? Really?

Prolonging adolescence by going straight from a highschool that teaches no real life skills to a college that does the same, is not a service to children.

Prolonging adolescence by going straight from a highschool that teaches no real life skills to a college that does the same, is not a service to children.

Moar upvotes ^^^^^^

Something’s wrong. Can you figure it out?

It’s the parents who were ignorant or who weren’t paying attention that got conned.

Both

Not sure how you mean it … but it’s a fact that a significant amount of the student debt involved here has been backstopped by stupid parents … i.e., they’ve co-signed for their feckless, spoiled brat children …

It’s the parents who were ignorant and not paying attention who conned their own kids.

Did you know that about half of those that were to be forgiven were for debt against a masters degree?? Dupped my A$$.

Anybody making a payment while the loans were in “suspension” got to apply 100% of the payment to the principal. Putting the burden on everyone else is pure socialism.

If the government would make the individual school become guarantors of any loan to its students, this program, along with all worthless degrees, would soon go away. Harvard does not want to risk its endowment trust funds on low performing students getting a degree in African American Studies.

That’s a reasonable part of the solution … but the real solution would be to get We The People out of the education con game … eliminate any and all federal jobs relating to ‘education’ — not just the Department of Education, but all of the grant and loan programs that involve US Citizens and Taxpayers in this scam.

Just as EV manufacturers raised their prices by the amounts of the most recent crop of tax credits … so, too, have many universities raised their tuition due to the expectation that all of this debt would be put on the backs of US Citizens and Taxpayers … all while those universities have been fully paid.

That’s not a game that I wish for US to play …

It’s amazing how the cost of college exploded with the advent of low cost loans, isn’t it? There were a scholarships, GI Bill and a few grants when I went to school. My BS degree cost about $6k in the early 70’s.

1st year’s tuition in ’65 was $103/semester, 2nd year was $106/semester. Had a career with a Fortune 50 company designing stuff that few would ever understand and paid plenty in income taxes. See no need for government to be in the education racket-but that’s like expecting flies to stay away from dog shit.

Twitter is dead. Go to GAB.com.

gab.com/Matt_Bracken/posts/110628457784017558

TRUTH BOMB ALERT

Sean Davis

@seanmdav

What comes next? Not merit-based university admissions. Instead, we’ll see the opposite.

Bolshevik madrassas masquerading as universities will eliminate admissions criteria that highlight differences in intelligence and ability — GPA, test scores, and academic achievements will no longer be evaluated.

Universities will claim a new, holistic approach to applicant evaluation so they can discriminate based on identity, but without obvious academic comparisons that make it easy to prove they’re discriminating against qualified candidates because of their race. Eliminate objective academic criteria like grades and test scores, and you eliminate the easiest way to discern whether someone who is otherwise qualified is being discriminated against because of his or her race or identity.

The goal of the modern university is not education of the nation’s best and brightest. The goal is indoctrination and credentialing. The corrupt university cartel is not going to suddenly do a 180 on its obvious goals because of a pesky court decisions telling it to stop being racist. They’re going to be even more race- and identity-obsessed going forward, but now they’ll start trying to hide it better.

If they do that, they die. Or at least they lose all credibility.

They have credibility left to lose?

Not quite exact, but close to Harrison Bergeron. We’ll get to that stop soon enough.

Maybe we should just lock away or kill all the “too-smarts” so the dim don’t feel inadequate or insecure. We’ll call that the “Cambodia option”

Ah fuck, just nuke it from orbit already.

“If payments are to resume without cancelation, we can expect a tremendous increase in defaults and forbearance,” said Yu, adding “There absolutely must be a plan to avoid the economic devastation.”

The plan was that responsible adults pay back debts that THEY FREELY, and WITHOUT COERCION signed up to be responsible for.

They should pay what they owe.

I say sell all the debt contracts to the Mafia.

Problem solved.

Wait.

The Buttons admin is behaving exactly like an organized crime family.

Why aren’t they making collections?

Aaah, the 85,000 new IRS agents.

Joe Buttons”we just found a use for yuse guys” [said in thick Italian/Brooklyn accent]

Fat Tony liked this comment

No one in their right mind would give a 17 or 18 year old $80,000 worth of loans. Can you guess why?

Women and minorities! of course.

Am I sad because you took out a loan so you could get a liberal arts degree and now you’re working at Burger King?

No I’m not.

you took out a loan so you could get a liberal arts degree

Hope you have a good tent and shoes losers!

Learn to code!

When did you go to college?

When did you go to college?

“When did you go to college?”

When I built the college, you know, because the graduates could not do it.

It’s called a contingency plan … and all universities have had them in place just in case the decision went the way it did.

All loans were once dischargeable in bankruptcy. until 2005, when Congress passed the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005, which made it so that no student loan — federal or private — could be discharged in bankruptcy unless the borrower can prove repaying the loan would cause “undue hardship,” a condition that is incredibly difficult to demonstrate unless the person has a severe disability. That essentially lumps student loan debt in with child support and criminal fines — other types of debt that can’t be discharged. lets see here, where are the massive prices increases the

This is a very racist person.

Seems a BOT. If not, a POS.

https://threadreaderapp.com/thread/1632074981747171330.html

“No black person will be able to succeed in a merit-based system”

I wonder what successful black people who were not affirmative-action hires think of this.

I have worked with people of many colours. I have seen brilliant POC and moronic whites. I have also seen the inverse. Which is why we NEED a merit-based, colour-blind system.

But sanity and reason left the building a LONG time ago. Not coming back until the current idiocracy burns to the ground and is rebuild by the moral, sane and talented. Like it always is.

I’m not a bot and I say 95% of niggers can’t make it without affirmative action and government jobs.

But surely there are at least a couple universities and colleges in Africa where they can enroll, aren’t there?

Grades mean nothing. They are inflated so that”educators” are successful at “teaching” HS graduation means nothing thousands get diplomas every year who can not read or do simple math.

“There absolutely must be a plan to avoid the economic devastation.”

For who?

The young adults who signed a legally binding contract, or the 50% of us still working and paying taxes?

On Google maps, the bridge is still there.

And it shows super fast speeds over it too.

Good News !

All loans were once dischargeable via bankruptcy until 2005, when Congress passed the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005, which made it so that no student loan — federal or private — could be discharged in bankruptcy unless the borrower can prove repaying the loan would cause “undue hardship,” a condition that is incredibly difficult to demonstrate unless the person has a severe disability. That essentially lumps student loan debt in with child support and criminal fines — other types of debt that can’t be discharged.

cui bono? Lets see here…

Lenders get guaranteed, risk free income, you know, a free lunch for them! Want 40 grand for gender studies degree? No problem, we got a loan for that!

Tuition doubles over a 10 year period? No problem, we got a loan for that!

The simple act of restoring the bankruptcy laws to prior status would reduce tuitions, probably shutter 50% or more useless degree mills. Loans For STEM degrees, honest trade skills (welding, plumbers, electricians, etc.) would still be available, and tuition would be lower as schools compete for the much reduced pile of money. Woke BS degrees would quickly disappear, as lenders would discriminate (the horror!) based on the type of degree being sought. Interest rates are there due to the RISK of lending, as not all loans would be repaid in the real world.

A smart lender would even give the borrowers say, 5 years to began repayments. This would allow the borrower to establish credit, build up savings, buy a house, etc. Doing this would have both the borrower and lender have “skin in the game”, making it much more painful for the borrower to declare bankruptcy.

This is no free lunch for the borrower, just the same rules for credit card debt and other unsecured loans. Bankruptcy is brutal. To wipe the slate clean you have to sell any assets you have, and are a financial pariah for a minimum 7 years or more.

Bankruptcy is immoral too, unless the lender is in agreement. Just because it is law, doesn’t make it right or moral.

MrLiberty – I agree to disagree. That is what interest is for, rate is set to balance for the amount of risk. The lender calculates best estimate for default rate, and sets interest rates accordingly.

It’s a two way street. Loans that cannot be discharged is a permanent guaranteed risk free income for the lender, which is bullshit and predatory. Nothing in life is guaranteed, so why should lenders capital be guaranteed?

One could argue that usury is immoral.

Lenders capital should be guaranteed because they bought the politicians. They should get what they paid for.

One should argue that usury is immoral! fify

Debt slavery, is still slavery.

Why was usury banned in history?

All I can say is, Ha HA HA HA HA HA!!!!!!

Supreme Court Rules Businesses Can Refuse Service To LGBTQ Customers

Is this the best Pride Month ever?

You know what huge corporations will do with the power to refuse customers?

This is a catastrophic failure for freedoms and liberties.

Isn’t Amazon already cutting services to speech “offenders”?

No fan of niggers but Clarence Thomas might be getting a little revenge.

I wonder if any of these students has considered that it is cheaper to buy a new ID than to pay off their loans?

Claim immi status….

“These artificial fingerprints sure came in handy. “