Story at-a-glance

- In mid-July 2023, JP Morgan Chase Bank canceled all my business bank accounts, along with the personal accounts of our CEO, CFO and their respective spouses and children

- As it turns out, Chase Bank has been working with a key government agency involved in the unconstitutional censorship of Americans for nearly two years. In December 2021, JP Morgan Chase chief information officer Lori Beer was selected to be a member of CISA’s brand-new Cybersecurity Advisory Committee

- A representative of Chase Bank was also present during a March 2022 Cybersecurity Advisory Committee Protecting Critical Infrastructure from Misinformation & Disinformation Subcommittee meeting, where they discussed how to organize information sharing between the public and private sector, and how to collaborate across channels to censor Americans

- Chase now insinuates it had a “legal obligation” to debank me because of FDA warning letters. If that’s the case, Chase would also be obligated to debank its own executives and employees who intentionally benefited from sex trafficking and child abuse, and defrauded investors with illegal investment schemes

- In the end, I believe we will find our debanking was politically motivated, and that Chase Bank’s direct involvement with CISA’s Cybersecurity Advisory Committee had something to do with it. Since debanking over political and religious views is illegal in Florida, I suspect this incident will eventually be added to Chase Bank’s growing list of crimes

As previously reported, in mid-July 2023, JP Morgan Chase Bank canceled all my business bank accounts, along with the personal accounts of our CEO, CFO and their respective spouses and children. This is despite a new Florida law that that specifically prohibits financial institutions from denying or canceling services based on political or religious beliefs.

What we’re seeing is the weaponization of finance, where people whose views or actions go against the official narrative are cut off from basic financial services. This is the social credit system at work. In short, the debanking of employees and their families is a social control tactic to make people start policing each other by punishing associations.

While Chase Bank has refused to give us a reason for the account closures, a representative told reporters that closures are typically only done for anti-money laundering purposes.1,2

However, no money laundering charges have ever leveled against me, and in a real money laundering case, they seize your accounts outright. They don’t give you a month to take your business elsewhere. So, insinuating that our accounts were canceled due to money laundering appears to be an attempt to disparage and slander us.

Internal documents from the Cybersecurity Advisory Committee (CISA), obtained from an ongoing lawsuit against the U.S. government, now helps shed light on why Chase Bank targeted my business.

What Was Chase Bank Doing at a Censorship Meeting?

As it turns out, a representative of Chase Bank (name redacted) was present during a March 1, 2022, Cybersecurity Advisory Committee Protecting Critical Infrastructure from Misinformation & Disinformation (MDM) Subcommittee meeting.3,4 In addition to JP Morgan Chase, other attendees included representatives from:5

|

FBI (Laura Dehmlow) |

Illinois Emergency Management Agency (IEMA) |

| CISA (Geoff Hale, Kim Wyman and Allison Snell) | The Center for Strategic and International Studies (CSIS), a Washington D.C.-based think tank |

| The University of Washington | |

| MountChor Technologies, a company that produces “technology-driven, mission focused solutions for critical infrastructure” | TekSynap, which supplies an array of services across multiple cloud providers |

| Arcfield, which provides engineering and integration capabilities for the U.S. intelligence community |

According to the meeting minutes,6 Laura Dehmlow, section chief for the FBI’s Foreign Influence Task Force (FITF), briefed the attendees about the FBI’s roles and responses in combating foreign influence. Dehmlow also warned that “subversive information” on social media could undermine public support for the U.S. government, and that “media infrastructure” needed to be held accountable.

One of the attendees asked Dehmlow to confirm that the mis- and disinformation under the FBI/FTIF’s purview was only related to foreign criminal activity, and that the “FBI does not perform narrative or content-based analysis.”

The attendee then suggested that CISA “might have a role based on the subcommittee helping to define the narrative so the ‘whole of government’ approach could be leveraged.”

The committee members went on to discuss what the government’s strategic approach related to misinformation and disinformation ought to be, how best to organize information sharing between the public and private sector, and how to collaborate across channels.

We now know that a formalized process was implemented that allowed government officials to log into a special portal where they could flag social media content for removal.7

The committee also sought to identify entities that had “done appropriate social media monitoring for the government.” We now have proof that CISA partnered with a censorship consortium called the Election Integrity Partnership (EIP), later rebranded as the Virality Project, to illegally censor Americans. I detailed this relationship in “How the Virality Project Threatens Our Freedom.”

What was Chase Bank doing at this meeting? Why was a major bank included in a meeting in which they were trying to tease out the best way for government to censor Americans?

With everything we now know about CISA’s domestic censorship activities, could the answer be that debanking “domestic threat actors” was on the table from the start? Did CISA have a hand in the bank’s decision to close my business accounts, and those of key employees and their families?

Chase Bank Has Been a CISA Cybersecurity Member Since 2021

A December 1, 2021, press release8 also lists JP Morgan Chase chief information officer Lori Beer as a member of CISA’s brand-new cybersecurity advisory committee, launched that month. According to that press release:9

“… the Agency’s new Cybersecurity Advisory Committee … will advise and provide recommendations to the Director on policies, programs, planning, and training to enhance the nation’s cyber defense …

The Committee will examine and make recommendations on a variety of topics collectively aimed at strengthening CISA and more broadly reshaping the cyber ecosystem to favor defense.

These topics include growing the cyber workforce; reducing systemic risk to national critical functions; igniting the power of the Hacker community to help defend the nation; combating misinformation and disinformation impacting the security of critical infrastructure; and transforming public-private partnership into true operational collaboration.”

So, Chase Bank has been working with a key government agency involved in the unconstitutional censorship of Americans for nearly two years. Mastercard is also included in this CISA advisory committee. Other notable members of this 23-person committee include:

| Steve Adler, Mayor of Austin, Texas |

| Marene Allison, Chief Information Security Officer at Johnson & Johnson |

| Vijaya Gadde, Legal, Public Policy & Trust and Safety Lead at Twitter |

| Nuala O’Connor, Senior Vice President & Chief Counsel for Walmart |

| Stephen Schmidt, Chief Information Security Officer for Amazon Web Services |

| George Stathakopoulos, VP of Corporate Information Security at Apple |

| Chris Young, Executive VP of Business Development, Strategy, and Ventures at Microsoft |

| Matthew Prince, CEO of Cloudflare, a software company that has been successfully targeted and hacked more than once since joining this committee.

In December 2021, a flaw in the Cloudflare software allowed for the theft of $130 million in cryptocurrencies,10 and in August 2022, they were targeted in a sophisticated phishing scam in which the hackers were able to obtain employee credentials that were then used in an effort to access Cloudflare’s internal network.11 Then, in August 2023, it was revealed that hackers are using “Cloudflare Tunnels to establish covert communication channels from compromised hosts and retain persistent access.”12 |

| Alex Stamos, a former security chief at Facebook and a partner of the Krebs Stamos Group, a cyber consulting firm. The other partner is Chris Krebs, former director of CISA. It was under Krebs’ leadership that CISA was transformed into a domestic surveillance and censorship agency.

Stamos is also head of the EIP/Virality Project, which partnered with CISA to carry out censorship activities on CISA’s behalf. Evidence shows the Virality Project frequently pressured social media companies to censor COVID-19-related information and/or label it as “misinformation” — even if the information was true. |

| Kate Starbird,13 associate professor of Human Centered Design & Engineering14 at the University of Washington and a former Twitter employee |

| Nicole Perlroth, a cybersecurity reporter for The New York Times |

Secret Censorship Group Sought to ‘Blackhole’ Me

The inclusion of Perlroth, a long-time reporter for The New York Times, on CISA’s Cybersecurity Advisory Committee is particularly interesting considering documents showing that the NYT played an important role in pressuring social media companies to censor anti-vaccine sentiment. Did Perlroth’s seat on the CISA committee have anything to do with that?

In an August 8, 2023, Public Substack article, investigative journalists Alex Gutentag, Leighton Woodhouse and Michael Shellenberger detail how nonprofits, the White House and legacy media colluded to push censorship for political purposes:15

“Yesterday Public reported16 for the first time that Facebook censored content at the request of the White House in order to guarantee White House support in a $1.2 billion battle with the European Union over data privacy.

It is a significant discovery because it points to a major and additional point of financial leverage that the U.S. government used to coerce censorship, in addition to widely discussed Section 230 liability protections, which President Biden, directly and indirectly, threatened — if Facebook refused its demands to censor.

But it all raises a question: why was the Biden White House so determined to censor Facebook in the first place? Until the Facebook Files, the answer had been that they wanted people to take the vaccine …

But now, the Facebook Files reveal that Facebook executives knew censoring disfavored vaccine views would backfire and explained to White House officials that censoring such views would violate established norms around freedom of speech. But the White House demanded more censorship, anyway …

In the summer of 2021, unable to convince every American to get vaccinated, the administration sought more and more extreme means to control the flow of information.

Facebook executive and top censor Aaron Berman identified the motivation behind the White House’s approach in a July 16 email: the administration was trying to scapegoat social media companies for its own policy failures …

Nonprofits played a role, particularly a London-based pro-censorship advocacy group called the Center for Countering Digital Hate (CCDH). Facebook considered the radical measure of ‘off-platform links enforcement’ and ‘blackholing’ vaccine critics named by the CCDH as the ‘Disinformation Dozen’ …

Demand for censorship also came from mainstream corporate news media. When the New York Times’ Sheera Frenkel published a story about Dr. Joseph Mercola on July 24, 2021,17 Facebook employees responded to the story by looking for ways to blackhole him …

Several Facebook employees engaged in an active effort to search for enforcement grounds, including retroactively looking at offending posts from months earlier. All three worked in concert: nonprofits, news media, and the White House …

Again and again, it became clear that it was the news media demanding White House censorship. ‘The White House rarely provides any specificity about what it wants removed,’ one employee wrote, ‘but it routinely complains to us about content identified in critical media reports.’

And why was the White House concerned about the news media? Because the news media shapes public opinion, and public opinion determines the outcomes of elections.”

CCDH Report Used to ID ‘Domestic Terrorists’

We now also know that the U.S. Department of Homeland Security (DHS) relied on the CCDH’s malign fabrications to identify “domestic threat actors,” meaning domestic terrorists.

This was discovered by my team in an August 2021 report18 on the DHS website titled “Combatting Targeted Disinformation Campaigns, Part 2,” created by the Public-Private Analytic Exchange Program (AEP).

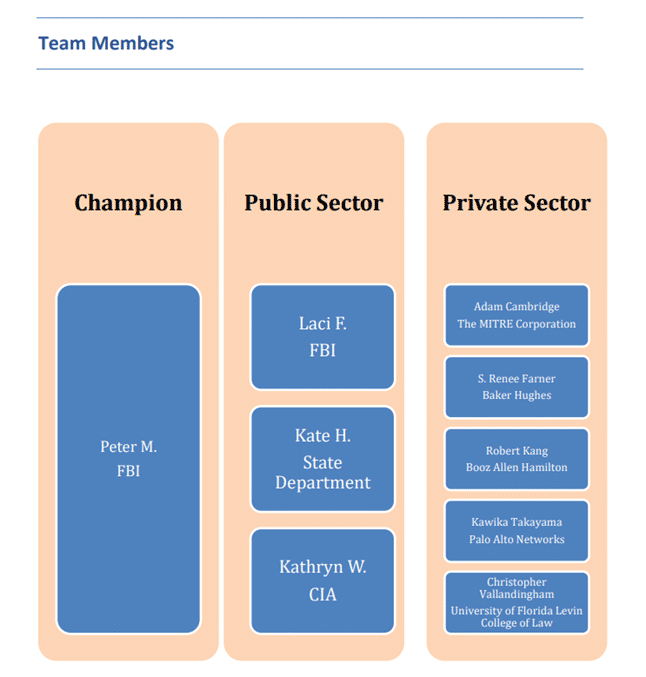

According to the DHS,19 the AEP “organizes teams of analysts from the private sector, academia, and public sector across all levels of government — federal, state, local, tribal, and territorial.” In this case, the team responsible for this report include two members of the FBI — listed only as “Peter M.” and “Laci F.” — someone from the State Department, and “Kathryn W.” from the CIA.

Curiously, only those from the private sector are identified with full names. Only the first names and the initial of their last names are listed for the public sector members.

While I cannot prove this is the case, I wonder if “Peter M.” refers to Peter M. Klismet Jr., author of “FBI Diary: Profiles of Evil.”20 According to his bio, Klismet was one of the first FBI agents to be hand-picked to undergo “ground-breaking, revolutionary and controversial training … made famous by the renowned Behavioral Science Unit.” Basically, Klismet is a profiler, which is what this report is all about.

Under section 2.1.2., which discusses how to identify domestic threat actors, the report specifically highlights the CCDH “Pandemic Profiteers: The Business of Anti-Vaxx” report, which features photos of the 12 “disinformation dozen” on its cover.

And, while it never spells out my name, it goes on to state “The New York Times later published a more detailed article on the person listed in the report as the greatest offender.” Guess who that person was? That’s right. Me.

Coincidence?

So, to summarize, Chase Bank was the only bank represented on CISA’s Cybersecurity Advisory Committee, as well as its subcommittee on “Protecting Critical Infrastructure from Misinformation & Disinformation.”

It’s also the only bank, so far, that has taken the extraordinary measure to debank employees and their family members of someone named in the CCDH’s “Disinformation Dozen” report and targeted by The New York Times (another committee member) as a “disinformation superspreader.”

And, U.S. intelligence agencies are all but spelling out my name in a report about identifying domestic “threat actors.” Are we supposed to think that’s coincidental?

Incidentally, Mastercard, the only credit card company on CISA’s Cybersecurity Advisory Committee, has also been accused of canceling accounts of conservative organizations and individuals,21 whereas the same allegations have not (to my knowledge) been leveled against Visa or Discover.

Chase Is No Stranger to Misconduct and Crime

It’s no small irony that while Chase Bank insinuates that my company is somehow involved in illegalities, Chase Bank continued doing business with the notorious pedophile and sex trafficker Jeffrey Epstein for years after his sordid dealings became known.22,23

In fact, Chase Bank is now going to pay $290 million to settle allegations that the bank knowingly benefited from Epstein’s illegal business.24 There’s also ongoing litigation against the bank by the U.S. Virgin Islands, the location of “Epstein Island,” where sex victims were brought and abused.

According to Mimi Liu, a lawyer for the Virgin Islands, Chase executives knew that Epstein was a sex trafficker by 2008 at the latest, and “broke every rule to facilitate his sex trafficking in exchange for Epstein’s wealth, connections and referrals.”25

In September 2020, Chase Bank also paid $920 million to settle trading misconduct charges. According to the Commodity Futures Trading Commission, Chase Bank manipulated trades of futures tied to precious metals and Treasury bonds for at least eight years.

Their “deceptive conduct” included spoof trades — an illegal practice where orders are placed and then canceled before execution to fool investors into thinking demand for the asset is higher than it actually is. Chase Bank is also ignoring evidence of money laundering by the Biden family.

By Own Admission Chase Is Obligated to Debank Its Executives

In response to a letter by Florida Chief Financial Officer Jimmy Patronis, in which he questioned the bank’s decision to close our accounts, a Chase spokesman replied that the accounts were closed because:26

“… the customer has been the subject of regulatory scrutiny by the Federal government on multiple occasions for engaging in illegal activity relating to the marketing and sale of consumer products and we have a legal obligation to prevent funds derived from these activities from flowing through our bank.”

The last “federal scrutiny” of our business was 2.5 years ago, when the Food and Drug Administration sent us a warning letter accusing us of selling vitamin C, D, quercetin and Pterostilbene Advanced to mitigate, prevent, treat, diagnose or cure COVID-19 is in violation of the Federal Food, Drug, and Cosmetic Act.

A warning letter is not proof of illegal activity. It’s an accusation. We responded to the FDA’s letter, letting them know their accusations were baseless, and that was the end of that. We had not violated the law, and I suspect the letter was nothing more than a ruse to bring bad press.

If Chase insists it has a “legal obligation” to debank me, my employees and their families, over an old FDA warning letter — which had no legal basis and never led to criminal charges — isn’t Chase Bank then also obligated to debank its own executives and employees who intentionally benefited from sex trafficking and child abuse, and defrauded investors with illegal investment schemes?

In the end, I believe we will find our debanking was politically motivated, and that Chase Bank’s direct involvement with CISA’s Cybersecurity Advisory Committee had something to do with it. Since debanking over political and religious views is now illegal in Florida, I suspect this incident will eventually be added to Chase Bank’s growing list of crimes.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

Wow. I guess when I go to hire a contractor, a qualifier will be that they not do business with Chase Bank.

Chase bank is Amazon , just one of the many business faces of Deep Shekels Inc.

Chase is a private company, bruh…they do what they want….reeeeeeee

Chase is a Rothschild bank. The Fed is a Rothschild central bank. Bank with another credit union or insured small town/county bank, problem solved.

If they run off their customers to push compliance , push back by not giving them access to your money.

ROTHSCHILD’S CRIME CONSTRUCT 1

The Rothschilds are headquartered in the Babylon-BIS-Tower in Basel

Debt is their control Mechanism

Their power goes far beyond the Banking Empire

War is their most profitable business

Countries and individuals turned into corporations

The world is ruled from three independent sovereign states

Debt must first be created before being able to create debt money

The Rothschilds have infiltrated royalty and aristocracy through breeding

The Four Horsemen of Banking (Bank of America, JP Morgan Chase, Citigroup and Wells Fargo) own the Four Horsemen of Oil (Exxon Mobil, Royal Dutch/Shell, BP and Chevron Texaco); in tandem with Deutsche Bank, BNP, Barclays and other European old money behemoths. But their monopoly over the global economy does not end at the edge of the oil patch.

According to company 10K filings to the SEC, the Four Horsemen of Banking are among the top ten stock holders of virtually every Fortune 500 corporation.[1]

So who then are the stockholders in these money center banks?

This information is guarded much more closely. My queries to bank regulatory agencies regarding stock ownership in the top 25 US bank holding companies were given Freedom of Information Act status, before being denied on “national security” grounds. This is rather ironic, since many of the bank’s stockholders reside in Europe.

One important repository for the wealth of the global oligarchy that owns these bank holding companies is US Trust Corporation – founded in 1853 and now owned by Bank of America. A recent US Trust Corporate Director and Honorary Trustee was Walter Rothschild. Other directors included Daniel Davison of JP Morgan Chase, Richard Tucker of Exxon Mobil, Daniel Roberts of Citigroup and Marshall Schwartz of Morgan Stanley. [2]

J. W. McCallister, an oil industry insider with House of Saud connections, wrote in The Grim Reaper that information he acquired from Saudi bankers cited 80% ownership of the New York Federal Reserve Bank- by far the most powerful Fed branch- by just eight families, four of which reside in the US. They are the Goldman Sachs, Rockefellers, Lehmans and Kuhn Loebs of New York; the Rothschilds of Paris and London; the Warburgs of Hamburg; the Lazards of Paris; and the Israel Moses Seifs of Rome.

CPA Thomas D. Schauf corroborates McCallister’s claims, adding that ten banks control all twelve Federal Reserve Bank branches.

He names N.M. Rothschild of London, Rothschild Bank of Berlin, Warburg Bank of Hamburg, Warburg Bank of Amsterdam, Lehman Brothers of New York, Lazard Brothers of Paris, Kuhn Loeb Bank of New York, Israel Moses Seif Bank of Italy, Goldman Sachs of New York and JP Morgan Chase Bank of New York.

Schauf lists William Rockefeller, Paul Warburg, Jacob Schiff and James Stillman as individuals who own large shares of the Fed. [3]

The Schiffs are insiders at Kuhn Loeb. The Stillmans are Citigroup insiders, who married into the Rockefeller clan at the turn of the century.

Eustace Mullins came to the same conclusions in his book The Secrets of the Federal Reserve, in which he displays charts connecting the Fed and its member banks to the families of Rothschild, Warburg, Rockefeller and the others. [4]

The control that these banking families exert over the global economy cannot be overstated and is quite intentionally shrouded in secrecy. Their corporate media arm is quick to discredit any information exposing this private central banking cartel as “conspiracy theory”. Yet the facts remain.

U.S. TRUST CORP:

Address:

114 West 47th Street

New York, New York 10036

U.S.A.

Telephone: (212) 852-1000

Fax: (212) 852-1140

Statistics:

Public Company

Incorporated: 1853 as the United States Trust Co. of New York

Employees: 2,558

Total Assets: $476.8 million (1995)

Stock Exchanges: NASDAQ

SICs: 6022 State Commercial Banks; 6091 Nondeposit Trust Facilities; 6712 Bank Holding Companies

Mullins presents some bare facts about the Federal Reserve System with subjects on: it IS NOT a U.S. government bank; it IS NOT controlled by Congress; it IS a privately owned Central Bank controlled by the PARASITE financiers in their own interest.

The Federal Reserve elite controls excessive interest rates, inflation, the printing of paper money, and have taken control of the depression of prosperity in the United States.

MOUR: