What’s Going on With Gold?

Guest Post by Dennis Miller at Miller On The Money

Guest Post by Dennis Miller at Miller On The Money

The price of gold has been swinging wildly over the last several months; from over $2,000 oz. in May, then dropped to around $1822 oz. early in October. The middle east war reignited and it quickly jumped back up around $50. What’s going on?

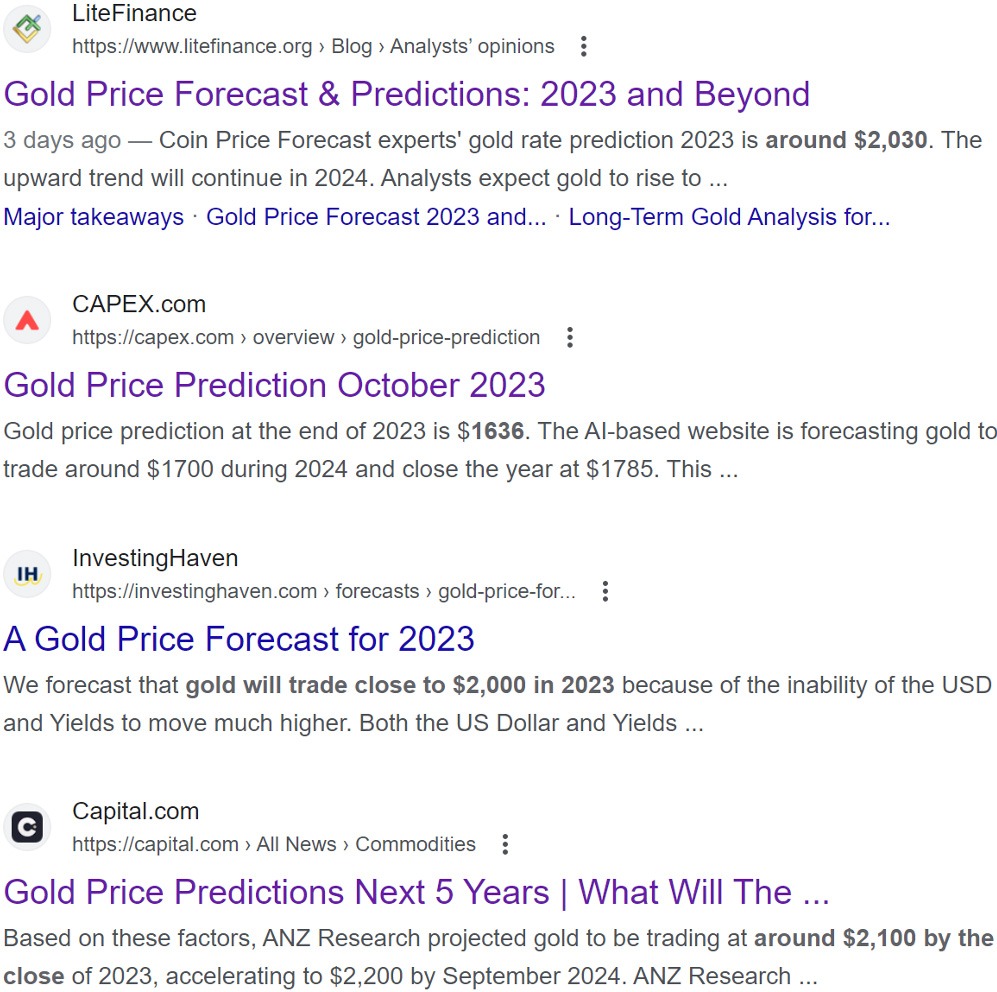

I Googled “Gold Price Prediction for 2023” and the responses were all over the place. Here is a screenshot of what popped up.

I Googled “Gold Price Prediction for 2023” and the responses were all over the place. Here is a screenshot of what popped up.

The swing was a low of $1636 and a high of $2100, almost $500 oz differential. In January one of the pundits will claim victory for their prognostication (aka guess).

The swing was a low of $1636 and a high of $2100, almost $500 oz differential. In January one of the pundits will claim victory for their prognostication (aka guess).

I started my writing career with Casey Research, a company chock full of gold experts. As good as they were, historical data was heavily relied upon; no one had a perfect crystal ball.

Why is gold so volatile and prices hard to predict? Prime XBT explains:

“Because gold is such a mature and established market, there are a number of factors that come into play when determining its price and how it is affected. Gold is also a rather unique asset compared to things like stocks and bonds, and that also makes it act differently. The fact that it operates as a hedge means one needs to look for factors that impact other assets differently.

A list of the factors to consider include: Consumption demand, Protection against volatility, Gold and inflation, Gold and interest rates, Good monsoon, Correlation with other asset classes, Geo political factors, Weakening dollar, Future gold demand.”

Read a good article on it, basically no one trusts the US dollar anymore and other countries are buying gold with their dollars. Makes sense.

If you look at a long-term chart of gold, it’s been making a base for 3 years. If it breaks out over $2100, I’d say it’s off to the races.

Gold will never breakout much over $2,100 until mushroom clouds appear.

The god’s of CBDC’s will NOT let it happen.

That is why it has stayed in a range for so long.

Brought a chunk back in 2011, with 2011 dollars, and it swooned shortly after.

It’s back to 2000, but in 2023 dollars.

yaaaay

“What’s Going on With Gold?”

Well,tis simple,is in me caches along with a lot of other goods.

I hope it does not rise quickly as that means inflation is running full blown/dollar crashed for good ect.

Friday is tomorrow.

I view inflation effect in groceries and energy/fuel utilities.

I think gold is a bargain now but everything else is sky high so buying Maples is a stretch.

A list of the factors to consider also includes production costs for mining and extraction (new supply) vs. gold demand for both industrial and personal uses. The vast majority of the market price does not reflect trade in physical gold but rather paper positions.

Gold prices are manipulated so I cannot for the life of me understand how the historical charts can provide anything but an account of bullshit. When the manipulation stops that is when the rubber hits the road and we find out if gold is nothing but a shiny paperweight or if it is the real deal.

ETF’s also known as paper gold, manipulate the market. They sell the same gold over and over. Just remember, when it comes to ETF’s, if you don’t hold it you don’t really own it.

Like bitcoin after the EMP blast.

A rising gold price signifies a failing dollar. They will protect the dollar. It is the key to their fiefdom. Confidence in the dollar must be maintained.

It’s only familiarity with the dollar that gives it any value currently, because it’s worthless. It’s just the vast majority of people aren’t aware of this.

I dump those green pieces of paper whenever I can for something with intrinsic value.

Gold sucks for the average punter. It’s too impractical for small holders. The in and out costs are too high. When you want to sell so does everyone else. Major security issues. You may need an assay when you sell, you may get tungsten when you buy. Put your money in BTC. Sure, BTC is volatile and it might fall in the short-term. If it does that’s the time to buy some more. BTC still has huge upside potential. There’s no other investment you can make that has the same potential for return. It’s not going to be outlawed or driven underground. Too many big players have taken a position and they are still buying. The ETFs launching next year are forgone conclusions. Mining reward halves around May next year. The concept has been well and truly proven, there’s no doubt any longer. Lots of reasons for optimism on price. Everyone with a portfolio should hodl some BTC.

Gold bugs please begin screaming hysterically, now……

“What’s going on with gold”? It’s simple, Dennis: The spot price is a total manipulation that has no basis in reality. Gold isn’t a commodity that can be priced in fiat dollars. Gold is real money, fiat dollars are just an imaginary valuation.