Guest Post by Nick Giambruno

The Strait of Hormuz is a narrow strip of water that links the Persian Gulf to the rest of the world.

It’s the world’s single-most important energy corridor, and there’s no alternative route.

Five of the world’s top 10 oil-producing countries—Saudi Arabia, Iran, Iraq, United Arab Emirates, and Kuwait—border the Persian Gulf, as does Qatar, the world’s largest liquefied natural gas (LNG) exporter. The Strait of Hormuz is their only sea route to the open ocean… and world markets.

At its narrowest point, the space available for shipping lanes is just 3.2 kilometers wide.

According to the US Energy Information Administration, more than 40% of global oil exports (around 21 million barrels) transit the Strait daily.

That’s more than $1.5 billion worth of oil every day.

And that’s not considering the immense amount of LNG— about 33% of the world’s daily LNG exports—and other goods transiting the Strait.

It’s hard to overstate the importance of the Strait of Hormuz to the global economy.

If someone were to disrupt the Strait, it would cause immediate global economic chaos as energy prices skyrocket.

Thanks to its commanding geography and expertise in unconventional and asymmetric warfare, Iran can shut down the Strait, and there’s not much anyone can do about it.

It’s Iran’s geopolitical trump card.

Analysts believe it would take weeks for the US military to reopen it, but nobody really knows if it would ultimately be successful. The Millennium Challenge 2002 war game suggests it wouldn’t be.

Military strategists have known about this situation for decades. But no one has found a realistic way to neutralize Iran’s power over the Strait.

Iran has been crystal clear that it will close the Strait in the case Israel or the US attacks it.

In other words, Iran holds a knife to the throat of the global economy.

The US has sought to overthrow the Iranian government since the 1979 Revolution—for over 40 years. Iran’s control over the Strait of Hormuz has always served as a big deterrent to US regime change ambitions and invasion plans.

Now, Iran and the US are headed toward a confrontation that will almost certainly disrupt the Strait.

The potential outbreak of an enormous regional war in the Middle East, with the prospect of the destruction of Israel and the collapse of the petrodollar system, could force the US to act against Iran this time.

If war breaks out between the US and Iran—an increasingly likely outcome—I have no doubt that Iran will close the Strait of Hormuz.

To call that a severe oil supply disruption would be a major understatement.

Consider this…

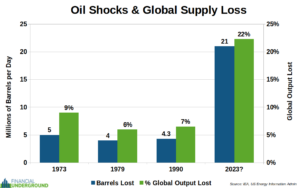

During the first oil shock in 1973, about 5 million barrels were removed from the global oil market. Daily global oil production was approximately 56 million barrels per day at the time, which means about 9% of the supply vanished.

Oil prices roughly quadrupled.

During the second oil shock in 1979, about 4 million barrels were removed from the global oil market. Daily global oil production was approximately 67 million barrels per day at the time, which means about 6% of the supply vanished.

Oil prices nearly tripled.

During the third oil shock in 1990, about 4.3 million barrels were removed from the global oil market. Daily global oil production was approximately 66 million barrels per day at the time, which means about 7% of the supply vanished.

Oil prices more than doubled.

If Iran were to shut down the Strait of Hormuz, it would remove a whopping 21 million barrels of oil from the global market. Today, global oil production is approximately 94 million barrels per day, which means about 22% of the worldwide oil supply could disappear.

As we can see in the chart below, it would be the largest oil supply shock the world has ever seen… by far.

If war with Iran proceeds and Tehran closes the Strait of Hormuz, I think the effect on the price of oil will be at least as severe as it was during the 1973 oil shock, which saw oil prices go up 4x.

A similar move today could see oil prices above $300 a barrel.

However, I consider that a conservative estimate because closing the Strait of Hormuz would cause a much larger supply shock than the 1973 OPEC oil embargo.

I think the market doesn’t appreciate how close we are to a war with Iran and the implications of it.

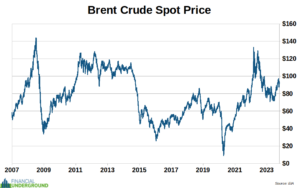

The oil price has barely moved despite the imminent danger to supplies.

We haven’t returned to pre-2014 levels yet, let alone the 2008 peak of over $140 per barrel.

But this anomaly in the oil market is a blessing because it’s handing us a golden opportunity with oil stocks.

I’m certainly not cheering for war. I despise war, which is the health of the State.

Regardless, a big war is highly likely, with significant investment implications that would be foolish to ignore.

That’s precisely why I just released an urgent new report with all the details, including what you must do to prepare.

It’s called The Most Dangerous Economic Crisis in 100 Years… the Top 3 Strategies You Need Right Now.

Click here to download the PDF now.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

Big if,… if Iran were to take some action that closed the strait, how would Israel/ US respond, and then how would Russia/ China respond t0 that

Doesn’t look anywhere near imminent now, but this could be a big trigger for actual war

To answer your question: U.S. would restrict petroleum exports. People seem to forget that the US is still one of the top oil producers…and most is exported.

Japan would be screwed…but prices would stabilize after notching a bit higher.

Any supply disruption would led to scads of retail petroleum bankruptcies. 47 years as a marketer & then as a consultant to the industry suggest the damage would be beyond repair.

I suspect this is the plan, to move everyone off of ICE.

No alternative route, yet….

What is Israel’s Ben Gurion canal plan and why Gaza matters

Named after Israel’s founding father, David Ben-Gurion, the project, conceived in the late 1960s, sought to create an alternative route to the Suez Canal, the primary shipping route connecting Europe and Asia…

Understanding the motivations behind the proposal requires exploring the complex history of the Suez Canal, the Tripartite Aggression of 1956, and the unexpected shocks to world trade resulting from its closures.

This backdrop underscores the potential strategic importance of an alternative canal, controlled by Israel, in the ever-evolving dynamics of the region…

If it goes ahead, it would be almost one-third longer than the current 193.3km Suez Canal, and whoever controls it will have enormous influence over the global supply routes for oil, grain, and shipping.

https://www.newarab.com/news/what-israels-ben-gurion-canal-plan-and-why-gaza-matters

Perhaps if the strait were closed, our nit-wit in chief would be forced to turn on the oil production spigot. If we pumped to full potential we could almost replace that 22%. Plus, if we pumped to the max, other countries such as the UK would have to legalize fracking, which would close the gap. As a bonus, Iran would put itself out of business because its oil goes through the strait also. We don’t want it to happen because there would be economic hell for awhile, but not the end of the world economy.

The shock and awe attack on the uSA is coming in December.

The muses just told me.

That’s when the comms lockdowns begin.

The door on speech is closing.

We got ourselves a regular Sven Jolly here!

Coming to you!

December sixth!

A date which will live in Hysterics.

If memory serves me correctly, the Arab oil embargo in 1976 caused the US to create the “STRATEGIC” Petroleum reserve so we wouldn’t be caught with our britches down again. Seems like The government just about pumped it dry recently. Do you see anything suspicious going on here? Or is it just me and my paranoia.? Looks like a plan.

Too bad North America doesn’t have any oil, oh wait, yes we do, almost more than anywhere else on the planet. I wonder why we don’t use it?