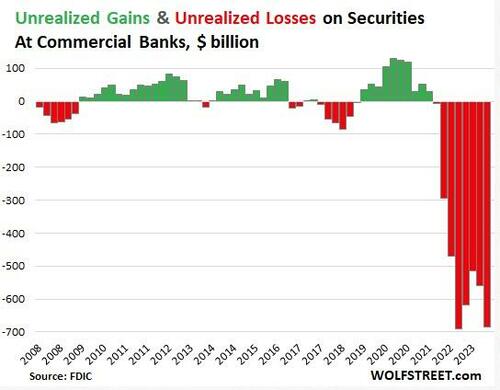

Unrealized losses on securities held by US banks exploded by 22% in the third quarter.

Of course, unrealized losses don’t really matter — until they do.

This is yet more evidence that the financial crisis that kicked off last March continues to bubble under the surface.

Unrealized losses, primarily on US Treasuries and mortgage-backed securities rose by $126 billion in Q3 and now total $684 billion, according to the FDIC’s quarterly bank data release.

Current unrealized losses are only slightly below the record set in the third quarter of 2022. This reflects the fact that the FDIC took over three failed banks earlier his year and ate their unrealized losses when it sold the banks’ assets, thus wiping them from the books.

Unrealized looses on securities are divided between two accounting methods.

- Unrealized losses on held-to-maturity (HTM) securities jumped by $81 billion to $391 billion.

- Unrealized losses on available-for-sale (AFS) securities jumped by $45 billion to $293 billion.

It’s important to understand these are only paper losses. Ostensibly, the banks will hold these bonds until maturity and then will be paid their face value. If it plays out this way, there won’t be any real losses.

The problem is that these unrealized losses drastically decrease a bank’s liquidity. If it has to sell bonds in order to raise capital, the bank will experience significant losses. This is exactly what took down Silicon Valley Bank last March.

Here’s what happened.

SVB sold a large portion of its bond portfolio at a $1.8 billion loss. At the time, SVB CEO Greg Becke said the bank made the sale “because we expect continued higher interest rates, pressured public and private markets, and elevated cash burn levels from our clients.”

The bank bought the bonds when interest rates were low. As a result, the $21 billion available for sale (AVS) bond portfolio was not yielding above cash burn. Meanwhile, rising interest rates caused the value of the portfolio to fall significantly. The plan was to sell the longer-term, lower-interest-rate bonds and reinvest the money into shorter-duration bonds with a higher yield. Instead, the sale dented the bank’s balance sheet and caused worried depositors to pull funds out of the bank.

WolfStreet explained more generally how these “irrelevant” unrealized losses can suddenly become relevant.

Banks, via a quirk in bank regulations, don’t have to mark these securities to market value, but can carry them at purchase price. The difference between market value and purchase price is the ‘unrealized gain or loss’ that the bank must disclose in its quarterly financial filings, so that we the depositors can see them and get spooked by them and yank our money out, us billionaires and centimillionaires first, on the two fundamental principles of investing: 1, he who panics first, panics best; and 2, after us the deluge.”

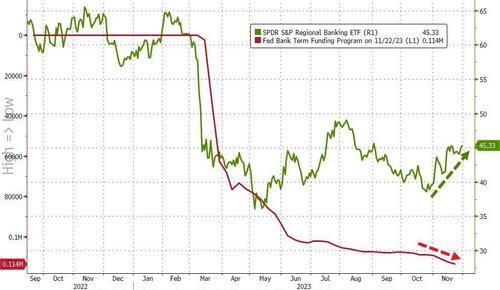

The Federal Reserve set up a bailout program to allow banks to deal with this problem. Instead of selling bonds at a loss, cash-strapped banks can go to the Fed’s Bank Term Funding Program (BTFP) and borrow against them “at par” (face value). This allows banks to use these undervalued assets to raise cash (at least temporarily) without realizing big losses on their balance sheets.

As unrealized losses rise, banks continue to tap into this bailout program more than nine months after the crisis kicked off.

Total outstanding loans in the BTFP program jumped by just over $5 billion in November alone.

In effect, the Fed managed to paper over the financial crisis with this bailout program.

It basically slapped a bandaid on it. But it has not addressed the underlying issue – the impact of rising interest rates on an economy and financial system addicted to easy money.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

What on Earth could have caused this? Who could have possibly seen this coming?

We will soon see a second round of banks going under. They have all their money invested in 30yr notes and MBS’s they cannot sell without taking huge losses. They are in a negative arbitrage and no solution to their situations.

The Fed is also loosing almost a trillion a year, and cannot help them.

Urge all of your democrat fam/friends to go “all in” on bank stocks.

The 10 Year Treasury yield is 4.35% now. It was about 4.6% on 9/30/23. On October 19, it was about 5%. If rates come down more, that will reduce the amount of banks’ unrealized losses. That’s a big “if”, though. I haven’t read anything about who has been buying bonds lately causing the yields to drop. It might just be Fed manipulation – although they’re supposed to be reducing, not increasing, their balance sheet.

What? The banks are in 30yr paper at less than 1%. What do you think a 30yr note paying less than 1% is worth?

About 62 cents on the dollar. Mostly they bought shorter durations than 30 year bonds, though. Mortgage-backed securities are extra problematic because you don’t know the duration. The suppositions are built around a 7 year average mortgage lifespan, but people with a 2.5% 30 year fixed will stay in the house longer than they would have expected. If they get divorced, the wife can live upstairs and the husband can have the basement and hit on the ceiling with a broom handle if she’s getting too loud. “Keep it down up there, you whore!”

No they did not. I am not sure where you get that. They bought mostly 30yr because the 30yr paid higher interests. The short term bonds at the time were paying practically nothing. They did this because they convinced themselves the bonds would always be liquid because interest rates would stay in the sub 1% range forever. In short, they believed their own bullshit. They believed the Fed was all powerful and could and would keep interest rates down and that good times for them would go on forever. They are now finding out they were wrong on all counts….

Yep. Here comes another pandemic.

.

MUCH more of Wall Street sleaze: https://wallstreetonparade.com/

.

The soulless mercenary defending J.P. Mordor Chase, Jeffrey Epstein’s friends:

Drug money does not flow only by trucks and underground pack mules , it flows through big banks.

Campaign contributions , to the correct people might help obtuse this fact.

THE UNDERGROUND EMPIRE – WHERE CRIME AND GOVERNMENT EMBRACE , a book by James Mills

And at what point did they unrealize they were in trouble?