Guest Post by Peter Onge

Fresh GDP numbers came in and it was a blowout. The kind of blowout that only a $2.7 trillion government deficit can buy while the private economy crumbles around it.

Another couple blowout GDP reports like this and Americans will be living under an overpass.

Biden’s GDP Miracle

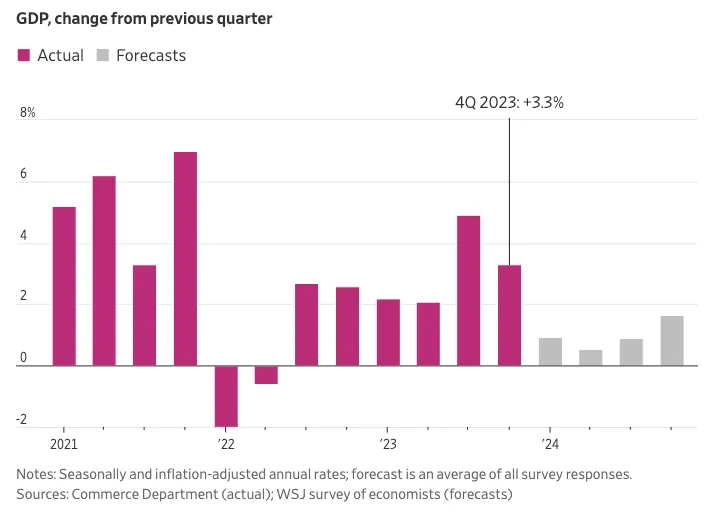

First the numbers. The Bureau of Economic Analaysis reported that GDP for the fourth quarter came in at 3.3% annualized. Which blew away estimates of 2.0%.

And it brought growth for all of last year to 2.5%.

Which is very healthy.

On paper.

Note the numbers are preliminary, so they’re subject to revision.

Still, the regime media rolled out their finest adjectives: CNN called it “shocking” — in a good way. The New York Times called it “stunning and spectacular.”

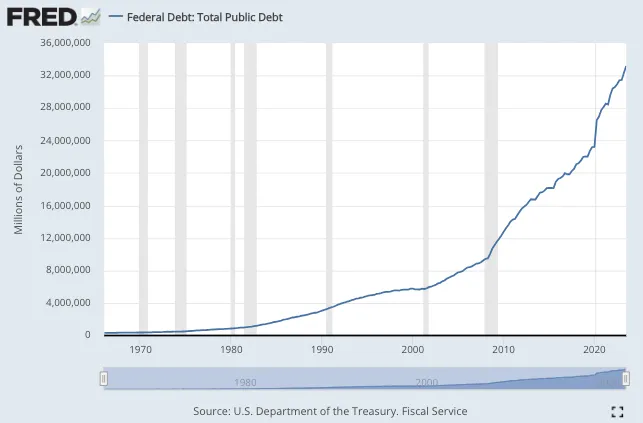

So what’s the problem? Debt.

Your grandkids bought it all. And then some.

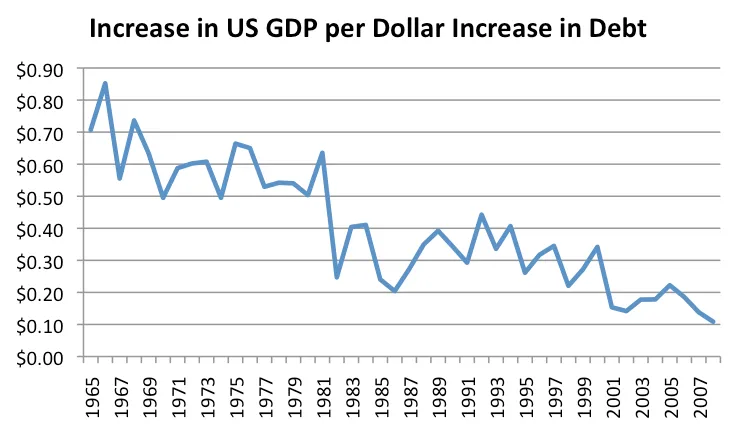

To see why, in the past 12 months the federal deficit increased by $1.3 trillion. Yet we only got half that in GDP — about $600 billion.

In other words, everything else shrank.

It’s even worse for that brave and stunning Q4 — there we got just $300 billion in extra GDP for — wait for it — $834 billion of new federal debt.

GDP vs Wealth

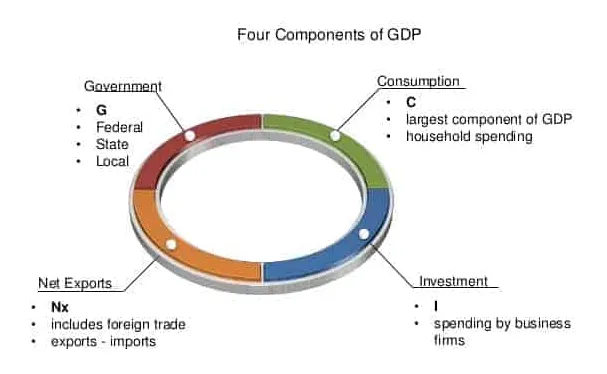

Remember that GDP isn’t measuring wealth, it’s measuring spending — production which is sold.

As Megan McArdle put it, GDP “counts the dollar value of our output, but not the actual improvement in our lives, or even in our economic condition.”

For example, if you dig holes and fill them, it’s GDP. In fact, you could build a missile, blow up the Golden Gate Bridge and every house within 5 miles of it, and it shows up as GDP. The missile cost money after all, and the government paid for it.

Of course, mainstream media — indeed, mainstream economics — pretends that GDP is identical to wealth. Pumping out articles celebrating GDP as prosperity.

That’s close enough when it’s private firms or individuals producing more to sell more — in that case, rising GDP means the country is getting richer. Because more stuff is being produced.

But it’s actually the opposite when it’s government spending. Because government’s job is taking wealth and lighting it on fire. That means when GDP is growing from government spending it’s not measuring wealth.

It’s measuring dissipation of wealth at best, destruction of wealth at worst.

Essentially, the pace at which we’re going Soviet, replacing private wealth with government waste.

So translating that brave and stunning GDP into the real world, we’re destroying wealth at rates not seen since 2008.

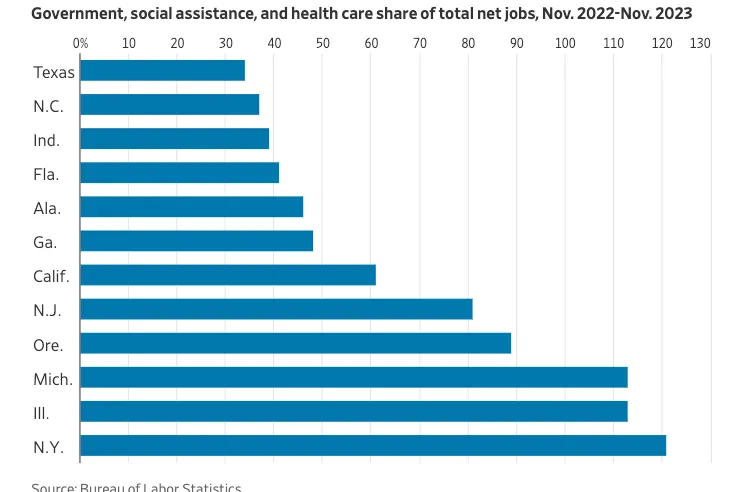

This actually lines up with what we’ve seen in jobs — in a recent video I mentioned that over half the jobs last year were actually government and government-related social service jobs.

In some states it was literally more than all the jobs created — in other words, the private sector is shrinking.

All these government jobs, of course, are unproductive — they’re not making us more prosperous as a society.

On the contrary, they’re taking wealth earned from productive activities and squandering them on vote-buying or worse — think of the wealth-destruction contained in a single EPA bureaucrat.

What’s Next

The lapdog media will keep playing along with the government statisticians and the gaslighting academics.

They’ll keep trashing regular Americans for posting their grocery bills and mortgage payments, praying they can maintain the illusion long enough for the next election.

Fortunately, there’s millions of us who can see the emperor is buck nekkid.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

Energy is the economy. You gotta spend energy to mine, produce and transport anything. I believe we are near the energy cliff and that’s what is promoting the psychosis everywhere….there isn’t enough of it to go around. Many believe in the abiotic and self refilling concept. While that may occur, I believe that it is still too slow a process to maintain the energy expenditures we currently have. That’s part of what getting rid of 7 billion people is about.

The monstrous edifice of debt will have a major impact on the global economy. There are too many IOUs that will never be repaid in anything close to anticipated value. That’s flat out impossible at this point.

While the longer term energy question comes into better focus over time, I’m think the economic crash event horizon is much closer at hand.

Steve St. Angelo gives an enlightening look at our current economy as it related to energy. Bottom line…exchange your green paper for more timeless forms of money. It’s a great video, not to be missed, for those who understand the connection between energy and the economy.

Exeter’s Pyramid refresher

The Silver symposium video: Play it at 1.75X speed

“A U.S. dollar is an I.O.U. from the Federal Reserve Bank. It’s not backed by gold or silver. It’s a promissory note that doesn’t actually promise anything.”

— P.J. O’Rourke

U.S. GDP is about $26 T. So it took running a deficit of 10.5% of GDP to create 2.5% growth.

How is 3% top line GDP growth good in anyone’s book when real inflation is at least 10%? That means we have to grow at 10% to break even.

That’s GNP. Gross National Product minus inflation = GDP.

The government lies about inflation to steal from COLA programs and to push people into a higher tax bracket.

Totally fake. The numbers will be downgraded, and CNBC will be shocked that there was no growth, even though they did that the last 11 of 12 months.

You think its bad in the US, here in Canuckistan the job numbers came out today and Twitchy, the Nazi propaganda journalist posing as finance minister, almost broke her arm patting herself on the back for her gubberment’s success. But, problem is – new job growth is all gubberment jobs and a few part-time ones while private sector jobs are disappearing!