Authored by Mike Shedlock via MishTalk.com,

Credit card debt surged to a record high in the fourth quarter. Even more troubling is a steep climb in 90 day or longer delinquencies.

Please consider the New York Fed Household Credit Report for the Fourth Quarter 2023, released this week.

Consumer Credit Key Points

- Aggregate household debt balances increased by $212 billion in the fourth quarter of 2023, a 1.2% rise from 2023Q3. Balances now stand at $17.50 trillion and have increased by $3.4 trillion since the end of 2019, just before the pandemic recession.

- Mortgage balances shown on consumer credit reports increased by $112 billion during the fourth quarter of 2023 and stood at $12.25 trillion at the end of December.

- Balances on home equity lines of credit (HELOC) increased by $11 billion, the seventh consecutive quarterly increase after 2022Q1, and there is now $360 billion in aggregate outstanding balances.

- Credit card balances, which are now at $1.13 trillion outstanding, increased by $50 billion (4.6%).

- Auto loan balances increased by $12 billion, continuing the upward trajectory that has been in place since 2020Q2, and now stand at $1.61 trillion.

- Other balances, which include retail cards and other consumer loans, grew by $25 billion. Student loan balances were effectively flat, with a $2 billion increase and stand at $1.6 trillion. In total, non-housing balances grew by $89 billion.

Record High Credit Card Debt

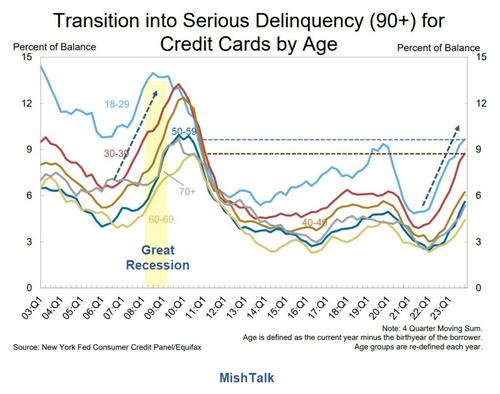

Credit card debt rose to a new record high of $1.13 trillion, up $50 billion in the quarter. Even more troubling is the surge in serious delinquencies, defined as 90 days or more past due.

For nearly all age groups, serious delinquencies are the highest since 2011 at best.

Auto Loan Delinquencies

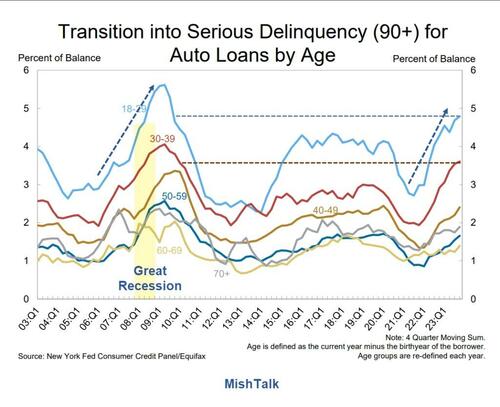

Serious delinquencies on auto loans have jumped from under 3 percent in mid-2021 to to 5 percent at the end of 2023 for age group 18-29.

Age group 30-39 is also troubling. Serious delinquencies for age groups 18-29 and 30-39 are at the highest levels since 2010.

Mortgage Loans

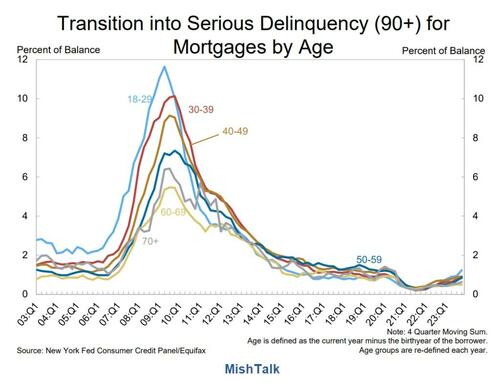

Unlike the Great Recession, mortgages are not a serious issue.

Everyone who could refinance did refinance and often at rates near 3.0 percent. After refinancing, monthly payments dropped. Finally, rising prices put risk of foreclosure very low for all but recent buyers who stretched too far to buy a house.

Yet, here again we see a small uptick across the board but especially noticeable for age group 18-29. But this will not be a replay of the Great Recession mortgage bust.

Economists are and writers are still struggling with what seems obvious if one bothers looking beyond the headline numbers.

For example on February 7, the Wall Street Journal posted Why Americans Are So Down on a Strong Economy

What’s Going On?

- In a single sentence, the economy is nowhere near as strong as the soft landing crowd thinks. That’s why people are down.

- Other than mortgages, this data is very recessionary. Consumers are struggling to maintain lifestyles and using credit cards to do so.

- The jobs picture is not rosy either, if anyone bothers to drill into the data instead of touting the headline numbers.

Jobs Soar but Full Time Employment Is Barely Changed Since May 2022

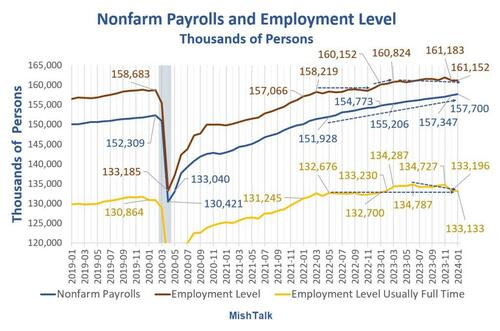

Payrolls are up by 5.77 million since May of 2022, but full time employment up only 457 thousand.

Nonfarm payrolls and employment levels from the BLS, chart by Mish.

No amount of BLS smoothing can hide this.

For discussion, please see Jobs Soar but Full Time Employment Is Barely Changed Since May 2022

Jobs increased but employment is stagnant. People are taking on multiple jobs or coming out of retirement to take part time jobs because they are struggling to make ends meet.

Sudden Stop

Writers and analysts cannot see the picture, especially left wing rags listening to Biden about how lovely this economy is. Polls show the real score. So do the above charts.

I now expect a sudden stop that is going to hit the Fed in the face like a ton of bricks. But which way?

I am open to the idea of a deflationary bust or a stagflation mess. The former will have the Fed cutting rates, the latter would be an extreme world of hurt with the Fed’s hands tied, unable to cut.

Either way it’s going to be a serious problem. It will be another economic payback for general Fed incompetence for time and time again holding rates too low, too long.

Soft landing? Forget about it.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

Gummint’s been running up its credit card balance since 1914. The pendulum returns, though . . . always:

.

Bang. You’re dead.

https://wtf1971.com/

That’s a good thing. Capital development is always the aim and should be rewarded. Many on that chart purchased a share of the capital. With out capital their would be no productivity. Without big capital , their would be no Columbus, no air planes, no ski resorts etc. etc….

ChatGPT needs grammar lessons.

Kids live in your parents basement. Work at least 60 hours a week. Even if it takes two or more jobs. Spend the money from one job. The other job(s) pay off debt save for a house invest or start a business.

You will eventually live better than your parents.

Speaking into the void. No one under 50 comes to this site

if they did, they’d be mocked relentlessly for living in their parents’ basements.

Catch 22.

But don’t do it too long…35 year olds who live in their parents basements have a hard time finding spouses and starting families.

And that’s a bad thing?

You’re an incel and a fag, aren’t you?

Anal mouse you have to be one to know one!

By your butthurt “logic”, I must be a plumber, if I know one.

As long as your head’s wedged in your shitter, give your spleen my regards.

Anal mouse you would know a lot about butthurt!

What difference does it make? There is no penalty for murder and robbery, so who’s going to penalize someone for credit default?

Personally,if I was tight financially and had good credit would get the max I could and buy preps/food/tools(including tools of freedom)/clothing and footwear/med supplies ect.I would max it out and melt me credit to the ground,really,at this point nothing to lose of value and everything to gain!

Gingers are the worst.

This is what happens when children raise children. My son is 26 and daughter is 34. They both have zero debt. We raised them to have discipline , especially with your money. Though, they are far from perfect. They do understand that debt is slavery.

That terrible discipline someone down voted allowed a very poor construction worker to retire at age 55 with everything bought and paid for. Ownership is another name for freedom. I need to get that lesson through to my daughter on her next visit to the land of freedom.

Somewhere on the internet I recently saw someone “explain” that rising credit card debt is a sign of a good economy – that people are spending money they don’t have because they’re so confident that they’ll be able to pay it back in the future.

The true owners are amoral.

And…..$9T (!) disappears from insanely faked Stock Market over just 2 years moving into CDds and MMFs (highest % outflow in history) but S&P reaches new highs every week.

Tr4 this is how.

Total dollars spent on share repurchase programs from the start of 2012 through end of 2021: $6.52 trillion.

Don’t worry about it ,you will not need any of those items where were all going.

Outstanding, I love it when the generation who thinks they have it all figured out and wants to tell the rest of us how to live, can’t even do it them selves. But hey, keep voting Dem.

But keep voting.

FIFY

I hope these kids fuck over the jew banks good and hard. Maybe this is the crack up boom you (((Austrian ))) school jews have been waiting on?

Fugnoramus or bot

Stagflation benefits government most in the two offered scenarios, so stagflation it is. Suffer, you deplorables, suffer!

Repos should bring used car prices crashing. Then it is time to buy.