Direct from BOOM Finance and Economics at the links below

This week BOOM has more revelations about the reality of Net Zero as well as yet again calling out the ‘renewables PsyOp”. BOOM also looks at Britcoin and CBDCs and asks whether the mega-banks are acting illegally when signing up to the ‘NZBA’

BOOM Finance and Economics seeks out the very best information from authoritative sources and strives for consistency in its quality and trustworthiness. Over 5 years, BOOM has developed a loyal readership which includes many of the world’s most senior economists, central bankers, their senior advisers, fund managers, and academics. If you want a real edge in understanding the complex world of finance and economics, subscribe to BOOM on Substack or as a Follower on LinkedIn.

BOOM EDITORIAL THIS WEEK

ARRIVAL LTD; A UK Electric Van Company has entered Administration. At one point, it was valued at GBP10bn on the stock market. This equates to US$12.6bn or almost $20bn Australian Dollars.

Their share price trend shows (exactly) what’s happening to all US listed electric car companies, renewable energy companies, Hydrogen energy companies and “Clean” energy companies (with some notable exceptions). BOOM has already documented those share price collapses in BOOM Substack editions dated, 12th and 19th November 2023.

Arguably one of the exceptions is Tesla. Tesla shares have been in a downtrend for over two years now since reaching their peak in late 2021. ARRIVAL Ltd has a slick website which looks and sounds similar to all the “renewable energy” companies, and their outline ‘plans’ are grandiose, revolutionary, but also impractical and delusional.

From their Website: “Arrival’s revolutionary Micro-factory production method means our EVs are sold at price parity with petrol and diesel equivalents. By levelling the market and building Arrival Micro-factories all over the world, we’re empowering local communities globally, giving them access to clean technologies that can help decarbonise their region and improve air quality. Together, these innovations can begin to help in the fight against climate injustice and inequality.”

BOOM is not sure what is meant by “clean technologies” as most electric vehicles are re-charged from gas or coal fired power stations. And BOOM is not sure what a “Micro-factory” is. BOOM is also unsure what “climate injustice” is or “climate inequality”. But that’s just BOOM.

At its High point, the shares of Arrival Ltd traded above US$1,800. They finished their trading on the OTC market in America on Friday at 2 cents. During the week, they had traded below 1 cent per share.

TESLA SHARES ARE UNCONVINCING. Meanwhile, Tesla shares (TSLA) finished the week up by 3% which sounds promising. However, they did so on progressively falling daily volumes. This is an unconvincing bounce. BOOM is waiting and watching closely for further weakness as this is the “moment of truth” for Tesla. We shall see. There is no need to make any predictions. There’s time to watch the market action closely for signs of strength or weakness over the next few weeks. The market will indicate the trending direction.

BANK OF ENGLAND HISTORY AND THE THEORY OF A “BRITCOIN” (CBDC).

The Bank of England (BoE) is the central bank of the United Kingdom. It was founded in 1694 as a private bank and was owned by private shareholders until 1946 when control was passed to the State under HMG nationalisation. It is the world’s eighth-oldest bank.

The “Governor and Company of the Bank of England”, or as most people know it ‘the BoE’, was established by Royal Charter in 1694, to raise money to fund a war with France. Over 1,200 people purchased shares (known at the time as “Bank stock”) totalling £1.2 million.

The first shareholders came from a variety of backgrounds, trades, and professions, including carpenters and grocers, merchants, doctors, knights, and royalty. The first subscription produced 1,520 separate names, contributing from as little as £25 to £10,000 (the amount subscribed by King William and Queen Mary).

In 1998 it became an independent public organisation, wholly owned by the Treasury Solicitor on behalf of the government, with a mandate to support the economic policies of the government of the day, but having independence in maintaining price stability. “Price stability” is code for the setting of official interest rates and is also known as ‘monetary policy’. In the 21st century, the Bank took on increased responsibility for maintaining and monitoring financial stability in the UK and it increasingly functions as a statutory regulator.

There are two other separate regulatory bodies involved in overseeing the UK financial sector — the Prudential Regulatory Authority which regulates 1,500 banks, building societies, credit unions, insurers, and major investment firms. The Financial Conduct Authority (FCA) regulates financial firms providing services to consumers and maintains the integrity of the financial markets in the UK. It focuses on the regulation of conduct by both retail and wholesale financial services firms. The FCA works alongside the Prudential Regulation Authority and the Financial Policy Committee to set regulatory requirements for the financial sector – BOOM focuses on the Bank of England.

The Office of the Treasury Solicitor goes back several centuries. The office was enshrined in law by the Treasury Solicitor Act 1876, which established the Treasury Solicitor as a corporation sole (an office with perpetual succession). A corporation sole is a legal entity consisting of a single (“sole”) incorporated office, occupied by a single (“sole”) natural person. This structure allows corporations (often religious corporations or Commonwealth governments) to pass without interruption from one officeholder to the next, giving the positions legal continuity with subsequent officeholders having identical powers and possessions to their predecessors.

The Treasury Solicitor is the head of the Government Legal Department (previously called the Treasury Solicitor’s Department) which is the largest in-house legal organisation in HMG. The department is a non-ministerial government department and executive agency. The Treasury Solicitor reports to the Attorney General for England and Wales. The department employs more than 1,900 solicitors and barristers to provide advice and legal representation on a huge range of issues to many government departments.

The Treasury Solicitor and Head of the Government Legal Service is currently Susanna McGibbon, a barrister and senior British civil servant. The Governor of the Bank of England is the most senior position in the BoE. The governor of the Bank of England is also chair of the Monetary Policy Committee, with a major role in guiding national economic and monetary policy, and is therefore one of the most important public officials in the United Kingdom. In its current incarnation, the Bank’s Court of Directors has 12 (or up to 14) members, of whom five are various designated executives of the bank. The 121st and current governor is Andrew Bailey, who began his term in March 2020.

BRITCOIN ANNOUNCEMENT – On 25th January this year, after 11 months of deliberations, the Bank issued a Report titled, “Bank of England and HM Treasury Respond to Digital Pound Consultation”

Concerning the future of a so-called “Digital Pound”, the Press Release confirmed that the BoE and HM Treasury would include primary legislation to guarantee all users’ privacy and control. And, to clarify that, these three points were highlighted.

- The response confirms that neither the Bank nor the Government would have access to users’ data.

- Authorities committed to maintaining access to cash for those who prefer it.

- Continuing work on digital currency will strengthen the UK’s position as a competitive global leader in finance.

It was also stated that “No final decision has been made to pursue a [so-called] digital pound – also called a central bank digital currency (CBDC).”

BOOM points out to readers that almost all UK pounds (and all national fiat currencies) are, in fact, currently digital – they reside on the electronic ledgers of the commercial banking system and the ledgers of the central bank. The exception is physical cash (notes and coins) – which is non-digital.

Regarding any possible CBDC, the Press Release went on to state – Quote, “Work will continue during the design phase exploring its feasibility and potential design choices. This will look at how a digital pound could be used in the UK economy, providing greater choice, convenience, and innovation for households and businesses making and accepting everyday payments.

The feedback from respondents from a range of industries and organisations was largely supportive of the proposed design set out in the 2023 Consultation Paper, while other respondents raised concerns about the implications of a digital pound for access to cash, users’ privacy, and control of their money.

To address these concerns, today’s publication confirms that, if a digital pound were to be implemented, primary legislation would be introduced, and this would guarantee users’ privacy and control. The Bank and HMG would not have access to any personal data and users would have freedom in how they spent their digital pounds. There would also be a further public consultation on a digital pound before the introduction of primary legislation. These commitments would give both Parliament and the public further opportunities to have their say.

In addition, today’s publication reiterates the commitment of HMG and the Bank to protect access to cash, even if a digital pound were introduced.”

“Trust in all forms of money is an absolute necessity. We know the decision on whether or not to introduce a digital pound in the UK will be a major one for the future of money. We must build that trust and have the support of the public and businesses who would be using it if introduced.”

Following the design phase, the Bank and the Government will decide whether or not to build a digital pound, and, if proceeding, would set out a timetable for further consultation on legislation and a potential launch.

These statements put to rest a lot of conjecture on the nature of any new “digital money/CBDC”. However, the debate is far from over and BOOM will have quite a lot to say about the matter.

At this juncture, it is important to say that BOOM prefers the terms Anonymous and Unconditional Electronic Cash (AUEC) in this context. BOOM herewith suggests and advises all central banks to use that term in the future. The Press Release went on to say, “What would a digital pound look like?” (there are eight dot points under this heading in the Press Release):

- A digital pound would complement the role of cash in a digital world and give people more choices in how they make everyday payments.

- £10 of a digital pound would always be worth the same as £10 in banknotes or coins.

- It would be issued by the Bank of England, widely available and convenient to use.

BOOM is strongly opposed to the last proposal of issuance by the central bank and advises all central banks to think hard before embarking upon such a policy.

BOOM has the strong opinion that any form of AUEC should be issued, NOT by any central bank but, by the Government as the democratically elected representative of the people or by the Government’s Treasury.

As BOOM often says: “Our Nation is our Currency and our Currency is our Nation”. This statement is a critical part of the Ethos of any Nation. Ethos is originally a Greek word meaning “character” that is used to describe the guiding beliefs or ideals that characterise a community, nation, or ideology; and the balance between caution and passion. Let’s examine the rest of the “dot points”.

- It would be easily exchangeable with other forms of money, including cash and bank deposits.

- It would be accessed through digital wallets offered to the public and businesses by the private sector through smartphones or smart cards.

BOOM is opposed to this proposal as it implies that fees (or interest) could be charged by the private sector in such an arrangement. Cash is the People’s Money and should never incur any cost for usage.

- It would be intended for payments made online, in-store, and between individuals, rather than for savings, and it would not pay interest.

BOOM has concerns about the comment “rather than for savings”. This suggests that a time limit could be placed on the holding of any proposed AUEC. The Bank of England must clarify that this is not the case or the intention. BOOM strongly suggests and advises the Bank of England to delete this phrase from any future communications.

- There would be restrictions, at least initially, on how much an individual or business could hold.

BOOM is again alerted to a major concern in this dot point – any restrictions on the volume of currency that could be held are suspicious of central control and time limitation and are not in the spirit of physical cash which can be held in any volume by citizens for any length of time and the supply of which must always be responsive to demand.

- Like banknotes, it would be a claim on the Bank of England, have intrinsic value, and be stable, unlike unbacked crypto-assets.

This last dot point is also of concern to BOOM. In BOOM’s strong opinion, AUEC should be a claim on the Treasury of the democratically elected Government of a Nation. If an AUEC was “issued by the central bank” and defined as “a claim on the central bank”, then the central bank would have control over the VOLUME of issuance.

Such control of money Volume by a central bank has never been the norm. Central Banks traditionally control the cost of money (via interest rate settings) while the volume of money supply is a function of borrower demand at the commercial banks and citizen demand for physical cash.

Thus, this amounts to a grab for much more monetary power being placed in an “independent organisation” (the central bank), essentially unanswerable to the democratic oversight of the People. This is not a good policy and must be opposed forcefully.

All is not lost (yet). The Press Release states at the very end, “As well as exploring the commercial, technological and operational elements of a digital pound, there will be continued engagement through a national conversation and further consultation with the public, businesses, and wider stakeholders to ensure this work takes account of all views.”

BOOM strongly suggests that the Bank of England and all other central banks consider BOOM’s concerns carefully as outlined in this editorial. If they get this wrong, The Peoples’ trust in their currency could be seriously weakened. That would be an unmitigated disaster for the nation in the long run.

DO WE NEED ANONYMOUS UNCONDITIONAL ELECTRONIC CASH (AUEC)? BOOM can see the arguments for a form of anonymous, unconditional electronic cash. However, there is a grave danger of destabilisation to the financial system if such an initiative was embarked upon without very, very careful consideration of the inherent risks. Trust in our governments and in our financial institutions is currently fragile. The issuance and encouraged circulation of more physical cash may be a much better way to solve all the problems. In that case, trust would not be put in any danger.

Currently, in all advanced economies, the supply of fresh new money is made up of 2-3% physical cash and 97-98% credit (bank loans). However, there is a major demographic problem developing in all the advanced economies; it is the projected falling number of the working-age population. As the working-age population slowly declines, the demand for fresh new bank loans will decline, thus the money supply will not be replenished. If this continues, the economy will eventually become starved of fresh new money and will enter an inevitable and persistent contraction.

It is not only the decreased creation of fresh new credit money that is a consideration. Credit money dies when bank loans are repaid. Thus, the credit money supply volume will decrease through both less creation and more destruction.

If physical cash is only 2-3% of the money supply, then the supply of new money and the health of the economy depends upon a constant demand for bank loans. If bank loan demand falls as older loans are progressively repaid, then the money supply will inevitably fall. This problem can only be corrected by increasing the working-age population to boost the demand for bank loans, through increased immigration, higher birth rates, or by increasing the use of physical cash.

Increasing and encouraging the use of physical cash to solve this problem of money supply sounds too easy to be true. It is a solution that is easy to effect and can be easily understood by The People. There is no need for “new forms of money”. BOOM recommends this action and it should be done immediately, as a matter of national urgency.

However, there remains a problem. Commercial banks make no revenue or profit from physical cash. They must store physical cash, handle it, secure it, distribute it, and recall it when the central bank requires them to do so. Physical cash is a major operations cost centre. Therefore, the bankers want to eliminate cash. After all, reducing overheads for both banks, as well as most companies, is a continual business process.

The bankers’ proposed “solution” is to create “Central Bank Digital Currencies” (CBDCs), issued and controlled by them, with their ‘utopian vision’ of a perfect economy. If they could achieve 100% control over the money supply, both in cost and in volume, their dreams would come true. But this overlooks one important fact about money.

Money is a creation of The People. Its existence depends on demand from The People. Banks cannot create ‘Bank Credit Money’ without borrower demand. Governments must create more physical cash upon demand from The People.

In summary, The People are actually at the centre of money demand and supply, not the bankers and not the government. Money is a public good that emanates from the desire to exchange promises in a trustworthy manner; understanding it is critical. This summarises two major misunderstandings that plague modern nations.

- Governments assume that they are in absolute power, forgetting that The People granted them that privilege temporarily and,

- The Banking Sector assumes that it creates and controls the bulk of fresh new money, but forgets that their banking licences are granted by The People and that borrower demand is essential for the banking system to function. Thus, the power of government and the power of money creation reside in the hands of The People.

CENTRAL BANK DIGITAL CURRENCIES CANNOT SUCCEED – THEY ARE INTELLECTUALLY BANKRUPT — THE DISASTROUS FAILURE OF NIGERIA’S CENTRAL BANK DIGITAL CURRENCY – THE eNAIRA – IS A CASE IN POINT. BOOM encourages all readers to review the BOOM Editorial, October 8, 2023, which deals with the eNaira.

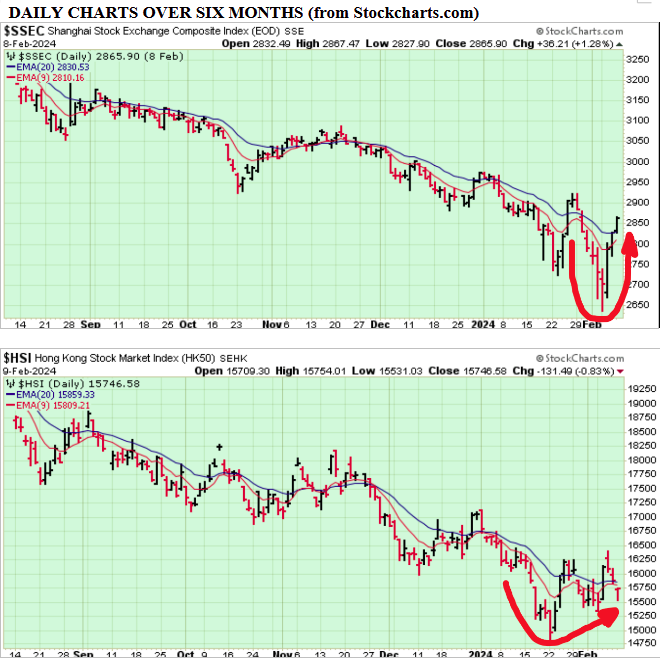

CHINA STOCKS BOUNCED STRONGLY AS BOOM HAD EXPECTED. The Doom and Gloom merchants are busy in the mainstream financial media at present, predicting (as always) the “certain collapse” of the Chinese financial system and its economy; the word propaganda springs to mind. BOOM stands in opposition to them, stating firmly that they are all (probably) wrong. BOOM’s recent forecasts may have nailed a possible major turning point, this time in China.

On 21st January, three short weeks ago, BOOM wrote, “BOOM’s China trade indicator has turned upwards in the last two months and is gaining strength. This is a reliable sign of increased Chinese trade which usually precedes a resurgence of the domestic economy.” And: “… if the upswing in external trade continues, then we should soon see a rebound in the Chinese economy and a subsequent rebound in stock prices.”

Then last weekend, on Sunday 4th February, BOOM wrote, “The Chinese stock market indices have not yet shown a base formation. However, with huge investment inflows and a recovering trade picture, there is potential for a significant turnaround soon in stock market valuations.”

During the week, the Shanghai Composite Index was bought heavily and ended up almost 5%. Daily trade volumes have been increasing since mid-January. Buyer enthusiasm was not as strong in the Hong Kong Hang Seng Index which finished the week up by 2.22%. However, the Dow Jones Shenzhen Index finished the week up by an impressive 7.35%.

CHINA STOCK INDICES — SHANGHAI — HONG KONG — SHENZEN

NO FARMERS – NO FOOD. PROTESTING FARMERS SURROUNDED BRUSSELS HEADQUARTERS OF THE EUROPEAN COMMISSION. Globally, farmers are complaining that prices for agricultural inputs such as fertilisers, crop protection chemicals (pesticides), and energy have risen, some by more than 250% over the past couple of years.

Last week, massive protests by farmers in the streets of Germany, Poland, France, the Netherlands, Italy, Portugal, and other European countries descended upon the unelected dictators of Europe, ensconced in their European Commission building in Brussels. And towards the end of the week, Polish farmers blocked border entry points with Ukraine.

The protests coincided with Thursday’s summit of EU leaders, with the farmers calling on them to scrap agricultural and environmental regulations. The unelected, European Commission President, Ursula von der Leyen, announced on Tuesday that she will scrap the contentious upcoming ‘Sustainable Use of Pesticides (SUR) Bill’ that had aimed to slash the use of chemical pesticides in agriculture. This was part of Von der Leyen’s pet climate change project which involves ambitious and legally binding plans to make the Continent “climate-neutral” [whatever that means] by 2050.

The SUR Bill set an impossible target to slash pesticide use by 50% by 2030. Last year, the Bill was rejected by the European Parliament.

THE UNELECTED URSULA VON DER LEYEN — HEAD OF THE EUROPEAN COMMISSION

In a radical statement last week, Ursula von der Leyen conceded defeat to the farmers as she addressed the European Parliament, saying, “Our farmers deserve to be listened to “. That is a welcome piece of common sense but quite a radical thought these days. She said, “I know that they are worried about the future of agriculture and their future as farmers.”

However, she could not resist the urge to re-iterate her religious belief in “man-made climate change” and to attack them at the same time by saying, “But they also know that agriculture needs to move to a more sustainable model of production so that their farms remain profitable in the years to come.” She wants her cake and eats it too. Everything is possible in the deluded minds of these European leaders. How can farmers be profitable in the future that she imagines?

The European Commission also cut the previously mandated 30% reduction in agricultural production by 2040. That looks like a cynical, temporary move to calm the farmers.

HAVE THE MAJOR US BANKS UNLAWFULLY ABANDONED THE US GOVERNMENT, THEIR SHAREHOLDERS, AND SOME OF THEIR MAJOR CUSTOMERS?

Some of the major US banks, Bank of America, Citigroup, Goldman Sachs, JPMorgan Chase, Morgan Stanley, and Wells Fargo have joined the UN-organised Net-Zero Banking Alliance (NZBA). The CEOs of each bank have signed the Commitment Statement as a pre-condition. In the “Commitment Statement, they have agreed to the following:

“We will align our business strategy to be consistent with and contribute to individuals’ needs and society’s goals, as expressed in the Sustainable Development Goals, the Paris Climate Agreement, and relevant national and regional frameworks.”

In other words, they have decided to abide by the oversight and agenda of the United Nations organisation rather than the US Government. In BOOM’s view, this is a repudiation of the US Government by these companies; a slap in the face to Congress and the Senate. This may be unlawful. The CEOs have decided that they will be answerable, not to their shareholders and not to their National government, but to a group of unelected officials who meet at the UN Headquarters. And, by the way, BOOM is not sure what a “framework” is.

When bankers abandon their government and take a separate road, beware. Further, they have agreed to, “proactively and responsibly consult, engage and partner with relevant stakeholders to achieve society’s goals.”

The term “stakeholders” is used frequently by Klaus Schwab of the World Economic Forum. It’s code for ‘corporate bodies’ and not individual citizens of nations. And, by the way, BOOM is not sure what the word “relevant” means in this context, or to which “society” they are referring. It is not a reference to their society of the United States nation.

Then they agreed to this. “We will implement our commitment to these Principles through effective governance and a culture of responsible banking”. And to “be transparent about and accountable for our positive and negative impacts and our contribution to society’s goal”.

This begs the question: Governance by whom? The unelected United Nations and/or the World Economic Forum perhaps? BOOM would hope that these companies are accountable and responsible entities; responsible to their shareholders and their national government. Further on, the statement reads, [BOOM Comments are in bold after each dot point].

We are pleased, together with other peer bank signatories, to commit to:

- Transition all operational and attributable GHG emissions from our lending and investment portfolios to align with pathways to net-zero by mid-century, or sooner, including CO2 emissions reaching net-zero at the latest by 2050, consistent with a maximum temperature rise of 1.5°C above pre-industrial levels by 2100.

- This approach will take into account the best available scientific knowledge, including the findings of the IPCC, so we commit to reviewing and (if necessary) revising our targets at least every five years after the target is set.

BOOM is mystified. What was the “temperature” they refer to as “pre-industrial”? And the “temperature” of what region on Earth? This appears to be Virtue Signalling gone mad. And what (exactly) is “the best scientific knowledge”? They go on:Use decarbonisation scenarios which: are from credible and well-recognised sources; are no/low overshoot; rely conservatively on negative emissions technologies; and to the extent possible, minimise misalignment with other Sustainable Development Goals. We will provide a rationale for the scenario(s) chosen.

BOOM is mystified again. Which “credible and well-recognised sources”? What is meant by “negative emissions technologies”? And so on:

- Prioritise our efforts where we have, or can have, the most significant impact, i.e. the most GHG-intensive and GHG-emitting sectors within our portfolios, which are key to the transition to a net-zero carbon economy.

BOOM assumes that this means the banks will (somehow) separate their greenhouse-gas-intensive and emitting customers from their non-GHG-emitting customers. Remember, all human beings emit carbon dioxide when they exhale. On what basis will this be done to stay within applicable US Laws?

Surely customers who are discriminated against on this basis can take legal action to defend themselves? Have the various CEOs’ generated a contingent liability? Contingent liabilities are liabilities that may be incurred by an entity depending on the outcome of an uncertain future event.

- Use the bank-led UNEP FI Guidelines for Climate Target Setting for Banks4 (“Guidelines”) to set scenario-based intermediate targets for 2030, or sooner, for priority GHG-intensive and GHG-emitting sectors.

- Publish annually and share with UNEP FI for review, to monitor consistency with the UN Race to Zero criteria and evidence that action is being taken in line with the commitments made here:

- Progress against absolute emissions and/or emissions intensity targets following relevant international and national GHG emissions reporting protocols and/or climate portfolio alignment methodologies.

- Progress against a board-level reviewed transition strategy setting out proposed actions and climate-related sectoral policies; and

- Disclosure for key sectors will be made within one year of the setting of the target.

Who (exactly) is UNEP FI (?) And who are they to set “banking guidelines”? What is the so-called “UN Race to Zero criteria”? Are the CEOs binding their Boards to a nebulous “review of transition strategy”?

Research reveals that UNEP FI is the United Nations Environment Programme Finance Initiative (UNEP FI). What right (exactly) do the CEOs have to bind their companies to an “initiative” of the United Nations? As far as BOOM is aware, the UN can only reach agreements with National Governments, not individual corporations.

- Contribute to the ongoing development of the Guidelines. We will meet this commitment through:

- Facilitating the necessary transition in the real economy through prioritising client engagement, and offering products and services to support clients’ transition;

- Engaging in corporate and industry (financial and real economy) action, as well as public policies, to help support a net-zero transition of economic sectors in line with science and considering associated social impacts;

- What (exactly) does this phrase mean “in line with science”? Which “science” are they referring to? Is it only science pre-approved by the IPCC and/or the UN? Is other science to be banned?

- Supporting innovation, the near-term deployment of existing viable technologies, and scaling up the financing of credible, safe, and high-quality climate solutions that are compatible with other Sustainable Development Goals.

BOOM wonders. What (exactly) is meant by “a credible, safe, and high-quality climate solution”?

- In implementing and reaching targets for all Scopes of emissions, offsets can play a role in supplementing decarbonisation in line with climate science.

Is “climate science” separate from other science

- The reliance on carbon offsetting for achieving end-state net zero should be restricted to carbon removals to balance residual emissions where there are limited technologically or financially viable alternatives to eliminate emissions. Offsets should always be additional and certified.

- This Commitment recognises the vital role of banks in supporting the transition of the real economy to net-zero emissions, but we will only succeed in achieving this objective if our clients and other stakeholders also play their part. We make this Commitment with the expectation that governments will follow through on their commitments to ensure that the objectives of the Paris Agreement are met.

The UNEP FI website summarises the “Commitment” made by the bank CEOs. Again, BOOM asks the question, “Are these lawful or unlawful under US State and National Laws?”

- The Commitment Statement is a pre-requisite for joining the Net-Zero Banking Alliance and is signed by a bank’s CEO. All banks that have signed the commitment will:

- Transition the operational and attributable greenhouse gas (GHG) emissions from their lending and investment portfolios to align with pathways to net zero by 2050 or sooner.

- Within 18 months of joining, set targets for 2030 or sooner and a 2050 target, with intermediary targets to be set every 5 years from 2030 onwards.

- Banks’ first 2030 targets will focus on priority sectors where the bank can have the most significant impact, ie. the most GHG-intensive sectors within their portfolios, with further sector targets to be set within 36 months.

- Annually publish absolute emissions and emissions intensity in line with best practice and within a year of setting targets, disclose progress against a board-level reviewed transition strategy setting out proposed actions and climate-related sectoral policies.

- Take a robust approach to the role of offsets in transition plans.

There is also a document on the website that describes, “Guidelines for Climate Target Setting for Banks”. However, the document is only available for Download if you provide your full name, job title, organisation, email address, region, and country. And you must agree to receive their newsletters and to accept their “data privacy statement” – which is not available.

There is also an “NZBA Intermediate Target Disclosure Checklist” which is publicly available. This is a set of Governance Guidelines set by the United Nations to which the banks must agree. Again, it is an agreement made between banking companies and the UN. The US Government is not part of the agreement, except in references. The word “government” does not appear in the 9-page document.

BANKS “NET ZERO AGENDA MUST BE STOPPED.” In response to this, 12 State Agriculture Commissioners have signed a letter to the six US banks mentioned above. The letter notes that this could result in “severe consequences” for farmers. The letter reads: “Achieving net-zero greenhouse gas emissions in agriculture requires a complete overhaul of on-farm infrastructure — one of the goals of the NZBA.” “This would have a catastrophic impact on our farmers”.

The letter also stated, “the goal of net zero emissions could permanently damage American agriculture and endanger our country’s food security” and said that “American farmers should not be forced to put our food supply at risk.”

Georgia Agriculture Commissioner Tyler Harper has said, “American agriculture is sending a clear signal: we will not bend the knee to the failed, left-wing climate agenda of the United Nations that seeks to cripple one of our country’s most critical industries.” and “Now more than ever, banks that do business with America should be unquestionably supporting American industries — and that starts with the one that puts food on our tables, clothes on our backs, and shelter over our heads.”

Harper continued: “The UN’s Net-Zero Banking Alliance would be the equivalent of a run on the bank for our nation’s agriculture industry and pose a serious threat to our national security — and it must be stopped. “

Will Hild, the executive director of watchdog group, ‘Consumers’ Research’, was reported as saying: “Farmers and ranchers are the foundation of our economy and international climate cartels like the NZBA pose nothing less than an existential threat to their future. By forcing ESG, Brian Moynihan and his cohort have driven the cost of doing business for small family farmers and independent ranchers to astronomical heights.”

“The Agriculture officials and Commissioners hit the nail on the head in their letter: should their misguided climate extremism continue unabated; these megabanks will put our entire food supply in serious jeopardy. I applaud the states for their action, and I look forward to working with them to defend American consumers from this corporate malfeasance.”

Thanks for reading BOOM Finance and Economics. Subscribe to BOOM Finance and Economics on Substack linked below. BOOM has developed a loyal readership over five years (on other platforms) which includes many of the world’s most senior economists, central bankers, fund managers, and academics. Dr Gerry Brady 2024

BOOM’s QUANTITATIVE BOOSTING FOR THE PEOPLES MONEY EXPLAINED: https://boomfinanceandeconomics.wordpress.com/2019/12/15/boom-as-at-15th-december-2019/ AND BOOM’s Perfect Economy: https://boomfinanceandeconomics.wordpress.com/2020/01/18/boom-as-at-19th-january-2020/

COMING NEXT:

- The Financial Jigsaw Part 2 – Chapter 3 – Perception v Reality – Saturday, February 17, 2024

- BOOM Weekly Global Review – Tuesday, February 20, 2024

- Letter from South Africa – Economic Reality – Saturday, February 24, 2024

In economics, things work until they don’t. Make your conclusions and do research. BOOM does not offer investment advice.

CLICK HERE FOR PODCASTS: OUR BRAVE NEW ECONOMIC WORLD

BANKS DON’T TAKE DEPOSITS, THEY BORROW YOUR MONEY: LOANS CREATE DEPOSITS — this is how almost all new money is created in the economy (by commercial banks making loans). https://www.bankofengland.co.uk/quarterly-bulletin/2014/q1/money-creation-in-the-modern-economy. Watch the short 15-minute video and see Professor Richard Werner brilliantly explaining how global banking systems work.

In 2014, Richard Werner provided the first empirical evidence that banks create credit out of thin air. They do this whenever they issue a loan or, more specifically, purchase a promissory note. This is a walk-through of exactly how they do it.

Many economists are unaware of this and even ignore the banking & finance sectors in their econometric models.

DISCLAIMER: All content is presented for educational and/or entertainment purposes only. Under no circumstances should it be mistaken for professional investment advice, nor is it at all intended to be taken as such. The commentary and other contents simply reflect the opinion of the authors alone on the current and future status of the markets and various economies. It is subject to error and change without notice. The presence of a link to a website does not indicate approval or endorsement of that web site or any services, products, or opinions that may be offered by them.

Neither the information nor any opinion expressed constitutes a solicitation to buy or sell any neither securities nor investments. Do NOT ever purchase any security or investment without doing your own and sufficient research. Neither BOOM Finance and Economics.com nor any of its principals or contributors are under any obligation to update or keep current the information contained herein. The principals and related parties may at times have positions in the securities or investments referred to and may make purchases or sales of these securities and investments while this site is live. The analysis contained is based on both technical and fundamental research.

Although the information contained is derived from sources that are believed to be reliable, they cannot be guaranteed.

Disclosure: We accept no advertising or compensation, and have no material connection to any products, brands, topics, or companies mentioned anywhere on the site.

Fair Use Notice: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of economic and social significance. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

I’m old enough to remember when they first started to use the term “stakeholder;” I actually had a Director correct me when I used “shareholder” in a meeting, sometime in the 1980s.

Stakeholder expands the traditional responsibility of corporate actions from shareholders only, to basically anyone who claims an interest. From Investopedia….

Et voilà! We get ESG: Environmental, Social and Governance.

Stakeholder capitalism is communism in disguise

The World Economic Forum has this push to replace shareholder capitalism with stakeholder capitalism — and that’s a fancy disguised way of saying the World Economic Forum is rapidly pushing to replace capitalism with communism…

“The good of a business is defined not only by its financial success, but also by the impact it has on our environment and communities,” wrote Bill Thomas, CEO of KPMG International, on the World Economic Forum website. “But if you can’t measure it, it’s hard to change it. That is why comparable, transparent and unified ESG-focused metrics are so important.”

What’s that mean?

ESG: Environmental, Social and Governance. So when the wonks working with WEF say that ESGs rather than profits — or more than profits — should be the defining factor of a business’s success, what they’re advocating is a new way of doing business…

Now throw in environmental regulatory compliance.

Now throw in Black Lives Matter agenda.

Now throw in vaccine mandates.

Now throw in any number of government-slash-activist driven social justice wish list items, and put them in the hand of the business to provide — and then change the definition of business success to rate more social justice cause, less profit versus loss. And then — and this is the biggie — then recognize and reward businesses for their social justice successes using Big Government carrots. Tax breaks. Favor with zoning and permitting requests. And the like.

https://www.washingtontimes.com/news/2021/sep/28/stakeholder-capitalism-communism-disguise/

Excellent find B_MC – many thanks for clarifying BOOM’s question. I will send him your comment. The positive is that by sidelining profits, corporations will go bust unless the taxpayer is robbed, but there are limits to the government’s fiscal largest. I think this will all fail in the end and the traditional way of doing business will prevail when local economies will emerge as successful providers.

https://austrianpeter.substack.com/p/the-financial-jigsaw-part-2-localisation?s=w

BOOM agrees B_MC, says:

“Correct, Stupid Schwab wants his cake and eat it. He wants Communism for the masses and Fascism for his corporate sponsors. That is a conflict scenario. He and his backers are idiots with a stupid plan”

My brother was chief of maintenance at a big car dealership about 1970-90 and said every year the manufacturer would send a team to explain the new car features that would confound Shade Tree mechanics and require new car owners to go to dealerships for repairs. Computers were a godsend for these greedy SOBs. We know the monetary costs but there is an unintended consequence: one day, the complexity will run into a Black Swan (a Coronal Mass Ejection perhaps) that sets us back 200 years. Then we will wish we had simple cheap basic machines (cars, washers, stoves, refrigerators, TVs, Central air/heat, etc) like in the 1950s that hadn’t broken so easily and could be repaired by most handymen.

We really will need to go back to the future.